Statistik Asas

| Nilai Portfolio | $ 446,725,645 |

| Kedudukan Semasa | 158 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

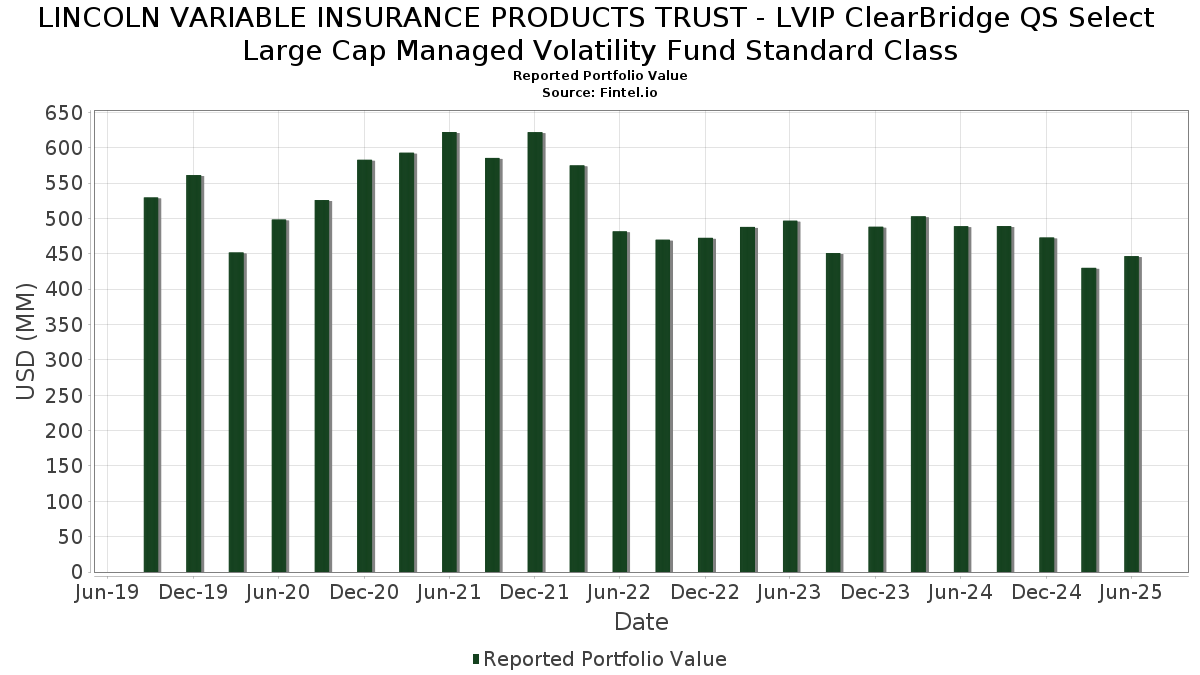

LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP ClearBridge QS Select Large Cap Managed Volatility Fund Standard Class telah mendedahkan 158 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 446,725,645 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP ClearBridge QS Select Large Cap Managed Volatility Fund Standard Class ialah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls (US:GVMXX) , and Meta Platforms, Inc. (US:META) . Kedudukan baharu LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP ClearBridge QS Select Large Cap Managed Volatility Fund Standard Class termasuk GS Connect S&P GSCI Enhanced Commodity Total Return ETN (US:GSCE) , Uber Technologies, Inc. (US:UBER) , VeriSign, Inc. (US:VRSN) , Tapestry, Inc. (US:TPR) , and Cencora, Inc. (US:COR) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.18 | 28.54 | 6.3792 | 1.9547 | |

| 0.07 | 34.15 | 7.6339 | 1.4177 | |

| 0.02 | 16.77 | 3.7493 | 0.8648 | |

| 0.04 | 10.86 | 2.4276 | 0.8273 | |

| 0.01 | 2.48 | 0.5547 | 0.5547 | |

| 0.01 | 8.83 | 1.9728 | 0.4938 | |

| 0.00 | 2.12 | 0.4747 | 0.4747 | |

| 0.02 | 1.71 | 0.3819 | 0.3819 | |

| 0.01 | 1.54 | 0.3449 | 0.2936 | |

| 0.00 | 1.13 | 0.2517 | 0.2517 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 18.97 | 18.97 | 4.2404 | -1.4410 | |

| 0.11 | 21.69 | 4.8477 | -0.7780 | |

| 0.00 | 0.68 | 0.1531 | -0.7274 | |

| 0.01 | 5.26 | 1.1756 | -0.4666 | |

| 0.00 | 0.00 | -0.3619 | ||

| 0.02 | 7.27 | 1.6256 | -0.3137 | |

| 0.03 | 5.20 | 1.1625 | -0.2325 | |

| 0.05 | 5.73 | 1.2803 | -0.2301 | |

| 0.00 | 0.00 | -0.2265 | ||

| 0.00 | 1.59 | 0.3557 | -0.2212 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-06 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.07 | -3.85 | 34.15 | 27.40 | 7.6339 | 1.4177 | |||

| NVDA / NVIDIA Corporation | 0.18 | 2.61 | 28.54 | 49.58 | 6.3792 | 1.9547 | |||

| AAPL / Apple Inc. | 0.11 | -3.22 | 21.69 | -10.61 | 4.8477 | -0.7780 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 18.97 | -22.57 | 18.97 | -22.57 | 4.2404 | -1.4410 | |||

| META / Meta Platforms, Inc. | 0.02 | 5.30 | 16.77 | 34.84 | 3.7493 | 0.8648 | |||

| AMZN / Amazon.com, Inc. | 0.07 | -11.12 | 15.58 | 2.49 | 3.4834 | -0.0424 | |||

| AVGO / Broadcom Inc. | 0.04 | -4.42 | 10.86 | 57.37 | 2.4276 | 0.8273 | |||

| JPM / JPMorgan Chase & Co. | 0.04 | -5.71 | 10.57 | 11.44 | 2.3622 | 0.1632 | |||

| NFLX / Netflix, Inc. | 0.01 | -3.64 | 8.83 | 38.38 | 1.9728 | 0.4938 | |||

| GOOGL / Alphabet Inc. | 0.05 | -4.75 | 8.47 | 8.55 | 1.8925 | 0.0839 | |||

| WMT / Walmart Inc. | 0.08 | -6.09 | 8.27 | 4.59 | 1.8479 | 0.0150 | |||

| V / Visa Inc. | 0.02 | -14.16 | 7.27 | -13.05 | 1.6256 | -0.3137 | |||

| GOOG / Alphabet Inc. | 0.04 | -8.18 | 6.63 | 4.25 | 1.4809 | 0.0072 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 6.56 | -8.71 | 1.4661 | -0.2002 | |||

| TJX / The TJX Companies, Inc. | 0.05 | -13.27 | 5.73 | -12.05 | 1.2803 | -0.2301 | |||

| BAC / Bank of America Corporation | 0.12 | -4.60 | 5.58 | 8.18 | 1.2474 | 0.0512 | |||

| PG / The Procter & Gamble Company | 0.03 | 16.13 | 5.37 | 8.55 | 1.2001 | 0.0533 | |||

| LLY / Eli Lilly and Company | 0.01 | -21.32 | 5.26 | -25.74 | 1.1756 | -0.4666 | |||

| ABBV / AbbVie Inc. | 0.03 | -2.42 | 5.20 | -13.56 | 1.1625 | -0.2325 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -1.11 | 4.50 | -9.80 | 1.0066 | -0.1511 | |||

| ETN / Eaton Corporation plc | 0.01 | -3.72 | 4.35 | 26.44 | 0.9729 | 0.1747 | |||

| JNJ / Johnson & Johnson | 0.03 | -3.63 | 4.33 | -11.25 | 0.9683 | -0.1634 | |||

| TRV / The Travelers Companies, Inc. | 0.02 | -8.17 | 4.24 | -7.08 | 0.9469 | -0.1105 | |||

| HON / Honeywell International Inc. | 0.02 | -3.68 | 3.92 | 5.91 | 0.8773 | 0.0181 | |||

| DIS / The Walt Disney Company | 0.03 | -3.64 | 3.70 | 21.07 | 0.8261 | 0.1182 | |||

| XOM / Exxon Mobil Corporation | 0.03 | -4.82 | 3.68 | -13.73 | 0.8233 | -0.1667 | |||

| TSLA / Tesla, Inc. | 0.01 | -3.09 | 3.61 | 18.79 | 0.8071 | 0.1022 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -9.67 | 3.54 | -8.84 | 0.7912 | -0.1090 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 11.84 | 3.44 | 35.29 | 0.7679 | 0.1790 | |||

| WM / Waste Management, Inc. | 0.01 | -3.69 | 3.42 | -4.82 | 0.7639 | -0.0687 | |||

| KO / The Coca-Cola Company | 0.05 | -10.32 | 3.33 | -11.41 | 0.7446 | -0.1274 | |||

| SNPS / Synopsys, Inc. | 0.01 | -3.88 | 3.04 | 14.91 | 0.6790 | 0.0660 | |||

| MA / Mastercard Incorporated | 0.01 | -2.37 | 2.96 | 0.10 | 0.6611 | -0.0241 | |||

| VMC / Vulcan Materials Company | 0.01 | -3.73 | 2.94 | 7.62 | 0.6567 | 0.0237 | |||

| EMR / Emerson Electric Co. | 0.02 | 9.78 | 2.88 | 33.52 | 0.6429 | 0.1433 | |||

| RTX / RTX Corporation | 0.02 | -3.68 | 2.71 | 6.19 | 0.6058 | 0.0139 | |||

| LIN / Linde plc | 0.01 | 14.86 | 2.70 | 15.74 | 0.6032 | 0.0625 | |||

| GE / General Electric Company | 0.01 | -8.12 | 2.63 | 18.16 | 0.5877 | 0.0717 | |||

| BA / The Boeing Company | 0.01 | 2.48 | 0.5547 | 0.5547 | |||||

| ICE / Intercontinental Exchange, Inc. | 0.01 | -11.62 | 2.43 | -6.00 | 0.5428 | -0.0563 | |||

| ETR / Entergy Corporation | 0.03 | 0.74 | 2.28 | -2.06 | 0.5096 | -0.0301 | |||

| CSCO / Cisco Systems, Inc. | 0.03 | -2.55 | 2.24 | 9.55 | 0.4999 | 0.0265 | |||

| CCK / Crown Holdings, Inc. | 0.02 | 24.80 | 2.22 | 43.98 | 0.4970 | 0.1389 | |||

| AMT / American Tower Corporation | 0.01 | -15.43 | 2.19 | -14.13 | 0.4890 | -0.1016 | |||

| WFC / Wells Fargo & Company | 0.03 | -4.36 | 2.18 | 6.75 | 0.4878 | 0.0137 | |||

| ECL / Ecolab Inc. | 0.01 | -3.80 | 2.16 | 2.27 | 0.4837 | -0.0071 | |||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.00 | 2.12 | 0.4747 | 0.4747 | |||||

| SYK / Stryker Corporation | 0.01 | -24.68 | 2.06 | -19.97 | 0.4606 | -0.1363 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 70.65 | 2.01 | 52.54 | 0.4491 | 0.1435 | |||

| ABT / Abbott Laboratories | 0.01 | -2.56 | 1.97 | -0.10 | 0.4402 | -0.0169 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -0.87 | 1.97 | 24.56 | 0.4400 | 0.0735 | |||

| PLTR / Palantir Technologies Inc. | 0.01 | 37.30 | 1.94 | 121.80 | 0.4345 | 0.2312 | |||

| KMI / Kinder Morgan, Inc. | 0.07 | -17.65 | 1.92 | -15.15 | 0.4296 | -0.0956 | |||

| MKC / McCormick & Company, Incorporated | 0.03 | -3.65 | 1.92 | -11.27 | 0.4296 | -0.0726 | |||

| C / Citigroup Inc. | 0.02 | -3.26 | 1.81 | 16.03 | 0.4047 | 0.0427 | |||

| T / AT&T Inc. | 0.06 | -8.91 | 1.80 | -6.77 | 0.4032 | -0.0455 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 33.59 | 1.75 | 49.19 | 0.3906 | 0.1509 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | -2.80 | 1.73 | 0.82 | 0.3856 | -0.0113 | |||

| UBER / Uber Technologies, Inc. | 0.02 | 1.71 | 0.3819 | 0.3819 | |||||

| GILD / Gilead Sciences, Inc. | 0.02 | 21.33 | 1.68 | 20.03 | 0.3766 | 0.0512 | |||

| BK / The Bank of New York Mellon Corporation | 0.02 | -10.40 | 1.68 | -2.67 | 0.3747 | -0.0247 | |||

| AMAT / Applied Materials, Inc. | 0.01 | -3.93 | 1.67 | 21.25 | 0.3725 | 0.0536 | |||

| SHW / The Sherwin-Williams Company | 0.00 | -3.94 | 1.64 | -5.52 | 0.3671 | -0.0361 | |||

| EME / EMCOR Group, Inc. | 0.00 | -1.13 | 1.63 | 43.11 | 0.3645 | 0.1002 | |||

| KR / The Kroger Co. | 0.02 | -2.71 | 1.62 | 3.12 | 0.3618 | -0.0023 | |||

| ADBE / Adobe Inc. | 0.00 | 32.61 | 1.61 | 33.83 | 0.3608 | 0.0810 | |||

| MO / Altria Group, Inc. | 0.03 | -1.11 | 1.61 | -3.37 | 0.3595 | -0.0266 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -21.50 | 1.59 | -36.05 | 0.3557 | -0.2212 | |||

| UGI / UGI Corporation | 0.04 | -8.85 | 1.57 | 0.38 | 0.3514 | -0.0118 | |||

| COST / Costco Wholesale Corporation | 0.00 | -14.94 | 1.57 | -10.97 | 0.3503 | -0.0579 | |||

| EXEL / Exelixis, Inc. | 0.04 | -16.21 | 1.55 | 0.00 | 0.3475 | -0.0129 | |||

| PANW / Palo Alto Networks, Inc. | 0.01 | 500.80 | 1.54 | 516.80 | 0.3449 | 0.2936 | |||

| MMM / 3M Company | 0.01 | -8.30 | 1.54 | -4.95 | 0.3433 | -0.0314 | |||

| R / Ryder System, Inc. | 0.01 | -3.47 | 1.51 | 6.71 | 0.3377 | 0.0094 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | -3.08 | 1.49 | -7.84 | 0.3339 | -0.0418 | |||

| PGR / The Progressive Corporation | 0.01 | -22.61 | 1.47 | -27.02 | 0.3284 | -0.1385 | |||

| MCK / McKesson Corporation | 0.00 | -37.64 | 1.45 | -7.59 | 0.3240 | 0.0038 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.01 | 65.13 | 1.45 | 22.21 | 0.3235 | 0.0890 | |||

| CVX / Chevron Corporation | 0.01 | -3.77 | 1.44 | -17.66 | 0.3212 | -0.0833 | |||

| PYPL / PayPal Holdings, Inc. | 0.02 | -7.62 | 1.41 | 5.23 | 0.3149 | 0.0044 | |||

| BMY / Bristol-Myers Squibb Company | 0.03 | -1.11 | 1.41 | -24.96 | 0.3146 | -0.1202 | |||

| NEM / Newmont Corporation | 0.02 | 46.75 | 1.39 | 34.85 | 0.3115 | 0.1457 | |||

| GM / General Motors Company | 0.03 | -1.11 | 1.38 | 3.52 | 0.3088 | -0.0008 | |||

| ORI / Old Republic International Corporation | 0.04 | -13.72 | 1.36 | -15.44 | 0.3037 | -0.0689 | |||

| DBX / Dropbox, Inc. | 0.05 | -1.11 | 1.34 | 5.86 | 0.2991 | 0.0061 | |||

| CF / CF Industries Holdings, Inc. | 0.01 | -2.56 | 1.34 | 14.69 | 0.2985 | 0.0285 | |||

| EOG / EOG Resources, Inc. | 0.01 | -3.07 | 1.33 | -9.60 | 0.2970 | -0.0438 | |||

| LNG / Cheniere Energy, Inc. | 0.01 | -5.52 | 1.33 | -0.60 | 0.2969 | -0.0129 | |||

| NRG / NRG Energy, Inc. | 0.01 | -9.05 | 1.33 | 53.00 | 0.2963 | 0.0954 | |||

| ORCL / Oracle Corporation | 0.01 | -52.32 | 1.32 | -25.45 | 0.2947 | -0.1153 | |||

| PEGA / Pegasystems Inc. | 0.02 | 93.33 | 1.32 | 50.51 | 0.2944 | 0.0915 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.01 | -1.11 | 1.28 | -1.84 | 0.2869 | -0.0162 | |||

| HD / The Home Depot, Inc. | 0.00 | -2.69 | 1.27 | -2.61 | 0.2841 | -0.0187 | |||

| FICO / Fair Isaac Corporation | 0.00 | -2.96 | 1.26 | -3.82 | 0.2815 | -0.0221 | |||

| MTG / MGIC Investment Corporation | 0.05 | -5.27 | 1.26 | 6.43 | 0.2813 | 0.0071 | |||

