Statistik Asas

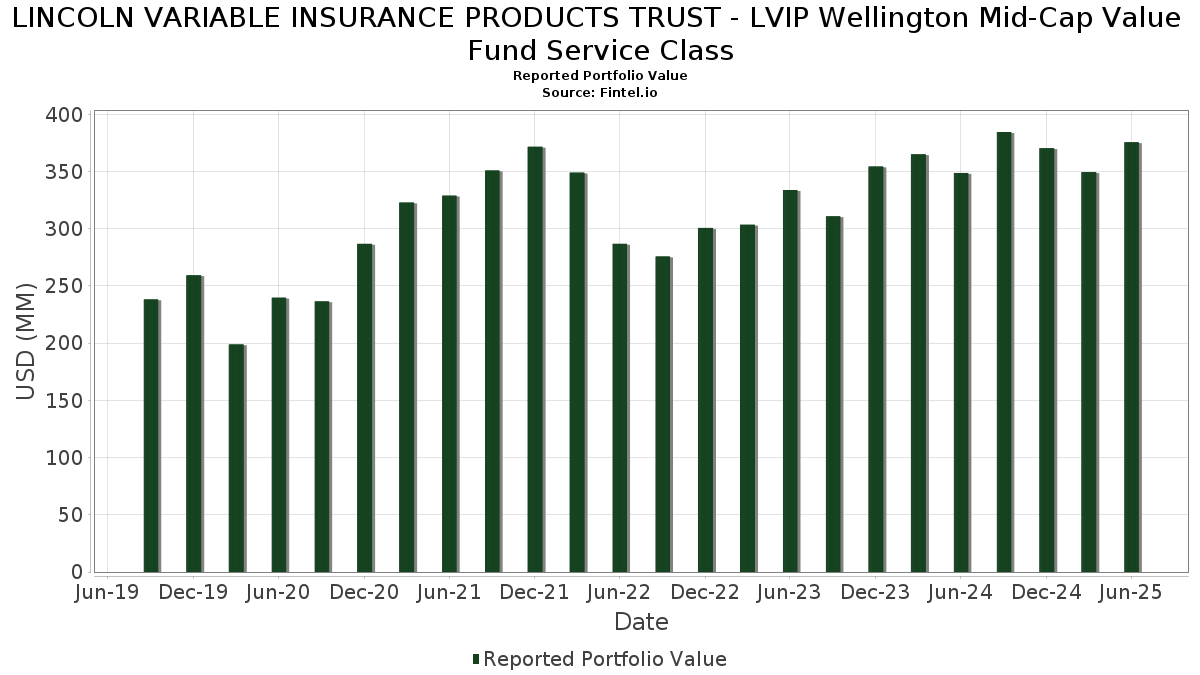

| Nilai Portfolio | $ 375,598,232 |

| Kedudukan Semasa | 89 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Wellington Mid-Cap Value Fund Service Class telah mendedahkan 89 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 375,598,232 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Wellington Mid-Cap Value Fund Service Class ialah Stifel Financial Corp. (US:SF) , US Foods Holding Corp. (US:USFD) , Synovus Financial Corp. (US:SNV) , Brixmor Property Group Inc. (US:BRX) , and Flex Ltd. (US:FLEX) . Kedudukan baharu LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP Wellington Mid-Cap Value Fund Service Class termasuk Silgan Holdings Inc. (DE:SL3) , CACI International Inc (US:CACI) , PTC Inc. (US:PTC) , Viavi Solutions Inc. (US:VIAV) , and Chesapeake Utilities Corporation (US:CPK) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.12 | 6.42 | 1.7069 | 1.7069 | |

| 0.01 | 5.64 | 1.4998 | 1.4998 | |

| 0.03 | 5.50 | 1.4645 | 1.4645 | |

| 0.37 | 3.74 | 0.9961 | 0.9961 | |

| 0.14 | 3.63 | 0.9664 | 0.9664 | |

| 0.14 | 6.81 | 1.8127 | 0.9488 | |

| 0.03 | 3.46 | 0.9203 | 0.9203 | |

| 0.06 | 5.39 | 1.4342 | 0.8706 | |

| 0.04 | 5.67 | 1.5088 | 0.7755 | |

| 0.02 | 2.70 | 0.7188 | 0.7188 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.9108 | ||

