Statistik Asas

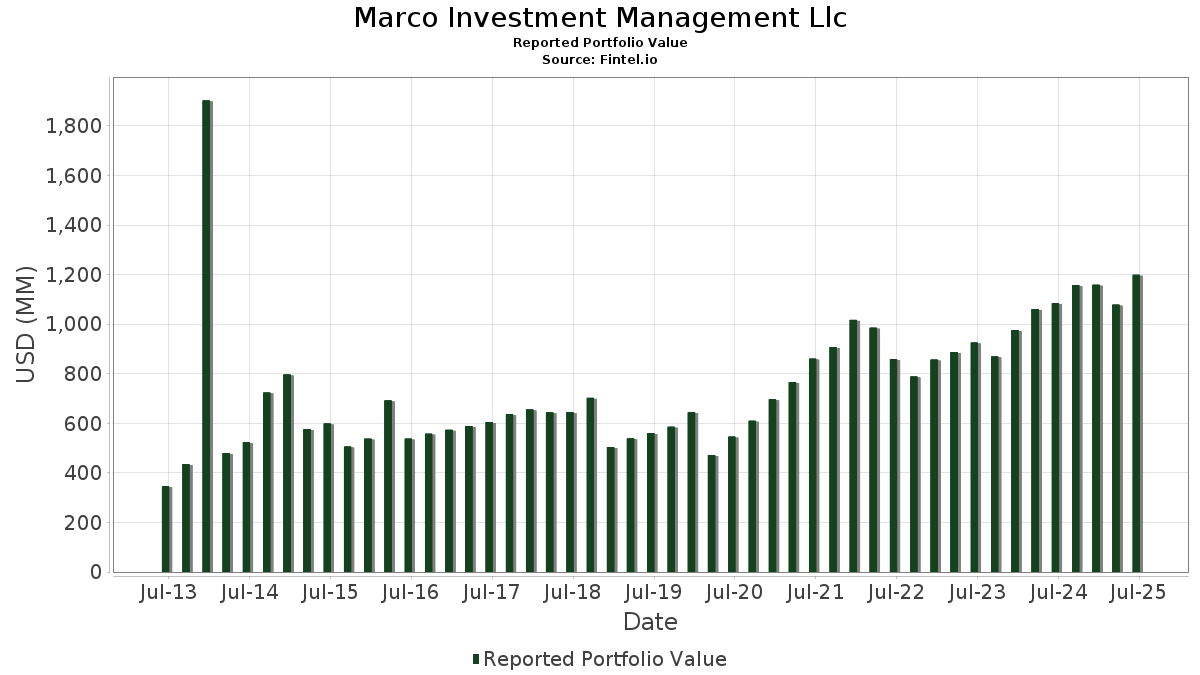

| Nilai Portfolio | $ 1,199,014,591 |

| Kedudukan Semasa | 220 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Marco Investment Management Llc telah mendedahkan 220 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,199,014,591 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Marco Investment Management Llc ialah Broadcom Inc. (US:AVGO) , Apple Inc. (US:AAPL) , JPMorgan Chase & Co. (US:JPM) , Microsoft Corporation (US:MSFT) , and Costco Wholesale Corporation (US:COST) . Kedudukan baharu Marco Investment Management Llc termasuk Lam Research Corporation (US:LRCX) , Curtiss-Wright Corporation (US:CW) , Federal Signal Corporation (US:FSS) , Schwab Strategic Trust - Schwab Fundamental U.S. Large Company ETF (US:FNDX) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.38 | 103.58 | 8.6391 | 2.8186 | |

| 0.13 | 27.45 | 2.2892 | 0.7310 | |

| 0.09 | 44.03 | 3.6720 | 0.6391 | |

| 0.05 | 32.80 | 2.7359 | 0.4260 | |

| 0.02 | 21.74 | 1.8132 | 0.2841 | |

| 0.16 | 46.08 | 3.8433 | 0.2701 | |

| 0.14 | 28.55 | 2.3808 | 0.2201 | |

| 0.07 | 27.97 | 2.3329 | 0.1441 | |

| 0.05 | 7.57 | 0.6316 | 0.1315 | |

| 0.07 | 22.69 | 1.8924 | 0.1226 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.27 | 56.10 | 4.6789 | -0.8964 | |

