Statistik Asas

| Nilai Portfolio | $ 297,000,236 |

| Kedudukan Semasa | 46 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

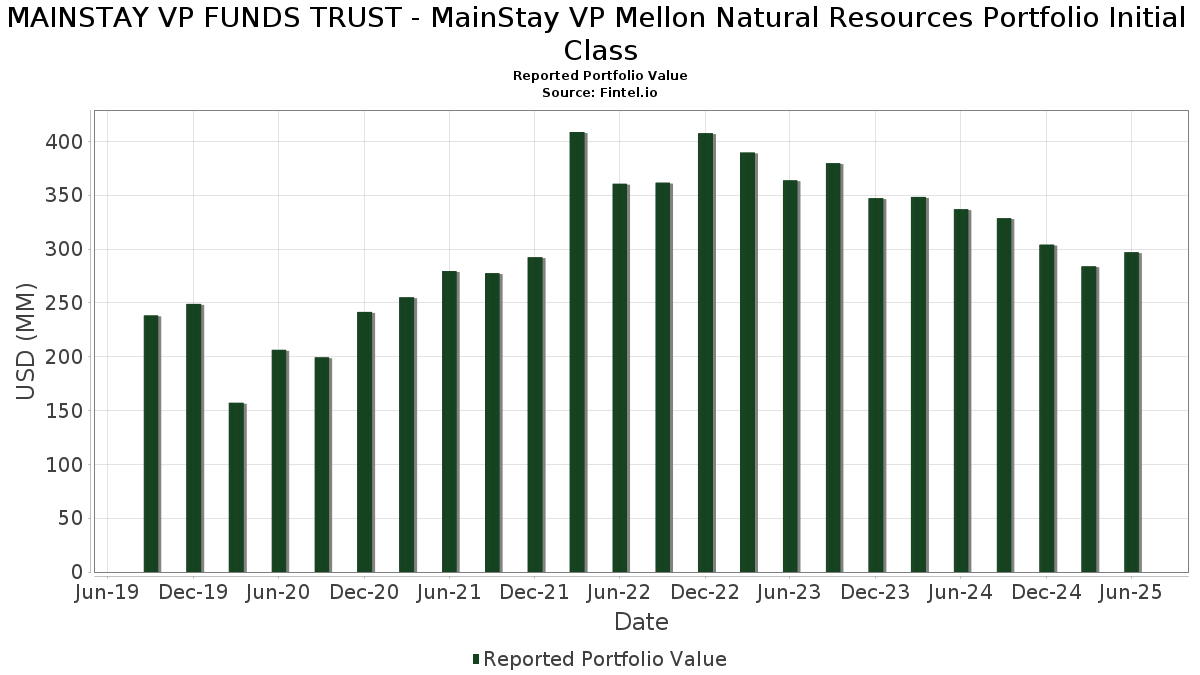

MAINSTAY VP FUNDS TRUST - MainStay VP Mellon Natural Resources Portfolio Initial Class telah mendedahkan 46 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 297,000,236 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas MAINSTAY VP FUNDS TRUST - MainStay VP Mellon Natural Resources Portfolio Initial Class ialah Phillips 66 (US:PSX) , International Paper Company (US:IP) , Freeport-McMoRan Inc. (US:FCX) , Darling Ingredients Inc. (US:DAR) , and Suncor Energy Inc. (US:SU) . Kedudukan baharu MAINSTAY VP FUNDS TRUST - MainStay VP Mellon Natural Resources Portfolio Initial Class termasuk Repsol, S.A. (ES:REP) , Packaging Corporation of America (US:PKG) , Hudbay Minerals Inc. (US:HBM) , Valterra Platinum Limited (DE:RPHA) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.35 | 10.47 | 3.6481 | 3.6481 | |

| 0.22 | 8.11 | 2.8264 | 1.9419 | |

| 0.01 | 4.43 | 1.5441 | 1.5441 | |

| 0.30 | 4.36 | 1.5178 | 1.5178 | |

| 0.02 | 3.50 | 1.2211 | 1.2211 | |

| 0.09 | 10.32 | 3.5983 | 1.1660 | |

| 0.29 | 3.06 | 1.0659 | 1.0659 | |

| 0.12 | 3.54 | 1.2320 | 0.9725 | |

| 5.52 | 5.52 | 1.9230 | 0.8565 | |

| 0.09 | 7.94 | 2.7666 | 0.7231 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -4.4077 | ||

| 0.63 | 8.57 | 2.9879 | -1.6762 | |

| 0.05 | 2.13 | 0.7441 | -1.5597 | |

| 0.84 | 7.24 | 2.5241 | -1.4478 | |

| 0.04 | 4.09 | 1.4246 | -1.4154 | |

| 0.02 | 3.17 | 1.1054 | -1.1493 | |

| 0.35 | 11.13 | 3.8792 | -1.0020 | |

| 0.11 | 11.36 | 3.9605 | -0.7872 | |

| 0.08 | 11.30 | 3.9379 | -0.7677 | |

| 0.27 | 11.72 | 4.0829 | -0.7391 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-25 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PSX / Phillips 66 | 0.11 | 0.58 | 12.61 | -2.82 | 4.3951 | -0.2495 | |||

| IP / International Paper Company | 0.25 | 0.00 | 11.77 | -12.22 | 4.1003 | -0.6967 | |||

| FCX / Freeport-McMoRan Inc. | 0.27 | -24.06 | 11.72 | -13.05 | 4.0829 | -0.7391 | |||

| DAR / Darling Ingredients Inc. | 0.31 | -10.89 | 11.59 | 8.22 | 4.0402 | 0.2063 | |||

