Statistik Asas

| Nilai Portfolio | $ 220,356,804 |

| Kedudukan Semasa | 254 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

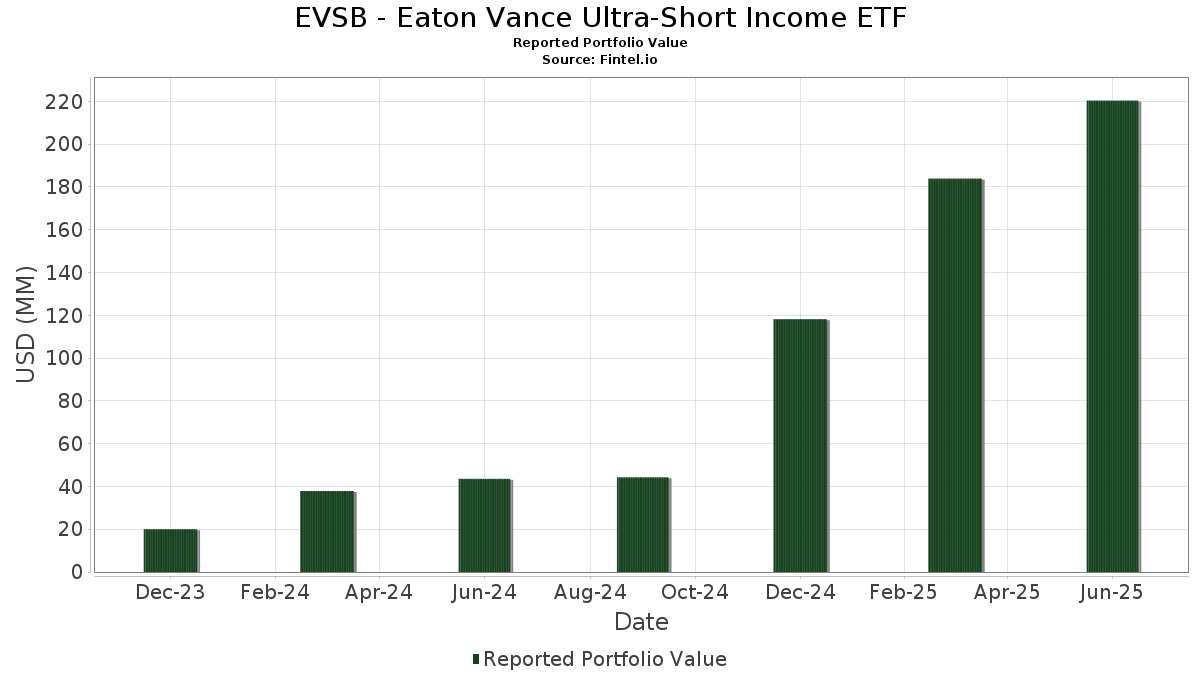

EVSB - Eaton Vance Ultra-Short Income ETF telah mendedahkan 254 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 220,356,804 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas EVSB - Eaton Vance Ultra-Short Income ETF ialah United States Treasury Note/Bond (US:US9128287B09) , Bank of America Corp. (US:US06051GLA57) , OneMain Financial Issuance Trust, Series 2022-S1, Class A (US:US68267HAA59) , Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , and Charter Communications Operating LLC / Charter Communications Operating Capital (US:US161175AY09) . Kedudukan baharu EVSB - Eaton Vance Ultra-Short Income ETF termasuk United States Treasury Note/Bond (US:US9128287B09) , Bank of America Corp. (US:US06051GLA57) , OneMain Financial Issuance Trust, Series 2022-S1, Class A (US:US68267HAA59) , Charter Communications Operating LLC / Charter Communications Operating Capital (US:US161175AY09) , and Goldman Sachs Group Inc/The (US:US38145GAM24) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 15.06 | 6.9710 | 6.9710 | ||

| 11.53 | 5.3372 | 5.3372 | ||

| 3.43 | 1.5857 | 1.5857 | ||

| 2.43 | 1.1251 | 1.1251 | ||

| 2.26 | 1.0473 | 1.0473 | ||

| 2.22 | 1.0274 | 1.0274 | ||

| 2.16 | 0.9985 | 0.9985 | ||

| 3.12 | 1.4457 | 0.9942 | ||

| 2.13 | 0.9868 | 0.9868 | ||

| 2.09 | 0.9676 | 0.9676 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.91 | 1.91 | 0.8851 | -5.1498 | |

| 0.74 | 0.3410 | -0.8111 | ||

| 0.51 | 0.2344 | -0.4243 | ||

| 0.22 | 0.1038 | -0.3562 | ||

| 0.93 | 0.4315 | -0.2831 | ||

| 3.09 | 1.4325 | -0.2535 | ||

| 0.58 | 0.2671 | -0.2532 | ||

| 2.56 | 1.1832 | -0.2475 | ||

| 1.54 | 0.7119 | -0.2391 | ||

| 1.42 | 0.6581 | -0.2278 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-22 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| U.S. Treasury Notes / DBT (US91282CKS97) | 15.06 | 6.9710 | 6.9710 | ||||||

