Statistik Asas

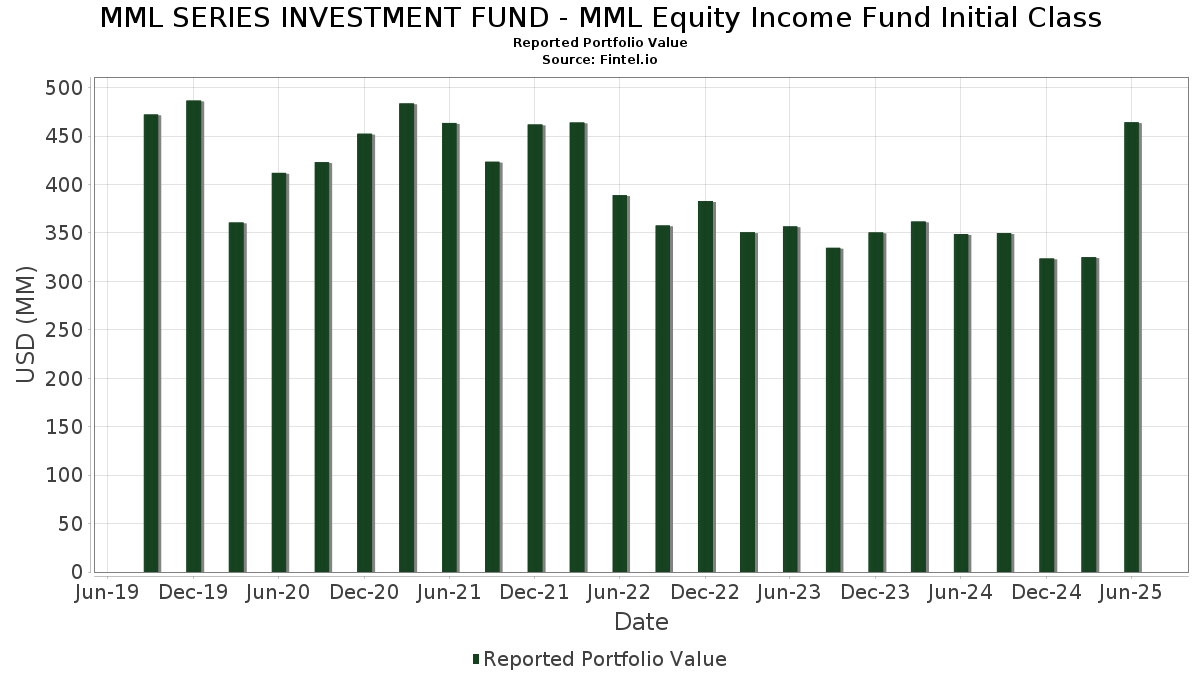

| Nilai Portfolio | $ 464,241,070 |

| Kedudukan Semasa | 125 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

MML SERIES INVESTMENT FUND - MML Equity Income Fund Initial Class telah mendedahkan 125 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 464,241,070 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas MML SERIES INVESTMENT FUND - MML Equity Income Fund Initial Class ialah MetLife, Inc. (US:MET) , The Southern Company (US:SO) , QUALCOMM Incorporated (US:QCOM) , The Charles Schwab Corporation (US:SCHW) , and JPMorgan Chase & Co. (US:JPM) . Kedudukan baharu MML SERIES INVESTMENT FUND - MML Equity Income Fund Initial Class termasuk Amazon.com, Inc. (US:AMZN) , Siemens Aktiengesellschaft (AT:SIE) , Alphabet Inc. (US:GOOGL) , The Procter & Gamble Company (US:PG) , and Alphabet Inc. (US:GOOG) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 7.68 | 1.6585 | 1.6585 | |

| 0.02 | 5.96 | 1.2875 | 1.2875 | |

| 0.03 | 5.58 | 1.2046 | 1.2046 | |

| 0.03 | 4.90 | 1.0579 | 1.0579 | |

| 0.02 | 4.36 | 0.9409 | 0.9409 | |

| 0.02 | 5.07 | 1.0958 | 0.9187 | |

| 3.80 | 0.8217 | 0.8217 | ||

| 3.38 | 3.38 | 0.7308 | 0.7308 | |

| 0.01 | 2.68 | 0.5795 | 0.5795 | |

| 0.01 | 3.62 | 0.7821 | 0.5661 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | 0.0000 | -1.3195 | |

| 0.01 | 1.05 | 0.2259 | -0.6028 | |

| 0.01 | 3.63 | 0.7847 | -0.5495 | |

| 0.06 | 5.48 | 1.1832 | -0.5106 | |

| 0.30 | 6.24 | 1.3469 | -0.5099 | |

| 0.02 | 5.94 | 1.2819 | -0.4820 | |

| 0.18 | 4.66 | 1.0064 | -0.4775 | |

| 0.03 | 2.84 | 0.6124 | -0.4429 | |

| 0.06 | 6.03 | 1.3018 | -0.4216 | |

| 0.04 | 5.15 | 1.1126 | -0.4178 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-25 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MET / MetLife, Inc. | 0.12 | 40.94 | 9.85 | 41.16 | 2.1273 | -0.0656 | |||

| SO / The Southern Company | 0.10 | 43.35 | 9.46 | 43.17 | 2.0422 | -0.0336 | |||

| QCOM / QUALCOMM Incorporated | 0.06 | 45.01 | 9.09 | 50.34 | 1.9641 | 0.0629 | |||

| SCHW / The Charles Schwab Corporation | 0.10 | 27.16 | 8.77 | 48.22 | 1.8933 | 0.0343 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | 37.01 | 8.70 | 61.92 | 1.8791 | 0.1904 | |||

| WFC / Wells Fargo & Company | 0.11 | 10.87 | 8.62 | 23.74 | 1.8617 | -0.3278 | |||

| ELV / Elevance Health, Inc. | 0.02 | 40.78 | 8.38 | 25.90 | 1.8102 | -0.2823 | |||

| LHX / L3Harris Technologies, Inc. | 0.03 | 25.30 | 8.05 | 50.17 | 1.7385 | 0.0537 | |||

| C / Citigroup Inc. | 0.09 | 36.06 | 7.96 | 63.17 | 1.7195 | 0.1857 | |||

| KMB / Kimberly-Clark Corporation | 0.06 | 49.52 | 7.91 | 35.54 | 1.7083 | -0.1258 | |||

| AMZN / Amazon.com, Inc. | 0.04 | 7.68 | 1.6585 | 1.6585 | |||||

| PM / Philip Morris International Inc. | 0.04 | 8.55 | 7.17 | 24.56 | 1.5480 | -0.2606 | |||

| CB / Chubb Limited | 0.02 | 20.40 | 7.09 | 15.50 | 1.5320 | -0.3981 | |||

| EQH / Equitable Holdings, Inc. | 0.12 | 25.07 | 6.99 | 34.72 | 1.5102 | -0.1213 | |||

| EQR / Equity Residential | 0.10 | 49.81 | 6.90 | 41.25 | 1.4903 | -0.0451 | |||

| BDX / Becton, Dickinson and Company | 0.04 | 54.37 | 6.45 | 16.09 | 1.3928 | -0.3532 | |||

| CF / CF Industries Holdings, Inc. | 0.07 | 32.06 | 6.40 | 55.48 | 1.3819 | 0.0884 | |||

| BA / The Boeing Company | 0.03 | 44.31 | 6.31 | 77.30 | 1.3634 | 0.2443 | |||

| KVUE / Kenvue Inc. | 0.30 | 20.94 | 6.24 | 5.57 | 1.3469 | -0.5099 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.07 | 44.04 | 6.19 | 16.08 | 1.3378 | -0.3393 | |||

| CVS / CVS Health Corporation | 0.09 | 45.39 | 6.15 | 48.05 | 1.3276 | 0.0225 | |||

| IP / International Paper Company | 0.13 | 46.73 | 6.05 | 28.78 | 1.3077 | -0.1698 | |||

| XOM / Exxon Mobil Corporation | 0.06 | 21.27 | 6.03 | 9.92 | 1.3018 | -0.4216 | |||

| FP / TotalEnergies SE | 0.10 | 23.61 | 6.03 | 17.63 | 1.3016 | -0.3085 | |||

| SIE / Siemens Aktiengesellschaft | 0.02 | 5.96 | 1.2875 | 1.2875 | |||||

| GE / General Electric Company | 0.02 | -17.76 | 5.94 | 5.76 | 1.2819 | -0.4820 | |||

| COP / ConocoPhillips | 0.07 | 73.58 | 5.91 | 48.32 | 1.2770 | 0.0242 | |||

| AEE / Ameren Corporation | 0.06 | 42.65 | 5.72 | 36.45 | 1.2355 | -0.0821 | |||

| GOOGL / Alphabet Inc. | 0.03 | 5.58 | 1.2046 | 1.2046 | |||||

| AIG / American International Group, Inc. | 0.06 | 3.26 | 5.48 | 1.65 | 1.1832 | -0.5106 | |||

| SWK / Stanley Black & Decker, Inc. | 0.08 | 46.88 | 5.22 | 29.44 | 1.1265 | -0.1400 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.04 | 3.18 | 5.15 | 5.79 | 1.1126 | -0.4178 | |||

| CL / Colgate-Palmolive Company | 0.06 | 78.46 | 5.13 | 73.15 | 1.1089 | 0.1768 | |||

| CI / The Cigna Group | 0.02 | 46.24 | 5.12 | 46.96 | 1.1059 | 0.0107 | |||

| LVS / Las Vegas Sands Corp. | 0.12 | 53.54 | 5.11 | 72.94 | 1.1031 | 0.1749 | |||

| DIS / The Walt Disney Company | 0.04 | 29.72 | 5.09 | 63.02 | 1.0997 | 0.1179 | |||

| CRM / Salesforce, Inc. | 0.02 | 786.05 | 5.07 | 801.07 | 1.0958 | 0.9187 | |||

| NWSA / News Corporation | 0.17 | 14.75 | 5.00 | 25.29 | 1.0798 | -0.1744 | |||

| BAC / Bank of America Corporation | 0.11 | 36.39 | 4.99 | 54.68 | 1.0784 | 0.0637 | |||

| MSFT / Microsoft Corporation | 0.01 | -2.57 | 4.94 | 29.08 | 1.0662 | -0.1356 | |||

| PG / The Procter & Gamble Company | 0.03 | 4.90 | 1.0579 | 1.0579 | |||||

| LUV / Southwest Airlines Co. | 0.15 | 44.52 | 4.79 | 39.62 | 1.0343 | -0.0438 | |||

| TXN / Texas Instruments Incorporated | 0.02 | 41.05 | 4.75 | 62.96 | 1.0254 | 0.1098 | |||

| WY / Weyerhaeuser Company | 0.18 | 12.49 | 4.66 | -1.29 | 1.0064 | -0.4775 | |||

| FITB / Fifth Third Bancorp | 0.11 | 51.30 | 4.64 | 58.75 | 1.0016 | 0.0835 | |||

| HBAN / Huntington Bancshares Incorporated | 0.28 | 12.35 | 4.63 | 25.45 | 0.9998 | -0.1599 | |||

| L / Loews Corporation | 0.05 | 26.88 | 4.53 | 26.54 | 0.9783 | -0.1468 | |||

| CSX / CSX Corporation | 0.14 | 67.11 | 4.42 | 85.28 | 0.9540 | 0.2047 | |||

| GOOG / Alphabet Inc. | 0.02 | 4.36 | 0.9409 | 0.9409 | |||||

| USB / U.S. Bancorp | 0.09 | 59.30 | 4.15 | 70.75 | 0.8965 | 0.1324 | |||

| FI / Fiserv, Inc. | 0.02 | 32.48 | 4.01 | 3.43 | 0.8666 | -0.3526 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.09 | 53.23 | 3.95 | 71.57 | 0.8539 | 0.1295 | |||

| CSA / Accenture plc | 0.01 | 46.91 | 3.89 | 40.74 | 0.8401 | -0.0287 | |||

| SRE / Sempra | 0.05 | 41.95 | 3.84 | 50.73 | 0.8287 | 0.0286 | |||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 3.80 | 0.8217 | 0.8217 | ||||||

| UPS / United Parcel Service, Inc. | 0.04 | 42.37 | 3.80 | 30.67 | 0.8207 | -0.0934 | |||

| MDT / Medtronic plc | 0.04 | 15.95 | 3.71 | 12.49 | 0.8014 | -0.2354 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 43.69 | 3.63 | -14.40 | 0.7847 | -0.5495 | |||

| HD / The Home Depot, Inc. | 0.01 | 426.77 | 3.62 | 427.07 | 0.7821 | 0.5661 | |||

| TSN / Tyson Foods, Inc. | 0.06 | 48.31 | 3.52 | 30.06 | 0.7607 | -0.0907 | |||

| D / Dominion Energy, Inc. | 0.06 | 21.59 | 3.41 | 22.59 | 0.7373 | -0.1381 | |||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 3.38 | 3.38 | 0.7308 | 0.7308 | |||||

| VTRS / Viatris Inc. | 0.36 | 47.46 | 3.21 | 51.18 | 0.6936 | 0.0260 | |||

| AMAT / Applied Materials, Inc. | 0.02 | 44.86 | 3.18 | 82.72 | 0.6875 | 0.1400 | |||

| ROK / Rockwell Automation, Inc. | 0.01 | 63.65 | 3.16 | 110.45 | 0.6828 | 0.2105 | |||

| SLB / Schlumberger Limited | 0.09 | 73.01 | 3.12 | 39.92 | 0.6732 | -0.0271 | |||

| FTV / Fortive Corporation | 0.06 | 183.41 | 2.94 | 101.92 | 0.6355 | 0.1774 | |||

| NEE / NextEra Energy, Inc. | 0.04 | 26.03 | 2.89 | 23.44 | 0.6244 | -0.1118 | |||

| CMI / Cummins Inc. | 0.01 | 43.36 | 2.89 | 49.79 | 0.6244 | 0.0178 | |||

| WMT / Walmart Inc. | 0.03 | -24.18 | 2.84 | -15.55 | 0.6124 | -0.4429 | |||

| MRK / Merck & Co., Inc. | 0.04 | 335.96 | 2.83 | 284.90 | 0.6111 | 0.3798 | |||

| WMB / The Williams Companies, Inc. | 0.04 | 20.55 | 2.78 | 26.71 | 0.5994 | -0.0890 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.04 | 48.88 | 2.71 | 41.60 | 0.5860 | -0.0164 | |||

| ALL / The Allstate Corporation | 0.01 | 2.68 | 0.5795 | 0.5795 | |||||

| CMCSA / Comcast Corporation | 0.07 | 46.34 | 2.67 | 41.53 | 0.5757 | -0.0162 | |||

| EQT / EQT Corporation | 0.05 | 4.39 | 2.66 | 13.99 | 0.5736 | -0.1590 | |||

| META / Meta Platforms, Inc. | 0.00 | 110.30 | 2.62 | 339.03 | 0.5662 | 0.3951 | |||

| NSC / Norfolk Southern Corporation | 0.01 | 28.97 | 2.61 | 39.41 | 0.5631 | -0.0248 | |||

| EXE / Expand Energy Corporation | 0.02 | 98.99 | 2.51 | 109.16 | 0.5426 | 0.1649 | |||

| REXR / Rexford Industrial Realty, Inc. | 0.07 | 59.89 | 2.47 | 45.34 | 0.5324 | -0.0009 | |||

| STT / State Street Corporation | 0.02 | 246.17 | 2.33 | 311.46 | 0.5039 | 0.3255 | |||

| RYN / Rayonier Inc. | 0.10 | 50.70 | 2.30 | 19.85 | 0.4969 | -0.1062 | |||

| BA.PRA / The Boeing Company - Preferred Security | 0.03 | 45.12 | 2.22 | 64.93 | 0.4784 | 0.0563 | |||

| AMD / Advanced Micro Devices, Inc. | 0.02 | 73.96 | 2.17 | 140.49 | 0.4696 | 0.1852 | |||

| VWAPY / Volkswagen AG - Depositary Receipt (Common Stock) | 0.20 | 52.80 | 2.15 | 59.07 | 0.4643 | 0.0394 | |||

| AGCO / AGCO Corporation | 0.02 | 70.92 | 2.12 | 90.40 | 0.4587 | 0.1083 | |||

| SOBO / South Bow Corporation | 0.08 | 60.29 | 2.10 | 62.89 | 0.4532 | 0.4532 | |||

| JNJ / Johnson & Johnson | 0.01 | -4.58 | 2.08 | -12.13 | 0.4492 | -0.2946 | |||

| US21871X1090 / Corebridge Financial, Inc. | 0.06 | 2.00 | 0.4310 | 0.4310 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 44.09 | 1.99 | 17.45 | 0.4290 | -0.1027 | |||

| SAN / Santander UK plc - Preferred Stock | 0.02 | 2.31 | 1.95 | -10.70 | 0.4220 | -0.2654 | |||

| TRP / TC Energy Corporation | 0.04 | 23.60 | 1.95 | 27.74 | 0.4208 | -0.0586 | |||

| PSX / Phillips 66 | 0.02 | 167.66 | 1.95 | 158.57 | 0.4207 | 0.1839 | |||

| MAT / Mattel, Inc. | 0.10 | 22.30 | 1.88 | 24.17 | 0.4060 | -0.0700 | |||

| BMY / Bristol-Myers Squibb Company | 0.04 | 57.68 | 1.82 | 19.75 | 0.3929 | -0.0849 | |||

| EOG / EOG Resources, Inc. | 0.01 | 43.34 | 1.75 | 33.66 | 0.3775 | -0.0334 | |||

| INTC / Intel Corporation | 0.08 | 54.79 | 1.69 | 52.72 | 0.3643 | 0.0171 | |||

| HES / Hess Corporation | 0.01 | 84.79 | 1.60 | 60.24 | 0.3465 | 0.0319 | |||

| WFG / West Fraser Timber Co. Ltd. | 0.02 | 75.54 | 1.60 | 67.26 | 0.3464 | 0.0450 | |||

| CAG / Conagra Brands, Inc. | 0.07 | 1.77 | 1.40 | -21.87 | 0.3018 | -0.2604 | |||

| ADBE / Adobe Inc. | 0.00 | -1.95 | 1.38 | -1.08 | 0.2977 | -0.1403 | |||

| DG / Dollar General Corporation | 0.01 | -13.77 | 1.29 | 12.14 | 0.2794 | -0.0831 | |||

| MMM / 3M Company | 0.01 | 3.89 | 1.26 | 7.76 | 0.2728 | -0.0958 | |||

| BIIB / Biogen Inc. | 0.01 | 53.41 | 1.21 | 40.72 | 0.2622 | -0.0088 | |||

| APO / Apollo Global Management, Inc. | 0.01 | 21.97 | 1.21 | 26.41 | 0.2616 | -0.0397 | |||

| VZ / Verizon Communications Inc. | 0.03 | 28.56 | 1.17 | 22.62 | 0.2531 | -0.0472 | |||

| CVX / Chevron Corporation | 0.01 | 704.92 | 1.15 | 590.36 | 0.2477 | 0.1954 | |||

| MS / Morgan Stanley | 0.01 | 37.85 | 1.07 | 66.46 | 0.2317 | 0.0291 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.02 | -24.37 | 1.06 | -34.12 | 0.2299 | -0.2780 | |||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.01 | -66.77 | 1.05 | -60.36 | 0.2259 | -0.6028 | |||

| XEL / Xcel Energy Inc. | 0.01 | 164.79 | 1.01 | 181.84 | 0.2181 | 0.1162 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.02 | 31.87 | 0.99 | 25.25 | 0.2132 | -0.0347 | |||

| RAL / Ralliant Corporation | 0.02 | 0.91 | 0.1970 | 0.1970 | |||||

| FERG / Ferguson Enterprises Inc. | 0.00 | -43.90 | 0.82 | -23.79 | 0.1772 | -0.1611 | |||

| SUI / Sun Communities, Inc. | 0.01 | 0.82 | 0.1765 | 0.1765 | |||||

| NEE.PRR / NextEra Energy, Inc. - Preferred Security | 0.02 | 20.34 | 0.76 | 17.75 | 0.1648 | -0.0389 | |||

| T / AT&T Inc. | 0.02 | 48.22 | 0.65 | 51.86 | 0.1411 | 0.0057 | |||

| HUM / Humana Inc. | 0.00 | 43.44 | 0.63 | 32.56 | 0.1363 | -0.0134 | |||

| GPN / Global Payments Inc. | 0.01 | 0.58 | 0.1243 | 0.1243 | |||||

| CAH / Cardinal Health, Inc. | 0.00 | -37.55 | 0.46 | -23.85 | 0.1001 | -0.0912 | |||

| KDP / Keurig Dr Pepper Inc. | 0.01 | 48.15 | 0.41 | 43.11 | 0.0877 | -0.0015 | |||

| PCG / PG&E Corporation | 0.02 | 51.28 | 0.25 | 22.39 | 0.0533 | -0.0099 | |||

| SIEGY / Siemens Aktiengesellschaft - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | -1.3195 | |||

| US76105Y1091 / T. Rowe Price Government Reserve Fund | 0.00 | 0.00 | 0.0000 | -0.0000 | |||||

| US76105Y1091 / T. Rowe Price Government Reserve Fund | 0.00 | -40.00 | 0.00 | -100.00 | 0.0000 | -0.0000 |