Statistik Asas

| Nilai Portfolio | $ 299,343,973 |

| Kedudukan Semasa | 184 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

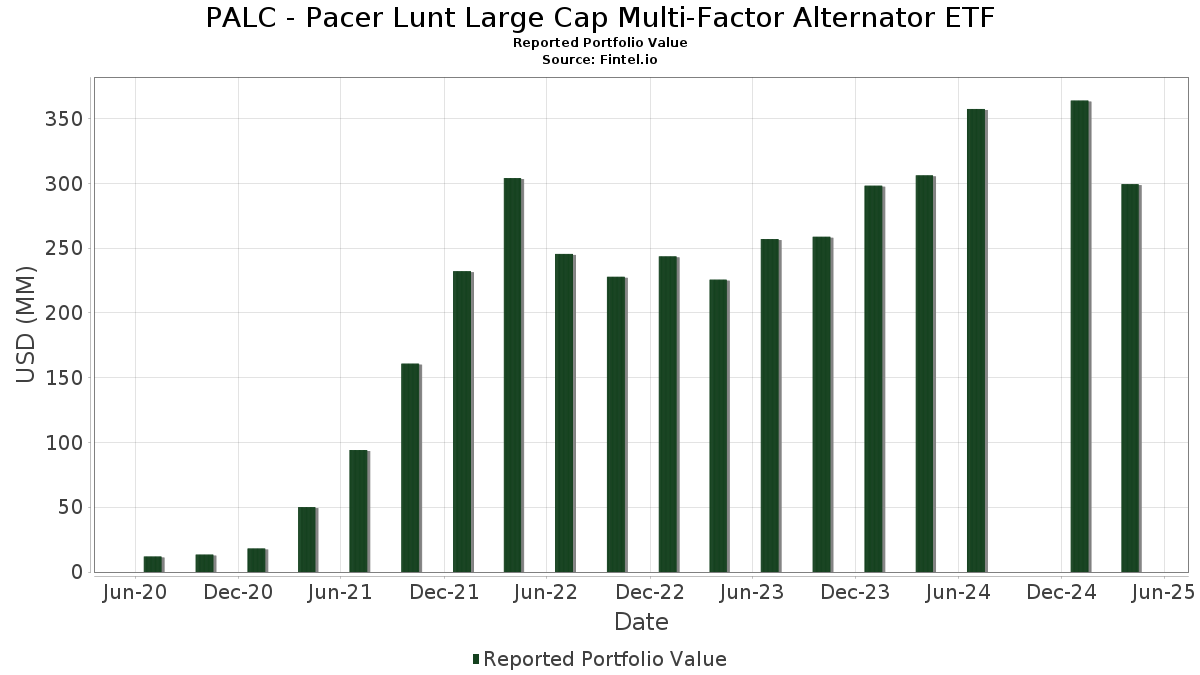

PALC - Pacer Lunt Large Cap Multi-Factor Alternator ETF telah mendedahkan 184 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 299,343,973 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas PALC - Pacer Lunt Large Cap Multi-Factor Alternator ETF ialah Berkshire Hathaway Inc. (US:BRK.B) , Exxon Mobil Corporation (US:XOM) , Chevron Corporation (US:CVX) , Bank of America Corporation (US:BAC) , and Wells Fargo & Company (US:WFC) . Kedudukan baharu PALC - Pacer Lunt Large Cap Multi-Factor Alternator ETF termasuk VICI Properties Inc. (US:VICI) , Regency Centers Corporation (US:REG) , BlackRock, Inc. (US:BLK) , PPG Industries, Inc. (US:PPG) , and Federal Realty Investment Trust (US:FRT) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 8.46 | 2.8920 | 2.8920 | |

| 7.08 | 7.08 | 2.4219 | 2.4219 | |

| 0.19 | 5.19 | 1.7749 | 1.7749 | |

| 0.02 | 4.77 | 1.6321 | 1.6321 | |

| 0.02 | 10.72 | 3.6650 | 1.5827 | |

| 0.06 | 2.94 | 1.0057 | 1.0057 | |

| 0.08 | 2.46 | 0.8427 | 0.8427 | |

| 0.01 | 3.36 | 1.1494 | 0.8124 | |

| 0.09 | 6.41 | 2.1924 | 0.8041 | |

| 0.01 | 3.68 | 1.2584 | 0.7559 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 1.29 | 0.4421 | -2.5148 | |

| 0.00 | 1.52 | 0.5193 | -2.2464 | |

| 0.01 | 1.61 | 0.5510 | -1.7686 | |

| 0.00 | 0.00 | -1.5614 | ||

| 0.00 | 1.51 | 0.5151 | -1.5017 | |

| 0.00 | 1.51 | 0.5172 | -1.2177 | |

| 0.01 | 1.65 | 0.5634 | -1.1626 | |

| 0.02 | 1.29 | 0.4408 | -1.0909 | |

| 0.01 | 1.37 | 0.4677 | -1.0408 | |

| 0.00 | 0.00 | -0.7921 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-06-30 untuk tempoh pelaporan 2025-04-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BRK.B / Berkshire Hathaway Inc. | 0.02 | 22.12 | 10.72 | 48.51 | 3.6650 | 1.5827 | |||

| XOM / Exxon Mobil Corporation | 0.08 | 8.46 | 2.8920 | 2.8920 | |||||

| CVX / Chevron Corporation | 0.05 | 26.24 | 7.10 | 6.51 | 2.4288 | 0.1839 | |||

| Mount Vernon Liquid Assets Portfolio, LLC / STIV (N/A) | 7.08 | 7.08 | 2.4219 | 2.4219 | |||||

| BAC / Bank of America Corporation | 0.16 | 9.24 | 6.53 | -5.91 | 2.2337 | 0.2963 | |||

| WFC / Wells Fargo & Company | 0.09 | 43.02 | 6.41 | 28.89 | 2.1924 | 0.8041 | |||

| VZ / Verizon Communications Inc. | 0.14 | 9.90 | 6.17 | 22.60 | 2.1090 | 0.4157 | |||

| CVS / CVS Health Corporation | 0.08 | 37.89 | 5.30 | 35.87 | 1.8134 | 0.4993 | |||

| T / AT&T Inc. | 0.19 | 5.19 | 1.7749 | 1.7749 | |||||

| CB / Chubb Limited | 0.02 | 4.77 | 1.6321 | 1.6321 | |||||

| CMCSA / Comcast Corporation | 0.13 | 139.64 | 4.34 | 81.09 | 1.4838 | 0.4898 | |||

| C / Citigroup Inc. | 0.06 | 28.89 | 4.05 | 8.23 | 1.3857 | 0.3408 | |||

| CI / The Cigna Group | 0.01 | 2.98 | 3.71 | -1.90 | 1.2679 | -0.0047 | |||

| ELV / Elevance Health, Inc. | 0.01 | 222.64 | 3.68 | 201.64 | 1.2584 | 0.7559 | |||

| GM / General Motors Company | 0.07 | -3.00 | 3.39 | -1.45 | 1.1601 | 0.0012 | |||

| COR / Cencora, Inc. | 0.01 | 133.96 | 3.36 | 188.00 | 1.1494 | 0.8124 | |||

| EXC / Exelon Corporation | 0.06 | 2.94 | 1.0057 | 1.0057 | |||||

| ED / Consolidated Edison, Inc. | 0.02 | 220.95 | 2.80 | 283.54 | 0.9561 | 0.7106 | |||

| MCK / McKesson Corporation | 0.00 | -12.39 | 2.78 | 5.02 | 0.9513 | 0.2118 | |||

| BK / The Bank of New York Mellon Corporation | 0.03 | 147.65 | 2.68 | 131.81 | 0.9173 | 0.5943 | |||

| VICI / VICI Properties Inc. | 0.08 | 2.46 | 0.8427 | 0.8427 | |||||

| F / Ford Motor Company | 0.24 | 182.08 | 2.38 | 180.21 | 0.8138 | 0.5767 | |||

| L / Loews Corporation | 0.03 | 320.36 | 2.21 | 386.37 | 0.7570 | 0.6035 | |||

| EVRG / Evergy, Inc. | 0.03 | 490.85 | 2.16 | 679.42 | 0.7384 | 0.6450 | |||

| MPC / Marathon Petroleum Corporation | 0.01 | 79.06 | 2.03 | 38.99 | 0.6949 | 0.2731 | |||

| KO / The Coca-Cola Company | 0.03 | -42.09 | 2.03 | -25.63 | 0.6937 | -0.4291 | |||

| PSX / Phillips 66 | 0.02 | 364.36 | 1.95 | 232.54 | 0.6675 | 0.4979 | |||

| RSG / Republic Services, Inc. | 0.01 | 198.50 | 1.95 | 285.18 | 0.6665 | 0.5205 | |||

| COF / Capital One Financial Corporation | 0.01 | -19.81 | 1.93 | 0.78 | 0.6598 | 0.0153 | |||

| CNC / Centene Corporation | 0.03 | 226.12 | 1.92 | 153.97 | 0.6567 | 0.4383 | |||

| KR / The Kroger Co. | 0.03 | 16.45 | 1.90 | 51.84 | 0.6480 | 0.2279 | |||

| VLO / Valero Energy Corporation | 0.02 | 221.81 | 1.89 | 131.17 | 0.6466 | 0.4105 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.01 | 1.87 | 0.6391 | 0.6391 | |||||

| ATO / Atmos Energy Corporation | 0.01 | 1.85 | 0.6327 | 0.6327 | |||||

| PNW / Pinnacle West Capital Corporation | 0.02 | 671.02 | 1.83 | 901.64 | 0.6268 | 0.5649 | |||

| FE / FirstEnergy Corp. | 0.04 | 313.55 | 1.77 | 345.59 | 0.6051 | 0.4942 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | 1.77 | 0.6038 | 0.6038 | |||||

| CME / CME Group Inc. | 0.01 | 24.85 | 1.75 | 73.88 | 0.5988 | 0.1810 | |||

| LIN / Linde plc | 0.00 | 6.45 | 1.74 | 6.38 | 0.5936 | 0.1228 | |||

| CL / Colgate-Palmolive Company | 0.02 | 84.08 | 1.71 | 95.88 | 0.5848 | 0.3409 | |||

| VRSN / VeriSign, Inc. | 0.01 | 66.22 | 1.70 | 118.25 | 0.5806 | 0.3634 | |||

| CMS / CMS Energy Corporation | 0.02 | 342.44 | 1.69 | 394.13 | 0.5765 | 0.4812 | |||

| PPL / PPL Corporation | 0.05 | 569.49 | 1.68 | 753.30 | 0.5749 | 0.4806 | |||

| DUK / Duke Energy Corporation | 0.01 | 1.65 | 0.5653 | 0.5653 | |||||

| ADP / Automatic Data Processing, Inc. | 0.01 | 6.45 | 1.65 | 5.56 | 0.5648 | 0.1283 | |||

| PG / The Procter & Gamble Company | 0.01 | -72.76 | 1.65 | -72.47 | 0.5634 | -1.1626 | |||

| MDLZ / Mondelez International, Inc. | 0.02 | -21.08 | 1.64 | -21.35 | 0.5607 | -0.0407 | |||

| LYB / LyondellBasell Industries N.V. | 0.03 | 572.73 | 1.62 | 294.17 | 0.5554 | 0.4364 | |||

| KDP / Keurig Dr Pepper Inc. | 0.05 | 1.62 | 0.5532 | 0.5532 | |||||

| YUM / Yum! Brands, Inc. | 0.01 | -17.42 | 1.62 | -4.77 | 0.5530 | 0.0789 | |||

| WEC / WEC Energy Group, Inc. | 0.01 | 1.62 | 0.5527 | 0.5527 | |||||

| PRU / Prudential Financial, Inc. | 0.02 | 64.43 | 1.61 | 52.89 | 0.5516 | 0.1964 | |||

| NI / NiSource Inc. | 0.04 | 371.57 | 1.61 | 395.69 | 0.5511 | 0.4601 | |||

| JNJ / Johnson & Johnson | 0.01 | -79.76 | 1.61 | -79.96 | 0.5510 | -1.7686 | |||

| ALL / The Allstate Corporation | 0.01 | 30.60 | 1.60 | 121.50 | 0.5461 | 0.2349 | |||

| TJX / The TJX Companies, Inc. | 0.01 | -56.30 | 1.59 | -50.25 | 0.5428 | -0.3776 | |||

| USB / U.S. Bancorp | 0.04 | 1.58 | 1.59 | 0.89 | 0.5428 | 0.0130 | |||

| O / Realty Income Corporation | 0.03 | 1.58 | 0.5403 | 0.5403 | |||||

| GD / General Dynamics Corporation | 0.01 | 1.58 | 0.5387 | 0.5387 | |||||

| ICE / Intercontinental Exchange, Inc. | 0.01 | 1.57 | 0.5359 | 0.5359 | |||||

| DTE / DTE Energy Company | 0.01 | 1.55 | 0.5317 | 0.5317 | |||||

| SO / The Southern Company | 0.02 | 1.55 | 0.5288 | 0.5288 | |||||

| ITW / Illinois Tool Works Inc. | 0.01 | -5.89 | 1.54 | -8.70 | 0.5279 | 0.0400 | |||

| BRO / Brown & Brown, Inc. | 0.01 | 565.45 | 1.53 | 643.20 | 0.5237 | 0.4640 | |||

| MO / Altria Group, Inc. | 0.03 | -55.19 | 1.52 | -49.27 | 0.5209 | -0.3170 | |||

| MCD / McDonald's Corporation | 0.00 | -86.16 | 1.52 | -84.68 | 0.5193 | -2.2464 | |||

| JKHY / Jack Henry & Associates, Inc. | 0.01 | 638.78 | 1.51 | 649.01 | 0.5174 | 0.4590 | |||

| MA / Mastercard Incorporated | 0.00 | -75.34 | 1.51 | -75.68 | 0.5172 | -1.2177 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 126.28 | 1.51 | 138.99 | 0.5157 | 0.2143 | |||

| V / Visa Inc. | 0.00 | -79.38 | 1.51 | -79.16 | 0.5151 | -1.5017 | |||

| SPGI / S&P Global Inc. | 0.00 | 50.96 | 1.50 | 59.26 | 0.5121 | -0.1329 | |||

| AEE / Ameren Corporation | 0.02 | 1.50 | 0.5112 | 0.5112 | |||||

| AIZ / Assurant, Inc. | 0.01 | 535.77 | 1.49 | 604.25 | 0.5108 | 0.4392 | |||

| HON / Honeywell International Inc. | 0.01 | -12.26 | 1.48 | 0.75 | 0.5067 | -0.0986 | |||

| AEP / American Electric Power Company, Inc. | 0.01 | 1.47 | 0.5042 | 0.5042 | |||||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | -60.20 | 1.47 | -56.51 | 0.5033 | -0.4406 | |||

| AJG / Arthur J. Gallagher & Co. | 0.00 | 227.02 | 1.47 | 270.45 | 0.5017 | 0.3873 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 77.86 | 1.47 | 73.70 | 0.5013 | 0.2576 | |||

| BSX / Boston Scientific Corporation | 0.01 | -25.39 | 1.46 | -25.04 | 0.5009 | -0.0443 | |||

| LHX / L3Harris Technologies, Inc. | 0.01 | 50.85 | 1.46 | 56.61 | 0.4986 | 0.2387 | |||

| LNT / Alliant Energy Corporation | 0.02 | 1.45 | 0.4943 | 0.4943 | |||||

| CHD / Church & Dwight Co., Inc. | 0.01 | 314.72 | 1.44 | 331.04 | 0.4939 | 0.3548 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -38.41 | 1.44 | -45.73 | 0.4933 | -0.2732 | |||

| REG / Regency Centers Corporation | 0.02 | 1.44 | 0.4928 | 0.4928 | |||||

| RTX / RTX Corporation | 0.01 | 0.24 | 1.43 | 35.65 | 0.4883 | 0.0339 | |||

| PEP / PepsiCo, Inc. | 0.01 | -51.81 | 1.43 | -62.18 | 0.4882 | -0.6004 | |||

| WELL / Welltower Inc. | 0.01 | 1.43 | 0.4875 | 0.4875 | |||||

| BR / Broadridge Financial Solutions, Inc. | 0.01 | 89.09 | 1.42 | 114.18 | 0.4857 | 0.2944 | |||

| FIS / Fidelity National Information Services, Inc. | 0.02 | 111.40 | 1.42 | 176.22 | 0.4846 | 0.2717 | |||

| WTW / Willis Towers Watson Public Limited Company | 0.00 | 200.46 | 1.41 | 180.56 | 0.4838 | 0.3431 | |||

| OTIS / Otis Worldwide Corporation | 0.01 | 12.89 | 1.41 | 13.89 | 0.4824 | 0.1367 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 49.74 | 1.40 | 40.52 | 0.4792 | 0.2009 | |||

| WM / Waste Management, Inc. | 0.01 | 104.97 | 1.40 | 136.21 | 0.4776 | 0.3068 | |||

| SYY / Sysco Corporation | 0.02 | 147.87 | 1.39 | 130.90 | 0.4755 | 0.3017 | |||

| PAYX / Paychex, Inc. | 0.01 | 132.13 | 1.39 | 131.61 | 0.4736 | 0.3065 | |||

| ROP / Roper Technologies, Inc. | 0.00 | 154.91 | 1.38 | 162.36 | 0.4721 | 0.3201 | |||

| WMT / Walmart Inc. | 0.01 | -50.19 | 1.38 | -29.45 | 0.4704 | -0.0920 | |||

| MET / MetLife, Inc. | 0.02 | -9.08 | 1.38 | 8.35 | 0.4702 | -0.0777 | |||

| ABT / Abbott Laboratories | 0.01 | -48.73 | 1.37 | -29.08 | 0.4679 | -0.3265 | |||

| TGT / Target Corporation | 0.01 | 66.92 | 1.37 | -37.86 | 0.4677 | -1.0408 | |||

| AVB / AvalonBay Communities, Inc. | 0.01 | 204.38 | 1.36 | 239.25 | 0.4642 | 0.2980 | |||

| VRSK / Verisk Analytics, Inc. | 0.00 | 122.17 | 1.35 | 129.25 | 0.4612 | 0.2969 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | -48.58 | 1.35 | 17.45 | 0.4603 | -0.0669 | |||

| BDX / Becton, Dickinson and Company | 0.01 | 1.34 | 0.4592 | 0.4592 | |||||

| HOLX / Hologic, Inc. | 0.02 | 539.11 | 1.34 | 355.78 | 0.4585 | 0.3736 | |||

| NDAQ / Nasdaq, Inc. | 0.02 | 139.68 | 1.34 | 0.98 | 0.4576 | -0.1145 | |||

| HUM / Humana Inc. | 0.01 | 171.08 | 1.33 | 35.78 | 0.4555 | 0.0516 | |||

| UDR / UDR, Inc. | 0.03 | 225.69 | 1.33 | 227.16 | 0.4532 | 0.3400 | |||

| VLTO / Veralto Corporation | 0.01 | 242.33 | 1.32 | 208.41 | 0.4514 | 0.3278 | |||

| GIS / General Mills, Inc. | 0.02 | 1.32 | 0.4508 | 0.4508 | |||||

| EXPD / Expeditors International of Washington, Inc. | 0.01 | 335.84 | 1.31 | 283.92 | 0.4493 | 0.3505 | |||

| AVY / Avery Dennison Corporation | 0.01 | 643.93 | 1.31 | 484.38 | 0.4479 | 0.2943 | |||

| SYK / Stryker Corporation | 0.00 | 30.89 | 1.31 | 49.49 | 0.4475 | 0.1949 | |||

| FDX / FedEx Corporation | 0.01 | 18.28 | 1.30 | -4.97 | 0.4448 | -0.0159 | |||

| MDT / Medtronic plc | 0.02 | -9.05 | 1.30 | -12.16 | 0.4446 | -0.1694 | |||

| BLK / BlackRock, Inc. | 0.00 | 1.30 | 0.4445 | 0.4445 | |||||

| COST / Costco Wholesale Corporation | 0.00 | -89.57 | 1.29 | -87.39 | 0.4421 | -2.5148 | |||

| ECL / Ecolab Inc. | 0.01 | 144.41 | 1.29 | 166.74 | 0.4415 | 0.3016 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | -75.35 | 1.29 | -76.51 | 0.4408 | -1.0909 | |||

| PPG / PPG Industries, Inc. | 0.01 | 1.28 | 0.4377 | 0.4377 | |||||

| AON / Aon plc | 0.00 | 22.52 | 1.23 | 17.22 | 0.4191 | 0.1273 | |||

| ADM / Archer-Daniels-Midland Company | 0.03 | 222.96 | 1.21 | 148.67 | 0.4143 | 0.2737 | |||

| FRT / Federal Realty Investment Trust | 0.01 | 1.21 | 0.4121 | 0.4121 | |||||

| ACGL / Arch Capital Group Ltd. | 0.01 | 46.94 | 1.20 | 39.24 | 0.4115 | 0.1619 | |||

| DHI / D.R. Horton, Inc. | 0.01 | 265.56 | 1.17 | 156.70 | 0.3994 | 0.2681 | |||

| FI / Fiserv, Inc. | 0.01 | 1.16 | 0.3956 | 0.3956 | |||||

| HLT / Hilton Worldwide Holdings Inc. | 0.01 | -53.04 | 1.15 | -58.64 | 0.3929 | -0.3825 | |||

| UNP / Union Pacific Corporation | 0.01 | 1.14 | 0.3901 | 0.3901 | |||||

| HIG / The Hartford Insurance Group, Inc. | 0.01 | 11.10 | 1.11 | 40.76 | 0.3779 | 0.1134 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.01 | 101.58 | 1.09 | 95.86 | 0.3726 | 0.2121 | |||

| CAH / Cardinal Health, Inc. | 0.01 | -2.47 | 1.06 | 11.47 | 0.3623 | 0.0970 | |||

| CHTR / Charter Communications, Inc. | 0.00 | 18.35 | 1.03 | 34.16 | 0.3535 | 0.1386 | |||

| DAL / Delta Air Lines, Inc. | 0.02 | -0.83 | 1.01 | -17.56 | 0.3437 | -0.0667 | |||

| LEN / Lennar Corporation | 0.01 | 35.61 | 0.92 | -16.70 | 0.3157 | -0.0043 | |||

| NUE / Nucor Corporation | 0.01 | 9.94 | 0.91 | -22.15 | 0.3129 | -0.0827 | |||

| FANG / Diamondback Energy, Inc. | 0.01 | 44.52 | 0.87 | -5.14 | 0.2970 | -0.0112 | |||

| DG / Dollar General Corporation | 0.01 | 100.24 | 0.84 | -10.04 | 0.2882 | -0.1424 | |||

| UAL / United Airlines Holdings, Inc. | 0.01 | 125.80 | 0.80 | 46.97 | 0.2740 | 0.1217 | |||

| KHC / The Kraft Heinz Company | 0.03 | 17.55 | 0.80 | -11.42 | 0.2733 | -0.0304 | |||

| MTB / M&T Bank Corporation | 0.00 | -20.28 | 0.79 | -6.37 | 0.2718 | -0.0137 | |||

| OXY / Occidental Petroleum Corporation | 0.02 | 127.40 | 0.78 | 45.07 | 0.2664 | 0.0452 | |||

| STT / State Street Corporation | 0.01 | 49.96 | 0.77 | 30.10 | 0.2616 | 0.0974 | |||

| CINF / Cincinnati Financial Corporation | 0.01 | 119.61 | 0.76 | 134.26 | 0.2597 | 0.1661 | |||

| TSN / Tyson Foods, Inc. | 0.01 | 25.40 | 0.75 | 26.81 | 0.2571 | 0.0572 | |||

| EG / Everest Group, Ltd. | 0.00 | 195.62 | 0.75 | 170.40 | 0.2564 | 0.1763 | |||

| HPE / Hewlett Packard Enterprise Company | 0.04 | 4.83 | 0.72 | 0.00 | 0.2471 | 0.0039 | |||

| DVN / Devon Energy Corporation | 0.02 | 44.10 | 0.72 | -14.42 | 0.2458 | -0.0368 | |||

| PHM / PulteGroup, Inc. | 0.01 | 134.47 | 0.70 | 82.29 | 0.2396 | 0.1286 | |||

| MOH / Molina Healthcare, Inc. | 0.00 | 0.66 | 0.2270 | 0.2270 | |||||

| DOW / Dow Inc. | 0.02 | 37.46 | 0.65 | -26.17 | 0.2222 | -0.0738 | |||

| CH1300646267 / Bunge Global SA | 0.01 | 10.17 | 0.65 | -14.74 | 0.2217 | -0.0344 | |||

| SYF / Synchrony Financial | 0.01 | -13.70 | 0.65 | 1.90 | 0.2207 | 0.0076 | |||

| HPQ / HP Inc. | 0.03 | -21.31 | 0.64 | -38.05 | 0.2199 | -0.0700 | |||

| Aptiv PLC / EC (JE00BTDN8H13) | 0.01 | 0.62 | 0.2109 | 0.2109 | |||||

| FITB / Fifth Third Bancorp | 0.02 | -11.57 | 0.59 | -12.93 | 0.2007 | -0.0260 | |||

| HAL / Halliburton Company | 0.03 | 0.55 | 0.1874 | 0.1874 | |||||

| STLD / Steel Dynamics, Inc. | 0.00 | -10.86 | 0.54 | -11.15 | 0.1856 | -0.0200 | |||

| HBAN / Huntington Bancshares Incorporated | 0.04 | -22.35 | 0.54 | -16.20 | 0.1841 | -0.0323 | |||

| BLL / Ball Corp. | 0.01 | 44.84 | 0.53 | 17.96 | 0.1820 | 0.0517 | |||

| CFG / Citizens Financial Group, Inc. | 0.01 | -17.91 | 0.52 | -11.34 | 0.1794 | -0.0195 | |||

| RF / Regions Financial Corporation | 0.03 | -19.90 | 0.52 | -15.11 | 0.1769 | -0.0284 | |||

| JBL / Jabil Inc. | 0.00 | -0.68 | 0.51 | 28.97 | 0.1754 | 0.0608 | |||

| BIIB / Biogen Inc. | 0.00 | 38.47 | 0.51 | 16.32 | 0.1733 | 0.0519 | |||

| BBY / Best Buy Co., Inc. | 0.01 | 9.86 | 0.44 | -0.46 | 0.1489 | 0.0016 | |||

| WBD / Warner Bros. Discovery, Inc. | 0.05 | 0.44 | 0.1488 | 0.1488 | |||||

| TAP / Molson Coors Beverage Company | 0.01 | 50.52 | 0.40 | 51.72 | 0.1354 | 0.0473 | |||

| GL / Globe Life Inc. | 0.00 | 0.37 | 0.1278 | 0.1278 | |||||

| MOS / The Mosaic Company | 0.01 | -7.95 | 0.36 | -10.81 | 0.1242 | -0.0129 | |||

| HII / Huntington Ingalls Industries, Inc. | 0.00 | 92.31 | 0.36 | 60.09 | 0.1221 | 0.0469 | |||

| LKQ / LKQ Corporation | 0.01 | 63.73 | 0.36 | 67.92 | 0.1218 | 0.0624 | |||

| SJM / The J. M. Smucker Company | 0.00 | 8.56 | 0.35 | 18.06 | 0.1210 | 0.0374 | |||

| UHS / Universal Health Services, Inc. | 0.00 | 9.49 | 0.35 | 13.96 | 0.1202 | 0.0162 | |||

| FOXA / Fox Corporation | 0.01 | 0.68 | 0.34 | 61.90 | 0.1164 | 0.0455 | |||

| KMX / CarMax, Inc. | 0.00 | 74.03 | 0.31 | 31.22 | 0.1066 | 0.0404 | |||

| CAG / Conagra Brands, Inc. | 0.01 | 0.31 | 0.1052 | 0.1052 | |||||

| EMN / Eastman Chemical Company | 0.00 | 27.35 | 0.26 | 3.66 | 0.0874 | 0.0045 | |||

| AES / The AES Corporation | 0.03 | 9.01 | 0.25 | -0.79 | 0.0859 | 0.0152 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.02 | 5.64 | 0.25 | -34.75 | 0.0844 | -0.0427 | |||

| APA / APA Corporation | 0.02 | 123.59 | 0.23 | 11.43 | 0.0803 | 0.0195 | |||

| PARA / Paramount Global | 0.02 | 36.11 | 0.23 | 40.00 | 0.0793 | 0.0237 | |||

| MHK / Mohawk Industries, Inc. | 0.00 | 87.61 | 0.23 | 73.28 | 0.0776 | 0.0335 | |||

| MGM / MGM Resorts International | 0.01 | 10.04 | 0.22 | 0.45 | 0.0759 | 0.0142 | |||

| U.S. Bank Money Market Deposit Account / STIV (8AMMF0A84) | 0.19 | -54.44 | 0.19 | -54.42 | 0.0654 | -0.0518 | |||

| BEN / Franklin Resources, Inc. | 0.01 | 28.81 | 0.18 | 5.75 | 0.0632 | 0.0044 | |||

| DELL / Dell Technologies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2704 | ||||

| NEE / NextEra Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7921 | ||||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3318 | ||||

| MTD / Mettler-Toledo International Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3442 | ||||

| GDDY / GoDaddy Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1390 | ||||

| TRGP / Targa Resources Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2498 | ||||

| ABNB / Airbnb, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4807 | ||||

| BX / Blackstone Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4966 | ||||

| TPL / Texas Pacific Land Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1318 | ||||

| PLTR / Palantir Technologies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5614 | ||||

| FMC / FMC Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0357 |