Statistik Asas

| Nilai Portfolio | $ 647,343,413 |

| Kedudukan Semasa | 69 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

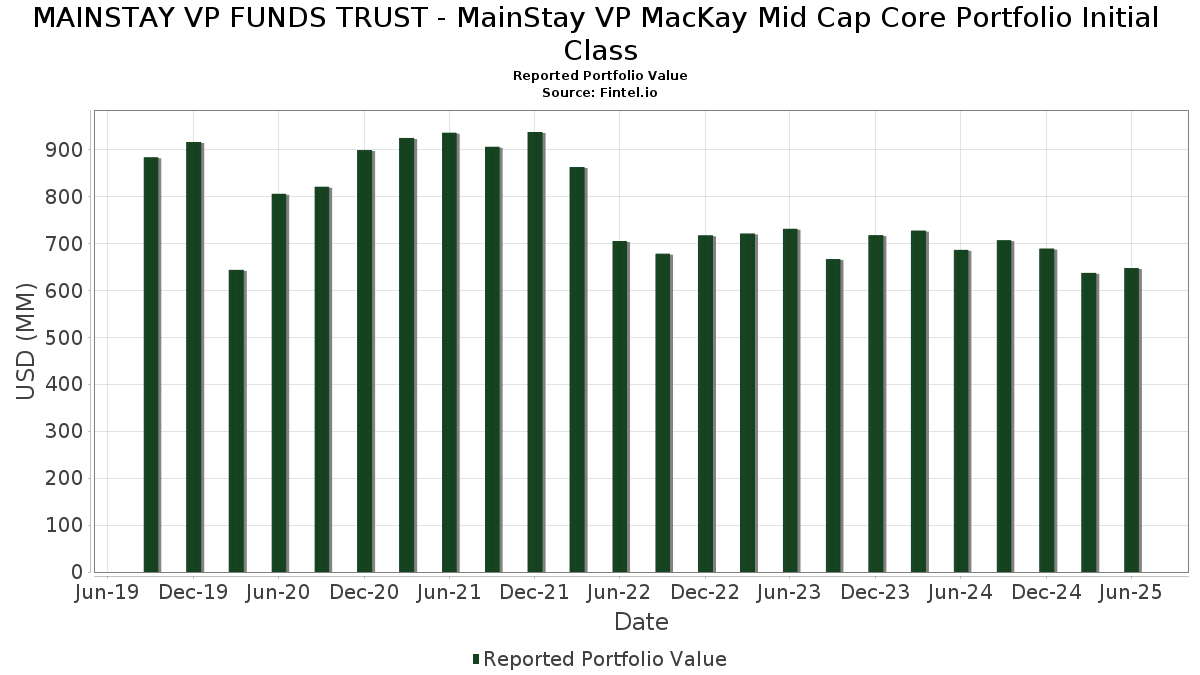

MAINSTAY VP FUNDS TRUST - MainStay VP MacKay Mid Cap Core Portfolio Initial Class telah mendedahkan 69 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 647,343,413 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas MAINSTAY VP FUNDS TRUST - MainStay VP MacKay Mid Cap Core Portfolio Initial Class ialah Aramark (US:ARMK) , MainStay US Government Liquidity Fund (US:56064L488) , BWX Technologies, Inc. (US:BWXT) , Rentokil Initial - ADR (US:RTOKY) , and Arthur J. Gallagher & Co. (US:AJG) . Kedudukan baharu MAINSTAY VP FUNDS TRUST - MainStay VP MacKay Mid Cap Core Portfolio Initial Class termasuk Flutter Entertainment plc (US:FLUT) , The Trade Desk, Inc. (US:TTD) , TechnipFMC plc (CH:FTI) , The Estée Lauder Companies Inc. (US:EL) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 10.15 | 1.5630 | 1.5630 | |

| 0.04 | 9.12 | 1.4045 | 1.4045 | |

| 0.04 | 10.46 | 1.6115 | 1.1364 | |

| 0.08 | 6.01 | 0.9265 | 0.9265 | |

| 0.09 | 11.44 | 1.7629 | 0.9180 | |

| 0.15 | 5.20 | 0.8008 | 0.8008 | |

| 0.06 | 4.91 | 0.7566 | 0.7566 | |

| 0.14 | 12.34 | 1.9001 | 0.7346 | |

| 0.14 | 7.89 | 1.2155 | 0.6839 | |

| 0.13 | 9.89 | 1.5237 | 0.6224 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.24 | 7.33 | 1.1292 | -0.8123 | |

| 0.13 | 4.67 | 0.7201 | -0.7756 | |

| 0.10 | 6.54 | 1.0071 | -0.7343 | |

| 0.06 | 12.59 | 1.9397 | -0.6683 | |

| 0.12 | 8.92 | 1.3735 | -0.6656 | |

| 0.02 | 7.63 | 1.1746 | -0.6022 | |

| 0.11 | 10.10 | 1.5555 | -0.5999 | |

| 0.14 | 8.82 | 1.3583 | -0.5553 | |

| 0.05 | 9.31 | 1.4334 | -0.4982 | |

| 0.12 | 9.00 | 1.3862 | -0.4387 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-25 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ARMK / Aramark | 0.37 | -25.08 | 15.49 | -9.12 | 2.3864 | -0.2882 | |||

