Statistik Asas

| Nilai Portfolio | $ 35,626,493 |

| Kedudukan Semasa | 229 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

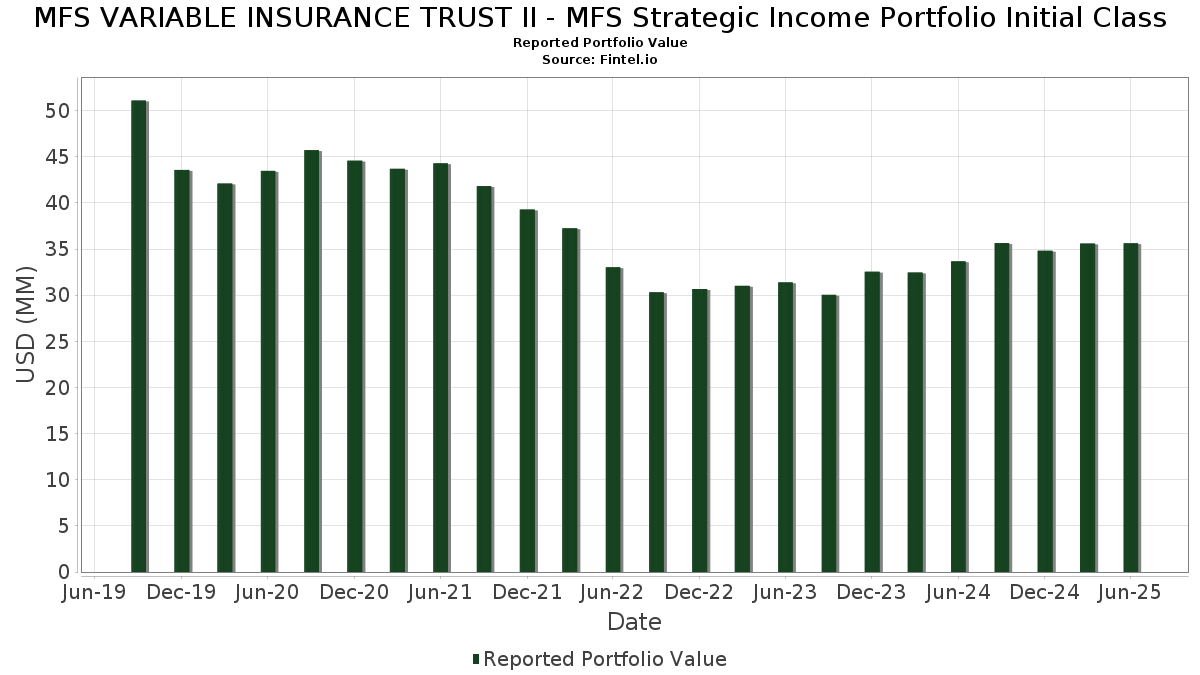

MFS VARIABLE INSURANCE TRUST II - MFS Strategic Income Portfolio Initial Class telah mendedahkan 229 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 35,626,493 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas MFS VARIABLE INSURANCE TRUST II - MFS Strategic Income Portfolio Initial Class ialah United States Treasury Note/Bond (US:US91282CHQ78) , TREASURY BOND (US:US912810TF57) , United States Treasury Note/Bond (US:US912810TW80) , United States Treasury Note/Bond (US:US912810TU25) , and United States Treasury Note/Bond (US:US91282CGC91) . Kedudukan baharu MFS VARIABLE INSURANCE TRUST II - MFS Strategic Income Portfolio Initial Class termasuk United States Treasury Note/Bond (US:US91282CHQ78) , TREASURY BOND (US:US912810TF57) , United States Treasury Note/Bond (US:US912810TW80) , United States Treasury Note/Bond (US:US912810TU25) , and United States Treasury Note/Bond (US:US91282CGC91) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.35 | 0.9764 | 0.9764 | ||

| 0.16 | 0.4359 | 0.4359 | ||

| 1.14 | 3.1687 | 0.3488 | ||

| 1.29 | 3.5847 | 0.3248 | ||

| 0.11 | 0.3100 | 0.3100 | ||

| 0.25 | 0.7077 | 0.2850 | ||

| 0.09 | 0.2568 | 0.2568 | ||

| 0.09 | 0.2502 | 0.2502 | ||

| 0.07 | 0.2025 | 0.2025 | ||

| 0.06 | 0.1644 | 0.1644 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.68 | 1.9005 | -0.3848 | ||

