Statistik Asas

| Nilai Portfolio | $ 1,623,456,000 |

| Kedudukan Semasa | 124 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

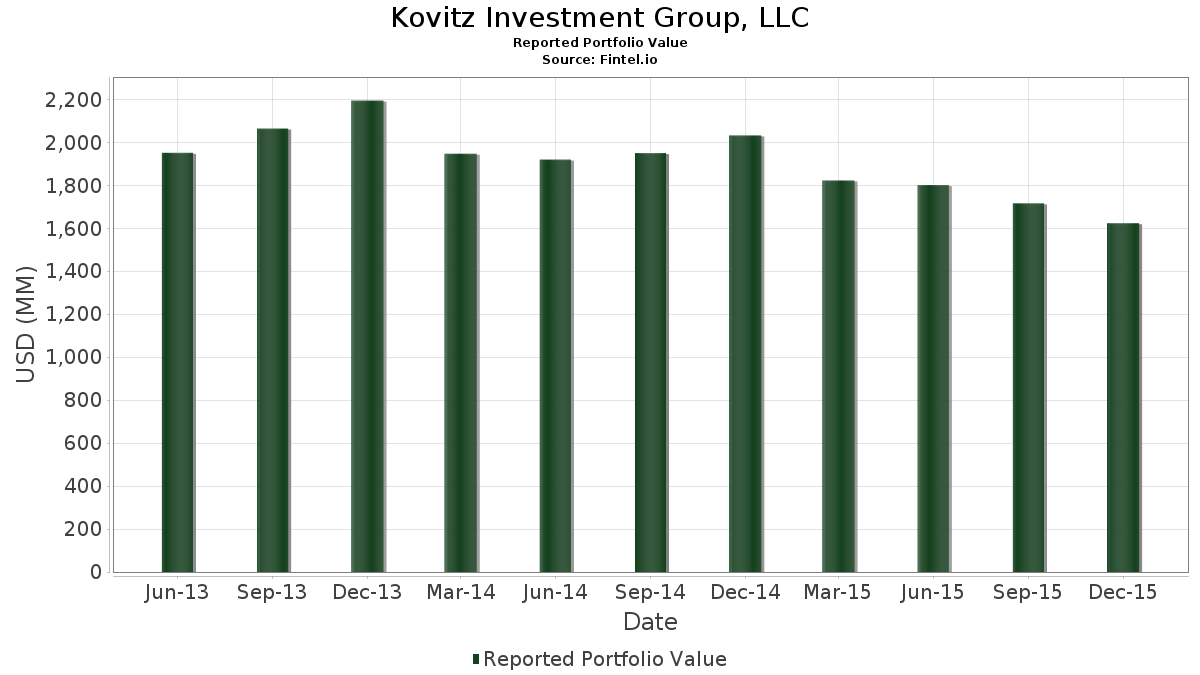

Kovitz Investment Group, LLC telah mendedahkan 124 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,623,456,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Kovitz Investment Group, LLC ialah Berkshire Hathaway Inc. (US:BRK.B) , Jacobs Solutions Inc. (US:J) , The Boeing Company (US:BA) , Quanta Services, Inc. (US:PWR) , and Apple Inc. (US:AAPL) . Kedudukan baharu Kovitz Investment Group, LLC termasuk PGIM Global High Yield Fund, Inc (US:GHY) , Macy's, Inc. (US:M) , Ares Dynamic Credit Allocation Fund, Inc. (US:ARDC) , Allspring Multi-Sector Income Fund (US:ERC) , and Barings Global Short Duration High Yield Fund (US:BGH) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.24 | 93.89 | 5.7832 | 0.8420 | |

| 0.60 | 86.17 | 5.3079 | 0.6270 | |

| 1.77 | 60.31 | 3.7147 | 0.5352 | |

| 2.13 | 37.10 | 2.2850 | 0.5106 | |

| 0.92 | 43.53 | 2.6813 | 0.4911 | |

| 0.05 | 35.35 | 2.1777 | 0.4875 | |

| 1.04 | 68.67 | 4.2296 | 0.4270 | |

| 0.73 | 96.19 | 5.9253 | 0.3968 | |

| 3.57 | 60.15 | 3.7051 | 0.3855 | |

| 0.34 | 36.26 | 2.2333 | 0.2890 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.29 | 30.58 | 1.8834 | -3.2813 | |

