Statistik Asas

| Nilai Portfolio | $ 8,431,355,154 |

| Kedudukan Semasa | 65 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

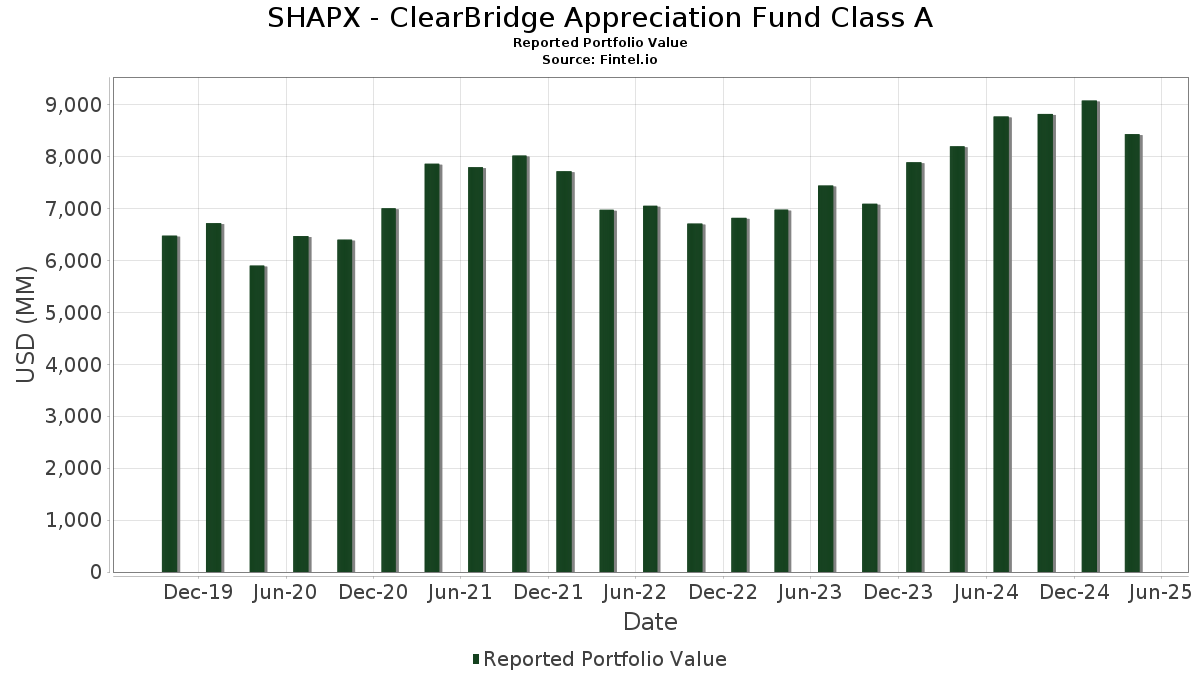

SHAPX - ClearBridge Appreciation Fund Class A telah mendedahkan 65 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 8,431,355,154 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas SHAPX - ClearBridge Appreciation Fund Class A ialah Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , NVIDIA Corporation (US:NVDA) , Amazon.com, Inc. (US:AMZN) , and Berkshire Hathaway Inc. (US:BRK.A) . Kedudukan baharu SHAPX - ClearBridge Appreciation Fund Class A termasuk McCormick & Company, Incorporated (US:MKC) , The Boeing Company (US:BA) , Workday, Inc. (US:WDAY) , WEC Energy Group, Inc. (US:WEC) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.09 | 83.49 | 0.9907 | 0.9907 | |

| 0.16 | 184.38 | 2.1878 | 0.8621 | |

| 0.25 | 46.38 | 0.5503 | 0.5503 | |

| 1.54 | 111.66 | 1.3249 | 0.5175 | |

| 0.17 | 42.49 | 0.5042 | 0.5042 | |

| 0.26 | 48.57 | 0.5763 | 0.4601 | |

| 1.07 | 205.23 | 2.4352 | 0.4430 | |

| 3.07 | 333.96 | 3.9628 | 0.4396 | |

| 0.53 | 119.59 | 1.4190 | 0.4201 | |

| 0.00 | 302.60 | 3.5907 | 0.4093 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.75 | 322.27 | 3.8241 | -0.8977 | |

| 1.89 | 401.56 | 4.7649 | -0.7368 | |

| 0.17 | 72.29 | 0.8578 | -0.5355 | |

| 0.94 | 149.68 | 1.7761 | -0.5188 | |

| 0.56 | 45.75 | 0.5428 | -0.4763 | |

| 0.52 | 83.10 | 0.9861 | -0.4356 | |

| 0.22 | 83.92 | 0.9958 | -0.4237 | |

| 0.25 | 33.71 | 0.4000 | -0.3887 | |

| 2.31 | 224.62 | 2.6653 | -0.3651 | |

| 0.53 | 45.17 | 0.5359 | -0.3205 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-06-25 untuk tempoh pelaporan 2025-04-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 1.68 | -0.78 | 664.02 | -5.51 | 7.8792 | 0.1369 | |||