| 0.14 | 26.00 | 2.1684 | -0.5060 | |

| 0.06 | 17.36 | 1.4481 | -0.3448 | |

| 0.02 | 6.20 | 0.5172 | -0.3203 | |

| 0.11 | 23.85 | 1.9887 | -0.3053 | |

| 0.06 | 21.02 | 1.7532 | -0.2958 | |

| 0.53 | 16.40 | 1.3682 | -0.2918 | |

| 0.26 | 18.46 | 1.5397 | -0.2285 | |

| 0.11 | 11.54 | 0.9627 | -0.2250 | |

| 0.04 | 39.79 | 3.3185 | -0.2175 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-06 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AVGO / Broadcom Inc. | 0.38 | 0.24 | 103.58 | 65.02 | 8.6391 | 2.8186 | |||

| AAPL / Apple Inc. | 0.27 | 1.02 | 56.10 | -6.69 | 4.6789 | -0.8964 | |||

| JPM / JPMorgan Chase & Co. | 0.16 | 1.19 | 46.08 | 19.59 | 3.8433 | 0.2701 | |||

| MSFT / Microsoft Corporation | 0.09 | 1.59 | 44.03 | 34.61 | 3.6720 | 0.6391 | |||

| COST / Costco Wholesale Corporation | 0.04 | -0.31 | 39.79 | 4.35 | 3.3185 | -0.2175 | |||

| GS / The Goldman Sachs Group, Inc. | 0.05 | 1.64 | 32.80 | 31.69 | 2.7359 | 0.4260 | |||

| QCOM / QUALCOMM Incorporated | 0.20 | 3.70 | 32.36 | 7.52 | 2.6989 | -0.0921 | |||

| PANW / Palo Alto Networks, Inc. | 0.14 | 2.16 | 28.55 | 22.52 | 2.3808 | 0.2201 | |||

| CAT / Caterpillar Inc. | 0.07 | 0.67 | 27.97 | 18.51 | 2.3329 | 0.1441 | |||

| ORCL / Oracle Corporation | 0.13 | 4.45 | 27.45 | 63.34 | 2.2892 | 0.7310 | |||

| ABBV / AbbVie Inc. | 0.14 | 1.75 | 26.00 | -9.85 | 2.1684 | -0.5060 | |||

| WMT / Walmart Inc. | 0.26 | 0.67 | 25.67 | 12.12 | 2.1412 | 0.0180 | |||

| LOW / Lowe's Companies, Inc. | 0.11 | 1.32 | 23.85 | -3.61 | 1.9887 | -0.3053 | |||

| CI / The Cigna Group | 0.07 | 0.22 | 23.73 | 0.70 | 1.9795 | -0.2060 | |||

| AXP / American Express Company | 0.07 | 0.28 | 22.69 | 18.88 | 1.8924 | 0.1226 | |||

| SYK / Stryker Corporation | 0.06 | 2.21 | 22.48 | 8.63 | 1.8752 | -0.0440 | |||

| FTXP / Foothills Exploration, Inc. | 0.02 | 0.06 | 21.74 | 31.85 | 1.8132 | 0.2841 | |||

| CSCO / Cisco Systems, Inc. | 0.31 | 0.66 | 21.38 | 13.17 | 1.7833 | 0.0314 | |||

| HD / The Home Depot, Inc. | 0.06 | -4.91 | 21.02 | -4.87 | 1.7532 | -0.2958 | |||

| KO / The Coca-Cola Company | 0.26 | -2.00 | 18.46 | -3.18 | 1.5397 | -0.2285 | |||

| GOOGL / Alphabet Inc. | 0.10 | 6.28 | 17.38 | 21.13 | 1.4496 | 0.1190 | |||

| UNH / UnitedHealth Group Incorporated | 0.06 | 50.76 | 17.36 | -10.20 | 1.4481 | -0.3448 | |||

| NXPI / NXP Semiconductors N.V. | 0.08 | 2.99 | 16.85 | 18.39 | 1.4057 | 0.0856 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.53 | 0.89 | 16.40 | -8.36 | 1.3682 | -0.2918 | |||

| SPY / SPDR S&P 500 ETF | 0.03 | 1.67 | 15.70 | 12.29 | 1.3096 | 0.0129 | |||

| CRM / Salesforce, Inc. | 0.06 | 4.54 | 15.07 | 6.23 | 1.2570 | -0.0586 | |||

| UNP / Union Pacific Corporation | 0.06 | 3.15 | 13.37 | 0.46 | 1.1152 | -0.1191 | |||