| 0.49 | 30.42 | 1.8740 | -1.7332 | |

| 0.00 | 0.00 | -1.5348 | ||

| 0.00 | 0.00 | -1.0107 | ||

| 0.02 | 3.88 | 0.2391 | -0.9369 | |

| 0.30 | 31.31 | 1.9284 | -0.5971 | |

| 0.83 | 40.09 | 2.4694 | -0.4205 | |

| 0.43 | 19.38 | 1.1939 | -0.1804 | |

| 0.41 | 18.91 | 1.1647 | -0.0951 | |

| 0.42 | 28.97 | 1.7844 | -0.0573 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2016-02-16 untuk tempoh pelaporan 2015-12-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BRK.B / Berkshire Hathaway Inc. | 0.73 | 0.14 | 96.19 | 1.40 | 5.9253 | 0.3968 | |||

| J / Jacobs Solutions Inc. | 2.24 | -1.20 | 93.89 | 10.73 | 5.7832 | 0.8420 | |||

| BA / The Boeing Company | 0.60 | -2.84 | 86.17 | 7.28 | 5.3079 | 0.6270 | |||

| PWR / Quanta Services, Inc. | 4.23 | 18.26 | 85.60 | -1.08 | 5.2729 | 0.2297 | |||

| AAPL / Apple Inc. | 0.76 | 2.79 | 79.72 | -1.89 | 4.9108 | 0.1752 | |||

| JPM / JPMorgan Chase & Co. | 1.04 | -2.83 | 68.67 | 5.23 | 4.2296 | 0.4270 | |||

| GM / General Motors Company | 1.77 | -2.44 | 60.31 | 10.53 | 3.7147 | 0.5352 | |||

| BAC / Bank of America Corporation | 3.57 | -2.25 | 60.15 | 5.59 | 3.7051 | 0.3855 | |||

| BK / The Bank of New York Mellon Corporation | 1.20 | -0.79 | 49.53 | 4.46 | 3.0509 | 0.2877 | |||

| KSS / Kohl's Corporation | 0.95 | 2.43 | 45.17 | 5.35 | 2.7823 | 0.2836 | |||

| WFC / Wells Fargo & Company | 0.82 | -0.60 | 44.80 | 5.23 | 2.7597 | 0.2786 | |||

| 19041P105 / CBS Corp. | 0.92 | -1.95 | 43.53 | 15.82 | 2.6813 | 0.4911 | |||

| BBBY / Bed Bath & Beyond, Inc. | 0.83 | -4.47 | 40.09 | -19.16 | 2.4694 | -0.4205 | |||

| HAL / Halliburton Company | 1.11 | -1.65 | 37.64 | -5.30 | 2.3186 | 0.0023 | |||

| JEF / Jefferies Financial Group Inc. | 2.13 | 41.94 | 37.10 | 21.83 | 2.2850 | 0.5106 | |||

| VMI / Valmont Industries, Inc. | 0.34 | -2.74 | 36.26 | 8.67 | 2.2333 | 0.2890 | |||

| GOOG / Alphabet Inc. | 0.05 | -2.27 | 35.35 | 21.90 | 2.1777 | 0.4875 | |||

| AON / Aon plc | 0.36 | -0.00 | 33.62 | 4.06 | 2.0706 | 0.1881 | |||

| CVS / CVS Health Corporation | 0.34 | -2.73 | 33.45 | -1.43 | 2.0605 | 0.0827 | |||

| UPS / United Parcel Service, Inc. | 0.34 | 0.11 | 33.11 | -2.38 | 2.0394 | 0.0629 | |||

| WMT / Walmart Inc. | 0.53 | 0.44 | 32.45 | -5.04 | 1.9987 | 0.0074 | |||

| DIS / The Walt Disney Company | 0.30 | -29.74 | 31.31 | -27.76 | 1.9284 | -0.5971 | |||

| ACN / Accenture plc | 0.29 | -23.79 | 30.58 | -65.50 | 1.8834 | -3.2813 | |||

| AIG / American International Group, Inc. | 0.49 | -54.93 | 30.42 | -50.85 | 1.8740 | -1.7332 | |||

| AXP / American Express Company | 0.42 | -2.30 | 28.97 | -8.34 | 1.7844 | -0.0573 | |||

| PCP / Precision Castparts Corporation | 0.12 | -8.40 | 27.26 | -7.48 | 1.6793 | -0.0379 | |||

