Statistik Asas

| Nilai Portfolio | $ 76,163,740 |

| Kedudukan Semasa | 106 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

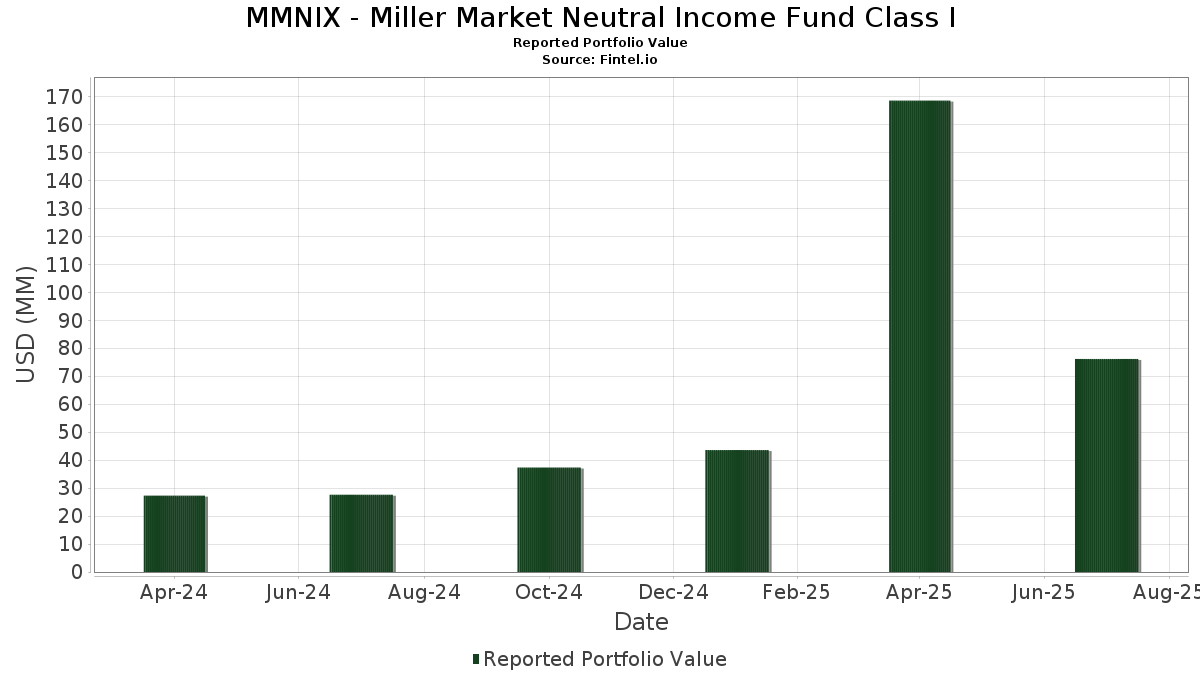

MMNIX - Miller Market Neutral Income Fund Class I telah mendedahkan 106 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 76,163,740 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas MMNIX - Miller Market Neutral Income Fund Class I ialah CONV. NOTE (US:US531229AQ58) , CONV. NOTE (US:US08265TAD19) , CONV. NOTE (DK:US04351PAD33) , Tyler Technologies Inc (US:US902252AB17) , and Ormat Technologies, Inc. 2.500%, Due 07/15/2027 (US:US686688AB85) . Kedudukan baharu MMNIX - Miller Market Neutral Income Fund Class I termasuk CONV. NOTE (US:US531229AQ58) , CONV. NOTE (US:US08265TAD19) , CONV. NOTE (DK:US04351PAD33) , Tyler Technologies Inc (US:US902252AB17) , and Ormat Technologies, Inc. 2.500%, Due 07/15/2027 (US:US686688AB85) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 34.50 | 47.5208 | 47.5208 | ||