| AMGN / Amgen Inc. | 0.04 | 2.41 | 11.99 | -8.22 | 0.9999 | -0.2114 | |||

| UPS / United Parcel Service, Inc. | 0.11 | -1.80 | 11.54 | -9.88 | 0.9627 | -0.2250 | |||

| HON / Honeywell International Inc. | 0.05 | 5.92 | 11.17 | 16.49 | 0.9320 | 0.0424 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.20 | 0.03 | 10.65 | 13.27 | 0.8884 | 0.0164 | |||

| LYB / LyondellBasell Industries N.V. | 0.18 | 32.68 | 10.18 | 9.05 | 0.8491 | -0.0166 | |||

| COP / ConocoPhillips | 0.11 | 4.80 | 9.91 | -10.45 | 0.8267 | -0.1997 | |||

| AFL / Aflac Incorporated | 0.09 | -1.18 | 9.74 | -6.28 | 0.8122 | -0.1513 | |||

| PG / The Procter & Gamble Company | 0.06 | 0.07 | 9.45 | -6.45 | 0.7883 | -0.1485 | |||

| PSX / Phillips 66 | 0.08 | 0.75 | 9.27 | -2.67 | 0.7733 | -0.1100 | |||

| ABT / Abbott Laboratories | 0.06 | -1.20 | 8.42 | 1.30 | 0.7021 | -0.0684 | |||

| MDT / Medtronic plc | 0.10 | 0.45 | 8.37 | -2.55 | 0.6978 | -0.0984 | |||

| XOM / Exxon Mobil Corporation | 0.08 | 0.94 | 8.25 | -8.50 | 0.6884 | -0.1481 | |||

| NOC / Northrop Grumman Corporation | 0.02 | 1.98 | 8.17 | -0.41 | 0.6815 | -0.0794 | |||

| DIS / The Walt Disney Company | 0.06 | 2.65 | 7.94 | 28.98 | 0.6619 | 0.0913 | |||

| MRK / Merck & Co., Inc. | 0.10 | 2.19 | 7.72 | -9.87 | 0.6442 | -0.1505 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.05 | -3.67 | 7.57 | 40.43 | 0.6316 | 0.1315 | |||

| AZO / AutoZone, Inc. | 0.00 | 2.14 | 7.45 | -0.56 | 0.6214 | -0.0734 | |||

| J / Jacobs Solutions Inc. | 0.05 | 6.03 | 7.23 | 15.31 | 0.6029 | 0.0215 | |||

| META / Meta Platforms, Inc. | 0.01 | 1.22 | 7.09 | 29.63 | 0.5911 | 0.0841 | |||

| SCHW / The Charles Schwab Corporation | 0.08 | 0.00 | 7.06 | 16.54 | 0.5889 | 0.0271 | |||

| GLD / SPDR Gold Trust | 0.02 | -35.10 | 6.20 | -31.34 | 0.5172 | -0.3203 | |||

| LHX / L3Harris Technologies, Inc. | 0.02 | 0.13 | 6.00 | 20.02 | 0.5006 | 0.0368 | |||

| LRCX / Lam Research Corporation | 0.06 | 5.87 | 0.0000 | ||||||

| AMZN / Amazon.com, Inc. | 0.03 | 26.29 | 5.75 | 45.64 | 0.4796 | 0.1134 | |||

| TSLA / Tesla, Inc. | 0.02 | 0.17 | 5.64 | 22.78 | 0.4703 | 0.0444 | |||

| MRVL / Marvell Technology, Inc. | 0.07 | 0.00 | 5.42 | 25.74 | 0.4519 | 0.0522 | |||

| PWR / Quanta Services, Inc. | 0.01 | -1.49 | 5.16 | 46.55 | 0.4304 | 0.1038 | |||

| ROP / Roper Technologies, Inc. | 0.01 | 1.28 | 5.15 | -2.61 | 0.4291 | -0.0608 | |||

| CVS / CVS Health Corporation | 0.07 | -0.48 | 5.13 | 1.32 | 0.4282 | -0.0417 | |||

| ETN / Eaton Corporation plc | 0.01 | 0.08 | 4.65 | 31.46 | 0.3876 | 0.0597 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -3.46 | 4.53 | -21.35 | 0.3775 | -0.1560 | |||