| 3.29 | 3.29 | 0.8760 | -1.7481 | |

| 0.00 | 0.00 | -1.5544 | ||

| 0.01 | 0.76 | 0.2029 | -1.2450 | |

| 0.02 | 1.80 | 0.4793 | -0.9824 | |

| 0.01 | 1.68 | 0.4474 | -0.8185 | |

| 0.00 | 0.00 | -0.7942 | ||

| 0.11 | 2.76 | 0.7355 | -0.7288 | |

| 0.05 | 3.44 | 0.9154 | -0.7116 | |

| 0.02 | 5.18 | 1.3793 | -0.6581 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-06 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SF / Stifel Financial Corp. | 0.07 | 22.67 | 7.51 | 35.08 | 1.9967 | 0.4081 | |||

| USFD / US Foods Holding Corp. | 0.09 | -2.43 | 6.93 | 14.79 | 1.8442 | 0.1177 | |||

| SNV / Synovus Financial Corp. | 0.13 | 18.16 | 6.86 | 30.83 | 1.8245 | 0.3259 | |||

| BRX / Brixmor Property Group Inc. | 0.26 | 3.05 | 6.82 | 1.07 | 1.8136 | -0.1147 | |||

| FLEX / Flex Ltd. | 0.14 | 49.41 | 6.81 | 125.52 | 1.8127 | 0.9488 | |||

| RS / Reliance, Inc. | 0.02 | -15.77 | 6.67 | -8.44 | 1.7733 | -0.3079 | |||

| AR / Antero Resources Corporation | 0.16 | 74.70 | 6.49 | 74.03 | 1.7276 | 0.6607 | |||

| CADE / Cadence Bank | 0.20 | 5.49 | 6.47 | 11.12 | 1.7202 | 0.0567 | |||

| VOYA / Voya Financial, Inc. | 0.09 | 15.74 | 6.46 | 21.26 | 1.7193 | 0.1958 | |||

| SL3 / Silgan Holdings Inc. | 0.12 | 6.42 | 1.7069 | 1.7069 | |||||

| SSB / SouthState Corporation | 0.07 | 2.25 | 6.37 | 1.37 | 1.6939 | -0.1016 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.03 | 26.31 | 6.35 | 23.96 | 1.6890 | 0.2248 | |||

| KMPR / Kemper Corporation | 0.10 | -3.69 | 6.26 | -7.02 | 1.6645 | -0.2592 | |||

| CPT / Camden Property Trust | 0.05 | -5.27 | 6.12 | -12.72 | 1.6292 | -0.3766 | |||

| R / Ryder System, Inc. | 0.04 | 99.97 | 5.67 | 121.18 | 1.5088 | 0.7755 | |||

| CACI / CACI International Inc | 0.01 | 5.64 | 1.4998 | 1.4998 | |||||

| WH / Wyndham Hotels & Resorts, Inc. | 0.07 | 74.33 | 5.53 | 56.42 | 1.4715 | 0.4606 | |||

| PTC / PTC Inc. | 0.03 | 5.50 | 1.4645 | 1.4645 | |||||

| JBTM / JBT Marel Corporation | 0.05 | 33.08 | 5.47 | 30.98 | 1.4545 | 0.2611 | |||

| WCC / WESCO International, Inc. | 0.03 | 38.80 | 5.45 | 65.53 | 1.4491 | 0.5084 | |||

| IR / Ingersoll Rand Inc. | 0.06 | 99.50 | 5.39 | 217.62 | 1.4342 | 0.8706 | |||

| MKSI / MKS Inc. | 0.05 | -1.89 | 5.36 | 21.62 | 1.4263 | 0.1661 | |||

| EPRT / Essential Properties Realty Trust, Inc. | 0.17 | -7.70 | 5.31 | -9.78 | 1.4140 | -0.2700 | |||

| TRU / TransUnion | 0.06 | 63.29 | 5.27 | 73.17 | 1.4012 | 0.5316 | |||

| MIDD / The Middleby Corporation | 0.04 | 13.21 | 5.25 | 7.26 | 1.3964 | -0.0025 | |||

| EG / Everest Group, Ltd. | 0.02 | -22.22 | 5.18 | -27.25 | 1.3793 | -0.6581 | |||

| BDC / Belden Inc. | 0.04 | 18.83 | 5.16 | 37.30 | 1.3731 | 0.2982 | |||

| AL / Air Lease Corporation | 0.09 | -22.73 | 5.13 | -6.44 | 1.3649 | -0.2029 | |||

| UMBF / UMB Financial Corporation | 0.05 | -11.36 | 5.08 | -7.80 | 1.3517 | -0.2238 | |||