| 2.76 | 3.8065 | 3.8065 | ||

| 2.34 | 3.2211 | 3.2211 | ||

| 2.01 | 2.7712 | 2.7712 | ||

| 1.96 | 2.7030 | 2.7030 | ||

| 1.78 | 2.4455 | 2.4455 | ||

| 1.76 | 2.4244 | 2.4244 | ||

| 1.72 | 2.3705 | 2.3705 | ||

| 1.69 | 2.3319 | 2.3319 | ||

| 1.65 | 2.2692 | 2.2692 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -0.03 | -1.95 | -2.6890 | -2.6890 | |

| -0.00 | -1.40 | -1.9327 | -1.9327 | |

| -0.19 | -1.21 | -1.6691 | -1.6691 | |

| -0.01 | -1.20 | -1.6594 | -1.6594 | |

| -0.00 | -0.88 | -1.2066 | -1.2066 | |

| -0.01 | -0.87 | -1.2034 | -1.2034 | |

| -0.04 | -0.87 | -1.2008 | -1.2008 | |

| -0.01 | -0.86 | -1.1817 | -1.1817 | |

| -0.00 | -0.78 | -1.0770 | -1.0770 | |

| -0.02 | -0.74 | -1.0171 | -1.0171 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-09-03 untuk tempoh pelaporan 2025-07-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BNP CASH DEPOSIT ACCT / STIV (N/A) | 34.50 | 47.5208 | 47.5208 | ||||||

| SMCI / Super Micro Computer, Inc. - Depositary Receipt (Common Stock) | 2.76 | 3.8065 | 3.8065 | ||||||

| N2ET34 / Cloudflare, Inc. - Depositary Receipt (Common Stock) | 2.34 | 3.2211 | 3.2211 | ||||||

| ITRI / Itron, Inc. | 2.01 | 2.7712 | 2.7712 | ||||||

| ARRY 2 7/8 07/01/31 / DBT (US04271TAC45) | 1.96 | 2.7030 | 2.7030 | ||||||

| US531229AQ58 / CONV. NOTE | 1.95 | 60.30 | 2.6931 | 0.4207 | |||||

| US08265TAD19 / CONV. NOTE | 1.93 | 163.61 | 2.6557 | -0.1014 | |||||

| US04351PAD33 / CONV. NOTE | 1.89 | 1.34 | 2.6051 | -0.8721 | |||||

| AEIS / Advanced Energy Industries, Inc. | 1.84 | 95.23 | 2.5389 | 0.7800 | |||||

| US902252AB17 / Tyler Technologies Inc | 1.81 | 42.95 | 2.4991 | -0.8847 | |||||

| RBRK 0 06/15/30 / DBT (US781154AC39) | 1.78 | 2.4455 | 2.4455 | ||||||

| US3434125080 / FLUOR CORP PC 6.5% PERP | 1.76 | 33.43 | 2.4255 | -0.0330 | |||||

| BOX / Box, Inc. | 1.76 | 2.4244 | 2.4244 | ||||||

| G2WR34 / Guidewire Software, Inc. - Depositary Receipt (Common Stock) | 1.72 | 3.80 | 2.3734 | -0.7176 | |||||

| Z2SC34 / Zscaler, Inc. - Depositary Receipt (Common Stock) | 1.72 | 2.3705 | 2.3705 | ||||||

| US686688AB85 / Ormat Technologies, Inc. 2.500%, Due 07/15/2027 | 1.70 | 9.24 | 2.3464 | -0.5585 | |||||

| ALRM / Alarm.com Holdings, Inc. | 1.69 | 2.3319 | 2.3319 | ||||||

| PPL 2 7/8 03/15/28 / DBT (US69352PAS20) | 1.68 | -2.16 | 2.3081 | -0.8819 | |||||

| C1NP34 / CenterPoint Energy, Inc. - Depositary Receipt (Common Stock) | 1.67 | -1.42 | 2.3011 | -0.8561 | |||||