| BAC / Bank of America Corporation | 0.09 | 0.25 | 4.44 | 13.69 | 0.3706 | 0.0081 | |||

| EOG / EOG Resources, Inc. | 0.04 | 2.21 | 4.43 | -4.67 | 0.3698 | -0.0615 | |||

| JNJ / Johnson & Johnson | 0.03 | -0.18 | 4.31 | -8.07 | 0.3594 | -0.0752 | |||

| AMD / Advanced Micro Devices, Inc. | 0.03 | -0.99 | 4.28 | 36.78 | 0.3567 | 0.0667 | |||

| MCD / McDonald's Corporation | 0.01 | 0.21 | 4.23 | -6.27 | 0.3531 | -0.0657 | |||

| MTZ / MasTec, Inc. | 0.02 | 4.43 | 4.20 | 52.54 | 0.3504 | 0.0949 | |||

| DUK / Duke Energy Corporation | 0.03 | 0.94 | 4.11 | -2.33 | 0.3429 | -0.0475 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.01 | -0.07 | 3.89 | 17.58 | 0.3247 | 0.0176 | |||

| AMAT / Applied Materials, Inc. | 0.02 | 0.00 | 3.86 | 26.16 | 0.3222 | 0.0382 | |||

| GPN / Global Payments Inc. | 0.05 | -15.42 | 3.75 | -30.86 | 0.3130 | -0.1904 | |||

| EXPE / Expedia Group, Inc. | 0.02 | 1.90 | 3.72 | 2.26 | 0.3101 | -0.0271 | |||

| O / Realty Income Corporation | 0.06 | 0.64 | 3.62 | -0.03 | 0.3015 | -0.0339 | |||

| VZ / Verizon Communications Inc. | 0.08 | 5.37 | 3.61 | 0.50 | 0.3015 | -0.0320 | |||

| PYPL / PayPal Holdings, Inc. | 0.05 | 6.11 | 3.61 | 20.88 | 0.3013 | 0.0241 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.04 | -1.55 | 3.47 | 0.43 | 0.2896 | -0.0310 | |||

| TJX / The TJX Companies, Inc. | 0.03 | -0.37 | 3.42 | 1.01 | 0.2849 | -0.0287 | |||

| PFE / Pfizer Inc. | 0.14 | -5.95 | 3.36 | -10.02 | 0.2800 | -0.0660 | |||

| IBM / International Business Machines Corporation | 0.01 | 0.29 | 3.17 | 18.90 | 0.2640 | 0.0171 | |||

| ACN / Accenture plc | 0.01 | -0.25 | 3.03 | -4.44 | 0.2529 | -0.0414 | |||

| SBUX / Starbucks Corporation | 0.03 | -4.60 | 3.01 | -10.88 | 0.2506 | -0.0621 | |||

| INTC / Intel Corporation | 0.13 | -0.02 | 2.90 | -1.39 | 0.2422 | -0.0309 | |||

| WFC / Wells Fargo & Company | 0.04 | 17.97 | 2.83 | 31.63 | 0.2361 | 0.0367 | |||

| EXAS / Exact Sciences Corporation | 0.05 | -2.20 | 2.75 | 20.05 | 0.2297 | 0.0170 | |||

| DLR / Digital Realty Trust, Inc. | 0.02 | 0.00 | 2.75 | 21.68 | 0.2290 | 0.0197 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.01 | -0.07 | 2.67 | 4.82 | 0.2231 | -0.0135 | |||

| MGA / Magna International Inc. | 0.07 | -2.97 | 2.63 | 10.25 | 0.2189 | -0.0019 | |||

| DRI / Darden Restaurants, Inc. | 0.01 | 0.00 | 2.33 | 4.92 | 0.1941 | -0.0116 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.01 | -5.25 | 2.26 | 12.03 | 0.1888 | 0.0014 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 26.59 | 2.22 | 38.86 | 0.1851 | 0.0369 | |||

| GILD / Gilead Sciences, Inc. | 0.02 | 0.25 | 2.17 | -0.82 | 0.1812 | -0.0219 | |||

| DG / Dollar General Corporation | 0.02 | 0.94 | 2.15 | 31.26 | 0.1794 | 0.0275 | |||

