Statistik Asas

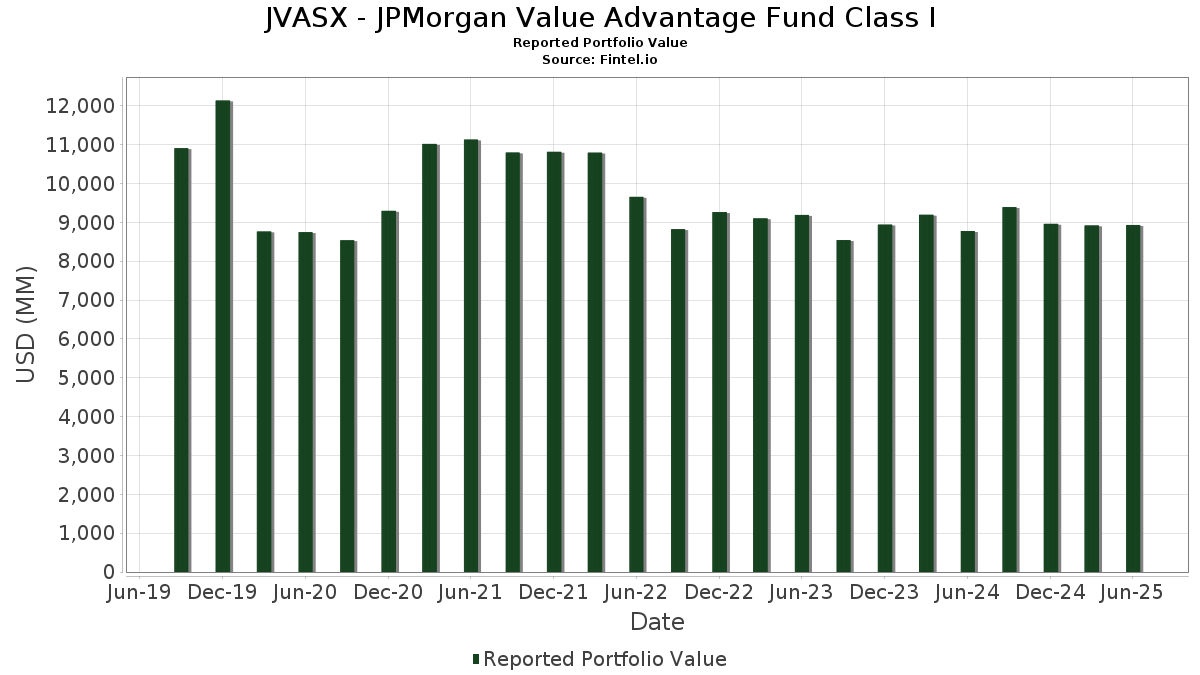

| Nilai Portfolio | $ 8,931,092,848 |

| Kedudukan Semasa | 124 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

JVASX - JPMorgan Value Advantage Fund Class I telah mendedahkan 124 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 8,931,092,848 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas JVASX - JPMorgan Value Advantage Fund Class I ialah Wells Fargo & Company (US:WFC) , Berkshire Hathaway Inc. (US:BRK.B) , JPMorgan Trust I. - JPMorgan Prime Money Market Fund IM (US:JIMXX) , Capital One Financial Corporation (US:COF) , and AbbVie Inc. (US:ABBV) . Kedudukan baharu JVASX - JPMorgan Value Advantage Fund Class I termasuk Omnicom Group Inc. (US:OMC) , Salesforce, Inc. (US:CRM) , Equinix, Inc. (US:EQIX) , Angi Inc. (US:ANGI) , and Hayward Holdings, Inc. (US:HAYW) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.52 | 113.94 | 1.2747 | 0.9119 | |

| 0.46 | 81.27 | 0.9092 | 0.6388 | |

| 0.31 | 68.33 | 0.7645 | 0.5158 | |

| 0.41 | 58.90 | 0.6589 | 0.4004 | |

| 0.82 | 101.24 | 1.1327 | 0.3956 | |

| 0.82 | 174.68 | 1.9543 | 0.3923 | |

| 0.47 | 33.78 | 0.3779 | 0.3779 | |

| 0.12 | 32.23 | 0.3605 | 0.3605 | |

| 4.08 | 327.17 | 3.6603 | 0.3454 | |

| 0.04 | 30.55 | 0.3417 | 0.3417 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.46 | 221.16 | 2.4743 | -0.6021 | |

