Statistik Asas

| Nilai Portfolio | $ 1,096,087,236 |

| Kedudukan Semasa | 28 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

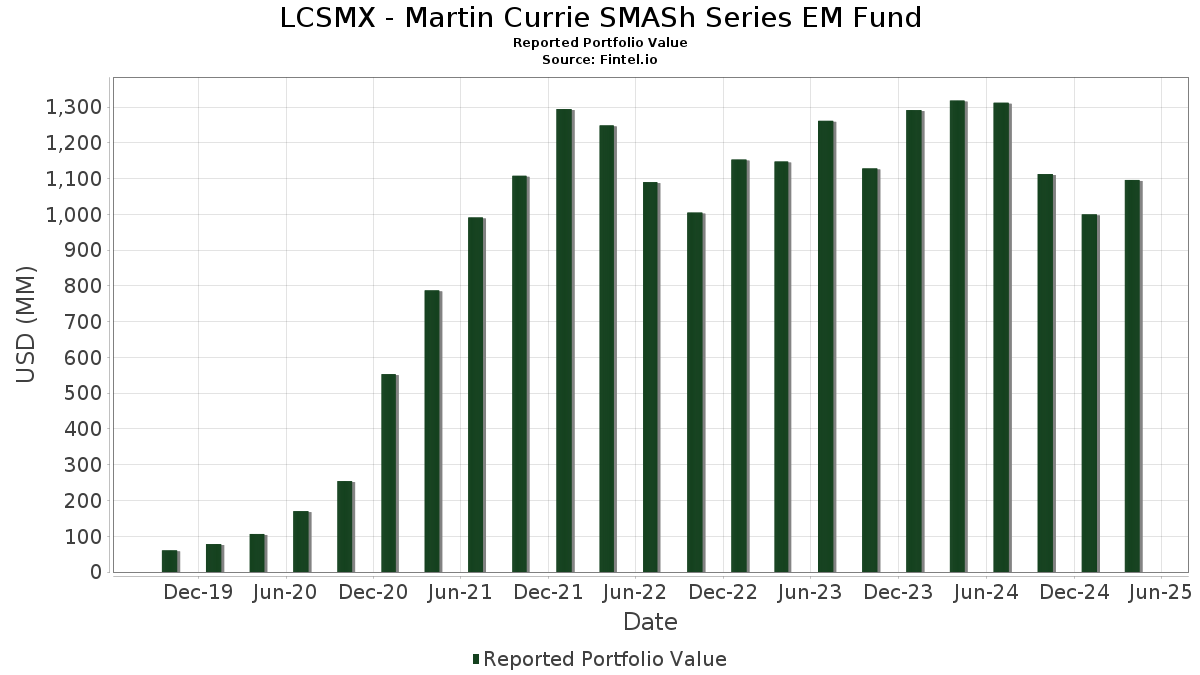

LCSMX - Martin Currie SMASh Series EM Fund telah mendedahkan 28 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,096,087,236 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas LCSMX - Martin Currie SMASh Series EM Fund ialah Reliance Industries Limited (IN:500325) , Samsung Electronics Co., Ltd. - Depositary Receipt (Common Stock) (GB:BC94) , Taiwan Semiconductor Manufacturing Company Limited (TW:2330) , Apollo Hospitals Enterprise Limited (IN:APOLLOHOSP) , and Titan Company Limited (IN:TITAN) . Kedudukan baharu LCSMX - Martin Currie SMASh Series EM Fund termasuk Taiwan Semiconductor Manufacturing Company Limited (TW:2330) , Mahindra & Mahindra Limited (IN:M&M) , Etihad Etisalat Co (SA:EEC) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.19 | 62.00 | 5.6207 | 5.6207 | |

| 1.31 | 45.29 | 4.1059 | 4.1059 | |

| 0.75 | 61.65 | 5.5896 | 2.0136 | |

| 40.55 | 40.55 | 3.6764 | 1.8073 | |

| 0.45 | 34.54 | 3.1310 | 1.7649 | |

| 0.86 | 14.46 | 1.3112 | 1.3112 | |

| 1.80 | 46.99 | 4.2598 | 0.5584 | |

| 4.46 | 74.13 | 6.7208 | 0.4694 | |

| 0.02 | 40.24 | 3.6478 | 0.4616 | |

| 12.76 | 29.97 | 2.7172 | 0.3562 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.45 | 55.82 | 5.0613 | -3.8411 | |

