Statistik Asas

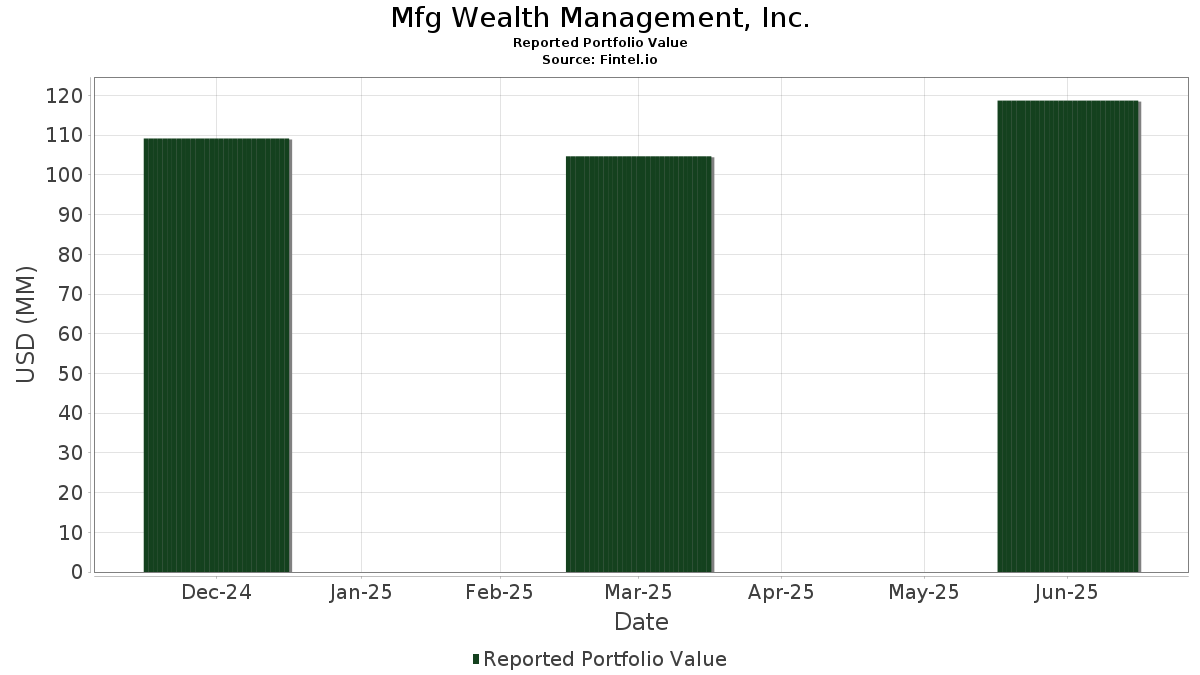

| Nilai Portfolio | $ 118,705,495 |

| Kedudukan Semasa | 51 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Mfg Wealth Management, Inc. telah mendedahkan 51 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 118,705,495 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Mfg Wealth Management, Inc. ialah Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares (US:NVDD) , ProShares Trust - ProShares UltraPro Russell2000 (US:URTY) , Palantir Technologies Inc. (US:PLTR) , Oracle Corporation (US:ORCL) , and Palo Alto Networks, Inc. (US:PANW) . Kedudukan baharu Mfg Wealth Management, Inc. termasuk ProShares Trust - ProShares UltraPro QQQ (US:TQQQ) , General Dynamics Corporation (US:GD) , Fluor Corporation (US:FLR) , NuScale Power Corporation (US:SMR) , and JPMorgan Chase & Co. (US:JPM) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 3.27 | 2.7511 | 2.7511 | |

| 0.01 | 2.58 | 2.1772 | 2.1772 | |

| 0.04 | 2.10 | 1.7723 | 1.7723 | |

| 0.03 | 3.94 | 3.3193 | 1.6051 | |

| 0.18 | 3.11 | 2.6213 | 1.5507 | |

| 0.05 | 1.83 | 1.5407 | 1.5407 | |

| 0.02 | 3.59 | 3.0237 | 1.4831 | |

| 0.03 | 1.74 | 1.4656 | 1.4656 | |

| 0.01 | 1.74 | 1.4654 | 1.4654 | |

| 0.00 | 1.70 | 1.4350 | 1.4350 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 1.80 | 1.5158 | -1.6880 | |

