Statistik Asas

| Nilai Portfolio | $ 135,407,227 |

| Kedudukan Semasa | 79 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

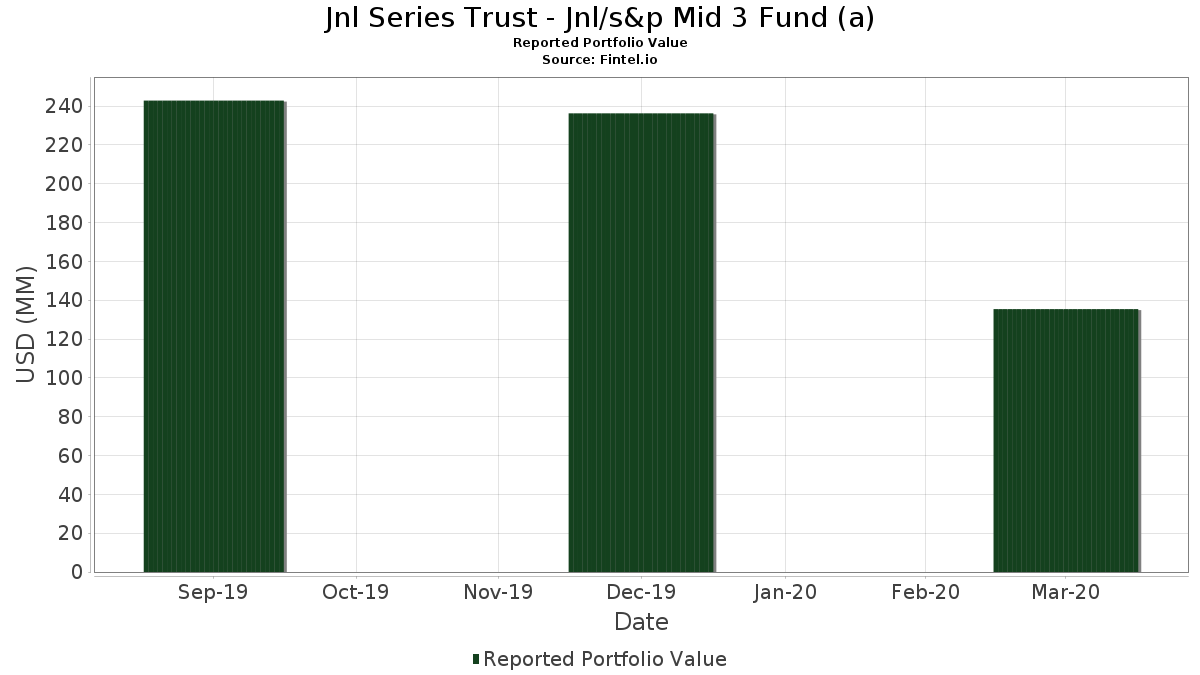

Jnl Series Trust - Jnl/s&p Mid 3 Fund (a) telah mendedahkan 79 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 135,407,227 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Jnl Series Trust - Jnl/s&p Mid 3 Fund (a) ialah Reliance, Inc. (US:RS) , Sprouts Farmers Market, Inc. (US:SFM) , Affiliated Managers Group, Inc. (US:AMG) , Steel Dynamics, Inc. (US:STLD) , and JNL Securities Lending Collateral Fund (US:46628D411) . Kedudukan baharu Jnl Series Trust - Jnl/s&p Mid 3 Fund (a) termasuk Affiliated Managers Group, Inc. (US:AMG) , Tripadvisor, Inc. (US:TRIP) , Cognex Corporation (US:CGNX) , RLI Corp. (US:RLI) , and Lear Corporation (US:LEA) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 4.74 | 3.6087 | 3.6087 | |

| 0.23 | 4.06 | 3.0858 | 3.0858 | |

| 0.26 | 4.83 | 3.6729 | 1.9108 | |

| 0.06 | 2.38 | 1.8079 | 1.8079 | |

| 0.03 | 2.26 | 1.7230 | 1.7230 | |

| 0.03 | 2.17 | 1.6541 | 1.6541 | |

| 0.05 | 2.12 | 1.6149 | 1.6149 | |

| 0.42 | 3.37 | 2.5673 | 1.4240 | |

| 0.31 | 3.76 | 2.8605 | 1.3043 | |

| 0.04 | 1.65 | 1.2552 | 1.2552 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.3094 | ||