| SU / Suncor Energy Inc. | 0.31 | 2.34 | 11.42 | -1.02 | 3.9816 | -0.1492 | |||

| XOM / Exxon Mobil Corporation | 0.11 | -52.62 | 11.36 | -13.17 | 3.9605 | -0.7872 | |||

| FANG / Diamondback Energy, Inc. | 0.08 | 0.00 | 11.30 | -14.06 | 3.9379 | -0.7677 | |||

| CNQ / Canadian Natural Resources Limited | 0.35 | -20.10 | 11.13 | -18.39 | 3.8792 | -1.0020 | |||

| MT / ArcelorMittal S.A. - Depositary Receipt (Common Stock) | 0.35 | -3.91 | 11.08 | 5.18 | 3.8624 | 0.0915 | |||

| AAL / Anglo American plc | 0.35 | 10.47 | 3.6481 | 3.6481 | |||||

| EXE / Expand Energy Corporation | 0.09 | 44.62 | 10.32 | 51.91 | 3.5983 | 1.1660 | |||

| CSCCF / Capstone Copper Corp. | 1.64 | -19.62 | 10.08 | -4.17 | 3.5123 | -0.2515 | |||

| MPC / Marathon Petroleum Corporation | 0.06 | 8.89 | 9.89 | 24.15 | 3.4468 | 0.5958 | |||

| PR / Permian Resources Corporation | 0.63 | -33.10 | 8.57 | -34.22 | 2.9879 | -1.6762 | |||

| RIO / Rio Tinto Group | 0.15 | 8.28 | 8.47 | 5.53 | 2.9536 | 0.0796 | |||

| MEOH / Methanex Corporation | 0.25 | 25.27 | 8.12 | 18.16 | 2.8300 | 0.3705 | |||

| MOS / The Mosaic Company | 0.22 | 133.51 | 8.11 | 162.43 | 2.8264 | 1.9419 | |||

| COP / ConocoPhillips | 0.09 | 62.70 | 7.94 | 39.04 | 2.7666 | 0.7231 | |||

| CTVA / Corteva, Inc. | 0.10 | -28.73 | 7.55 | -9.66 | 2.6315 | 0.0747 | |||

| CRGY / Crescent Energy Company | 0.84 | -14.71 | 7.24 | -34.74 | 2.5241 | -1.4478 | |||

| TECK / Teck Resources Limited | 0.18 | 0.00 | 7.16 | 10.84 | 2.4938 | 0.1834 | |||

| Smurfit WestRock plc / EC (IE00028FXN24) | 0.16 | -16.93 | 6.90 | -20.45 | 2.4062 | -0.7000 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 5.93 | 26.97 | 5.93 | 26.97 | 2.0657 | 0.3949 | |||

| CCK / Crown Holdings, Inc. | 0.06 | -24.66 | 5.71 | -13.07 | 1.9904 | -0.3613 | |||

| 56064L488 / MainStay US Government Liquidity Fund | 5.52 | 85.17 | 5.52 | 85.20 | 1.9230 | 0.8565 | |||

| EQT / EQT Corporation | 0.08 | -28.64 | 4.78 | -22.12 | 1.6655 | -0.5302 | |||

| GEV / GE Vernova Inc. | 0.01 | 4.43 | 1.5441 | 1.5441 | |||||

| REP / Repsol, S.A. | 0.30 | 4.36 | 1.5178 | 1.5178 | |||||

| CF / CF Industries Holdings, Inc. | 0.04 | -56.24 | 4.09 | -48.49 | 1.4246 | -1.4154 | |||

| AMCR / Amcor plc | 0.43 | 18.21 | 3.96 | 12.02 | 1.3804 | 0.1147 | |||

| AGCO / AGCO Corporation | 0.04 | -25.93 | 3.94 | -17.47 | 1.3719 | -0.3349 | |||

| NUE / Nucor Corporation | 0.03 | -11.09 | 3.66 | -4.31 | 1.2759 | -0.0932 | |||

| CCJ / Cameco Corporation | 0.05 | -51.58 | 3.64 | -12.66 | 1.2696 | -0.2234 | |||

| PAAS / Pan American Silver Corp. | 0.12 | 343.45 | 3.54 | 387.59 | 1.2320 | 0.9725 | |||

| PKG / Packaging Corporation of America | 0.02 | 3.50 | 1.2211 | 1.2211 | |||||

| VLO / Valero Energy Corporation | 0.02 | -56.77 | 3.17 | -56.97 | 1.1054 | -1.1493 | |||

| IMPUY / Impala Platinum Holdings Limited - Depositary Receipt (Common Stock) | 0.35 | -33.90 | 3.17 | -13.59 | 1.1036 | -0.2080 | |||

| HBM / Hudbay Minerals Inc. | 0.29 | 3.06 | 1.0659 | 1.0659 | |||||

| DE / Deere & Company | 0.01 | 53.56 | 2.75 | 66.40 | 0.9582 | 0.3667 | |||

| VG / Venture Global, Inc. | 0.15 | 0.00 | 2.40 | 51.23 | 0.8357 | 0.2683 | |||

| AR / Antero Resources Corporation | 0.05 | -66.70 | 2.13 | -66.85 | 0.7441 | -1.5597 | |||

| TFDXX / Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class | 2.00 | 2.00 | 0.6970 | 0.6970 | |||||

| IVPAF / Ivanhoe Mines Ltd. | 0.25 | 81.51 | 1.90 | 60.59 | 0.6606 | 0.2381 | |||

| RPHA / Valterra Platinum Limited | 0.04 | 1.64 | 0.5705 | 0.5705 | |||||

| MP / MP Materials Corp. | 0.04 | 1.48 | 0.5142 | 0.5142 | |||||

| FRO / Frontline plc | 0.09 | 0.00 | 1.45 | 10.47 | 0.5042 | 0.0356 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -4.4077 |