| C / Citigroup Inc. | 0.52 | -2.91 | 27.07 | 1.27 | 1.6672 | 0.1097 | |||

| GLW / Corning Incorporated | 1.47 | -0.79 | 26.86 | 5.93 | 1.6544 | 0.1768 | |||

| KMX / CarMax, Inc. | 0.41 | 6.91 | 22.36 | -2.74 | 1.3776 | 0.0376 | |||

| KO / The Coca-Cola Company | 0.49 | -2.27 | 21.25 | 4.65 | 1.3091 | 0.1257 | |||

| GOOGL / Alphabet Inc. | 0.03 | -6.24 | 21.05 | 14.28 | 1.2966 | 0.2232 | |||

| AAL / American Airlines Group Inc. | 0.46 | -2.20 | 19.64 | 6.67 | 1.2096 | 0.1368 | |||

| HOG / Harley-Davidson, Inc. | 0.43 | -0.59 | 19.38 | -17.81 | 1.1939 | -0.1804 | |||

| BHI / Baker Hughes Inc. | 0.41 | -1.37 | 18.91 | -12.53 | 1.1647 | -0.0951 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.19 | -0.91 | 16.45 | 1.54 | 1.0133 | 0.0692 | |||

| FTI / TechnipFMC plc | 0.46 | 4.06 | 13.34 | -2.62 | 0.8216 | 0.0234 | |||

| SLB / Schlumberger Limited | 0.17 | -1.17 | 11.81 | -0.06 | 0.7275 | 0.0388 | |||

| 00B65Z9D7 / Noble Corporation plc | 0.74 | -10.42 | 7.76 | -13.38 | 0.4781 | -0.0441 | |||

| QCOM / QUALCOMM Incorporated | 0.10 | 17.73 | 5.12 | 9.53 | 0.3157 | 0.0430 | |||

| NKE / NIKE, Inc. | 0.08 | 93.89 | 4.99 | -1.46 | 0.3072 | 0.0123 | |||

| SPY / SPDR S&P 500 ETF | 0.02 | 154.49 | 4.35 | 170.73 | 0.2678 | 0.1742 | |||

| JNJ / Johnson & Johnson | 0.04 | -0.48 | 4.00 | 9.53 | 0.2463 | 0.0336 | |||

| UNP / Union Pacific Corporation | 0.05 | 1,427.62 | 3.94 | 1,250.68 | 0.2429 | 0.2259 | |||

| SPY / SPDR S&P 500 ETF | Put | 0.02 | -13.90 | 3.88 | -80.76 | 0.2391 | -0.9369 | ||

| MCD / McDonald's Corporation | 0.03 | -2.27 | 3.71 | 17.18 | 0.2286 | 0.0440 | |||

| ESV / Ensco plc | 0.23 | -7.26 | 3.50 | 1.36 | 0.2155 | 0.0144 | |||

| GE / General Electric Company | 0.11 | -0.43 | 3.38 | 22.98 | 0.2080 | 0.0480 | |||

| NEE / NextEra Energy, Inc. | 0.03 | -1.24 | 3.31 | 5.18 | 0.2038 | 0.0205 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | -20.00 | 3.17 | -18.93 | 0.1950 | -0.0326 | |||

| XOM / Exxon Mobil Corporation | 0.04 | -1.41 | 2.95 | 3.37 | 0.1815 | 0.0154 | |||

| GHY / PGIM Global High Yield Fund, Inc | 0.20 | 2.88 | 0.1774 | 0.1774 | |||||

| HD / The Home Depot, Inc. | 0.02 | -0.41 | 2.70 | 14.01 | 0.1664 | 0.0283 | |||

| PG / The Procter & Gamble Company | 0.03 | -1.17 | 2.68 | 9.08 | 0.1650 | 0.0219 | |||

| ABBV / AbbVie Inc. | 0.04 | -0.37 | 2.40 | 8.50 | 0.1478 | 0.0189 | |||

| ALL / The Allstate Corporation | 0.04 | -0.97 | 2.23 | 5.60 | 0.1372 | 0.0143 | |||

| ABT / Abbott Laboratories | 0.04 | -0.49 | 1.98 | 11.09 | 0.1222 | 0.0181 | |||

| PEP / PepsiCo, Inc. | 0.02 | 0.27 | 1.95 | 6.26 | 0.1202 | 0.0132 | |||

| ED / Consolidated Edison, Inc. | 0.03 | -0.66 | 1.92 | -4.53 | 0.1183 | 0.0011 | |||