| 1.18 | 46.00 | 4.1706 | -2.7257 | |

| 1.41 | 30.97 | 2.8076 | -1.2427 | |

| 0.78 | 31.96 | 2.8974 | -0.8435 | |

| 2.34 | 24.52 | 2.2230 | -0.7558 | |

| 1.54 | 61.54 | 5.5793 | -0.6625 | |

| 2.15 | 55.73 | 5.0526 | -0.6609 | |

| 3.88 | 29.19 | 2.6462 | -0.5122 | |

| 1.25 | 40.00 | 3.6269 | -0.4988 | |

| 0.90 | 38.41 | 3.4827 | -0.3420 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-06-25 untuk tempoh pelaporan 2025-04-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 500325 / Reliance Industries Limited | 4.46 | 4.90 | 74.13 | 19.68 | 6.7208 | 0.4694 | |||

| BC94 / Samsung Electronics Co., Ltd. - Depositary Receipt (Common Stock) | 0.07 | 2.71 | 65.11 | 11.88 | 5.9029 | 0.0290 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 2.19 | 62.00 | 5.6207 | 5.6207 | |||||

| APOLLOHOSP / Apollo Hospitals Enterprise Limited | 0.75 | 65.12 | 61.65 | 74.01 | 5.5896 | 2.0136 | |||

| TITAN / Titan Company Limited | 1.54 | -0.05 | 61.54 | -0.49 | 5.5793 | -0.6625 | |||

| 000660 / SK hynix Inc. | 0.45 | -31.71 | 55.82 | -36.71 | 5.0613 | -3.8411 | |||

| RJHI / COMMON STOCK SAR10. | 2.15 | -0.05 | 55.73 | -1.55 | 5.0526 | -0.6609 | |||

| 500247 / Kotak Mahindra Bank Limited | 1.80 | 7.21 | 46.99 | 28.12 | 4.2598 | 0.5584 | |||

| 005930 / Samsung Electronics Co., Ltd. | 1.18 | -38.38 | 46.00 | -32.68 | 4.1706 | -2.7257 | |||

| M&M / Mahindra & Mahindra Limited | 1.31 | 45.29 | 4.1059 | 4.1059 | |||||

| Western Asset Institutional US Treasury Reserves / STIV (US52470G8419) | 40.55 | 118.98 | 40.55 | 118.98 | 3.6764 | 1.8073 | |||

| MELI / MercadoLibre, Inc. | 0.02 | 5.11 | 40.24 | 27.46 | 3.6478 | 0.4616 | |||

| 300750 / Contemporary Amperex Technology Co., Limited | 1.25 | 9.13 | 40.00 | -2.13 | 3.6269 | -0.4988 | |||

| UTCEM / UltraTech Cement Ltd | 0.28 | -0.05 | 39.16 | 4.15 | 3.5500 | -0.2445 | |||

| 2454 / MediaTek Inc. | 0.90 | 3.31 | 38.41 | 1.37 | 3.4827 | -0.3420 | |||

| 055550 / Shinhan Financial Group Co., Ltd. | 0.98 | 2.69 | 35.56 | 6.53 | 3.2238 | -0.1449 | |||

| SA1510P1UMH1 / DR SULAIMAN AL HABIB MEDICAL COMMON STOCK | 0.45 | 160.40 | 34.54 | 155.15 | 3.1310 | 1.7649 | |||

| 300124 / Shenzhen Inovance Technology Co.,Ltd | 3.43 | 2.69 | 33.73 | 21.40 | 3.0578 | 0.2537 | |||

| TCS / Tata Consultancy Services Limited | 0.78 | -0.05 | 31.96 | -13.78 | 2.8974 | -0.8435 | |||

| FG1 / Antofagasta plc | 1.41 | -25.44 | 30.97 | -22.83 | 2.8076 | -1.2427 | |||

| B3SA3 / B3 S.A. - Brasil, Bolsa, Balcão | 12.76 | 3.51 | 29.97 | 28.13 | 2.7172 | 0.3562 | |||

| 2382 / Quanta Computer Inc. | 3.88 | -1.57 | 29.19 | -6.73 | 2.6462 | -0.5122 | |||

| 2308 / Delta Electronics, Inc. | 2.34 | 3.31 | 24.52 | -16.92 | 2.2230 | -0.7558 | |||

| CNE100005576 / Eastroc Beverage Group Co. Ltd., Class A | 0.49 | 2.69 | 19.36 | 20.67 | 1.7549 | 0.1359 | |||

| 603605 / Proya Cosmetics Co.,Ltd. | 1.23 | 2.69 | 16.17 | 16.41 | 1.4662 | 0.0641 | |||

| EEC / Etihad Etisalat Co | 0.86 | 14.46 | 1.3112 | 1.3112 | |||||

| ODPV3 / Odontoprev S.A. | 7.59 | -0.05 | 14.28 | -2.29 | 1.2944 | -0.1804 | |||

| 300760 / Shenzhen Mindray Bio-Medical Electronics Co., Ltd. | 0.29 | 2.72 | 8.79 | -3.41 | 0.7966 | -0.1214 |