| AAPL / Apple Inc. | 1.89 | -10.70 | 401.56 | -19.59 | 4.7649 | -0.7368 | |||

| NVDA / NVIDIA Corporation | 3.07 | 15.12 | 333.96 | 4.43 | 3.9628 | 0.4396 | |||

| AMZN / Amazon.com, Inc. | 1.75 | -3.09 | 322.27 | -24.81 | 3.8241 | -0.8977 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | -8.03 | 302.60 | 4.79 | 3.5907 | 0.4093 | |||

| META / Meta Platforms, Inc. | 0.51 | 27.02 | 281.77 | 1.19 | 3.3435 | 0.2756 | |||

| V / Visa Inc. | 0.77 | -4.27 | 267.06 | -3.23 | 3.1690 | 0.1285 | |||

| JPM / JPMorgan Chase & Co. | 1.07 | -0.78 | 262.04 | -9.20 | 3.1094 | -0.0700 | |||

| WMT / Walmart Inc. | 2.31 | -17.58 | 224.62 | -18.34 | 2.6653 | -0.3651 | |||

| AVGO / Broadcom Inc. | 1.07 | 30.47 | 205.23 | 13.49 | 2.4352 | 0.4430 | |||

| LLY / Eli Lilly and Company | 0.21 | -12.56 | 192.50 | -3.08 | 2.2842 | 0.0960 | |||

| TJX / The TJX Companies, Inc. | 1.47 | -10.40 | 188.52 | -7.60 | 2.2370 | -0.0108 | |||

| TRV / The Travelers Companies, Inc. | 0.71 | -0.78 | 187.38 | 6.89 | 2.2235 | 0.2921 | |||

| NFLX / Netflix, Inc. | 0.16 | 32.24 | 184.38 | 53.22 | 2.1878 | 0.8621 | |||

| BAC / Bank of America Corporation | 4.55 | -0.78 | 181.36 | -14.54 | 2.1521 | -0.1859 | |||

| ETN / Eaton Corporation plc | 0.52 | 15.16 | 154.12 | 3.85 | 1.8288 | 0.1937 | |||

| WM / Waste Management, Inc. | 0.64 | -0.78 | 149.81 | 5.12 | 1.7777 | 0.2076 | |||

| GOOGL / Alphabet Inc. | 0.94 | -7.68 | 149.68 | -28.14 | 1.7761 | -0.5188 | |||

| HON / Honeywell International Inc. | 0.71 | -0.78 | 149.44 | -6.64 | 1.7732 | 0.0097 | |||

| ADP / Automatic Data Processing, Inc. | 0.49 | -6.38 | 147.79 | -7.12 | 1.7536 | 0.0007 | |||

| JNJ / Johnson & Johnson | 0.82 | -0.78 | 127.84 | 1.93 | 1.5170 | 0.1352 | |||

| VMC / Vulcan Materials Company | 0.48 | 8.00 | 126.80 | 3.34 | 1.5046 | 0.1528 | |||

| PG / The Procter & Gamble Company | 0.75 | 21.52 | 122.72 | 19.01 | 1.4562 | 0.3202 | |||

| AMT / American Tower Corporation | 0.53 | 8.22 | 119.59 | 31.89 | 1.4190 | 0.4201 | |||

| XOM / Exxon Mobil Corporation | 1.11 | -0.78 | 117.52 | -1.90 | 1.3944 | 0.0748 | |||

| SNPS / Synopsys, Inc. | 0.26 | -0.78 | 117.08 | -13.33 | 1.3893 | -0.0990 | |||

| ABBV / AbbVie Inc. | 0.60 | -0.78 | 116.84 | 5.26 | 1.3865 | 0.1636 | |||

| DIS / The Walt Disney Company | 1.28 | 17.40 | 116.36 | -5.56 | 1.3807 | 0.0233 | |||

| KO / The Coca-Cola Company | 1.54 | 33.31 | 111.66 | 52.36 | 1.3249 | 0.5175 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.16 | -0.78 | 107.35 | -10.34 | 1.2737 | -0.0452 | |||

| ICE / Intercontinental Exchange, Inc. | 0.60 | -0.78 | 100.80 | 4.27 | 1.1961 | 0.1311 | |||