| 0.29 | 0.29 | 0.8048 | -0.3494 | |

| 0.06 | 0.1650 | -0.1008 | ||

| 0.16 | 0.4492 | -0.0859 | ||

| 0.90 | 2.5093 | -0.0737 | ||

| 0.05 | 0.1284 | -0.0727 | ||

| 1.13 | 3.1337 | -0.0692 | ||

| 0.95 | 2.6373 | -0.0648 | ||

| 0.78 | 2.1641 | -0.0526 | ||

| 0.50 | 1.3769 | -0.0460 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-25 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US91282CHQ78 / United States Treasury Note/Bond | 2.11 | 0.53 | 5.8501 | 0.0181 | |||||

| U.S. Treasury Bonds / DBT (US912810TZ12) | 1.29 | 10.17 | 3.5847 | 0.3248 | |||||

| U.S. Treasury Bonds / DBT (US912810TX63) | 1.14 | 12.65 | 3.1687 | 0.3488 | |||||

| US912810TF57 / TREASURY BOND | 1.13 | -2.00 | 3.1337 | -0.0692 | |||||

| US912810TW80 / United States Treasury Note/Bond | 0.95 | -2.27 | 2.6373 | -0.0648 | |||||

| U.S. Treasury Notes / DBT (US91282CLW90) | 0.90 | -2.70 | 2.5093 | -0.0737 | |||||

| US912810TU25 / United States Treasury Note/Bond | 0.78 | -2.26 | 2.1641 | -0.0526 | |||||

| US91282CGC91 / United States Treasury Note/Bond | 0.68 | -16.71 | 1.9005 | -0.3848 | |||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 0.50 | -3.13 | 1.3769 | -0.0460 | |||||

| US95000U2U64 / Wells Fargo & Co | 0.39 | 1.82 | 1.0888 | 0.0171 | |||||

| US06051GKD06 / Bank of America Corp | 0.37 | 1.96 | 1.0165 | 0.0196 | |||||

| U.S. Treasury Notes / DBT (US91282CMZ13) | 0.35 | 0.9764 | 0.9764 | ||||||

| US960386AM29 / Wabtec Corp | 0.31 | 0.33 | 0.8497 | 0.0020 | |||||

| US55291X1090 / MFS Institutional Money Market Portfolio | 0.29 | -30.15 | 0.29 | -30.19 | 0.8048 | -0.3494 | |||

| US303901BB79 / Fairfax Financial Holdings Ltd | 0.29 | 0.71 | 0.7933 | 0.0041 | |||||

| PFP 2024-11 Ltd / ABS-CBDO (US69291WAC64) | 0.27 | 0.37 | 0.7577 | 0.0017 | |||||

| US03880RAJ86 / Arbor Realty Commercial Real Estate Notes 2021-FL4 Ltd | 0.26 | 0.39 | 0.7123 | 0.0021 | |||||

| U.S. Treasury Notes / DBT (US91282CKX82) | 0.25 | 68.21 | 0.7077 | 0.2850 | |||||

| NATIONAL FIN AUTH NH UTL REV / DBT (US63610HAA05) | 0.25 | -0.40 | 0.7023 | -0.0040 | |||||

| Dryden 113 CLO Ltd / ABS-CBDO (US26253EBB39) | 0.25 | 0.40 | 0.6961 | 0.0005 | |||||

| US92916GBH65 / Voya 2012-4 Ltd | 0.25 | 0.00 | 0.6957 | -0.0009 | |||||

| US64129KBJ51 / Neuberger Berman CLO XV | 0.25 | 0.00 | 0.6953 | -0.0016 | |||||

| Northwoods Capital XIV-B Ltd / ABS-CBDO (US66860CAN39) | 0.25 | 0.40 | 0.6952 | 0.0013 | |||||

| US58003UAE82 / MF1 Multifamily Housing Mortgage Loan Trust, Series 2020-FL4, Class B | 0.25 | 0.40 | 0.6952 | -0.0000 | |||||

| Palmer Square Loan Funding 2024-3 Ltd / ABS-CBDO (US69690EAC30) | 0.25 | 0.00 | 0.6951 | -0.0013 | |||||

| Black Diamond Clo 2019-2 Ltd / ABS-CBDO (US09204GAM15) | 0.25 | 0.00 | 0.6950 | -0.0013 | |||||

| Dryden 104 CLO Ltd / ABS-CBDO (US26253BAS34) | 0.25 | 0.00 | 0.6950 | -0.0014 | |||||

| Shackleton 2015-VII-R CLO Ltd / ABS-CBDO (US81883AAU34) | 0.25 | 0.40 | 0.6949 | 0.0016 | |||||

| AGL CLO 1 LTD / ABS-CBDO (US00119HAS94) | 0.25 | 0.81 | 0.6948 | 0.0037 | |||||

| US253393AF94 / Dick's Sporting Goods, Inc. | 0.25 | 1.24 | 0.6826 | 0.0077 | |||||

| US889184AC18 / Toledo Hospital | 0.24 | 0.85 | 0.6621 | 0.0040 | |||||

| US29278GBA58 / ENEL FINANCE INTERNATIONAL NV | 0.23 | 0.88 | 0.6336 | 0.0036 | |||||

| US05526DBJ37 / BAT Capital Corp | 0.23 | 0.44 | 0.6330 | 0.0021 | |||||

| US06738ECE32 / Barclays PLC | 0.23 | 1.35 | 0.6308 | 0.0093 | |||||

| Sammons Financial Group Inc / DBT (US79588TAF75) | 0.22 | 0.45 | 0.6248 | 0.0016 | |||||

| US73358SAA15 / Port of Beaumont Industrial Development Authority | 0.22 | -2.70 | 0.6025 | -0.0164 | |||||

| US296110GG80 / ESCAMBIA CNTY FL HLTH FACS AUTH | 0.22 | -0.46 | 0.5985 | -0.0051 | |||||

| US949746TD35 / Wells Fargo & Co | 0.21 | 0.95 | 0.5914 | 0.0047 | |||||

| US444859BV38 / Humana Inc | 0.20 | 1.00 | 0.5629 | 0.0050 | |||||

| US04505AAA79 / Ashtead Capital Inc | 0.20 | 1.51 | 0.5629 | 0.0081 | |||||

| US045054AQ67 / Ashtead Capital Inc | 0.20 | 1.52 | 0.5613 | 0.0089 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 0.20 | 0.00 | 0.5599 | -0.0014 | |||||

| Bain Capital Credit CLO 2020-3 Ltd / ABS-CBDO (US05684CAZ86) | 0.20 | 0.00 | 0.5565 | -0.0011 | |||||

| US01400EAF07 / ALCON FINANCE CORP | 0.20 | -0.50 | 0.5516 | -0.0048 | |||||

| Bain Capital Credit CLO 2021-4 Ltd / ABS-CBDO (US05685AAW80) | 0.20 | 1.03 | 0.5484 | 0.0030 | |||||

| US06051GKL22 / BAC 3.846 03/08/37 | 0.20 | 2.08 | 0.5468 | 0.0095 | |||||

| Venture 43 CLO Ltd / ABS-CBDO (US92290CAX74) | 0.19 | 1.04 | 0.5406 | 0.0041 | |||||

| US15239XAA63 / Central American Bottling Corp / CBC Bottling Holdco SL / Beliv Holdco SL | 0.19 | 1.05 | 0.5377 | 0.0048 | |||||

| US68622TAA97 / Organon Finance 1 LLC | 0.19 | 3.23 | 0.5346 | 0.0142 | |||||

| US00774MAB19 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.19 | 1.05 | 0.5337 | 0.0034 | |||||

| US26884LAL36 / EQT Corporation | 0.19 | 0.00 | 0.5325 | 0.0000 | |||||

| COMM 2024-CBM Mortgage Trust / ABS-MBS (US12674GAG91) | 0.19 | -1.04 | 0.5289 | -0.0059 | |||||

| US05401AAP66 / Avolon Holdings Funding Ltd | 0.18 | 1.10 | 0.5116 | 0.0038 | |||||

| US92769VAJ89 / Virgin Media Finance PLC | 0.18 | 6.43 | 0.5079 | 0.0305 | |||||

| US404280CQ03 / HSBC Holdings PLC | 0.18 | 1.69 | 0.5038 | 0.0066 | |||||

| US108555GG22 / BRIDGEVIEW IL | 0.18 | 0.00 | 0.4962 | -0.0007 | |||||

| XS2384701020 / Nigeria Government International Bond | 0.18 | 5.95 | 0.4961 | 0.0257 | |||||

| US902613AD01 / UBS Group AG | 0.18 | 2.92 | 0.4912 | 0.0144 | |||||

| US10112RBE36 / Boston Properties LP | 0.18 | 2.33 | 0.4900 | 0.0105 | |||||

| US254709AS70 / Discover Financial Services | 0.18 | 1.74 | 0.4885 | 0.0071 | |||||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 0.18 | 1.74 | 0.4871 | 0.0073 | |||||

| US893647BP15 / CORP. NOTE | 0.17 | 3.01 | 0.4772 | 0.0146 | |||||

| US703343AD59 / Patrick Industries Inc | 0.17 | 3.05 | 0.4723 | 0.0151 | |||||

| US66573RAA68 / Northern Star Resources Ltd | 0.17 | 0.60 | 0.4716 | 0.0018 | |||||

| US808513CH62 / Charles Schwab Corp/The | 0.17 | 1.83 | 0.4661 | 0.0067 | |||||

| B1BT34 / Truist Financial Corporation - Depositary Receipt (Common Stock) | 0.17 | 1.23 | 0.4609 | 0.0061 | |||||

| New Residential Mortgage Loan Trust 2024-NQM1 / ABS-MBS (US64828DAA54) | 0.17 | -8.84 | 0.4608 | -0.0436 | |||||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JJ70) | 0.17 | -5.17 | 0.4608 | -0.0260 | |||||

| US03880RAA77 / Arbor Realty Collateralized Loan Obligation Ltd | 0.16 | -16.15 | 0.4492 | -0.0859 | |||||

| US694308JJ74 / Pacific Gas and Electric Co | 0.16 | -3.61 | 0.4455 | -0.0172 | |||||

| SHR Trust 2024-LXRY / ABS-MBS (US784234AC03) | 0.16 | -0.62 | 0.4433 | -0.0025 | |||||

| US48275RAJ68 / KREF, Series 2021-FL2, Class D | 0.16 | -0.62 | 0.4422 | -0.0050 | |||||

| US15118JAA34 / Cellnex Finance Co SA | 0.16 | 0.64 | 0.4379 | 0.0029 | |||||

| 2914 / Japan Tobacco Inc. | 0.16 | 0.4359 | 0.4359 | ||||||

| US44332PAH47 / HUB International Ltd | 0.16 | 1.30 | 0.4356 | 0.0055 | |||||

| US21871XAP42 / Corebridge Financial Inc | 0.15 | 0.65 | 0.4300 | 0.0032 | |||||

| US718172CX57 / PHILIP MORRIS INTERNATIONAL INC | 0.15 | 1.32 | 0.4289 | 0.0034 | |||||

| US097023CW33 / BOEING CO 5.805 5/50 | 0.15 | 0.66 | 0.4237 | 0.0023 | |||||

| US90276WAS61 / UBS Commercial Mortgage Trust 2017-C7 | 0.15 | 0.67 | 0.4222 | 0.0029 | |||||

| US01883LAD55 / Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer | 0.15 | 2.08 | 0.4109 | 0.0073 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 0.15 | 0.69 | 0.4081 | 0.0043 | |||||

| US1248EPCE15 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.14 | 5.15 | 0.3974 | 0.0172 | |||||

| US29250NAZ87 / Enbridge Inc | 0.14 | 1.44 | 0.3938 | 0.0053 | |||||

| US29250NBF15 / Enbridge Inc | 0.14 | 1.44 | 0.3925 | 0.0053 | |||||

| US74529JQY46 / PUERTO RICO SALES TAX FING CORP SALES TAX REVENUE | 0.14 | -8.55 | 0.3863 | -0.0381 | |||||

| US25714PEF18 / Dominican Republic International Bond | 0.14 | 1.47 | 0.3845 | 0.0056 | |||||

| US30251GBC06 / FMG Resources August 2006 Pty Ltd | 0.14 | 3.85 | 0.3765 | 0.0120 | |||||

| US50212YAF16 / LPL Holdings Inc | 0.13 | 0.00 | 0.3749 | 0.0014 | |||||

| US853496AH04 / Standard Industries Inc/NJ | 0.13 | 3.08 | 0.3738 | 0.0107 | |||||

| US24703TAG13 / Dell International LLC / EMC Corp | 0.13 | 0.76 | 0.3718 | 0.0033 | |||||

| US38141GZM94 / Goldman Sachs Group Inc/The | 0.13 | 2.31 | 0.3702 | 0.0070 | |||||

| Macquarie Airfinance Holdings Ltd / DBT (US55609NAD03) | 0.13 | 1.54 | 0.3676 | 0.0052 | |||||

| US501889AF63 / LKQ Corp | 0.13 | 1.57 | 0.3602 | 0.0040 | |||||

| US72650RBN17 / Plains All American Pipeline LP / PAA Finance Corp | 0.13 | 1.57 | 0.3586 | 0.0043 | |||||

| US670001AH91 / Novelis Corp | 0.13 | 3.31 | 0.3496 | 0.0107 | |||||

| Boston Properties LP / DBT (US10112RBJ23) | 0.12 | 1.67 | 0.3412 | 0.0050 | |||||

| US161175CA05 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.12 | 6.19 | 0.3357 | 0.0188 | |||||

| US75575WAJ53 / Ready Capital Mortgage Financing 2021-FL7 LLC | 0.12 | 0.00 | 0.3331 | -0.0006 | |||||

| A2RW34 / Arrow Electronics, Inc. - Depositary Receipt (Common Stock) | 0.12 | 1.71 | 0.3329 | 0.0060 | |||||

| MF1 2024-FL16 / ABS-CBDO (US55287EAG26) | 0.12 | 0.00 | 0.3316 | -0.0023 | |||||

| Performance Food Group Inc / DBT (US71376LAF76) | 0.12 | 2.61 | 0.3298 | 0.0087 | |||||

| LoanCore 2025 2025-CRE8 Issuer LLC / ABS-CBDO (US53947FAE16) | 0.12 | 0.00 | 0.3237 | -0.0020 | |||||

| US037389BB82 / Aon Corp | 0.12 | 0.88 | 0.3211 | 0.0018 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 0.11 | 3.70 | 0.3123 | 0.0098 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0.11 | 0.91 | 0.3112 | 0.0029 | |||||

| Dwight 2025-FL1 Issuer LLC / ABS-CBDO (US233636AC39) | 0.11 | 0.3100 | 0.3100 | ||||||

| US803014AB57 / Santos Finance Ltd | 0.11 | 1.83 | 0.3095 | 0.0052 | |||||

| US12505BAG59 / CBRE Services Inc | 0.11 | 0.92 | 0.3072 | 0.0016 | |||||

| US37940XAD49 / Global Payments Inc | 0.11 | 1.85 | 0.3066 | 0.0037 | |||||

| Angel Oak Mortgage Trust 2024-10 / ABS-MBS (US034933AA90) | 0.11 | -5.36 | 0.2966 | -0.0157 | |||||

| US067316AG42 / Bacardi Ltd | 0.11 | 0.00 | 0.2945 | 0.0005 | |||||

| US097751BZ39 / Bombardier, Inc. | 0.10 | 1.96 | 0.2918 | 0.0062 | |||||

| Panther Escrow Issuer LLC / DBT (US69867RAA59) | 0.10 | 1.98 | 0.2887 | 0.0050 | |||||

| US900123AY60 / Turkey Government International Bond | 0.10 | 1.98 | 0.2878 | 0.0038 | |||||

| US92328MAE30 / Venture Global Calcasieu Pass LLC | 0.10 | 1.98 | 0.2866 | 0.0040 | |||||

| US65342QAM42 / NEXTERA ENERGY OPERATING REGD 144A P/P 7.25000000 | 0.10 | 4.08 | 0.2849 | 0.0110 | |||||

| AmWINS Group Inc / DBT (US031921AC31) | 0.10 | 1.00 | 0.2832 | 0.0027 | |||||

| EQT Trust 2024-EXTR / ABS-MBS (US29439DAE13) | 0.10 | 1.00 | 0.2830 | 0.0028 | |||||

| Store Master Funding I-VII XIV XIX XX XXIV XXII / ABS-O (US86212XAP50) | 0.10 | 0.00 | 0.2826 | -0.0010 | |||||

| EQT Trust 2024-EXTR / ABS-MBS (US29439DAC56) | 0.10 | 1.00 | 0.2825 | 0.0034 | |||||

| BSPRT 2024-FL11 Issuer LLC / ABS-CBDO (US05613RAC25) | 0.10 | 1.01 | 0.2793 | 0.0013 | |||||

| Store Master Funding I-VII XIV XIX XX XXIV XXII / ABS-O (US86212XAN03) | 0.10 | 0.00 | 0.2791 | -0.0016 | |||||

| MF1 2024-FL14 LLC / ABS-CBDO (US55416AAG40) | 0.10 | 0.00 | 0.2790 | -0.0006 | |||||

| ELM Trust 2024-ELM / ABS-MBS (US26860XBE04) | 0.10 | 0.00 | 0.2788 | -0.0022 | |||||

| BDS 2024-FL13 LLC / ABS-CBDO (US05555MAA71) | 0.10 | 0.00 | 0.2786 | -0.0005 | |||||

| MF1 2024-FL15 / ABS-CBDO (US58003MAG15) | 0.10 | 0.00 | 0.2783 | -0.0006 | |||||

| BMP 2024-MF23 / ABS-MBS (US05593JAE01) | 0.10 | 1.01 | 0.2782 | 0.0007 | |||||

| BMP 2024-MF23 / ABS-MBS (US05593JAG58) | 0.10 | 1.01 | 0.2782 | 0.0007 | |||||

| MF1 2024-FL15 / ABS-CBDO (US58003MAE66) | 0.10 | 0.00 | 0.2782 | -0.0005 | |||||

| US88948ABE64 / Toll Road Investors Partnership II LP | 0.10 | 3.09 | 0.2781 | 0.0062 | |||||