| 0.02 | 2.74 | 2.3083 | -1.6124 | |

| 0.00 | 0.00 | -1.1193 | ||

| 0.01 | 1.03 | 0.8648 | -0.9805 | |

| 0.00 | 1.63 | 1.3771 | -0.7722 | |

| 0.00 | 0.00 | -0.7506 | ||

| 0.13 | 2.23 | 1.8814 | -0.5355 | |

| 0.01 | 2.75 | 2.3201 | -0.3143 | |

| 0.05 | 2.77 | 2.3354 | -0.2844 | |

| 0.01 | 2.24 | 1.8850 | -0.2681 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-09 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.03 | -5.33 | 4.56 | 38.03 | 3.8374 | 0.6840 | |||

| URTY / ProShares Trust - ProShares UltraPro Russell2000 | 0.10 | 45.43 | 4.12 | 66.84 | 3.4681 | 1.1107 | |||

| PLTR / Palantir Technologies Inc. | 0.03 | 35.95 | 3.94 | 119.62 | 3.3193 | 1.6051 | |||

| ORCL / Oracle Corporation | 0.02 | 42.34 | 3.59 | 122.64 | 3.0237 | 1.4831 | |||

| PANW / Palo Alto Networks, Inc. | 0.02 | 0.39 | 3.45 | 20.38 | 2.9059 | 0.1688 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.04 | 1.41 | 3.45 | 5.03 | 2.9033 | -0.2316 | |||

| C / Citigroup Inc. | 0.04 | 0.66 | 3.44 | 20.68 | 2.9010 | 0.1753 | |||

| UBER / Uber Technologies, Inc. | 0.04 | 12.60 | 3.42 | 44.18 | 2.8793 | 0.6148 | |||

| TQQQ / ProShares Trust - ProShares UltraPro QQQ | 0.04 | 3.27 | 2.7511 | 2.7511 | |||||

| AMZN / Amazon.com, Inc. | 0.01 | 2.04 | 3.15 | 17.66 | 2.6560 | 0.0961 | |||

| BA / The Boeing Company | 0.01 | 20.20 | 3.14 | 47.67 | 2.6438 | 0.6135 | |||

| KEY / KeyCorp | 0.18 | 154.86 | 3.11 | 177.77 | 2.6213 | 1.5507 | |||

| GE / General Electric Company | 0.01 | -0.35 | 3.10 | 28.13 | 2.6096 | 0.3003 | |||

| META / Meta Platforms, Inc. | 0.00 | 37.29 | 2.96 | 75.92 | 2.4927 | 0.8849 | |||

| SOFI / SoFi Technologies, Inc. | 0.16 | 3.55 | 2.95 | 62.14 | 2.4825 | 0.7462 | |||

| AVGO / Broadcom Inc. | 0.01 | 60.49 | 2.89 | 164.44 | 2.4306 | 1.3874 | |||

| D / Dominion Energy, Inc. | 0.05 | 0.29 | 2.77 | 1.09 | 2.3354 | -0.2844 | |||

| AAPL / Apple Inc. | 0.01 | 8.13 | 2.75 | -0.11 | 2.3201 | -0.3143 | |||

| TSLA / Tesla, Inc. | 0.01 | 2.45 | 2.74 | 25.58 | 2.3124 | 0.2242 | |||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.02 | -33.80 | 2.74 | -33.24 | 2.3083 | -1.6124 | |||

| SPLG / SPDR Series Trust - SPDR Portfolio S&P 500 ETF | 0.04 | -1.07 | 2.69 | 9.36 | 2.2651 | -0.0838 | |||

| MSFT / Microsoft Corporation | 0.01 | -1.15 | 2.65 | 30.96 | 2.2347 | 0.2999 | |||

| CARR / Carrier Global Corporation | 0.04 | 9.60 | 2.61 | 26.53 | 2.1985 | 0.2279 | |||