| 0.00 | 0.00 | -0.5330 | ||

| 3.04 | 140.61 | 1.5731 | -0.4964 | |

| 0.06 | 34.00 | 0.3804 | -0.4622 | |

| 176.17 | 176.21 | 1.9713 | -0.3299 | |

| 0.26 | 25.14 | 0.2813 | -0.2963 | |

| 0.96 | 137.41 | 1.5373 | -0.2560 | |

| 1.49 | 133.34 | 1.4918 | -0.2513 | |

| 0.94 | 174.19 | 1.9488 | -0.2475 | |

| 0.18 | 70.61 | 0.7900 | -0.2397 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-26 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| WFC / Wells Fargo & Company | 4.08 | -0.44 | 327.17 | 11.12 | 3.6603 | 0.3454 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.46 | -11.27 | 221.16 | -19.06 | 2.4743 | -0.6021 | |||

| JIMXX / JPMorgan Trust I. - JPMorgan Prime Money Market Fund IM | 176.17 | -13.79 | 176.21 | -13.80 | 1.9713 | -0.3299 | |||

| COF / Capital One Financial Corporation | 0.82 | 6.11 | 174.68 | 25.91 | 1.9543 | 0.3923 | |||

| ABBV / AbbVie Inc. | 0.94 | 0.79 | 174.19 | -10.71 | 1.9488 | -0.2475 | |||

| MTB / M&T Bank Corporation | 0.87 | -0.44 | 167.98 | 8.05 | 1.8792 | 0.1291 | |||

| BAC / Bank of America Corporation | 3.44 | -0.44 | 162.81 | 12.90 | 1.8215 | 0.1980 | |||

| PM / Philip Morris International Inc. | 0.80 | 0.79 | 146.11 | 15.64 | 1.6346 | 0.2122 | |||

| BMY / Bristol-Myers Squibb Company | 3.04 | 0.79 | 140.61 | -23.51 | 1.5731 | -0.4964 | |||

| CVX / Chevron Corporation | 0.96 | 0.79 | 137.41 | -13.73 | 1.5373 | -0.2560 | |||

| COP / ConocoPhillips | 1.49 | 0.79 | 133.34 | -13.88 | 1.4918 | -0.2513 | |||

| TRV / The Travelers Companies, Inc. | 0.48 | -9.71 | 128.73 | -8.66 | 1.4402 | -0.1465 | |||

| NTRS / Northern Trust Corporation | 0.99 | -0.44 | 125.30 | 27.97 | 1.4018 | 0.2994 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.06 | -0.44 | 123.73 | 5.06 | 1.3842 | 0.0584 | |||

| STT / State Street Corporation | 1.11 | -0.44 | 118.40 | 18.26 | 1.3246 | 0.1974 | |||

| COR / Cencora, Inc. | 0.39 | -2.98 | 117.91 | 4.61 | 1.3192 | 0.0502 | |||

| HSIC / Henry Schein, Inc. | 1.60 | 5.00 | 117.09 | 11.99 | 1.3100 | 0.1329 | |||

| AMZN / Amazon.com, Inc. | 0.52 | 206.65 | 113.94 | 253.60 | 1.2747 | 0.9119 | |||

| TXN / Texas Instruments Incorporated | 0.55 | 11.68 | 113.88 | 29.03 | 1.2740 | 0.2804 | |||

| SNX / TD SYNNEX Corporation | 0.84 | 0.79 | 113.60 | 31.56 | 1.2709 | 0.2987 | |||

| L / Loews Corporation | 1.23 | -0.44 | 112.43 | -0.71 | 1.2578 | -0.0169 | |||

| JNJ / Johnson & Johnson | 0.72 | 4.49 | 110.63 | -3.75 | 1.2377 | -0.0564 | |||

| RTX / RTX Corporation | 0.72 | 0.79 | 104.69 | 11.10 | 1.1712 | 0.1104 | |||

| DIS / The Walt Disney Company | 0.82 | 23.08 | 101.24 | 54.64 | 1.1327 | 0.3956 | |||

| EOG / EOG Resources, Inc. | 0.83 | 0.79 | 99.03 | -6.00 | 1.1079 | -0.0781 | |||

| LH / Labcorp Holdings Inc. | 0.37 | 12.42 | 96.28 | 26.80 | 1.0771 | 0.2223 | |||

| RF / Regions Financial Corporation | 3.99 | -0.44 | 93.82 | 7.77 | 1.0496 | 0.0695 | |||

| NEE / NextEra Energy, Inc. | 1.35 | 11.92 | 93.69 | 9.60 | 1.0481 | 0.0858 | |||

| CI / The Cigna Group | 0.28 | -7.43 | 93.42 | -6.98 | 1.0452 | -0.0855 | |||

| HPE / Hewlett Packard Enterprise Company | 4.41 | 0.79 | 90.27 | 33.58 | 1.0099 | 0.2491 | |||

| MCD / McDonald's Corporation | 0.30 | 0.79 | 89.03 | -5.73 | 0.9960 | -0.0672 | |||

| DOV / Dover Corporation | 0.48 | 0.79 | 87.71 | 5.12 | 0.9812 | 0.0419 | |||

| KDP / Keurig Dr Pepper Inc. | 2.65 | 0.79 | 87.53 | -2.63 | 0.9792 | -0.0328 | |||

| LOW / Lowe's Companies, Inc. | 0.38 | 0.79 | 84.34 | -4.12 | 0.9435 | -0.0468 | |||

| UNH / UnitedHealth Group Incorporated | 0.27 | 42.29 | 83.29 | -15.25 | 0.9319 | -0.1746 | |||

| GOOG / Alphabet Inc. | 0.46 | 256.68 | 81.27 | 244.96 | 0.9092 | 0.6388 | |||

| FDX / FedEx Corporation | 0.35 | 0.79 | 80.07 | -6.02 | 0.8958 | -0.0634 | |||

| AMH / American Homes 4 Rent | 2.18 | -0.44 | 78.63 | -5.02 | 0.8796 | -0.0523 | |||

| MTG / MGIC Investment Corporation | 2.82 | -0.44 | 78.57 | 11.86 | 0.8791 | 0.0882 | |||

| REG / Regency Centers Corporation | 1.10 | 0.79 | 78.15 | -2.67 | 0.8743 | -0.0297 | |||

| WSC / WillScot Holdings Corporation | 2.79 | 22.98 | 76.48 | 21.21 | 0.8556 | 0.1453 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.51 | -0.44 | 76.04 | -12.06 | 0.8507 | -0.1228 | |||

| CSL / Carlisle Companies Incorporated | 0.20 | 0.79 | 74.84 | 10.52 | 0.8372 | 0.0749 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.39 | -0.44 | 73.35 | 5.60 | 0.8206 | 0.0386 | |||

| SCHW / The Charles Schwab Corporation | 0.80 | -0.44 | 73.27 | 16.05 | 0.8197 | 0.1089 | |||

| PG / The Procter & Gamble Company | 0.46 | 0.79 | 72.69 | -5.78 | 0.8133 | -0.0553 | |||

| GD / General Dynamics Corporation | 0.25 | 0.79 | 72.07 | 7.84 | 0.8063 | 0.0539 | |||

| VZ / Verizon Communications Inc. | 1.66 | 0.79 | 71.94 | -3.86 | 0.8049 | -0.0376 | |||

| MS / Morgan Stanley | 0.50 | -0.44 | 71.09 | 20.21 | 0.7953 | 0.1295 | |||

| MLM / Martin Marietta Materials, Inc. | 0.13 | 0.79 | 70.91 | 15.72 | 0.7933 | 0.1034 | |||

| HCA / HCA Healthcare, Inc. | 0.18 | -30.36 | 70.61 | -22.80 | 0.7900 | -0.2397 | |||

| WDC / Western Digital Corporation | 1.09 | 0.79 | 69.82 | 59.52 | 0.7811 | 0.2884 | |||

| WMB / The Williams Companies, Inc. | 1.10 | -4.87 | 68.92 | -0.01 | 0.7710 | -0.0049 | |||

| JBL / Jabil Inc. | 0.31 | 93.02 | 68.33 | 209.38 | 0.7645 | 0.5158 | |||

| UNP / Union Pacific Corporation | 0.30 | 7.85 | 68.17 | 5.04 | 0.7626 | 0.0320 | |||

| CPAY / Corpay, Inc. | 0.20 | -0.44 | 67.57 | -5.26 | 0.7559 | -0.0470 | |||

| Smurfit WestRock plc / EC (IE00028FXN24) | 1.56 | 15.78 | 67.30 | 10.87 | 0.7529 | 0.0695 | |||

| MDT / Medtronic plc | 0.77 | 0.79 | 66.79 | -2.23 | 0.7473 | -0.0219 | |||

| KMI / Kinder Morgan, Inc. | 2.22 | 0.79 | 65.15 | 3.86 | 0.7289 | 0.0227 | |||

| AXP / American Express Company | 0.20 | -19.84 | 65.05 | -4.96 | 0.7277 | -0.0428 | |||

