Statistik Asas

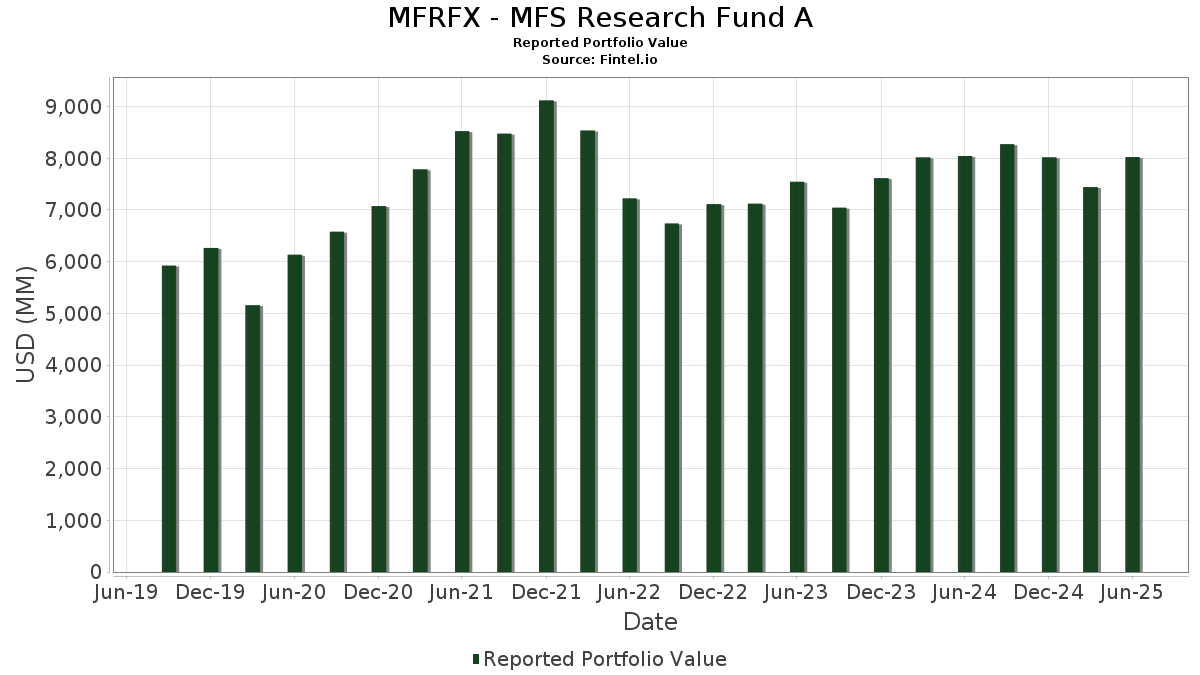

| Nilai Portfolio | $ 8,021,674,761 |

| Kedudukan Semasa | 105 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

MFRFX - MFS Research Fund A telah mendedahkan 105 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 8,021,674,761 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas MFRFX - MFS Research Fund A ialah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Amazon.com, Inc. (US:AMZN) , Meta Platforms, Inc. (US:META) , and Apple Inc. (US:AAPL) . Kedudukan baharu MFRFX - MFS Research Fund A termasuk The TJX Companies, Inc. (US:TJX) , Union Pacific Corporation (US:UNP) , BJ's Wholesale Club Holdings, Inc. (US:BJ) , American International Group, Inc. (US:AIG) , and Vistra Corp. (US:VST) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.43 | 238.83 | 2.9771 | 2.9771 | |

| 0.73 | 200.71 | 2.5019 | 2.0074 | |

| 0.72 | 105.56 | 1.3159 | 1.3159 | |

| 1.39 | 689.62 | 8.5964 | 1.1629 | |

| 0.36 | 80.24 | 1.0002 | 1.0002 | |

| 2.76 | 436.79 | 5.4448 | 0.9320 | |

| 0.40 | 48.80 | 0.6083 | 0.6083 | |

| 0.51 | 377.52 | 4.7059 | 0.5446 | |

| 73.02 | 73.02 | 0.9103 | 0.5284 | |

| 0.16 | 36.83 | 0.4592 | 0.4592 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 24.05 | 0.2998 | -0.8578 | |