| US9128287B09 / United States Treasury Note/Bond | 11.53 | 5.3372 | 5.3372 | ||||||

| US06051GLA57 / Bank of America Corp. | 3.50 | 4.67 | 1.6189 | -0.1971 | |||||

| US68267HAA59 / OneMain Financial Issuance Trust, Series 2022-S1, Class A | 3.43 | 1.5857 | 1.5857 | ||||||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 3.36 | 75.84 | 3.36 | 75.84 | 1.5565 | 0.6713 | |||

| US161175AY09 / Charter Communications Operating LLC / Charter Communications Operating Capital | 3.12 | 276.14 | 1.4457 | 0.9942 | |||||

| US38145GAM24 / Goldman Sachs Group Inc/The | 3.09 | -0.26 | 1.4325 | -0.2535 | |||||

| US89788MAH51 / Truist Financial Corp. | 2.71 | 361.84 | 1.2555 | 0.9360 | |||||

| US172967NX53 / Citigroup, Inc. | 2.56 | -2.93 | 1.1832 | -0.2475 | |||||

| US10569QAD60 / BRAVO Residential Funding Trust 2021-HE1 | 2.43 | 1.1251 | 1.1251 | ||||||

| US830867AA59 / Delta Air Lines Inc / SkyMiles IP Ltd | 2.43 | 0.54 | 1.1238 | -0.1883 | |||||

| US46647PBT21 / JPMORGAN CHASE and CO 1.045%/VAR 11/19/2026 | 2.26 | 1.0473 | 1.0473 | ||||||

| US46652LU215 / JABIL INC | 2.22 | 1.0274 | 1.0274 | ||||||

| Crossroads Asset Trust, Series 2025-A, Class A2 / ABS-O (US22767VAB45) | 2.16 | 0.9985 | 0.9985 | ||||||

| Brookfield Infrastructure Holdings Canada, Inc. / STIV (US11275MX762) | 2.13 | 0.9868 | 0.9868 | ||||||

| Oceanview Mortgage Trust, Series 2025-3, Class AF1 / ABS-MBS (US67648CAU45) | 2.09 | 0.9676 | 0.9676 | ||||||

| US517834AE74 / Las Vegas Sands Corp | 2.07 | 0.9605 | 0.9605 | ||||||

| US95000U2F97 / Wells Fargo & Co | 2.06 | 0.9516 | 0.9516 | ||||||

| US12803RAB06 / CaixaBank SA | 2.04 | 0.9437 | 0.9437 | ||||||

| US06279JAC36 / Bank of Ireland Group PLC | 2.04 | -0.39 | 0.9429 | -0.1680 | |||||

| US25160PAJ66 / Deutsche Bank AG/New York NY | 1.99 | 0.9216 | 0.9216 | ||||||

| US29278GAZ19 / Enel Finance International NV | 1.99 | 38.11 | 0.9197 | 0.1381 | |||||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 1.91 | -82.78 | 1.91 | -82.78 | 0.8851 | -5.1498 | |||

| US87161CAN56 / Synovus Financial Corp | 1.85 | 6.95 | 0.8550 | -0.0832 | |||||

| US345397B280 / FORD MTR CR CO LLC 3.375% 11/13/2025 | 1.84 | 727.48 | 0.8508 | 0.7300 | |||||

| US15135BAR24 / Centene Corp | 1.80 | 204.41 | 0.8317 | 0.5106 | |||||

| US780082AD52 / Royal Bank of Canada Bond | 1.70 | 1,344.07 | 0.7892 | 0.7245 | |||||

| US46115HAW79 / Intesa Sanpaolo SpA | 1.68 | 36.64 | 0.7772 | 0.1096 | |||||

| US025676AM95 / American Equity Investment Life Holding Co. | 1.65 | 187.30 | 0.7649 | 0.4523 | |||||

| US0158578734 / Algonquin Power & Utilities Corp | 1.65 | 26.90 | 0.7644 | 0.0569 | |||||

| US46647PBW59 / JPMorgan Chase & Co | 1.62 | 0.7482 | 0.7482 | ||||||

| US25755TAE01 / Domino's Pizza Master Issuer LLC | 1.61 | 0.06 | 0.7443 | -0.1285 | |||||

| US902613AS79 / UBS Group AG | 1.60 | 0.7423 | 0.7423 | ||||||

| US629377CN02 / NRG ENERGY INC | 1.60 | 108.46 | 0.7414 | 0.3236 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.60 | -2.44 | 0.7397 | -0.1503 | |||||

| HCA, Inc. / STIV (US40412BUJ06) | 1.60 | 0.7389 | 0.7389 | ||||||

| US62854AAN46 / Mylan NV | 1.60 | 90.79 | 0.7385 | 0.2837 | |||||

| US80281LAM72 / Santander UK Group Holdings PLC | 1.59 | 0.7373 | 0.7373 | ||||||

| US63306A4114 / National Bank of Canada into Bristol-Myers Squibb Co. | 1.54 | 35.74 | 0.7141 | 0.0965 | |||||