| M / Macy's, Inc. | 0.05 | 1.89 | 0.1163 | 0.1163 | |||||

| VEU / Vanguard International Equity Index Funds - Vanguard FTSE All-World ex-US ETF | 0.04 | 9.70 | 1.68 | 11.72 | 0.1034 | 0.0158 | |||

| IBM / International Business Machines Corporation | 0.01 | -0.87 | 1.57 | -5.91 | 0.0970 | -0.0005 | |||

| ARDC / Ares Dynamic Credit Allocation Fund, Inc. | 0.12 | 1.56 | 0.0963 | 0.0963 | |||||

| ERC / Allspring Multi-Sector Income Fund | 0.13 | 1.50 | 0.0923 | 0.0923 | |||||

| BGH / Barings Global Short Duration High Yield Fund | 0.09 | 1.49 | 0.0920 | 0.0920 | |||||

| MIN / MFS Intermediate Income Trust | 0.31 | 1.41 | 0.0871 | 0.0871 | |||||

| DSU / BlackRock Debt Strategies Fund, Inc. | 0.42 | 1.41 | 0.0865 | 0.0865 | |||||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.01 | -35.67 | 1.40 | -32.02 | 0.0862 | -0.0338 | |||

| RTX / RTX Corporation | 0.01 | -1.39 | 1.39 | 6.44 | 0.0855 | 0.0095 | |||

| MCR / MFS Charter Income Trust | 0.18 | 1.38 | 0.0851 | 0.0851 | |||||

| FRA / BlackRock Floating Rate Income Strategies Fund, Inc. | 0.10 | 1.34 | 0.0827 | 0.0827 | |||||

| MMT / MFS Multimarket Income Trust | 0.22 | 1.19 | 0.0735 | 0.0735 | |||||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.04 | -11.79 | 1.18 | -12.83 | 0.0728 | -0.0062 | |||

| HIO / Western Asset High Income Opportunity Fund Inc. | 0.24 | 1.14 | 0.0704 | 0.0704 | |||||

| HTR / Brookfield Total Return Fund Inc. | 0.05 | 1.14 | 0.0703 | 0.0703 | |||||

| LLY / Eli Lilly and Company | 0.01 | 0.00 | 1.12 | 0.72 | 0.0693 | 0.0042 | |||

| LOV / Spark Networks SE - ADR | 0.28 | -16.08 | 1.09 | 12.19 | 0.0674 | 0.0106 | |||

| US9576671088 / Western Asset Variable Rate Strategic Fund Inc. | 0.06 | 1.02 | 0.0631 | 0.0631 | |||||

| TSI / TCW Strategic Income Fund, Inc. | 0.19 | 1.02 | 0.0631 | 0.0631 | |||||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -3.40 | 1.02 | 2.72 | 0.0628 | 0.0050 | |||

| DFS / Discover Financial Services | 0.02 | 0.00 | 1.01 | 3.15 | 0.0625 | 0.0052 | |||

| EVG / Eaton Vance Short Duration Diversified Income Fund | 0.07 | 0.99 | 0.0607 | 0.0607 | |||||

| CSCO / Cisco Systems, Inc. | 0.04 | 0.42 | 0.97 | 3.86 | 0.0596 | 0.0053 | |||

| CVX / Chevron Corporation | 0.01 | -3.59 | 0.97 | 10.01 | 0.0596 | 0.0083 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | 0.00 | 0.88 | 2.44 | 0.0543 | 0.0042 | |||

| MMM / 3M Company | 0.01 | -0.88 | 0.85 | 5.32 | 0.0524 | 0.0053 | |||

| OIH / VanEck ETF Trust - VanEck Oil Services ETF | 0.03 | 0.84 | 0.0518 | 0.0518 | |||||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.01 | 0.00 | 0.81 | 5.48 | 0.0498 | 0.0051 | |||

| MHY / Western Asset Managed High Income Fund. | 0.17 | 0.76 | 0.0471 | 0.0471 | |||||

| XHNWX / Pioneer Diversified High Income | 0.05 | 0.76 | 0.0465 | 0.0465 | |||||

| VCR / Vanguard World Fund - Vanguard Consumer Discretionary ETF | 0.01 | 0.72 | 0.0446 | 0.0446 | |||||

