Statistik Asas

| Nilai Portfolio | $ 48,314,321 |

| Kedudukan Semasa | 69 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

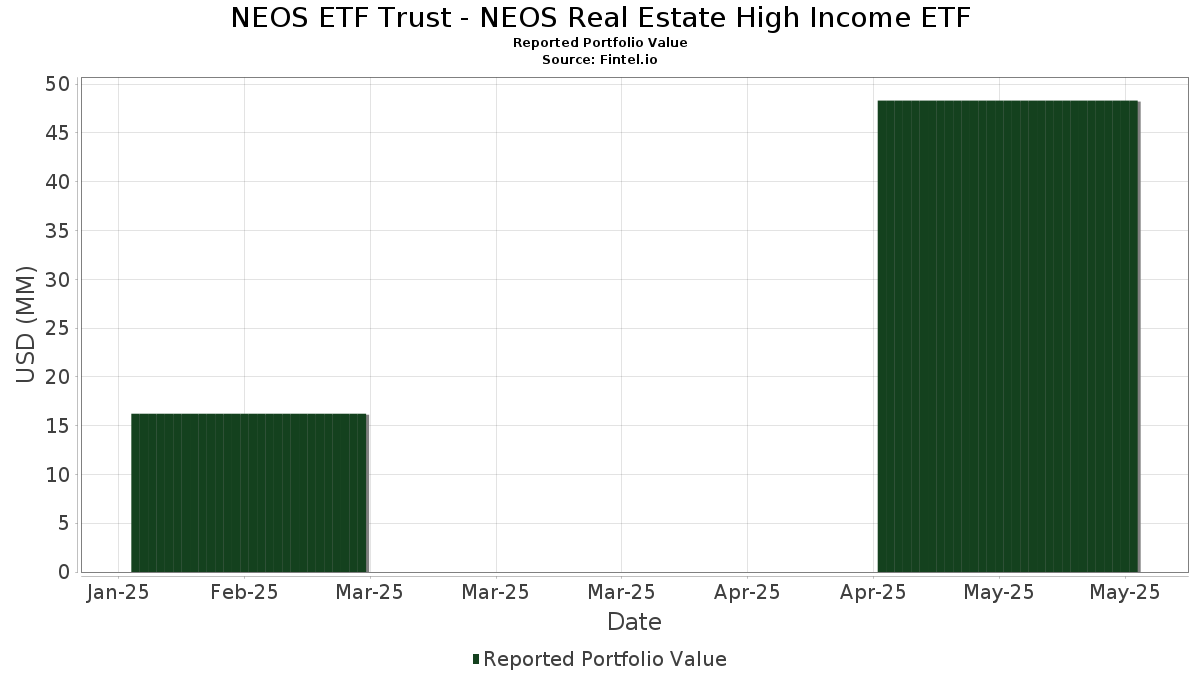

NEOS ETF Trust - NEOS Real Estate High Income ETF telah mendedahkan 69 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 48,314,321 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas NEOS ETF Trust - NEOS Real Estate High Income ETF ialah Prologis, Inc. (US:PLD) , American Tower Corporation (US:AMT) , Welltower Inc. (US:WELL) , Equinix, Inc. (US:EQIX) , and Digital Realty Trust, Inc. (US:DLR) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 3.40 | 7.0354 | 2.2466 | |

| 0.53 | 0.53 | 1.0969 | 1.0051 | |

| 0.01 | 2.02 | 4.1834 | 0.5147 | |

| 0.02 | 3.66 | 7.5649 | 0.4448 | |

| 0.02 | 1.63 | 3.3709 | 0.2920 | |

| 0.00 | 0.93 | 1.9187 | 0.1934 | |

| 0.01 | 1.80 | 3.7352 | 0.1705 | |

| 0.01 | 1.08 | 2.2272 | 0.1652 | |

| 0.03 | 1.85 | 3.8249 | 0.0646 | |

| 0.01 | 0.39 | 0.8045 | 0.0595 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 2.27 | 4.6925 | -1.7753 | |

| 0.07 | 0.07 | 0.1479 | -1.2101 | |

| 0.03 | 3.66 | 7.5772 | -0.9488 | |

| 0.01 | 1.86 | 3.8460 | -0.4499 | |

| 0.01 | 1.38 | 2.8461 | -0.3769 | |

| 0.01 | 0.40 | 0.8343 | -0.3467 | |

| -0.16 | -0.3281 | -0.3281 | ||

| 0.03 | 0.70 | 1.4469 | -0.2018 | |

| 0.00 | 0.39 | 0.8116 | -0.1452 | |

| 0.01 | 1.09 | 2.2543 | -0.1420 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-24 untuk tempoh pelaporan 2025-05-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PLD / Prologis, Inc. | 0.03 | 203.58 | 3.66 | 166.06 | 7.5772 | -0.9488 | |||

| AMT / American Tower Corporation | 0.02 | 204.69 | 3.66 | 218.10 | 7.5649 | 0.4448 | |||

| WELL / Welltower Inc. | 0.02 | 337.62 | 3.40 | 340.28 | 7.0354 | 2.2466 | |||

| EQIX / Equinix, Inc. | 0.00 | 121.06 | 2.27 | 117.35 | 4.6925 | -1.7753 | |||

| DLR / Digital Realty Trust, Inc. | 0.01 | 211.11 | 2.02 | 241.39 | 4.1834 | 0.5147 | |||

| SPG / Simon Property Group, Inc. | 0.01 | 205.85 | 1.86 | 168.11 | 3.8460 | -0.4499 | |||

| O / Realty Income Corporation | 0.03 | 206.72 | 1.85 | 204.95 | 3.8249 | 0.0646 | |||

| PSA / Public Storage | 0.01 | 208.81 | 1.80 | 213.74 | 3.7352 | 0.1705 | |||

| CCI / Crown Castle Inc. | 0.02 | 207.35 | 1.63 | 228.23 | 3.3709 | 0.2920 | |||

| CBRE / CBRE Group, Inc. | 0.01 | 200.14 | 1.38 | 164.42 | 2.8461 | -0.3769 | |||

| VICI / VICI Properties Inc. | 0.04 | 207.02 | 1.25 | 199.76 | 2.5819 | 0.0025 | |||

| EXR / Extra Space Storage Inc. | 0.01 | 206.45 | 1.19 | 203.83 | 2.4666 | 0.0345 | |||

| CSGP / CoStar Group, Inc. | 0.02 | 214.82 | 1.16 | 204.21 | 2.3926 | 0.0343 | |||

| AVB / AvalonBay Communities, Inc. | 0.01 | 208.07 | 1.09 | 182.12 | 2.2543 | -0.1420 | |||

| IRM / Iron Mountain Incorporated | 0.01 | 205.21 | 1.08 | 224.10 | 2.2272 | 0.1652 | |||

| VTR / Ventas, Inc. | 0.02 | 218.79 | 1.05 | 196.88 | 2.1692 | -0.0231 | |||

| SBAC / SBA Communications Corporation | 0.00 | 212.83 | 0.93 | 233.45 | 1.9187 | 0.1934 | |||

| EQR / Equity Residential | 0.01 | 207.77 | 0.89 | 191.18 | 1.8447 | -0.0527 | |||

| INVH / Invitation Homes Inc. | 0.02 | 207.27 | 0.72 | 204.68 | 1.4824 | 0.0248 | |||

| WY / Weyerhaeuser Company | 0.03 | 205.20 | 0.70 | 162.78 | 1.4469 | -0.2018 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.00 | 208.56 | 0.68 | 188.09 | 1.4025 | -0.0579 | |||

| ESS / Essex Property Trust, Inc. | 0.00 | 214.74 | 0.67 | 187.18 | 1.3925 | -0.0611 | |||

| SUI / Sun Communities, Inc. | 0.00 | 212.00 | 0.55 | 182.56 | 1.1422 | -0.0666 | |||

| KIM / Kimco Realty Corporation | 0.03 | 208.21 | 0.54 | 196.13 | 1.1111 | -0.0107 | |||

| Northern US Government Money Market Fund / STIV (US6651628488) | 0.53 | 3,476.45 | 0.53 | 3,685.71 | 1.0969 | 1.0051 | |||

| WPC / W. P. Carey Inc. | 0.01 | 206.34 | 0.51 | 199.42 | 1.0608 | 0.0002 | |||

| GLPI / Gaming and Leisure Properties, Inc. | 0.01 | 207.19 | 0.48 | 186.75 | 0.9872 | -0.0459 | |||

| CPT / Camden Property Trust | 0.00 | 211.42 | 0.47 | 195.57 | 0.9678 | -0.0146 | |||

| UDR / UDR, Inc. | 0.01 | 205.48 | 0.46 | 180.61 | 0.9600 | -0.0659 | |||

| DOC / Healthpeak Properties, Inc. | 0.03 | 207.08 | 0.45 | 162.43 | 0.9406 | -0.1370 | |||

| ELS / Equity LifeStyle Properties, Inc. | 0.01 | 206.40 | 0.45 | 184.91 | 0.9380 | -0.0507 | |||

| AMH / American Homes 4 Rent | 0.01 | 208.06 | 0.45 | 215.60 | 0.9218 | 0.0459 | |||

| REG / Regency Centers Corporation | 0.01 | 209.86 | 0.44 | 191.33 | 0.9055 | -0.0245 | |||

| NLY / Annaly Capital Management, Inc. | 0.02 | 217.66 | 0.41 | 173.83 | 0.8464 | -0.0780 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.01 | 208.10 | 0.40 | 112.11 | 0.8343 | -0.3467 | |||

| HST / Host Hotels & Resorts, Inc. | 0.03 | 205.14 | 0.40 | 192.70 | 0.8316 | -0.0180 | |||

| Z / Zillow Group, Inc. | 0.01 | 223.50 | 0.40 | 184.29 | 0.8240 | -0.0470 | |||

| JLL / Jones Lang LaSalle Incorporated | 0.00 | 210.04 | 0.39 | 154.55 | 0.8116 | -0.1452 | |||

| LAMR / Lamar Advertising Company | 0.00 | 206.60 | 0.39 | 199.24 | 0.8115 | -0.0051 | |||

| OHI / Omega Healthcare Investors, Inc. | 0.01 | 221.88 | 0.39 | 223.33 | 0.8045 | 0.0595 | |||

| BXP / Boston Properties, Inc. | 0.01 | 209.82 | 0.36 | 195.12 | 0.7516 | -0.0135 | |||

| CUBE / CubeSmart | 0.01 | 208.65 | 0.36 | 219.47 | 0.7481 | 0.0476 | |||

| EGP / EastGroup Properties, Inc. | 0.00 | 234.15 | 0.32 | 211.65 | 0.6660 | 0.0225 | |||

| ADC / Agree Realty Corporation | 0.00 | 220.39 | 0.30 | 229.67 | 0.6221 | 0.0524 | |||

| AGNC / AGNC Investment Corp. | 0.03 | 210.18 | 0.30 | 166.96 | 0.6196 | -0.0781 | |||

| REXR / Rexford Industrial Realty, Inc. | 0.01 | 211.57 | 0.30 | 166.67 | 0.6128 | -0.0776 | |||

| NNN / NNN REIT, Inc. | 0.01 | 208.69 | 0.29 | 204.17 | 0.6045 | 0.0086 | |||

| BRX / Brixmor Property Group Inc. | 0.01 | 210.07 | 0.29 | 182.35 | 0.5976 | -0.0373 | |||

| FRT / Federal Realty Investment Trust | 0.00 | 214.22 | 0.27 | 186.32 | 0.5632 | -0.0292 | |||

| STAG / STAG Industrial, Inc. | 0.01 | 214.16 | 0.25 | 211.39 | 0.5099 | 0.0185 | |||

| FR / First Industrial Realty Trust, Inc. | 0.00 | 209.01 | 0.24 | 168.89 | 0.5017 | -0.0596 | |||

| STWD / Starwood Property Trust, Inc. | 0.01 | 207.73 | 0.24 | 197.47 | 0.4883 | -0.0053 | |||

| VNO / Vornado Realty Trust | 0.01 | 208.55 | 0.23 | 178.31 | 0.4782 | -0.0396 | |||

| RITM / Rithm Capital Corp. | 0.02 | 207.21 | 0.22 | 182.89 | 0.4466 | -0.0276 | |||

| HR / Healthcare Realty Trust Incorporated | 0.01 | 206.72 | 0.19 | 160.27 | 0.3942 | -0.0603 | |||

| CUZ / Cousins Properties Incorporated | 0.01 | 208.72 | 0.17 | 185.25 | 0.3621 | -0.0173 | |||

| COLD / Americold Realty Trust, Inc. | 0.01 | 206.62 | 0.16 | 123.61 | 0.3334 | -0.1171 | |||

| SBRA / Sabra Health Care REIT, Inc. | 0.01 | 206.99 | 0.15 | 225.53 | 0.3180 | 0.0233 | |||

| ZG / Zillow Group, Inc. | 0.00 | 216.22 | 0.13 | 184.78 | 0.2724 | -0.0175 | |||

| KRC / Kilroy Realty Corporation | 0.00 | 215.16 | 0.13 | 186.36 | 0.2619 | -0.0139 | |||

| MRP / Millrose Properties, Inc. | 0.00 | 190.79 | 0.12 | 254.29 | 0.2585 | 0.0402 | |||

| RYN / Rayonier Inc. | 0.01 | 221.32 | 0.12 | 192.86 | 0.2550 | -0.0105 | |||

| PCH / PotlatchDeltic Corporation | 0.00 | 213.85 | 0.10 | 166.67 | 0.2159 | -0.0272 | |||

| LINE / Lineage, Inc. | 0.00 | 214.91 | 0.09 | 124.39 | 0.1923 | -0.0657 | |||

| HHH / Howard Hughes Holdings Inc. | 0.00 | 197.85 | 0.08 | 158.62 | 0.1566 | -0.0259 | |||

| FXFXX / First American Funds Inc - First American Treasury Obligations Fund Class X | 0.07 | -67.39 | 0.07 | -67.58 | 0.1479 | -1.2101 | |||

| SEG / Seaport Entertainment Group Inc. | 0.00 | 216.13 | 0.01 | 150.00 | 0.0119 | -0.0016 | |||

| IYR 06/20/2025 97 C / DE (N/A) | -0.06 | -0.1234 | -0.1234 | ||||||

| IYR 06/20/2025 95 C / DE (N/A) | -0.16 | -0.3281 | -0.3281 |