| RTX / RTX Corporation | 0.80 | -0.78 | 100.47 | -2.95 | 1.1922 | 0.0517 | |||

| UNH / UnitedHealth Group Incorporated | 0.24 | 18.86 | 99.43 | -9.86 | 1.1798 | -0.0353 | |||

| ETR / Entergy Corporation | 1.18 | 4.22 | 98.04 | 6.90 | 1.1634 | 0.1530 | |||

| LIN / Linde plc | 0.21 | -0.78 | 93.58 | 0.80 | 1.1104 | 0.0876 | |||

| US52470G4780 / WA Premier Institutional U.S. Treasury Reserves-Premium Shares | 89.85 | -24.40 | 89.85 | -24.40 | 1.0661 | -0.2432 | |||

| JTSXX / JPMorgan Trust I. - JPMorgan 100% U.S. Treasury Securities Money Market Fund Inst | 89.85 | -24.40 | 89.85 | -24.40 | 1.0661 | -0.2432 | |||

| ECL / Ecolab Inc. | 0.35 | -0.78 | 86.89 | -0.29 | 1.0310 | 0.0710 | |||

| KMI / Kinder Morgan, Inc. | 3.27 | -0.78 | 86.11 | -5.04 | 1.0218 | 0.0227 | |||

| EMR / Emerson Electric Co. | 0.81 | -0.78 | 85.18 | -19.75 | 1.0107 | -0.1586 | |||

| SYK / Stryker Corporation | 0.22 | -31.84 | 83.92 | -34.87 | 0.9958 | -0.4237 | |||

| MKC / McCormick & Company, Incorporated | 1.09 | 83.49 | 0.9907 | 0.9907 | |||||

| PGR / The Progressive Corporation | 0.30 | -0.78 | 83.17 | 13.43 | 0.9869 | 0.1791 | |||

| GOOG / Alphabet Inc. | 0.52 | -17.70 | 83.10 | -35.60 | 0.9861 | -0.4356 | |||

| ORCL / Oracle Corporation | 0.52 | -0.78 | 73.85 | -17.90 | 0.8763 | -0.1147 | |||

| SHW / The Sherwin-Williams Company | 0.21 | -0.78 | 72.42 | -2.23 | 0.8593 | 0.0433 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.17 | -20.36 | 72.29 | -42.84 | 0.8578 | -0.5355 | |||

| CCK / Crown Holdings, Inc. | 0.72 | -0.78 | 69.17 | 8.78 | 0.8208 | 0.1203 | |||

| TMUS / T-Mobile US, Inc. | 0.28 | 36.10 | 69.00 | 44.27 | 0.8188 | 0.2919 | |||

| CVX / Chevron Corporation | 0.43 | -25.70 | 58.83 | -32.24 | 0.6981 | -0.2584 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.46 | -0.78 | 54.01 | 17.76 | 0.6409 | 0.1356 | |||

| TSLA / Tesla, Inc. | 0.18 | 64.13 | 51.24 | 14.46 | 0.6080 | 0.1148 | |||

| PANW / Palo Alto Networks, Inc. | 0.26 | 483.91 | 48.57 | 498.23 | 0.5763 | 0.4601 | |||

| CME / CME Group Inc. | 0.17 | -11.15 | 47.26 | 4.08 | 0.5608 | 0.0605 | |||

| BA / The Boeing Company | 0.25 | 46.38 | 0.5503 | 0.5503 | |||||

| ANET / Arista Networks Inc | 0.56 | -30.73 | 45.75 | -50.55 | 0.5428 | -0.4763 | |||

| MRK / Merck & Co., Inc. | 0.53 | -32.61 | 45.17 | -41.90 | 0.5359 | -0.3205 | |||

| EQT / EQT Corporation | 0.89 | -25.06 | 44.22 | -27.52 | 0.5247 | -0.1475 | |||

| CP / Canadian Pacific Kansas City Limited | 0.60 | -0.78 | 43.42 | -9.67 | 0.5153 | -0.0143 | |||

| WDAY / Workday, Inc. | 0.17 | 42.49 | 0.5042 | 0.5042 | |||||

| UNP / Union Pacific Corporation | 0.18 | -0.78 | 39.60 | -13.65 | 0.4699 | -0.0353 | |||

| SBUX / Starbucks Corporation | 0.45 | 65.20 | 35.68 | 22.81 | 0.4234 | 0.1033 | |||

| PEP / PepsiCo, Inc. | 0.25 | -47.66 | 33.71 | -52.91 | 0.4000 | -0.3887 | |||

| WEC / WEC Energy Group, Inc. | 0.19 | 21.34 | 0.2532 | 0.2532 | |||||

| COP / ConocoPhillips | 0.22 | -42.61 | 19.18 | -48.25 | 0.2276 | -0.1808 |