| PFE / Pfizer Inc. | 0.02 | -0.25 | 0.72 | 2.55 | 0.0445 | 0.0035 | |||

| WEC / WEC Energy Group, Inc. | 0.01 | 0.71 | 0.0437 | 0.0437 | |||||

| MAN / ManpowerGroup Inc. | 0.01 | 0.00 | 0.67 | 2.94 | 0.0410 | 0.0033 | |||

| ROST / Ross Stores, Inc. | 0.01 | -9.16 | 0.64 | 0.79 | 0.0394 | 0.0024 | |||

| MSFT / Microsoft Corporation | 0.01 | 1.07 | 0.61 | 26.78 | 0.0373 | 0.0095 | |||

| INTC / Intel Corporation | 0.02 | -1.18 | 0.58 | 12.89 | 0.0356 | 0.0058 | |||

| NOV / NOV Inc. | 0.02 | 0.55 | 0.0339 | 0.0339 | |||||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.01 | -0.88 | 0.52 | -4.26 | 0.0318 | 0.0004 | |||

| AMGN / Amgen Inc. | 0.00 | 1.11 | 0.52 | 18.62 | 0.0318 | 0.0064 | |||

| COP / ConocoPhillips | 0.01 | -15.16 | 0.49 | -17.51 | 0.0302 | -0.0044 | |||

| DE / Deere & Company | 0.01 | 132.15 | 0.49 | 139.02 | 0.0302 | 0.0182 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.01 | -3.96 | 0.44 | -1.56 | 0.0273 | 0.0011 | |||

| FDX / FedEx Corporation | 0.00 | 0.00 | 0.43 | 3.64 | 0.0263 | 0.0023 | |||

| CAT / Caterpillar Inc. | 0.01 | -9.29 | 0.42 | -5.61 | 0.0259 | -0.0001 | |||

| VZ / Verizon Communications Inc. | 0.01 | -54.79 | 0.42 | -52.01 | 0.0257 | -0.0250 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 0.00 | 0.41 | -0.72 | 0.0254 | 0.0012 | |||

| / Diamond Offshore Drilling Inc | 0.02 | -16.34 | 0.40 | 2.06 | 0.0245 | 0.0018 | |||

| DOW / Dow Inc. | 0.01 | 0.45 | 0.37 | 21.93 | 0.0226 | 0.0226 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | 5.38 | 0.36 | 8.06 | 0.0223 | 0.0028 | |||

| EMR / Emerson Electric Co. | 0.01 | -6.36 | 0.35 | 1.44 | 0.0217 | 0.0015 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | -2.58 | 0.33 | 2.46 | 0.0205 | 0.0016 | |||

| MRK / Merck & Co., Inc. | 0.01 | 3.13 | 0.33 | 10.51 | 0.0201 | 0.0029 | |||

| XRT / SPDR Series Trust - SPDR S&P Retail ETF | 0.01 | 0.33 | 0.0200 | 0.0200 | |||||

| KMB / Kimberly-Clark Corporation | 0.00 | -2.52 | 0.30 | 13.85 | 0.0182 | 0.0031 | |||

| T / AT&T Inc. | 0.01 | -7.29 | 0.28 | -1.78 | 0.0170 | 0.0006 | |||

| AEE / Ameren Corporation | 0.01 | -1.64 | 0.26 | 0.39 | 0.0160 | 0.0009 | |||

| PSX / Phillips 66 | 0.00 | -3.12 | 0.25 | 3.25 | 0.0156 | 0.0013 | |||

| TGT / Target Corporation | 0.00 | -15.56 | 0.23 | -21.93 | 0.0145 | -0.0031 | |||

| NTRS / Northern Trust Corporation | 0.00 | -1.09 | 0.23 | 4.59 | 0.0140 | 0.0013 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | 9.45 | 0.22 | 3.24 | 0.0137 | 0.0011 | |||

| CMCSA / Comcast Corporation | 0.00 | 0.22 | 0.0136 | 0.0136 | |||||

| MDT / Medtronic plc | 0.00 | 0.22 | 0.0134 | 0.0134 | |||||

| XISDX / Prudential Short Duration High | 0.01 | 0.20 | 0.0122 | 0.0122 | |||||

| BGT / BlackRock Floating Rate Income Trust | 0.02 | 0.20 | 0.0120 | 0.0120 | |||||

| EXPD / Expeditors International of Washington, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5348 | ||||

| VIAB / Viacom, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0107 | ||||

| OCN / Ocwen Financial Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0557 |