| US06738ECC75 / Barclays PLC | 1.54 | -12.17 | 0.7119 | -0.2391 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.53 | 0.7092 | 0.7092 | ||||||

| US345397C437 / Ford Motor Credit Co LLC | 1.52 | 216.46 | 0.7035 | 0.4426 | |||||

| HSBC26C / HSBC Holdings PLC | 1.44 | 21.88 | 0.6655 | 0.0246 | |||||

| US80281LAS43 / SANTANDER UK GROUP HOLDINGS PLC | 1.42 | -12.82 | 0.6581 | -0.2278 | |||||

| NMEF Funding LLC, Series 2025-A, Class A2 / ABS-O (US62919VAB71) | 1.42 | 0.07 | 0.6580 | -0.1137 | |||||

| US17287HAA86 / CITADEL FINANCE LLC | 1.37 | 0.6354 | 0.6354 | ||||||

| US90932LAG23 / United Airlines Inc | 1.36 | 0.6295 | 0.6295 | ||||||

| US25470DAL38 / Discovery Communications LLC | 1.31 | 41.30 | 0.6054 | 0.1025 | |||||

| US65339KBS87 / NextEra Energy Capital Holdings Inc | 1.31 | -8.99 | 0.6050 | -0.1753 | |||||

| US750236AW16 / RADIAN GROUP INC | 1.30 | 0.6026 | 0.6026 | ||||||

| US85236KAE29 / Stack Infrastructure Issuer LLC | 1.29 | 113.53 | 0.5992 | 0.2698 | |||||

| US418751AE33 / HAT Holdings I LLC / HAT Holdings II LLC | 1.26 | 0.88 | 0.5849 | -0.0955 | |||||

| GNMA, Series 2025-2, Class FB / ABS-MBS (US38385BP536) | 1.23 | -1.60 | 0.5710 | -0.1100 | |||||

| GNMA, Series 2023-101, Class FM / ABS-MBS (US38384CBT53) | 1.23 | 0.5686 | 0.5686 | ||||||

| US832248AZ15 / Smithfield Foods Inc | 1.20 | 0.5568 | 0.5568 | ||||||

| US20602DAA90 / Concentrix Corp | 1.19 | -4.63 | 0.5531 | -0.1274 | |||||

| US525931AB72 / Lendbuzz Securitization Trust 2023-3 | 1.18 | -15.45 | 0.5472 | -0.2130 | |||||

| US00928QAT85 / Aircastle Ltd | 1.14 | 19.29 | 0.5273 | 0.0085 | |||||

| PNC Bank NA / DBT (US69353RFY99) | 1.11 | 0.5156 | 0.5156 | ||||||

| US87166FAD50 / Synchrony Bank | 1.10 | 4.55 | 0.5105 | -0.0625 | |||||

| Crown Castle International Corp. / STIV (US22823PV599) | 1.09 | 0.5067 | 0.5067 | ||||||

| Brookfield Infrastructure Holdings Canada, Inc. / STIV (US11275MU875) | 1.09 | 0.5041 | 0.5041 | ||||||

| US891906AC37 / Global Payments Inc | 1.08 | 0.4998 | 0.4998 | ||||||

| US50155QAJ94 / Kyndryl Holdings, Inc. | 1.08 | 1,394.44 | 0.4981 | 0.1358 | |||||

| US361841AH26 / GLP Capital LP / GLP Financing II Inc | 1.08 | 0.4981 | 0.4981 | ||||||

| US77313LAA17 / Rocket Mortgage LLC / Rocket Mortgage Co-Issuer Inc | 1.07 | 77.61 | 0.4958 | 0.1677 | |||||

| Chase Auto Credit Linked Notes, Series 2025-1, Class B / ABS-O (US46591HCS76) | 1.06 | 0.4923 | 0.4923 | ||||||

| PNC Bank NA / DBT (US69353RFX17) | 1.06 | 0.4916 | 0.4916 | ||||||

| US929771AE35 / Wachovia Corp 6.605% Notes 10/1/2025 | 1.06 | 0.4903 | 0.4903 | ||||||

| Verdant Receivables LLC, Series 2025-1A, Class A2 / ABS-O (US92340GAB68) | 1.06 | 0.4900 | 0.4900 | ||||||

| US05946KAK79 / Banco Bilbao Vizcaya Argentaria S.A. | 1.06 | 31.63 | 0.4894 | 0.0526 | |||||

| Hyundai Capital America / DBT (US44891ADU88) | 1.05 | 0.4882 | 0.4882 | ||||||

| US928881AB78 / Vontier Corp. | 1.05 | 13.34 | 0.4838 | -0.0174 | |||||

| US89788MAJ18 / Truist Financial Corp | 1.04 | -0.19 | 0.4830 | -0.0854 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAT98) | 1.04 | -17.96 | 0.4804 | -0.2070 | |||||

| US88338QAA85 / THRM_23-1A | 1.03 | 1,952.00 | 0.4752 | 0.4477 | |||||

| US83368RAZ55 / Societe Generale SA | 1.01 | 0.4676 | 0.4676 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.01 | 0.4673 | 0.4673 | ||||||

| US456837AU72 / ING Groep NV | 1.00 | 189.63 | 0.4653 | 0.2766 | |||||

| US904678AU32 / UniCredit SpA | 0.96 | 176.59 | 0.4431 | 0.2549 | |||||

| US95000U3C57 / Wells Fargo & Co. | 0.95 | 0.4397 | 0.4397 | ||||||

| US36143L2A26 / GA Global Funding Trust | 0.93 | -29.13 | 0.4315 | -0.2831 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0.91 | 1.23 | 0.4199 | -0.0672 | |||||

| Research-Driven Pagaya Motor Asset Trust, Series 2025-1A, Class A / ABS-O (US76089YAA73) | 0.91 | -4.74 | 0.4193 | -0.0971 | |||||

| US00130HCE36 / CORP. NOTE | 0.90 | 85.19 | 0.4169 | 0.1527 | |||||

| US00914AAH59 / Air Lease Corp | 0.87 | 38.44 | 0.4018 | 0.0606 | |||||

| US126650CL25 / CVS Health Corp | 0.86 | 7.78 | 0.3978 | -0.0357 | |||||

| US92212KAB26 / Vantage Data Centers LLC | 0.85 | 285.97 | 0.3950 | 0.2748 | |||||

| US02005NBF69 / Ally Financial Inc | 0.85 | 0.3944 | 0.3944 | ||||||

| US44891ACQ85 / Hyundai Capital America | 0.85 | -0.35 | 0.3923 | -0.0700 | |||||

| US68268VAB18 / OneMain Financial Issuance Trust 2022-2 | 0.84 | 0.3905 | 0.3905 | ||||||

| INTOWN Mortgage Trust, Series 2025-STAY, Class B / ABS-MBS (US46117WAC64) | 0.84 | 0.12 | 0.3879 | -0.0669 | |||||

| ACM Auto Trust, Series 2025-2A, Class A / ABS-O (US00161TAA97) | 0.84 | 0.3871 | 0.3871 | ||||||

| US06738EAP07 / Barclays PLC | 0.83 | 0.12 | 0.3837 | -0.0661 | |||||

| US00080QAF28 / ABN AMRO Bank NV | 0.83 | 62.48 | 0.3829 | 0.1062 | |||||

| US345397XU23 / Ford Motor Credit Co LLC | 0.83 | 0.3826 | 0.3826 | ||||||

| US22003BAL09 / Corporate Office Properties LP | 0.81 | -7.71 | 0.3770 | -0.1023 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.79 | -5.36 | 0.3679 | -0.0881 | |||||

| US17288XAB01 / Citadel LP | 0.79 | -6.09 | 0.3640 | -0.0911 | |||||

| US742855AA76 / Prodigy Finance CM2021-1 Designated Activity Co | 0.78 | -9.05 | 0.3632 | -0.1054 | |||||

| US085770AA31 / Berry Global Escrow Corp. | 0.78 | 0.00 | 0.3591 | -0.0626 | |||||

| MRX / Marex Group plc | 0.75 | 0.3494 | 0.3494 | ||||||

| EVLN / Morgan Stanley ETF Trust - Eaton Vance Floating-Rate ETF | 0.01 | 0.75 | 0.3462 | 0.3462 | |||||

| SoFi Consumer Loan Program Trust, Series 2025-2, Class A / ABS-O (US83407HAA59) | 0.75 | 0.3455 | 0.3455 | ||||||

| US01166VAA70 / Alaska Airlines 2020-1 Class A Pass Through Trust | 0.75 | 207.85 | 0.3452 | 0.2136 | |||||

| US57110PAB76 / Marlette Funding Trust, Series 2023-1A, Class B | 0.74 | -65.27 | 0.3410 | -0.8111 | |||||

| US26884UAC36 / EPR Properties | 0.73 | -7.79 | 0.3399 | -0.0930 | |||||

| US00253XAA90 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 0.73 | 3.87 | 0.3359 | -0.0438 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 0.72 | 15.34 | 0.3343 | -0.0063 | |||||

| US87020PAX50 / Swedbank AB | 0.72 | -0.14 | 0.3311 | -0.0583 | |||||

| US064159HB54 / Bank of Nova Scotia (Halifax, NS) Bond | 0.70 | 0.14 | 0.3239 | -0.0559 | |||||

| US008252AN84 / Affiliated Managers Group Inc | 0.70 | 0.14 | 0.3236 | -0.0553 | |||||

| US599191AA16 / Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd | 0.70 | -11.35 | 0.3219 | -0.1045 | |||||

| SoFi Consumer Loan Program Trust, Series 2025-1, Class A / ABS-O (US83406YAA91) | 0.70 | -21.47 | 0.3218 | -0.1595 | |||||

| Athene Global Funding / DBT (US04685A4A66) | 0.68 | 161.30 | 0.3158 | 0.1734 | |||||

| Lendbuzz Securitization Trust, Series 2025-2A, Class A2 / ABS-O (US52611JAB61) | 0.65 | 0.3018 | 0.3018 | ||||||

| US12803VAA35 / CAJUN 2021-1 A2 11/51 | 0.61 | 1.33 | 0.2818 | -0.0447 | |||||

| US08576PAH47 / Berry Global Inc | 0.61 | 82.58 | 0.2815 | 0.1003 | |||||

| Pagaya AI Debt Grantor Trust, Series 2025-1, Class A2 / ABS-O (US69544NAB38) | 0.60 | 0.00 | 0.2786 | -0.0481 | |||||

| Oportun Issuance Trust, Series 2025-A, Class A / ABS-O (US68377TAA60) | 0.60 | -0.17 | 0.2777 | -0.0485 | |||||

| US07274NAJ28 / Bayer US Finance II LLC | 0.60 | 362.02 | 0.2761 | 0.2058 | |||||

| US05583JAN28 / BPCE SA | 0.58 | -30.53 | 0.2680 | -0.1844 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.58 | -39.81 | 0.2671 | -0.2532 | |||||

| US694308JL21 / PACIFIC GAS and ELECTRIC CO 3.45% 07/01/2025 | 0.57 | 0.52 | 0.2662 | -0.0450 | |||||

| US Bank NA / DBT (US90331HPS66) | 0.57 | 0.2653 | 0.2653 | ||||||

| US43730VAE83 / CORP CMO | 0.57 | 0.2636 | 0.2636 | ||||||

| US233046AN14 / DB Master Finance LLC | 0.57 | 0.71 | 0.2625 | -0.0437 | |||||

| US87342RAG92 / Taco Bell Funding LLC | 0.57 | 0.71 | 0.2625 | -0.0437 | |||||

| Goldman Sachs Bank USA / DBT (US38151LAG59) | 0.56 | 542.53 | 0.2591 | 0.2114 | |||||

| US71654QCB68 / Petroleos Mexicanos | 0.55 | 22.15 | 0.2530 | 0.0097 | |||||

| US827048AX76 / Silgan Holdings Inc | 0.54 | 0.2514 | 0.2514 | ||||||

| Bank of New York Mellon (The) / DBT (US06405LAF85) | 0.54 | 0.2483 | 0.2483 | ||||||

| Reach ABS Trust, Series 2025-1A, Class A / ABS-O (US75525PAA03) | 0.53 | -19.58 | 0.2458 | -0.1127 | |||||

| US75050KAA43 / Radnor RE Ltd., Series 2023-1, Class M1A | 0.53 | -21.36 | 0.2454 | -0.1209 | |||||

| US709599BE30 / Penske Truck Leasing Co. Lp / PTL Finance Corp. | 0.51 | -32.77 | 0.2378 | -0.1770 | |||||

| US78081BAH69 / Royalty Pharma PLC | 0.51 | 368.52 | 0.2345 | 0.1757 | |||||

| US95058XAG34 / Wendy's Funding LLC | 0.51 | 0.00 | 0.2345 | -0.0408 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0.51 | -58.25 | 0.2344 | -0.4243 | |||||

| HCA, Inc. / DBT (US404119CY34) | 0.50 | -16.30 | 0.2307 | -0.0931 | |||||

| US26208LAD01 / DRIVEN BRANDS FUNDING LLC | 0.50 | -0.20 | 0.2296 | -0.0403 | |||||

| US05578AAP30 / BPCE SA | 0.49 | 0.82 | 0.2271 | -0.0373 | |||||

| US85207UAK16 / Sprint Corp | 0.48 | 0.2244 | 0.2244 | ||||||

| Auxilior Term Funding LLC, Series 2024-1A, Class A2 / ABS-O (US05335FAB76) | 0.48 | -27.69 | 0.2239 | -0.1394 | |||||

| US15089QAK04 / Celanese US Holdings LLC | 0.48 | 1.05 | 0.2233 | -0.0361 | |||||

| US46115HBU05 / INTESA SANPAOLO SPA | 0.48 | -0.62 | 0.2230 | -0.0400 | |||||

| US31677AAB08 / Fifth Third Bank | 0.48 | 0.2208 | 0.2208 | ||||||

| US68377GAB23 / OPTN_21-B | 0.48 | -23.96 | 0.2207 | -0.1197 | |||||

| US91159HHM51 / U.s. Bancorp Bond | 0.48 | 0.2200 | 0.2200 | ||||||

| US428291AN87 / Hexcel Corp | 0.47 | 0.2179 | 0.2179 | ||||||

| US46657FAA30 / JP Morgan Mortgage Trust 2023-HE2 | 0.47 | -16.13 | 0.2167 | -0.0867 | |||||

| US29444UBQ85 / EQUINIX INC 1.45% 05/15/2026 | 0.47 | 0.2162 | 0.2162 | ||||||

| US89114TZD70 / Toronto-Dominion Bank/The | 0.47 | 0.2160 | 0.2160 | ||||||

| US37045XDK90 / General Motors Financial Co Inc | 0.47 | 0.2158 | 0.2158 | ||||||

| US14040HCU77 / Capital One Financial Corp | 0.46 | 1.98 | 0.2153 | -0.0321 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.46 | 0.2118 | 0.2118 | ||||||

| US87165BAG86 / Synchrony Financial | 0.45 | 0.00 | 0.2082 | -0.0361 | |||||

| US15089QAM69 / Celanese US Holdings LLC | 0.45 | 1.83 | 0.2063 | -0.0314 | |||||

| US817743AA56 / N/A | 0.44 | 0.00 | 0.2041 | -0.0353 | |||||

| US26208LAE83 / DRIVEN BRANDS FUNDING LLC | 0.43 | -0.23 | 0.1998 | -0.0350 | |||||

| STAR Trust, Series 2025-SFR5, Class A / ABS-O (US85520CAA36) | 0.43 | -0.23 | 0.1971 | -0.0347 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.42 | 79.57 | 0.1955 | 0.0673 | |||||

| US05610MAA09 / BX_22-CSMO | 0.42 | 0.1936 | 0.1936 | ||||||

| US418751AL75 / HAT HOLDINGS I LLC/HAT REGD 144A P/P 8.00000000 | 0.41 | 0.73 | 0.1907 | -0.0317 | |||||

| ACM Auto Trust, Series 2025-1A, Class A / ABS-O (US00161EAA29) | 0.39 | -24.32 | 0.1819 | -0.1001 | |||||

| GNMA, Series 2024-43, Class FB / ABS-MBS (US38384KNV97) | 0.39 | 0.1785 | 0.1785 | ||||||

| US36143L2G95 / GA Global Funding Trust | 0.38 | 0.1744 | 0.1744 | ||||||

| US902613AU26 / UBS Group AG | 0.37 | 73.15 | 0.1733 | 0.0555 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.37 | -18.58 | 0.1705 | -0.0755 | |||||

| Tricon Residential Trust, Series 2025-SFR1, Class B / ABS-O (US895974AB93) | 0.35 | 0.29 | 0.1623 | -0.0279 | |||||

| Lendbuzz Securitization Trust, Series 2024-1A, Class A2 / ABS-O (US525935AB86) | 0.34 | -17.08 | 0.1554 | -0.0646 | |||||

| US26209XAA90 / DRIVEN BRANDS FUNDING LLC | 0.32 | 0.1497 | 0.1497 | ||||||

| US233046AK74 / DB Master Finance LLC | 0.31 | 0.00 | 0.1450 | -0.0254 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.30 | -16.30 | 0.1405 | -0.0562 | |||||

| FHLMC STACR REMIC Trust, Series 2024-DNA1, Class M1 / ABS-MBS (US35564NAX12) | 0.30 | -12.50 | 0.1394 | -0.0480 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.28 | -14.24 | 0.1311 | -0.0487 | |||||

| Tricon Residential Trust, Series 2025-SFR1, Class C / ABS-O (US895974AC76) | 0.28 | 0.00 | 0.1297 | -0.0225 | |||||

| US30227FAA84 / Extended Stay America Trust | 0.28 | -0.71 | 0.1292 | -0.0239 | |||||

| US68269MAC82 / OneMain Financial Issuance Trust 2021-1 | 0.28 | 0.1278 | 0.1278 | ||||||

| US55608JBF49 / Macquarie Group Ltd | 0.28 | 0.1274 | 0.1274 | ||||||

| US882925AB67 / Theorem Funding Trust 2022-3 | 0.25 | -0.79 | 0.1164 | -0.0213 | |||||

| US24703TAE64 / Dell International LLC / EMC Corp | 0.25 | -56.50 | 0.1163 | -0.1975 | |||||

| Ally Bank Auto Credit-Linked Notes, Series 2024-A, Class B / ABS-O (US02007GZ551) | 0.25 | -11.70 | 0.1157 | -0.0379 | |||||

| US13805AAA51 / CANPACK SA / Eastern PA Land Investment Holding LLC | 0.25 | 0.82 | 0.1148 | -0.0185 | |||||

| PEAC Solutions Receivables LLC, Series 2024-1A, Class A2 / ABS-O (US69433BAB36) | 0.24 | -16.25 | 0.1098 | -0.0440 | |||||

| US55903VBA08 / Warnermedia Holdings Inc | 0.23 | 0.1080 | 0.1080 | ||||||

| US959802AZ22 / Western Union Co/The | 0.22 | -73.52 | 0.1038 | -0.3562 | |||||

| US47216QAB95 / JDE Peet's NV | 0.21 | 0.0969 | 0.0969 | ||||||

| Oportun Funding Trust, Series 2024-3, Class A / ABS-O (US68377NAA90) | 0.21 | -30.20 | 0.0967 | -0.0654 | |||||

| US233046AF89 / DB Master Finance LLC | 0.21 | 0.98 | 0.0957 | -0.0156 | |||||

| Octane Receivables Trust, Series 2024-2A, Class A2 / ABS-O (US67578YAB20) | 0.20 | -18.07 | 0.0945 | -0.0413 | |||||

| US165183CZ56 / Chesapeake Funding II LLC, Series 2023-2A, Class A1 | 0.20 | -15.00 | 0.0945 | -0.0362 | |||||

| US05602HAA14 / BPR Trust 2022-SSP | 0.20 | 0.00 | 0.0927 | -0.0164 | |||||

| US05609VAA35 / BX Commercial Mortgage Trust 2021-VOLT | 0.19 | -2.53 | 0.0896 | -0.0184 | |||||

| ACM Auto Trust, Series 2024-2A, Class A / ABS-O (US00461WAA99) | 0.19 | -32.00 | 0.0869 | -0.0626 | |||||

| Ally Bank Auto Credit-Linked Notes, Series 2024-B, Class B / ABS-O (US02007G4C45) | 0.19 | -10.95 | 0.0867 | -0.0275 | |||||

| Oscar US Funding XVII LLC, Series 2024-2A, Class A2 / ABS-O (US68784BAB09) | 0.18 | -16.44 | 0.0852 | -0.0343 | |||||

| FHLMC STACR REMIC Trust, Series 2024-HQA1, Class A1 / ABS-MBS (US35564NBW20) | 0.18 | -2.70 | 0.0837 | -0.0170 | |||||

| Lendbuzz Securitization Trust, Series 2025-1A, Class A2 / ABS-O (US525938AC09) | 0.18 | 0.00 | 0.0836 | -0.0143 | |||||

| US20754LAA70 / Fannie Mae Connecticut Avenue Securities | 0.18 | -18.14 | 0.0819 | -0.0352 | |||||

| US52608MAB46 / Lendbuzz Securitization Trust 2023-2 | 0.18 | -16.67 | 0.0813 | -0.0332 | |||||

| ORL Trust, Series 2024-GLKS, Class A / ABS-MBS (US67120DAA37) | 0.18 | 0.00 | 0.0811 | -0.0143 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.17 | -7.49 | 0.0804 | -0.0215 | |||||

| Alterna Funding III LLC, Series 2024-1A, Class A / ABS-O (US02157JAA34) | 0.17 | 0.00 | 0.0782 | -0.0135 | |||||

| Octane Receivables Trust, Series 2024-3A, Class A2 / ABS-O (US67571GAB86) | 0.17 | -4.57 | 0.0773 | -0.0180 | |||||

| Hyundai Capital America / DBT (US44891ADA25) | 0.17 | -34.13 | 0.0770 | -0.0600 | |||||

| US25755TAJ97 / Domino's Pizza Master Issuer LLC | 0.17 | 0.00 | 0.0765 | -0.0132 | |||||

| US30227FAE07 / Extended Stay America Trust | 0.16 | -0.62 | 0.0747 | -0.0138 | |||||

| Oportun Issuance Trust, Series 2024-1A, Class B / ABS-O (US68377JAC45) | 0.16 | -7.69 | 0.0723 | -0.0199 | |||||

| Ally Bank Auto Credit-Linked Notes, Series 2024-A, Class C / ABS-O (US02007GZ635) | 0.16 | -11.93 | 0.0722 | -0.0240 | |||||

| Oportun Funding Trust, Series 2024-3, Class B / ABS-O (US68377NAB73) | 0.15 | 0.00 | 0.0695 | -0.0121 | |||||

| US87342RAC88 / Taco Bell Funding LLC | 0.15 | 0.67 | 0.0695 | -0.0120 | |||||

| US172967HB08 / Citigroup Inc | 0.15 | 67.42 | 0.0691 | 0.0205 | |||||

| Mercury Financial Credit Card Master Trust, Series 2024-2A, Class A / ABS-O (US58940BAZ94) | 0.15 | -0.67 | 0.0687 | -0.0124 | |||||

| HLTN Commercial Mortgage Trust, Series 2024-DPLO, Class A / ABS-MBS (US40424UAA51) | 0.14 | 0.00 | 0.0649 | -0.0114 | |||||

| TX Trust, Series 2024-HOU, Class A / ABS-MBS (US90216DAA00) | 0.14 | 0.00 | 0.0645 | -0.0115 | |||||

| US08860DAB91 / BHG Securitization Trust 2022-C | 0.14 | -22.16 | 0.0635 | -0.0324 | |||||

| Octane Receivables Trust, Series 2024-RVM1, Class A / ABS-O (US67579FAA49) | 0.12 | -11.43 | 0.0577 | -0.0185 | |||||

| US26442UAA25 / Duke Energy Progress LLC | 0.12 | 0.00 | 0.0573 | -0.0098 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-HE2, Class A1 / ABS-O (US46593HAA68) | 0.12 | -13.57 | 0.0564 | -0.0199 | |||||

| US830867AB33 / Delta Air Lines Inc / SkyMiles IP Ltd | 0.12 | -28.99 | 0.0559 | -0.0364 | |||||

| Clarus Capital Funding LLC, Series 2024-1A, Class A2 / ABS-O (US18271JAB89) | 0.12 | -9.45 | 0.0534 | -0.0161 | |||||

| DLLMT LLC, Series 2024-1A, Class A2 / ABS-O (US23347AAC53) | 0.11 | -16.79 | 0.0506 | -0.0208 | |||||

| Chesapeake Funding II LLC, Series 2024-1A, Class A2 / ABS-O (US165183DJ06) | 0.11 | -12.40 | 0.0495 | -0.0164 | |||||

| Oscar US Funding XVI LLC, Series 2024-1A, Class A2 / ABS-O (US68784GAB95) | 0.11 | -30.92 | 0.0490 | -0.0339 | |||||

| Enterprise Fleet Financing LLC, Series 2024-2, Class A2 / ABS-O (US29375RAB24) | 0.10 | -20.16 | 0.0477 | -0.0229 | |||||

| Pagaya Ai Debt Grantor Trust, Series 2024-9, Class A / ABS-O (US69546QAA67) | 0.10 | -15.25 | 0.0466 | -0.0179 | |||||

| Wingspire Equipment Finance LLC, Series 2024-1A, Class A2 / ABS-O (US97415AAB89) | 0.10 | 0.00 | 0.0463 | -0.0080 | |||||

| Reach ABS Trust, Series 2024-2A, Class A / ABS-O (US75525HAA86) | 0.10 | -25.00 | 0.0449 | -0.0251 | |||||

| US88339FAB94 / Theorem Funding Trust 2022-2 | 0.09 | -1.09 | 0.0422 | -0.0080 | |||||

| US780097BA81 / Natwest Group PLC | 0.09 | 0.0418 | 0.0418 | ||||||

| US30333LAB45 / FHF Issuer Trust 2023-2 | 0.09 | -19.27 | 0.0412 | -0.0186 | |||||

| ACHV ABS Trust, Series 2024-3AL, Class B / ABS-O (US00092KAB08) | 0.09 | -24.35 | 0.0406 | -0.0220 | |||||

| US30227FAG54 / Extended Stay America Trust | 0.09 | -1.16 | 0.0398 | -0.0073 | |||||

| Lendbuzz Securitization Trust, Series 2024-3A, Class A2 / ABS-O (US52609YAB74) | 0.09 | -13.27 | 0.0394 | -0.0141 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.08 | -9.78 | 0.0388 | -0.0114 | |||||

| US87264ABU88 / T-Mobile USA Inc | 0.08 | 0.0379 | 0.0379 | ||||||

| Blue Owl Asset Leasing Trust LLC, Series 2024-1A, Class A2 / ABS-O (US095921AB86) | 0.08 | -15.05 | 0.0367 | -0.0142 | |||||

| US29375CAB54 / Enterprise Fleet Financing 2023-1 LLC | 0.08 | -25.74 | 0.0351 | -0.0198 | |||||

| US46656UAA16 / JP Morgan Mortgage Trust 2023-HE1 | 0.07 | -12.50 | 0.0328 | -0.0108 | |||||

| US882925AA84 / Theorem Funding Trust 2022-3 | 0.07 | -56.60 | 0.0321 | -0.0546 | |||||

| US74390NAC65 / Prosper Marketplace Issuance Trust Series 2023-1A, Class B | 0.07 | -66.00 | 0.0318 | -0.0773 | |||||

| Reach Abs Trust, Series 2024-1A, Class A / ABS-MBS (US75526PAA93) | 0.06 | -41.75 | 0.0281 | -0.0279 | |||||

| US03236YAB11 / Amur Equipment Finance Receivables XII LLC | 0.05 | -18.18 | 0.0211 | -0.0089 | |||||

| GLS Auto Select Receivables Trust, Series 2024-1A, Class A2 / ABS-O (US37988XAB10) | 0.04 | -14.58 | 0.0190 | -0.0074 | |||||

| US465985AA77 / JP Morgan Mortgage Trust 2023-HE3 | 0.04 | -15.91 | 0.0176 | -0.0065 | |||||

| US55316VAA26 / MHC Commercial Mortgage Trust 2021-MHC | 0.03 | -60.29 | 0.0129 | -0.0244 | |||||

| HPEFS Equipment Trust, Series 2024-1A, Class A2 / ABS-O (US403963AB73) | 0.03 | -72.83 | 0.0120 | -0.0384 | |||||

| Prosper Marketplace Issuance Trust, Series 2024-1A, Class A / ABS-O (US74363CAA71) | 0.02 | -52.50 | 0.0091 | -0.0129 | |||||

| DLLST LLC, Series 2024-1A, Class A2 / ABS-O (US23346HAB33) | 0.01 | -57.14 | 0.0059 | -0.0096 | |||||

| GM Financial Consumer Automobile Receivables Trust, Series 2024-1, Class A2A / ABS-O (US36268GAB14) | 0.01 | -54.55 | 0.0025 | -0.0037 | |||||

| SFS Auto Receivables Securitization Trust, Series 2024-1A, Class A2 / ABS-O (US78435VAB80) | 0.00 | -75.00 | 0.0021 | -0.0067 | |||||

| US06054YAB39 / Bank of America Auto Trust 2023-2 | 0.00 | -95.65 | 0.0012 | -0.0238 | |||||

| U.S. Treasury 2 Year Notes / DIR (N/A) | -0.00 | -0.0023 | -0.0023 | ||||||

| U.S. Treasury 5 Year Notes / DIR (N/A) | -0.01 | -0.0025 | -0.0025 |