| RTX / RTX Corporation | 0.01 | 0.28 | 2.06 | 10.54 | 0.1715 | -0.0010 | |||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.04 | -2.16 | 1.85 | -3.04 | 0.1546 | -0.0227 | |||

| GOOGL / Alphabet Inc. | 0.01 | 1.27 | 1.85 | 15.01 | 0.1541 | 0.0051 | |||

| TFC / Truist Financial Corporation | 0.04 | -8.60 | 1.80 | -4.55 | 0.1504 | -0.0247 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 0.00 | 1.78 | 15.55 | 0.1487 | 0.0056 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.01 | -2.08 | 1.71 | 6.29 | 0.1425 | -0.0066 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | -0.38 | 1.70 | -9.69 | 0.1416 | -0.0327 | |||

| MOS / The Mosaic Company | 0.04 | 1.63 | 1.59 | 37.24 | 0.1328 | 0.0252 | |||

| LLY / Eli Lilly and Company | 0.00 | -1.81 | 1.57 | -7.34 | 0.1307 | -0.0261 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.03 | 0.28 | 1.49 | 5.43 | 0.1247 | -0.0068 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.01 | 4.69 | 1.43 | 28.48 | 0.1193 | 0.0160 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.02 | 0.00 | 1.40 | 6.29 | 0.1171 | -0.0054 | |||

| CVX / Chevron Corporation | 0.01 | 0.00 | 1.39 | -14.44 | 0.1158 | -0.0346 | |||

| BMY / Bristol-Myers Squibb Company | 0.03 | -4.19 | 1.36 | -27.27 | 0.1137 | -0.0601 | |||

| AGCO / AGCO Corporation | 0.01 | 0.00 | 1.35 | 11.47 | 0.1127 | 0.0003 | |||

| CSX / CSX Corporation | 0.04 | 0.63 | 1.34 | 11.54 | 0.1121 | 0.0004 | |||

| MO / Altria Group, Inc. | 0.02 | 25.41 | 1.34 | 22.51 | 0.1117 | 0.0103 | |||

| CTVA / Corteva, Inc. | 0.02 | 0.13 | 1.23 | 18.63 | 0.1025 | 0.0064 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.02 | -0.51 | 1.20 | -5.59 | 0.1001 | -0.0178 | |||

| IFF / International Flavors & Fragrances Inc. | 0.02 | -15.14 | 1.20 | -19.58 | 0.0997 | -0.0381 | |||

| ROL / Rollins, Inc. | 0.02 | 0.00 | 1.18 | 4.41 | 0.0988 | -0.0064 | |||

| OKLO / Oklo Inc. | 0.02 | -22.86 | 1.10 | 100.00 | 0.0914 | 0.0405 | |||

| DD / DuPont de Nemours, Inc. | 0.02 | -0.46 | 1.07 | -8.58 | 0.0888 | -0.0192 | |||

| DOV / Dover Corporation | 0.01 | 2.74 | 1.03 | 7.17 | 0.0861 | -0.0032 | |||

| APA / APA Corporation | 0.06 | 1.21 | 1.02 | -11.96 | 0.0848 | -0.0223 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -7.73 | 1.00 | -15.79 | 0.0832 | -0.0267 | |||

| STZ / Constellation Brands, Inc. | 0.01 | 0.00 | 0.98 | -11.36 | 0.0820 | -0.0209 | |||

| SO / The Southern Company | 0.01 | 1.12 | 0.94 | 0.97 | 0.0784 | -0.0079 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.01 | 0.38 | 0.92 | -7.26 | 0.0767 | -0.0153 | |||

| RPM / RPM International Inc. | 0.01 | 0.04 | 0.91 | -5.03 | 0.0757 | -0.0129 | |||

| GPC / Genuine Parts Company | 0.01 | 2.48 | 0.89 | 4.32 | 0.0745 | -0.0049 | |||

| DOW / Dow Inc. | 0.03 | -9.35 | 0.88 | -31.25 | 0.0736 | -0.0454 | |||

| T / AT&T Inc. | 0.03 | 1.28 | 0.87 | 3.58 | 0.0724 | -0.0053 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.01 | 0.00 | 0.84 | 3.33 | 0.0700 | -0.0053 | |||