| 56064L488 / MainStay US Government Liquidity Fund | 15.31 | 23.39 | 15.31 | 23.39 | 2.3578 | 0.4115 | |||

| BWXT / BWX Technologies, Inc. | 0.10 | -5.72 | 15.03 | 37.68 | 2.3154 | 0.6026 | |||

| RTOKY / Rentokil Initial - ADR | 0.60 | -0.67 | 14.40 | 4.11 | 2.2186 | 0.0480 | |||

| AJG / Arthur J. Gallagher & Co. | 0.04 | -5.87 | 12.96 | -12.72 | 1.9965 | -0.3334 | |||

| AIZ / Assurant, Inc. | 0.06 | -19.54 | 12.59 | -24.25 | 1.9397 | -0.6683 | |||

| COHR / Coherent Corp. | 0.14 | 20.87 | 12.34 | 66.06 | 1.9001 | 0.7346 | |||

| HXL / Hexcel Corporation | 0.22 | 6.05 | 12.31 | 9.40 | 1.8964 | 0.1308 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.06 | -0.67 | 11.98 | 0.07 | 1.8457 | -0.0329 | |||

| AEE / Ameren Corporation | 0.12 | -0.67 | 11.76 | -4.98 | 1.8116 | -0.1302 | |||

| VRSK / Verisk Analytics, Inc. | 0.04 | -12.46 | 11.49 | -8.38 | 1.7698 | -0.1977 | |||

| TWLO / Twilio Inc. | 0.09 | 67.32 | 11.44 | 112.52 | 1.7629 | 0.9180 | |||

| DOV / Dover Corporation | 0.06 | 22.17 | 11.35 | 27.42 | 1.7489 | 0.3510 | |||

| ATR / AptarGroup, Inc. | 0.07 | -12.56 | 11.35 | -7.81 | 1.7481 | -0.1833 | |||

| MASI / Masimo Corporation | 0.07 | 10.54 | 11.34 | 11.63 | 1.7467 | 0.1529 | |||

| VRSN / VeriSign, Inc. | 0.04 | -5.63 | 11.08 | 7.35 | 1.7074 | 0.0875 | |||

| EXAS / Exact Sciences Corporation | 0.21 | 5.17 | 11.06 | 29.10 | 1.7040 | 0.3597 | |||

| EPAM / EPAM Systems, Inc. | 0.06 | 11.00 | 10.99 | 16.25 | 1.6932 | 0.2097 | |||

| PTC / PTC Inc. | 0.06 | 14.48 | 10.78 | 27.33 | 1.6608 | 0.3323 | |||

| WST / West Pharmaceutical Services, Inc. | 0.05 | 7.21 | 10.56 | 4.77 | 1.6273 | 0.0454 | |||

| TDY / Teledyne Technologies Incorporated | 0.02 | -6.77 | 10.53 | -4.04 | 1.6221 | -0.0995 | |||

| EVR / Evercore Inc. | 0.04 | 16.22 | 10.46 | 138.24 | 1.6115 | 1.1364 | |||

| RL / Ralph Lauren Corporation | 0.04 | -0.67 | 10.46 | 23.43 | 1.6114 | 0.2817 | |||

| CIEN / Ciena Corporation | 0.13 | 6.29 | 10.43 | 43.06 | 1.6062 | 0.4626 | |||

| FLUT / Flutter Entertainment plc | 0.04 | 10.15 | 1.5630 | 1.5630 | |||||

| AOS / Amdocs Limited | 0.11 | -26.29 | 10.10 | -26.50 | 1.5555 | -0.5999 | |||

| RJF / Raymond James Financial, Inc. | 0.07 | 9.15 | 10.10 | 20.51 | 1.5554 | 0.2409 | |||

| ZBRA / Zebra Technologies Corporation | 0.03 | 5.61 | 9.96 | 15.26 | 1.5349 | 0.1785 | |||

| EHC / Encompass Health Corporation | 0.08 | -27.34 | 9.90 | -12.02 | 1.5256 | -0.2405 | |||

| MRVL / Marvell Technology, Inc. | 0.13 | 36.96 | 9.89 | 72.17 | 1.5237 | 0.6224 | |||

| MORN / Morningstar, Inc. | 0.03 | 48.58 | 9.87 | 55.55 | 1.5197 | 0.5246 | |||

| COO / The Cooper Companies, Inc. | 0.14 | 12.46 | 9.75 | -5.13 | 1.5021 | -0.1105 | |||

| IEX / IDEX Corporation | 0.05 | 3.05 | 9.63 | -0.02 | 1.4838 | -0.0279 | |||

| BURL / Burlington Stores, Inc. | 0.04 | 7.07 | 9.47 | 4.52 | 1.4583 | 0.0371 | |||

| WCN / Waste Connections, Inc. | 0.05 | -20.99 | 9.31 | -24.42 | 1.4334 | -0.4982 | |||

| SBAC / SBA Communications Corporation | 0.04 | 9.12 | 1.4045 | 1.4045 | |||||

| LDOS / Leidos Holdings, Inc. | 0.06 | 16.30 | 9.05 | 35.97 | 1.3947 | 0.3499 | |||

| MKC / McCormick & Company, Incorporated | 0.12 | -16.01 | 9.00 | -22.64 | 1.3862 | -0.4387 | |||

| WMS / Advanced Drainage Systems, Inc. | 0.08 | -16.01 | 8.97 | -11.21 | 1.3819 | -0.2034 | |||

| CHDN / Churchill Downs Incorporated | 0.09 | -4.31 | 8.94 | -12.98 | 1.3770 | -0.2347 | |||

| DLB / Dolby Laboratories, Inc. | 0.12 | -25.81 | 8.92 | -31.39 | 1.3735 | -0.6656 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.04 | -24.45 | 8.92 | -11.47 | 1.3733 | -0.2068 | |||

| VTR / Ventas, Inc. | 0.14 | -21.28 | 8.82 | -27.71 | 1.3583 | -0.5553 | |||

| EXLS / ExlService Holdings, Inc. | 0.19 | -10.80 | 8.47 | -11.99 | 1.3046 | -0.0937 | |||

| BRX / Brixmor Property Group Inc. | 0.32 | -0.67 | 8.45 | -2.57 | 1.3012 | -0.0591 | |||

| FANG / Diamondback Energy, Inc. | 0.06 | 15.62 | 8.42 | -0.64 | 1.2974 | -0.0325 | |||

| RRX / Regal Rexnord Corporation | 0.06 | -24.74 | 8.30 | -4.17 | 1.2790 | -0.0804 | |||

| CMS / CMS Energy Corporation | 0.12 | -8.49 | 8.23 | -15.59 | 1.2670 | -0.2618 | |||

| LNT / Alliant Energy Corporation | 0.14 | -0.67 | 8.22 | -6.66 | 1.2655 | -0.1153 | |||

| MAS / Masco Corporation | 0.13 | -6.14 | 8.13 | -13.13 | 1.2520 | -0.2159 | |||

| 2IS / Trane Technologies plc | 0.02 | -14.90 | 8.10 | 10.48 | 1.2472 | 0.0974 | |||

| CBSH / Commerce Bancshares, Inc. | 0.13 | -9.03 | 8.00 | -9.12 | 1.2317 | -0.1487 | |||

| PSTG / Pure Storage, Inc. | 0.14 | 79.05 | 7.89 | 132.88 | 1.2155 | 0.6839 | |||

| CTRA / Coterra Energy Inc. | 0.31 | -9.28 | 7.89 | -20.33 | 1.2147 | -0.3381 | |||

| CHE / Chemed Corporation | 0.02 | -14.91 | 7.63 | -32.67 | 1.1746 | -0.6022 | |||

| MKTX / MarketAxess Holdings Inc. | 0.03 | -25.78 | 7.47 | -23.38 | 1.1514 | -0.3792 | |||

| MTCH / Match Group, Inc. | 0.24 | -40.17 | 7.33 | -40.76 | 1.1292 | -0.8123 | |||

| HSY / The Hershey Company | 0.04 | -18.92 | 6.75 | -21.33 | 1.0392 | -0.3063 | |||

| RYAN / Ryan Specialty Holdings, Inc. | 0.10 | -36.00 | 6.54 | -41.10 | 1.0071 | -0.7343 | |||

| UMBF / UMB Financial Corporation | 0.06 | -0.67 | 6.44 | 3.32 | 0.9920 | 0.0141 | |||

| ENTG / Entegris, Inc. | 0.08 | -15.64 | 6.37 | -22.22 | 0.9811 | -0.3038 | |||

| LAMR / Lamar Advertising Company | 0.05 | -27.21 | 6.14 | -22.36 | 0.9453 | -0.2948 | |||

| TTD / The Trade Desk, Inc. | 0.08 | 6.01 | 0.9265 | 0.9265 | |||||

| RHI / Robert Half Inc. | 0.14 | -0.67 | 5.89 | -25.25 | 0.9077 | -0.3291 | |||

| FTI / TechnipFMC plc | 0.15 | 5.20 | 0.8008 | 0.8008 | |||||

| TFX / Teleflex Incorporated | 0.04 | -0.67 | 4.93 | -14.92 | 0.7589 | -0.1496 | |||

| EL / The Estée Lauder Companies Inc. | 0.06 | 4.91 | 0.7566 | 0.7566 | |||||

| AMH / American Homes 4 Rent | 0.13 | -52.89 | 4.67 | -54.59 | 0.7201 | -0.7756 | |||

| WLK / Westlake Corporation | 0.05 | -0.67 | 3.62 | -24.59 | 0.5583 | -0.1958 |