| CYBR / CyberArk Software Ltd. | 1.65 | 2.2692 | 2.2692 | ||||||

| PSN / Parsons Corporation | 1.64 | 3.21 | 2.2607 | -0.7024 | |||||

| COLL / Collegium Pharmaceutical, Inc. | 1.64 | 59.98 | 2.2531 | 0.3472 | |||||

| D2AS34 / DoorDash, Inc. - Depositary Receipt (Common Stock) | 1.63 | 2.2467 | 2.2467 | ||||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 1.61 | -1.83 | 2.2145 | -0.8360 | |||||

| MTSI 0 12/15/29 / DBT (US55405YAC49) | 1.57 | 67.70 | 2.1609 | 0.4173 | |||||

| PRGS / Progress Software Corporation | 1.56 | 37.65 | 2.1507 | 0.0373 | |||||

| BBIO / BridgeBio Pharma, Inc. | 1.55 | 88.79 | 2.1360 | 0.6052 | |||||

| US40637HAF64 / CONV. NOTE | 1.54 | -1.41 | 2.1266 | -0.7901 | |||||

| L2IV34 / LivaNova PLC - Depositary Receipt (Common Stock) | 1.50 | 6.52 | 2.0708 | -0.5597 | |||||

| HAE / Haemonetics Corporation | 1.50 | 2.0645 | 2.0645 | ||||||

| IMCR / Immunocore Holdings plc - Depositary Receipt (Common Stock) | 1.49 | 46.27 | 2.0557 | 0.1548 | |||||

| US26210CAD65 / Dropbox, Inc. | 1.49 | -2.81 | 2.0508 | -0.8017 | |||||

| MTH / Meritage Homes Corporation | 1.48 | 2.0434 | 2.0434 | ||||||

| ITGR 1 7/8 03/15/30 / DBT (US45826HAC34) | 1.47 | -7.18 | 2.0312 | -0.9284 | |||||

| US00971TAL52 / CONV. NOTE | 1.44 | 45.70 | 1.9865 | 0.1425 | |||||

| US60471A1016 / Mirion Technologies, Inc. | 1.42 | 1.9562 | 1.9562 | ||||||

| 360 / Life360, Inc. - Depositary Receipt (Common Stock) | 1.42 | 1.9542 | 1.9542 | ||||||

| US47804M7204 / JHF II STRATEGIC EQ ALLOCATI MUTUAL FUND | 1.37 | 21.28 | 1.8847 | -0.2181 | |||||

| AMPH / Amphastar Pharmaceuticals, Inc. | 1.29 | -0.46 | 1.7801 | -0.6398 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 1.27 | 1.7546 | 1.7546 | ||||||

| W1EC34 / WEC Energy Group, Inc. - Depositary Receipt (Common Stock) | 1.16 | 1.5932 | 1.5932 | ||||||

| TTEK / Tetra Tech, Inc. | 1.14 | 7.14 | 1.5712 | -0.4114 | |||||

| CSGS / CSG Systems International, Inc. | 1.11 | 1.56 | 1.5244 | -0.5057 | |||||

| US393657AM33 / GBX 2 7/8 04/15/28 | 1.07 | 3.39 | 1.4698 | -0.4521 | |||||

| ODD 0 06/15/30 / DBT (US67579RAA86) | 1.06 | 1.4541 | 1.4541 | ||||||

| B2LN34 / BlackLine, Inc. - Depositary Receipt (Common Stock) | 1.04 | 1.4356 | 1.4356 | ||||||

| LMAT / LeMaitre Vascular, Inc. | 1.00 | -3.94 | 1.3771 | -0.5620 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 1.00 | -4.13 | 1.3758 | -0.5655 | |||||

| R2GE34 / Repligen Corporation - Depositary Receipt (Common Stock) | 0.97 | -5.53 | 1.3428 | -0.5796 | |||||

| D1EX34 / DexCom, Inc. - Depositary Receipt (Common Stock) | 0.93 | 2.21 | 1.2750 | -0.4127 | |||||

| G1PI34 / Global Payments Inc. - Depositary Receipt (Common Stock) | 0.91 | 2.02 | 1.2518 | -0.4066 | |||||

