Statistik Asas

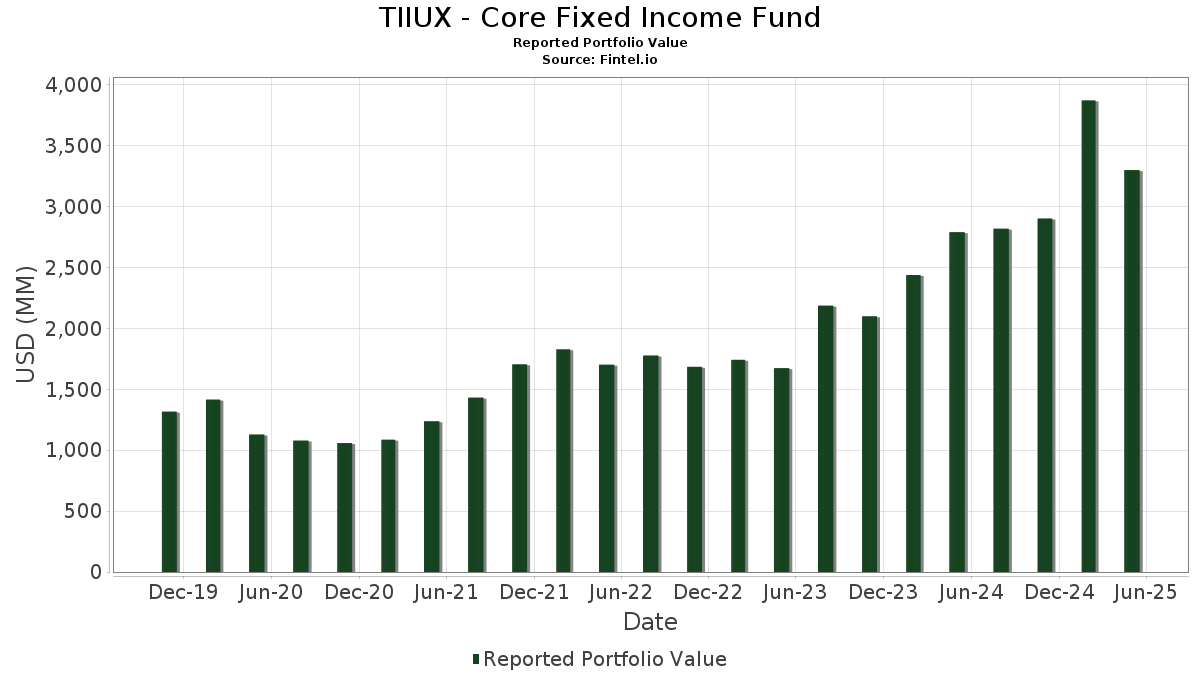

| Nilai Portfolio | $ 3,298,399,753 |

| Kedudukan Semasa | 4,318 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

TIIUX - Core Fixed Income Fund telah mendedahkan 4,318 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 3,298,399,753 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas TIIUX - Core Fixed Income Fund ialah Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , Edwards Lifesciences Corporation (US:EW) , Uniform Mortgage-Backed Security, TBA (US:US01F0226757) , United States Treas Bds Bond (US:US912810RD28) , and Ginnie Mae II Pool (US:US36179WTY48) . Kedudukan baharu TIIUX - Core Fixed Income Fund termasuk Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , Fannie Mae Pool (US:US3138LNX630) , FN MA4513 (US:US31418EAP51) , FNMA, Other (US:US3140LFXA79) , and iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF (US:HYG) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 147.90 | 9.0935 | 9.0935 | ||

| 147.90 | 9.0935 | 9.0935 | ||

| 147.90 | 9.0935 | 9.0935 | ||

| 64.05 | 3.9378 | 3.9378 | ||

| 64.05 | 3.9378 | 3.9378 | ||

| 22.86 | 1.4058 | 1.4058 | ||

| 22.86 | 1.4058 | 1.4058 | ||

| 20.82 | 1.2801 | 1.2801 | ||

| 16.43 | 1.0100 | 1.0100 | ||

| 16.43 | 1.0100 | 1.0100 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -22.73 | -1.3978 | -1.3978 | ||

| -22.73 | -1.3978 | -1.3978 | ||

| -22.73 | -1.3978 | -1.3978 | ||

| 0.12 | 0.0074 | -1.2826 | ||

| 0.28 | 0.0174 | -1.2632 | ||

| 1.11 | 0.0683 | -0.8933 | ||

| 1.96 | 0.1208 | -0.7872 | ||

| 1.96 | 0.1208 | -0.7872 | ||

| 1.96 | 0.1208 | -0.7872 | ||

| 0.37 | 0.0225 | -0.7433 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-28 untuk tempoh pelaporan 2025-05-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FUTURE CONTRACT ON US 2YR NOTE (CBT) SEP25 0.00000000 / DIR (N/A) | 147.90 | 9.0935 | 9.0935 | ||||||

| FUTURE CONTRACT ON US 2YR NOTE (CBT) SEP25 0.00000000 / DIR (N/A) | 147.90 | 9.0935 | 9.0935 | ||||||

| FUTURE CONTRACT ON US 2YR NOTE (CBT) SEP25 0.00000000 / DIR (N/A) | 147.90 | 9.0935 | 9.0935 | ||||||

| FUTURE CONTRACT ON US 5YR NOTE (CBT) SEP25 0.00000000 / DIR (N/A) | 64.05 | 3.9378 | 3.9378 | ||||||

| FUTURE CONTRACT ON US 5YR NOTE (CBT) SEP25 0.00000000 / DIR (N/A) | 64.05 | 3.9378 | 3.9378 | ||||||

| FUTURE CONTRACT ON US ULTRA BOND CBT SEP25 0.00000000 / DIR (N/A) | 22.86 | 1.4058 | 1.4058 | ||||||

| FUTURE CONTRACT ON US ULTRA BOND CBT SEP25 0.00000000 / DIR (N/A) | 22.86 | 1.4058 | 1.4058 | ||||||

| FUTURE CONTRACT ON US 10YR NOTE (CBT)SEP25 0.00000000 / DIR (N/A) | 20.82 | 1.2801 | 1.2801 | ||||||

| UNITED STATES TREASURY BOND 4.62500000 / DBT (US912810UB25) | 19.31 | -16.74 | 1.1869 | -0.0419 | |||||

| UNITED STATES TREASURY BOND 4.62500000 / DBT (US912810UB25) | 19.31 | -16.74 | 1.1869 | -0.0419 | |||||

| UNITED STATES TREASURY BOND 4.62500000 / DBT (US912810UB25) | 19.31 | -16.74 | 1.1869 | -0.0419 | |||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CLW90) | 18.10 | 50.68 | 1.1129 | 0.4762 | |||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CLW90) | 18.10 | 50.68 | 1.1129 | 0.4762 | |||||

| FREDDIE MAC POOL UMBS P#SD3983 5.50000000 / ABS-MBS (US3132E0M823) | 16.96 | -3.70 | 1.0425 | 0.1093 | |||||

| FREDDIE MAC POOL UMBS P#SD3983 5.50000000 / ABS-MBS (US3132E0M823) | 16.96 | -3.70 | 1.0425 | 0.1093 | |||||

| UNITED STATES TREASURY BILL ZCP 0.00000000 / STIV (US912797LW51) | 16.43 | 1.0100 | 1.0100 | ||||||

| UNITED STATES TREASURY BILL ZCP 0.00000000 / STIV (US912797LW51) | 16.43 | 1.0100 | 1.0100 | ||||||

| UNITED STATES TREASURY BILL ZCP 0.00000000 / STIV (US912797LW51) | 16.43 | 1.0100 | 1.0100 | ||||||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 14.34 | 0.8815 | 0.8815 | ||||||

| GINNIE MAE II POOL P#MB0025 5.00000000 / ABS-MBS (US3618N5A332) | 13.00 | -2.56 | 0.7995 | 0.0922 | |||||

| GINNIE MAE II POOL P#MB0025 5.00000000 / ABS-MBS (US3618N5A332) | 13.00 | -2.56 | 0.7995 | 0.0922 | |||||

| GINNIE MAE II POOL P#MB0025 5.00000000 / ABS-MBS (US3618N5A332) | 13.00 | -2.56 | 0.7995 | 0.0922 | |||||

| GINNIE MAE II POOL P#MB0025 5.00000000 / ABS-MBS (US3618N5A332) | 13.00 | -2.56 | 0.7995 | 0.0922 | |||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CMZ13) | 12.61 | 0.7753 | 0.7753 | ||||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CMZ13) | 12.61 | 0.7753 | 0.7753 | ||||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CMZ13) | 12.61 | 0.7753 | 0.7753 | ||||||

| FUTURE CONTRACT ON US LONG BOND(CBT) SEP25 0.00000000 / DIR (N/A) | 12.41 | 0.7628 | 0.7628 | ||||||

| FUTURE CONTRACT ON US LONG BOND(CBT) SEP25 0.00000000 / DIR (N/A) | 12.41 | 0.7628 | 0.7628 | ||||||

| FUTURE CONTRACT ON US LONG BOND(CBT) SEP25 0.00000000 / DIR (N/A) | 12.41 | 0.7628 | 0.7628 | ||||||

| FANNIE MAE POOL UMBS P#MA5586 5.50000000 / ABS-MBS (US31418FF443) | 10.70 | 0.6578 | 0.6578 | ||||||

| FANNIE MAE POOL UMBS P#MA5586 5.50000000 / ABS-MBS (US31418FF443) | 10.70 | 0.6578 | 0.6578 | ||||||

| FANNIE MAE POOL UMBS P#MA5586 5.50000000 / ABS-MBS (US31418FF443) | 10.70 | 0.6578 | 0.6578 | ||||||

| FANNIE MAE POOL UMBS P#MA5586 5.50000000 / ABS-MBS (US31418FF443) | 10.70 | 0.6578 | 0.6578 | ||||||

| FANNIE MAE POOL UMBS P#FA1020 3.00000000 / ABS-MBS (US3140W1D265) | 10.64 | 0.6542 | 0.6542 | ||||||

| FANNIE MAE POOL UMBS P#FA1020 3.00000000 / ABS-MBS (US3140W1D265) | 10.64 | 0.6542 | 0.6542 | ||||||

| FANNIE MAE POOL UMBS P#FA1020 3.00000000 / ABS-MBS (US3140W1D265) | 10.64 | 0.6542 | 0.6542 | ||||||

| FREDDIE MAC POOL UMBS P#SD0907 3.00000000 / ABS-MBS (US3132DNAG88) | 10.22 | 0.6286 | 0.6286 | ||||||

| FREDDIE MAC POOL UMBS P#SD0907 3.00000000 / ABS-MBS (US3132DNAG88) | 10.22 | 0.6286 | 0.6286 | ||||||

| FREDDIE MAC POOL UMBS P#SD0907 3.00000000 / ABS-MBS (US3132DNAG88) | 10.22 | 0.6286 | 0.6286 | ||||||

| EW / Edwards Lifesciences Corporation | 9.67 | 0.5946 | 0.5946 | ||||||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 8.96 | 364.52 | 0.5507 | 0.4091 | |||||

| GINNIE MAE II POOL P#MA8873 2.50000000 / ABS-MBS (US36179X2E54) | 8.90 | 0.5474 | 0.5474 | ||||||

| GINNIE MAE II POOL P#MA8873 2.50000000 / ABS-MBS (US36179X2E54) | 8.90 | 0.5474 | 0.5474 | ||||||

| GINNIE MAE II POOL P#MA8873 2.50000000 / ABS-MBS (US36179X2E54) | 8.90 | 0.5474 | 0.5474 | ||||||

| US912810RD28 / United States Treas Bds Bond | 8.81 | -4.69 | 0.5419 | 0.0518 | |||||

| FANNIE MAE POOL UMBS P#BX0388 4.50000000 / ABS-MBS (US3140N4NE38) | 8.72 | -3.66 | 0.5364 | 0.0565 | |||||

| FANNIE MAE POOL UMBS P#BX0388 4.50000000 / ABS-MBS (US3140N4NE38) | 8.72 | -3.66 | 0.5364 | 0.0565 | |||||

| FANNIE MAE POOL UMBS P#BX0388 4.50000000 / ABS-MBS (US3140N4NE38) | 8.72 | -3.66 | 0.5364 | 0.0565 | |||||

| US36179WTY48 / Ginnie Mae II Pool | 8.50 | -17.16 | 0.5227 | -0.0212 | |||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CNC19) | 7.85 | 0.4826 | 0.4826 | ||||||

| US3138LNX630 / Fannie Mae Pool | 7.49 | 0.4605 | 0.4605 | ||||||

| GINNIE MAE II POOL P#MA9852 6.00000000 / ABS-MBS (US36179Y5M26) | 7.44 | 0.4573 | 0.4573 | ||||||

| GINNIE MAE II POOL P#MA9852 6.00000000 / ABS-MBS (US36179Y5M26) | 7.44 | 0.4573 | 0.4573 | ||||||

| GINNIE MAE II POOL P#MA9852 6.00000000 / ABS-MBS (US36179Y5M26) | 7.44 | 0.4573 | 0.4573 | ||||||

| FANNIE MAE POOL UMBS P#MA5701 6.00000000 / ABS-MBS (US31418FKP17) | 7.25 | 0.4459 | 0.4459 | ||||||

| FANNIE MAE POOL UMBS P#MA5701 6.00000000 / ABS-MBS (US31418FKP17) | 7.25 | 0.4459 | 0.4459 | ||||||

| FANNIE MAE POOL UMBS P#MA5701 6.00000000 / ABS-MBS (US31418FKP17) | 7.25 | 0.4459 | 0.4459 | ||||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CMU26) | 6.87 | 0.4227 | 0.4227 | ||||||

| US31418EAP51 / FN MA4513 | 6.67 | 0.4099 | 0.4099 | ||||||

| GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2024-51 CL GC 3.50000000 / ABS-CBDO (US38384KG547) | 6.65 | 0.4089 | 0.4089 | ||||||

| GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2024-51 CL GC 3.50000000 / ABS-CBDO (US38384KG547) | 6.65 | 0.4089 | 0.4089 | ||||||

| GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2024-51 CL GC 3.50000000 / ABS-CBDO (US38384KG547) | 6.65 | 0.4089 | 0.4089 | ||||||

| FANNIE MAE POOL UMBS P#BY2978 5.00000000 / ABS-MBS (US3140NKJY88) | 6.50 | -2.37 | 0.3999 | 0.0468 | |||||

| FANNIE MAE POOL UMBS P#BY2978 5.00000000 / ABS-MBS (US3140NKJY88) | 6.50 | -2.37 | 0.3999 | 0.0468 | |||||

| FANNIE MAE POOL UMBS P#BY2978 5.00000000 / ABS-MBS (US3140NKJY88) | 6.50 | -2.37 | 0.3999 | 0.0468 | |||||

| FANNIE MAE POOL UMBS P#BY2978 5.00000000 / ABS-MBS (US3140NKJY88) | 6.50 | -2.37 | 0.3999 | 0.0468 | |||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CJW29) | 6.39 | 0.33 | 0.3929 | 0.0553 | |||||

| GINNIE MAE II POOL P#MA9851 5.50000000 / ABS-MBS (US36179Y5L43) | 6.35 | -4.60 | 0.3906 | 0.0377 | |||||

| GINNIE MAE II POOL P#MA9851 5.50000000 / ABS-MBS (US36179Y5L43) | 6.35 | -4.60 | 0.3906 | 0.0377 | |||||

| GINNIE MAE II POOL P#MA9851 5.50000000 / ABS-MBS (US36179Y5L43) | 6.35 | -4.60 | 0.3906 | 0.0377 | |||||

| US3140XDSU13 / Fannie Mae Pool | 6.09 | -37.56 | 0.3743 | -0.1424 | |||||

| US3140LFXA79 / FNMA, Other | 6.07 | 0.3731 | 0.3731 | ||||||

| UNITED STATES TREASURY NOTE 4.12500000 / DBT (US91282CKG59) | 6.04 | 0.15 | 0.3715 | 0.0517 | |||||

| UNITED STATES TREASURY NOTE 4.12500000 / DBT (US91282CKG59) | 6.04 | 0.15 | 0.3715 | 0.0517 | |||||

| UNITED STATES TREASURY NOTE 4.12500000 / DBT (US91282CKG59) | 6.04 | 0.15 | 0.3715 | 0.0517 | |||||

| UNITED STATES TREASURY NOTE 4.12500000 / DBT (US91282CKG59) | 6.04 | 0.15 | 0.3715 | 0.0517 | |||||

| US01F0306781 / UMBS TBA | 6.04 | 2,802.88 | 0.3713 | 0.3528 | |||||

| US91282CEF41 / United States Treasury Note/Bond | 5.85 | 0.41 | 0.3596 | 0.0509 | |||||

| US3140QPKP13 / Federal National Mortgage Association | 5.55 | -22.25 | 0.3410 | -0.0370 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 5.35 | 1.15 | 0.3289 | 0.0486 | |||||

| US36179W7K87 / Ginnie Mae II Pool | 5.33 | -32.62 | 0.3280 | -0.0916 | |||||

| UNITED STATES TREASURY NOTE 4.62500000 / DBT (US91282CMM00) | 5.24 | -17.54 | 0.3220 | -0.0146 | |||||

| UNITED STATES TREASURY NOTE 4.62500000 / DBT (US91282CMM00) | 5.24 | -17.54 | 0.3220 | -0.0146 | |||||

| UNITED STATES TREASURY NOTE 4.62500000 / DBT (US91282CMM00) | 5.24 | -17.54 | 0.3220 | -0.0146 | |||||

| UNITED STATES TREASURY NOTE 4.62500000 / DBT (US91282CKP58) | 5.12 | 0.18 | 0.3150 | 0.0440 | |||||

| UNITED STATES TREASURY NOTE 4.62500000 / DBT (US91282CKP58) | 5.12 | 0.18 | 0.3150 | 0.0440 | |||||

| UNITED STATES TREASURY NOTE 4.62500000 / DBT (US91282CKP58) | 5.12 | 0.18 | 0.3150 | 0.0440 | |||||

| UNITED STATES TREASURY NOTE 4.50000000 / DBT (US91282CKT70) | 5.10 | 150.59 | 0.3137 | 0.2058 | |||||

| UNITED STATES TREASURY NOTE 4.50000000 / DBT (US91282CKT70) | 5.10 | 150.59 | 0.3137 | 0.2058 | |||||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0.06 | 5.09 | 0.3131 | 0.3131 | |||||

| UNITED STATES TREASURY NOTE 3.75000000 / DBT (US91282CLG41) | 4.98 | -4.90 | 0.3064 | 0.0286 | |||||

| UNITED STATES TREASURY NOTE 3.75000000 / DBT (US91282CLG41) | 4.98 | -4.90 | 0.3064 | 0.0286 | |||||

| UNITED STATES TREASURY NOTE 3.75000000 / DBT (US91282CLG41) | 4.98 | -4.90 | 0.3064 | 0.0286 | |||||

| UNITED STATES TREASURY NOTE 3.75000000 / DBT (US91282CLG41) | 4.98 | -4.90 | 0.3064 | 0.0286 | |||||

| GINNIE MAE II POOL P#MA9100 2.50000000 / ABS-MBS (US36179YDD31) | 4.87 | 0.2992 | 0.2992 | ||||||

| GINNIE MAE II POOL P#MA9100 2.50000000 / ABS-MBS (US36179YDD31) | 4.87 | 0.2992 | 0.2992 | ||||||

| SEASONED LOANS STRUCTURED TRANSACTION TRUST SERIES 2025-1 SER 2025-1 CL A1 3.00000000 / ABS-CBDO (US35564CTW72) | 4.83 | 0.2967 | 0.2967 | ||||||

| SEASONED LOANS STRUCTURED TRANSACTION TRUST SERIES 2025-1 SER 2025-1 CL A1 3.00000000 / ABS-CBDO (US35564CTW72) | 4.83 | 0.2967 | 0.2967 | ||||||

| SEASONED LOANS STRUCTURED TRANSACTION TRUST SERIES 2025-1 SER 2025-1 CL A1 3.00000000 / ABS-CBDO (US35564CTW72) | 4.83 | 0.2967 | 0.2967 | ||||||

| UNITED STATES TREASURY NOTE 4.37500000 / DBT (US91282CMK44) | 4.81 | -48.73 | 0.2958 | -0.2015 | |||||

| UNITED STATES TREASURY NOTE 4.37500000 / DBT (US91282CMK44) | 4.81 | -48.73 | 0.2958 | -0.2015 | |||||

| UNITED STATES TREASURY NOTE 4.37500000 / DBT (US91282CMK44) | 4.81 | -48.73 | 0.2958 | -0.2015 | |||||

| US36179YDJ01 / Ginnie Mae II Pool | 4.66 | -3.80 | 0.2867 | 0.0298 | |||||

| UNITED STATES TREASURY NOTE 4.12500000 / DBT (US91282CKA89) | 4.65 | 0.00 | 0.2859 | 0.0394 | |||||

| UNITED STATES TREASURY NOTE 4.12500000 / DBT (US91282CKA89) | 4.65 | 0.00 | 0.2859 | 0.0394 | |||||

| UNITED STATES TREASURY NOTE 4.12500000 / DBT (US91282CKA89) | 4.65 | 0.00 | 0.2859 | 0.0394 | |||||

| US3133AR2T19 / FREDDIE MAC POOL UMBS P#QC7086 2.50000000 | 4.53 | 395.08 | 0.2783 | 0.2291 | |||||

| US01F0626634 / Uniform Mortgage-Backed Security, TBA | 4.49 | 65.11 | 0.2758 | 0.1222 | |||||

| GINNIE MAE II POOL P#MA9417 2.50000000 / ABS-MBS (US36179YPA63) | 4.44 | 0.2730 | 0.2730 | ||||||

| GINNIE MAE II POOL P#MA9417 2.50000000 / ABS-MBS (US36179YPA63) | 4.44 | 0.2730 | 0.2730 | ||||||

| GINNIE MAE II POOL P#MA9417 2.50000000 / ABS-MBS (US36179YPA63) | 4.44 | 0.2730 | 0.2730 | ||||||

| UNITED KINGDOM GILT /GBP/ REGD REG S 4.12500000 / DBT (GB00BQC82B83) | 4.32 | -10.62 | 0.2655 | 0.0094 | |||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CJZ59) | 4.17 | -13.11 | 0.2564 | 0.0020 | |||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CJZ59) | 4.17 | -13.11 | 0.2564 | 0.0020 | |||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CJZ59) | 4.17 | -13.11 | 0.2564 | 0.0020 | |||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CJZ59) | 4.17 | -13.11 | 0.2564 | 0.0020 | |||||

| UNITED STATES TREASURY BOND 4.62500000 / DBT (US912810UG12) | 4.12 | 0.2530 | 0.2530 | ||||||

| US33830JAE55 / Five Guys Holdings Inc | 4.10 | -8.86 | 0.2522 | 0.0136 | |||||

| US31418DYX47 / UMBS | 4.09 | -16.38 | 0.2515 | -0.0078 | |||||

| US78433DAA28 / SEB Funding LLC | 4.09 | -0.37 | 0.2515 | 0.0339 | |||||

| US466365AC73 / Jack In The Box Funding LLC | 4.09 | -1.59 | 0.2514 | 0.0312 | |||||

| US21H0526606 / Ginnie Mae | 4.07 | -38.91 | 0.2502 | -0.1263 | |||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP LLC SER 2024-3A CL A REGD 144A P/P 5.23000000 / ABS-CBDO (US05377RJK14) | 4.07 | -0.49 | 0.2501 | 0.0335 | |||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP LLC SER 2024-3A CL A REGD 144A P/P 5.23000000 / ABS-CBDO (US05377RJK14) | 4.07 | -0.49 | 0.2501 | 0.0335 | |||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP LLC SER 2024-3A CL A REGD 144A P/P 5.23000000 / ABS-CBDO (US05377RJK14) | 4.07 | -0.49 | 0.2501 | 0.0335 | |||||

| US3132DWBY84 / Freddie Mac Pool | 4.05 | -4.60 | 0.2488 | 0.0240 | |||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CKX82) | 4.05 | 0.25 | 0.2487 | 0.0349 | |||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CKX82) | 4.05 | 0.25 | 0.2487 | 0.0349 | |||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CKX82) | 4.05 | 0.25 | 0.2487 | 0.0349 | |||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CKX82) | 4.05 | 0.25 | 0.2487 | 0.0349 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 3.99 | -8.57 | 0.2453 | 0.0140 | |||||

| FREDDIE MAC POOL UMBS P#SD8432 6.00000000 / ABS-MBS (US3132DWLM37) | 3.94 | -4.60 | 0.2422 | 0.0233 | |||||

| FREDDIE MAC POOL UMBS P#SD8432 6.00000000 / ABS-MBS (US3132DWLM37) | 3.94 | -4.60 | 0.2422 | 0.0233 | |||||

| FREDDIE MAC POOL UMBS P#SD8432 6.00000000 / ABS-MBS (US3132DWLM37) | 3.94 | -4.60 | 0.2422 | 0.0233 | |||||

| US91282CFF32 / United States Treasury Note/Bond | 3.89 | -14.69 | 0.2389 | -0.0025 | |||||

| FANNIE MAE POOL UMBS P#BZ3763 4.29000000 / ABS-MBS (US3140NYFD81) | 3.83 | 0.2352 | 0.2352 | ||||||

| FANNIE MAE POOL UMBS P#BZ3763 4.29000000 / ABS-MBS (US3140NYFD81) | 3.83 | 0.2352 | 0.2352 | ||||||

| FANNIE MAE POOL UMBS P#BZ3763 4.29000000 / ABS-MBS (US3140NYFD81) | 3.83 | 0.2352 | 0.2352 | ||||||

| US06051GHG73 / Bank of America Corp | 3.78 | 0.16 | 0.2324 | 0.0324 | |||||

| SHR TRUST 2024-LXRY SER 2024-LXRY CL A V/R REGD 144A P/P 6.27871000 / ABS-CBDO (US784234AA47) | 3.73 | -0.29 | 0.2291 | 0.0311 | |||||

| SHR TRUST 2024-LXRY SER 2024-LXRY CL A V/R REGD 144A P/P 6.27871000 / ABS-CBDO (US784234AA47) | 3.73 | -0.29 | 0.2291 | 0.0311 | |||||

| SALUDA GRADE ALTERNATIVE MORTGAGE TRUST SER 2024-CES1 CL A1 V/R REGD 144A P/P 6.30600000 / ABS-CBDO (US79581VAA08) | 3.61 | -8.55 | 0.2218 | 0.0128 | |||||

| SALUDA GRADE ALTERNATIVE MORTGAGE TRUST SER 2024-CES1 CL A1 V/R REGD 144A P/P 6.30600000 / ABS-CBDO (US79581VAA08) | 3.61 | -8.55 | 0.2218 | 0.0128 | |||||

| SALUDA GRADE ALTERNATIVE MORTGAGE TRUST SER 2024-CES1 CL A1 V/R REGD 144A P/P 6.30600000 / ABS-CBDO (US79581VAA08) | 3.61 | -8.55 | 0.2218 | 0.0128 | |||||

| CCAS 2024-1 LLC SER 2024-1A CL A REGD 144A P/P 7.12400000 / ABS-CBDO (US12516NAD30) | 3.59 | -0.36 | 0.2205 | 0.0297 | |||||

| US912810TN81 / United States Treasury Note/Bond | 3.54 | -27.97 | 0.2179 | -0.0429 | |||||

| STACK INFRASTRUCTURE ISSUER LLC SER 2024-1A CL A2 REGD 144A P/P 5.90000000 / ABS-CBDO (US85236KAM45) | 3.54 | -0.84 | 0.2177 | 0.0284 | |||||

| STACK INFRASTRUCTURE ISSUER LLC SER 2024-1A CL A2 REGD 144A P/P 5.90000000 / ABS-CBDO (US85236KAM45) | 3.54 | -0.84 | 0.2177 | 0.0284 | |||||

| STACK INFRASTRUCTURE ISSUER LLC SER 2024-1A CL A2 REGD 144A P/P 5.90000000 / ABS-CBDO (US85236KAM45) | 3.54 | -0.84 | 0.2177 | 0.0284 | |||||

| STACK INFRASTRUCTURE ISSUER LLC SER 2024-1A CL A2 REGD 144A P/P 5.90000000 / ABS-CBDO (US85236KAM45) | 3.54 | -0.84 | 0.2177 | 0.0284 | |||||

| US31418D4X74 / Fannie Mae Pool | 3.50 | -20.11 | 0.2150 | -0.0170 | |||||

| SDAL TRUST 2025-DAL SER 2025-DAL CL B V/R REGD 144A P/P 7.26932000 / ABS-CBDO (US78437RAC34) | 3.47 | 0.2137 | 0.2137 | ||||||

| SDAL TRUST 2025-DAL SER 2025-DAL CL B V/R REGD 144A P/P 7.26932000 / ABS-CBDO (US78437RAC34) | 3.47 | 0.2137 | 0.2137 | ||||||

| SDAL TRUST 2025-DAL SER 2025-DAL CL B V/R REGD 144A P/P 7.26932000 / ABS-CBDO (US78437RAC34) | 3.47 | 0.2137 | 0.2137 | ||||||

| METRONET INFRASTRUCTURE ISSUER LLC SER 2024-1A CL A2 REGD 144A P/P 6.23000000 / ABS-CBDO (US59170JAG31) | 3.45 | -0.49 | 0.2118 | 0.0283 | |||||

| METRONET INFRASTRUCTURE ISSUER LLC SER 2024-1A CL A2 REGD 144A P/P 6.23000000 / ABS-CBDO (US59170JAG31) | 3.45 | -0.49 | 0.2118 | 0.0283 | |||||

| METRONET INFRASTRUCTURE ISSUER LLC SER 2024-1A CL A2 REGD 144A P/P 6.23000000 / ABS-CBDO (US59170JAG31) | 3.45 | -0.49 | 0.2118 | 0.0283 | |||||

| US36179X2J42 / GOVERNMENT NATIONAL MORTGAGE CORPORATION | 3.42 | -4.18 | 0.2100 | 0.0211 | |||||

| US91282CGS44 / United States Treasury Note/Bond | 3.38 | 0.36 | 0.2076 | 0.0293 | |||||

| FREDDIE MAC POOL UMBS P#SB1008 4.00000000 / ABS-MBS (US3132CXDM11) | 3.33 | -5.63 | 0.2050 | 0.0178 | |||||

| FREDDIE MAC POOL UMBS P#SB1008 4.00000000 / ABS-MBS (US3132CXDM11) | 3.33 | -5.63 | 0.2050 | 0.0178 | |||||

| FREDDIE MAC POOL UMBS P#SB1008 4.00000000 / ABS-MBS (US3132CXDM11) | 3.33 | -5.63 | 0.2050 | 0.0178 | |||||

| US912810TM09 / United States Treasury Note/Bond | 3.28 | 51.01 | 0.2017 | 0.0865 | |||||

| FANNIE MAE POOL UMBS P#BL6075 2.44000000 / ABS-MBS (US3140HXXD70) | 3.25 | 0.1998 | 0.1998 | ||||||

| SALUDA GRADE ALTERNATIVE MORTGAGE TRUST SER 2023-FIG4 CL A V/R REGD 144A P/P 6.71800000 / ABS-CBDO (US79581UAA25) | 3.24 | -6.03 | 0.1993 | 0.0165 | |||||

| SALUDA GRADE ALTERNATIVE MORTGAGE TRUST SER 2023-FIG4 CL A V/R REGD 144A P/P 6.71800000 / ABS-CBDO (US79581UAA25) | 3.24 | -6.03 | 0.1993 | 0.0165 | |||||

| SALUDA GRADE ALTERNATIVE MORTGAGE TRUST SER 2023-FIG4 CL A V/R REGD 144A P/P 6.71800000 / ABS-CBDO (US79581UAA25) | 3.24 | -6.03 | 0.1993 | 0.0165 | |||||

| US91282CBQ33 / United States Treasury Note/Bond | 3.22 | -20.71 | 0.1982 | -0.0173 | |||||

| FANNIE MAE POOL UMBS P#BQ7009 2.50000000 / ABS-MBS (US3140KSYF87) | 3.20 | 0.1967 | 0.1967 | ||||||

| FANNIE MAE POOL UMBS P#BQ7009 2.50000000 / ABS-MBS (US3140KSYF87) | 3.20 | 0.1967 | 0.1967 | ||||||

| FANNIE MAE POOL UMBS P#BQ7009 2.50000000 / ABS-MBS (US3140KSYF87) | 3.20 | 0.1967 | 0.1967 | ||||||

| GINNIE MAE II POOL P#MA9604 5.00000000 / ABS-MBS (US36179YU511) | 3.18 | -3.84 | 0.1956 | 0.0203 | |||||

| GINNIE MAE II POOL P#MA9604 5.00000000 / ABS-MBS (US36179YU511) | 3.18 | -3.84 | 0.1956 | 0.0203 | |||||

| GINNIE MAE II POOL P#MA9604 5.00000000 / ABS-MBS (US36179YU511) | 3.18 | -3.84 | 0.1956 | 0.0203 | |||||

| US912810RV26 / United States Treas Bds Bond | 3.17 | 9.59 | 0.1947 | 0.0416 | |||||

| US68249DAA72 / One New York Plaza Trust 2020-1NYP | 3.14 | 0.06 | 0.1932 | 0.0267 | |||||

| US746954AA44 / Qdoba Funding LLC, Series 2023-1A, Class A2 | 3.12 | -1.30 | 0.1919 | 0.0243 | |||||

| GINNIE MAE II POOL P#MA9599 2.50000000 / ABS-MBS (US36179YUY84) | 3.08 | 0.1894 | 0.1894 | ||||||

| GINNIE MAE II POOL P#MA9599 2.50000000 / ABS-MBS (US36179YUY84) | 3.08 | 0.1894 | 0.1894 | ||||||

| GINNIE MAE II POOL P#MA9599 2.50000000 / ABS-MBS (US36179YUY84) | 3.08 | 0.1894 | 0.1894 | ||||||

| GINNIE MAE II POOL P#MA9599 2.50000000 / ABS-MBS (US36179YUY84) | 3.08 | 0.1894 | 0.1894 | ||||||

| GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2021-119 CL JG 1.50000000 / ABS-CBDO (US38382UX974) | 3.08 | 0.1893 | 0.1893 | ||||||

| US62547NAB55 / COMMERCIAL MORTGAGE BACKED SECURITIES | 3.06 | 0.1879 | 0.1879 | ||||||

| UNITED STATES TREASURY BOND 4.50000000 / DBT (US912810UE63) | 3.04 | -55.67 | 0.1872 | -0.1768 | |||||

| UNITED STATES TREASURY BOND 4.50000000 / DBT (US912810UE63) | 3.04 | -55.67 | 0.1872 | -0.1768 | |||||

| UNITED STATES TREASURY BOND 4.50000000 / DBT (US912810UE63) | 3.04 | -55.67 | 0.1872 | -0.1768 | |||||

| UNITED STATES TREASURY BOND 4.50000000 / DBT (US912810UE63) | 3.04 | -55.67 | 0.1872 | -0.1768 | |||||

| US91282CEN74 / United States Treasury Note/Bond | 2.94 | 0.41 | 0.1805 | 0.0255 | |||||

| CYRUSONE DATA CENTERS ISSUER I LLC SER 2024-1A CL A2 REGD 144A P/P 4.76000000 / ABS-CBDO (US23284BAF13) | 2.90 | -0.79 | 0.1785 | 0.0234 | |||||

| CYRUSONE DATA CENTERS ISSUER I LLC SER 2024-1A CL A2 REGD 144A P/P 4.76000000 / ABS-CBDO (US23284BAF13) | 2.90 | -0.79 | 0.1785 | 0.0234 | |||||

| CYRUSONE DATA CENTERS ISSUER I LLC SER 2024-1A CL A2 REGD 144A P/P 4.76000000 / ABS-CBDO (US23284BAF13) | 2.90 | -0.79 | 0.1785 | 0.0234 | |||||

| US36179WVT25 / GNII II 2% 01/20/2052#MA7826 | 2.90 | -4.22 | 0.1785 | 0.0179 | |||||

| US91282CJR34 / United States Treasury Note/Bond - When Issued | 2.80 | 0.39 | 0.1721 | 0.0244 | |||||

| US36179XHW92 / Ginnie Mae II Pool | 2.79 | -5.74 | 0.1715 | 0.0146 | |||||

| GINNIE MAE II POOL P#MA9235 2.50000000 / ABS-MBS (US36179YHL11) | 2.79 | 0.1714 | 0.1714 | ||||||

| GINNIE MAE II POOL P#MA9235 2.50000000 / ABS-MBS (US36179YHL11) | 2.79 | 0.1714 | 0.1714 | ||||||

| GINNIE MAE II POOL P#MA9235 2.50000000 / ABS-MBS (US36179YHL11) | 2.79 | 0.1714 | 0.1714 | ||||||

| GS MORTGAGE-BACKED SECURITIES TRUST 2025-SL1 SER 2025-SL1 CL A1 V/R REGD 144A P/P 5.84700000 / ABS-CBDO (US362960AA42) | 2.79 | 0.1713 | 0.1713 | ||||||

| GS MORTGAGE-BACKED SECURITIES TRUST 2025-SL1 SER 2025-SL1 CL A1 V/R REGD 144A P/P 5.84700000 / ABS-CBDO (US362960AA42) | 2.79 | 0.1713 | 0.1713 | ||||||

| US91282CJJ18 / US TREASURY NOTE 4.5% 11-15-33 | 2.73 | -18.87 | 0.1679 | -0.0105 | |||||

| XS2066744231 / Carnival PLC | 2.72 | 43.52 | 0.1675 | 0.0669 | |||||

| XS2066744231 / Carnival PLC | 2.72 | 43.52 | 0.1675 | 0.0669 | |||||

| XS2066744231 / Carnival PLC | 2.72 | 43.52 | 0.1675 | 0.0669 | |||||

| US98920MAA09 / ZAXBY_21-1A | 2.72 | -1.38 | 0.1672 | 0.0211 | |||||

| US31418EV567 / FNMA 30YR 4% 09/01/2053# | 2.68 | -3.73 | 0.1649 | 0.0173 | |||||

| US3140QRJV65 / Fannie Mae Pool | 2.66 | -3.56 | 0.1634 | 0.0174 | |||||

| UNITED STATES TREASURY BOND 4.25000000 / DBT (US912810UC08) | 2.64 | -63.13 | 0.1624 | -0.2173 | |||||

| UNITED STATES TREASURY BOND 4.25000000 / DBT (US912810UC08) | 2.64 | -63.13 | 0.1624 | -0.2173 | |||||

| US36179W2W70 / Ginnie Mae II Pool | 2.62 | -5.63 | 0.1608 | 0.0139 | |||||

| US91282CFY21 / TREASURY NOTE | 2.59 | -3.04 | 0.1591 | 0.0176 | |||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 2.51 | 0.1542 | 0.1542 | ||||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 2.51 | 0.1542 | 0.1542 | ||||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 2.51 | 0.1542 | 0.1542 | ||||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 2.51 | 0.1542 | 0.1542 | ||||||

| PRET 2025-NPL3 LLC SER 2025-NPL3 CL A1 V/R REGD 144A P/P 6.70760000 / ABS-CBDO (US74143HAA32) | 2.51 | 0.1542 | 0.1542 | ||||||

| PRET 2025-NPL3 LLC SER 2025-NPL3 CL A1 V/R REGD 144A P/P 6.70760000 / ABS-CBDO (US74143HAA32) | 2.51 | 0.1542 | 0.1542 | ||||||

| PRET 2025-NPL3 LLC SER 2025-NPL3 CL A1 V/R REGD 144A P/P 6.70760000 / ABS-CBDO (US74143HAA32) | 2.51 | 0.1542 | 0.1542 | ||||||

| BUSINESS JET SECURITIES 2024-2 LLC SER 2024-2A CL C REGD 144A P/P 7.97400000 / ABS-CBDO (US12326TAC27) | 2.50 | 0.1537 | 0.1537 | ||||||

| BUSINESS JET SECURITIES 2024-2 LLC SER 2024-2A CL C REGD 144A P/P 7.97400000 / ABS-CBDO (US12326TAC27) | 2.50 | 0.1537 | 0.1537 | ||||||

| BUSINESS JET SECURITIES 2024-2 LLC SER 2024-2A CL C REGD 144A P/P 7.97400000 / ABS-CBDO (US12326TAC27) | 2.50 | 0.1537 | 0.1537 | ||||||

| US91282CFZ95 / TREASURY NOTE | 2.50 | 0.28 | 0.1537 | 0.0215 | |||||

| US912810SX72 / UNITED STATES TREASURY BOND 2.375% 05/15/2051 | 2.49 | -6.59 | 0.1534 | 0.0118 | |||||

| US00774MAV72 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 2.48 | -12.79 | 0.1526 | 0.0018 | |||||

| US172967LS86 / Citigroup Inc | 2.47 | 0.24 | 0.1519 | 0.0213 | |||||

| US38141GWZ35 / Goldman Sachs Group Inc/The | 2.47 | 0.28 | 0.1516 | 0.0213 | |||||

| FANNIE MAE POOL UMBS P#BS4628 2.06000000 / ABS-MBS (US3140LFEA80) | 2.45 | 0.1505 | 0.1505 | ||||||

| FANNIE MAE POOL UMBS P#BS4628 2.06000000 / ABS-MBS (US3140LFEA80) | 2.45 | 0.1505 | 0.1505 | ||||||

| FANNIE MAE POOL UMBS P#BS4628 2.06000000 / ABS-MBS (US3140LFEA80) | 2.45 | 0.1505 | 0.1505 | ||||||

| US3132DWA522 / UMBS Freddie Mac Pool | 2.43 | -3.84 | 0.1493 | 0.0155 | |||||

| US3133BPTT57 / FED HM LN PC POOL QF2362 FR 11/52 FIXED 4 | 2.43 | -5.08 | 0.1492 | 0.0137 | |||||

| US00178XAH61 / AMSR Trust, Series 2019-SFR1, Class H | 2.42 | 0.1489 | 0.1489 | ||||||

| US33767WAN39 / FirstKey Homes 2020-SFR1 Trust | 2.41 | 0.1484 | 0.1484 | ||||||

| US3140LU2M20 / Fannie Mae Pool | 2.39 | -4.86 | 0.1467 | 0.0138 | |||||

| NRM FHT1 EXCESS OWNER LLC SER 2025-FHT1 CL A S/UP REGD 144A P/P 6.54500000 / ABS-CBDO (US64832EAA73) | 2.37 | 0.1456 | 0.1456 | ||||||

| NRM FHT1 EXCESS OWNER LLC SER 2025-FHT1 CL A S/UP REGD 144A P/P 6.54500000 / ABS-CBDO (US64832EAA73) | 2.37 | 0.1456 | 0.1456 | ||||||

| NRM FHT1 EXCESS OWNER LLC SER 2025-FHT1 CL A S/UP REGD 144A P/P 6.54500000 / ABS-CBDO (US64832EAA73) | 2.37 | 0.1456 | 0.1456 | ||||||

| NBC FUNDING LLC SER 2024-1A CL A2 REGD 144A P/P 6.75000000 / ABS-CBDO (US62878YAC84) | 2.36 | -1.50 | 0.1449 | 0.0181 | |||||

| NBC FUNDING LLC SER 2024-1A CL A2 REGD 144A P/P 6.75000000 / ABS-CBDO (US62878YAC84) | 2.36 | -1.50 | 0.1449 | 0.0181 | |||||

| FOUNDRY JV HOLDCO LLC REGD 144A P/P 6.20000000 / DBT (US350930AJ29) | 2.35 | -26.32 | 0.1444 | -0.0246 | |||||

| FOUNDRY JV HOLDCO LLC REGD 144A P/P 6.20000000 / DBT (US350930AJ29) | 2.35 | -26.32 | 0.1444 | -0.0246 | |||||

| US43730NAG16 / Home Partners of America 2022-1 Trust | 2.34 | 0.1441 | 0.1441 | ||||||

| US74971BBA26 / RFM Reremic Trust, Series 2022-FRR1, Class BK64 | 2.34 | 0.1440 | 0.1440 | ||||||

| US3132DQK549 / Federal Home Loan Mortgage Corp. | 2.34 | -6.03 | 0.1438 | 0.0119 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 2.32 | -18.77 | 0.1429 | -0.0087 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 2.32 | -18.77 | 0.1429 | -0.0087 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 2.32 | -18.77 | 0.1429 | -0.0087 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 2.32 | -18.77 | 0.1429 | -0.0087 | |||||

| US74333YAN85 / Progress Residential Trust, Series 2022-SFR1, Class F | 2.32 | 0.1425 | 0.1425 | ||||||

| US3133EKBP04 / FEDERAL FARM CREDIT BANKS FUNDING CORP 3.50000000 | 2.32 | -2.53 | 0.1424 | 0.0165 | |||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CMN82) | 2.31 | 0.1418 | 0.1418 | ||||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CMN82) | 2.31 | 0.1418 | 0.1418 | ||||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CMN82) | 2.31 | 0.1418 | 0.1418 | ||||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CMF58) | 2.31 | -50.72 | 0.1418 | -0.1062 | |||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CMF58) | 2.31 | -50.72 | 0.1418 | -0.1062 | |||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CMF58) | 2.31 | -50.72 | 0.1418 | -0.1062 | |||||

| US830867AB33 / Delta Air Lines Inc / SkyMiles IP Ltd | 2.29 | -12.14 | 0.1407 | 0.0027 | |||||

| VCAT 2025 NPL2 LLC SER 2025-NPL2 CL A1 V/R REGD 144A P/P 5.97700000 / ABS-CBDO (US92243PAA66) | 2.28 | 0.1399 | 0.1399 | ||||||

| US64016NAE76 / Neighborly Issuer 2023-1 | 2.23 | -1.81 | 0.1370 | 0.0167 | |||||

| US912810SE91 / United States Treas Bds Bond | 2.22 | 173.19 | 0.1366 | 0.0934 | |||||

| US95000U2U64 / Wells Fargo & Co | 2.20 | -0.09 | 0.1355 | 0.0186 | |||||

| FANNIE MAE POOL UMBS P#FS7979 2.00000000 / ABS-MBS (US3140XP2M09) | 2.19 | -3.90 | 0.1349 | 0.0139 | |||||

| FANNIE MAE POOL UMBS P#FS7979 2.00000000 / ABS-MBS (US3140XP2M09) | 2.19 | -3.90 | 0.1349 | 0.0139 | |||||

| FANNIE MAE POOL UMBS P#FS7979 2.00000000 / ABS-MBS (US3140XP2M09) | 2.19 | -3.90 | 0.1349 | 0.0139 | |||||

| FANNIE MAE POOL UMBS P#FS7979 2.00000000 / ABS-MBS (US3140XP2M09) | 2.19 | -3.90 | 0.1349 | 0.0139 | |||||

| US31418EDH09 / Fannie Mae Pool | 2.19 | -3.44 | 0.1346 | 0.0144 | |||||

| US91282CFH97 / United States Treasury Note/Bond | 2.12 | 0.43 | 0.1306 | 0.0185 | |||||

| US91282CHA27 / United States Treasury Note/Bond | 2.11 | 0.43 | 0.1297 | 0.0184 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 2.11 | -36.49 | 0.1295 | -0.0463 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 2.11 | -36.49 | 0.1295 | -0.0463 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 2.11 | -36.49 | 0.1295 | -0.0463 | |||||

| US36179YKL73 / GNII II 2.5% 10/20/2053#MA9299 | 2.11 | 0.1294 | 0.1294 | ||||||

| US3133KNXS79 / FED HM LN PC POOL RA6989 FR 03/52 FIXED 3 | 2.10 | -3.80 | 0.1292 | 0.0134 | |||||

| US599191AA16 / Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd | 2.09 | 79.45 | 0.1283 | 0.0667 | |||||

| US23636ABC45 / Danske Bank A/S | 2.08 | -16.04 | 0.1282 | -0.0034 | |||||

| US35563GAB59 / Freddie Mac Multifamily Structured Credit Risk | 2.07 | 0.1272 | 0.1272 | ||||||

| US31418D2M38 / Fannie Mae Pool | 2.06 | -4.36 | 0.1268 | 0.0125 | |||||

| DAI-ICHI LIFE INSURANCE REGD V/R /PERP/ 144A P/P 6.20000000 / DBT (US23381LAA26) | 2.06 | -12.46 | 0.1266 | 0.0019 | |||||

| DAI-ICHI LIFE INSURANCE REGD V/R /PERP/ 144A P/P 6.20000000 / DBT (US23381LAA26) | 2.06 | -12.46 | 0.1266 | 0.0019 | |||||

| DAI-ICHI LIFE INSURANCE REGD V/R /PERP/ 144A P/P 6.20000000 / DBT (US23381LAA26) | 2.06 | -12.46 | 0.1266 | 0.0019 | |||||

| DAI-ICHI LIFE INSURANCE REGD V/R /PERP/ 144A P/P 6.20000000 / DBT (US23381LAA26) | 2.06 | -12.46 | 0.1266 | 0.0019 | |||||

| DBSG 2024-ALTA MORTGAGE TRUST SER 2024-ALTA CL A V/R REGD 144A P/P 5.94558000 / ABS-CBDO (US239918AA37) | 2.06 | -0.15 | 0.1264 | 0.0173 | |||||

| DBSG 2024-ALTA MORTGAGE TRUST SER 2024-ALTA CL A V/R REGD 144A P/P 5.94558000 / ABS-CBDO (US239918AA37) | 2.06 | -0.15 | 0.1264 | 0.0173 | |||||

| DBSG 2024-ALTA MORTGAGE TRUST SER 2024-ALTA CL A V/R REGD 144A P/P 5.94558000 / ABS-CBDO (US239918AA37) | 2.06 | -0.15 | 0.1264 | 0.0173 | |||||

| DBSG 2024-ALTA MORTGAGE TRUST SER 2024-ALTA CL A V/R REGD 144A P/P 5.94558000 / ABS-CBDO (US239918AA37) | 2.06 | -0.15 | 0.1264 | 0.0173 | |||||

| SANTANDER DRIVE AUTO RECEIVABLES TRUST 2024-2 SER 2024-2 CL D REGD 6.28000000 / ABS-CBDO (US80286YAF97) | 2.05 | 0.1263 | 0.1263 | ||||||

| SANTANDER DRIVE AUTO RECEIVABLES TRUST 2024-2 SER 2024-2 CL D REGD 6.28000000 / ABS-CBDO (US80286YAF97) | 2.05 | 0.1263 | 0.1263 | ||||||

| SANTANDER DRIVE AUTO RECEIVABLES TRUST 2024-2 SER 2024-2 CL D REGD 6.28000000 / ABS-CBDO (US80286YAF97) | 2.05 | 0.1263 | 0.1263 | ||||||

| SANTANDER DRIVE AUTO RECEIVABLES TRUST 2024-2 SER 2024-2 CL D REGD 6.28000000 / ABS-CBDO (US80286YAF97) | 2.05 | 0.1263 | 0.1263 | ||||||

| US35563FAB76 / FHLMC Multifamily Structured Pass-Through Certificates, Series 2021-MN1, Class M2 | 2.04 | 0.1256 | 0.1256 | ||||||

| A&D MORTGAGE TRUST 2024-NQM4 SER 2024-NQM4 CL A1 REGD 144A P/P 5.46400000 / ABS-CBDO (US002939AC08) | 2.03 | -4.16 | 0.1247 | 0.0126 | |||||

| A&D MORTGAGE TRUST 2024-NQM4 SER 2024-NQM4 CL A1 REGD 144A P/P 5.46400000 / ABS-CBDO (US002939AC08) | 2.03 | -4.16 | 0.1247 | 0.0126 | |||||

| A&D MORTGAGE TRUST 2024-NQM4 SER 2024-NQM4 CL A1 REGD 144A P/P 5.46400000 / ABS-CBDO (US002939AC08) | 2.03 | -4.16 | 0.1247 | 0.0126 | |||||

| A&D MORTGAGE TRUST 2024-NQM4 SER 2024-NQM4 CL A1 REGD 144A P/P 5.46400000 / ABS-CBDO (US002939AC08) | 2.03 | -4.16 | 0.1247 | 0.0126 | |||||

| UNITED STATES TREASURY NOTE 4.62500000 / DBT (US91282CKV27) | 2.03 | 0.00 | 0.1247 | 0.0172 | |||||

| UNITED STATES TREASURY NOTE 4.62500000 / DBT (US91282CKV27) | 2.03 | 0.00 | 0.1247 | 0.0172 | |||||

| UNITED STATES TREASURY NOTE 4.62500000 / DBT (US91282CKV27) | 2.03 | 0.00 | 0.1247 | 0.0172 | |||||

| US694308JM04 / PACIFIC GAS and ELECTRIC CO 4.55% 07/01/2030 | 2.02 | 0.1244 | 0.1244 | ||||||

| ELECTRICITE DE FRANCE SA REGD 144A P/P 5.75000000 / DBT (US28504DAF06) | 2.02 | 20.43 | 0.1244 | 0.0353 | |||||

| ELECTRICITE DE FRANCE SA REGD 144A P/P 5.75000000 / DBT (US28504DAF06) | 2.02 | 20.43 | 0.1244 | 0.0353 | |||||

| ELECTRICITE DE FRANCE SA REGD 144A P/P 5.75000000 / DBT (US28504DAF06) | 2.02 | 20.43 | 0.1244 | 0.0353 | |||||

| ELECTRICITE DE FRANCE SA REGD 144A P/P 5.75000000 / DBT (US28504DAF06) | 2.02 | 20.43 | 0.1244 | 0.0353 | |||||

| UNITED STATES TREASURY NOTE 4.50000000 / DBT (US91282CKR15) | 2.02 | 0.00 | 0.1243 | 0.0171 | |||||

| UNITED STATES TREASURY NOTE 4.50000000 / DBT (US91282CKR15) | 2.02 | 0.00 | 0.1243 | 0.0171 | |||||

| UNITED STATES TREASURY NOTE 4.50000000 / DBT (US91282CKR15) | 2.02 | 0.00 | 0.1243 | 0.0171 | |||||

| UNITED STATES TREASURY NOTE 4.50000000 / DBT (US91282CKJ98) | 2.02 | -0.05 | 0.1242 | 0.0171 | |||||

| UNITED STATES TREASURY NOTE 4.50000000 / DBT (US91282CKJ98) | 2.02 | -0.05 | 0.1242 | 0.0171 | |||||

| UNITED STATES TREASURY NOTE 4.50000000 / DBT (US91282CKJ98) | 2.02 | -0.05 | 0.1242 | 0.0171 | |||||

| US845467AS85 / Southwestern Energy Co | 2.02 | -29.11 | 0.1240 | -0.0268 | |||||

| GINNIE MAE II POOL P#MA9725 5.50000000 / ABS-MBS (US36179YYW82) | 2.01 | -4.87 | 0.1239 | 0.0116 | |||||

| US74332VAL99 / PROGRESS RESIDENTIAL 2022-SFR2 TR 4.8% 04/17/2027 144A | 2.01 | 0.1239 | 0.1239 | ||||||

| US92538QAA85 / VERUS SECURITIZATION TRUST 2021-7 1.829% 10/25/2066 144A | 2.01 | -3.77 | 0.1238 | 0.0129 | |||||

| UNITED STATES TREASURY NOTE 4.12500000 / DBT (US91282CLR06) | 2.01 | -82.21 | 0.1238 | -0.4757 | |||||

| MFA 2024-RTL3 TRUST SER 2024-RTL3 CL A1 V/R REGD 144A P/P 5.91300000 / ABS-CBDO (US59319PAA49) | 2.00 | 0.1232 | 0.1232 | ||||||

| MFA 2024-RTL3 TRUST SER 2024-RTL3 CL A1 V/R REGD 144A P/P 5.91300000 / ABS-CBDO (US59319PAA49) | 2.00 | 0.1232 | 0.1232 | ||||||

| MFA 2024-RTL3 TRUST SER 2024-RTL3 CL A1 V/R REGD 144A P/P 5.91300000 / ABS-CBDO (US59319PAA49) | 2.00 | 0.1232 | 0.1232 | ||||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CJT99) | 2.00 | 0.05 | 0.1230 | 0.0170 | |||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CJT99) | 2.00 | 0.05 | 0.1230 | 0.0170 | |||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CJT99) | 2.00 | 0.05 | 0.1230 | 0.0170 | |||||

| US91282CGC91 / United States Treasury Note/Bond | 2.00 | 0.25 | 0.1229 | 0.0172 | |||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CLQ23) | 2.00 | 0.20 | 0.1229 | 0.0172 | |||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CLQ23) | 2.00 | 0.20 | 0.1229 | 0.0172 | |||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CLQ23) | 2.00 | 0.20 | 0.1229 | 0.0172 | |||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CLQ23) | 2.00 | 0.20 | 0.1229 | 0.0172 | |||||

| TOORAK MORTGAGE TRUST 2025-RRTL1 SER 2025-RRTL1 CL A1 V/R REGD 144A P/P 5.52400000 / ABS-CBDO (US89053JAB35) | 1.99 | 0.1224 | 0.1224 | ||||||

| 200 PARK FUNDING TRUST REGD 144A P/P 5.74000000 / DBT (US901928AA97) | 1.98 | 145.53 | 0.1217 | 0.0790 | |||||

| 200 PARK FUNDING TRUST REGD 144A P/P 5.74000000 / DBT (US901928AA97) | 1.98 | 145.53 | 0.1217 | 0.0790 | |||||

| 200 PARK FUNDING TRUST REGD 144A P/P 5.74000000 / DBT (US901928AA97) | 1.98 | 145.53 | 0.1217 | 0.0790 | |||||

| RCO IX MORTGAGE LLC 2025-2 SER 2025-2 CL A1 V/R REGD 144A P/P 6.51310000 / ABS-CBDO (US754930AA39) | 1.98 | 0.1216 | 0.1216 | ||||||

| RCO IX MORTGAGE LLC 2025-2 SER 2025-2 CL A1 V/R REGD 144A P/P 6.51310000 / ABS-CBDO (US754930AA39) | 1.98 | 0.1216 | 0.1216 | ||||||

| RCO IX MORTGAGE LLC 2025-2 SER 2025-2 CL A1 V/R REGD 144A P/P 6.51310000 / ABS-CBDO (US754930AA39) | 1.98 | 0.1216 | 0.1216 | ||||||

| US36265AAA97 / Goldman Sachs Mortgage Securities Trust | 1.97 | -54.86 | 0.1209 | -0.1099 | |||||

| UNITED STATES TREASURY NOTE 3.50000000 / DBT (US91282CLN91) | 1.96 | -88.53 | 0.1208 | -0.7872 | |||||

| UNITED STATES TREASURY NOTE 3.50000000 / DBT (US91282CLN91) | 1.96 | -88.53 | 0.1208 | -0.7872 | |||||

| UNITED STATES TREASURY NOTE 3.50000000 / DBT (US91282CLN91) | 1.96 | -88.53 | 0.1208 | -0.7872 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 1.96 | 487.69 | 0.1203 | 0.1027 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 1.96 | 487.69 | 0.1203 | 0.1027 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 1.96 | 487.69 | 0.1203 | 0.1027 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 1.96 | 487.69 | 0.1203 | 0.1027 | |||||

| DIVERSIFIED GAS & OIL CO REGD 9.75000000 / DBT (NO0013513606) | 1.94 | 0.1192 | 0.1192 | ||||||

| ROCK TRUST 2024-CNTR SER 2024-CNTR CL B REGD 144A P/P 5.93035000 / ABS-CBDO (US74970WAC47) | 1.94 | -49.03 | 0.1192 | -0.0823 | |||||

| ROCK TRUST 2024-CNTR SER 2024-CNTR CL B REGD 144A P/P 5.93035000 / ABS-CBDO (US74970WAC47) | 1.94 | -49.03 | 0.1192 | -0.0823 | |||||

| ROCK TRUST 2024-CNTR SER 2024-CNTR CL B REGD 144A P/P 5.93035000 / ABS-CBDO (US74970WAC47) | 1.94 | -49.03 | 0.1192 | -0.0823 | |||||

| ROCK TRUST 2024-CNTR SER 2024-CNTR CL B REGD 144A P/P 5.93035000 / ABS-CBDO (US74970WAC47) | 1.94 | -49.03 | 0.1192 | -0.0823 | |||||

| FTAIM / FTAI Aviation Ltd. - Preferred Stock | 1.93 | 76.53 | 0.1189 | 0.0608 | |||||

| FTAIM / FTAI Aviation Ltd. - Preferred Stock | 1.93 | 76.53 | 0.1189 | 0.0608 | |||||

| FTAIM / FTAI Aviation Ltd. - Preferred Stock | 1.93 | 76.53 | 0.1189 | 0.0608 | |||||

| US912810SW99 / United States Treasury Note/Bond | 1.93 | -54.37 | 0.1186 | -0.1054 | |||||

| US00178XAE31 / AMSR Trust, Series 2019-SFR1, Class E | 1.92 | 0.1182 | 0.1182 | ||||||

| US33767WAL72 / FirstKey Homes 2020-SFR1 Trust | 1.92 | 0.1180 | 0.1180 | ||||||

| US12569RAB42 / CIM Trust 2023-R1 | 1.91 | -3.73 | 0.1176 | 0.0123 | |||||

| BP CAP MARKETS AMERICA REGD 5.22700000 / DBT (US10373QCA67) | 1.91 | -37.61 | 0.1174 | -0.0447 | |||||

| US62548QAD34 / Multifamily Connecticut Avenue Securities Trust 2020-01 | 1.87 | 0.1153 | 0.1153 | ||||||

| CONSUMER PORTFOLIO SERVICES AUTO TRUST 2025-B SER 2025-B CL D REGD 144A P/P 5.56000000 / ABS-CBDO (US12630SAD36) | 1.87 | 0.1148 | 0.1148 | ||||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 1.87 | 0.1148 | 0.1148 | ||||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 1.87 | 0.1148 | 0.1148 | ||||||

| US67115DAA00 / Onslow Bay Mortgage Loan Trust | 1.86 | -1.84 | 0.1146 | 0.0140 | |||||

| US055631BQ75 / BMD2 2019-FRR1 5A1 | 1.86 | 0.1142 | 0.1142 | ||||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 1.85 | -3.49 | 0.1139 | 0.0122 | |||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 1.85 | -3.49 | 0.1139 | 0.0122 | |||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 1.85 | -3.49 | 0.1139 | 0.0122 | |||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 1.85 | -3.49 | 0.1139 | 0.0122 | |||||

| US3140N26Y26 / Fannie Mae Pool | 1.84 | -3.92 | 0.1131 | 0.0117 | |||||

| COL17CT03342 / Colombian TES | 1.83 | 0.1127 | 0.1127 | ||||||

| US3132DMRX55 / Freddie Mac Pool | 1.82 | -3.44 | 0.1122 | 0.0120 | |||||

| GLS AUTO RECEIVABLES ISSUER TRUST 2025-2 SER 2025-2A CL D REGD 144A P/P 5.59000000 / ABS-CBDO (US37989BAL62) | 1.82 | 0.1117 | 0.1117 | ||||||

| OPORTUN ISSUANCE TRUST 2025-A SER 2025-A CL D REGD 144A P/P 7.25000000 / ABS-CBDO (US68377TAD00) | 1.81 | 0.1116 | 0.1116 | ||||||

| BAMLL RE-REMIC TRUST 2024-FRR3 SER 2024-FRR3 CL C V/R REGD 144A P/P 0.64710400 / ABS-CBDO (US054988AE07) | 1.81 | 0.1116 | 0.1116 | ||||||

| BAMLL RE-REMIC TRUST 2024-FRR3 SER 2024-FRR3 CL C V/R REGD 144A P/P 0.64710400 / ABS-CBDO (US054988AE07) | 1.81 | 0.1116 | 0.1116 | ||||||

| BAMLL RE-REMIC TRUST 2024-FRR3 SER 2024-FRR3 CL C V/R REGD 144A P/P 0.64710400 / ABS-CBDO (US054988AE07) | 1.81 | 0.1116 | 0.1116 | ||||||

| US3132DWDR16 / UMBS | 1.81 | -4.12 | 0.1115 | 0.0112 | |||||

| BAMLL RE-REMIC TRUST 2024-FRR2 SER 2024-FRR2 CL C V/R REGD 144A P/P 1.23229400 / ABS-CBDO (US05493UAE64) | 1.81 | 0.1114 | 0.1114 | ||||||

| BAMLL RE-REMIC TRUST 2024-FRR2 SER 2024-FRR2 CL C V/R REGD 144A P/P 1.23229400 / ABS-CBDO (US05493UAE64) | 1.81 | 0.1114 | 0.1114 | ||||||

| BAMLL RE-REMIC TRUST 2024-FRR2 SER 2024-FRR2 CL C V/R REGD 144A P/P 1.23229400 / ABS-CBDO (US05493UAE64) | 1.81 | 0.1114 | 0.1114 | ||||||

| BAMLL RE-REMIC TRUST 2024-FRR2 SER 2024-FRR2 CL C V/R REGD 144A P/P 1.23229400 / ABS-CBDO (US05493UAE64) | 1.81 | 0.1114 | 0.1114 | ||||||

| US36459DAS09 / GAM 2022-FRR3 BK61 1/52 | 1.81 | 0.1112 | 0.1112 | ||||||

| US3140XGX460 / FNMA 30YR UMBS SUPER | 1.81 | -4.14 | 0.1112 | 0.0112 | |||||

| FREDDIE MAC POOL UMBS P#SD8395 5.50000000 / ABS-MBS (US3132DWKG77) | 1.81 | -3.68 | 0.1111 | 0.0117 | |||||

| FREDDIE MAC POOL UMBS P#SD8395 5.50000000 / ABS-MBS (US3132DWKG77) | 1.81 | -3.68 | 0.1111 | 0.0117 | |||||

| FREDDIE MAC POOL UMBS P#SD8395 5.50000000 / ABS-MBS (US3132DWKG77) | 1.81 | -3.68 | 0.1111 | 0.0117 | |||||

| FREDDIE MAC POOL UMBS P#SD8395 5.50000000 / ABS-MBS (US3132DWKG77) | 1.81 | -3.68 | 0.1111 | 0.0117 | |||||

| IDG000023904 / Indonesia Treasury Bond | 1.80 | 2.85 | 0.1110 | 0.0180 | |||||

| US3140MGKG50 / UMBS | 1.80 | -3.95 | 0.1107 | 0.0113 | |||||

| US68236JAA97 / One Bryant Park Trust 2019-OBP | 1.80 | 342.26 | 0.1107 | 0.0881 | |||||

| MARS INC REGD 144A P/P 5.70000000 / DBT (US571676BC81) | 1.79 | 0.1101 | 0.1101 | ||||||

| MARS INC REGD 144A P/P 5.70000000 / DBT (US571676BC81) | 1.79 | 0.1101 | 0.1101 | ||||||

| US3132DWDD20 / Freddie Mac Pool | 1.79 | -4.23 | 0.1100 | 0.0110 | |||||

| AVOLON HOLDINGS FNDG LTD REGD 144A P/P 5.15000000 / DBT (US05401AAX90) | 1.78 | 0.1096 | 0.1096 | ||||||

| AVOLON HOLDINGS FNDG LTD REGD 144A P/P 5.15000000 / DBT (US05401AAX90) | 1.78 | 0.1096 | 0.1096 | ||||||

| FANNIE MAE POOL UMBS P#BZ3797 4.69000000 / ABS-MBS (US3140NYGF21) | 1.78 | 0.1094 | 0.1094 | ||||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1.78 | 0.1093 | 0.1093 | ||||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1.78 | 0.1093 | 0.1093 | ||||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1.78 | 0.1093 | 0.1093 | ||||||

| UNITED STATES TREASURY NOTE 3.62500000 / DBT (US91282CLK52) | 1.78 | -86.82 | 0.1093 | -0.6054 | |||||

| US912810TD00 / United States Treasury Note/Bond | 1.78 | -6.92 | 0.1092 | 0.0081 | |||||

| CHERRY SECURITIZATION TRUST 2025-1 SER 2025-1A CL A REGD 144A P/P 6.13000000 / ABS-CBDO (US16473RAA23) | 1.77 | 0.1085 | 0.1085 | ||||||

| CHERRY SECURITIZATION TRUST 2025-1 SER 2025-1A CL A REGD 144A P/P 6.13000000 / ABS-CBDO (US16473RAA23) | 1.77 | 0.1085 | 0.1085 | ||||||

| US3140MNN932 / Fannie Mae Pool | 1.76 | -4.08 | 0.1084 | 0.0110 | |||||

| US36262MAC29 / GS Mortgage Securities Corportation Trust 2021-IP | 1.76 | 0.00 | 0.1082 | 0.0149 | |||||

| US91282CCH25 / United States Treasury Note/Bond | 1.76 | 21.52 | 0.1080 | 0.0018 | |||||

| US3132DWDJ99 / Freddie Mac Pool | 1.75 | -66.91 | 0.1077 | -0.1729 | |||||

| US91282CGV72 / United States Treasury Note/Bond | 1.75 | 0.00 | 0.1077 | 0.0149 | |||||

| UPSTART SECURITIZATION TRUST 2025-1 SER 2025-1 CL A REGD 144A P/P 5.45000000 / ABS-CBDO (US91684PAA49) | 1.75 | 0.1077 | 0.1077 | ||||||

| UPSTART SECURITIZATION TRUST 2025-1 SER 2025-1 CL A REGD 144A P/P 5.45000000 / ABS-CBDO (US91684PAA49) | 1.75 | 0.1077 | 0.1077 | ||||||

| UPSTART SECURITIZATION TRUST 2025-1 SER 2025-1 CL A REGD 144A P/P 5.45000000 / ABS-CBDO (US91684PAA49) | 1.75 | 0.1077 | 0.1077 | ||||||

| ABL 2024-RTL1 SER 2024-RTL1 CL A1 V/R REGD 144A P/P 6.07500000 / ABS-CBDO (US00092EAA64) | 1.75 | 0.1077 | 0.1077 | ||||||

| ABL 2024-RTL1 SER 2024-RTL1 CL A1 V/R REGD 144A P/P 6.07500000 / ABS-CBDO (US00092EAA64) | 1.75 | 0.1077 | 0.1077 | ||||||

| ABL 2024-RTL1 SER 2024-RTL1 CL A1 V/R REGD 144A P/P 6.07500000 / ABS-CBDO (US00092EAA64) | 1.75 | 0.1077 | 0.1077 | ||||||

| US3133KRMR20 / FREDDIE MAC POOL UMBS P#RA9368 5.00000000 | 1.75 | -4.33 | 0.1073 | 0.0106 | |||||

| / Emera Inc. | 1.74 | 0.1071 | 0.1071 | ||||||

| US3140XJR391 / Federal National Mortgage Association, Inc. | 1.74 | -3.71 | 0.1070 | 0.0112 | |||||

| SAGB / Republic of South Africa Government Bond | 1.74 | -8.73 | 0.1067 | 0.0059 | |||||

| FANNIE MAE-ACES SER 2023-M2 CL 3A2 V/R 1.97900000 / ABS-CBDO (US3136BPWE72) | 1.73 | 0.1065 | 0.1065 | ||||||

| UNITED STATES TREASURY BOND 4.50000000 / DBT (US912810TZ12) | 1.73 | -4.74 | 0.1064 | 0.0101 | |||||

| UNITED STATES TREASURY BOND 4.50000000 / DBT (US912810TZ12) | 1.73 | -4.74 | 0.1064 | 0.0101 | |||||

| UNITED STATES TREASURY BOND 4.50000000 / DBT (US912810TZ12) | 1.73 | -4.74 | 0.1064 | 0.0101 | |||||

| US3140QNCD27 / FANNIE MAE POOL UMBS P#CB2767 2.00000000 | 1.73 | -4.49 | 0.1061 | 0.0104 | |||||

| US46647PCC86 / JPMorgan Chase & Co | 1.72 | -17.67 | 0.1060 | -0.0050 | |||||

| US3132DWC767 / Freddie Mac Pool | 1.72 | -4.12 | 0.1060 | 0.0107 | |||||

| UNITED STATES TREASURY BOND 4.62500000 / DBT (US912810UA42) | 1.72 | -82.28 | 0.1056 | -0.4078 | |||||

| UNITED STATES TREASURY BOND 4.62500000 / DBT (US912810UA42) | 1.72 | -82.28 | 0.1056 | -0.4078 | |||||

| UNITED STATES TREASURY BOND 4.62500000 / DBT (US912810UA42) | 1.72 | -82.28 | 0.1056 | -0.4078 | |||||

| UNITED STATES TREASURY NOTE 3.75000000 / DBT (US91282CMW81) | 1.72 | 0.1056 | 0.1056 | ||||||

| UNITED STATES TREASURY NOTE 3.75000000 / DBT (US91282CMW81) | 1.72 | 0.1056 | 0.1056 | ||||||

| UNITED STATES TREASURY NOTE 3.75000000 / DBT (US91282CMW81) | 1.72 | 0.1056 | 0.1056 | ||||||

| US74331GAJ85 / Progress Residential 2023-SFR2 Trust | 1.72 | 0.1055 | 0.1055 | ||||||

| LHOME MORTGAGE TRUST 2025-RTL1 SER 2025-RTL1 CL A1 V/R REGD 144A P/P 5.65200000 / ABS-CBDO (US50205UAA97) | 1.70 | 0.1046 | 0.1046 | ||||||

| FANNIE MAE POOL UMBS P#BL6933 1.89000000 / ABS-MBS (US3140HYV395) | 1.70 | 0.1046 | 0.1046 | ||||||

| FANNIE MAE POOL UMBS P#BL6933 1.89000000 / ABS-MBS (US3140HYV395) | 1.70 | 0.1046 | 0.1046 | ||||||

| FANNIE MAE POOL UMBS P#BL6933 1.89000000 / ABS-MBS (US3140HYV395) | 1.70 | 0.1046 | 0.1046 | ||||||

| US91087BAV27 / United Mexican States | 1.70 | -0.82 | 0.1046 | 0.0137 | |||||

| US92840VAG77 / Vistra Operations Co LLC | 1.69 | -42.39 | 0.1039 | -0.0515 | |||||

| US12570GAB59 / CIM Trust 2023-R3 | 1.68 | -3.72 | 0.1035 | 0.0108 | |||||

| US3140M82X60 / FANNIE MAE POOL UMBS P#BU7089 2.00000000 | 1.68 | -5.03 | 0.1034 | 0.0096 | |||||

| US31418EB908 / FNMA UMBS, 30 Year | 1.67 | -4.07 | 0.1029 | 0.0104 | |||||

| US74333QAN51 / Progress Residential Trust, Series 2021-SFR9, Class F | 1.66 | -33.06 | 0.1022 | -0.0293 | |||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CJX02) | 1.66 | -71.35 | 0.1022 | -0.2053 | |||||

| UNITED STATES TREASURY NOTE 4.37500000 / DBT (US91282CMD01) | 1.64 | -1.02 | 0.1011 | 0.0130 | |||||

| UNITED STATES TREASURY NOTE 4.37500000 / DBT (US91282CMD01) | 1.64 | -1.02 | 0.1011 | 0.0130 | |||||

| UNITED STATES TREASURY NOTE 4.37500000 / DBT (US91282CMD01) | 1.64 | -1.02 | 0.1011 | 0.0130 | |||||

| OAK STREET INVESTMENT GRADE NET LEASE FUND SERIES 2 SER 2020-1A CL B1 REGD 144A P/P 5.11000000 / ABS-CBDO (US67181DAG60) | 1.63 | 0.56 | 0.1000 | 0.0142 | |||||

| OAK STREET INVESTMENT GRADE NET LEASE FUND SERIES 2 SER 2020-1A CL B1 REGD 144A P/P 5.11000000 / ABS-CBDO (US67181DAG60) | 1.63 | 0.56 | 0.1000 | 0.0142 | |||||

| OAK STREET INVESTMENT GRADE NET LEASE FUND SERIES 2 SER 2020-1A CL B1 REGD 144A P/P 5.11000000 / ABS-CBDO (US67181DAG60) | 1.63 | 0.56 | 0.1000 | 0.0142 | |||||

| US45823TAL08 / Intact Financial Corp | 1.62 | 14.14 | 0.0998 | 0.0245 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 1.62 | 78.63 | 0.0998 | 0.0516 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 1.62 | 78.63 | 0.0998 | 0.0516 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 1.62 | 78.63 | 0.0998 | 0.0516 | |||||

| US91282CJC64 / United States Treasury Note/Bond | 1.62 | -0.12 | 0.0994 | 0.0136 | |||||

| US91282CJG78 / U.S. Treasury Notes | 1.61 | 0.12 | 0.0989 | 0.0137 | |||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP LLC SER 2025-1A CL C REGD 144A P/P 5.87000000 / ABS-CBDO (US05377RKN34) | 1.61 | 0.0987 | 0.0987 | ||||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP LLC SER 2025-1A CL C REGD 144A P/P 5.87000000 / ABS-CBDO (US05377RKN34) | 1.61 | 0.0987 | 0.0987 | ||||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP LLC SER 2025-1A CL C REGD 144A P/P 5.87000000 / ABS-CBDO (US05377RKN34) | 1.61 | 0.0987 | 0.0987 | ||||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 1.60 | 12.80 | 0.0987 | 0.0233 | |||||

| GINNIE MAE II POOL P#MA9853 6.50000000 / ABS-MBS (US36179Y5N09) | 1.60 | 0.0982 | 0.0982 | ||||||

| GINNIE MAE II POOL P#MA9853 6.50000000 / ABS-MBS (US36179Y5N09) | 1.60 | 0.0982 | 0.0982 | ||||||

| GINNIE MAE II POOL P#MA9853 6.50000000 / ABS-MBS (US36179Y5N09) | 1.60 | 0.0982 | 0.0982 | ||||||

| US3140XLTR90 / Fannie Mae Pool | 1.59 | -3.93 | 0.0978 | 0.0100 | |||||

| US3140XHHV29 / Fannie Mae Pool | 1.59 | -3.99 | 0.0978 | 0.0100 | |||||

| US912810PU60 / Us Treasury Bond Bond | 1.59 | -37.42 | 0.0977 | -0.0369 | |||||

| US3140MNM371 / FN 05/52 FIXED 3 | 1.59 | -4.98 | 0.0975 | 0.0091 | |||||

| US3132DWC270 / FR SD8189 | 1.58 | -4.07 | 0.0972 | 0.0099 | |||||

| US65249BAA70 / News Corp | 1.56 | -21.02 | 0.0961 | -0.0088 | |||||

| US91282CGQ87 / United States Treasury Note/Bond | 1.56 | 831.14 | 0.0956 | 0.0863 | |||||

| US3132DVMB89 / FNCL UMBS 2.5 SD7554 04-01-52 | 1.55 | -4.72 | 0.0956 | 0.0091 | |||||

| US698299BS24 / Panama Government International Bond | 1.55 | -19.46 | 0.0955 | -0.0067 | |||||

| STATE OF ISRAEL REGD SER 30Y 5.75000000 / DBT (US46514BRM18) | 1.54 | -5.81 | 0.0948 | 0.0080 | |||||

| STATE OF ISRAEL REGD SER 30Y 5.75000000 / DBT (US46514BRM18) | 1.54 | -5.81 | 0.0948 | 0.0080 | |||||

| STATE OF ISRAEL REGD SER 30Y 5.75000000 / DBT (US46514BRM18) | 1.54 | -5.81 | 0.0948 | 0.0080 | |||||

| US91282CHF14 / United States Treasury Note/Bond | 1.54 | 0.33 | 0.0946 | 0.0133 | |||||

| US91282CJM47 / United States Treasury Note/Bond | 1.54 | -35.96 | 0.0944 | -0.0326 | |||||

| US3132DWDQ33 / UMBS | 1.53 | -4.01 | 0.0944 | 0.0096 | |||||

| US23345LAA70 / DOLP Trust 2021-NYC | 1.53 | -0.97 | 0.0944 | 0.0122 | |||||

| US55903VBE20 / Warnermedia Holdings Inc | 1.53 | -42.22 | 0.0943 | -0.0464 | |||||

| EXETER SELECT AUTOMOBILE RECEIVABLES TRUST 2025-1 SER 2025-1 CL B REGD 4.87000000 / ABS-CBDO (US30185AAD37) | 1.50 | 0.0924 | 0.0924 | ||||||

| EXETER SELECT AUTOMOBILE RECEIVABLES TRUST 2025-1 SER 2025-1 CL B REGD 4.87000000 / ABS-CBDO (US30185AAD37) | 1.50 | 0.0924 | 0.0924 | ||||||

| EXETER SELECT AUTOMOBILE RECEIVABLES TRUST 2025-1 SER 2025-1 CL B REGD 4.87000000 / ABS-CBDO (US30185AAD37) | 1.50 | 0.0924 | 0.0924 | ||||||

| US038413AC49 / Aqua Finance Trust, Series 2020-AA, Class C | 1.50 | 757.71 | 0.0923 | 0.0830 | |||||

| FANNIE MAE POOL UMBS P#FS8795 6.00000000 / ABS-MBS (US3140XQXZ57) | 1.49 | -3.18 | 0.0918 | 0.0101 | |||||

| FANNIE MAE POOL UMBS P#FS8795 6.00000000 / ABS-MBS (US3140XQXZ57) | 1.49 | -3.18 | 0.0918 | 0.0101 | |||||

| CHARTER COMM OPT LLC/CAP REGD 6.10000000 / DBT (US161175CQ56) | 1.48 | 0.75 | 0.0912 | 0.0132 | |||||

| CHARTER COMM OPT LLC/CAP REGD 6.10000000 / DBT (US161175CQ56) | 1.48 | 0.75 | 0.0912 | 0.0132 | |||||

| US31418D3H34 / Fannie Mae Pool | 1.48 | -4.40 | 0.0910 | 0.0090 | |||||

| US91282CFV81 / United States Treasury Note/Bond | 1.46 | -63.91 | 0.0901 | -0.1249 | |||||

| US38141GYJ74 / Goldman Sachs Group Inc/The | 1.46 | -12.51 | 0.0899 | 0.0013 | |||||

| US12592SAA50 / CIM Trust 2021-R5 | 1.45 | -3.98 | 0.0891 | 0.0091 | |||||

| CONOCOPHILLIPS COMPANY REGD 5.50000000 / DBT (US20826FBM77) | 1.45 | -15.10 | 0.0889 | -0.0014 | |||||

| CONOCOPHILLIPS COMPANY REGD 5.50000000 / DBT (US20826FBM77) | 1.45 | -15.10 | 0.0889 | -0.0014 | |||||

| CONOCOPHILLIPS COMPANY REGD 5.50000000 / DBT (US20826FBM77) | 1.45 | -15.10 | 0.0889 | -0.0014 | |||||

| CONOCOPHILLIPS COMPANY REGD 5.50000000 / DBT (US20826FBM77) | 1.45 | -15.10 | 0.0889 | -0.0014 | |||||

| ENTERPRISE FLEET FINANCING 2025-2 LLC SER 2025-2 CL A4 REGD 144A P/P 4.58000000 / ABS-CBDO (US29375TAD46) | 1.44 | 0.0888 | 0.0888 | ||||||

| ENTERPRISE FLEET FINANCING 2025-2 LLC SER 2025-2 CL A4 REGD 144A P/P 4.58000000 / ABS-CBDO (US29375TAD46) | 1.44 | 0.0888 | 0.0888 | ||||||

| ENTERPRISE FLEET FINANCING 2025-2 LLC SER 2025-2 CL A4 REGD 144A P/P 4.58000000 / ABS-CBDO (US29375TAD46) | 1.44 | 0.0888 | 0.0888 | ||||||

| ENTERPRISE FLEET FINANCING 2025-2 LLC SER 2025-2 CL A4 REGD 144A P/P 4.58000000 / ABS-CBDO (US29375TAD46) | 1.44 | 0.0888 | 0.0888 | ||||||

| US06051GKQ19 / Bank of America Corp | 1.44 | 0.28 | 0.0888 | 0.0124 | |||||

| US902613AH15 / UBS Group AG | 1.44 | -24.53 | 0.0887 | -0.0126 | |||||

| N1TA34 / NetApp, Inc. - Depositary Receipt (Common Stock) | 1.44 | 0.0886 | 0.0886 | ||||||

| N1TA34 / NetApp, Inc. - Depositary Receipt (Common Stock) | 1.44 | 0.0886 | 0.0886 | ||||||

| N1TA34 / NetApp, Inc. - Depositary Receipt (Common Stock) | 1.44 | 0.0886 | 0.0886 | ||||||

| US3132DNFL29 / FREDDIE MAC POOL UMBS P#SD1071 3.50000000 | 1.43 | -6.86 | 0.0877 | 0.0066 | |||||

| US912810TQ13 / United States Treasury Note/Bond | 1.42 | -61.02 | 0.0876 | -0.1061 | |||||

| LENDMARK FUNDING TRUST 2025-1 SER 2025-1A CL E REGD 144A P/P 8.91000000 / ABS-CBDO (US52604QAE35) | 1.42 | 0.0872 | 0.0872 | ||||||

| LENDMARK FUNDING TRUST 2025-1 SER 2025-1A CL E REGD 144A P/P 8.91000000 / ABS-CBDO (US52604QAE35) | 1.42 | 0.0872 | 0.0872 | ||||||

| LENDMARK FUNDING TRUST 2025-1 SER 2025-1A CL E REGD 144A P/P 8.91000000 / ABS-CBDO (US52604QAE35) | 1.42 | 0.0872 | 0.0872 | ||||||

| US35564KKY46 / Freddie Mac STACR REMIC Trust 2021-DNA6 | 1.42 | -5.72 | 0.0871 | 0.0074 | |||||

| US3132DWDC47 / Freddie Mac Pool | 1.41 | -71.26 | 0.0867 | -0.1733 | |||||

| US46647PBE51 / JPMorgan Chase & Co | 1.41 | 0.64 | 0.0867 | 0.0124 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 1.41 | 38.72 | 0.0866 | 0.0328 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 1.41 | 38.72 | 0.0866 | 0.0328 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 1.41 | 38.72 | 0.0866 | 0.0328 | |||||

| US91282CHT18 / US TNOTE 3.875% DUE 08/15/2033 | 1.41 | -0.64 | 0.0864 | 0.0114 | |||||

| US826943AD45 / Sierra Timeshare 2023-1 Receivables Funding LLC | 1.40 | 0.0864 | 0.0864 | ||||||

| US46647PDF09 / JPMorgan Chase & Co | 1.40 | -27.85 | 0.0861 | -0.0168 | |||||

| US91282CHC82 / United States Treasury Note/Bond | 1.38 | 470.66 | 0.0850 | 0.0712 | |||||

| CROCKETT PARTNERS EQUIPMENT CO IIA LLC SER 2024-1C CL A REGD 144A P/P 6.05000000 / ABS-CBDO (US22689LAA35) | 1.37 | -4.98 | 0.0845 | 0.0079 | |||||

| CROCKETT PARTNERS EQUIPMENT CO IIA LLC SER 2024-1C CL A REGD 144A P/P 6.05000000 / ABS-CBDO (US22689LAA35) | 1.37 | -4.98 | 0.0845 | 0.0079 | |||||

| US91159HJL50 / US Bancorp | 1.37 | -0.51 | 0.0843 | 0.0113 | |||||

| FREDDIE MAC POOL UMBS P#SD8428 4.00000000 / ABS-MBS (US3132DWLH42) | 1.37 | -3.32 | 0.0841 | 0.0091 | |||||

| US3140XGLT44 / FANNIE MAE POOL UMBS P#FS1237 3.50000000 | 1.37 | -5.00 | 0.0841 | 0.0078 | |||||

| US00928QAU58 / Aircastle Ltd | 1.36 | -47.20 | 0.0836 | -0.0529 | |||||

| US00928QAU58 / Aircastle Ltd | 1.36 | -47.20 | 0.0836 | -0.0529 | |||||

| US00928QAU58 / Aircastle Ltd | 1.36 | -47.20 | 0.0836 | -0.0529 | |||||

| SERVICE EXPERTS ISSUER 2024-1 LLC SER 2024-1A CL A REGD 144A P/P 6.39000000 / ABS-CBDO (US81758FAA84) | 1.36 | -6.41 | 0.0835 | 0.0066 | |||||

| SERVICE EXPERTS ISSUER 2024-1 LLC SER 2024-1A CL A REGD 144A P/P 6.39000000 / ABS-CBDO (US81758FAA84) | 1.36 | -6.41 | 0.0835 | 0.0066 | |||||

| UNITED STATES TREASURY NOTE 4.25000000 / DBT (US91282CKC46) | 1.36 | 0.07 | 0.0834 | 0.0116 | |||||

| US91159HJN17 / US Bancorp | 1.36 | 2,558.82 | 0.0834 | 0.0807 | |||||

| US00287YBX67 / CORP. NOTE | 1.36 | 0.74 | 0.0834 | 0.0120 | |||||

| US91282CFU09 / United States Treasury Note/Bond - When Issued | 1.35 | 0.15 | 0.0830 | 0.0116 | |||||

| SOUTHERN CAL EDISON REGD 5.90000000 / DBT (US842400JH78) | 1.34 | 20.43 | 0.0827 | 0.0235 | |||||

| SOUTHERN CAL EDISON REGD 5.90000000 / DBT (US842400JH78) | 1.34 | 20.43 | 0.0827 | 0.0235 | |||||

| OMNIS FUNDING TRUST REGD 144A P/P 6.72200000 / DBT (US68218WAA27) | 1.34 | 0.0821 | 0.0821 | ||||||

| US38141GYN86 / Goldman Sachs Group Inc/The | 1.33 | 0.45 | 0.0821 | 0.0116 | |||||

| SERVPRO MASTER ISSUER LLC SER 2024-1A CL A2 REGD 144A P/P 6.17400000 / ABS-CBDO (US817743AJ65) | 1.33 | -0.30 | 0.0820 | 0.0111 | |||||

| SERVPRO MASTER ISSUER LLC SER 2024-1A CL A2 REGD 144A P/P 6.17400000 / ABS-CBDO (US817743AJ65) | 1.33 | -0.30 | 0.0820 | 0.0111 | |||||

| SERVPRO MASTER ISSUER LLC SER 2024-1A CL A2 REGD 144A P/P 6.17400000 / ABS-CBDO (US817743AJ65) | 1.33 | -0.30 | 0.0820 | 0.0111 | |||||

| SERVPRO MASTER ISSUER LLC SER 2024-1A CL A2 REGD 144A P/P 6.17400000 / ABS-CBDO (US817743AJ65) | 1.33 | -0.30 | 0.0820 | 0.0111 | |||||

| US91282CBL46 / United States Treasury Note/Bond | 1.33 | -73.78 | 0.0819 | -0.1872 | |||||

| RIO TINTO FIN USA PLC REGD 5.75000000 / DBT (US76720AAV89) | 1.33 | 0.0818 | 0.0818 | ||||||

| RIO TINTO FIN USA PLC REGD 5.75000000 / DBT (US76720AAV89) | 1.33 | 0.0818 | 0.0818 | ||||||

| RIO TINTO FIN USA PLC REGD 5.75000000 / DBT (US76720AAV89) | 1.33 | 0.0818 | 0.0818 | ||||||

| RIO TINTO FIN USA PLC REGD 5.75000000 / DBT (US76720AAV89) | 1.33 | 0.0818 | 0.0818 | ||||||

| US3140QNDG49 / Fannie Mae Pool | 1.33 | -3.97 | 0.0818 | 0.0084 | |||||

| US91282CHM64 / U.S. Treasury Notes | 1.33 | -0.15 | 0.0817 | 0.0112 | |||||

| MARS INC REGD 144A P/P 5.20000000 / DBT (US571676BA26) | 1.32 | 0.0811 | 0.0811 | ||||||

| FANNIE MAE POOL UMBS P#FS7835 5.50000000 / ABS-MBS (US3140XPV556) | 1.31 | -3.33 | 0.0804 | 0.0087 | |||||

| FANNIE MAE POOL UMBS P#FS7835 5.50000000 / ABS-MBS (US3140XPV556) | 1.31 | -3.33 | 0.0804 | 0.0087 | |||||

| FANNIE MAE POOL UMBS P#FS7835 5.50000000 / ABS-MBS (US3140XPV556) | 1.31 | -3.33 | 0.0804 | 0.0087 | |||||

| US632525BB69 / National Australia Bank Ltd | 1.31 | -15.26 | 0.0802 | -0.0014 | |||||

| US79582AAA51 / Saluda Grade Alternative Mortgage Trust, Series 2023-FIG3, Class A | 1.30 | -5.87 | 0.0800 | 0.0067 | |||||

| US31418D3G50 / Fannie Mae Pool | 1.30 | -4.21 | 0.0798 | 0.0080 | |||||

| US200447AH32 / Comision Federal de Electricidad | 1.30 | 2.21 | 0.0796 | 0.0125 | |||||

| TOTALENERGIES CAPITAL SA REGD 5.42500000 / DBT (US89157XAF87) | 1.29 | -19.20 | 0.0792 | -0.0053 | |||||

| TOTALENERGIES CAPITAL SA REGD 5.42500000 / DBT (US89157XAF87) | 1.29 | -19.20 | 0.0792 | -0.0053 | |||||

| TOTALENERGIES CAPITAL SA REGD 5.42500000 / DBT (US89157XAF87) | 1.29 | -19.20 | 0.0792 | -0.0053 | |||||

| DANSKE / Danske Bank A/S | 1.29 | 0.08 | 0.0792 | 0.0110 | |||||

| DANSKE / Danske Bank A/S | 1.29 | 0.08 | 0.0792 | 0.0110 | |||||

| DANSKE / Danske Bank A/S | 1.29 | 0.08 | 0.0792 | 0.0110 | |||||

| US3132DMYZ21 / FREDDIE MAC POOL UMBS P#SD0728 2.50000000 | 1.28 | -3.75 | 0.0788 | 0.0082 | |||||

| US91282CHY03 / United States Treasury Note/Bond | 1.28 | -0.23 | 0.0786 | 0.0107 | |||||

| US225401AU28 / Credit Suisse Group AG | 1.27 | -14.80 | 0.0778 | -0.0009 | |||||

| US3133B3L540 / Freddie Mac Pool | 1.26 | -4.10 | 0.0778 | 0.0079 | |||||

| 2914 / Japan Tobacco Inc. | 1.26 | 0.0775 | 0.0775 | ||||||

| 2914 / Japan Tobacco Inc. | 1.26 | 0.0775 | 0.0775 | ||||||

| 2914 / Japan Tobacco Inc. | 1.26 | 0.0775 | 0.0775 | ||||||

| US00973RAD52 / Aker BP ASA | 1.25 | -29.59 | 0.0771 | -0.0173 | |||||

| US00973RAD52 / Aker BP ASA | 1.25 | -29.59 | 0.0771 | -0.0173 | |||||

| LENDMARK FUNDING TRUST 2024-2 SER 2024-2A CL E REGD 144A P/P 8.47000000 / ABS-CBDO (US52590AAE47) | 1.25 | 0.0770 | 0.0770 | ||||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CNA52) | 1.25 | 0.0766 | 0.0766 | ||||||

| US12563RAC88 / CIM TRUST 2021-R1 A2 2.4% 08/25/2056 144A | 1.24 | -4.97 | 0.0765 | 0.0071 | |||||

| AMERICAN CREDIT ACCEPTANCE RECEIVABLES TRUST 2025-2 SER 2025-2 CL D REGD 144A P/P 5.50000000 / ABS-CBDO (US024938AG74) | 1.24 | 0.0760 | 0.0760 | ||||||

| AMERICAN CREDIT ACCEPTANCE RECEIVABLES TRUST 2025-2 SER 2025-2 CL D REGD 144A P/P 5.50000000 / ABS-CBDO (US024938AG74) | 1.24 | 0.0760 | 0.0760 | ||||||

| AMERICAN CREDIT ACCEPTANCE RECEIVABLES TRUST 2025-2 SER 2025-2 CL D REGD 144A P/P 5.50000000 / ABS-CBDO (US024938AG74) | 1.24 | 0.0760 | 0.0760 | ||||||

| US88732JBB35 / Time Warner Cable Inc. 5.50% 09/01/41 | 1.24 | -23.70 | 0.0760 | -0.0098 | |||||

| AMSR 2025-SFR1 TRUST SER 2025-SFR1 CL E2 REGD 144A P/P 3.65500000 / ABS-CBDO (US00182MAL54) | 1.23 | 0.0757 | 0.0757 | ||||||

| SABRE GLBL INC REGD 144A P/P 10.75000000 / DBT (US78573NAL64) | 1.23 | 15.33 | 0.0754 | 0.0190 | |||||

| SABRE GLBL INC REGD 144A P/P 10.75000000 / DBT (US78573NAL64) | 1.23 | 15.33 | 0.0754 | 0.0190 | |||||

| SABRE GLBL INC REGD 144A P/P 10.75000000 / DBT (US78573NAL64) | 1.23 | 15.33 | 0.0754 | 0.0190 | |||||

| SABRE GLBL INC REGD 144A P/P 10.75000000 / DBT (US78573NAL64) | 1.23 | 15.33 | 0.0754 | 0.0190 | |||||

| RCKT MORTGAGE TRUST 2024-CES9 SER 2024-CES9 CL A1A V/R REGD 144A P/P 5.58200000 / ABS-CBDO (US749426AA06) | 1.22 | -4.37 | 0.0753 | 0.0074 | |||||

| RCKT MORTGAGE TRUST 2024-CES9 SER 2024-CES9 CL A1A V/R REGD 144A P/P 5.58200000 / ABS-CBDO (US749426AA06) | 1.22 | -4.37 | 0.0753 | 0.0074 | |||||

| RCKT MORTGAGE TRUST 2024-CES9 SER 2024-CES9 CL A1A V/R REGD 144A P/P 5.58200000 / ABS-CBDO (US749426AA06) | 1.22 | -4.37 | 0.0753 | 0.0074 | |||||

| RCKT MORTGAGE TRUST 2024-CES9 SER 2024-CES9 CL A1A V/R REGD 144A P/P 5.58200000 / ABS-CBDO (US749426AA06) | 1.22 | -4.37 | 0.0753 | 0.0074 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 1.22 | 0.33 | 0.0752 | 0.0106 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 1.22 | 0.33 | 0.0752 | 0.0106 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 1.22 | 0.33 | 0.0752 | 0.0106 | |||||

| US912810RM27 / United States Treas Bds Bond | 1.22 | 183.45 | 0.0748 | 0.0303 | |||||

| FR001400F067 / Credit Agricole SA | 1.22 | 8.77 | 0.0747 | 0.0155 | |||||

| UNITED STATES TREASURY BOND 4.75000000 / DBT (US912810UJ50) | 1.22 | 0.0747 | 0.0747 | ||||||

| UNITED STATES TREASURY BOND 4.75000000 / DBT (US912810UJ50) | 1.22 | 0.0747 | 0.0747 | ||||||

| UNITED STATES TREASURY BOND 4.75000000 / DBT (US912810UJ50) | 1.22 | 0.0747 | 0.0747 | ||||||

| UNITED STATES TREASURY BOND 4.75000000 / DBT (US912810UJ50) | 1.22 | 0.0747 | 0.0747 | ||||||

| US68377WAA99 / Oportun Issuance Trust 2021-C | 1.21 | 0.0747 | 0.0747 | ||||||

| US01F0606677 / Uniform Mortgage-Backed Security, TBA | 1.21 | 21.10 | 0.0745 | 0.0179 | |||||

| EXETER SELECT AUTOMOBILE RECEIVABLES TRUST 2025-1 SER 2025-1 CL C REGD 5.40000000 / ABS-CBDO (US30185AAE10) | 1.21 | 0.0745 | 0.0745 | ||||||

| EXETER SELECT AUTOMOBILE RECEIVABLES TRUST 2025-1 SER 2025-1 CL C REGD 5.40000000 / ABS-CBDO (US30185AAE10) | 1.21 | 0.0745 | 0.0745 | ||||||

| EXETER SELECT AUTOMOBILE RECEIVABLES TRUST 2025-1 SER 2025-1 CL C REGD 5.40000000 / ABS-CBDO (US30185AAE10) | 1.21 | 0.0745 | 0.0745 | ||||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 1.21 | -18.08 | 0.0741 | -0.0038 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 1.21 | -18.08 | 0.0741 | -0.0038 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 1.21 | -18.08 | 0.0741 | -0.0038 | |||||

| US05609PAL22 / BX 2021-LBA3 Mortgage Trust | 1.21 | -0.08 | 0.0741 | 0.0101 | |||||

| US3132DWG982 / FNCL UMBS 5.5 SD8324 05-01-53 | 1.20 | 0.0740 | 0.0740 | ||||||

| CAFL 2025-RRTL1 ISSUER LP SER 2025-RRTL1 CL A1 V/R REGD 144A P/P 5.68400000 / ABS-CBDO (US124760AA71) | 1.20 | 0.0740 | 0.0740 | ||||||

| CAFL 2025-RRTL1 ISSUER LP SER 2025-RRTL1 CL A1 V/R REGD 144A P/P 5.68400000 / ABS-CBDO (US124760AA71) | 1.20 | 0.0740 | 0.0740 | ||||||

| BOOZ ALLEN HAMILTON INC REGD 5.95000000 / DBT (US09951LAD55) | 1.20 | 0.0736 | 0.0736 | ||||||

| BOOZ ALLEN HAMILTON INC REGD 5.95000000 / DBT (US09951LAD55) | 1.20 | 0.0736 | 0.0736 | ||||||

| BOOZ ALLEN HAMILTON INC REGD 5.95000000 / DBT (US09951LAD55) | 1.20 | 0.0736 | 0.0736 | ||||||

| FRONTIER ISSUER LLC SER 2024-1 CL A2 REGD 144A P/P 6.19000000 / ABS-CBDO (US35910EAK01) | 1.20 | -1.08 | 0.0735 | 0.0094 | |||||

| FRONTIER ISSUER LLC SER 2024-1 CL A2 REGD 144A P/P 6.19000000 / ABS-CBDO (US35910EAK01) | 1.20 | -1.08 | 0.0735 | 0.0094 | |||||

| FRONTIER ISSUER LLC SER 2024-1 CL A2 REGD 144A P/P 6.19000000 / ABS-CBDO (US35910EAK01) | 1.20 | -1.08 | 0.0735 | 0.0094 | |||||

| US59156RCA41 / MetLife Inc | 1.19 | -19.95 | 0.0733 | -0.0056 | |||||

| US3140XHWZ67 / FANNIE MAE POOL FN FS2463 | 1.19 | -4.80 | 0.0732 | 0.0070 | |||||

| US3140QSA434 / Fannie Mae Pool | 1.19 | -4.88 | 0.0731 | 0.0069 | |||||

| US3140XKPZ79 / FANNIE MAE POOL UMBS P#FS4039 5.50000000 | 1.19 | -6.01 | 0.0731 | 0.0060 | |||||

| US05571AAR68 / BPCE SA | 1.18 | 0.0724 | 0.0724 | ||||||

| US91282CHB00 / TREASURY NOTE | 1.18 | 0.09 | 0.0724 | 0.0100 | |||||

| US46592XAC83 / JP Morgan Mortgage Trust 2021-13 | 1.17 | -4.35 | 0.0717 | 0.0071 | |||||

| SANTANDER HOLDINGS USA REGD V/R 5.74100000 / DBT (US80282KBQ85) | 1.17 | 0.0717 | 0.0717 | ||||||

| SANTANDER HOLDINGS USA REGD V/R 5.74100000 / DBT (US80282KBQ85) | 1.17 | 0.0717 | 0.0717 | ||||||

| SANTANDER HOLDINGS USA REGD V/R 5.74100000 / DBT (US80282KBQ85) | 1.17 | 0.0717 | 0.0717 | ||||||

| US22550L2M24 / Credit Suisse AG/New York NY | 1.17 | -49.48 | 0.0717 | -0.0506 | |||||

| US11043XAA19 / British Airways Pass Through Trust, Series 2019-1, Class AA | 1.17 | -2.92 | 0.0717 | 0.0081 | |||||

| US3140QNCC44 / Fannie Mae Pool | 1.17 | -4.27 | 0.0717 | 0.0071 | |||||

| US29670VAA70 / Essential Properties LP | 1.16 | -46.50 | 0.0716 | -0.0437 | |||||

| US643821AB76 / New Economy Assets Phase 1 Sponsor LLC | 1.16 | 0.09 | 0.0712 | 0.0099 | |||||

| US3140XCZR28 / FANNIE MAE POOL UMBS P#FM8851 1.50000000 | 1.15 | -4.08 | 0.0709 | 0.0072 | |||||

| US3133KN6X66 / UMBS | 1.15 | -3.21 | 0.0705 | 0.0077 | |||||

| US3132DVL869 / FREDDIE MAC POOL UMBS P#SD7551 3.00000000 | 1.14 | -4.59 | 0.0704 | 0.0068 | |||||

| US912810SL35 / United States Treasury Note/Bond | 1.14 | -36.87 | 0.0703 | -0.0256 | |||||

| US1248EPCP61 / CCO Holdings LLC / CCO Holdings Capital Corp | 1.14 | 72.21 | 0.0701 | 0.0350 | |||||

| US69377NAA72 / PRET_22-RN2 | 1.13 | -3.90 | 0.0696 | 0.0072 | |||||

| US36179XLF14 / Ginnie Mae II Pool | 1.13 | -4.97 | 0.0694 | 0.0065 | |||||

| US3140XLA245 / UMBS | 1.12 | -3.77 | 0.0691 | 0.0072 | |||||

| GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-53 CL SL V/R 3.84346000 / ABS-CBDO (US38383XJ546) | 1.12 | 0.0690 | 0.0690 | ||||||

| FANNIE MAE POOL UMBS P#BZ3877 5.18000000 / ABS-MBS (US3140NYJX00) | 1.12 | 0.0689 | 0.0689 | ||||||

| FANNIE MAE POOL UMBS P#BZ3877 5.18000000 / ABS-MBS (US3140NYJX00) | 1.12 | 0.0689 | 0.0689 | ||||||

| FANNIE MAE POOL UMBS P#BZ3877 5.18000000 / ABS-MBS (US3140NYJX00) | 1.12 | 0.0689 | 0.0689 | ||||||

| FANNIE MAE POOL UMBS P#BZ3877 5.18000000 / ABS-MBS (US3140NYJX00) | 1.12 | 0.0689 | 0.0689 | ||||||

| UNITED STATES TREASURY BOND 4.12500000 / DBT (US912810UD80) | 1.12 | 528.09 | 0.0688 | 0.0593 | |||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CLF67) | 1.11 | -56.86 | 0.0683 | -0.0681 | |||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CLF67) | 1.11 | -56.86 | 0.0683 | -0.0681 | |||||

| US21H0606630 / Ginnie Mae | 1.11 | -93.47 | 0.0683 | -0.8933 | |||||

| SOUTH BOW USA INFRA HLDS REGD 144A P/P 5.02600000 / DBT (US83007CAC64) | 1.11 | -25.05 | 0.0683 | -0.0103 | |||||

| US3132DVKW45 / Federal Home Loan Mortgage Corp. Fixed Rate Participation Certificates | 1.11 | -26.80 | 0.0682 | -0.0121 | |||||

| BANK OF AMERICA CORP REGD V/R 5.51800000 / DBT (US06051GMD87) | 1.11 | 388.11 | 0.0681 | 0.0561 | |||||

| PERIMETER MASTER NOTE BUSINESS TRUST SER 2025-1A CL A REGD 144A P/P 5.58000000 / ABS-CBDO (US71384PBC41) | 1.10 | 0.0678 | 0.0678 | ||||||

| PERIMETER MASTER NOTE BUSINESS TRUST SER 2025-1A CL A REGD 144A P/P 5.58000000 / ABS-CBDO (US71384PBC41) | 1.10 | 0.0678 | 0.0678 | ||||||

| US3140FXTT96 / Fannie Mae Pool | 1.10 | -7.02 | 0.0676 | 0.0049 | |||||

| UNITED STATES TREASURY NOTE 4.12500000 / DBT (US91282CLX73) | 1.10 | -75.59 | 0.0674 | -0.1703 | |||||

| UNITED STATES TREASURY NOTE 4.12500000 / DBT (US91282CLX73) | 1.10 | -75.59 | 0.0674 | -0.1703 | |||||

| UNITED STATES TREASURY NOTE 4.12500000 / DBT (US91282CLX73) | 1.10 | -75.59 | 0.0674 | -0.1703 | |||||

| FANNIE MAE POOL UMBS P#CB6348 4.50000000 / ABS-MBS (US3140QSBS91) | 1.09 | -4.20 | 0.0673 | 0.0068 | |||||

| FANNIE MAE POOL UMBS P#CB6348 4.50000000 / ABS-MBS (US3140QSBS91) | 1.09 | -4.20 | 0.0673 | 0.0068 | |||||

| FANNIE MAE POOL UMBS P#CB6348 4.50000000 / ABS-MBS (US3140QSBS91) | 1.09 | -4.20 | 0.0673 | 0.0068 | |||||

| US02209SBL60 / Altria Group Inc | 1.09 | 0.74 | 0.0672 | 0.0097 | |||||

| US912810SU34 / United States Treasury Note/Bond | 1.09 | -6.90 | 0.0672 | 0.0050 | |||||

| XS2558978883 / CaixaBank SA | 1.09 | -45.68 | 0.0672 | -0.0394 | |||||

| US3140JAPG72 / Fannie Mae Pool | 1.09 | -3.63 | 0.0671 | 0.0071 | |||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CMB45) | 1.09 | -62.15 | 0.0670 | -0.0855 | |||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CMB45) | 1.09 | -62.15 | 0.0670 | -0.0855 | |||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CMB45) | 1.09 | -62.15 | 0.0670 | -0.0855 | |||||

| UNITED STATES TREASURY NOTE 4.00000000 / DBT (US91282CMB45) | 1.09 | -62.15 | 0.0670 | -0.0855 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 1.09 | 0.0669 | 0.0669 | ||||||

| US95000U2M49 / Wells Fargo & Co | 1.09 | -72.53 | 0.0668 | -0.1427 | |||||

| US91282CEP23 / WI TREASURY N/B REGD 2.87500000 | 1.09 | -18.67 | 0.0667 | -0.0040 | |||||

| BRIDGECREST LENDING AUTO SECURITIZATION TRUST 2025-2 SER 2025-2 CL D REGD 5.62000000 / ABS-CBDO (US10807HAF38) | 1.08 | 0.0666 | 0.0666 | ||||||

| BRIDGECREST LENDING AUTO SECURITIZATION TRUST 2025-2 SER 2025-2 CL D REGD 5.62000000 / ABS-CBDO (US10807HAF38) | 1.08 | 0.0666 | 0.0666 | ||||||

| BRIDGECREST LENDING AUTO SECURITIZATION TRUST 2025-2 SER 2025-2 CL D REGD 5.62000000 / ABS-CBDO (US10807HAF38) | 1.08 | 0.0666 | 0.0666 | ||||||

| XS2164646304 / APT Pipelines Ltd. | 1.07 | 9.83 | 0.0660 | 0.0142 | |||||

| US91282CJK80 / US TREASURY N/B 4.625% 11-15-26 | 1.07 | -0.19 | 0.0660 | 0.0090 | |||||

| US55617LAQ59 / Macy's Retail Holdings LLC | 1.07 | -1.56 | 0.0658 | 0.0082 | |||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CMV09) | 1.07 | 0.0657 | 0.0657 | ||||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CMV09) | 1.07 | 0.0657 | 0.0657 | ||||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CMV09) | 1.07 | 0.0657 | 0.0657 | ||||||

| UNITED STATES TREASURY NOTE 3.87500000 / DBT (US91282CMV09) | 1.07 | 0.0657 | 0.0657 | ||||||

| GINNIE MAE II POOL P#DH0822 7.50000000 / ABS-MBS (US3618K84F08) | 1.06 | 0.0653 | 0.0653 | ||||||

| GINNIE MAE II POOL P#DH0822 7.50000000 / ABS-MBS (US3618K84F08) | 1.06 | 0.0653 | 0.0653 | ||||||

| GINNIE MAE II POOL P#DH0822 7.50000000 / ABS-MBS (US3618K84F08) | 1.06 | 0.0653 | 0.0653 | ||||||

| US912810RP57 / United States Treas Bds Bond | 1.05 | -5.50 | 0.0645 | 0.0057 | |||||

| US912810TL26 / TREASURY BOND | 1.04 | -59.59 | 0.0637 | -0.0722 | |||||

| US912810TJ79 / United States Treasury Note/Bond | 1.04 | -6.59 | 0.0637 | 0.0049 | |||||

| US912810RJ97 / United States Treas Bds Bond | 1.03 | -5.23 | 0.0635 | 0.0058 | |||||

| US018820AC48 / ALLIANZ SE | 1.03 | -1.53 | 0.0634 | 0.0079 | |||||

| AQUA FINANCE ISSUER TRUST 2025-A SER 2025-A CL C REGD 144A P/P 5.81000000 / ABS-CBDO (US038394AC67) | 1.03 | 0.0632 | 0.0632 | ||||||

| AQUA FINANCE ISSUER TRUST 2025-A SER 2025-A CL C REGD 144A P/P 5.81000000 / ABS-CBDO (US038394AC67) | 1.03 | 0.0632 | 0.0632 | ||||||

| AQUA FINANCE ISSUER TRUST 2025-A SER 2025-A CL C REGD 144A P/P 5.81000000 / ABS-CBDO (US038394AC67) | 1.03 | 0.0632 | 0.0632 | ||||||

| UNITED STATES TREASURY NOTE 4.62500000 / DBT (US91282CKU44) | 1.03 | -0.10 | 0.0632 | 0.0087 | |||||

| UNITED STATES TREASURY NOTE 4.62500000 / DBT (US91282CKU44) | 1.03 | -0.10 | 0.0632 | 0.0087 | |||||

| US912810TF57 / TREASURY BOND | 1.02 | -4.59 | 0.0627 | 0.0061 | |||||

| US14162VAB27 / Sabra Health Care LP | 1.02 | -49.30 | 0.0626 | -0.0438 | |||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 1.02 | -83.81 | 0.0625 | -0.2702 | |||||

| UNITED STATES TREASURY NOTE 4.37500000 / DBT (US91282CKZ31) | 1.01 | 0.10 | 0.0621 | 0.0086 | |||||

| UNITED STATES TREASURY NOTE 4.37500000 / DBT (US91282CKZ31) | 1.01 | 0.10 | 0.0621 | 0.0086 | |||||

| UNITED STATES TREASURY NOTE 4.37500000 / DBT (US91282CKZ31) | 1.01 | 0.10 | 0.0621 | 0.0086 | |||||

| UNITED STATES TREASURY NOTE 4.37500000 / DBT (US91282CKZ31) | 1.01 | 0.10 | 0.0621 | 0.0086 | |||||

| BP CAPITAL MARKETS PLC REGD V/R /PERP/ 6.45000000 / DBT (US05565QDW50) | 1.01 | -1.47 | 0.0620 | 0.0077 | |||||

| BP CAPITAL MARKETS PLC REGD V/R /PERP/ 6.45000000 / DBT (US05565QDW50) | 1.01 | -1.47 | 0.0620 | 0.0077 | |||||

| BP CAPITAL MARKETS PLC REGD V/R /PERP/ 6.45000000 / DBT (US05565QDW50) | 1.01 | -1.47 | 0.0620 | 0.0077 | |||||

| BP CAPITAL MARKETS PLC REGD V/R /PERP/ 6.45000000 / DBT (US05565QDW50) | 1.01 | -1.47 | 0.0620 | 0.0077 | |||||

| US00206RLJ94 / AT&T, Inc. | 1.01 | -7.19 | 0.0620 | 0.0044 | |||||