| D / Dominion Energy, Inc. | 0.01 | 5.36 | 0.83 | 6.30 | 0.0690 | -0.0032 | |||

| C / Citigroup Inc. | 0.01 | 0.79 | 0.82 | 20.74 | 0.0685 | 0.0055 | |||

| EBAY / eBay Inc. | 0.01 | 0.00 | 0.75 | 9.81 | 0.0626 | -0.0007 | |||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.01 | 0.00 | 0.74 | -1.07 | 0.0618 | -0.0077 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 3.93 | 0.71 | 14.98 | 0.0596 | 0.0019 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.01 | -0.63 | 0.69 | -9.87 | 0.0579 | -0.0135 | |||

| AYI / Acuity Inc. | 0.00 | 0.00 | 0.69 | 13.39 | 0.0572 | 0.0011 | |||

| DE / Deere & Company | 0.00 | 1.38 | 0.67 | 9.84 | 0.0559 | -0.0007 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.01 | 0.00 | 0.67 | -1.62 | 0.0558 | -0.0073 | |||

| SYY / Sysco Corporation | 0.01 | 0.00 | 0.66 | 0.92 | 0.0550 | -0.0056 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -1.64 | 0.63 | 8.59 | 0.0528 | -0.0012 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.00 | 0.00 | 0.62 | -0.96 | 0.0516 | -0.0064 | |||

| ROST / Ross Stores, Inc. | 0.00 | 0.00 | 0.61 | -0.16 | 0.0511 | -0.0058 | |||

| AMTM / Amentum Holdings, Inc. | 0.03 | -13.98 | 0.59 | 11.47 | 0.0495 | 0.0002 | |||

| PM / Philip Morris International Inc. | 0.00 | 3.76 | 0.59 | 19.07 | 0.0490 | 0.0032 | |||

| STM / STMicroelectronics N.V. - Depositary Receipt (Common Stock) | 0.02 | -9.73 | 0.56 | 25.06 | 0.0470 | 0.0052 | |||

| CHD / Church & Dwight Co., Inc. | 0.01 | -3.51 | 0.53 | -15.79 | 0.0441 | -0.0141 | |||

| V / Visa Inc. | 0.00 | -0.07 | 0.52 | 1.36 | 0.0434 | -0.0043 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | -0.31 | 0.52 | 0.98 | 0.0430 | -0.0044 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.03 | 1.47 | 0.50 | -0.99 | 0.0418 | -0.0052 | |||

| INMD / InMode Ltd. | 0.03 | -0.43 | 0.50 | -18.92 | 0.0415 | -0.0154 | |||

| MCK / McKesson Corporation | 0.00 | 0.00 | 0.49 | 9.07 | 0.0411 | -0.0009 | |||

| HUM / Humana Inc. | 0.00 | 0.00 | 0.49 | -7.75 | 0.0408 | -0.0083 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.46 | -0.65 | 0.0386 | -0.0046 | |||

| CARR / Carrier Global Corporation | 0.01 | 0.00 | 0.46 | 15.40 | 0.0382 | 0.0014 | |||

| NFLX / Netflix, Inc. | 0.00 | -39.18 | 0.46 | -12.67 | 0.0380 | -0.0104 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.00 | 1.16 | 0.45 | 1.37 | 0.0372 | -0.0036 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 1.49 | 0.44 | 2.33 | 0.0368 | -0.0031 | |||

| OKE / ONEOK, Inc. | 0.00 | 5.67 | 0.41 | -13.06 | 0.0339 | -0.0095 | |||

| GIS / General Mills, Inc. | 0.01 | -60.10 | 0.40 | -65.48 | 0.0333 | -0.0737 | |||

| GGG / Graco Inc. | 0.00 | 0.00 | 0.40 | 2.86 | 0.0330 | -0.0026 | |||

| USB / U.S. Bancorp | 0.01 | -3.71 | 0.39 | 3.17 | 0.0326 | -0.0025 | |||

| SLB / Schlumberger Limited | 0.01 | 0.00 | 0.39 | -19.17 | 0.0324 | -0.0122 | |||

| CWST / Casella Waste Systems, Inc. | 0.00 | 0.00 | 0.39 | 3.49 | 0.0322 | -0.0024 | |||

| PEP / PepsiCo, Inc. | 0.00 | 0.00 | 0.38 | -12.01 | 0.0318 | -0.0084 | |||

| BXMX / Nuveen S&P 500 Buy-Write Income Fund | 0.03 | 0.00 | 0.38 | 5.59 | 0.0316 | -0.0016 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.00 | -5.97 | 0.36 | -10.70 | 0.0300 | -0.0073 | |||