| WKC / World Kinect Corporation | 0.85 | 4.41 | 1.1753 | -0.3473 | |||||

| AVAV / AeroVironment, Inc. | 0.47 | 0.6408 | 0.6408 | ||||||

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 0.22 | 185.53 | 0.2992 | 0.1570 | |||||

| DXCM / DexCom, Inc. | Short | -0.00 | -0.00 | -0.15 | 13.28 | -0.2003 | 0.0391 | ||

| PCG / PG&E Corporation | Short | -0.01 | -34.30 | -0.16 | -44.37 | -0.2182 | 0.3111 | ||

| AMPH / Amphastar Pharmaceuticals, Inc. | Short | -0.01 | -17.82 | -0.17 | -29.67 | -0.2395 | 0.2198 | ||

| GPN / Global Payments Inc. | Short | -0.00 | -0.00 | -0.20 | 4.74 | -0.2753 | 0.0801 | ||

| IMCR / Immunocore Holdings plc - Depositary Receipt (Common Stock) | Short | -0.01 | 38.46 | -0.24 | 50.64 | -0.3250 | -0.0334 | ||

| AVAV / AeroVironment, Inc. | Short | -0.00 | -0.24 | -0.3318 | -0.3318 | ||||

| RGEN / Repligen Corporation | Short | -0.00 | -17.24 | -0.28 | -30.00 | -0.3871 | 0.3585 | ||

| MTH / Meritage Homes Corporation | Short | -0.00 | 17.07 | -0.32 | 15.77 | -0.4453 | 0.0752 | ||

| OMCL / Omnicell, Inc. | Short | -0.01 | -0.84 | -0.37 | -1.62 | -0.5041 | 0.1890 | ||

| AKAM / Akamai Technologies, Inc. | Short | -0.00 | 44.12 | -0.37 | 36.63 | -0.5151 | -0.0047 | ||

| LMAT / LeMaitre Vascular, Inc. | Short | -0.00 | -0.00 | -0.39 | -10.57 | -0.5372 | 0.2743 | ||

| LIVN / LivaNova PLC | Short | -0.01 | 8.99 | -0.41 | 24.32 | -0.5638 | 0.0497 | ||

| BSY / Bentley Systems, Incorporated | Short | -0.01 | 161.82 | -0.42 | 189.58 | -0.5751 | -0.0308 | ||

| GBX / The Greenbrier Companies, Inc. | Short | -0.01 | -2.04 | -0.44 | 5.06 | -0.6017 | 0.1728 | ||

| HAE / Haemonetics Corporation | Short | -0.01 | -0.48 | -0.6630 | -0.6630 | ||||

| AUR / Aurora Innovation, Inc. | Short | -0.09 | -0.49 | -0.6811 | -0.6811 | ||||

| CSGS / CSG Systems International, Inc. | Short | -0.01 | 5.26 | -0.50 | 9.43 | -0.6884 | 0.1631 | ||

| ODD / Oddity Tech Ltd. | Short | -0.01 | -0.50 | -0.6950 | -0.6950 | ||||

| ALRM / Alarm.com Holdings, Inc. | Short | -0.01 | 38.81 | -0.51 | 41.50 | -0.6999 | -0.0308 | ||

| WKC / World Kinect Corporation | Short | -0.02 | 28.97 | -0.51 | 40.22 | -0.7025 | -0.0247 | ||

| BL / BlackLine, Inc. | Short | -0.01 | 11.76 | -0.51 | 27.18 | -0.7038 | 0.0441 | ||

| ZS / Zscaler, Inc. | Short | -0.00 | -0.54 | -0.7474 | -0.7474 | ||||

| DBX / Dropbox, Inc. | Short | -0.02 | -4.76 | -0.54 | -9.35 | -0.7486 | 0.3684 | ||

| TTEK / Tetra Tech, Inc. | Short | -0.02 | 23.66 | -0.60 | 45.83 | -0.8199 | -0.0587 | ||

| PRGS / Progress Software Corporation | Short | -0.01 | 31.05 | -0.60 | 5.10 | -0.8246 | 0.2366 | ||