| 0.23 | 65.47 | 0.8161 | -0.6477 | |

| 0.18 | 24.81 | 0.3093 | -0.4777 | |

| 0.26 | 77.80 | 0.9698 | -0.3891 | |

| 0.03 | 10.21 | 0.1273 | -0.3397 | |

| 1.16 | 203.84 | 2.5409 | -0.3219 | |

| 0.49 | 91.70 | 1.1431 | -0.3180 | |

| 0.30 | 51.99 | 0.6481 | -0.2849 | |

| 0.64 | 98.20 | 1.2241 | -0.2809 | |

| 0.73 | 65.51 | 0.8167 | -0.2656 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-26 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 1.39 | -5.93 | 689.62 | 24.65 | 8.5964 | 1.1629 | |||

| NVDA / NVIDIA Corporation | 2.76 | -10.79 | 436.79 | 30.04 | 5.4448 | 0.9320 | |||

| AMZN / Amazon.com, Inc. | 1.76 | -4.82 | 386.72 | 9.75 | 4.8206 | 0.0866 | |||

| META / Meta Platforms, Inc. | 0.51 | -4.82 | 377.52 | 21.89 | 4.7059 | 0.5446 | |||

| AAPL / Apple Inc. | 1.62 | 22.82 | 332.22 | 13.44 | 4.1413 | 0.2066 | |||

| MA / Mastercard Incorporated | 0.43 | 238.83 | 2.9771 | 2.9771 | |||||

| JPM / JPMorgan Chase & Co. | 0.71 | -4.82 | 206.52 | 12.49 | 2.5743 | 0.1077 | |||

| GOOGL / Alphabet Inc. | 1.16 | -16.05 | 203.84 | -4.33 | 2.5409 | -0.3219 | |||

| AVGO / Broadcom Inc. | 0.73 | 231.26 | 200.71 | 445.38 | 2.5019 | 2.0074 | |||

| CRM / Salesforce, Inc. | 0.40 | -4.82 | 110.25 | -3.28 | 1.3743 | -0.1572 | |||

| RTX / RTX Corporation | 0.72 | 105.56 | 1.3159 | 1.3159 | |||||

| JNJ / Johnson & Johnson | 0.64 | -4.82 | 98.20 | -12.33 | 1.2241 | -0.2809 | |||

| ABBV / AbbVie Inc. | 0.49 | -4.82 | 91.70 | -15.68 | 1.1431 | -0.3180 | |||

| HD / The Home Depot, Inc. | 0.24 | -4.82 | 87.36 | -4.78 | 1.0890 | -0.1437 | |||

| XOM / Exxon Mobil Corporation | 0.79 | 31.90 | 85.67 | 19.55 | 1.0679 | 0.1051 | |||

| SCHW / The Charles Schwab Corporation | 0.89 | -4.82 | 81.43 | 10.94 | 1.0150 | 0.0289 | |||

| ETN / Eaton Corporation plc | 0.23 | -4.82 | 81.20 | 25.00 | 1.0122 | 0.1394 | |||

| CME / CME Group Inc. | 0.29 | -4.82 | 80.67 | -1.11 | 1.0056 | -0.0905 | |||

| AMT / American Tower Corporation | 0.36 | 80.24 | 1.0002 | 1.0002 | |||||

| EMR / Emerson Electric Co. | 0.60 | 21.11 | 79.53 | 47.28 | 0.9914 | 0.2659 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.42 | -4.82 | 78.79 | 0.95 | 0.9822 | -0.0665 | |||

| CI / The Cigna Group | 0.24 | -4.82 | 77.85 | -4.36 | 0.9704 | -0.1232 | |||

| ACN / Accenture plc | 0.26 | -19.69 | 77.80 | -23.08 | 0.9698 | -0.3891 | |||

| LRCX / Lam Research Corporation | 0.79 | -4.82 | 76.46 | 27.44 | 0.9532 | 0.1470 | |||

| MDT / Medtronic plc | 0.87 | -4.82 | 75.49 | -7.67 | 0.9410 | -0.1575 | |||

| HWM / Howmet Aerospace Inc. | 0.40 | -4.82 | 75.30 | 36.56 | 0.9387 | 0.1978 | |||

| CDNS / Cadence Design Systems, Inc. | 0.24 | -20.87 | 75.07 | -4.13 | 0.9357 | -0.1163 | |||

| US55291X1090 / MFS Institutional Money Market Portfolio | 73.02 | 156.94 | 73.02 | 156.94 | 0.9103 | 0.5284 | |||

| ARMK / Aramark | 1.68 | -4.82 | 70.25 | 15.45 | 0.8757 | 0.0581 | |||

| MS / Morgan Stanley | 0.50 | -4.82 | 70.16 | 14.92 | 0.8746 | 0.0543 | |||

| BSX / Boston Scientific Corporation | 0.65 | -4.82 | 69.45 | 1.34 | 0.8657 | -0.0550 | |||

| COP / ConocoPhillips | 0.73 | -4.82 | 65.51 | -18.67 | 0.8167 | -0.2656 | |||

| CB / Chubb Limited | 0.23 | -37.36 | 65.47 | -39.91 | 0.8161 | -0.6477 | |||

| AON / Aon plc | 0.18 | -4.82 | 64.04 | -14.91 | 0.7983 | -0.2130 | |||

| OMC / Omnicom Group Inc. | 0.88 | 12.80 | 63.38 | -2.13 | 0.7900 | -0.0800 | |||

| CNSWF / Constellation Software Inc. | 0.02 | -14.80 | 62.42 | -1.35 | 0.7781 | -0.0721 | |||

| PM / Philip Morris International Inc. | 0.33 | -4.82 | 60.32 | 9.21 | 0.7520 | 0.0098 | |||

| SPF / Spotify Technology S.A. | 0.08 | 19.95 | 60.03 | 67.33 | 0.7483 | 0.2663 | |||

| USFD / US Foods Holding Corp. | 0.76 | 2.16 | 58.89 | 20.19 | 0.7341 | 0.0758 | |||

| TRU / TransUnion | 0.67 | -4.82 | 58.81 | 0.93 | 0.7331 | -0.0498 | |||

| CRH / CRH plc | 0.64 | 17.68 | 58.80 | 22.81 | 0.7329 | 0.0897 | |||

| PEP / PepsiCo, Inc. | 0.44 | -4.82 | 58.11 | -16.18 | 0.7244 | -0.2071 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.21 | 2.63 | 56.70 | 20.13 | 0.7067 | 0.0726 | |||

| TT / Trane Technologies plc | 0.13 | 41.15 | 55.61 | 83.25 | 0.6932 | 0.2855 | |||

| TEAM / Atlassian Corporation | 0.27 | 24.54 | 53.89 | 19.19 | 0.6717 | 0.0643 | |||

| MCK / McKesson Corporation | 0.07 | -16.50 | 53.24 | -9.09 | 0.6636 | -0.1231 | |||

| GD / General Dynamics Corporation | 0.18 | 3.01 | 52.11 | 10.22 | 0.6495 | 0.0143 | |||

| STE / STERIS plc | 0.22 | -4.82 | 52.04 | 0.88 | 0.6487 | -0.0444 | |||

| FI / Fiserv, Inc. | 0.30 | -4.10 | 51.99 | -25.13 | 0.6481 | -0.2849 | |||

| BDX / Becton, Dickinson and Company | 0.30 | 10.81 | 51.78 | -16.67 | 0.6454 | -0.1894 | |||