| CVS / CVS Health Corporation | 0.91 | 0.79 | 63.02 | 2.62 | 0.7050 | 0.0136 | |||

| PSA / Public Storage | 0.21 | 0.79 | 62.76 | -1.19 | 0.7022 | -0.0129 | |||

| AXTA / Axalta Coating Systems Ltd. | 2.10 | 0.79 | 62.22 | -9.79 | 0.6961 | -0.0804 | |||

| CB / Chubb Limited | 0.21 | -17.61 | 60.72 | -20.96 | 0.6793 | -0.1855 | |||

| POST / Post Holdings, Inc. | 0.55 | 0.79 | 59.82 | -5.56 | 0.6692 | -0.0439 | |||

| MIDD / The Middleby Corporation | 0.41 | 170.66 | 58.90 | 156.45 | 0.6589 | 0.4004 | |||

| MHK / Mohawk Industries, Inc. | 0.56 | 0.79 | 58.80 | -7.46 | 0.6578 | -0.0575 | |||

| ALGN / Align Technology, Inc. | 0.31 | 0.79 | 58.51 | 20.12 | 0.6545 | 0.1062 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.75 | 0.79 | 58.22 | 2.80 | 0.6514 | 0.0138 | |||

| AZO / AutoZone, Inc. | 0.02 | 0.79 | 57.93 | -1.87 | 0.6481 | -0.0165 | |||

| JBHT / J.B. Hunt Transport Services, Inc. | 0.40 | 47.66 | 57.37 | 43.32 | 0.6418 | 0.1912 | |||

| BKNG / Booking Holdings Inc. | 0.01 | -14.27 | 55.01 | 7.73 | 0.6154 | 0.0405 | |||

| GPK / Graphic Packaging Holding Company | 2.60 | -0.44 | 54.84 | -19.19 | 0.6136 | -0.1505 | |||

| WRB / W. R. Berkley Corporation | 0.74 | -8.23 | 54.44 | -5.25 | 0.6091 | -0.0378 | |||

| MRK / Merck & Co., Inc. | 0.69 | 0.79 | 54.32 | -11.12 | 0.6077 | -0.0803 | |||

| SBAC / SBA Communications Corporation | 0.23 | -0.44 | 54.00 | 6.28 | 0.6041 | 0.0321 | |||

| LAMR / Lamar Advertising Company | 0.44 | 0.79 | 53.54 | 7.50 | 0.5989 | 0.0383 | |||

| ETN / Eaton Corporation plc | 0.14 | 23.10 | 51.75 | 61.67 | 0.5790 | 0.2186 | |||

| PCG / PG&E Corporation | 3.71 | -0.44 | 51.69 | -19.21 | 0.5783 | -0.1420 | |||

| HST / Host Hotels & Resorts, Inc. | 3.31 | 0.79 | 50.86 | 8.94 | 0.5691 | 0.0434 | |||

| FBIN / Fortune Brands Innovations, Inc. | 0.99 | 20.02 | 50.75 | 1.49 | 0.5678 | 0.0048 | |||

| XEL / Xcel Energy Inc. | 0.72 | 0.79 | 49.30 | -3.04 | 0.5515 | -0.0209 | |||

| PEP / PepsiCo, Inc. | 0.37 | 0.79 | 49.03 | -11.25 | 0.5485 | -0.0734 | |||

| LUV / Southwest Airlines Co. | 1.51 | 27.16 | 49.00 | 22.85 | 0.5482 | 0.0991 | |||

| ADI / Analog Devices, Inc. | 0.20 | 0.79 | 47.77 | 18.95 | 0.5344 | 0.0823 | |||

| SLGN / Silgan Holdings Inc. | 0.87 | 0.79 | 47.24 | 6.82 | 0.5285 | 0.0306 | |||

| EXPE / Expedia Group, Inc. | 0.28 | -8.35 | 46.84 | -8.03 | 0.5241 | -0.0494 | |||

| ACGL / Arch Capital Group Ltd. | 0.51 | -0.44 | 46.27 | -5.75 | 0.5176 | -0.0350 | |||

| PKG / Packaging Corporation of America | 0.23 | -0.44 | 44.17 | -5.25 | 0.4942 | -0.0307 | |||

| AMP / Ameriprise Financial, Inc. | 0.08 | -0.44 | 42.32 | 9.77 | 0.4734 | 0.0394 | |||

| TRU / TransUnion | 0.47 | 28.63 | 41.47 | 36.39 | 0.4639 | 0.1216 | |||

| CTRA / Coterra Energy Inc. | 1.63 | 32.43 | 41.27 | 16.30 | 0.4617 | 0.0622 | |||