| ITGR / Integer Holdings Corporation | Short | -0.01 | -13.85 | -0.61 | -26.07 | -0.8371 | 0.6925 | ||

| PSN / Parsons Corporation | Short | -0.01 | 6.33 | -0.62 | 17.99 | -0.8586 | 0.1255 | ||

| BOX / Box, Inc. | Short | -0.02 | -0.74 | -1.0171 | -1.0171 | ||||

| CYBR / CyberArk Software Ltd. | Short | -0.00 | -0.78 | -1.0770 | -1.0770 | ||||

| WEC / WEC Energy Group, Inc. | Short | -0.01 | 2.86 | -0.79 | 2.48 | -1.0819 | 0.3464 | ||

| COLL / Collegium Pharmaceutical, Inc. | Short | -0.03 | 50.86 | -0.79 | 66.95 | -1.0860 | -0.2058 | ||

| MTSI / MACOM Technology Solutions Holdings, Inc. | Short | -0.01 | 86.29 | -0.79 | 146.42 | -1.0910 | -0.4918 | ||

| LIF / Life360, Inc. | Short | -0.01 | -0.86 | -1.1817 | -1.1817 | ||||

| MIR / Mirion Technologies, Inc. | Short | -0.04 | -0.87 | -1.2008 | -1.2008 | ||||

| RBRK / Rubrik, Inc. | Short | -0.01 | -0.87 | -1.2034 | -1.2034 | ||||

| DASH / DoorDash, Inc. | Short | -0.00 | -0.88 | -1.2066 | -1.2066 | ||||

| DUK / Duke Energy Corporation | Short | -0.01 | -1.35 | -0.89 | -1.66 | -1.2233 | 0.4590 | ||

| ORA / Ormat Technologies, Inc. | Short | -0.01 | 49.25 | -0.89 | 83.95 | -1.2317 | -0.3255 | ||

| HALO / Halozyme Therapeutics, Inc. | Short | -0.01 | -8.54 | -0.90 | -10.72 | -1.2392 | 0.6375 | ||

| BBIO / BridgeBio Pharma, Inc. | Short | -0.02 | 73.64 | -0.90 | 114.25 | -1.2438 | -0.4576 | ||

| GWRE / Guidewire Software, Inc. | Short | -0.00 | 10.26 | -0.97 | 21.80 | -1.3401 | 0.1478 | ||

| ASND / Ascendis Pharma A/S - Depositary Receipt (Common Stock) | Short | -0.01 | -6.56 | -0.99 | -4.91 | -1.3624 | 0.5747 | ||

| CNP / CenterPoint Energy, Inc. | Short | -0.03 | -0.00 | -1.02 | 0.10 | -1.4065 | 0.4937 | ||

| PPL / PPL Corporation | Short | -0.03 | -2.02 | -1.04 | -4.24 | -1.4307 | 0.5890 | ||

| AEIS / Advanced Energy Industries, Inc. | Short | -0.01 | 127.27 | -1.04 | 224.30 | -1.4353 | -0.8364 | ||

| NET / Cloudflare, Inc. | Short | -0.01 | -1.20 | -1.6594 | -1.6594 | ||||

| ARRY / Array Technologies, Inc. | Short | -0.19 | -1.21 | -1.6691 | -1.6691 | ||||

| FLR / Fluor Corporation | Short | -0.02 | 24.14 | -1.23 | 101.98 | -1.6893 | -0.5582 | ||

| FWONK / Formula One Group | Short | -0.01 | 63.29 | -1.29 | 84.86 | -1.7833 | -0.4782 | ||

| ITRI / Itron, Inc. | Short | -0.01 | 13.04 | -1.30 | 26.59 | -1.7843 | 0.1233 | ||

| TYL / Tyler Technologies, Inc. | Short | -0.00 | -1.40 | -1.9327 | -1.9327 | ||||

| SMCI / Super Micro Computer, Inc. | Short | -0.03 | -1.95 | -2.6890 | -2.6890 |