| OKTA / Okta, Inc. | 0.51 | -4.82 | 51.13 | -9.57 | 0.6374 | -0.1223 | |||

| NDSN / Nordson Corporation | 0.24 | 12.10 | 51.06 | 19.13 | 0.6365 | 0.0606 | |||

| MRVL / Marvell Technology, Inc. | 0.64 | -4.82 | 49.77 | 19.65 | 0.6204 | 0.0615 | |||

| APD / Air Products and Chemicals, Inc. | 0.17 | 2.38 | 48.99 | -2.08 | 0.6107 | -0.0616 | |||

| TJX / The TJX Companies, Inc. | 0.40 | 48.80 | 0.6083 | 0.6083 | |||||

| DUK / Duke Energy Corporation | 0.41 | -4.82 | 48.47 | -7.92 | 0.6043 | -0.1030 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.11 | -17.75 | 48.46 | -24.47 | 0.6041 | -0.2580 | |||

| CTVA / Corteva, Inc. | 0.64 | -4.82 | 48.04 | 12.73 | 0.5988 | 0.0263 | |||

| PFE / Pfizer Inc. | 1.97 | -4.82 | 47.85 | -8.95 | 0.5965 | -0.1096 | |||

| TYL / Tyler Technologies, Inc. | 0.08 | 14.57 | 47.84 | 16.82 | 0.5963 | 0.0461 | |||

| BKNG / Booking Holdings Inc. | 0.01 | -4.82 | 47.11 | 19.61 | 0.5873 | 0.0581 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.22 | -4.82 | 46.23 | 9.88 | 0.5763 | 0.0110 | |||

| WTY / Willis Towers Watson Public Limited Company | 0.15 | -4.82 | 45.65 | -13.68 | 0.5690 | -0.1415 | |||

| TE Connectivity plc / EC (IE000IVNQZ81) | 0.26 | -4.82 | 44.28 | 13.60 | 0.5520 | 0.0283 | |||

| MCO / Moody's Corporation | 0.09 | -4.82 | 44.06 | 2.52 | 0.5493 | -0.0282 | |||

| EPAM / EPAM Systems, Inc. | 0.25 | -4.82 | 43.89 | -0.32 | 0.5471 | -0.0445 | |||

| SHW / The Sherwin-Williams Company | 0.13 | 1.63 | 43.40 | -0.07 | 0.5410 | -0.0425 | |||

| NXPI / NXP Semiconductors N.V. | 0.20 | -4.82 | 43.09 | 9.42 | 0.5371 | 0.0080 | |||

| CL / Colgate-Palmolive Company | 0.47 | -4.82 | 42.95 | -7.66 | 0.5354 | -0.0896 | |||

| A / Agilent Technologies, Inc. | 0.36 | -4.82 | 42.72 | -3.98 | 0.5325 | -0.0652 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.55 | -9.37 | 42.67 | 23.12 | 0.5319 | 0.0215 | |||

| WAT / Waters Corporation | 0.12 | -4.82 | 42.58 | -9.86 | 0.5307 | -0.1039 | |||

| Aptiv plc / EC (JE00BTDN8H13) | 0.60 | 5.73 | 40.87 | 21.22 | 0.5095 | 0.0565 | |||

| RRX / Regal Rexnord Corporation | 0.28 | -4.82 | 40.27 | 21.19 | 0.5019 | 0.0555 | |||

| HUBS / HubSpot, Inc. | 0.07 | 15.13 | 39.62 | 12.18 | 0.4939 | 0.0193 | |||

| EXR / Extra Space Storage Inc. | 0.27 | -4.82 | 39.48 | -5.49 | 0.4921 | -0.0691 | |||

| NTRS / Northern Trust Corporation | 0.31 | -4.82 | 38.87 | 22.33 | 0.4845 | 0.0576 | |||