| VVV / Valvoline Inc. | 0.13 | -9.34 | 5.05 | -1.73 | 1.3446 | -0.3439 | |||

| WBS / Webster Financial Corporation | 0.09 | -4.63 | 5.00 | 1.01 | 1.3305 | -0.0849 | |||

| DCO / Ducommun Incorporated | 0.06 | 15.39 | 4.97 | 64.30 | 1.3211 | 0.4570 | |||

| NGVT / Ingevity Corporation | 0.11 | 0.68 | 4.92 | 9.59 | 1.3078 | 0.0254 | |||

| IEX / IDEX Corporation | 0.03 | 3.77 | 4.84 | 0.69 | 1.2881 | -0.0868 | |||

| PRGS / Progress Software Corporation | 0.08 | 11.72 | 4.81 | 38.45 | 1.2809 | 0.2868 | |||

| COLB / Columbia Banking System, Inc. | 0.20 | 4.18 | 4.76 | -2.32 | 1.2669 | -0.1271 | |||

| FFIV / F5, Inc. | 0.02 | 1.47 | 4.66 | 12.17 | 1.2406 | 0.0520 | |||

| PRGO / Perrigo Company plc | 0.17 | -0.61 | 4.64 | -5.29 | 1.2349 | -0.1662 | |||

| DOX / Amdocs Limited | 0.05 | 15.71 | 4.47 | 36.48 | 1.1897 | 0.1936 | |||

| ABCB / Ameris Bancorp | 0.07 | 3.04 | 4.37 | 15.81 | 1.1617 | 0.0837 | |||

| FR / First Industrial Realty Trust, Inc. | 0.09 | 0.63 | 4.27 | -10.24 | 1.1356 | -0.2240 | |||

| ADS / Bread Financial Holdings Inc | 0.07 | 18.11 | 4.20 | 34.70 | 1.1187 | 0.2263 | |||

| ALGM / Allegro MicroSystems, Inc. | 0.12 | -2.57 | 4.14 | 32.55 | 1.1007 | 0.2084 | |||

| QGEN / Qiagen N.V. | 0.09 | -18.49 | 4.13 | -2.43 | 1.0990 | -0.1114 | |||

| SARO / StandardAero, Inc. | 0.13 | 51.25 | 4.13 | 79.70 | 1.0979 | 0.4413 | |||

| OSW / OneSpaWorld Holdings Limited | 0.20 | 16.58 | 4.02 | 41.59 | 1.0708 | 0.2581 | |||

| AHR / American Healthcare REIT, Inc. | 0.11 | 4.40 | 4.01 | 26.58 | 1.0681 | 0.1614 | |||

| BCC / Boise Cascade Company | 0.05 | 4.78 | 4.00 | -7.26 | 1.0645 | -0.1690 | |||

| CW / Curtiss-Wright Corporation | 0.01 | -33.60 | 3.98 | 2.23 | 1.0598 | -0.0540 | |||

| SGI / Somnigroup International Inc. | 0.06 | 30.89 | 3.97 | 48.76 | 1.0569 | 0.2934 | |||

| AVNT / Avient Corporation | 0.12 | 54.47 | 3.95 | 34.34 | 1.0502 | 0.2099 | |||

| VIAV / Viavi Solutions Inc. | 0.37 | 3.74 | 0.9961 | 0.9961 | |||||

| TPG / TPG Inc. | 0.07 | 8.18 | 3.71 | 19.63 | 0.9877 | 0.1005 | |||

| ICLR / ICON Public Limited Company | 0.03 | 127.47 | 3.65 | 89.11 | 0.9701 | 0.4187 | |||

| JHX / James Hardie Industries plc - Depositary Receipt (Common Stock) | 0.14 | 3.63 | 0.9664 | 0.9664 | |||||

| CARG / CarGurus, Inc. | 0.11 | 20.35 | 3.62 | 38.25 | 0.9628 | 0.2146 | |||

| SHOO / Steven Madden, Ltd. | 0.15 | 111.15 | 3.59 | 90.05 | 0.9553 | 0.4152 | |||

| ATMU / Atmus Filtration Technologies Inc. | 0.10 | 18.31 | 3.56 | 17.32 | 0.9465 | 0.0795 | |||

| SMPL / The Simply Good Foods Company | 0.11 | 30.50 | 3.47 | 19.54 | 0.9230 | 0.0932 | |||

