Statistik Asas

| Nilai Portfolio | $ 297,496,132 |

| Kedudukan Semasa | 66 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

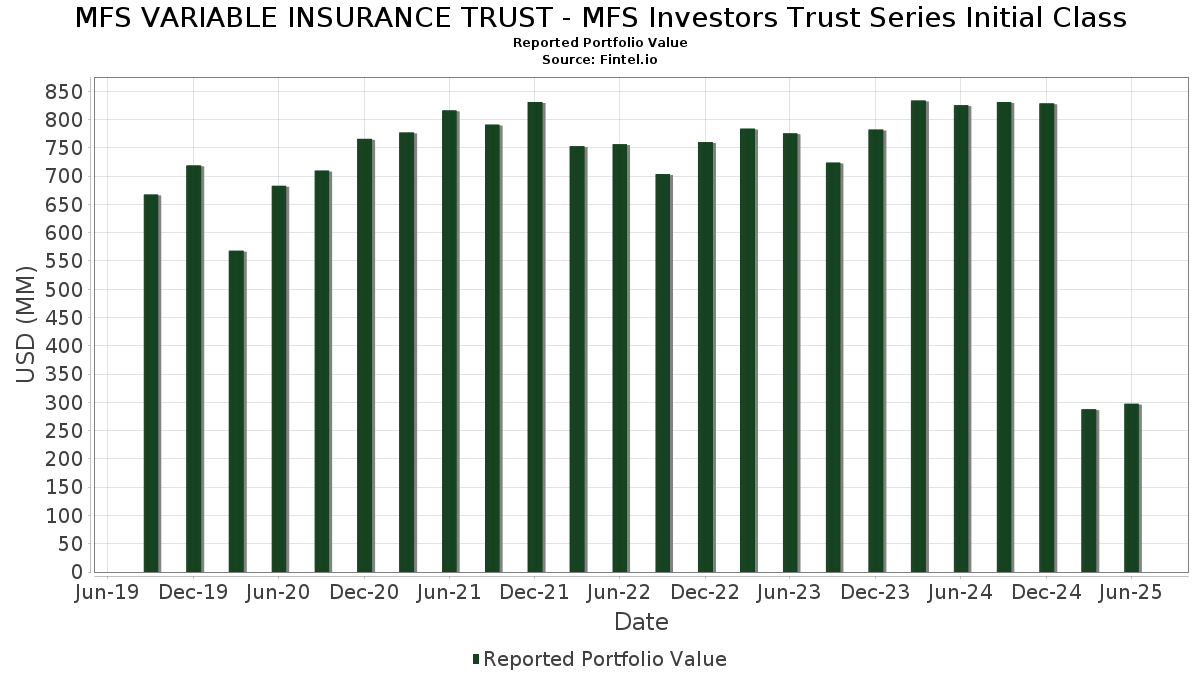

MFS VARIABLE INSURANCE TRUST - MFS Investors Trust Series Initial Class telah mendedahkan 66 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 297,496,132 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas MFS VARIABLE INSURANCE TRUST - MFS Investors Trust Series Initial Class ialah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Amazon.com, Inc. (US:AMZN) , Meta Platforms, Inc. (US:META) , and Alphabet Inc. (US:GOOGL) . Kedudukan baharu MFS VARIABLE INSURANCE TRUST - MFS Investors Trust Series Initial Class termasuk Veralto Corporation (US:VLTO) , KLA Corporation (US:KLAC) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 12.26 | 4.1199 | 2.0617 | |

| 0.11 | 17.10 | 5.7498 | 1.9364 | |

| 0.05 | 26.98 | 9.0696 | 1.6351 | |

| 0.07 | 15.91 | 5.3476 | 0.5800 | |

| 0.01 | 1.46 | 0.4902 | 0.4902 | |

| 0.01 | 1.43 | 0.4795 | 0.4795 | |

| 0.00 | 1.20 | 0.4038 | 0.4038 | |

| 0.00 | 1.19 | 0.3987 | 0.3987 | |

| 0.02 | 5.57 | 1.8735 | 0.3762 | |

| 0.07 | 3.11 | 1.0447 | 0.3540 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 4.20 | 1.4109 | -0.7112 | |

| 0.13 | 2.66 | 0.8943 | -0.6774 | |

| 0.03 | 4.95 | 1.6651 | -0.6387 | |

| 0.02 | 6.63 | 2.2300 | -0.6004 | |

| 0.05 | 10.39 | 3.4942 | -0.5920 | |

| 0.06 | 11.23 | 3.7758 | -0.4420 | |

| 0.06 | 4.22 | 1.4195 | -0.4377 | |

| 0.01 | 4.26 | 1.4331 | -0.3959 | |

| 0.02 | 2.68 | 0.9025 | -0.3937 | |

| 0.05 | 4.50 | 1.5124 | -0.3773 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-25 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.05 | -4.82 | 26.98 | 26.12 | 9.0696 | 1.6351 | |||

| NVDA / NVIDIA Corporation | 0.11 | 6.93 | 17.10 | 55.87 | 5.7498 | 1.9364 | |||

| AMZN / Amazon.com, Inc. | 0.07 | 0.56 | 15.91 | 15.96 | 5.3476 | 0.5800 | |||

| META / Meta Platforms, Inc. | 0.02 | 61.59 | 12.26 | 106.94 | 4.1199 | 2.0617 | |||

| GOOGL / Alphabet Inc. | 0.06 | -18.79 | 11.23 | -7.46 | 3.7758 | -0.4420 | |||

| AAPL / Apple Inc. | 0.05 | -4.29 | 10.39 | -11.60 | 3.4942 | -0.5920 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | -6.12 | 8.33 | 10.96 | 2.8015 | 0.1912 | |||

| V / Visa Inc. | 0.02 | -19.60 | 6.63 | -18.55 | 2.2300 | -0.6004 | |||

| CRM / Salesforce, Inc. | 0.02 | -4.29 | 5.90 | -2.74 | 1.9816 | -0.1248 | |||

| MA / Mastercard Incorporated | 0.01 | -4.30 | 5.89 | -1.88 | 1.9797 | -0.1062 | |||

| 3EC / Eaton Corporation plc | 0.02 | -1.51 | 5.57 | 29.36 | 1.8735 | 0.3762 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | -4.33 | 4.96 | 23.96 | 1.6682 | 0.2769 | |||

| FI / Fiserv, Inc. | 0.03 | -4.30 | 4.95 | -25.28 | 1.6651 | -0.6387 | |||

| CME / CME Group Inc. | 0.02 | -14.40 | 4.93 | -11.07 | 1.6584 | -0.2694 | |||

| CPW / Check Point Software Technologies Ltd. | 0.02 | -9.61 | 4.93 | -12.24 | 1.6559 | -0.2949 | |||

| HWM / Howmet Aerospace Inc. | 0.03 | -34.13 | 4.87 | -5.49 | 1.6382 | -0.1537 | |||

| PG / The Procter & Gamble Company | 0.03 | 0.30 | 4.83 | -6.25 | 1.6252 | -0.1666 | |||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.03 | -4.29 | 4.57 | 14.24 | 1.5374 | 0.1461 | |||

| AMT / American Tower Corporation | 0.02 | -7.27 | 4.53 | -5.80 | 1.5221 | -0.1484 | |||

| MDT / Medtronic plc | 0.05 | -14.71 | 4.50 | -17.25 | 1.5124 | -0.3773 | |||

| AON / Aon plc | 0.01 | -5.98 | 4.43 | -15.95 | 1.4882 | -0.3422 | |||

| COST / Costco Wholesale Corporation | 0.00 | -12.77 | 4.38 | -8.69 | 1.4735 | -0.1948 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | -11.79 | 4.26 | -19.00 | 1.4331 | -0.3959 | |||

| CB / Chubb Limited | 0.01 | 2.89 | 4.24 | -1.30 | 1.4268 | -0.0675 | |||

| XEL / Xcel Energy Inc. | 0.06 | -17.87 | 4.22 | -21.00 | 1.4195 | -0.4377 | |||

| COP / ConocoPhillips | 0.05 | -19.57 | 4.20 | -31.26 | 1.4109 | -0.7112 | |||

| CI / The Cigna Group | 0.01 | -16.16 | 4.19 | -15.76 | 1.4070 | -0.3195 | |||

| JNJ / Johnson & Johnson | 0.03 | -5.69 | 3.99 | -13.14 | 1.3424 | -0.2552 | |||

| STE / STERIS plc | 0.02 | -10.07 | 3.92 | -4.67 | 1.3172 | -0.1114 | |||

| WTY / Willis Towers Watson Public Limited Company | 0.01 | -2.01 | 3.86 | -11.12 | 1.2977 | -0.2118 | |||

| EMR / Emerson Electric Co. | 0.03 | 11.11 | 3.85 | 35.15 | 1.2940 | 0.3040 | |||

| LRCX / Lam Research Corporation | 0.04 | 0.44 | 3.70 | 34.48 | 1.2442 | 0.2878 | |||

| XOM / Exxon Mobil Corporation | 0.03 | -4.29 | 3.50 | -13.27 | 1.1779 | -0.2258 | |||

| ADI / Analog Devices, Inc. | 0.01 | -8.56 | 3.50 | 7.92 | 1.1778 | 0.0496 | |||

| BAC / Bank of America Corporation | 0.07 | -12.67 | 3.46 | -1.00 | 1.1627 | -0.0511 | |||

| LIN / Linde plc | 0.01 | -9.00 | 3.36 | -8.28 | 1.1278 | -0.1437 | |||

| HD / The Home Depot, Inc. | 0.01 | -8.32 | 3.19 | -8.27 | 1.0734 | -0.1364 | |||

| A / Agilent Technologies, Inc. | 0.03 | -4.29 | 3.14 | -3.45 | 1.0544 | -0.0745 | |||

| ABT / Abbott Laboratories | 0.02 | -25.07 | 3.14 | -23.18 | 1.0541 | -0.3643 | |||

| ARMK / Aramark | 0.07 | 28.91 | 3.11 | 56.37 | 1.0447 | 0.3540 | |||

| AME / AMETEK, Inc. | 0.02 | -4.30 | 2.97 | 0.61 | 0.9987 | -0.0275 | |||

| ALLE / Allegion plc | 0.02 | -4.30 | 2.78 | 5.70 | 0.9348 | 0.0207 | |||

| BDX / Becton, Dickinson and Company | 0.02 | -4.29 | 2.68 | -28.04 | 0.9025 | -0.3937 | |||

| RTX / RTX Corporation | 0.02 | -75.24 | 2.68 | -57.95 | 0.9018 | 0.1016 | |||

| SO / The Southern Company | 0.03 | -4.25 | 2.67 | -4.38 | 0.8962 | -0.0727 | |||

| KVUE / Kenvue Inc. | 0.13 | -32.61 | 2.66 | -41.18 | 0.8943 | -0.6774 | |||

| CL / Colgate-Palmolive Company | 0.03 | 0.31 | 2.65 | -2.68 | 0.8898 | -0.0554 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.01 | -3.49 | 2.62 | 11.38 | 0.8816 | 0.0636 | |||

| LNT / Alliant Energy Corporation | 0.04 | 0.12 | 2.40 | -5.91 | 0.8077 | -0.0798 | |||

| HUBB / Hubbell Incorporated | 0.01 | -15.45 | 2.30 | 4.36 | 0.7733 | 0.0073 | |||

| TXN / Texas Instruments Incorporated | 0.01 | -4.30 | 2.29 | 10.56 | 0.7711 | 0.0502 | |||

| DGE / Diageo plc | 0.09 | 9.44 | 2.22 | 5.26 | 0.7466 | 0.0134 | |||

| NDAQ / Nasdaq, Inc. | 0.02 | -77.02 | 2.19 | -64.66 | 0.7367 | -0.0496 | |||

| WM / Waste Management, Inc. | 0.01 | -4.30 | 2.11 | -5.42 | 0.7100 | -0.0660 | |||

| APH / Amphenol Corporation | 0.02 | 29.98 | 2.04 | 95.68 | 0.6857 | 0.3235 | |||

| ASML / ASML Holding N.V. | 0.00 | -24.29 | 1.88 | -8.64 | 0.6324 | -0.0834 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.00 | -4.31 | 1.85 | -19.74 | 0.6222 | -0.1791 | |||

| EPAM / EPAM Systems, Inc. | 0.01 | 5.33 | 1.78 | 10.29 | 0.5986 | 0.0376 | |||

| VLTO / Veralto Corporation | 0.01 | 1.46 | 0.4902 | 0.4902 | |||||

| OTIS / Otis Worldwide Corporation | 0.01 | 1.43 | 0.4795 | 0.4795 | |||||

| TRU / TransUnion | 0.02 | 6.83 | 1.39 | 13.27 | 0.4677 | 0.0409 | |||

| IJF / ICON Public Limited Company | 0.01 | -4.40 | 1.22 | -20.59 | 0.4087 | -0.1230 | |||

| KLAC / KLA Corporation | 0.00 | 1.20 | 0.4038 | 0.4038 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 1.19 | 0.3987 | 0.3987 | |||||

| US55291X1090 / MFS Institutional Money Market Portfolio | 1.08 | 36.67 | 1.08 | 36.66 | 0.3635 | 0.0885 | |||

| ZTS / Zoetis Inc. | 0.01 | -13.99 | 0.82 | -22.61 | 0.2750 | 0.1469 |