Statistik Asas

| Nilai Portfolio | $ 1,939,995,622 |

| Kedudukan Semasa | 44 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

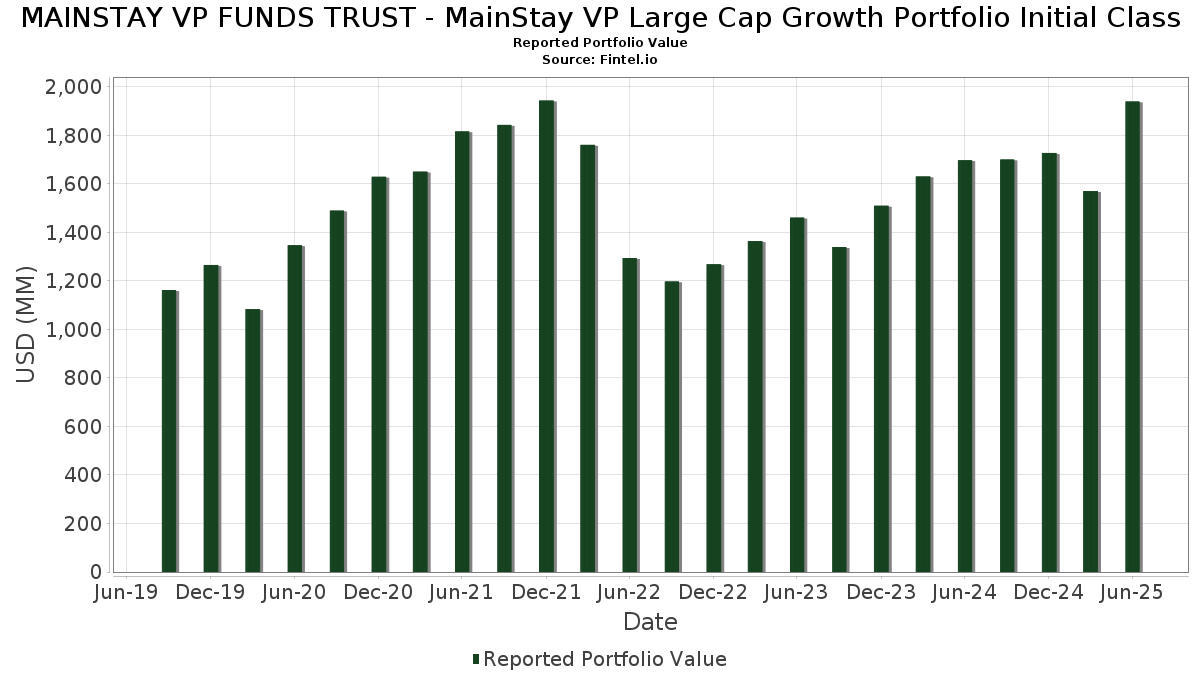

MAINSTAY VP FUNDS TRUST - MainStay VP Large Cap Growth Portfolio Initial Class telah mendedahkan 44 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,939,995,622 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas MAINSTAY VP FUNDS TRUST - MainStay VP Large Cap Growth Portfolio Initial Class ialah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Amazon.com, Inc. (US:AMZN) , Meta Platforms, Inc. (US:META) , and Broadcom Inc. (US:AVGO) . Kedudukan baharu MAINSTAY VP FUNDS TRUST - MainStay VP Large Cap Growth Portfolio Initial Class termasuk Vertiv Holdings Co (US:VRT) , Ares Management Corporation (US:ARES) , KLA Corporation (US:KLAC) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.22 | 49.63 | 2.5502 | 1.9181 | |

| 0.24 | 30.73 | 1.5790 | 1.5790 | |

| 0.06 | 49.23 | 2.5293 | 1.5584 | |

| 0.36 | 99.66 | 5.1207 | 1.2056 | |

| 0.93 | 147.18 | 7.5623 | 1.0599 | |

| 0.10 | 18.19 | 0.9344 | 0.9344 | |

| 0.14 | 30.93 | 1.5893 | 0.7557 | |

| 0.30 | 15.77 | 0.8103 | 0.7112 | |

| 0.04 | 54.50 | 2.8003 | 0.6615 | |

| 0.56 | 54.76 | 2.8136 | 0.6422 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.46 | 93.82 | 4.8204 | -1.2047 | |

| 0.08 | 19.82 | 1.0183 | -0.8515 | |

| 3.81 | 3.81 | 0.1958 | -0.7259 | |

| 0.10 | 21.60 | 1.1096 | -0.7238 | |

| 0.08 | 61.90 | 3.1802 | -0.7103 | |

| 0.58 | 127.67 | 6.5599 | -0.5708 | |

| 0.02 | 27.70 | 1.4230 | -0.5425 | |

| 0.06 | 20.10 | 1.0327 | -0.4370 | |

| 0.09 | 49.66 | 2.5516 | -0.4015 | |

| 0.11 | 20.72 | 1.0646 | -0.3364 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-25 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.38 | -0.99 | 188.24 | 31.19 | 9.6720 | 0.5095 | |||

| NVDA / NVIDIA Corporation | 0.93 | -0.85 | 147.18 | 44.53 | 7.5623 | 1.0599 | |||

| AMZN / Amazon.com, Inc. | 0.58 | -0.85 | 127.67 | 14.33 | 6.5599 | -0.5708 | |||

| META / Meta Platforms, Inc. | 0.14 | -1.97 | 106.31 | 25.53 | 5.4624 | 0.0547 | |||

| AVGO / Broadcom Inc. | 0.36 | -1.27 | 99.66 | 62.55 | 5.1207 | 1.2056 | |||

| AAPL / Apple Inc. | 0.46 | 7.65 | 93.82 | -0.57 | 4.8204 | -1.2047 | |||

| LLY / Eli Lilly and Company | 0.08 | 7.63 | 61.90 | 1.59 | 3.1802 | -0.7103 | |||

| V / Visa Inc. | 0.16 | 48.50 | 55.82 | 50.45 | 2.8681 | 0.4989 | |||

| LRCX / Lam Research Corporation | 0.56 | 20.27 | 54.76 | 61.03 | 2.8136 | 0.6422 | |||

| NFLX / Netflix, Inc. | 0.04 | 13.31 | 54.50 | 62.71 | 2.8003 | 0.6615 | |||

| SPF / Spotify Technology S.A. | 0.07 | -13.94 | 50.43 | 20.06 | 2.5913 | -0.0911 | |||

| MA / Mastercard Incorporated | 0.09 | 4.74 | 49.66 | 7.38 | 2.5516 | -0.4015 | |||

| SNOW / Snowflake Inc. | 0.22 | 212.89 | 49.63 | 353.48 | 2.5502 | 1.9181 | |||

| INTU / Intuit Inc. | 0.06 | 133.64 | 49.23 | 192.79 | 2.5293 | 1.5584 | |||

| ISRG / Intuitive Surgical, Inc. | 0.09 | 20.57 | 48.57 | 32.29 | 2.4957 | 0.1512 | |||

| NOW / ServiceNow, Inc. | 0.04 | 0.60 | 43.11 | 29.91 | 2.2148 | 0.0960 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.71 | 27.43 | 39.61 | 42.51 | 2.0350 | 0.2604 | |||

| BKNG / Booking Holdings Inc. | 0.01 | 5.67 | 34.52 | 32.79 | 1.7737 | 0.1137 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.12 | 64.08 | 31.60 | 92.06 | 1.6238 | 0.5730 | |||

| TSLA / Tesla, Inc. | 0.10 | -7.30 | 31.12 | 13.63 | 1.5991 | -0.1498 | |||

| ORCL / Oracle Corporation | 0.14 | 51.53 | 30.93 | 136.96 | 1.5893 | 0.7557 | |||

| VRT / Vertiv Holdings Co | 0.24 | 30.73 | 1.5790 | 1.5790 | |||||

| DASH / DoorDash, Inc. | 0.12 | 5.15 | 29.42 | 41.81 | 1.5116 | 0.1869 | |||

| LPLA / LPL Financial Holdings Inc. | 0.08 | -5.60 | 28.42 | 8.20 | 1.4604 | -0.2170 | |||

| ALNY / Alnylam Pharmaceuticals, Inc. | 0.09 | 4.53 | 28.05 | 26.24 | 1.4413 | 0.0224 | |||

| FICO / Fair Isaac Corporation | 0.02 | -9.23 | 27.70 | -10.02 | 1.4230 | -0.5425 | |||

| SYK / Stryker Corporation | 0.07 | 4.73 | 27.51 | 11.31 | 1.4136 | -0.1647 | |||

| 2IS / Trane Technologies plc | 0.06 | 4.82 | 25.99 | 36.08 | 1.3353 | 0.1158 | |||

| WDAY / Workday, Inc. | 0.10 | 4.81 | 23.33 | 7.71 | 1.1988 | -0.1843 | |||

| TXN / Texas Instruments Incorporated | 0.11 | 15.59 | 22.10 | 33.56 | 1.1356 | 0.0789 | |||

| AXON / Axon Enterprise, Inc. | 0.03 | 62.15 | 21.88 | 155.27 | 1.1243 | 0.5769 | |||

| CTAS / Cintas Corporation | 0.10 | -30.64 | 21.60 | -24.78 | 1.1096 | -0.7238 | |||

| ECL / Ecolab Inc. | 0.08 | 30.96 | 21.36 | 39.19 | 1.0974 | 0.1175 | |||

| HWM / Howmet Aerospace Inc. | 0.11 | -34.18 | 20.72 | -5.57 | 1.0646 | -0.3364 | |||

| DHR / Danaher Corporation | 0.10 | 4.85 | 20.42 | 1.03 | 1.0493 | -0.2414 | |||

| 3EC / Eaton Corporation plc | 0.06 | -26.58 | 20.10 | -21.03 | 1.0327 | -0.4370 | |||

| GE / General Electric Company | 0.08 | -47.37 | 19.82 | -32.32 | 1.0183 | -0.8515 | |||

| SHOP / Shopify Inc. | 0.16 | 1.38 | 18.94 | 22.49 | 0.9729 | -0.0143 | |||

| ARES / Ares Management Corporation | 0.10 | 18.19 | 0.9344 | 0.9344 | |||||

| AJG / Arthur J. Gallagher & Co. | 0.05 | 4.79 | 17.15 | -2.83 | 0.8814 | -0.2459 | |||

| PLTR / Palantir Technologies Inc. | 0.12 | 4.68 | 16.98 | 69.08 | 0.8725 | 0.2312 | |||

| CH1134540470 / On Holding AG | 0.30 | 400.00 | 15.77 | 764.16 | 0.8103 | 0.7112 | |||

| KLAC / KLA Corporation | 0.01 | 11.73 | 0.6029 | 0.6029 | |||||

| 56064L488 / MainStay US Government Liquidity Fund | 3.81 | -73.60 | 3.81 | -73.60 | 0.1958 | -0.7259 |