| MDLZ / Mondelez International, Inc. | 0.57 | -4.82 | 38.35 | -5.39 | 0.4780 | -0.0666 | |||

| FERG / Ferguson Enterprises Inc. | 0.18 | -4.82 | 38.17 | 29.35 | 0.4758 | 0.0793 | |||

| LNT / Alliant Energy Corporation | 0.63 | -4.82 | 37.84 | -10.56 | 0.4717 | -0.0967 | |||

| DG / Dollar General Corporation | 0.32 | 45.39 | 37.15 | 22.32 | 0.4631 | 0.0618 | |||

| UNP / Union Pacific Corporation | 0.16 | 36.83 | 0.4592 | 0.4592 | |||||

| EXPE / Expedia Group, Inc. | 0.22 | -4.82 | 36.63 | -4.49 | 0.4565 | -0.0587 | |||

| PCG / PG&E Corporation | 2.58 | -4.82 | 35.98 | -22.77 | 0.4485 | -0.1774 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.33 | 35.85 | 0.4468 | 0.4468 | |||||

| AIG / American International Group, Inc. | 0.41 | 35.38 | 0.4410 | 0.4410 | |||||

| KKR / KKR & Co. Inc. | 0.26 | -4.82 | 35.24 | 9.52 | 0.4392 | 0.0070 | |||

| PPL / PPL Corporation | 1.04 | -4.82 | 35.12 | -10.67 | 0.4378 | -0.0904 | |||

| CDW / CDW Corporation | 0.19 | -4.82 | 34.43 | 6.07 | 0.4292 | -0.0069 | |||

| KVUE / Kenvue Inc. | 1.64 | -4.82 | 34.41 | -16.92 | 0.4289 | -0.1276 | |||

| SBUX / Starbucks Corporation | 0.37 | -35.08 | 34.31 | -23.58 | 0.4277 | -0.1340 | |||

| JBHT / J.B. Hunt Transport Services, Inc. | 0.22 | -4.82 | 31.79 | -7.62 | 0.3963 | -0.0661 | |||

| VST / Vistra Corp. | 0.16 | 31.00 | 0.3864 | 0.3864 | |||||

| HUM / Humana Inc. | 0.11 | -4.82 | 25.73 | -12.06 | 0.3208 | -0.0724 | |||

| VLO / Valero Energy Corporation | 0.19 | -4.82 | 25.12 | -3.12 | 0.3132 | -0.0353 | |||

| HES / Hess Corporation | 0.18 | -51.16 | 24.81 | -57.64 | 0.3093 | -0.4777 | |||

| GIS / General Mills, Inc. | 0.47 | -4.82 | 24.31 | -17.52 | 0.3030 | -0.0930 | |||

| SBAC / SBA Communications Corporation | 0.10 | -73.85 | 24.05 | -72.09 | 0.2998 | -0.8578 | |||

| LNG / Cheniere Energy, Inc. | 0.09 | -4.82 | 23.04 | 0.17 | 0.2873 | -0.0218 | |||

| ESTC / Elastic N.V. | 0.27 | -4.82 | 22.80 | -9.91 | 0.2843 | -0.0558 | |||

| EL / The Estée Lauder Companies Inc. | 0.27 | -4.82 | 21.50 | 16.53 | 0.2680 | 0.0201 | |||

| EVR / Evercore Inc. | 0.08 | 20.27 | 0.2527 | 0.2527 | |||||

| FTI / TechnipFMC plc | 0.54 | -4.82 | 18.59 | 3.44 | 0.2317 | -0.0097 | |||

| IJF / ICON Public Limited Company | 0.12 | -4.82 | 17.24 | -20.89 | 0.2149 | -0.0779 | |||

| IT / Gartner, Inc. | 0.03 | -69.49 | 10.21 | -70.62 | 0.1273 | -0.3397 | |||

| CA21037X1345 / CONSTELLATION SOFTWARE INC | 0.03 | 0.00 | 0.00 | 0.0000 | 0.0000 |