Statistik Asas

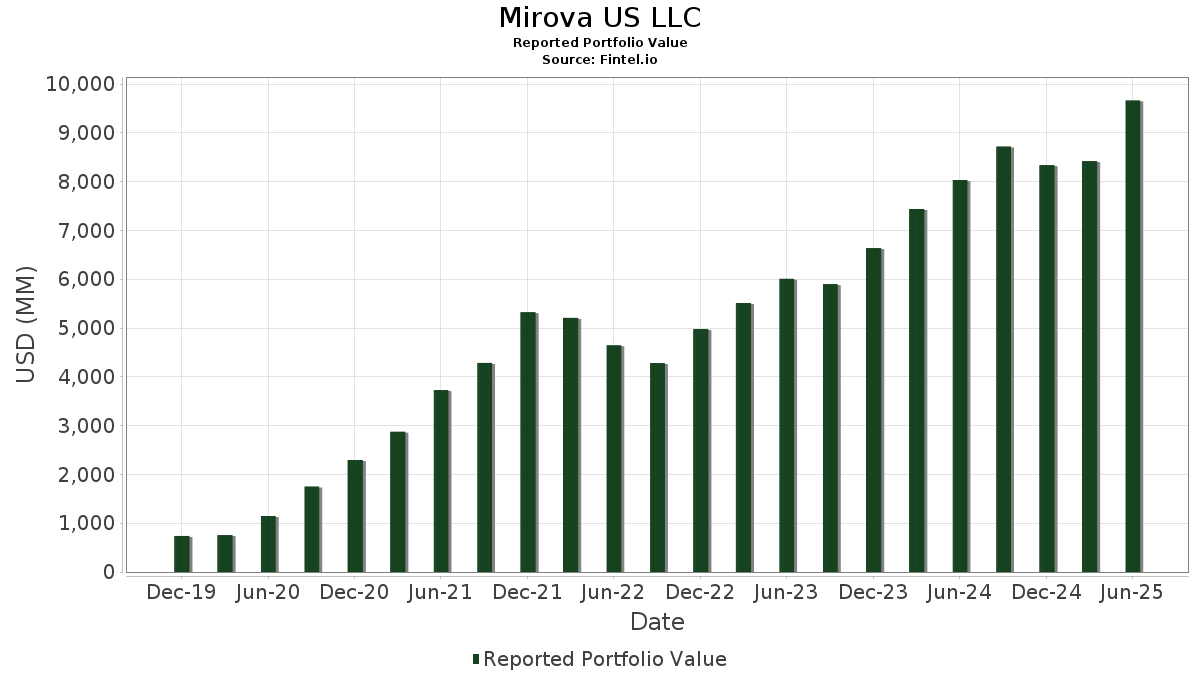

| Nilai Portfolio | $ 9,660,960,075 |

| Kedudukan Semasa | 35 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Mirova US LLC telah mendedahkan 35 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 9,660,960,075 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Mirova US LLC ialah Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares (US:NVDD) , Microsoft Corporation (US:MSFT) , Mastercard Incorporated (US:MA) , Ecolab Inc. (US:ECL) , and Roper Technologies, Inc. (US:ROP) . Kedudukan baharu Mirova US LLC termasuk Hubbell Incorporated (US:HUBB) , Nasdaq, Inc. (US:NDAQ) , Eversource Energy (US:ES) , Intuit Inc. (US:INTU) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 6.64 | 1,049.39 | 10.8622 | 3.9119 | |

| 1.96 | 976.81 | 10.1109 | 2.9673 | |

| 2.70 | 333.32 | 3.4502 | 1.9739 | |

| 0.34 | 139.39 | 1.4428 | 1.4428 | |

| 3.02 | 348.91 | 3.6115 | 1.3048 | |

| 0.57 | 308.72 | 3.1956 | 0.9339 | |

| 2.93 | 229.26 | 2.3730 | 0.7573 | |

| 1.80 | 407.02 | 4.2131 | 0.7277 | |

| 1.78 | 364.79 | 3.7759 | 0.3089 | |

| 0.94 | 156.42 | 1.6191 | 0.2758 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 3.83 | 285.40 | 2.9542 | -2.8773 | |

| 0.40 | 308.11 | 3.1893 | -2.8017 | |

| 0.69 | 278.58 | 2.8835 | -1.7790 | |

| 1.17 | 230.96 | 2.3907 | -1.0831 | |

| 0.73 | 415.80 | 4.3039 | -0.6575 | |

| 1.07 | 601.67 | 6.2278 | -0.4985 | |

| 3.99 | 277.07 | 2.8679 | -0.4321 | |

| 1.52 | 347.30 | 3.5949 | -0.4285 | |

| 1.68 | 233.73 | 2.4193 | -0.4133 | |

| 0.77 | 230.51 | 2.3860 | -0.3538 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-23 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 6.64 | 23.01 | 1,049.39 | 79.32 | 10.8622 | 3.9119 | |||

| MSFT / Microsoft Corporation | 1.96 | 22.56 | 976.81 | 62.40 | 10.1109 | 2.9673 | |||

| MA / Mastercard Incorporated | 1.07 | 3.62 | 601.67 | 6.24 | 6.2278 | -0.4985 | |||

| ECL / Ecolab Inc. | 2.05 | 3.72 | 553.11 | 10.23 | 5.7252 | -0.2341 | |||

| ROP / Roper Technologies, Inc. | 0.73 | 3.53 | 415.80 | -0.47 | 4.3039 | -0.6575 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 1.80 | 1.65 | 407.02 | 38.70 | 4.2131 | 0.7277 | |||

| PANW / Palo Alto Networks, Inc. | 1.78 | 4.20 | 364.79 | 24.96 | 3.7759 | 0.3089 | |||

| SHOP / Shopify Inc. | 3.02 | 48.70 | 348.91 | 79.64 | 3.6115 | 1.3048 | |||

| WM / Waste Management, Inc. | 1.52 | 3.73 | 347.30 | 2.52 | 3.5949 | -0.4285 | |||

| TJX / The TJX Companies, Inc. | 2.70 | 164.50 | 333.32 | 168.17 | 3.4502 | 1.9739 | |||

| ISRG / Intuitive Surgical, Inc. | 0.57 | 47.76 | 308.72 | 62.12 | 3.1956 | 0.9339 | |||

| LLY / Eli Lilly and Company | 0.40 | -35.28 | 308.11 | -38.92 | 3.1893 | -2.8017 | |||

| V / Visa Inc. | 0.83 | 3.68 | 293.25 | 5.04 | 3.0354 | -0.2805 | |||

| EBAY / eBay Inc. | 3.83 | -47.13 | 285.40 | -41.87 | 2.9542 | -2.8773 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.69 | -12.91 | 278.58 | -29.04 | 2.8835 | -1.7790 | |||

| NEE / NextEra Energy, Inc. | 3.99 | 1.83 | 277.07 | -0.28 | 2.8679 | -0.4321 | |||

| XYL / Xylem Inc. | 2.00 | 4.94 | 258.78 | 13.64 | 2.6787 | -0.0260 | |||

| AWK / American Water Works Company, Inc. | 1.68 | 3.93 | 233.73 | -2.00 | 2.4193 | -0.4133 | |||

| DHR / Danaher Corporation | 1.17 | -18.05 | 230.96 | -21.03 | 2.3907 | -1.0831 | |||

| ACN / Accenture plc | 0.77 | 4.32 | 230.51 | -0.07 | 2.3860 | -0.3538 | |||

| EW / Edwards Lifesciences Corporation | 2.93 | 56.17 | 229.26 | 68.52 | 2.3730 | 0.7573 | |||

| CRM / Salesforce, Inc. | 0.68 | 4.43 | 185.21 | 6.12 | 1.9171 | -0.1558 | |||

| WTS / Watts Water Technologies, Inc. | 0.75 | 2.65 | 184.01 | 23.78 | 1.9046 | 0.1391 | |||

| CP / Canadian Pacific Kansas City Limited | 2.18 | 1.17 | 173.04 | 14.23 | 1.7911 | -0.0080 | |||

| FSLR / First Solar, Inc. | 0.94 | 5.62 | 156.42 | 38.30 | 1.6191 | 0.2758 | |||

| BALL / Ball Corporation | 2.67 | 4.91 | 149.71 | 13.01 | 1.5496 | -0.0238 | |||

| HUBB / Hubbell Incorporated | 0.34 | 139.39 | 1.4428 | 1.4428 | |||||

| AGCO / AGCO Corporation | 1.25 | 3.23 | 129.29 | 15.04 | 1.3382 | 0.0035 | |||

| VLTO / Veralto Corporation | 1.13 | 5.45 | 113.73 | 9.24 | 1.1772 | -0.0593 | |||

| WMS / Advanced Drainage Systems, Inc. | 0.71 | 2.59 | 81.36 | 8.45 | 0.8421 | -0.0488 | |||

| NDAQ / Nasdaq, Inc. | 0.06 | 5.80 | 0.0601 | 0.0601 | |||||

| ES / Eversource Energy | 0.06 | 3.68 | 0.0381 | 0.0381 | |||||

| JCI / Johnson Controls International plc | 0.02 | 69.59 | 2.59 | 123.77 | 0.0268 | 0.0130 | |||

| INTU / Intuit Inc. | 0.00 | 2.53 | 0.0262 | 0.0262 | |||||

| CL / Colgate-Palmolive Company | 0.02 | 17.19 | 1.72 | 13.72 | 0.0178 | -0.0002 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ENPH / Enphase Energy, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| APTV / Aptiv PLC | 0.00 | -100.00 | 0.00 | 0.0000 |