Statistik Asas

| Nilai Portfolio | $ 25,630,234 |

| Kedudukan Semasa | 79 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

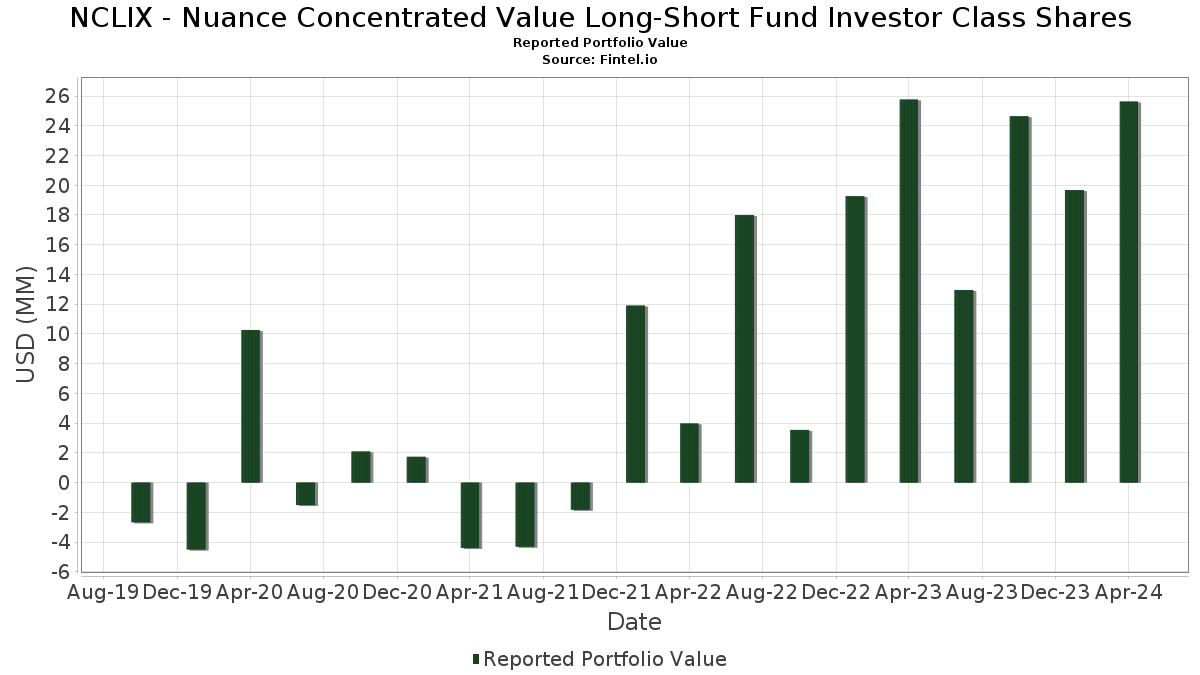

NCLIX - Nuance Concentrated Value Long-Short Fund Investor Class Shares telah mendedahkan 79 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 25,630,234 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas NCLIX - Nuance Concentrated Value Long-Short Fund Investor Class Shares ialah Henkel AG & Co. KGaA - Depositary Receipt (Common Stock) (US:HENKY) , 3M Company (US:MMM) , First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , DENTSPLY SIRONA Inc. (US:XRAY) , and Kimberly-Clark Corporation (US:KMB) . Kedudukan baharu NCLIX - Nuance Concentrated Value Long-Short Fund Investor Class Shares termasuk Solventum Corporation (US:SOLV) , IDACORP, Inc. (US:IDA) , Globe Life Inc. (US:GL) , American Water Works Company, Inc. (US:AWK) , and Hologic, Inc. (US:HOLX) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 8.80 | 8.80 | 8.7245 | 3.2137 | |

| 0.13 | 5.55 | 5.4960 | 2.6144 | |

| 0.04 | 2.29 | 2.2694 | 2.2694 | |

| 0.02 | 2.25 | 2.2315 | 2.2315 | |

| 0.00 | 0.00 | 1.7567 | ||

| 0.06 | 2.92 | 2.8964 | 1.3684 | |

| -0.01 | -0.74 | -0.7308 | 1.2183 | |

| -0.02 | -0.67 | -0.6630 | 1.2179 | |

| -0.01 | -0.69 | -0.6819 | 1.1431 | |

| -0.01 | -0.74 | -0.7310 | 1.0709 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 1.15 | 1.1367 | -2.2886 | |