| CPK / Chesapeake Utilities Corporation | 0.03 | 3.46 | 0.9203 | 0.9203 | |||||

| OGS / ONE Gas, Inc. | 0.05 | -36.40 | 3.44 | -39.55 | 0.9154 | -0.7116 | |||

| LIVN / LivaNova PLC | 0.07 | -0.59 | 3.35 | 13.92 | 0.8909 | 0.0507 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 3.29 | -64.13 | 3.29 | -64.13 | 0.8760 | -1.7481 | |||

| VNOM / Viper Energy, Inc. | 0.08 | -1.12 | 3.23 | -16.51 | 0.8601 | -0.2467 | |||

| MBUU / Malibu Boats, Inc. | 0.10 | 17.02 | 3.14 | 19.55 | 0.8364 | 0.0845 | |||

| FLR / Fluor Corporation | 0.06 | -7.52 | 3.13 | 32.35 | 0.8329 | 0.1568 | |||

| MOH / Molina Healthcare, Inc. | 0.01 | 15.99 | 3.08 | 4.91 | 0.8187 | -0.0200 | |||

| EVR / Evercore Inc. | 0.01 | 12.87 | 2.99 | 9.96 | 0.7963 | 0.0618 | |||

| CHRD / Chord Energy Corporation | 0.03 | -0.59 | 2.99 | -14.58 | 0.7949 | -0.2052 | |||

| FLS / Flowserve Corporation | 0.06 | -33.48 | 2.96 | -28.71 | 0.7864 | -0.3988 | |||

| MOGA / Moog, Inc. - Class A | 0.02 | -53.27 | 2.95 | 4.42 | 0.7855 | 0.0251 | |||

| AEG / Aegon Ltd. - Depositary Receipt (Common Stock) | 0.39 | -43.28 | 2.81 | -37.69 | 0.7465 | -0.5409 | |||

| CTRA / Coterra Energy Inc. | 0.11 | -38.54 | 2.76 | -46.03 | 0.7355 | -0.7288 | |||

| CCS / Century Communities, Inc. | 0.05 | 20.67 | 2.76 | 1.28 | 0.7345 | -0.0448 | |||

| BOOT / Boot Barn Holdings, Inc. | 0.02 | 2.70 | 0.7188 | 0.7188 | |||||

| AXTA / Axalta Coating Systems Ltd. | 0.09 | 79.09 | 2.66 | 60.25 | 0.7071 | 0.2331 | |||

| GT / The Goodyear Tire & Rubber Company | 0.25 | -16.22 | 2.58 | -5.97 | 0.6876 | -0.0982 | |||

| FIVE / Five Below, Inc. | 0.02 | -18.80 | 2.58 | 42.15 | 0.6866 | 0.1676 | |||

| HAYW / Hayward Holdings, Inc. | 0.17 | 2.39 | 0.6367 | 0.6367 | |||||

| PRAA / PRA Group, Inc. | 0.15 | 5.70 | 2.22 | -24.40 | 0.5904 | -0.2487 | |||

| ALLY / Ally Financial Inc. | 0.05 | 2.06 | 0.5469 | 0.5469 | |||||

| DEI / Douglas Emmett, Inc. | 0.13 | 4.30 | 1.97 | -1.99 | 0.5243 | -0.0504 | |||

| ACHC / Acadia Healthcare Company, Inc. | 0.09 | 11.33 | 1.93 | -16.68 | 0.5143 | -0.1490 | |||

| IDA / IDACORP, Inc. | 0.02 | -64.53 | 1.80 | -64.77 | 0.4793 | -0.9824 | |||

| EXE / Expand Energy Corporation | 0.01 | -63.84 | 1.68 | -62.03 | 0.4474 | -0.8185 | |||

| PEGA / Pegasystems Inc. | 0.03 | 5.93 | 1.63 | -17.53 | 0.4344 | -0.1316 | |||

| BRSL / Brightstar Lottery PLC | 0.10 | 6.57 | 1.56 | 3.67 | 0.4138 | -0.0153 | |||

| EVO / Evotec SE - Depositary Receipt (Common Stock) | 0.36 | -5.94 | 1.52 | 18.29 | 0.4044 | 0.0370 | |||

| EQT / EQT Corporation | 0.01 | -86.20 | 0.76 | -84.95 | 0.2029 | -1.2450 | |||

| GNTX / Gentex Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.7942 | ||||

| IWN / iShares Trust - iShares Russell 2000 Value ETF | 0.00 | -100.00 | 0.00 | -100.00 | -1.9108 | ||||

| FBHS / Fortune Brands Home & Security Inc | 0.00 | -100.00 | 0.00 | -100.00 | -1.5544 |