| CMI / Cummins Inc. | 0.00 | 2.09 | 0.35 | 6.67 | 0.0294 | -0.0012 | |||

| ROAD / Construction Partners, Inc. | 0.00 | -14.80 | 0.34 | 26.02 | 0.0283 | 0.0033 | |||

| BX / Blackstone Inc. | 0.00 | 0.00 | 0.34 | 6.98 | 0.0281 | -0.0011 | |||

| COF / Capital One Financial Corporation | 0.00 | 0.00 | 0.34 | 18.66 | 0.0281 | 0.0018 | |||

| DXCM / DexCom, Inc. | 0.00 | 0.00 | 0.33 | 27.52 | 0.0275 | 0.0036 | |||

| DSGX / The Descartes Systems Group Inc. | 0.00 | 0.00 | 0.33 | 0.61 | 0.0274 | -0.0028 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.32 | 2.54 | 0.0269 | -0.0023 | |||

| OEF / iShares Trust - iShares S&P 100 ETF | 0.00 | 0.00 | 0.32 | 12.32 | 0.0267 | 0.0003 | |||

| VBR / Vanguard Index Funds - Vanguard Small-Cap Value ETF | 0.00 | 0.00 | 0.32 | 4.61 | 0.0266 | -0.0016 | |||

| EA / Electronic Arts Inc. | 0.00 | 0.00 | 0.31 | 10.60 | 0.0261 | -0.0002 | |||

| YUM / Yum! Brands, Inc. | 0.00 | 0.00 | 0.31 | -5.76 | 0.0260 | -0.0047 | |||

| GE / General Electric Company | 0.00 | 0.09 | 0.30 | 28.51 | 0.0253 | 0.0034 | |||

| ECML / EA Series Trust - Euclidean Fundamental Value ETF | 0.01 | 0.00 | 0.30 | 0.33 | 0.0252 | -0.0027 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.00 | 0.30 | 25.94 | 0.0251 | 0.0029 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.00 | 6.61 | 0.30 | 2.39 | 0.0251 | -0.0021 | |||

| IYW / iShares Trust - iShares U.S. Technology ETF | 0.00 | 0.00 | 0.29 | 23.53 | 0.0246 | 0.0024 | |||

| BK / The Bank of New York Mellon Corporation | 0.00 | 4.23 | 0.28 | 13.15 | 0.0238 | 0.0004 | |||

| RBC / RBC Bearings Incorporated | 0.00 | -8.64 | 0.28 | 9.23 | 0.0237 | -0.0004 | |||

| UVE / Universal Insurance Holdings, Inc. | 0.01 | 0.00 | 0.28 | 16.88 | 0.0231 | 0.0012 | |||

| ESE / ESCO Technologies Inc. | 0.00 | 0.00 | 0.27 | 20.44 | 0.0226 | 0.0018 | |||

| IWO / iShares Trust - iShares Russell 2000 Growth ETF | 0.00 | 0.00 | 0.27 | 12.03 | 0.0225 | 0.0001 | |||

| LNG / Cheniere Energy, Inc. | 0.00 | 0.00 | 0.27 | 5.12 | 0.0223 | -0.0013 | |||

| RSG / Republic Services, Inc. | 0.00 | 0.00 | 0.27 | 1.91 | 0.0223 | -0.0020 | |||

| FSV / FirstService Corporation | 0.00 | 0.00 | 0.26 | 5.20 | 0.0220 | -0.0012 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 0.26 | 3.54 | 0.0220 | -0.0016 | |||

| BA / The Boeing Company | 0.00 | 0.25 | 0.0212 | 0.0212 | |||||

| NOVT / Novanta Inc. | 0.00 | 0.25 | 0.0212 | 0.0212 | |||||

| VV / Vanguard Index Funds - Vanguard Large-Cap ETF | 0.00 | 0.00 | 0.25 | 10.96 | 0.0212 | -0.0000 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | 0.00 | 0.25 | 6.78 | 0.0211 | -0.0009 | |||

| MDLZ / Mondelez International, Inc. | 0.00 | 0.00 | 0.25 | -0.40 | 0.0210 | -0.0025 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.01 | 0.00 | 0.25 | -4.98 | 0.0207 | -0.0036 | |||