| -0.03 | -3.70 | -3.6618 | -1.8045 | |

| -0.01 | -3.43 | -3.3993 | -1.5079 | |

| 0.00 | 0.75 | 0.7408 | -1.4184 | |

| -0.02 | -3.53 | -3.4936 | -1.4152 | |

| 0.10 | 9.24 | 9.1594 | -1.4107 | |

| 0.01 | 0.77 | 0.7619 | -1.1677 | |

| 0.01 | 0.96 | 0.9489 | -1.0359 | |

| 0.08 | 1.45 | 1.4359 | -1.0281 | |

| 0.27 | 8.02 | 7.9456 | -0.9108 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2024-06-18 untuk tempoh pelaporan 2024-04-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HENKY / Henkel AG & Co. KGaA - Depositary Receipt (Common Stock) | 0.54 | -18.70 | 9.66 | -14.27 | 9.5715 | 0.7361 | |||

| MMM / 3M Company | 0.10 | -32.97 | 9.24 | -31.43 | 9.1594 | -1.4107 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 8.80 | 25.28 | 8.80 | 25.29 | 8.7245 | 3.2137 | |||

| XRAY / DENTSPLY SIRONA Inc. | 0.27 | -17.79 | 8.02 | -29.01 | 7.9456 | -0.9108 | |||

| KMB / Kimberly-Clark Corporation | 0.04 | -29.92 | 6.00 | -20.91 | 5.9476 | -0.0031 | |||

| QGEN / Qiagen N.V. | 0.13 | 55.67 | 5.55 | 50.95 | 5.4960 | 2.6144 | |||

| UUGRY / United Utilities Group PLC - Depositary Receipt (Common Stock) | 0.21 | -17.39 | 5.38 | -19.85 | 5.3320 | 0.0685 | |||

| NTRS / Northern Trust Corporation | 0.05 | -31.38 | 4.21 | -29.02 | 4.1696 | -0.4780 | |||

| PEGRY / Pennon Group Plc - Depositary Receipt (Common Stock) | 0.25 | -13.04 | 4.18 | -18.81 | 4.1396 | 0.1049 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.02 | -38.95 | 2.95 | -34.35 | 2.9227 | -0.6000 | |||

| CWT / California Water Service Group | 0.06 | 38.24 | 2.92 | 50.00 | 2.8964 | 1.3684 | |||

| HSIC / Henry Schein, Inc. | 0.04 | -12.63 | 2.62 | -19.13 | 2.5931 | 0.0559 | |||

| CLX / The Clorox Company | 0.02 | -16.99 | 2.47 | -15.49 | 2.4488 | 0.1559 | |||

| MWA / Mueller Water Products, Inc. | 0.15 | -48.66 | 2.39 | -40.70 | 2.3699 | -0.7919 | |||

| NVST / Envista Holdings Corporation | 0.12 | 52.60 | 2.39 | 27.77 | 2.3669 | 0.9013 | |||

| SOLV / Solventum Corporation | 0.04 | 2.29 | 2.2694 | 2.2694 | |||||

| IDA / IDACORP, Inc. | 0.02 | 2.25 | 2.2315 | 2.2315 | |||||

| DGX / Quest Diagnostics Incorporated | 0.02 | -23.52 | 2.11 | -17.73 | 2.0879 | 0.0800 | |||

| WERN / Werner Enterprises, Inc. | 0.06 | -2.49 | 2.09 | -15.67 | 2.0744 | 0.1277 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -33.55 | 1.48 | -29.92 | 1.4653 | -0.1885 | |||

| KNRRY / Knorr-Bremse AG - Depositary Receipt (Common Stock) | 0.08 | -61.23 | 1.45 | -53.88 | 1.4359 | -1.0281 | |||

| AVO / Mission Produce, Inc. | 0.13 | -42.93 | 1.43 | -35.17 | 1.4122 | -0.3114 | |||

| HR / Healthcare Realty Trust Incorporated | 0.08 | -70.27 | 1.15 | -73.74 | 1.1367 | -2.2886 | |||