| INGR / Ingredion Incorporated | 0.01 | -5.95 | 1.26 | -5.64 | 0.2806 | -0.0280 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -8.32 | 1.24 | -4.97 | 0.2782 | -0.0254 | |||

| APP / AppLovin Corporation | 0.00 | -27.95 | 1.24 | -4.84 | 0.2772 | -0.0249 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | -9.32 | 1.23 | 15.77 | 0.2742 | 0.0286 | |||

| VIRT / Virtu Financial, Inc. | 0.03 | -3.08 | 1.23 | 13.94 | 0.2741 | 0.0244 | |||

| EQT / EQT Corporation | 0.02 | -3.67 | 1.22 | 5.19 | 0.2716 | 0.0036 | |||

| CL / Colgate-Palmolive Company | 0.01 | -7.59 | 1.20 | -10.38 | 0.2683 | -0.0422 | |||

| CME / CME Group Inc. | 0.00 | -14.16 | 1.19 | -10.80 | 0.2659 | -0.0434 | |||

| NOW / ServiceNow, Inc. | 0.00 | -22.93 | 1.19 | -0.50 | 0.2650 | -0.0112 | |||

| DOCU / DocuSign, Inc. | 0.01 | -7.24 | 1.16 | -11.24 | 0.2596 | -0.0438 | |||

| SWKS / Skyworks Solutions, Inc. | 0.02 | 309.45 | 1.16 | 158.71 | 0.2592 | 0.1675 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.01 | -3.75 | 1.16 | -9.06 | 0.2583 | -0.0363 | |||

| EBAY / eBay Inc. | 0.02 | -3.16 | 1.14 | 6.47 | 0.2539 | 0.0065 | |||

| VRSN / VeriSign, Inc. | 0.00 | 1.13 | 0.2517 | 0.2517 | |||||

| GAP / The Gap, Inc. | 0.05 | -4.61 | 1.11 | 0.91 | 0.2489 | -0.0069 | |||

| CP / Canadian Pacific Kansas City Limited | 0.01 | -3.71 | 1.10 | 8.69 | 0.2463 | 0.0113 | |||

| UTHR / United Therapeutics Corporation | 0.00 | -1.12 | 1.09 | -7.83 | 0.2447 | -0.0307 | |||

| GEN / Gen Digital Inc. | 0.04 | -7.61 | 1.09 | 2.36 | 0.2428 | -0.0033 | |||

| TPR / Tapestry, Inc. | 0.01 | 1.07 | 0.2395 | 0.2395 | |||||

| AMGN / Amgen Inc. | 0.00 | -3.19 | 1.07 | -13.23 | 0.2390 | -0.0468 | |||

| SEIC / SEI Investments Company | 0.01 | -1.10 | 1.05 | 14.57 | 0.2356 | 0.0221 | |||

| CSL / Carlisle Companies Incorporated | 0.00 | -9.05 | 1.05 | -0.28 | 0.2348 | -0.0094 | |||

| UAL / United Airlines Holdings, Inc. | 0.01 | -1.11 | 1.04 | 14.07 | 0.2322 | 0.0210 | |||

| FAST / Fastenal Company | 0.02 | 97.79 | 1.04 | 7.14 | 0.2316 | 0.0073 | |||

| COR / Cencora, Inc. | 0.00 | 1.01 | 0.2263 | 0.2263 | |||||

| TWLO / Twilio Inc. | 0.01 | -32.22 | 1.00 | -13.90 | 0.2229 | -0.0457 | |||

| EA / Electronic Arts Inc. | 0.01 | 25.23 | 0.99 | 38.30 | 0.2222 | 0.0556 | |||

| CRUS / Cirrus Logic, Inc. | 0.01 | -1.11 | 0.98 | 3.47 | 0.2201 | -0.0006 | |||

| UNP / Union Pacific Corporation | 0.00 | -3.99 | 0.97 | -6.56 | 0.2168 | -0.0237 | |||

| RNG / RingCentral, Inc. | 0.03 | -6.50 | 0.95 | 7.07 | 0.2133 | 0.0066 | |||

| CROX / Crocs, Inc. | 0.01 | 0.95 | 0.2129 | 0.2129 | |||||

| SBUX / Starbucks Corporation | 0.01 | -3.76 | 0.95 | -10.08 | 0.2115 | -0.0326 | |||

| VICI / VICI Properties Inc. | 0.03 | 0.93 | 0.2069 | 0.2069 | |||||

| G / Genpact Limited | 0.02 | 0.92 | 0.2053 | 0.2053 | |||||

| STLD / Steel Dynamics, Inc. | 0.01 | -3.75 | 0.90 | -1.53 | 0.2015 | -0.0107 | |||

| OVV / Ovintiv Inc. | 0.02 | -1.10 | 0.90 | -12.08 | 0.2002 | -0.0360 | |||

| STT / State Street Corporation | 0.01 | -1.11 | 0.83 | 17.47 | 0.1850 | 0.0216 | |||

| PPC / Pilgrim's Pride Corporation | 0.02 | -65.01 | 0.82 | -6.79 | 0.1843 | 0.0102 | |||

| FR / First Industrial Realty Trust, Inc. | 0.02 | -8.80 | 0.82 | -18.73 | 0.1826 | -0.0503 | |||

| AGO / Assured Guaranty Ltd. | 0.01 | -1.11 | 0.81 | -2.28 | 0.1822 | -0.0111 | |||

| ZM / Zoom Communications Inc. | 0.01 | -3.07 | 0.81 | 2.54 | 0.1807 | -0.0023 | |||

| LRCX / Lam Research Corporation | 0.01 | 286.55 | 0.79 | -53.92 | 0.1776 | -0.1742 | |||

| UNM / Unum Group | 0.01 | -4.04 | 0.79 | -4.80 | 0.1773 | -0.0160 | |||

| RS / Reliance, Inc. | 0.00 | -1.09 | 0.77 | 7.56 | 0.1718 | 0.0060 | |||

| BSX / Boston Scientific Corporation | 0.01 | -9.05 | 0.76 | -3.19 | 0.1696 | -0.0121 | |||

| AXS / AXIS Capital Holdings Limited | 0.01 | -9.30 | 0.73 | -6.14 | 0.1643 | -0.0171 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -69.72 | 0.68 | -81.99 | 0.1531 | -0.7274 | |||

| WU / The Western Union Company | 0.08 | -8.36 | 0.67 | -27.15 | 0.1495 | -0.0632 | |||

| PVH / PVH Corp. | 0.01 | -1.11 | 0.64 | 4.91 | 0.1435 | 0.0017 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | -1.12 | 0.62 | -10.49 | 0.1394 | -0.0220 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -9.50 | 0.59 | -25.19 | 0.1330 | -0.0512 | |||

| JAZZ / Jazz Pharmaceuticals plc | 0.01 | 11.96 | 0.59 | -1.33 | 0.1328 | 0.0136 | |||

| BLDR / Builders FirstSource, Inc. | 0.01 | -8.32 | 0.59 | -14.35 | 0.1308 | -0.0277 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | -47.89 | 0.58 | -33.56 | 0.1289 | -0.0722 | |||

| SMG / The Scotts Miracle-Gro Company | 0.01 | -51.13 | 0.56 | -41.24 | 0.1252 | -0.0959 | |||

| TAP / Molson Coors Beverage Company | 0.01 | -29.82 | 0.53 | -44.56 | 0.1186 | -0.1033 | |||

| CMCSA / Comcast Corporation | 0.01 | -31.29 | 0.50 | -33.55 | 0.1121 | -0.0629 | |||

| WEC / WEC Energy Group, Inc. | 0.00 | -3.99 | 0.47 | -8.14 | 0.1060 | -0.0138 | |||

| MEDP / Medpace Holdings, Inc. | 0.00 | -1.11 | 0.45 | 1.83 | 0.0997 | -0.0018 | |||

| S+P500 EMINI FUT SEP25 / DE (000000000) | 0.40 | 0.0883 | 0.0883 | ||||||

| LYFT / Lyft, Inc. | 0.02 | -70.12 | 0.26 | -49.32 | 0.0583 | -0.0467 | |||

| S+P MID 400 EMINI SEP25 / DE (000000000) | 0.01 | 0.0031 | 0.0031 | ||||||

| E-MINI RUSS 2000 SEP25 / DE (000000000) | 0.01 | 0.0017 | 0.0017 | ||||||

| SCCO / Southern Copper Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1916 | ||||

| DOCS / Doximity, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1321 | ||||

| SPG / Simon Property Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3619 | ||||

| US361ESC0496 / ESC GCI LIBERTY INC SR | 0.01 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| WDAY / Workday, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2265 |