| 0.17 | 1.61 | 1.2263 | -1.7836 | |

| 0.00 | 0.00 | -1.6604 | ||

| 0.00 | 0.00 | -1.4287 | ||

| 0.04 | 1.71 | 1.2989 | -1.3999 | |

| 0.00 | 0.00 | -1.3815 | ||

| 0.00 | 0.00 | -1.1829 | ||

| 0.00 | 0.00 | -1.0635 | ||

| 0.37 | 0.86 | 0.6545 | -0.9305 | |

| 0.06 | 1.02 | 0.7765 | -0.8227 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2020-05-28 untuk tempoh pelaporan 2020-03-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| RS / Reliance, Inc. | 0.06 | -27.56 | 5.17 | -47.02 | 3.9320 | -0.3340 | |||

| SFM / Sprouts Farmers Market, Inc. | 0.26 | 24.71 | 4.83 | 19.81 | 3.6729 | 1.9108 | |||

| AMG / Affiliated Managers Group, Inc. | 0.08 | 4.74 | 3.6087 | 3.6087 | |||||

| STLD / Steel Dynamics, Inc. | 0.21 | 9.63 | 4.63 | -27.42 | 3.5214 | 0.7331 | |||

| 46628D411 / JNL Securities Lending Collateral Fund | 4.55 | -41.08 | 4.55 | -41.09 | 3.4598 | 0.0848 | |||

| AFG / American Financial Group, Inc. | 0.06 | 8.78 | 4.22 | -30.47 | 3.2120 | 0.5564 | |||

| TRIP / Tripadvisor, Inc. | 0.23 | 4.06 | 3.0858 | 3.0858 | |||||

| KAR / OPENLANE, Inc. | 0.31 | 91.86 | 3.76 | 5.68 | 2.8605 | 1.3043 | |||

| AEO / American Eagle Outfitters, Inc. | 0.42 | 138.66 | 3.37 | 29.07 | 2.5673 | 1.4240 | |||

| FL / Foot Locker, Inc. | 0.15 | 1.33 | 3.32 | -42.70 | 2.5289 | -0.0078 | |||

| MSM / MSC Industrial Direct Co., Inc. | 0.05 | 43.72 | 2.75 | 0.70 | 2.0909 | 0.8972 | |||

| RNR / RenaissanceRe Holdings Ltd. | 0.02 | 0.87 | 2.71 | -22.14 | 2.0605 | 0.4768 | |||

| YELP / Yelp Inc. | 0.13 | -20.93 | 2.39 | -59.08 | 1.8179 | -0.7350 | |||

| CRUS / Cirrus Logic, Inc. | 0.04 | -3.33 | 2.38 | -23.02 | 1.8097 | 0.4586 | |||

| CGNX / Cognex Corporation | 0.06 | 2.38 | 1.8079 | 1.8079 | |||||

| TGNA / TEGNA Inc. | 0.22 | 82.03 | 2.35 | 18.43 | 1.7843 | 0.9184 | |||

| EXEL / Exelixis, Inc. | 0.13 | -15.66 | 2.32 | -17.58 | 1.7664 | 0.5346 | |||

| RLI / RLI Corp. | 0.03 | 2.26 | 1.7230 | 1.7230 | |||||

| UFS / Domtar Corporation | 0.10 | 115.62 | 2.19 | 22.07 | 1.6662 | 0.8813 | |||

| LEA / Lear Corporation | 0.03 | 2.17 | 1.6541 | 1.6541 | |||||

| SEIC / SEI Investments Company | 0.05 | 24.80 | 2.12 | -11.69 | 1.6153 | 0.5640 | |||

| OC / Owens Corning | 0.05 | 2.12 | 1.6149 | 1.6149 | |||||

| AYI / Acuity Inc. | 0.02 | 19.29 | 2.09 | -25.97 | 1.5882 | 0.3553 | |||

| GNTX / Gentex Corporation | 0.09 | 1.06 | 2.08 | -22.73 | 1.5829 | 0.4055 | |||

