Statistik Asas

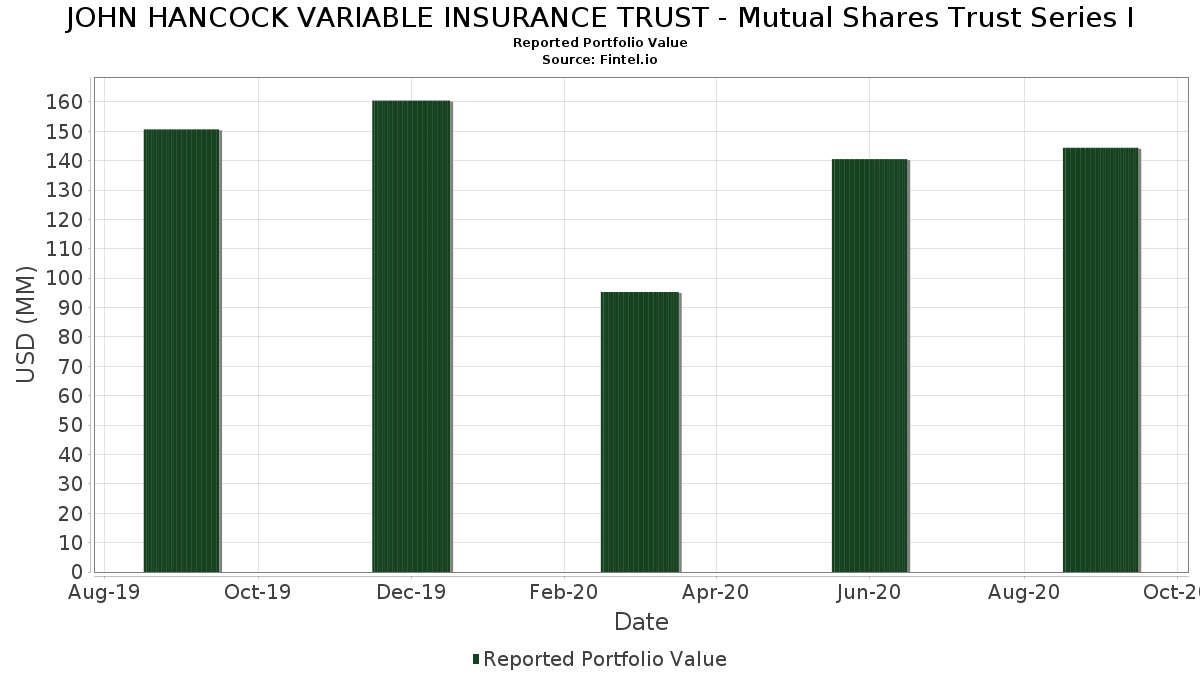

| Nilai Portfolio | $ 144,379,666 |

| Kedudukan Semasa | 52 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

JOHN HANCOCK VARIABLE INSURANCE TRUST - Mutual Shares Trust Series I telah mendedahkan 52 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 144,379,666 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas JOHN HANCOCK VARIABLE INSURANCE TRUST - Mutual Shares Trust Series I ialah Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOGL) , Verizon Communications Inc. (US:VZ) , and Koninklijke Ahold Delhaize N.V. - Depositary Receipt (Common Stock) (US:ADRNY) . Kedudukan baharu JOHN HANCOCK VARIABLE INSURANCE TRUST - Mutual Shares Trust Series I termasuk Roche Holding AG (US:RHHBF) , Applied Materials, Inc. (US:AMAT) , Kimberly-Clark Corporation (US:KMB) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 2.93 | 2.0283 | 2.0283 | |

| 0.04 | 2.09 | 1.4458 | 1.4458 | |

| 0.09 | 3.92 | 2.7107 | 1.0464 | |

| 0.00 | 4.41 | 3.0562 | 1.0455 | |

| 0.01 | 1.47 | 1.0193 | 1.0193 | |

| 0.01 | 2.13 | 1.4772 | 0.6590 | |

| 0.04 | 5.22 | 3.6120 | 0.5639 | |

| 0.02 | 2.17 | 1.5005 | 0.5420 | |

| 0.08 | 5.04 | 3.4914 | 0.4280 | |

| 0.08 | 4.69 | 3.2448 | 0.3905 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 6.30 | 4.3601 | -1.9520 | |

