Statistik Asas

| Nilai Portfolio | $ 403,896,801 |

| Kedudukan Semasa | 471 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

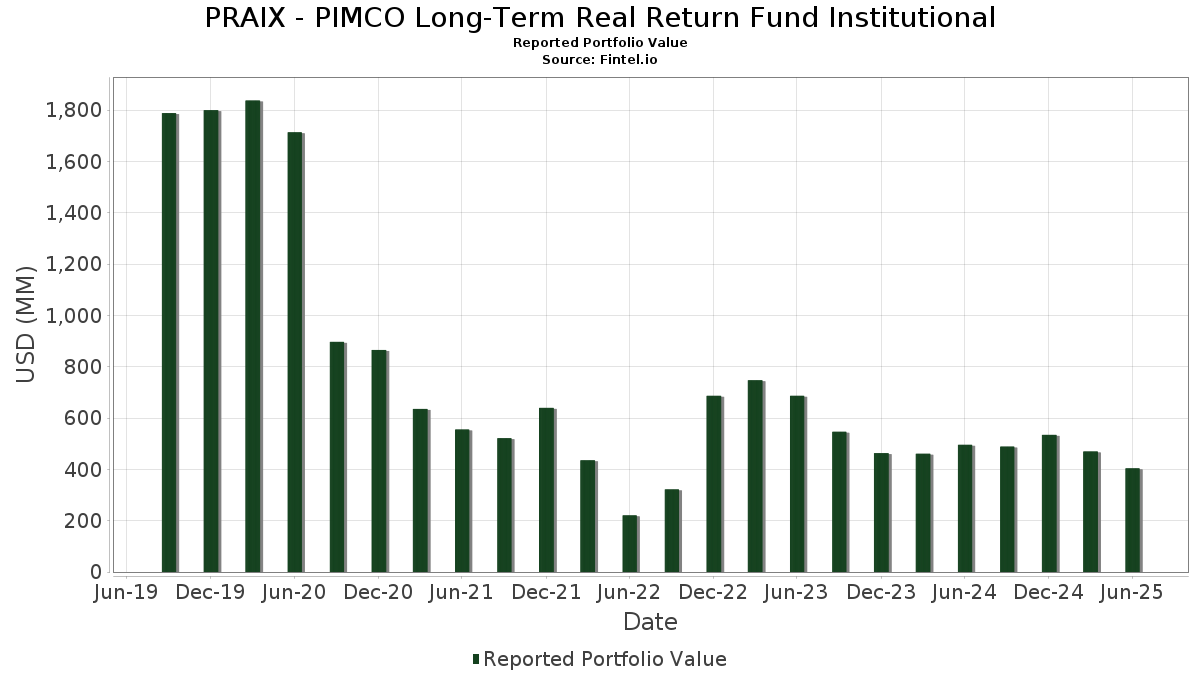

PRAIX - PIMCO Long-Term Real Return Fund Institutional telah mendedahkan 471 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 403,896,801 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas PRAIX - PIMCO Long-Term Real Return Fund Institutional ialah United States Treasury Inflation Indexed Bonds (US:US912810RF75) , United States Treasury Inflation Indexed Bonds (US:US912810RL44) , United States Treasury Inflation Indexed Bonds (US:US912810QV35) , US TREASURY I/L 1.5% 02-15-53 (US:US912810TP30) , and United States Treasury Inflation Indexed Bonds (US:US912810RW09) . Kedudukan baharu PRAIX - PIMCO Long-Term Real Return Fund Institutional termasuk United States Treasury Inflation Indexed Bonds (US:US912810RF75) , United States Treasury Inflation Indexed Bonds (US:US912810RL44) , United States Treasury Inflation Indexed Bonds (US:US912810QV35) , US TREASURY I/L 1.5% 02-15-53 (US:US912810TP30) , and United States Treasury Inflation Indexed Bonds (US:US912810RW09) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 9.58 | 2.6591 | 2.6481 | ||

| 8.85 | 2.4562 | 2.4562 | ||

| 6.01 | 1.6695 | 1.6695 | ||

| 17.71 | 4.9160 | 1.3884 | ||

| 7.02 | 1.9489 | 0.8183 | ||

| 5.35 | 1.4856 | 0.6201 | ||

| 9.59 | 2.6625 | 0.4750 | ||

| 1.55 | 0.4301 | 0.4301 | ||

| 9.65 | 2.6781 | 0.3834 | ||

| 16.28 | 4.5215 | 0.3717 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -120.55 | -33.4701 | -33.4701 | ||

| -11.13 | -3.0890 | -3.0890 | ||

| 9.85 | 2.7346 | -1.2560 | ||

| 29.81 | 8.2770 | -0.8047 | ||

| 1.48 | 0.4105 | -0.7018 | ||

| 36.08 | 10.0164 | -0.4123 | ||

| 15.53 | 4.3107 | -0.3904 | ||

| 16.06 | 4.4595 | -0.3839 | ||

| 15.32 | 4.2547 | -0.3662 | ||

| 2.91 | 0.8074 | -0.3114 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-28 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US912810RF75 / United States Treasury Inflation Indexed Bonds | 36.08 | -15.12 | 10.0164 | -0.4123 | |||||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 34.68 | -13.96 | 9.6287 | -0.2616 | |||||

| TSY INFL IX N/B 02/54 2.125 / DBT (US912810TY47) | 29.81 | -19.46 | 8.2770 | -0.8047 | |||||

| US912810QV35 / United States Treasury Inflation Indexed Bonds | 29.71 | -10.08 | 8.2495 | 0.1420 | |||||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 28.49 | -14.18 | 7.9098 | -0.2352 | |||||

| US912810RW09 / United States Treasury Inflation Indexed Bonds | 24.66 | -13.47 | 6.8468 | -0.1463 | |||||

| US912810QP66 / United States Treasury Inflation Indexed Bonds | 23.14 | -12.33 | 6.4240 | -0.0518 | |||||

| US912810RA88 / United States Treasury Inflation Indexed Bonds | 22.57 | -10.63 | 6.2676 | 0.0698 | |||||

| US912810SB52 / United States Treasury Inflation Indexed Bonds | 20.05 | -11.01 | 5.5669 | 0.0388 | |||||

| US912810RR14 / United States Treasury Inflation Indexed Bonds | 19.35 | -16.32 | 5.3734 | -0.3015 | |||||

| TSY INFL IX N/B 02/55 2.375 / DBT (US912810UH94) | 17.71 | 23.16 | 4.9160 | 1.3884 | |||||

| US912810SG40 / United States Treasury Inflation Indexed Bonds | 16.28 | -3.71 | 4.5215 | 0.3717 | |||||

| US912810SM18 / US TII .25 02/15/2050 (TIPS) | 16.06 | -18.63 | 4.4595 | -0.3839 | |||||

| US912810QF84 / United States Treasury Inflation Indexed Bonds | 15.53 | -18.96 | 4.3107 | -0.3904 | |||||

| US912810SV17 / United States Treasury Inflation Indexed Bonds | 15.32 | -18.63 | 4.2547 | -0.3662 | |||||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 14.29 | -4.80 | 3.9672 | 0.2843 | |||||

| US01F0426811 / UMBS TBA | 9.85 | -42.94 | 2.7346 | -1.2560 | |||||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 9.65 | -2.81 | 2.6781 | 0.3834 | |||||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 9.59 | 1.36 | 2.6625 | 0.4750 | |||||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 9.58 | 21,665.91 | 2.6591 | 2.6481 | |||||

| US36179XNC64 / Ginnie Mae II Pool | 8.85 | 2.4562 | 2.4562 | ||||||

| JP1120241K56 / Japanese Government CPI Linked Bond | 8.12 | 5.65 | 2.2548 | 0.3687 | |||||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 7.37 | -5.43 | 2.0459 | 0.2444 | |||||

| TSY INFL IX N/B 10/29 1.625 / DBT (US91282CLV18) | 7.02 | 52.36 | 1.9489 | 0.8183 | |||||

| US38382YM425 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-H02 CL JF V/R 5.45906000 | 6.79 | 0.00 | 1.8858 | 0.2193 | |||||

| IT0005246134 / Italy Buoni Poliennali Del Tesoro | 6.41 | 9.98 | 1.7810 | 0.3499 | |||||

| GNMA II POOL MB0420 G2 06/55 FIXED 3.5 / ABS-MBS (US3618N5PE30) | 6.01 | 1.6695 | 1.6695 | ||||||

| IT0005415416 / Italy Buoni Poliennali Del Tesoro | 5.72 | 9.54 | 1.5874 | 0.3068 | |||||

| EW / Edwards Lifesciences Corporation | 5.35 | 228.22 | 1.4856 | 0.6201 | |||||

| TSY INFL IX N/B 07/34 1.875 / DBT (US91282CLE92) | 3.89 | 0.15 | 1.0800 | 0.1271 | |||||

| FNMA POOL MA5295 FN 03/54 FIXED 6 / ABS-MBS (US31418E3D02) | 3.64 | -4.91 | 1.0106 | 0.0715 | |||||

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 2.99 | 0.91 | 0.8295 | 0.1031 | |||||

| US55284AAA60 / MF1 2021-FL7 Ltd | 2.91 | -36.21 | 0.8074 | -0.3114 | |||||

| US55285AAA51 / MF1 2022-FL9 LLC SER 2022-FL9 CL A V/R REGD 144A P/P 2.96000000 | 2.74 | -4.47 | 0.7603 | 0.0570 | |||||

| TSY INFL IX N/B 01/34 1.75 / DBT (US91282CJY84) | 2.59 | 0.31 | 0.7184 | 0.0854 | |||||

| US05610AAW80 / BX Trust, Series 2022-FOX2, Class A2 | 2.42 | -6.20 | 0.6725 | 0.0390 | |||||

| IRS EUR 0.19700 11/08/22-30Y LCH / DIR (EZ3H5XY3RVT8) | 2.27 | 10.97 | 0.6294 | 0.1283 | |||||

| US03880RAA77 / Arbor Realty Collateralized Loan Obligation Ltd | 2.18 | -15.75 | 0.6059 | -0.0298 | |||||

| US80556XAG25 / Saxon Asset Securities Trust 2006-2 | 2.15 | -4.28 | 0.5960 | 0.0457 | |||||

| US12559QAF90 / CIT Mortgage Loan Trust 2007-1 | 2.02 | -6.08 | 0.5619 | 0.0333 | |||||

| AVOCA STATIC CLO AVOST 1A AR 144A / ABS-CBDO (XS2935873880) | 1.96 | 0.62 | 0.5446 | 0.0663 | |||||

| US93936NAC74 / WASHINGTON MUTUAL MORTGAGE PAS WMALT 2007 4 1A3 | 1.81 | -0.33 | 0.5013 | 0.0567 | |||||

| RFR USD SOFR/2.86500 02/13/24-30Y LCH / DIR (EZLBBPTCYY71) | 1.79 | 12.95 | 0.4966 | 0.1080 | |||||

| US78486BAA26 / STARWOOD COMMERCIAL MORTGAGE T STWD 2021 FL2 A 144A | 1.56 | -27.32 | 0.4331 | -0.0935 | |||||

| GNMA II POOL MB0022 G2 11/54 FIXED 3.5 / ABS-MBS (US3618N5AY58) | 1.55 | 0.4301 | 0.4301 | ||||||

| US91282CAQ42 / USTN TII 0.125% 10/15/2025 | 1.48 | -67.39 | 0.4105 | -0.7018 | |||||

| ACI12NZL6 / JAPAN GOVT CPI LINKED BONDS 03/28 0.1 | 1.40 | 5.04 | 0.3880 | 0.0614 | |||||

| US06760GAA94 / Barings CLO Ltd 2018-I | 1.31 | -8.22 | 0.3626 | 0.0133 | |||||

| IRS EUR 0.19500 11/04/22-30Y LCH / DIR (EZZLWXLX9PF2) | 1.29 | 16.08 | 0.3590 | 0.0856 | |||||

| GNMA II POOL MB0201 G2 02/55 FIXED 3.5 / ABS-MBS (US3618N5GK90) | 1.28 | 0.3542 | 0.3542 | ||||||

| US38380LJY02 / Government National Mortgage Association | 1.24 | -1.12 | 0.3447 | 0.0366 | |||||

| IRS EUR 0.19000 11/04/22-30Y LCH / DIR (EZZLWXLX9PF2) | 1.24 | 11.05 | 0.3433 | 0.0700 | |||||

| TIAA CLO LTD TIA 2018 1A A1AR 144A / ABS-CBDO (US88631YAL11) | 1.20 | -6.69 | 0.3331 | 0.0177 | |||||

| US12670FAE07 / COUNTRYWIDE ASSET-BACKED CERTIFICATES SER 2007-9 CL 2A4 V/R REGD 1.95800000 | 1.15 | -2.39 | 0.3184 | 0.0302 | |||||

| US05951EAC12 / Banc of America Funding Trust, Series 2006-J, Class 2A1 | 1.14 | -4.13 | 0.3162 | 0.0248 | |||||

| US91282CHP95 / United States Treasury Inflation Indexed Bonds | 1.13 | 0.53 | 0.3134 | 0.0380 | |||||

| US437084QA78 / Home Equity Asset Trust | 1.06 | -7.67 | 0.2941 | 0.0125 | |||||

| US38382YC921 / GOVERNMENT NATIONAL MORTGAGE A GNR 2022 H24 FD | 1.00 | 0.00 | 0.2787 | 0.0325 | |||||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 1.00 | -5.29 | 0.2784 | 0.0187 | |||||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 0.94 | 1.18 | 0.2612 | 0.0332 | |||||

| US576436CG29 / MASTR SPECIALIZED LOAN TRUST MASD 2005 2 M3 144A | 0.94 | -10.34 | 0.2601 | 0.0037 | |||||

| US3137F4CZ38 / FHLMC, Multifamily Structured Pass-Through Certificates, Series KBX1, Class A2 | 0.81 | 0.25 | 0.2262 | 0.0268 | |||||

| US07389KAA97 / BEAR STEARNS ALT A TRUST II BSAAT 2007 1 1A1 | 0.79 | -1.50 | 0.2186 | 0.0223 | |||||

| US3137BY3C20 / Freddie Mac REMICS | 0.78 | -3.36 | 0.2157 | 0.0185 | |||||

| US03072SHJ78 / AMERIQUEST MORTGAGE SECURITIES AMSI 2003 AR3 M4 | 0.77 | -3.39 | 0.2140 | 0.0184 | |||||

| CA135087VS05 / Canadian Government Real Return Bond | 0.72 | 5.12 | 0.1995 | 0.0319 | |||||

| XS2313672177 / MAN GLG EURO CLO GLGE 5A A1R 144A | 0.72 | -23.12 | 0.1986 | -0.0298 | |||||

| US94983PAF53 / Wells Fargo Mortgage Backed Securities 2006-AR4 Trust | 0.71 | -3.52 | 0.1982 | 0.0168 | |||||

| US03880KAA25 / Arbor Realty Commercial Real Estate Notes 2021-FL3 Ltd | 0.69 | -19.63 | 0.1922 | -0.0192 | |||||

| US12669WAA45 / Countrywide Asset-Backed Certificates | 0.69 | -2.41 | 0.1915 | 0.0181 | |||||

| US76114CAG15 / Residential Asset Securitization Trust, Series 2007-A6, Class 2A1 | 0.65 | -2.11 | 0.1802 | 0.0175 | |||||

| US45660L4E63 / RESIDENTIAL ASSET SECURITIZATI RAST 2005 A15 3A1 | 0.54 | -5.24 | 0.1507 | 0.0103 | |||||

| US059526AB99 / BANC OF AMERICA FUNDING CORPOR BAFC 2007 6 A1 | 0.53 | -1.30 | 0.1480 | 0.0155 | |||||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | 0.53 | 0.1461 | 0.1461 | ||||||

| US52525AAA25 / LEHMAN XS TRUST SERIES 2007-20N SER 2007-20N CL A1 V/R REGD 2.85800000 | 0.49 | -8.22 | 0.1365 | 0.0050 | |||||

| US288542AA12 / ELLINGTON LOAN ACQUISITION TRUST 2007-1 SER 2007-1 CL A1 V/R REGD 144A P/P 2.80800000 | 0.46 | -5.89 | 0.1286 | 0.0078 | |||||

| US46626LHB99 / JP MORGAN MORTGAGE ACQUISITION JPMAC 2006 FRE2 M1 | 0.46 | -7.98 | 0.1282 | 0.0050 | |||||

| INF SWAP US IT 2.31125 02/24/21-10Y LCH / DIR (EZ0098TXC0B7) | 0.45 | -4.24 | 0.1256 | 0.0098 | |||||

| INF SWAP US IT 2.703 05/25/21-5Y LCH / DIR (000000000) | 0.41 | 0.1129 | 0.1129 | ||||||

| INF SWAP US IT 2.668 05/14/21-10Y LCH / DIR (EZG6KSM7YGS6) | 0.40 | -6.91 | 0.1123 | 0.0056 | |||||

| US50189XAA37 / LCM LOAN INCOME FUND I LTD SER 1A CL A V/R REGD 144A P/P 6.61775000 | 0.39 | -34.52 | 0.1069 | -0.0374 | |||||

| RFRF USD SOFR/2.23650 11/21/23-30Y LCH / DIR (EZX8X7WQFX07) | 0.38 | 6.69 | 0.1066 | 0.0184 | |||||

| US92926UAC53 / WaMu Mortgage Pass-Through Trust, Series 2007-HY2, Class 2A1 | 0.36 | 0.56 | 0.0991 | 0.0120 | |||||

| US912828Z377 / United States Treasury Inflation Indexed Bonds | 0.35 | 1.44 | 0.0980 | 0.0125 | |||||

| US170255AA19 / CHL MORTGAGE PASS-THROUGH TRUST 2007-1 SER 2007-1 CL A1 REGD 6.00000000 | 0.35 | -1.68 | 0.0976 | 0.0099 | |||||

| RFRF USD SOFR/2.28500 11/15/23-30Y LCH / DIR (EZ6VRNVRPQ25) | 0.33 | 7.12 | 0.0921 | 0.0161 | |||||

| US45662FAA84 / INDYMAC INDA MORTGAGE LOAN TRU INDA 2006 AR3 1A1 | 0.32 | -5.83 | 0.0897 | 0.0054 | |||||

| US17309QAG91 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2006 WFH3 M3 | 0.29 | 0.00 | 0.0818 | 0.0094 | |||||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | 0.29 | 0.0792 | 0.0792 | ||||||

| IT0005387052 / Italy Buoni Poliennali Del Tesoro | 0.28 | 11.42 | 0.0788 | 0.0163 | |||||

| US12639PAA66 / CSMC Mortgage-Backed Trust 2007-6 | 0.28 | -2.10 | 0.0779 | 0.0077 | |||||

| US3140X7SQ35 / FANNIE MAE POOL UMBS P#FM4126 4.00000000 | 0.28 | -2.45 | 0.0777 | 0.0075 | |||||

| US21H0326700 / GNMA2 30YR TBA(REG C) 3.5 TBA 07-01-50 | 0.27 | 0.0757 | 0.0757 | ||||||

| US1248RHAC14 / CREDIT-BASED ASSET SERVICING & SECURITIZATIO SER 2007-CB6 CL A3 V/R REGD 144A P/P 2.04275000 | 0.27 | -2.21 | 0.0738 | 0.0073 | |||||

| TREASURY BILL 07/25 0.00000 / DBT (US912797LW51) | 0.26 | 0.0729 | 0.0729 | ||||||

| CH1174335732 / Credit Suisse Group AG | 0.24 | 9.30 | 0.0654 | 0.0125 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.23 | 0.0650 | 0.0650 | ||||||

| US617487AF06 / MORGAN STANLEY MORTGAGE LOAN T MSM 2006 16AX 3A1 | 0.22 | 0.00 | 0.0614 | 0.0070 | |||||

| US46651QAA58 / JP Morgan Chase Commercial Mortgage Securities Trust 2019-FL12 | 0.22 | -1.79 | 0.0610 | 0.0061 | |||||

| US61915CAA71 / MORTGAGEIT TRUST MHL 2007 2 A1 | 0.21 | 0.00 | 0.0593 | 0.0069 | |||||

| US83612TAA07 / Soundview Home Loan Trust 2007-OPT1 | 0.20 | -0.99 | 0.0559 | 0.0060 | |||||

| US68389FGK49 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2005 1 M1 | 0.19 | -5.37 | 0.0541 | 0.0035 | |||||

| 3MO EURO EURIBOR SEP26 IFLL 20260914 / DIR (GB00J8R2ZN46) | 0.19 | 889.47 | 0.0524 | 0.0477 | |||||

| US36242DA604 / GSAMP TRUST GSAMP 2005 HE2 M2 | 0.18 | -1.68 | 0.0491 | 0.0051 | |||||

| RFR USD SOFR/3.50000 06/20/24-30Y CME / DIR (EZV8ZC6L7CY8) | 0.17 | 15.44 | 0.0479 | 0.0112 | |||||

| US060505FL38 / Bank of America Corp | 0.16 | 0.00 | 0.16 | 0.62 | 0.0451 | 0.0055 | |||

| US75971FAD50 / RENAISSANCE HOME EQUITY LOAN T RAMC 2007 3 AF1 | 0.15 | -1.28 | 0.0429 | 0.0044 | |||||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.14 | 0.0396 | 0.0396 | ||||||

| EURO-BUND FUTURE SEP25 XEUR 20250908 / DIR (DE000F1NGF53) | 0.14 | 0.0377 | 0.0377 | ||||||

| US64830KAA51 / New Residential Mortgage Loan Trust 2018-3 | 0.13 | -3.76 | 0.0357 | 0.0029 | |||||

| US74924EAA55 / RALI Series 2007-QH8 Trust | 0.13 | -3.08 | 0.0352 | 0.0031 | |||||

| INF SWAP EM NI 2.7 04/15/23-30Y LCH / DIR (EZ0Y9J6GR2R2) | 0.12 | 7.96 | 0.0341 | 0.0062 | |||||

| BUONI POLIENNALI DEL TES SR UNSECURED 144A REGS 05/36 1 / DBT (IT0005588881) | 0.12 | 13.08 | 0.0338 | 0.0074 | |||||

| US83613DAD84 / SOUNDVIEW HOME LOAN TRUST 2007-OPT2 SER 2007-OPT2 CL 2A3 V/R REGD 1.88800000 | 0.11 | -0.88 | 0.0314 | 0.0033 | |||||

| US05530VAN91 / BCAP LLC TRUST BCAP 2007 AA3 2A1A | 0.11 | -5.13 | 0.0311 | 0.0023 | |||||

| EURO-OAT FUTURE SEP25 XEUR 20250908 / DIR (DE000F1NGGA8) | 0.11 | 0.0301 | 0.0301 | ||||||

| INF SWAP EM NI 2.763 09/15/23-30Y LCH / DIR (EZSV4JHYN6X0) | 0.11 | 7.07 | 0.0296 | 0.0052 | |||||

| US126697AA90 / CWABS ASSET-BACKED CERTIFICATES TRUST 2007-12 SER 2007-12 CL 1A1 V/R REGD 2.44800000 | 0.10 | -2.97 | 0.0274 | 0.0026 | |||||

| INF SWAP EM NI 2.59 12/15/22-30Y LCH / DIR (EZQNRNKDZTL1) | 0.09 | 9.41 | 0.0260 | 0.0050 | |||||

| US45660LJZ31 / Residential Asset Securitization Trust, Series 2005-A5, Class A3 | 0.09 | -3.12 | 0.0259 | 0.0021 | |||||

| US362334ND27 / GSAA TRUST SER 2006-7 CL AF4A V/R REGD 6.22000000 | 0.09 | -3.16 | 0.0258 | 0.0024 | |||||

| US01852TAA16 / Alliance Bancorp Trust | 0.09 | -3.16 | 0.0258 | 0.0025 | |||||

| RFR JPY MUTK/0.50000 12/15/21-10Y LCH / DIR (EZBGMDDJHGZ6) | 0.09 | -20.72 | 0.0246 | -0.0027 | |||||

| US17311WAA53 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 AR4 1A1A | 0.09 | -1.15 | 0.0241 | 0.0027 | |||||

| US17307GT577 / Citigroup Mortgage Loan Trust Inc | 0.08 | -1.27 | 0.0219 | 0.0024 | |||||

| RFR USD SOFR/3.25000 03/19/25-10Y LCH / DIR (EZG5Z5S944W5) | 0.08 | -12.79 | 0.0210 | -0.0001 | |||||

| US07386HVS74 / BEAR STEARNS ALT A TRUST BALTA 2005 7 22A1 | 0.07 | -4.05 | 0.0200 | 0.0017 | |||||

| US12667CAD48 / Countrywide Asset-Backed Certificates, Series 2006-19, Class 2A3 | 0.07 | -2.74 | 0.0197 | 0.0017 | |||||

| US83611DAA63 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2006 NLC1 A1 144A | 0.07 | -1.43 | 0.0193 | 0.0019 | |||||

| US12668ATT24 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 62 2A1 | 0.07 | 0.00 | 0.0187 | 0.0021 | |||||

| INF SWAP EM NI 2.736 10/15/23-30Y LCH / DIR (EZW0QN60W2Z4) | 0.07 | 63.41 | 0.0187 | 0.0085 | |||||

| US61750SAA06 / MORGAN STANLEY CAPITAL INC MSAC 2006 HE8 A1 | 0.06 | -1.54 | 0.0180 | 0.0018 | |||||

| US83611MML99 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2006 OPT2 A4 | 0.06 | -4.69 | 0.0170 | 0.0011 | |||||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0.06 | 0.0157 | 0.0157 | ||||||

| INABS / Home Equity Mortgage Loan Asset-Backed Trust Series INABS 2007-A | 0.05 | -1.89 | 0.0147 | 0.0016 | |||||

| INF SWAP GB NI 3.5 08/15/24-10Y LCH / DIR (EZ2T5PFXSD76) | 0.05 | 128.57 | 0.0134 | 0.0082 | |||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.05 | 0.0132 | 0.0132 | ||||||

| INF SWAP EM NI 2.682 10/15/23-30Y LCH / DIR (EZW0QN60W2Z4) | 0.04 | 7.32 | 0.0124 | 0.0022 | |||||

| US17310VAD29 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2006 HE3 A2D | 0.04 | -2.22 | 0.0123 | 0.0012 | |||||

| FCT / Fincantieri S.p.A. | 0.04 | 8.11 | 0.0114 | 0.0022 | |||||

| US02149DAN93 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2006 HY13 4A1 | 0.04 | -2.44 | 0.0114 | 0.0013 | |||||

| AUST 10Y BOND FUT SEP25 XSFE 20250915 / DIR (000000000) | 0.04 | 0.0111 | 0.0111 | ||||||

| US885220FS76 / THORNBURG MORTGAGE SECURITIES TRUST 2004-3 TMST 2004-3 A | 0.04 | 0.00 | 0.0108 | 0.0010 | |||||

| US89177HAA05 / Towd Point Mortgage Trust, Series 2019-HY2, Class A1 | 0.04 | -7.32 | 0.0108 | 0.0005 | |||||

| US23332UEM27 / DSLA Mortgage Loan Trust, Series 2005-AR4, Class 2A1A | 0.04 | 0.00 | 0.0099 | 0.0011 | |||||

| US52522HAM43 / Lehman XS Trust, Series 2006-8, Class 3A4 | 0.04 | -2.78 | 0.0098 | 0.0010 | |||||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.03 | 0.0094 | 0.0094 | ||||||

| INF SWAP EM NI 2.59 03/15/22-30Y LCH / DIR (EZG97SKZBKQ4) | 0.03 | 17.86 | 0.0094 | 0.0024 | |||||

| US54251TAC36 / Long Beach Mortgage Loan Trust 2006-7 | 0.03 | 0.00 | 0.0093 | 0.0011 | |||||

| US35729TAA07 / Fremont Home Loan Trust, Series 2006-C, Class 1A1 | 0.03 | -3.03 | 0.0092 | 0.0010 | |||||

| RFR JPY MUT+5.89/0.4500 03/20/19-10Y LCH / DIR (EZ372SBFZ7Z5) | 0.03 | -23.81 | 0.0089 | -0.0015 | |||||

| US75114NAA28 / RALI Series Trust | 0.03 | -3.03 | 0.0089 | 0.0008 | |||||

| US863579UU02 / STRUCTURED ADJUSTABLE RATE MOR SARM 2005 15 4A1 | 0.03 | -3.12 | 0.0088 | 0.0009 | |||||

| US761136AJ94 / RESIDENTIAL ASSET SECURITIZATI RAST 2007 A1 A9 | 0.03 | -3.23 | 0.0085 | 0.0008 | |||||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.03 | 0.0082 | 0.0082 | ||||||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.03 | 0.0081 | 0.0081 | ||||||

| US92922F7P73 / WAMU_05-AR17 | 0.03 | -3.45 | 0.0081 | 0.0009 | |||||

| RFR JPY MUTK/0.55000 09/14/23-5Y LCH / DIR (EZ0DH7NGQM44) | 0.03 | -42.86 | 0.0080 | -0.0041 | |||||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.03 | 0.0078 | 0.0078 | ||||||

| US45661JAA16 / IndyMac INDB Mortgage Loan Trust, Series 2006-1, Class A1 | 0.03 | 0.00 | 0.0078 | 0.0008 | |||||

| US94985YAA55 / WELLS FARGO MORTGAGE BACKED SE WFMBS 2007 AR8 A1 | 0.03 | -6.90 | 0.0078 | 0.0005 | |||||

| US058928AF91 / BANC OF AMERICA FUNDING CORPOR BAFC 2006 B 3A1 | 0.03 | 0.00 | 0.0075 | 0.0009 | |||||

| EURO-BTP FUTURE SEP25 XEUR 20250908 / DIR (DE000F1NGF38) | 0.03 | 0.0074 | 0.0074 | ||||||

| US126670JV14 / CHL MORTGAGE PASS-THROUGH TRUST 2005-HYB9 SER 2005-HYB9 CL 2A1 V/R REGD 3.93850000 | 0.03 | 0.00 | 0.0070 | 0.0008 | |||||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0068 | 0.0068 | ||||||

| US3137B5HZ98 / Freddie Mac REMICS | 0.02 | 0.00 | 0.0062 | 0.0006 | |||||

| US93362FAJ21 / WAMU MORTGAGE PASS THROUGH CER WAMU 2006 AR8 3A1 | 0.02 | 0.00 | 0.0062 | 0.0007 | |||||

| US36185MBL54 / GMAC MORTGAGE CORPORATION LOAN TRUST | 0.02 | 0.00 | 0.0060 | 0.0007 | |||||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0.02 | 0.0060 | 0.0060 | ||||||

| LME PRI ALUM FUTR JUL25 XLME 20250714 / DCO (GB00FVN2W437) | 0.02 | 157.14 | 0.0052 | 0.0033 | |||||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0.02 | 0.0052 | 0.0052 | ||||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0049 | 0.0049 | ||||||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.02 | 0.0048 | 0.0048 | ||||||

| US92922FBV94 / WaMu Mortgage Pass-Through Certificates Trust, Series 2003-AR9, Class 1A6 | 0.02 | -5.88 | 0.0045 | 0.0004 | |||||

| INF SWAP GB NI 3.466 09/15/24-10Y LCH / DIR (EZ6H5KXS0QT8) | 0.02 | 220.00 | 0.0045 | 0.0031 | |||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.02 | 0.0044 | 0.0044 | ||||||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0.02 | 0.0043 | 0.0043 | ||||||

| RFR USD SOFR/4.25000 12/20/23-2Y LCH / DIR (EZM7XR6RB2D5) | 0.02 | -250.00 | 0.0043 | 0.0070 | |||||

| US92977YBR18 / WACHOVIA MORTGAGE LOAN TRUST, WMLT 2005 B 4A1 | 0.02 | 0.00 | 0.0043 | 0.0004 | |||||

| NATURAL GAS FUTR SEP25 XNYM 20250827 / DCO (000000000) | 0.02 | 0.0042 | 0.0042 | ||||||

| CORN FUTURE SEP25 XCBT 20250912 / DCO (000000000) | 0.01 | 0.0040 | 0.0040 | ||||||

| SILVER FUTURE SEP25 XCEC 20250926 / DCO (000000000) | 0.01 | 0.0039 | 0.0039 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.01 | 0.0037 | 0.0037 | ||||||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0037 | 0.0037 | ||||||

| US12555DAB10 / CIM Trust, Series 2019-INV1, Class A2 | 0.01 | -7.14 | 0.0037 | 0.0002 | |||||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0.01 | 0.0035 | 0.0035 | ||||||

| BOUGHT GBP SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0034 | 0.0034 | ||||||

| US05401AAR23 / Avolon Holdings Funding Ltd | 0.01 | 0.00 | 0.0032 | 0.0004 | |||||

| INF SWAP EM NI 2.58 03/15/22-30Y LCH / DIR (EZG97SKZBKQ4) | 0.01 | -64.29 | 0.0028 | -0.0042 | |||||

| US23245CAA80 / COUNTRYWIDE ASSET-BACKED CERTIFICATES SER 2007-1 CL 1A V/R REGD 1.84800000 | 0.01 | 0.00 | 0.0028 | 0.0003 | |||||

| PLATINUM FUTURE OCT25 XNYM 20251029 / DCO (000000000) | 0.01 | 0.0028 | 0.0028 | ||||||

| US12667LAA08 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 21 1A | 0.01 | 0.00 | 0.0026 | 0.0002 | |||||

| US32052DAG60 / First Horizon Alternative Mortgage Securities Trust, Series 2006-FA8, Class 1A7 | 0.01 | -11.11 | 0.0025 | 0.0002 | |||||

| US00442BAB71 / ACE SECURITIES CORP. ACE 2006 HE4 A2A | 0.01 | 0.00 | 0.0023 | 0.0003 | |||||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0023 | 0.0023 | ||||||

| US07388DAS71 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2006 2 3A2 | 0.01 | 0.00 | 0.0023 | 0.0002 | |||||

| US46629QAW69 / J.P. Morgan Mortgage Acquisition Trust 2006-Ch2 | 0.01 | -11.11 | 0.0022 | -0.0001 | |||||

| US93934FBT84 / WASHINGTON MUTUAL MORTGAGE PAS WMALT 2005 7 3CB | 0.01 | 0.00 | 0.0021 | 0.0002 | |||||

| LME NICKEL FUTURE JUL25 XLME 20250714 / DCO (GB00H249F944) | 0.01 | 250.00 | 0.0021 | 0.0016 | |||||

| US12465MAA27 / C-BASS 2006-CB9 TRUST | 0.01 | 0.00 | 0.0019 | 0.0002 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0019 | 0.0019 | ||||||

| US437084CE47 / Home Equity Asset Trust | 0.01 | -14.29 | 0.0019 | 0.0001 | |||||

| LME PRI ALUM FUTR SEP25 XLME 20250915 / DCO (GB00FW35KF69) | 0.01 | 0.0018 | 0.0018 | ||||||

| RFR JPY MUT+5.89/0.3000 03/20/18-10Y LCH / DIR (EZLFVTBKWB45) | 0.01 | -25.00 | 0.0018 | -0.0002 | |||||

| US007036TE63 / ADJUSTABLE RATE MORTGAGE TRUST ARMT 2005 10 3A11 | 0.01 | 0.00 | 0.0017 | 0.0002 | |||||

| CORN FUTURE DEC25 XCBT 20251212 / DCO (000000000) | 0.01 | 0.0017 | 0.0017 | ||||||

| US313398VT33 / FSPC T-35 A V/R 9/25/31 1.84800000 | 0.01 | -14.29 | 0.0017 | -0.0001 | |||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0016 | 0.0016 | ||||||

| NY HARB ULSD FUT DEC25 XNYM 20251128 / DCO (000000000) | 0.01 | 0.0016 | 0.0016 | ||||||

| MILL WHEAT EURO SEP25 XPAR 20250910 / DCO (FREN00432202) | 0.01 | 400.00 | 0.0016 | 0.0013 | |||||

| US59020UGF66 / Merrill Lynch Mortgage Investors Trust, Series 2004-D, Class A1 | 0.01 | 0.00 | 0.0016 | 0.0001 | |||||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.01 | 0.0015 | 0.0015 | ||||||

| RFR JPY MUT+5.89/0.3000 09/20/17-10Y LCH / DIR (EZCHL9CX9GW0) | 0.01 | -16.67 | 0.0015 | -0.0002 | |||||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0014 | 0.0014 | ||||||

| LME LEAD FUTURE JUL25 XLME 20250714 / DCO (GB00H249FY92) | 0.00 | 0.0014 | 0.0012 | ||||||

| LME LEAD FUTURE JUL25 XLME 20250714 / DCO (GB00H249FY92) | 0.00 | 0.0014 | 0.0012 | ||||||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0013 | 0.0013 | ||||||

| EURO-SCHATZ FUT SEP25 XEUR 20250908 / DIR (DE000F1NGF79) | 0.00 | 0.0013 | 0.0013 | ||||||

| KC HRW WHEAT FUT DEC25 XCBT 20251212 / DCO (000000000) | 0.00 | 0.0011 | 0.0011 | ||||||

| SUGAR 11 (WORLD) OCT25 IFUS 20250930 / DCO (000000000) | 0.00 | 0.0011 | 0.0011 | ||||||

| US05949CKT26 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2005 J 2A4 | 0.00 | 0.00 | 0.0011 | 0.0001 | |||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0011 | 0.0011 | ||||||

| US07387AGE91 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2005 12 23A1 | 0.00 | 0.00 | 0.0011 | 0.0001 | |||||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0010 | 0.0010 | ||||||

| COPPER FUTURE SEP25 XCEC 20250926 / DCO (000000000) | 0.00 | 0.0010 | 0.0010 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0009 | 0.0009 | ||||||

| GASOLINE RBOB FUT DEC25 XNYM 20251128 / DCO (000000000) | 0.00 | 0.0009 | 0.0009 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0009 | 0.0009 | ||||||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0009 | 0.0009 | ||||||

| JPN 10Y BOND(OSE) SEP25 XOSE 20250912 / DIR (000000000) | 0.00 | 0.0008 | 0.0008 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0008 | 0.0008 | ||||||

| US17307GW530 / Citigroup Mortgage Loan Trust 2005-11 | 0.00 | 0.00 | 0.0008 | 0.0001 | |||||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0008 | 0.0008 | ||||||

| LOW SU GASOIL G DEC25 IFEU 20251211 / DCO (GB00H6D17608) | 0.00 | 0.0008 | 0.0008 | ||||||

| BOUGHT ZAR SOLD USD 20250723 / DFE (000000000) | 0.00 | 0.0008 | 0.0008 | ||||||

| LME ZINC FUTURE SEP25 XLME 20250915 / DCO (GB00H24CQ015) | 0.00 | 0.0008 | 0.0008 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0008 | 0.0008 | ||||||

| KC HRW WHEAT FUT SEP25 XCBT 20250912 / DCO (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| WTI CRUDE FUTURE DEC25 XNYM 20251120 / DCO (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| SOYBEAN MEAL FUTR JAN26 XCBT 20260114 / DCO (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| LME NICKEL FUTURE SEP25 XLME 20250915 / DCO (GB00H24CMP86) | 0.00 | 0.0006 | 0.0006 | ||||||

| US86360KAA60 / Structured Asset Mortgage Investments II Trust 2006-AR3 | 0.00 | 0.00 | 0.0006 | 0.0001 | |||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| BOUGHT ZAR SOLD USD 20250723 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| BOUGHT ZAR SOLD USD 20250723 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| WHEAT FUTURE(CBT) DEC25 XCBT 20251212 / DCO (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| WHEAT FUTURE(CBT) SEP25 XCBT 20250912 / DCO (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| LME LEAD FUTURE SEP25 XLME 20250915 / DCO (GB00H24CNG60) | 0.00 | 0.0004 | 0.0004 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | ||||||

| SOYBEAN FUTURE JAN26 XCBT 20260114 / DCO (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| US17307GXR46 / Citigroup Mortgage Loan Trust Inc | 0.00 | 0.00 | 0.0003 | 0.0000 | |||||

| COTTON NO.2 FUTR DEC25 IFUS 20251208 / DCO (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| WHITE SUGAR (ICE) OCT25 IFEU 20250915 / DCO (GB00KFPXMP88) | 0.00 | 0.0003 | 0.0003 | ||||||

| NATURAL GAS FUTR JAN26 XNYM 20251229 / DCO (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| BOUGHT NZD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| INF SWAP EM NI 2.6 05/15/22-10Y LCH / DIR (EZYR3JTTYH67) | 0.00 | -100.00 | 0.0003 | -0.0004 | |||||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT ZAR SOLD USD 20250723 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| LME ZINC FUTURE JUL25 XLME 20250714 / DCO (GB00H249H767) | 0.00 | -100.00 | 0.0001 | -0.0002 | |||||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| LEAN HOGS FUTURE OCT25 XCME 20251014 / DCO (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| SUGAR 11 (WORLD) MAR26 IFUS 20260227 / DCO (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT KRW SOLD USD 20250708 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| SOYBEAN OIL FUTR JAN26 XCBT 20260114 / DCO (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT NOK SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| INF SWAP EM NI 2.4875 05/15/22-15Y LCH / DIR (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009403131 / JYSKE REALKREDIT A/S COVERED 10/53 1 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009403644 / JYSKE REALKREDIT A/S COVERED 10/53 1.5 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0004612454 / REALKREDIT DANMARK A/S COVERED 10/50 1 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009397739 / JYSKE REALKREDIT A/S COVERED 10/50 1 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0004616018 / Realkredit Danmark A/S | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009527376 / Nykredit Realkredit A/S, Series 01E | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009527103 / NYKREDIT REALKREDIT AS COVERED REGS 10/43 0.5 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009527293 / NYKREDIT REALKREDIT AS COVERED REGS 10/53 1 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0004616281 / REALKREDIT DKK SR SEC SF COVERED 1.0% 10-01-53 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009527616 / NYKREDIT REALKREDIT AS COVERED REGS 10/53 1.5 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0004619467 / Realkredit Danmark A/S | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009397069 / JYSKE REALKREDIT A/S COVERED REGS 10/50 1 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0002050368 / Nordea Kredit Realkreditaktieselskab | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0002050012 / NORDEA KREDIT REALKREDIT /DKK/ REGD 1.50000000 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0002047141 / Nordea Kredit Realkreditaktieselskab | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009403727 / JYSKE REALKREDIT A/S COVERED 10/53 1.5 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009528424 / NYKREDIT REALKREDIT AS COVERED REGS 10/53 1.5 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009399784 / JYSKE REALKREDIT A/S COVERED 10/43 0.5 | 0.00 | 0.0000 | 0.0000 | ||||||

| DK0009522815 / NYKREDIT REALKREDIT AS COVERED REGS 10/50 1 | 0.00 | 0.0000 | 0.0000 | ||||||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD NOK BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SGX IRON ORE 62 SEP25 XSIM 20250930 / DCO (SGXDB0712503) | -0.00 | -0.0000 | -0.0000 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| LIVE CATTLE FUTR OCT25 XCME 20251031 / DCO (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| SOLD KRW BOUGHT USD 20250708 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| SOLD KRW BOUGHT USD 20250714 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| INF SWAP EM NI 2.421 05/15/22-30Y LCH / DIR (EZ2FWGWN9JD1) | -0.00 | -0.0001 | 0.0001 | ||||||

| SOLD NOK BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| BRENT CRUDE FUTR MAR26 IFEU 20260130 / DCO (GB00H47KCH57) | -0.00 | -0.0001 | -0.0001 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD ILS BOUGHT USD 20250709 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SOLD NZD BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SOLD PLN BOUGHT USD 20250710 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| SOYBEAN FUTURE NOV25 XCBT 20251114 / DCO (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| GOLD 100 OZ FUTR DEC25 XCEC 20251229 / DCO (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| SOLD NZD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| LME ZINC FUTURE SEP25 XLME 20250915 / DCO (GB00H24CQ015) | -0.00 | -0.0005 | -0.0005 | ||||||

| SOLD ILS BOUGHT USD 20250718 / DFE (000000000) | -0.00 | -0.0008 | -0.0008 | ||||||

| SOLD ILS BOUGHT USD 20250718 / DFE (000000000) | -0.00 | -0.0008 | -0.0008 | ||||||

| LME ZINC FUTURE JUL25 XLME 20250714 / DCO (GB00H249H767) | -0.00 | -300.00 | -0.0008 | -0.0012 | |||||

| SOYBEAN OIL FUTR DEC25 XCBT 20251212 / DCO (000000000) | -0.00 | -0.0009 | -0.0009 | ||||||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0009 | -0.0009 | ||||||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0010 | -0.0010 | ||||||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0010 | -0.0010 | ||||||

| LME NICKEL FUTURE JUL25 XLME 20250714 / DCO (GB00H249F944) | -0.00 | -250.00 | -0.0010 | -0.0016 | |||||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.01 | -0.0014 | -0.0014 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.01 | -0.0016 | -0.0016 | ||||||

| LME LEAD FUTURE SEP25 XLME 20250915 / DCO (GB00H24CNG60) | -0.01 | -0.0016 | -0.0016 | ||||||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.01 | -0.0017 | -0.0017 | ||||||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0019 | -0.0019 | ||||||

| SOLD PLN BOUGHT USD 20250710 / DFE (000000000) | -0.01 | -0.0022 | -0.0022 | ||||||

| SOLD CHF BOUGHT USD 20250804 / DFE (000000000) | -0.01 | -0.0023 | -0.0023 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.01 | -0.0024 | -0.0024 | ||||||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0024 | -0.0024 | ||||||

| 317U84TA3 PIMCO SWAPTION 2.44 PUT EUR 20270125 / DIR (EZTFF0T0MM94) | -0.01 | -33.33 | -0.0024 | 0.0007 | |||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0026 | -0.0026 | ||||||

| IRS EUR 2.11200 09/02/25-2Y LCH / DIR (EZQ9KPR82S16) | -0.01 | -400.00 | -0.0027 | -0.0035 | |||||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.01 | -0.0029 | -0.0029 | ||||||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.01 | -0.0030 | -0.0030 | ||||||

| LME PRI ALUM FUTR SEP25 XLME 20250915 / DCO (GB00FW35KF69) | -0.01 | -0.0031 | -0.0031 | ||||||

| INF SWAP EM NI 2.034 09/15/24-10Y LCH / DIR (EZN396K1L0G6) | -0.01 | 266.67 | -0.0033 | -0.0024 | |||||

| SOLD PLN BOUGHT USD 20250710 / DFE (000000000) | -0.01 | -0.0033 | -0.0033 | ||||||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0034 | -0.0034 | ||||||

| 317U84SA4 PIMCO SWAPTION 2.44 CALL EUR 2027012 / DIR (EZ3172RBNXR7) | -0.01 | 8.33 | -0.0038 | -0.0007 | |||||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0039 | -0.0039 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.01 | -0.0040 | -0.0040 | ||||||

| COFFEE 'C' FUTURE DEC25 IFUS 20251218 / DCO (000000000) | -0.02 | -0.0043 | -0.0043 | ||||||

| SOYBEAN MEAL FUTR DEC25 XCBT 20251212 / DCO (000000000) | -0.02 | -0.0047 | -0.0047 | ||||||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.02 | -0.0049 | -0.0049 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.02 | -0.0052 | -0.0052 | ||||||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.02 | -0.0054 | -0.0054 | ||||||

| LME PRI ALUM FUTR JUL25 XLME 20250714 / DCO (GB00FVN2W437) | -0.02 | -385.71 | -0.0056 | -0.0075 | |||||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | -0.02 | -0.0060 | -0.0060 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.02 | -0.0061 | -0.0061 | ||||||

| INF SWAP EM NI 2.049 08/15/24-10Y LCH / DIR (EZDNND6WTG36) | -0.02 | 144.44 | -0.0062 | -0.0038 | |||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.02 | -0.0062 | -0.0062 | ||||||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | -0.02 | -0.0069 | -0.0069 | ||||||

| INF SWAP EM NI 2.975 08/15/22-5Y LCH / DIR (EZ8PCG447QQ1) | -0.03 | 47.06 | -0.0071 | -0.0028 | |||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0072 | -0.0072 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0072 | -0.0072 | ||||||

| 317U80OA6 PIMCO FPPSWAPTION 2.5 PUT EUR / DIR (EZX2S49T0J63) | -0.03 | -33.33 | -0.0078 | 0.0026 | |||||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.03 | -0.0079 | -0.0079 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0081 | -0.0081 | ||||||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.03 | -0.0082 | -0.0082 | ||||||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.03 | -0.0083 | -0.0083 | ||||||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.03 | -0.0083 | -0.0083 | ||||||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.03 | -0.0085 | -0.0085 | ||||||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.03 | -0.0086 | -0.0086 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0086 | -0.0086 | ||||||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | -0.03 | -0.0088 | -0.0088 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0088 | -0.0088 | ||||||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.03 | -0.0088 | -0.0088 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0089 | -0.0089 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0090 | -0.0090 | ||||||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.03 | -0.0091 | -0.0091 | ||||||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.03 | -0.0092 | -0.0092 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0092 | -0.0092 | ||||||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.03 | -0.0093 | -0.0093 | ||||||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0.03 | -0.0093 | -0.0093 | ||||||

| SOLD CHF BOUGHT USD 20250702 / DFE (000000000) | -0.03 | -0.0094 | -0.0094 | ||||||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | -0.03 | -0.0095 | -0.0095 | ||||||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -0.04 | -0.0100 | -0.0100 | ||||||

| EURO-BUXL 30Y BND SEP25 XEUR 20250908 / DIR (DE000F1NGF87) | -0.04 | -0.0118 | -0.0118 | ||||||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.05 | -0.0132 | -0.0132 | ||||||

| 317U80NA7 PIMCO FPPSWAPTION 2.5 CALL EUR / DIR (EZVYB6CMXS84) | -0.05 | 10.20 | -0.0151 | -0.0029 | |||||

| IRS EUR 2.12000 09/03/25-2Y LCH / DIR (EZ96RKPCNS84) | -0.06 | -456.25 | -0.0158 | -0.0198 | |||||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | -0.06 | -0.0160 | -0.0160 | ||||||

| RFRF USD SOFR/2.30000 11/15/23-5Y LCH / DIR (EZSXB4TMLK87) | -0.06 | -10.94 | -0.0160 | -0.0003 | |||||

| EURO-BOBL FUTURE SEP25 XEUR 20250908 / DIR (DE000F1NGF61) | -0.06 | -0.0170 | -0.0170 | ||||||

| 317U7XUA8 PIMCO FPPSWAPTION 2.35 PUT EUR / DIR (EZ221JVG9JT4) | -0.09 | -30.33 | -0.0237 | 0.0064 | |||||

| 317U7XVA7 PIMCO FPPSWAPTION 2.35 CALL EUR / DIR (EZM13T8B0L79) | -0.11 | 5.83 | -0.0305 | -0.0052 | |||||

| INF SWAP EM NI 1.38 03/15/21-10Y LCH / DIR (EZHGZY9N2Y63) | -0.12 | 7.48 | -0.0322 | -0.0057 | |||||

| RFR USD SOFR/3.08500 02/13/24-10Y LCH / DIR (EZQ51B8J0P93) | -0.12 | -85.56 | -0.0332 | 0.1690 | |||||

| RFR USD SOFR/4.10000 09/02/25-27Y* LCH / DIR (000000000) | -0.15 | -0.0410 | -0.0410 | ||||||

| GB00HB9WVH19 / 3 Month Euro Euribor | -0.15 | 341.18 | -0.0419 | -0.0334 | |||||

| 3175RWRC3 INF CAP FWD EU JUN35 3 CALL / DIR (000000000) | -0.15 | -0.0420 | -0.0420 | ||||||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | -0.17 | -0.0469 | -0.0469 | ||||||

| RFR USD SOFR/3.75000 09/02/25-7Y* LCH / DIR (000000000) | -0.18 | -0.0496 | -0.0496 | ||||||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | -0.21 | -0.0591 | -0.0591 | ||||||

| SOLD EUR BOUGHT USD 20250804 / DFE (000000000) | -0.23 | -0.0649 | -0.0649 | ||||||

| RFR GBP SONIO/3.50000 03/19/25-5Y LCH / DIR (EZ4P0PH8GZ40) | -0.24 | -0.0667 | -0.0667 | ||||||

| INF SWAP US IT 1.9975 07/25/19-10Y LCH / DIR (000000000) | -0.34 | -0.0943 | -0.0943 | ||||||

| RFRF USD SOFR/2.34000 11/21/23-5Y LCH / DIR (EZRPM2SGQXB3) | -0.41 | -10.48 | -0.1140 | -0.0015 | |||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0.54 | -0.1501 | -0.1501 | ||||||

| US LONG BOND(CBT) SEP25 XCBT 20250919 / DIR (000000000) | -0.77 | -0.2140 | -0.2140 | ||||||

| EZ793V7PSCT8 / INF SWAP US IT 1.8825 11/20/19-10Y LCH | -1.52 | -2.94 | -0.4226 | -0.0381 | |||||

| IRS EUR 2.25000 09/17/25-10Y LCH / DIR (EZNLCZXFPVL3) | -1.58 | -28.46 | -0.4378 | 0.1029 | |||||

| REVERSE REPO BANK OF AMERICA REVERSE REPO / RA (000000000) | -11.13 | -3.0890 | -3.0890 | ||||||

| REVERSE REPO THE BANK OF NOVA REVERSE REPO / RA (000000000) | -120.55 | -33.4701 | -33.4701 |