| GL / Globe Life Inc. | 0.01 | 1.06 | 1.0502 | 1.0502 | |||||

| NOC / Northrop Grumman Corporation | 0.00 | 45.56 | 1.03 | 57.95 | 1.0242 | 0.5114 | |||

| MKC / McCormick & Company, Incorporated | 0.01 | 31.37 | 1.00 | 46.49 | 0.9937 | 0.4573 | |||

| AWK / American Water Works Company, Inc. | 0.01 | 0.99 | 0.9834 | 0.9834 | |||||

| SJW / SJW Group | 0.02 | 0.99 | 0.9808 | 0.9808 | |||||

| HOLX / Hologic, Inc. | 0.01 | 0.97 | 0.9599 | 0.9599 | |||||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.01 | -60.48 | 0.96 | -62.19 | 0.9489 | -1.0359 | |||

| ILMN / Illumina, Inc. | 0.01 | -63.69 | 0.77 | -68.78 | 0.7619 | -1.1677 | |||

| WAT / Waters Corporation | 0.00 | -72.09 | 0.75 | -72.87 | 0.7408 | -1.4184 | |||

| INDB / Independent Bank Corp. | 0.01 | -56.15 | 0.71 | -60.73 | 0.7079 | -0.7185 | |||

| TOWN / TowneBank | 0.03 | -60.36 | 0.68 | -63.56 | 0.6709 | -0.7844 | |||

| LNN / Lindsay Corporation | 0.00 | -44.52 | 0.47 | -50.48 | 0.4612 | -0.2757 | |||

| MRTN / Marten Transport, Ltd. | 0.02 | 0.37 | 0.3669 | 0.3669 | |||||

| PEP / PepsiCo, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.7879 | ||||

| PPG / PPG Industries, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.7420 | ||||

| KO / The Coca-Cola Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.7974 | ||||

| PLD / Prologis, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 1.7567 | ||||

| TGT / Target Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.7764 | ||||

| WY / Weyerhaeuser Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.7431 | ||||

| LOW / Lowe's Companies, Inc. | Short | -0.00 | -37.72 | -0.63 | -33.30 | -0.6240 | 0.1162 | ||

| OTIS / Otis Worldwide Corporation | Short | -0.01 | -35.53 | -0.66 | -33.54 | -0.6508 | 0.1238 | ||

| CSX / CSX Corporation | Short | -0.02 | -70.03 | -0.67 | -72.10 | -0.6630 | 1.2179 | ||

| PAYX / Paychex, Inc. | Short | -0.01 | -69.71 | -0.69 | -70.43 | -0.6819 | 1.1431 | ||

| MCD / McDonald's Corporation | Short | -0.00 | -25.57 | -0.69 | -30.59 | -0.6859 | 0.0959 | ||

| CMI / Cummins Inc. | Short | -0.00 | -39.78 | -0.69 | -28.89 | -0.6881 | 0.0779 | ||

| MMC / Marsh & McLennan Companies, Inc. | Short | -0.00 | -34.36 | -0.70 | -32.49 | -0.6905 | 0.1186 | ||

| COST / Costco Wholesale Corporation | Short | -0.00 | -35.07 | -0.70 | -32.47 | -0.6949 | 0.1192 | ||

| PH / Parker-Hannifin Corporation | Short | -0.00 | -40.84 | -0.70 | -30.57 | -0.6976 | 0.0978 | ||

| ETN / Eaton Corporation plc | Short | -0.00 | -45.65 | -0.73 | -29.72 | -0.7197 | 0.0906 | ||

| AXP / American Express Company | Short | -0.00 | -0.73 | -0.7282 | -0.7282 | ||||

| MDLZ / Mondelez International, Inc. | Short | -0.01 | -68.96 | -0.74 | -70.34 | -0.7308 | 1.2183 | ||

| CNQ / Canadian Natural Resources Limited | Short | -0.01 | -72.91 | -0.74 | -67.91 | -0.7310 | 1.0709 | ||

| JPM / JPMorgan Chase & Co. | Short | -0.00 | -34.74 | -0.74 | -28.17 | -0.7353 | 0.0755 | ||

| CARR / Carrier Global Corporation | Short | -0.01 | -31.05 | -0.74 | -22.50 | -0.7375 | 0.0156 | ||