| WY / Weyerhaeuser Company | 1.59 | 0.79 | 40.93 | -11.57 | 0.4579 | -0.0632 | |||

| OSCR / Oscar Health, Inc. | 1.87 | -0.44 | 40.13 | 62.83 | 0.4489 | 0.1715 | |||

| BBY / Best Buy Co., Inc. | 0.59 | 0.79 | 39.93 | -8.09 | 0.4468 | -0.0424 | |||

| BBWI / Bath & Body Works, Inc. | 1.30 | 0.79 | 39.04 | -0.41 | 0.4367 | -0.0046 | |||

| STZ / Constellation Brands, Inc. | 0.24 | -15.59 | 38.94 | -25.18 | 0.4357 | -0.1503 | |||

| GNTX / Gentex Corporation | 1.71 | 12.52 | 37.60 | 6.19 | 0.4206 | 0.0220 | |||

| MUSA / Murphy USA Inc. | 0.09 | 0.79 | 37.59 | -12.73 | 0.4205 | -0.0644 | |||

| IAC / IAC Inc. | 0.99 | 0.79 | 36.99 | -18.08 | 0.4138 | -0.0945 | |||

| FITB / Fifth Third Bancorp | 0.88 | -0.44 | 36.25 | 4.47 | 0.4056 | 0.0149 | |||

| KNSL / Kinsale Capital Group, Inc. | 0.07 | -0.44 | 36.09 | -1.01 | 0.4038 | -0.0067 | |||

| IP / International Paper Company | 0.76 | -0.44 | 35.81 | -12.60 | 0.4006 | -0.0607 | |||

| KTB / Kontoor Brands, Inc. | 0.54 | 23.53 | 35.34 | 27.07 | 0.3954 | 0.0823 | |||

| RYN / Rayonier Inc. | 1.56 | 48.73 | 34.66 | 18.32 | 0.3877 | 0.0580 | |||

| COLB / Columbia Banking System, Inc. | 1.48 | -0.44 | 34.59 | -6.66 | 0.3870 | -0.0302 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.06 | -45.12 | 34.00 | -54.57 | 0.3804 | -0.4622 | |||

| OMC / Omnicom Group Inc. | 0.47 | 33.78 | 0.3779 | 0.3779 | |||||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.07 | 0.78 | 33.34 | -7.45 | 0.3730 | -0.0326 | |||

| CRM / Salesforce, Inc. | 0.12 | 32.23 | 0.3605 | 0.3605 | |||||

| ETR / Entergy Corporation | 0.38 | 0.79 | 31.28 | -2.01 | 0.3499 | -0.0094 | |||

| EQIX / Equinix, Inc. | 0.04 | 30.55 | 0.3417 | 0.3417 | |||||

| PEG / Public Service Enterprise Group Incorporated | 0.36 | 0.79 | 30.55 | 3.09 | 0.3417 | 0.0081 | |||

| CSCO / Cisco Systems, Inc. | 0.42 | -40.75 | 29.02 | -33.39 | 0.3247 | -0.1658 | |||

| HUM / Humana Inc. | 0.11 | 0.79 | 26.98 | -6.88 | 0.3019 | -0.0243 | |||

| EGP / EastGroup Properties, Inc. | 0.16 | 0.79 | 26.79 | -4.38 | 0.2997 | -0.0157 | |||

| RJF / Raymond James Financial, Inc. | 0.17 | -0.44 | 25.57 | 9.93 | 0.2861 | 0.0242 | |||

| FRT / Federal Realty Investment Trust | 0.26 | -49.54 | 25.14 | -51.00 | 0.2813 | -0.2963 | |||

| CBRE / CBRE Group, Inc. | 0.18 | 0.79 | 24.93 | 7.98 | 0.2789 | 0.0190 | |||

| PGR / The Progressive Corporation | 0.08 | -0.44 | 20.17 | -6.12 | 0.2257 | -0.0162 | |||

| APLE / Apple Hospitality REIT, Inc. | 1.26 | -0.44 | 14.66 | -10.00 | 0.1641 | -0.0194 | |||

| COLM / Columbia Sportswear Company | 0.17 | 0.79 | 10.21 | -18.67 | 0.1142 | -0.0271 | |||

| ANGI / Angi Inc. | 0.51 | 7.84 | 0.0877 | 0.0877 | |||||

| HAYW / Hayward Holdings, Inc. | 0.53 | 7.30 | 0.0816 | 0.0816 | |||||

| DLR / Digital Realty Trust, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5330 |