Statistik Asas

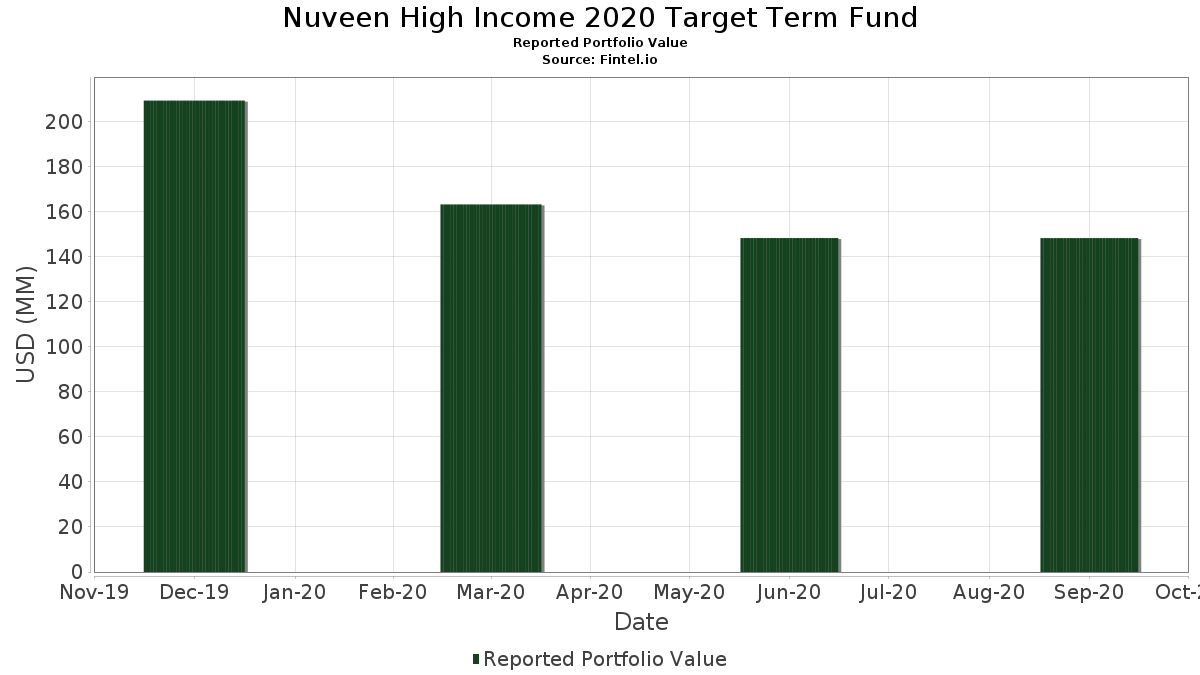

| Nilai Portfolio | $ 148,234,778 |

| Kedudukan Semasa | 49 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Nuveen High Income 2020 Target Term Fund telah mendedahkan 49 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 148,234,778 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Nuveen High Income 2020 Target Term Fund ialah CASH MGMT BILL 0.000000% 10/27/2020 (US:US9127964K26) , Ford Motor Credit Co LLC (US:US345397YS67) , Jupiter Securitization Co LLC (US:4820P2K12) , Limited Brands, Inc. 6.625% Senior Notes 04/01/21 (US:US532716AT46) , and CIT GROUP INC SR UNSECURED 03/21 4.125 (US:US125581GV41) . Kedudukan baharu Nuveen High Income 2020 Target Term Fund termasuk CASH MGMT BILL 0.000000% 10/27/2020 (US:US9127964K26) , Ford Motor Credit Co LLC (US:US345397YS67) , Jupiter Securitization Co LLC (US:4820P2K12) , Limited Brands, Inc. 6.625% Senior Notes 04/01/21 (US:US532716AT46) , and CIT GROUP INC SR UNSECURED 03/21 4.125 (US:US125581GV41) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 22.10 | 14.6902 | 14.6902 | ||

| 4.00 | 2.6590 | 2.6590 | ||

| 3.00 | 1.9942 | 1.9942 | ||

| 3.00 | 1.9942 | 1.9942 | ||

| 3.00 | 1.9942 | 1.9942 | ||

| 3.00 | 1.9942 | 1.9942 | ||

| 3.00 | 1.9941 | 1.9941 | ||

| 3.00 | 1.9941 | 1.9941 | ||

| 3.00 | 1.9941 | 1.9941 | ||

| 3.00 | 1.9941 | 1.9941 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.49 | 0.3229 | -3.3000 | ||

| 0.91 | 0.6073 | -0.6556 | ||

| 3.13 | 2.0833 | -0.0407 | ||

| 3.40 | 2.2626 | -0.0392 | ||

| 2.51 | 1.6682 | -0.0295 | ||

| 3.98 | 2.6488 | -0.0195 | ||

| 3.42 | 2.2701 | -0.0151 | ||

| 2.52 | 1.6723 | -0.0145 | ||

| 1.50 | 0.9985 | -0.0144 | ||

| 1.25 | 0.8340 | -0.0104 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2020-11-27 untuk tempoh pelaporan 2020-09-30. Pelabur ini tidak mendedahkan sekuriti yang dikira dalam saham, jadi lajur berkaitan saham dalam jadual di bawah tidak dimasukkan. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|

| US9127964K26 / CASH MGMT BILL 0.000000% 10/27/2020 | 22.10 | 14.6902 | 14.6902 | |||

| US345397YS67 / Ford Motor Credit Co LLC | 7.49 | 0.63 | 4.9794 | 0.0069 | ||

| 4820P2K12 / Jupiter Securitization Co LLC | 4.00 | 2.6590 | 2.6590 | |||

| US532716AT46 / Limited Brands, Inc. 6.625% Senior Notes 04/01/21 | 3.98 | -0.25 | 2.6488 | -0.0195 | ||

| US125581GV41 / CIT GROUP INC SR UNSECURED 03/21 4.125 | 3.42 | -0.15 | 2.2701 | -0.0151 | ||

| US64110LAE65 / Netflix, Inc. Bond | 3.40 | -1.22 | 2.2626 | -0.0392 | ||

| US988498AG64 / Yum! Brands Inc 3.875% Senior Notes 11/01/20 | 3.17 | 0.03 | 2.1083 | -0.0093 | ||

| US526057CK83 / Lennar Corp | 3.13 | -1.45 | 2.0833 | -0.0407 | ||

| Old Line Funding LLC / STIV (67983TK54) | 3.00 | 1.9942 | 1.9942 | |||

| 30229AK65 / Exxon Mobil Corp | 3.00 | 0.03 | 1.9942 | -0.0086 | ||

| Columbia Funding Co LLC / STIV (19767CK70) | 3.00 | 1.9942 | 1.9942 | |||

| Bennington Stark Capital Co LLC / STIV (08224LKD7) | 3.00 | 1.9942 | 1.9942 | |||

| NRW Bank / STIV (62939LKD0) | 3.00 | 1.9942 | 1.9942 | |||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 3.00 | 1.9941 | 1.9941 | |||

| Lloyds Bank PLC / STIV (53943RKD0) | 3.00 | 1.9941 | 1.9941 | |||

| 12619TKD5 / CRC Funding LLC | 3.00 | 1.9941 | 1.9941 | |||

| Cornell University / STIV (21920NKF8) | 3.00 | 1.9941 | 1.9941 | |||

| Corp Andina de Fomento / STIV (2198X2KE8) | 3.00 | 1.9940 | 1.9940 | |||

| Kells Funding LLC / STIV (PPEF0C5R0) | 3.00 | 1.9940 | 1.9940 | |||

| Private Export Funding Corp / STIV (7426M2KW0) | 3.00 | 1.9939 | 1.9939 | |||

| 22533TKU9 / Credit Agricole Corporate and Investment Bank/New York | 3.00 | 0.07 | 1.9939 | -0.0087 | ||

| MetLife Short Term Funding LLC / STIV (59157TKW2) | 3.00 | 1.9939 | 1.9939 | |||

| Crown Point Capital Co LLC / STIV (2284K0KN4) | 3.00 | 1.9939 | 1.9939 | |||

| Thunder Bay Funding LLC / STIV (88602TKS1) | 3.00 | 1.9939 | 1.9939 | |||

| Manhattan Asset Funding Co LLC / STIV (56274LKU7) | 3.00 | 1.9939 | 1.9939 | |||

| Halkin Finance LLC / STIV (40588LKU2) | 3.00 | 1.9939 | 1.9939 | |||

| 39021UKU9 / GREAT BRDGE CPTL CO LL | 3.00 | 0.07 | 1.9939 | -0.0084 | ||

| Sheffield Receivables Co LLC / STIV (82124LKS0) | 3.00 | 1.9938 | 1.9938 | |||

| Ciesco LLC / STIV (17177LKW3) | 3.00 | 1.9938 | 1.9938 | |||

| US85571BAP04 / Starwood Property Trust Inc | 3.00 | 1.70 | 1.9929 | 0.0239 | ||

| US63938CAA62 / Navient Corp | 2.87 | 0.42 | 1.9078 | -0.0014 | ||

| US745867AV39 / PulteGroup Inc | 2.52 | -0.40 | 1.6723 | -0.0145 | ||

| US900123BH29 / Turkey Government International Bond | 2.51 | -1.26 | 1.6682 | -0.0295 | ||

| US910047AG49 / United Airlines Holdings Inc | 2.51 | 1.01 | 1.6660 | 0.0085 | ||

| AVOL / Park Aerospace Holdings Ltd | 2.36 | 0.90 | 1.5720 | 0.0064 | ||

| US71654QAX07 / Petroleos Mexicanos | 2.27 | 1.11 | 1.5088 | 0.0095 | ||

| US02005NBG43 / Ally Financial Inc | 2.03 | -0.10 | 1.3522 | -0.0079 | ||

| US12553NK204 / Cigna Corporation | 2.00 | 1.3295 | 1.3295 | |||

| US247361ZM39 / Delta Air Lines Inc | 1.99 | 2.47 | 1.3244 | 0.0251 | ||

| US296464AA84 / Eskom Holdings SOC Ltd | 1.95 | 2.52 | 1.2967 | 0.0258 | ||

| US00928QAM33 / Aircastle Ltd Senior Notes 9.75% 08/01/2018 | 1.81 | 1.06 | 1.2019 | 0.0067 | ||

| US06739GBP37 / Barclays Bank Plc 5.140% Lower Tier 2 Notes 10/14/20 | 1.50 | -0.92 | 0.9985 | -0.0144 | ||

| US65412AAA07 / Nigeria Government International Bond | 1.25 | -0.79 | 0.8340 | -0.0104 | ||

| US37247DAN66 / Genworth Finl Inc Fixed Rt Senior Notes 7.2% 02/15/2021 | 1.00 | 7.49 | 0.6681 | 0.0435 | ||

| 94XL / Gold Fields Orogen Holdings BVI Ltd | 1.00 | -0.50 | 0.6632 | -0.0061 | ||

| US059613AC35 / Banco Nacional de Costa Rica | 0.91 | -51.69 | 0.6073 | -0.6556 | ||

| US85748R0096 / Dreyfus Institutional Preferred Government Plus Money Market Fund | 0.49 | -91.06 | 0.3229 | -3.3000 | ||

| US38869PAK03 / Graphic Packaging Intl 4.75% 04/15/21 | 0.45 | -0.44 | 0.3014 | -0.0030 | ||

| US74153QAH56 / Pride Intl Inc Del Fixed Rt Notes 6.875% 08/15/2020 | 0.11 | -5.83 | 0.0755 | -0.0047 |