| TGT / Target Corporation | 0.00 | -0.28 | 0.24 | -5.47 | 0.0202 | -0.0036 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.00 | 0.00 | 0.24 | 2.55 | 0.0201 | -0.0017 | |||

| VMC / Vulcan Materials Company | 0.00 | 0.00 | 0.23 | 11.96 | 0.0196 | 0.0001 | |||

| MMSI / Merit Medical Systems, Inc. | 0.00 | 0.00 | 0.23 | -11.74 | 0.0195 | -0.0050 | |||

| DSI / iShares Trust - iShares ESG MSCI KLD 400 ETF | 0.00 | 0.00 | 0.23 | 13.73 | 0.0194 | 0.0004 | |||

| EXPO / Exponent, Inc. | 0.00 | 0.00 | 0.23 | -8.03 | 0.0192 | -0.0040 | |||

| IJS / iShares Trust - iShares S&P Small-Cap 600 Value ETF | 0.00 | 0.00 | 0.23 | 2.24 | 0.0190 | -0.0017 | |||

| STVN / Stevanato Group S.p.A. | 0.01 | 0.23 | 0.0190 | 0.0190 | |||||

| WMB / The Williams Companies, Inc. | 0.00 | 0.00 | 0.22 | 5.19 | 0.0186 | -0.0011 | |||

| EFV / iShares Trust - iShares MSCI EAFE Value ETF | 0.00 | 0.00 | 0.22 | 7.77 | 0.0185 | -0.0006 | |||

| VT / Vanguard International Equity Index Funds - Vanguard Total World Stock ETF | 0.00 | 0.22 | 0.0184 | 0.0184 | |||||

| CW / Curtiss-Wright Corporation | 0.00 | 0.22 | 0.0183 | 0.0183 | |||||

| AEP / American Electric Power Company, Inc. | 0.00 | -0.89 | 0.22 | -6.01 | 0.0183 | -0.0033 | |||

| MLM / Martin Marietta Materials, Inc. | 0.00 | 0.22 | 0.0183 | 0.0183 | |||||

| NUE / Nucor Corporation | 0.00 | 0.00 | 0.22 | 7.50 | 0.0180 | -0.0006 | |||

| IOO / iShares Trust - iShares Global 100 ETF | 0.00 | 0.22 | 0.0180 | 0.0180 | |||||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.00 | 0.21 | 0.0178 | 0.0178 | |||||

| BCPC / Balchem Corporation | 0.00 | 0.00 | 0.21 | -4.11 | 0.0176 | -0.0028 | |||

| PBA / Pembina Pipeline Corporation | 0.01 | 0.00 | 0.21 | -6.31 | 0.0174 | -0.0033 | |||

| SSD / Simpson Manufacturing Co., Inc. | 0.00 | 0.00 | 0.21 | -0.96 | 0.0172 | -0.0021 | |||

| FSS / Federal Signal Corporation | 0.00 | 0.21 | 0.0172 | 0.0172 | |||||

| EXR / Extra Space Storage Inc. | 0.00 | 0.00 | 0.20 | -0.97 | 0.0171 | -0.0020 | |||

| SPSC / SPS Commerce, Inc. | 0.00 | 0.20 | 0.0170 | 0.0170 | |||||

| FNDX / Schwab Strategic Trust - Schwab Fundamental U.S. Large Company ETF | 0.01 | 0.20 | 0.0169 | 0.0169 | |||||

| ITOT / iShares Trust - iShares Core S&P Total U.S. Stock Market ETF | 0.00 | 0.20 | 0.0167 | 0.0167 | |||||

| CCCS / CCC Intelligent Solutions Holdings Inc. | 0.02 | 22.79 | 0.15 | 28.57 | 0.0128 | 0.0017 | |||

| ELDN / Eledon Pharmaceuticals, Inc. | 0.03 | 0.00 | 0.08 | -19.61 | 0.0069 | -0.0027 | |||

| PVL / Permianville Royalty Trust | 0.01 | 0.00 | 0.02 | 22.22 | 0.0019 | 0.0001 | |||

| DRIO / DarioHealth Corp. | 0.02 | 0.00 | 0.01 | 9.09 | 0.0011 | -0.0000 | |||

| CWAN / Clearwater Analytics Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NEOG / Neogen Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MAA / Mid-America Apartment Communities, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WY / Weyerhaeuser Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AAON / AAON, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IAC / IAC Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |