Statistik Asas

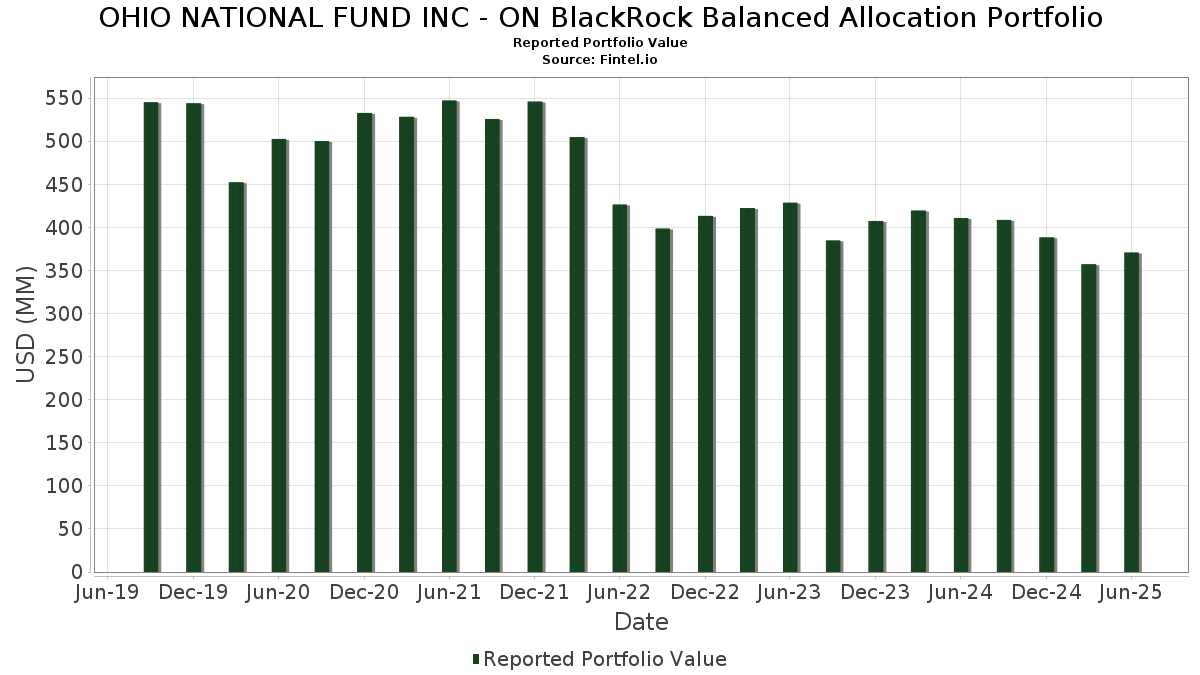

| Nilai Portfolio | $ 370,642,057 |

| Kedudukan Semasa | 228 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

OHIO NATIONAL FUND INC - ON BlackRock Balanced Allocation Portfolio telah mendedahkan 228 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 370,642,057 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas OHIO NATIONAL FUND INC - ON BlackRock Balanced Allocation Portfolio ialah Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) . Kedudukan baharu OHIO NATIONAL FUND INC - ON BlackRock Balanced Allocation Portfolio termasuk UnitedHealth Group Inc (US:US91324PDP45) , MPLX LP (US:US55336VBV18) , Hasbro, Inc. (US:US418056AZ06) , Waste Connections Inc (CA:WCNCN) , and Glencore Funding LLC (US:US378272BE79) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.13 | 20.80 | 5.5393 | 1.4107 | |

| 0.04 | 21.42 | 5.7056 | 1.0267 | |

| 0.01 | 3.03 | 0.8062 | 0.8062 | |

| 0.02 | 6.25 | 1.6651 | 0.6162 | |

| 0.03 | 2.88 | 0.7671 | 0.5904 | |

| 0.02 | 3.01 | 0.8028 | 0.5658 | |

| 0.00 | 2.22 | 0.5913 | 0.4958 | |

| 0.00 | 1.83 | 0.4885 | 0.4885 | |

| 0.00 | 2.34 | 0.6233 | 0.4592 | |

| 0.03 | 3.08 | 0.8200 | 0.4379 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 1.47 | 0.3924 | -0.6692 | |

| 0.08 | 17.24 | 4.5927 | -0.6356 | |

| 0.01 | 1.28 | 0.3406 | -0.5176 | |

| 0.01 | 1.56 | 0.4160 | -0.3685 | |

| 0.01 | 1.72 | 0.4586 | -0.3384 | |

| 0.00 | 0.48 | 0.1281 | -0.3266 | |

| 0.01 | 0.59 | 0.1569 | -0.3218 | |

| 0.00 | 2.65 | 0.7059 | -0.3124 | |

| 0.00 | 3.15 | 0.8376 | -0.3045 | |

| 0.00 | 1.52 | 0.4055 | -0.3005 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-27 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.04 | -4.56 | 21.42 | 26.46 | 5.7056 | 1.0267 | |||

| NVDA / NVIDIA Corporation | 0.13 | -4.55 | 20.80 | 39.15 | 5.5393 | 1.4107 | |||

| AAPL / Apple Inc. | 0.08 | -1.37 | 17.24 | -8.90 | 4.5927 | -0.6356 | |||

| AMZN / Amazon.com, Inc. | 0.06 | 0.00 | 12.64 | 15.31 | 3.3675 | 0.3388 | |||

| META / Meta Platforms, Inc. | 0.01 | -5.19 | 9.05 | 21.42 | 2.4111 | 0.3517 | |||

| GOOGL / Alphabet Inc. | 0.04 | -3.00 | 7.34 | 10.56 | 1.9549 | 0.1209 | |||

| AVGO / Broadcom Inc. | 0.02 | 0.00 | 6.25 | 64.66 | 1.6651 | 0.6162 | |||

| WMT / Walmart Inc. | 0.05 | 38.67 | 4.95 | 54.46 | 1.3189 | 0.4333 | |||

| GOOG / Alphabet Inc. | 0.02 | -4.52 | 4.25 | 8.42 | 1.1314 | 0.0491 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 0.00 | 3.98 | 18.20 | 1.0607 | 0.1299 | |||

| BAC / Bank of America Corporation | 0.08 | 0.00 | 3.80 | 13.41 | 1.0111 | 0.0864 | |||

| MS / Morgan Stanley | 0.02 | 36.49 | 3.51 | 64.79 | 0.9348 | 0.3465 | |||

| HD / The Home Depot, Inc. | 0.01 | 0.00 | 3.48 | 0.03 | 0.9269 | -0.0340 | |||

| MDT / Medtronic plc | 0.04 | 16.74 | 3.30 | 13.24 | 0.8791 | 0.0740 | |||

| COST / Costco Wholesale Corporation | 0.00 | -27.33 | 3.15 | -23.92 | 0.8376 | -0.3045 | |||

| SCHW / The Charles Schwab Corporation | 0.03 | 90.97 | 3.08 | 122.56 | 0.8200 | 0.4379 | |||

| TSLA / Tesla, Inc. | 0.01 | -27.88 | 3.03 | -11.62 | 0.8064 | -0.1396 | |||

| CRM / Salesforce, Inc. | 0.01 | 3.03 | 0.8062 | 0.8062 | |||||

| CAH / Cardinal Health, Inc. | 0.02 | 188.09 | 3.01 | 251.28 | 0.8028 | 0.5658 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | 0.00 | 2.91 | 1.18 | 0.7759 | -0.0195 | |||

| ETR / Entergy Corporation | 0.03 | 362.93 | 2.88 | 350.70 | 0.7671 | 0.5904 | |||

| LLY / Eli Lilly and Company | 0.00 | -23.84 | 2.65 | -28.11 | 0.7059 | -0.3124 | |||

| PH / Parker-Hannifin Corporation | 0.00 | -24.47 | 2.65 | -13.19 | 0.7044 | -0.1373 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 2.51 | 43.64 | 0.6680 | 0.1856 | |||

| CTAS / Cintas Corporation | 0.01 | -27.26 | 2.45 | -21.13 | 0.6531 | -0.2056 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -34.13 | 2.38 | -17.22 | 0.6337 | -0.1603 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | 375.77 | 2.34 | 293.94 | 0.6233 | 0.4592 | |||

| PFE / Pfizer Inc. | 0.10 | 58.25 | 2.31 | 51.44 | 0.6147 | 0.1936 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 16.00 | 2.30 | 5.81 | 0.6117 | 0.0121 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 2.24 | 2.56 | 0.5968 | -0.0069 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | 0.00 | 2.24 | 3.71 | 0.5953 | -0.0002 | |||

| PM / Philip Morris International Inc. | 0.01 | 0.00 | 2.23 | 14.75 | 0.5949 | 0.0572 | |||

| EQIX / Equinix, Inc. | 0.00 | 558.25 | 2.22 | 543.48 | 0.5913 | 0.4958 | |||

| BMY / Bristol-Myers Squibb Company | 0.05 | 54.24 | 2.12 | 38.02 | 0.5647 | 0.1948 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 2.10 | 3.66 | 0.5590 | -0.0002 | |||

| ADBE / Adobe Inc. | 0.01 | 0.00 | 2.09 | 0.87 | 0.5571 | -0.0157 | |||

| ICE / Intercontinental Exchange, Inc. | 0.01 | 0.00 | 2.06 | 6.35 | 0.5484 | 0.0137 | |||

| GMZB / Ally Financial Inc. - Preferred Stock | 2.03 | 1.96 | 0.5401 | -0.0095 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 2.02 | 1.25 | 0.5392 | -0.0129 | |||||

| MSI / Motorola Solutions, Inc. | 0.00 | -19.23 | 2.00 | -22.42 | 0.5338 | -0.1799 | |||

| CMCSA / Comcast Corporation | 0.06 | -12.17 | 1.99 | -15.05 | 0.5309 | -0.1173 | |||

| US91324PDP45 / UnitedHealth Group Inc | 1.97 | 0.56 | 0.5258 | -0.0166 | |||||

| US55336VBV18 / MPLX LP | 1.97 | 1.02 | 0.5252 | -0.0140 | |||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 1.95 | -1.17 | 0.5188 | -0.0254 | |||||

| D1VN34 / Devon Energy Corporation - Depositary Receipt (Common Stock) | 1.94 | 0.67 | 0.5173 | -0.0155 | |||||

| US418056AZ06 / Hasbro, Inc. | 1.93 | 1.37 | 0.5136 | -0.0119 | |||||

| DVN / Devon Energy Corporation | 0.06 | 62.20 | 1.90 | 37.95 | 0.5065 | 0.1258 | |||

| ABBV / AbbVie Inc. | 0.01 | 19.59 | 1.88 | 5.93 | 0.4998 | 0.0106 | |||

| WCNCN / Waste Connections Inc | 1.86 | 2.09 | 0.4956 | -0.0077 | |||||

| FDX / FedEx Corporation | 0.01 | 380.55 | 1.85 | 348.67 | 0.4937 | 0.3794 | |||

| INTU / Intuit Inc. | 0.00 | 1.83 | 0.4885 | 0.4885 | |||||

| US378272BE79 / Glencore Funding LLC | 1.80 | 2.33 | 0.4802 | -0.0065 | |||||

| LRCX / Lam Research Corporation | 0.02 | -9.34 | 1.80 | 21.38 | 0.4796 | 0.0698 | |||

| US172967MY46 / Citigroup Inc | 1.77 | 1.96 | 0.4719 | -0.0080 | |||||

| US40434LAJ44 / HP, Inc. | 1.77 | 1.67 | 0.4714 | -0.0094 | |||||

| US37045XDL73 / GENERAL MOTORS FINL CO SR UNSECURED 06/31 2.7 | 1.75 | 2.64 | 0.4663 | -0.0049 | |||||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 1.73 | 3.77 | 0.4619 | 0.0003 | |||

| SPG / Simon Property Group, Inc. | 0.01 | -38.35 | 1.72 | -40.35 | 0.4586 | -0.3384 | |||

| PKG / Packaging Corporation of America | 0.01 | -19.81 | 1.61 | -23.68 | 0.4284 | -0.1538 | |||

| MCO / Moody's Corporation | 0.00 | 0.00 | 1.60 | 7.74 | 0.4261 | 0.0158 | |||

| CME / CME Group Inc. | 0.01 | -22.92 | 1.60 | -19.90 | 0.4256 | -0.1256 | |||

| US20030NCY58 / Comcast Corp | 1.57 | 0.84 | 0.4173 | -0.0117 | |||||

| PGR / The Progressive Corporation | 0.01 | -41.68 | 1.56 | -45.00 | 0.4160 | -0.3685 | |||

| MRK / Merck & Co., Inc. | 0.02 | 27.12 | 1.55 | 12.18 | 0.4120 | 0.0309 | |||

| BK / The Bank of New York Mellon Corporation - Depositary Receipt (Common Stock) | 1.53 | 0.66 | 0.4069 | -0.0122 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 1.52 | -40.45 | 0.4055 | -0.3005 | |||

| APH / Amphenol Corporation | 0.02 | -45.91 | 1.49 | -18.56 | 0.3975 | -0.1087 | |||

| US69349LAR96 / PNC Bank NA | 1.49 | 1.22 | 0.3963 | -0.0097 | |||||

| V / Visa Inc. | 0.00 | -62.16 | 1.47 | -61.67 | 0.3924 | -0.6692 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 3.55 | 1.43 | 40.04 | 0.3819 | 0.1449 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | 0.00 | 1.43 | -1.10 | 0.3816 | -0.0184 | |||

| AME / AMETEK, Inc. | 0.01 | 252.25 | 1.39 | 282.92 | 0.3704 | 0.2829 | |||

| PLTR / Palantir Technologies Inc. | 0.01 | 45.12 | 1.35 | 134.49 | 0.3604 | 0.2010 | |||

| US191216DL17 / Coca-Cola Co. (The) | 1.33 | -0.38 | 0.3539 | -0.0145 | |||||

| US314353AA14 / FedEx Corp 2020-1 Class AA Pass Through Trust | 1.31 | 2.10 | 0.3492 | -0.0055 | |||||

| ED / Consolidated Edison, Inc. | 0.01 | 0.00 | 1.30 | -9.25 | 0.3451 | -0.0493 | |||

| RL / Ralph Lauren Corporation | 0.00 | 1.29 | 0.3440 | 0.3440 | |||||

| US260543CK73 / Dow Chemical Co/The | 1.29 | 0.70 | 0.3429 | -0.0102 | |||||

| CL / Colgate-Palmolive Company | 0.01 | -57.57 | 1.28 | -58.87 | 0.3406 | -0.5176 | |||

| UBER / Uber Technologies, Inc. | 0.01 | 0.00 | 1.26 | 28.06 | 0.3344 | 0.0636 | |||

| MRVL / Marvell Technology, Inc. | 0.02 | 283.61 | 1.23 | 383.14 | 0.3282 | 0.2576 | |||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1.21 | 1.17 | 0.3235 | -0.0080 | |||||

| BX / Blackstone Inc. | 0.01 | 1.19 | 0.3183 | 0.3183 | |||||

| SHELL FINANCE US INC COMPANY GUAR 05/46 4 / DBT (US822905AE56) | 1.19 | -0.75 | 0.3176 | -0.0143 | |||||

| US90932JAA07 / United Airlines 2019-2 Class AA Pass Through Trust | 1.18 | -2.55 | 0.3152 | -0.0201 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 1.18 | 0.43 | 0.3136 | -0.0101 | |||||

| US025816DA48 / American Express Co. | 1.17 | 1.12 | 0.3119 | -0.0080 | |||||

| US87264ABF12 / CORP. NOTE | 1.17 | 1.30 | 0.3104 | -0.0073 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 0.00 | 1.11 | 38.09 | 0.2965 | 0.0739 | |||

| US26441CAT27 / Duke Energy Corp | 1.11 | 0.54 | 0.2958 | -0.0093 | |||||

| TRGP / Targa Resources Corp. | 0.01 | 232.31 | 1.10 | 188.68 | 0.2923 | 0.1872 | |||

| US166764BY53 / CHEVRON CORP NEW 2.236% 05/11/2030 | 1.10 | 1.67 | 0.2918 | -0.0058 | |||||

| PG / The Procter & Gamble Company | 0.01 | 0.00 | 1.07 | -6.53 | 0.2859 | -0.0313 | |||

| BSX / Boston Scientific Corporation | 0.01 | 121.04 | 1.07 | 135.54 | 0.2843 | 0.1590 | |||

| US427866BE76 / HSY 1.7 06/01/30 | 1.06 | 1.82 | 0.2833 | -0.0051 | |||||

| US72147KAK43 / Pilgrim's Pride Corp 6.250%, Due 07/01/33 | 1.06 | 2.13 | 0.2816 | -0.0043 | |||||

| BWA / BorgWarner Inc. | 0.03 | 0.00 | 1.04 | 16.82 | 0.2777 | 0.0312 | |||

| US75886FAE79 / Regeneron Pharmaceuticals Inc | 1.04 | 1.86 | 0.2776 | -0.0051 | |||||

| US928563AL97 / VMware Inc | 1.04 | 2.16 | 0.2774 | -0.0043 | |||||

| APOLLO DEBT SOLUTIONS BD SR UNSECURED 07/31 6.7 / DBT (US03770DAD57) | 1.04 | 0.78 | 0.2767 | -0.0082 | |||||

| US88732JAJ79 / Time Warner Cable 6.55% Guaranteed Notes 5/1/37 | 1.03 | 4.14 | 0.2751 | 0.0011 | |||||

| HCA INC COMPANY GUAR 03/32 5.5 / DBT (US404119DA49) | 1.03 | 2.28 | 0.2749 | -0.0040 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 1.03 | 2.18 | 0.2746 | -0.0043 | |||||

| BANK OF AMERICA CORP SR UNSECURED 01/36 VAR / DBT (US06051GMM86) | 1.03 | 1.08 | 0.2738 | -0.0073 | |||||

| US25466AAN19 / Discover Bank | 1.02 | 0.29 | 0.2729 | -0.0093 | |||||

| OAKTREE STRATEGIC CREDIT SR UNSECURED 07/29 6.5 / DBT (US67403AAE91) | 1.02 | 0.29 | 0.2727 | -0.0093 | |||||

| US337158AJ88 / FIRST HORIZON BANK | 1.02 | 0.2724 | 0.2724 | ||||||

| HYUNDAI CAPITAL AMERICA SR UNSECURED 144A 01/30 5.3 / DBT (US44891ADM62) | 1.02 | 1.49 | 0.2720 | -0.0061 | |||||

| BHP BILLITON FIN USA LTD COMPANY GUAR 02/35 5.3 / DBT (US055451BL10) | 1.02 | 1.19 | 0.2719 | -0.0067 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 1.02 | 0.89 | 0.2718 | -0.0076 | |||||

| TOL / Toll Brothers, Inc. | 0.01 | -13.15 | 1.02 | -6.08 | 0.2717 | -0.0285 | |||

| MO / Altria Group, Inc. - Depositary Receipt (Common Stock) | 1.02 | 0.99 | 0.2715 | -0.0072 | |||||

| 30064K105 / Exacttarget, Inc. | 1.02 | 1.09 | 0.2713 | -0.0070 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.02 | 1.40 | 0.2710 | -0.0063 | |||||

| US29278NAF06 / Energy Transfer Operating LP | 1.01 | 0.80 | 0.2703 | -0.0078 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 1.01 | 0.60 | 0.2700 | -0.0082 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1.01 | 1.31 | 0.2686 | -0.0062 | |||||

| US05526DBP96 / BAT CAPITAL CORP COMPANY GUAR 04/27 4.7 | 1.00 | 0.30 | 0.2676 | -0.0090 | |||||

| US30212PBK03 / Expedia Group Inc | 1.00 | 0.50 | 0.2674 | -0.0087 | |||||

| ETN / Eaton Corporation plc | 0.00 | -60.14 | 1.00 | -47.68 | 0.2673 | -0.2623 | |||

| KCN / Kinross Gold Corp | 1.00 | 0.40 | 0.2666 | -0.0085 | |||||

| TAKEDA US FIN COMPANY GUAR 07/35 5.2 / DBT (US87406BAA08) | 1.00 | 0.2663 | 0.2663 | ||||||

| CON EDISON CO OF NY INC SR UNSECURED 05/54 5.7 / DBT (US209111GK37) | 1.00 | 0.20 | 0.2659 | -0.0094 | |||||

| US49456BAG68 / KINDER MORGAN INC COMPANY GUAR 12/34 5.3 | 1.00 | 1.12 | 0.2657 | -0.0069 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1.00 | 0.40 | 0.2657 | -0.0087 | |||||

| JERSEY CENTRAL PWR + LT SR UNSECURED 01/35 5.1 / DBT (US476556DF91) | 1.00 | 0.2655 | 0.2655 | ||||||

| US911365BG81 / United Rentals North America Inc | 1.00 | 1.43 | 0.2653 | -0.0062 | |||||

| US87305QCP46 / TTX COMPANY | 0.99 | -2.27 | 0.2641 | -0.0161 | |||||

| COMMONWEALTH EDISON CO 1ST MORTGAGE 06/54 5.65 / DBT (US202795KA72) | 0.99 | 0.00 | 0.2639 | -0.0096 | |||||

| TJX / The TJX Companies, Inc. | 0.01 | -35.26 | 0.99 | -34.37 | 0.2635 | -0.1529 | |||

| US015271AK55 / Alexandria Real Estate Equities Inc | 0.99 | 0.61 | 0.2634 | -0.0082 | |||||

| US96949LAD73 / Williams Cos Inc/The | 0.99 | 0.51 | 0.2632 | -0.0083 | |||||

| US07330MAC10 / Truist Bank | 0.99 | 1.02 | 0.2632 | -0.0070 | |||||

| US10373QAV23 / BP CAP MARKETS AMERICA COMPANY GUAR 01/27 3.017 | 0.98 | 0.61 | 0.2619 | -0.0081 | |||||

| US05723KAE01 / Baker Hughes, a GE Co., LLC/Baker Hughes Co-Obligor, Inc. | 0.98 | 0.20 | 0.2609 | -0.0090 | |||||

| US03027XAX84 / AMERICAN TOWER CORP SR UNSECURED 01/27 2.75 | 0.98 | 0.83 | 0.2600 | -0.0074 | |||||

| US03522AAH32 / Anheuser-Busch Cos LLC / Anheuser-Busch InBev Worldwide Inc | 0.98 | -49.43 | 0.2599 | -0.2728 | |||||

| FDX / FedEx Corporation - Depositary Receipt (Common Stock) | 0.97 | 0.83 | 0.2589 | -0.0074 | |||||

| US718172CJ63 / PHILIP MORRIS INTL INC SR UNSECURED 08/29 3.375 | 0.96 | 1.15 | 0.2569 | -0.0066 | |||||

| US406216BJ98 / Halliburton Co. COM | 0.96 | 0.31 | 0.2563 | -0.0086 | |||||

| US00206RFW79 / AT&T Inc. | 0.96 | 0.42 | 0.2552 | -0.0083 | |||||

| US00287YBX67 / CORP. NOTE | 0.96 | 1.27 | 0.2547 | -0.0062 | |||||

| US68389XAV73 / Oracle Corp | 0.95 | 2.04 | 0.2529 | -0.0040 | |||||

| US023608AJ15 / AMEREN CORP SR UNSECURED 01/31 3.5 | 0.94 | 1.61 | 0.2516 | -0.0050 | |||||

| C / Citigroup Inc. | 0.01 | -36.07 | 0.94 | -23.33 | 0.2513 | -0.0887 | |||

| US521865BB05 / Lear Corp. | 0.94 | 1.95 | 0.2510 | -0.0043 | |||||

| US092113AR00 / BLACK HILLS CORP SR UNSECURED 10/29 3.05 | 0.94 | 1.08 | 0.2497 | -0.0065 | |||||

| US87612EBJ47 / Target Corp. | 0.92 | -49.09 | 0.2457 | -0.2547 | |||||

| XOM / Exxon Mobil Corporation | 0.01 | 0.00 | 0.92 | -9.36 | 0.2451 | -0.0353 | |||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0.92 | -2.14 | 0.2440 | -0.0145 | |||||

| US00774MAX39 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.91 | 2.26 | 0.2413 | -0.0034 | |||||

| US023135BF28 / Amazon.com Inc | 0.90 | 0.56 | 0.2409 | -0.0074 | |||||

| US50077LAX47 / KRAFT HEINZ FOODS CO 4.625% 10/01/2039 | 0.90 | -0.99 | 0.2389 | -0.0115 | |||||

| VZ / Verizon Communications Inc. | 0.02 | 0.00 | 0.90 | -4.58 | 0.2384 | -0.0208 | |||

| US857477BP72 / State Street Corp | 0.88 | 1.84 | 0.2356 | -0.0042 | |||||

| US09247XAS09 / BlackRock Inc | 0.86 | 1.53 | 0.2298 | -0.0049 | |||||

| UPS / United Parcel Service, Inc. | 0.01 | 89.78 | 0.86 | 21.94 | 0.2281 | 0.0581 | |||

| FIX / Comfort Systems USA, Inc. | 0.00 | 0.00 | 0.85 | 66.47 | 0.2275 | 0.0857 | |||

| US33767BAC37 / FIRSTENERGY TRANSMISSION SR UNSECURED 144A 04/49 4.55 | 0.85 | -0.94 | 0.2257 | -0.0106 | |||||

| US202795JG61 / COMMONWEALTH EDISON CO 1ST MORTGAGE 11/45 4.35 | 0.85 | 0.60 | 0.2251 | -0.0071 | |||||

| FLS / Flowserve Corporation | 0.02 | 0.83 | 0.2216 | 0.2216 | |||||

| CMI / Cummins Inc. | 0.00 | 0.00 | 0.83 | 4.53 | 0.2214 | 0.0016 | |||

| DIS / The Walt Disney Company | 0.01 | 38.03 | 0.83 | 81.40 | 0.2208 | 0.1151 | |||

| JBS USA HOLD/FOOD GRP/CO COMPANY GUAR 144A 04/66 6.375 / DBT (US472140AJ19) | 0.81 | 0.2146 | 0.2146 | ||||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -41.83 | 0.80 | -52.59 | 0.2123 | -0.2522 | |||

| US224044CC99 / Cox Communications Inc | 0.79 | -0.87 | 0.2114 | -0.0098 | |||||

| US00115AAF66 / AEP TRANSMISSION CO LLC SR UNSECURED 12/46 4 | 0.79 | -0.63 | 0.2105 | -0.0093 | |||||

| US207597EL50 / CONNECTICUT LIGHT + PWR 1ST REF MORT 04/48 4 | 0.78 | -0.88 | 0.2089 | -0.0096 | |||||

| NDAQ / Nasdaq, Inc. | 0.01 | 0.00 | 0.78 | 17.82 | 0.2079 | 0.0250 | |||

| BLACKROCK FUNDING INC COMPANY GUAR 01/55 5.35 / DBT (US09290DAK72) | 0.78 | -42.76 | 0.2076 | -0.1684 | |||||

| NEM / Newmont Corporation | 0.01 | 98.02 | 0.77 | 132.63 | 0.2052 | 0.1261 | |||

| ECL / Ecolab Inc. | 0.00 | -27.65 | 0.76 | -23.11 | 0.2030 | -0.0708 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.01 | 0.00 | 0.76 | -5.01 | 0.2021 | -0.0185 | |||

| US00115AAH23 / AEP TRANSMISSION CO LLC SR UNSECURED 12/47 3.75 | 0.76 | 0.00 | 0.2016 | -0.0075 | |||||

| US95000U2Q52 / Wells Fargo & Co | 0.76 | 1.34 | 0.2013 | -0.0046 | |||||

| XS1040508167 / Imperial Brands Finance plc | 0.75 | 0.2004 | 0.2004 | ||||||

| US74456QBT22 / Public Service Electric & Gas Co | 0.74 | -1.33 | 0.1973 | -0.0099 | |||||

| HON / Honeywell International Inc. | 0.00 | -41.09 | 0.70 | -34.58 | 0.1866 | -0.0723 | |||

| LNG / Cheniere Energy, Inc. | 0.00 | 0.00 | 0.69 | 5.20 | 0.1835 | 0.0027 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | -59.24 | 0.68 | -56.80 | 0.1813 | -0.2536 | |||

| US26443TAB26 / Duke Energy Indiana LLC | 0.68 | 0.15 | 0.1807 | -0.0065 | |||||

| US341081FX06 / Florida Power & Light Co | 0.68 | -0.59 | 0.1799 | -0.0078 | |||||

| DRI / Darden Restaurants, Inc. | 0.00 | -62.93 | 0.65 | -47.93 | 0.1740 | 0.1740 | |||

| BEACH ACQUISITION BIDCO BEACH ACQUISITION BIDCO / DBT (US07337JAC18) | 0.65 | 0.1739 | 0.1739 | ||||||

| FLEX / Flex Ltd. | 0.01 | -25.91 | 0.65 | 37.23 | 0.1719 | 0.0519 | |||

| OGE / OGE Energy Corp. | 0.01 | -20.11 | 0.64 | -22.89 | 0.1706 | -0.0588 | |||

| NUE / Nucor Corporation | 0.00 | -27.06 | 0.64 | -21.41 | 0.1691 | -0.0543 | |||

| US548661DZ79 / Lowe's Cos Inc | 0.62 | -0.16 | 0.1664 | -0.0063 | |||||

| US92343VFU35 / Verizon Communications 4.862%, due 08/21/2046 | 0.62 | 0.00 | 0.1659 | -0.0061 | |||||

| AXP / American Express Company | 0.00 | 0.00 | 0.61 | 18.76 | 0.1635 | 0.0205 | |||

| SIXTH STREET LENDING PAR SR UNSECURED 144A 07/30 6.125 / DBT (US829932AE25) | 0.61 | 1.16 | 0.1627 | -0.0041 | |||||

| CNC / Centene Corporation | 0.01 | -42.05 | 0.61 | -48.25 | 0.1616 | -0.1619 | |||

| DAL / Delta Air Lines, Inc. | 0.01 | 0.00 | 0.61 | 12.85 | 0.1616 | 0.0130 | |||

| CUBE / CubeSmart | 0.01 | 0.00 | 0.60 | -0.50 | 0.1608 | -0.0068 | |||

| KO / The Coca-Cola Company | 0.01 | -65.59 | 0.59 | -66.01 | 0.1569 | -0.3218 | |||

| MTZ / MasTec, Inc. | 0.00 | 0.00 | 0.58 | 46.12 | 0.1555 | 0.0451 | |||

| RTX / RTX Corporation | 0.00 | 0.58 | 0.1532 | 0.1532 | |||||

| KDP / Keurig Dr Pepper Inc. | 0.02 | -53.52 | 0.57 | -56.61 | 0.1523 | -0.1523 | |||

| NTRA / Natera, Inc. | 0.00 | 0.00 | 0.56 | 19.49 | 0.1503 | 0.0198 | |||

| VTR / Ventas, Inc. | 0.01 | -23.50 | 0.56 | -29.76 | 0.1486 | -0.0707 | |||

| WMB / The Williams Companies, Inc. | 0.01 | 0.54 | 0.1442 | 0.1442 | |||||

| WCN / Waste Connections, Inc. | 0.00 | 134.68 | 0.53 | 221.82 | 0.1417 | 0.1117 | |||

| COP / ConocoPhillips | 0.01 | 0.00 | 0.53 | -14.50 | 0.1400 | -0.0299 | |||

| FTNT / Fortinet, Inc. | 0.00 | -66.00 | 0.52 | -62.69 | 0.1392 | -0.2474 | |||

| WM / Waste Management, Inc. | 0.00 | 0.00 | 0.52 | -1.14 | 0.1389 | -0.0068 | |||

| AZO / AutoZone, Inc. | 0.00 | 0.52 | 0.1384 | 0.1384 | |||||

| HBAN / Huntington Bancshares Incorporated | 0.03 | 235.36 | 0.51 | 266.43 | 0.1367 | 0.1112 | |||

| ESTC / Elastic N.V. | 0.01 | 0.49 | 0.1295 | 0.1295 | |||||

| NOW / ServiceNow, Inc. | 0.00 | -77.37 | 0.48 | -70.78 | 0.1281 | -0.3266 | |||

| PCG / PG&E Corporation | 0.03 | 0.47 | 0.1264 | 0.1264 | |||||

| BMRN / BioMarin Pharmaceutical Inc. | 0.01 | 0.00 | 0.46 | -22.18 | 0.1216 | -0.0406 | |||

| ACN / Accenture plc | 0.00 | -64.95 | 0.45 | -66.47 | 0.1211 | -0.2530 | |||

| TT / Trane Technologies plc | 0.00 | -71.62 | 0.44 | -63.21 | 0.1185 | -0.2150 | |||

| YUM / Yum! Brands, Inc. | 0.00 | 0.44 | 0.1174 | 0.1174 | |||||

| AR / Antero Resources Corporation | 0.01 | 0.42 | 0.1128 | 0.1128 | |||||

| USP3143NBK92 / Corp Nacional del Cobre de Chile | 0.42 | 0.97 | 0.1105 | -0.0030 | |||||

| HEIA / Heico Corp. - Class A | 0.00 | -88.90 | 0.39 | -72.75 | 0.1050 | -0.2296 | |||

| EW / Edwards Lifesciences Corporation | 0.00 | 0.00 | 0.37 | 8.09 | 0.0997 | 0.0039 | |||

| FI / Fiserv, Inc. | 0.00 | 16.18 | 0.37 | 87.24 | 0.0979 | 0.0622 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | 0.36 | 0.0958 | 0.0958 | |||||

| GD / General Dynamics Corporation | 0.00 | -59.73 | 0.35 | -56.99 | 0.0945 | -0.1330 | |||

| UNP / Union Pacific Corporation | 0.00 | -23.72 | 0.35 | -15.51 | 0.0944 | -0.0057 | |||

| LAD / Lithia Motors, Inc. | 0.00 | 37.62 | 0.34 | 56.22 | 0.0905 | 0.0512 | |||

| FICO / Fair Isaac Corporation | 0.00 | 0.00 | 0.31 | -0.95 | 0.0837 | -0.0039 | |||

| FOXA / Fox Corporation | 0.01 | 0.00 | 0.29 | -1.02 | 0.0776 | -0.0037 | |||

| S+P500 EMINI FUT SEP25 XCME 20250919 / DE (000000000) | 0.13 | 0.0340 | 0.0340 | ||||||

| US90933HAA32 / United Airlines Pass Through Trust, Series 2016-1, Class B | 0.08 | 1.28 | 0.0211 | -0.0007 | |||||

| FOX / Fox Corporation | 0.00 | -1.72 | 0.04 | -2.78 | 0.0094 | -0.0007 | |||

| US92343VCQ59 / Verizon Communications Inc | 0.00 | -100.00 | 0.0000 | -0.2609 | |||||

| IRM / Iron Mountain Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.2948 | ||||

| STZ / Constellation Brands, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1480 | ||||

| SAIL / SailPoint, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0175 | ||||

| TXRH / Texas Roadhouse, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1450 |