| ACM / AECOM | 0.07 | -13.90 | 2.05 | -40.40 | 1.5611 | 0.0553 | |||

| CAKE / The Cheesecake Factory Incorporated | 0.12 | 21.66 | 1.99 | -46.53 | 1.5173 | -0.1137 | |||

| MD / Pediatrix Medical Group, Inc. | 0.17 | 69.76 | 1.98 | -28.91 | 1.5083 | 0.2890 | |||

| DECK / Deckers Outdoor Corporation | 0.01 | -11.62 | 1.93 | -29.85 | 1.4699 | 0.2652 | |||

| TXRH / Texas Roadhouse, Inc. | 0.04 | -2.81 | 1.84 | -28.74 | 1.4003 | 0.2710 | |||

| CRI / Carter's, Inc. | 0.03 | 3.80 | 1.80 | -37.60 | 1.3702 | 0.1080 | |||

| EVR / Evercore Inc. | 0.04 | 7.11 | 1.72 | -34.02 | 1.3105 | 0.1690 | |||

| SBRA / Sabra Health Care REIT, Inc. | 0.16 | 0.00 | 1.72 | -48.82 | 1.3055 | -0.1609 | |||

| WSM / Williams-Sonoma, Inc. | 0.04 | -52.22 | 1.71 | -72.34 | 1.2989 | -1.3999 | |||

| NSP / Insperity, Inc. | 0.04 | 1.65 | 1.2552 | 1.2552 | |||||

| RH / RH | 0.02 | 1.65 | 1.2529 | 1.2529 | |||||

| BRX / Brixmor Property Group Inc. | 0.17 | -46.73 | 1.61 | -76.59 | 1.2263 | -1.7836 | |||

| THG / The Hanover Insurance Group, Inc. | 0.02 | 2.07 | 1.58 | -32.38 | 1.2020 | 0.1806 | |||

| US7153471005 / Perspecta Inc | 0.08 | 209.23 | 1.51 | 113.44 | 1.1482 | 0.8388 | |||

| TMHC / Taylor Morrison Home Corporation | 0.14 | 1.51 | 1.1476 | 1.1476 | |||||

| SIX / Six Flags Entertainment Corporation | 0.12 | 47.41 | 1.47 | -59.03 | 1.1217 | -0.4518 | |||

| PII / Polaris Inc. | 0.03 | 9.10 | 1.46 | -48.37 | 1.1122 | -0.1255 | |||

| CBRL / Cracker Barrel Old Country Store, Inc. | 0.02 | 9.11 | 1.45 | -44.19 | 1.1008 | -0.0793 | |||

| NCR / NCR Corp. | 0.08 | 62.66 | 1.45 | -8.72 | 1.0993 | 0.3782 | |||

| MAN / ManpowerGroup Inc. | 0.03 | 1.44 | 1.0974 | 1.0974 | |||||

| AM / Antero Midstream Corporation | 0.68 | 1.43 | 1.0900 | 1.0900 | |||||

| NAVI / Navient Corporation | 0.18 | 2.17 | 1.39 | -43.40 | 1.0571 | -0.0162 | |||

| LSTR / Landstar System, Inc. | 0.01 | -33.01 | 1.38 | -43.60 | 1.0523 | -0.0203 | |||

| SABR / Sabre Corporation | 0.23 | 49.48 | 1.35 | -60.50 | 1.0233 | -0.4658 | |||

| EPR / EPR Properties | 0.05 | 1.25 | 0.9509 | 0.9509 | |||||

| LECO / Lincoln Electric Holdings, Inc. | 0.02 | -36.04 | 1.22 | -54.37 | 0.9259 | -0.2407 | |||

| PEB / Pebblebrook Hotel Trust | 0.10 | 1.13 | 0.8600 | 0.8600 | |||||

| EXP / Eagle Materials Inc. | 0.02 | -47.50 | 1.07 | -66.19 | 0.8170 | -0.5711 | |||

| NVT / nVent Electric plc | 0.06 | -62.04 | 1.02 | -70.96 | 0.7765 | -0.8227 | |||