| US06541DBT00 / BANK 2023-BNK46 B 6.963% 08/15/2056 | 0.10 | 0.00 | 0.2773 | 0.0015 | |||||

| MF1 2024-FL16 / ABS-CBDO (US55287EAE77) | 0.10 | 0.00 | 0.2769 | -0.0014 | |||||

| AREIT 2025-CRE10 Ltd / ABS-CBDO (US00193DAE85) | 0.10 | 0.00 | 0.2765 | -0.0012 | |||||

| US55608JBE73 / Macquarie Group Ltd | 0.10 | 0.00 | 0.2764 | 0.0007 | |||||

| US03880KAJ34 / Arbor Realty Commercial Real Estate Notes 2021-FL3 Ltd | 0.10 | 0.00 | 0.2760 | 0.0001 | |||||

| MF1 2025-FL17 LLC / ABS-CBDO (US55287HAG56) | 0.10 | 0.00 | 0.2756 | -0.0023 | |||||

| MF1 2025-FL17 LLC / ABS-CBDO (US55287HAE09) | 0.10 | 0.00 | 0.2756 | -0.0023 | |||||

| Angel Oak Mortgage Trust 2024-12 / ABS-MBS (US034932AA18) | 0.10 | -7.62 | 0.2714 | -0.0222 | |||||

| US737446AQ74 / Post Holdings Inc | 0.10 | 3.23 | 0.2671 | 0.0071 | |||||

| COLT 2024-5 Mortgage Loan Trust / ABS-MBS (US19685AAA79) | 0.10 | -6.86 | 0.2659 | -0.0187 | |||||

| COLT 2024-1 Mortgage Loan Trust / ABS-MBS (US19688TAA34) | 0.10 | -10.38 | 0.2658 | -0.0314 | |||||

| COLT 2025-1 / ABS-MBS (US196920AC66) | 0.10 | -4.04 | 0.2653 | -0.0121 | |||||

| US11135FAS02 / BROADCOM INC 4.3% 11/15/2032 | 0.09 | 2.20 | 0.2588 | 0.0036 | |||||

| Affirm Asset Securitization Trust 2025-X1 / ABS-O (US00834MAA18) | 0.09 | 0.2568 | 0.2568 | ||||||

| OBX 2025-NQM1 Trust / ABS-MBS (US673914AC13) | 0.09 | -4.17 | 0.2563 | -0.0124 | |||||

| Venture Global LNG Inc / DBT (US92332YAE14) | 0.09 | 2.27 | 0.2528 | 0.0060 | |||||

| LPL Holdings Inc / DBT (US50212YAQ70) | 0.09 | 0.2502 | 0.2502 | ||||||

| US889184AD90 / Toledo Hospital/The | 0.09 | -1.12 | 0.2470 | -0.0011 | |||||

| Verus Securitization Trust 2024-8 / ABS-MBS (US92540PAA66) | 0.09 | -5.38 | 0.2468 | -0.0136 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2024-NQM1 / ABS-MBS (US61775UAA60) | 0.09 | -8.33 | 0.2467 | -0.0208 | |||||

| Business Jet Securities 2024-2 LLC / ABS-O (US12326TAA60) | 0.09 | -6.38 | 0.2466 | -0.0166 | |||||

| US75606DAL55 / REALOGY GROUP LLC / REALOGY CO-ISSUER CORP 5.75% 01/15/2029 144A | 0.09 | 7.41 | 0.2430 | 0.0154 | |||||

| US775109BN09 / Rogers Communications Inc | 0.09 | 3.61 | 0.2392 | 0.0061 | |||||

| US808513CB92 / Charles Schwab Corp/The | 0.09 | 0.00 | 0.2382 | 0.0014 | |||||

| OBX 2024-NQM14 Trust / ABS-MBS (US67119XAC83) | 0.08 | -6.67 | 0.2338 | -0.0191 | |||||

| US378272BE79 / Glencore Funding LLC | 0.08 | 2.60 | 0.2205 | 0.0046 | |||||

| US55361AAU88 / MSWF Commercial Mortgage Trust 2023-2 | 0.08 | 1.28 | 0.2196 | 0.0008 | |||||

| POST / Post Holdings, Inc. | 0.08 | 2.63 | 0.2180 | 0.0042 | |||||

| US59523UAR86 / Mid-America Apartments LP | 0.08 | 2.70 | 0.2127 | 0.0043 | |||||