| YUM / Yum! Brands, Inc. | Short | -0.01 | -30.62 | -0.75 | -24.34 | -0.7397 | 0.0338 | ||

| SHW / The Sherwin-Williams Company | Short | -0.00 | -35.63 | -1.45 | -36.64 | -1.4414 | 0.3587 | ||

| DHI / D.R. Horton, Inc. | Short | -0.01 | -29.03 | -1.48 | -29.23 | -1.4689 | 0.1738 | ||

| PSX / Phillips 66 | Short | -0.01 | 43.65 | -1.52 | 42.58 | -1.5033 | -0.6688 | ||

| LEN / Lennar Corporation | Short | -0.01 | 51.17 | -1.54 | 52.98 | -1.5252 | -0.7361 | ||

| AZO / AutoZone, Inc. | Short | -0.00 | -40.93 | -1.54 | -36.78 | -1.5263 | 0.3840 | ||

| VLO / Valero Energy Corporation | Short | -0.01 | -43.02 | -1.59 | -34.41 | -1.5719 | 0.3246 | ||

| TJX / The TJX Companies, Inc. | Short | -0.02 | -33.10 | -1.60 | -33.68 | -1.5830 | 0.3056 | ||

| UNP / Union Pacific Corporation | Short | -0.01 | -29.81 | -1.61 | -31.77 | -1.5969 | 0.2548 | ||

| ADP / Automatic Data Processing, Inc. | Short | -0.01 | -33.14 | -1.63 | -34.22 | -1.6180 | 0.3276 | ||

| HCA / HCA Healthcare, Inc. | Short | -0.01 | -26.13 | -1.69 | -24.96 | -1.6726 | 0.0906 | ||

| ITW / Illinois Tool Works Inc. | Short | -0.01 | -22.30 | -1.69 | -27.29 | -1.6768 | 0.1484 | ||

| COP / ConocoPhillips | Short | -0.01 | -31.89 | -1.70 | -23.53 | -1.6881 | 0.0584 | ||

| ACGL / Arch Capital Group Ltd. | Short | -0.02 | 38.26 | -1.74 | 56.86 | -1.7231 | -0.8540 | ||

| 24W5 / Ferguson plc | Short | -0.01 | -32.41 | -1.74 | -24.46 | -1.7233 | 0.0823 | ||

| CVX / Chevron Corporation | Short | -0.01 | -29.49 | -1.75 | -22.87 | -1.7344 | 0.0450 | ||

| WELL / Welltower Inc. | Short | -0.02 | -28.33 | -1.77 | -21.04 | -1.7550 | 0.0043 | ||

| HD / The Home Depot, Inc. | Short | -0.01 | -35.43 | -3.05 | -38.87 | -3.0261 | 0.8905 | ||

| ORLY / O'Reilly Automotive, Inc. | Short | -0.00 | -40.20 | -3.14 | -40.77 | -3.1086 | 1.0444 | ||

| MPC / Marathon Petroleum Corporation | Short | -0.02 | -43.99 | -3.29 | -38.55 | -3.2561 | 0.9362 | ||

| CAT / Caterpillar Inc. | Short | -0.01 | 27.65 | -3.43 | 42.21 | -3.3993 | -1.5079 | ||

| ALL / The Allstate Corporation | Short | -0.02 | 21.43 | -3.53 | 33.02 | -3.4936 | -1.4152 | ||

| PGR / The Progressive Corporation | Short | -0.02 | -45.25 | -3.63 | -36.04 | -3.5949 | 0.8521 | ||

| RSG / Republic Services, Inc. | Short | -0.02 | -37.32 | -3.65 | -29.78 | -3.6144 | 0.4590 | ||

| RCL / Royal Caribbean Cruises Ltd. | Short | -0.03 | 42.45 | -3.70 | 56.04 | -3.6618 | -1.8045 | ||

| CTAS / Cintas Corporation | Short | -0.01 | -33.63 | -3.70 | -27.72 | -3.6637 | 0.3478 | ||

| WM / Waste Management, Inc. | Short | -0.02 | -36.57 | -3.70 | -28.92 | -3.6639 | 0.4149 | ||

| TT / Trane Technologies plc | Short | -0.01 | -38.74 | -4.00 | -22.86 | -3.9601 | 0.1025 |