| CVLT / Commvault Systems, Inc. | 0.02 | 7.83 | 1.01 | -2.22 | 0.7697 | 0.3172 | |||

| MMS / Maximus, Inc. | 0.02 | -47.19 | 0.97 | -58.71 | 0.7386 | -0.2889 | |||

| AN / AutoNation, Inc. | 0.03 | -1.36 | 0.95 | -43.10 | 0.7256 | -0.0072 | |||

| SBH / Sally Beauty Holdings, Inc. | 0.12 | -14.27 | 0.93 | -62.05 | 0.7107 | -0.3656 | |||

| PTEN / Patterson-UTI Energy, Inc. | 0.37 | 6.06 | 0.86 | -76.27 | 0.6545 | -0.9305 | |||

| 46628D437 / JNL Government Money Market Fund | 0.84 | -5.86 | 0.84 | -5.83 | 0.6392 | 0.2489 | |||

| TPH / Tri Pointe Homes, Inc. | 0.09 | -18.95 | 0.82 | -54.39 | 0.6243 | -0.1623 | |||

| MAC / The Macerich Company | 0.15 | 0.82 | 0.6239 | 0.6239 | |||||

| US2782651036 / Eaton Vance Corp. | 0.03 | 0.81 | 0.6198 | 0.6198 | |||||

| DDS / Dillard's, Inc. | 0.02 | -37.56 | 0.81 | -68.62 | 0.6145 | -0.5105 | |||

| AMCX / AMC Networks Inc. | 0.03 | 0.00 | 0.81 | -38.49 | 0.6143 | 0.0406 | |||

| BYD / Boyd Gaming Corporation | 0.05 | -10.71 | 0.78 | -57.02 | 0.5968 | -0.2009 | |||

| MLHR / Herman Miller Inc. | 0.03 | 100.55 | 0.68 | 6.80 | 0.5141 | 0.2377 | |||

| LANC / Lancaster Colony Corporation | 0.00 | 0.00 | 0.63 | -9.55 | 0.4756 | 0.1730 | |||

| CLB / Core Laboratories Inc. | 0.05 | 0.56 | 0.4295 | 0.4295 | |||||

| SIGI / Selective Insurance Group, Inc. | 0.01 | 0.55 | 0.4203 | 0.4203 | |||||

| GNW / Genworth Financial, Inc. | 0.16 | 0.53 | 0.4016 | 0.4016 | |||||

| US7587501039 / Regal-Beloit Corp. | 0.01 | 0.50 | 0.3825 | 0.3825 | |||||

| CXW / CoreCivic, Inc. | 0.04 | 0.74 | 0.47 | -35.32 | 0.3558 | 0.0399 | |||

| ASGN / ASGN Incorporated | 0.01 | 11.69 | 0.43 | -44.46 | 0.3286 | -0.0112 | |||

| FHI / Federated Hermes, Inc. | 0.02 | 0.41 | 0.3115 | 0.3115 | |||||

| CHX / ChampionX Corporation | 0.03 | 17.87 | 0.19 | -80.00 | 0.1458 | -0.2720 | |||

| SVC / Service Properties Trust | 0.03 | -29.22 | 0.18 | -84.31 | 0.1394 | -0.3706 | |||

| US912796SV23 / United States Treasury Bill | 0.09 | 0.0692 | 0.0692 | ||||||

| US912796TY52 / TREASURY BILL 12/20 0.00000 | 0.02 | 0.0167 | 0.0167 | ||||||

| TER / Teradyne, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.6604 | ||||

| ODFL / Old Dominion Freight Line, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1829 | ||||

| BHF / Brighthouse Financial, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.4287 | ||||

| MDP / Meredith Holdings Corp | 0.00 | -100.00 | 0.00 | -100.00 | -0.7206 | ||||

| EQT / EQT Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.3815 | ||||

| BBBY / Bed Bath & Beyond, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.3094 | ||||

| GDOT / Green Dot Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.0635 | ||||

| FUTURE - CASH SETTLED / DE (N/A) | -0.00 | -100.03 | -0.0012 | -0.0012 |