| US46647PBP09 / JPMORGAN CHASE and CO 2.956/VAR 05/13/2031 | 0.07 | 1.37 | 0.2081 | 0.0031 | |||||

| US929566AL19 / Wabash National Corp | 0.07 | 1.37 | 0.2061 | 0.0010 | |||||

| Stellantis Financial Underwritten Enhanced Lease Trust 2025-A / ABS-O (US858928AB07) | 0.07 | 0.2025 | 0.2025 | ||||||

| COLT 2024-2 Mortgage Loan Trust / ABS-MBS (US12665LAA26) | 0.07 | -10.26 | 0.1965 | -0.0232 | |||||

| US87612GAB77 / Targa Resources Corp | 0.07 | -1.45 | 0.1901 | -0.0027 | |||||

| OBX 2024-NQM3 Trust / ABS-MBS (US67118KAA16) | 0.07 | -6.85 | 0.1892 | -0.0165 | |||||

| Verus Securitization Trust 2024-2 / ABS-MBS (US92539UAA88) | 0.07 | -8.22 | 0.1878 | -0.0180 | |||||

| American Credit Acceptance Receivables Trust 2024-2 / ABS-O (US02531BAE92) | 0.06 | 0.00 | 0.1800 | -0.0007 | |||||

| US87612BBS07 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 0.06 | 1.59 | 0.1792 | 0.0020 | |||||

| Verus Securitization Trust 2024-1 / ABS-MBS (US92540EAA10) | 0.06 | -12.33 | 0.1784 | -0.0259 | |||||

| US87612BBU52 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 0.06 | 1.64 | 0.1735 | 0.0014 | |||||

| US88732JBD90 / Time Warner Cable LLC | 0.06 | 5.17 | 0.1704 | 0.0071 | |||||

| US06051GHM42 / Bank of America Corp | 0.06 | 0.00 | 0.1690 | 0.0012 | |||||

| US01626PAM86 / Alimentation Couche-Tard Inc | 0.06 | 1.69 | 0.1688 | 0.0025 | |||||

| US61747YFG52 / Morgan Stanley | 0.06 | 1.69 | 0.1680 | 0.0018 | |||||

| JBS USA LUX Sarl / JBS USA Food Co / JBS USA Foods Group / DBT (US472140AA00) | 0.06 | 1.69 | 0.1670 | 0.0010 | |||||

| US459506AL51 / International Flavors & Fragrances Inc | 0.06 | -37.89 | 0.1650 | -0.1008 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 0.06 | 0.1644 | 0.1644 | ||||||

| Angel Oak Mortgage Trust 2024-9 / ABS-MBS (US03466JAA79) | 0.06 | -9.23 | 0.1643 | -0.0172 | |||||

| US21071BAA35 / Consumers 2023 Securitization Funding LLC | 0.06 | -1.72 | 0.1602 | -0.0013 | |||||

| BERKS CNTY PA MUNI AUTH / DBT (US084538JL27) | 0.06 | 0.00 | 0.1563 | -0.0009 | |||||

| US163851AF58 / Chemours Co/The | 0.06 | 1.82 | 0.1563 | 0.0022 | |||||

| CC / The Chemours Company | 0.06 | 0.00 | 0.1561 | -0.0001 | |||||

| EMRLD Borrower LP / Emerald Co-Issuer Inc / DBT (US26873CAB81) | 0.06 | 1.85 | 0.1553 | 0.0040 | |||||

| US571903BG74 / Marriott International Inc/MD | 0.06 | 1.85 | 0.1539 | 0.0029 | |||||

| Santander Drive Auto Receivables Trust 2025-1 / ABS-O (US80288DAC02) | 0.06 | 0.00 | 0.1534 | -0.0003 | |||||

| MSWF Commercial Mortgage Trust 2023-2 / ABS-MBS (US55361AAX28) | 0.05 | 0.00 | 0.1519 | -0.0000 | |||||

| US073250BW13 / Bayview Financial Revolving Asset Trust 2005-E | 0.05 | -1.85 | 0.1499 | -0.0012 | |||||

| US04033GAB32 / ARI Fleet Lease Trust 2023-B | 0.05 | -18.46 | 0.1491 | -0.0322 | |||||

| US912810TT51 / United States Treasury Note/Bond | 0.05 | -3.64 | 0.1489 | -0.0050 | |||||

| US21871XAM11 / Corebridge Financial Inc | 0.05 | -2.08 | 0.1332 | -0.0005 | |||||

| US775109CK50 / Rogers Communications Inc | 0.05 | 2.17 | 0.1312 | 0.0025 | |||||

| US05401AAJ07 / Avolon Holdings Funding Ltd | 0.05 | 0.00 | 0.1300 | 0.0005 | |||||

| Exeter Automobile Receivables Trust 2025-1 / ABS-O (US30167MAB37) | 0.05 | -17.86 | 0.1300 | -0.0260 | |||||

| Affirm Asset Securitization Trust 2024-X2 / ABS-O (US00833QAA31) | 0.05 | -36.11 | 0.1284 | -0.0727 | |||||

| US88948ABB26 / Toll Road Investors Partnership II LP | 0.04 | 2.33 | 0.1228 | 0.0018 | |||||

| Acrec 2025 Fl 3 LLC / ABS-CBDO (US00112HAG20) | 0.04 | 0.00 | 0.1118 | -0.0005 | |||||

| Hyundai Capital America / DBT (US44891ACY10) | 0.04 | 0.00 | 0.1047 | 0.0004 | |||||

| US912810TD00 / United States Treasury Note/Bond | 0.04 | -2.70 | 0.1018 | -0.0035 | |||||

| US29103CAA62 / Emerald Debt Merger Sub LLC | 0.04 | 0.00 | 0.0994 | 0.0019 | |||||

| Virginia Power Fuel Securitization LLC / DBT (US92808VAA08) | 0.04 | -22.22 | 0.0990 | -0.0275 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.04 | 2.94 | 0.0974 | 0.0006 | |||||

| Ferguson Enterprises Inc / DBT (US31488VAA52) | 0.03 | 0.00 | 0.0938 | 0.0016 | |||||

| US097023CV59 / BOEING CO 5.705% 05/01/2040 | 0.03 | 0.00 | 0.0933 | 0.0013 | |||||

| US67884XCP06 / Oklahoma Development Finance Authority Revenue Bonds | 0.03 | 0.0919 | 0.0919 | ||||||

| STZB34 / Constellation Brands, Inc. - Depositary Receipt (Common Stock) | 0.03 | 0.0869 | 0.0869 | ||||||

| US88948ABG13 / Toll Road Investors Partnership II LP | 0.03 | 3.33 | 0.0865 | 0.0021 | |||||

| US476556DD44 / Jersey Central Power & Light Co | 0.03 | 0.00 | 0.0828 | 0.0010 | |||||

| American Credit Acceptance Receivables Trust 2024-2 / ABS-O (US02531BAC37) | 0.03 | 0.00 | 0.0754 | -0.0003 | |||||

| US61747YFF79 / Morgan Stanley | 0.03 | 0.00 | 0.0715 | 0.0003 | |||||

| US ULTRA BOND CBT SEP25 / DIR (000000000) | 0.02 | 0.0690 | 0.0690 | ||||||

| US054989AA67 / BAT CAPITAL CORP 6.343000% 08/02/2030 | 0.02 | 0.00 | 0.0539 | 0.0006 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.0513 | 0.0006 | |||||

| US21871XAK54 / Corebridge Financial Inc | 0.02 | 0.00 | 0.0467 | 0.0001 | |||||

| US303901BJ06 / Fairfax Financial Holdings Ltd. | 0.01 | 0.00 | 0.0387 | 0.0006 | |||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 0.01 | 0.0311 | 0.0311 | ||||||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 0.01 | 0.0296 | 0.0296 | ||||||

| DLLST 2024-1 LLC / ABS-O (US23346HAB33) | 0.01 | -60.00 | 0.0190 | -0.0235 | |||||

| US31371KML25 / Fannie Mae Pool | 0.01 | 0.00 | 0.0145 | -0.0014 | |||||

| US3137FVNJ75 / Freddie Mac Multifamily Structured Pass Through Certificates | 0.01 | 0.00 | 0.0141 | -0.0007 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.00 | 0.0107 | 0.0107 | ||||||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | 0.00 | 0.0060 | 0.0060 | ||||||

| US31405JSG03 / UMBS | 0.00 | 0.00 | 0.0058 | -0.0001 | |||||

| US3136ABC354 / Fannie Mae REMICS | 0.00 | 0.00 | 0.0040 | -0.0004 | |||||

| US83162CPS60 / United States Small Business Administration | 0.00 | 0.0014 | -0.0000 | ||||||

| US22608WAR07 / CREST 2004-1 Ltd | 0.00 | 0.0000 | -0.0000 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.00 | -0.0017 | -0.0017 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.00 | -0.0024 | -0.0024 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.00 | -0.0027 | -0.0027 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0032 | -0.0032 |