| 0.00 | 0.00 | -1.2478 | ||

| 0.03 | 6.58 | 4.5550 | -1.2028 | |

| 0.00 | 0.00 | -1.1103 | ||

| 0.04 | 3.23 | 2.2365 | -0.9188 | |

| 0.00 | 0.00 | -0.8343 | ||

| 1.58 | 1.58 | 1.0953 | -0.7834 | |

| 0.00 | 1.08 | 0.7453 | -0.5574 | |

| 0.00 | 0.76 | 0.5249 | -0.4622 | |

| 0.26 | 2.92 | 2.0228 | -0.4406 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2020-11-24 untuk tempoh pelaporan 2020-09-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.03 | -21.04 | 6.58 | -18.39 | 4.5550 | -1.2028 | |||

| AAPL / Apple Inc. | 0.05 | 124.45 | 6.30 | -28.75 | 4.3601 | -1.9520 | |||

| GOOGL / Alphabet Inc. | 0.00 | -5.42 | 6.17 | -2.25 | 4.2681 | -0.2358 | |||

| VZ / Verizon Communications Inc. | 0.09 | 0.00 | 5.40 | 7.91 | 3.7397 | 0.1648 | |||

| ADRNY / Koninklijke Ahold Delhaize N.V. - Depositary Receipt (Common Stock) | 0.18 | 0.00 | 5.38 | 8.45 | 3.7226 | 0.1819 | |||

| JNJ / Johnson & Johnson | 0.04 | 15.46 | 5.22 | 22.24 | 3.6120 | 0.5639 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.08 | 3.22 | 5.04 | 17.55 | 3.4914 | 0.4280 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.06 | 8.54 | 4.89 | 8.16 | 3.3848 | 0.1570 | |||

| ORCL / Oracle Corporation | 0.08 | 8.57 | 4.69 | 17.26 | 3.2448 | 0.3905 | |||

| AZO / AutoZone, Inc. | 0.00 | 50.20 | 4.41 | 56.80 | 3.0562 | 1.0455 | |||

| DANOY / Danone S.A. - Depositary Receipt (Common Stock) | 0.07 | 7.44 | 4.27 | 0.26 | 2.9570 | -0.0854 | |||

| CMCSA / Comcast Corporation | 0.09 | 0.00 | 4.16 | 18.69 | 2.8793 | 0.3766 | |||

| 05935 / Samsung Electronics Co Ltd | 0.09 | 52.05 | 3.92 | 68.03 | 2.7107 | 1.0464 | |||

| MGDDY / Compagnie Générale des Établissements Michelin Société en commandite par actions - Depositary Receipt (Common Stock) | 0.04 | 5.62 | 3.87 | 8.77 | 2.6794 | 0.1385 | |||

| CRH / CRH plc | 0.11 | 4.17 | 3.84 | 9.73 | 2.6558 | 0.1594 | |||

| MRK / Merck & Co., Inc. | 0.04 | 10.06 | 3.35 | 18.05 | 2.3185 | 0.2927 | |||

| HINKF / Heineken N.V. | 0.04 | -24.27 | 3.23 | -26.89 | 2.2365 | -0.9188 | |||

| PM / Philip Morris International Inc. | 0.04 | 0.00 | 3.00 | 7.02 | 2.0793 | 0.0754 | |||

| RHHBF / Roche Holding AG | 0.01 | 2.93 | 2.0283 | 2.0283 | |||||

| AMCR / Amcor plc | 0.26 | -22.66 | 2.92 | -15.28 | 2.0228 | -0.4406 | |||

| TSCDF / Tesco PLC | 0.99 | -9.65 | 2.70 | -11.87 | 1.8712 | -0.3191 | |||

| CAP / Capgemini SE | 0.02 | -17.45 | 2.69 | -8.24 | 1.8653 | -0.2314 | |||

| AJG / Arthur J. Gallagher & Co. | 0.02 | 0.00 | 2.60 | 8.27 | 1.8030 | 0.0857 | |||

| WTKWY / Wolters Kluwer N.V. - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 2.32 | 9.15 | 1.6030 | 0.0878 | |||

| AKZOY / Akzo Nobel N.V. - Depositary Receipt (Common Stock) | 0.02 | -12.43 | 2.31 | -1.49 | 1.6008 | -0.0754 | |||

| HD / The Home Depot, Inc. | 0.01 | -8.71 | 2.19 | 1.20 | 1.5127 | -0.0292 | |||

| SAN / Santander UK plc - Preferred Stock | 0.02 | 64.35 | 2.17 | 61.48 | 1.5005 | 0.5420 | |||

| NOC / Northrop Grumman Corporation | 0.01 | 81.49 | 2.13 | 86.29 | 1.4772 | 0.6590 | |||

| PHG / Koninklijke Philips N.V. - Depositary Receipt (Common Stock) | 0.04 | -14.95 | 2.11 | -14.06 | 1.4604 | -0.2920 | |||

| AMAT / Applied Materials, Inc. | 0.04 | 2.09 | 1.4458 | 1.4458 | |||||

| INTC / Intel Corporation | 0.04 | 57.81 | 1.96 | 36.59 | 1.3568 | 0.3320 | |||

| MITEY / Mitsubishi Estate Co., Ltd. - Depositary Receipt (Common Stock) | 0.12 | 0.00 | 1.81 | 1.63 | 1.2520 | -0.0185 | |||

| 24W5 / Ferguson plc | 0.02 | -7.92 | 1.78 | 13.38 | 1.2315 | 0.1105 | |||

| EA / Electronic Arts Inc. | 0.01 | 0.00 | 1.76 | -1.23 | 1.2206 | -0.0543 | |||

| FBHS / Fortune Brands Home & Security Inc | 0.02 | -28.02 | 1.76 | -2.55 | 1.2184 | -0.0717 | |||

| CB / Chubb Limited | 0.02 | 4.47 | 1.75 | -4.17 | 1.2097 | -0.0928 | |||

| FANUF / Fanuc Corporation | 0.01 | 0.00 | 1.71 | 7.08 | 1.1824 | 0.0431 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | 0.00 | 1.67 | 2.33 | 1.1579 | -0.0091 | |||

| ASBFY / Associated British Foods plc - Depositary Receipt (Common Stock) | 0.07 | 0.00 | 1.64 | 1.80 | 1.1338 | -0.0148 | |||

| 7839989D1 / SSC GOVERNMENT MM GVMXX GVMXX | 1.58 | -39.86 | 1.58 | -39.87 | 1.0953 | -0.7834 | |||

| SBUX / Starbucks Corporation | 0.02 | 0.00 | 1.53 | 16.82 | 1.0578 | 0.1232 | |||

| JCI / Johnson Controls International plc | 0.04 | -29.62 | 1.49 | -15.76 | 1.0287 | -0.2313 | |||

| WM / Waste Management, Inc. | 0.01 | 0.00 | 1.48 | 6.85 | 1.0258 | 0.0355 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 1.47 | 1.0193 | 1.0193 | |||||

| CL / Colgate-Palmolive Company | 0.02 | 0.00 | 1.37 | 5.31 | 0.9476 | 0.0194 | |||

| DIISY / Direct Line Insurance Group plc - Depositary Receipt (Common Stock) | 0.38 | 0.00 | 1.34 | 4.04 | 0.9271 | 0.0077 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.04 | 0.00 | 1.24 | -10.93 | 0.8578 | -0.1357 | |||

| SWK / Stanley Black & Decker, Inc. | 0.01 | -29.78 | 1.15 | -18.30 | 0.7981 | -0.2093 | |||

| OTIS / Otis Worldwide Corporation | 0.02 | -33.90 | 1.10 | -27.48 | 0.7586 | -0.3198 | |||

| ACN / Accenture plc | 0.00 | -43.93 | 1.08 | -41.01 | 0.7453 | -0.5574 | |||

| UNP / Union Pacific Corporation | 0.00 | -52.89 | 0.76 | -45.15 | 0.5249 | -0.4622 | |||

| SOLD EUR/BOUGHT USD / DFE (N/A) | 0.08 | 0.0522 | 0.0522 | ||||||

| PPG / PPG Industries, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8343 | ||||

| UPS / United Parcel Service, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1103 | ||||

| CSCO / Cisco Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2478 |