| GD / General Dynamics Corporation | 0.01 | 2.58 | 2.1772 | 2.1772 | |||||

| RKT / Rocket Companies, Inc. | 0.18 | 37.58 | 2.52 | 61.64 | 2.1235 | 0.6337 | |||

| ABT / Abbott Laboratories | 0.02 | -0.96 | 2.45 | 1.58 | 2.0625 | -0.2407 | |||

| ENB / Enbridge Inc. | 0.05 | -0.78 | 2.25 | 1.49 | 1.8933 | -0.2224 | |||

| WM / Waste Management, Inc. | 0.01 | 0.45 | 2.24 | -0.71 | 1.8850 | -0.2681 | |||

| DOC / Healthpeak Properties, Inc. | 0.13 | 1.94 | 2.23 | -11.70 | 1.8814 | -0.5355 | |||

| EXE / Expand Energy Corporation | 0.02 | -0.53 | 2.11 | 4.50 | 1.7803 | -0.1519 | |||

| FLR / Fluor Corporation | 0.04 | 2.10 | 1.7723 | 1.7723 | |||||

| BAC / Bank of America Corporation | 0.04 | 0.44 | 1.89 | 13.86 | 1.5920 | 0.0069 | |||

| SMR / NuScale Power Corporation | 0.05 | 1.83 | 1.5407 | 1.5407 | |||||

| CCI / Crown Castle Inc. | 0.02 | 3.20 | 1.81 | 1.74 | 1.5248 | -0.1752 | |||

| T / AT&T Inc. | 0.06 | -47.57 | 1.80 | -46.35 | 1.5158 | -1.6880 | |||

| GLW / Corning Incorporated | 0.03 | 1.74 | 1.4656 | 1.4656 | |||||

| JPM / JPMorgan Chase & Co. | 0.01 | 1.74 | 1.4654 | 1.4654 | |||||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.00 | 0.51 | 1.74 | 5.53 | 1.4633 | -0.1099 | |||

| NFLX / Netflix, Inc. | 0.00 | 1.70 | 1.4350 | 1.4350 | |||||

| UPS / United Parcel Service, Inc. | 0.02 | 14.47 | 1.69 | 5.02 | 1.4278 | -0.1135 | |||

| LLY / Eli Lilly and Company | 0.00 | -23.02 | 1.63 | -27.35 | 1.3771 | -0.7722 | |||

| STLD / Steel Dynamics, Inc. | 0.01 | 0.60 | 1.53 | 2.97 | 1.2868 | -0.1306 | |||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | 0.02 | 30.25 | 1.37 | 26.29 | 1.1539 | 0.1176 | |||

| CTVA / Corteva, Inc. | 0.02 | -0.27 | 1.29 | 18.07 | 1.0906 | 0.0435 | |||

| UEC / Uranium Energy Corp. | 0.16 | 1.10 | 0.9272 | 0.9272 | |||||

| IBIT / iShares Bitcoin Trust ETF | 0.02 | 1.04 | 0.8779 | 0.8779 | |||||

| DOCU / DocuSign, Inc. | 0.01 | -44.46 | 1.03 | -46.87 | 0.8648 | -0.9805 | |||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.01 | -14.58 | 0.92 | -14.57 | 0.7714 | -0.2527 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.00 | 9.92 | 0.33 | 35.10 | 0.2790 | 0.0443 | |||

| SPYD / SPDR Series Trust - SPDR Portfolio S&P 500 High Dividend ETF | 0.01 | -3.44 | 0.28 | -7.33 | 0.2347 | -0.0528 | |||

| JEPI / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Equity Premium Income ETF | 0.00 | -19.05 | 0.27 | -19.41 | 0.2308 | -0.0942 | |||

| CRM / Salesforce, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TMUS / T-Mobile US, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| POOL / Pool Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GOOG / Alphabet Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ABBV / AbbVie Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MMM / 3M Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -1.1193 | ||||

| ZG / Zillow Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CLF / Cleveland-Cliffs Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7506 | ||||

| AAON / AAON, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DE / Deere & Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VLO / Valero Energy Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DXCM / DexCom, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CAT / Caterpillar Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OXY / Occidental Petroleum Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |