Statistik Asas

| Nilai Portfolio | $ 2,342,276,783 |

| Kedudukan Semasa | 468 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

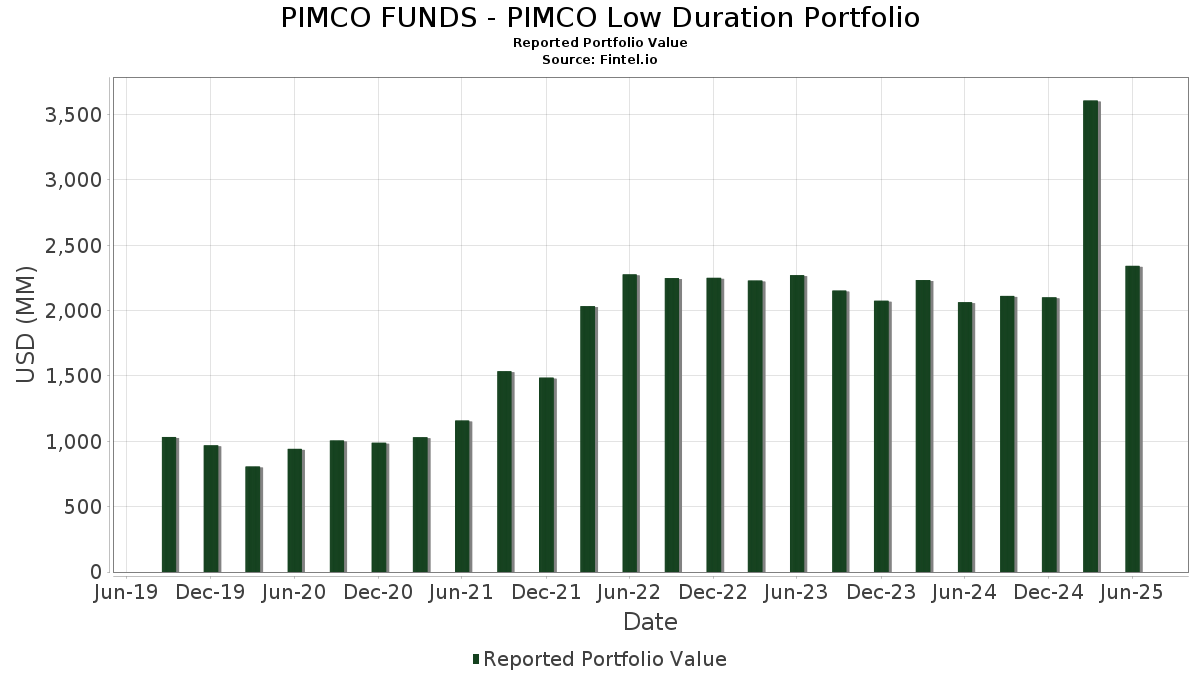

PIMCO FUNDS - PIMCO Low Duration Portfolio telah mendedahkan 468 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 2,342,276,783 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas PIMCO FUNDS - PIMCO Low Duration Portfolio ialah FNCL UMBS 4.5 CB4800 10-01-52 (US:US3140QQKN48) , UMBS TBA (US:US01F0306781) , Federal Home Loan Mortgage Corp. (US:US3132DWFE84) , Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , and BANK 2019-BNK22 BANK 2019-BN22 A4 (US:US06540XBG51) . Kedudukan baharu PIMCO FUNDS - PIMCO Low Duration Portfolio termasuk FNCL UMBS 4.5 CB4800 10-01-52 (US:US3140QQKN48) , UMBS TBA (US:US01F0306781) , Federal Home Loan Mortgage Corp. (US:US3132DWFE84) , Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , and BANK 2019-BNK22 BANK 2019-BN22 A4 (US:US06540XBG51) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 221.00 | 9.5750 | 9.5750 | ||

| 37.73 | 1.6348 | 1.6348 | ||

| 37.60 | 1.6290 | 1.6290 | ||

| 30.28 | 1.3121 | 1.3121 | ||

| 19.49 | 0.8443 | 0.8443 | ||

| 17.03 | 0.7377 | 0.7377 | ||

| 10.13 | 0.4391 | 0.3745 | ||

| 6.80 | 0.2948 | 0.2948 | ||

| 5.80 | 0.2515 | 0.2515 | ||

| 5.38 | 0.2330 | 0.2330 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 684.56 | 29.6590 | -1.1743 | ||

| 50.27 | 2.1778 | -0.1481 | ||

| 35.96 | 1.5579 | -0.1015 | ||

| 22.60 | 0.9794 | -0.0960 | ||

| 39.06 | 1.6922 | -0.0919 | ||

| 5.38 | 0.2331 | -0.0762 | ||

| 5.09 | 0.2205 | -0.0708 | ||

| 3.21 | 0.1391 | -0.0602 | ||

| 16.06 | 0.6956 | -0.0601 | ||

| 1.35 | 0.0585 | -0.0517 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-28 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US TREASURY N/B 09/26 3.5 / DBT (US91282CLP40) | 684.56 | 0.15 | 29.6590 | -1.1743 | |||||

| REPO BANK AMERICA REPO / RA (000000000) | 221.00 | 9.5750 | 9.5750 | ||||||

| FED HM LN PC POOL SD8408 FR 03/54 FIXED 5.5 / ABS-MBS (US3132DWKV45) | 50.27 | -2.52 | 2.1778 | -0.1481 | |||||

| US3140QQKN48 / FNCL UMBS 4.5 CB4800 10-01-52 | 39.06 | -1.25 | 1.6922 | -0.0919 | |||||

| US01F0306781 / UMBS TBA | 37.73 | 1.6348 | 1.6348 | ||||||

| REPO BANK AMERICA REPO / RA (000000000) | 37.60 | 1.6290 | 1.6290 | ||||||

| US3132DWFE84 / Federal Home Loan Mortgage Corp. | 35.96 | -2.25 | 1.5579 | -0.1015 | |||||

| TSY INFL IX N/B 01/35 2.125 / DBT (US91282CML27) | 30.28 | 1.3121 | 1.3121 | ||||||

| FREDDIE MAC FHR 5513 MF / ABS-MBS (US3137HKEX87) | 22.60 | -5.18 | 0.9794 | -0.0960 | |||||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 19.49 | 0.8443 | 0.8443 | ||||||

| US TREASURY N/B 05/35 4.25 / DBT (US91282CNC19) | 17.03 | 0.7377 | 0.7377 | ||||||

| FED HM LN PC POOL SD8516 FR 03/55 FIXED 6 / ABS-MBS (US3132DWN905) | 16.06 | -4.16 | 0.6956 | -0.0601 | |||||

| US06540XBG51 / BANK 2019-BNK22 BANK 2019-BN22 A4 | 11.67 | 1.47 | 0.5058 | -0.0132 | |||||

| US01F0406854 / UMBS TBA | 10.13 | 586.12 | 0.4391 | 0.3745 | |||||

| US46647PDG81 / JPMorgan Chase & Co. | 10.11 | 0.41 | 0.4379 | -0.0162 | |||||

| US09659W2M50 / BNP Paribas SA | 9.91 | 1.32 | 0.4295 | -0.0119 | |||||

| US404280DZ92 / HSBC HOLDINGS PLC REGD V/R 5.88700000 | 9.13 | -0.14 | 0.3956 | -0.0169 | |||||

| US88240TAA97 / Texas Electric Market Stabilization Funding N LLC | 9.08 | 0.23 | 0.3934 | -0.0152 | |||||

| US3134GW6C50 / FEDERAL HOME LOAN MORTGAGE CORP 0.80000000 | 8.83 | 0.87 | 0.3824 | -0.0123 | |||||

| US44935VAE92 / HALST_23-C | 8.77 | -0.34 | 0.3801 | -0.0170 | |||||

| US12434CAA27 / BX Trust, Series 2021-SDMF, Class A | 8.58 | 0.36 | 0.3719 | -0.0139 | |||||

| US05608RAA32 / BX Trust | 8.30 | 0.16 | 0.3594 | -0.0142 | |||||

| US3140XDRC24 / FNMA POOL FM9482 FN 11/51 FIXED VAR | 8.19 | -2.49 | 0.3549 | -0.0240 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 8.18 | 0.17 | 0.3544 | -0.0140 | |||||

| US06051GLA57 / Bank of America Corp. | 8.00 | -0.05 | 0.3466 | -0.0145 | |||||

| US3132DWGF41 / FR SD8298 | 7.47 | -2.81 | 0.3236 | -0.0231 | |||||

| AVIS BUDGET RENTAL CAR FUNDING AESOP 2024 1A A 144A / ABS-O (US05377RHY36) | 7.20 | 0.52 | 0.3118 | -0.0112 | |||||

| SCE.PRK / SCE Trust V - Preferred Security | 7.04 | 0.23 | 0.3051 | -0.0118 | |||||

| BACR / Barclays Bank PLC - Corporate Bond/Note | 7.00 | 0.10 | 0.3031 | -0.0122 | |||||

| US065405AE24 / BANK, Series 2019-BN16, Class A4 | 6.95 | 1.16 | 0.3012 | -0.0088 | |||||

| US6500358R24 / NEW YORK ST URBAN DEV CORP REV REGD N/C B/E 3.54000000 | 6.94 | 0.59 | 0.3006 | -0.0105 | |||||

| US06539LBB53 / BANK 2018-BNK13 | 6.92 | 0.93 | 0.3000 | -0.0095 | |||||

| US29478JAA88 / EQUS 2021-EQAZ Mortgage Trust | 6.90 | 0.57 | 0.2989 | -0.0105 | |||||

| US05377RHM97 / Avis Budget Rental Car Funding AESOP LLC | 6.86 | 0.13 | 0.2971 | -0.0118 | |||||

| FNMA POOL BZ3619 FN 04/30 FIXED 4.6 / ABS-MBS (US3140NYAV35) | 6.80 | 0.2948 | 0.2948 | ||||||

| US90117PAC95 / AOTA_15-1211 | 6.72 | -2.37 | 0.2911 | -0.0193 | |||||

| US05377RHC16 / AESOP 23-5 A 144A 5.78% 04-20-28/27 | 6.53 | -0.08 | 0.2830 | -0.0119 | |||||

| US3132DNYF40 / Federal Home Loan Mortgage Corporation | 6.51 | -3.07 | 0.2821 | -0.0209 | |||||

| US38141GWL49 / GOLDMAN SACHS GROUP INC SR UNSECURED 06/28 VAR | 6.41 | 0.53 | 0.2777 | -0.0099 | |||||

| MASSMUTUAL GLOBAL FUNDIN MASSMUTUAL GLOBAL FUNDIN / DBT (US57629W5B21) | 6.41 | 0.49 | 0.2775 | -0.0101 | |||||

| US06051GJB68 / Bank of America Corp | 6.40 | 1.78 | 0.2773 | -0.0064 | |||||

| US07274EAH62 / Bayer US Finance LLC | 6.30 | -0.22 | 0.2731 | -0.0119 | |||||

| DK0009391104 / JYSKE REALKREDIT A/S /DKK/ REGD SER 321E 1.00000000 | 6.29 | 0.91 | 0.2727 | -0.0087 | |||||

| US36268DAA00 / GMREV 23-2 A 144A 5.77% 08-11-36/11-13-28 | 6.28 | 0.27 | 0.2723 | -0.0105 | |||||

| US025816CS64 / American Express Co | 6.09 | 0.74 | 0.2638 | -0.0088 | |||||

| NISSAN AUTO LEASE TRUST NALT 2024 A A3 / ABS-O (US65481CAD65) | 6.02 | -0.07 | 0.2610 | -0.0109 | |||||

| CBAMR LTD CBAMR 2019 9A AR 144A / ABS-CBDO (US14987VAN91) | 6.02 | 0.13 | 0.2607 | -0.0104 | |||||

| FORD CREDIT AUTO LEASE TRUST FORDL 2024 A A3 / ABS-O (US345290AD29) | 6.01 | -0.15 | 0.2605 | -0.0111 | |||||

| US06051GJQ38 / Bank of America Corp | 5.98 | 0.84 | 0.2593 | -0.0084 | |||||

| US38141GZK39 / Goldman Sachs Group Inc/The | 5.95 | 0.61 | 0.2578 | -0.0090 | |||||

| US3138LHW915 / FANNIE MAE POOL UMBS P#AN5171 3.29000000 | 5.92 | 0.48 | 0.2565 | -0.0093 | |||||

| EMPIRE DISTRICT BONDCO SR SECURED 01/35 4.943 / DBT (US291918AA87) | 5.89 | 0.31 | 0.2550 | -0.0097 | |||||

| US225401AV01 / Credit Suisse Group AG | 5.87 | 0.17 | 0.2544 | -0.0100 | |||||

| US3132XGVV55 / FHLMC | 5.81 | 0.38 | 0.2519 | -0.0093 | |||||

| MADISON PARK FUNDING LTD MDPK 2020 46A ARR 144A / ABS-CBDO (US55822AAW71) | 5.81 | 0.64 | 0.2516 | -0.0087 | |||||

| FNMA POOL BZ3505 FN 04/30 FIXED 4.25 / ABS-MBS (US3140NX3P67) | 5.80 | 0.2515 | 0.2515 | ||||||

| US00217VAA89 / AREIT 2022-CRE7 LLC | 5.78 | -10.77 | 0.2505 | -0.0418 | |||||

| US05522RDG02 / BA Credit Card Trust | 5.63 | -0.04 | 0.2437 | -0.0101 | |||||

| US14041NGD75 / CAPITAL ONE MULTI-ASST EXEC TR 4.42% 05/15/2028 | 5.61 | 0.04 | 0.2429 | -0.0099 | |||||

| FLORIDA POWER + LIGHT CO FLORIDA POWER + LIGHT CO / DBT (US341081GT84) | 5.54 | 0.71 | 0.2400 | -0.0081 | |||||

| US61747YFD22 / Morgan Stanley | 5.51 | 0.58 | 0.2386 | -0.0084 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 5.44 | -0.04 | 0.2359 | -0.0098 | |||||

| VIRGINIA POWER FUEL SEC SR SECURED 05/29 5.088 / DBT (US92808VAA08) | 5.38 | -21.54 | 0.2331 | -0.0762 | |||||

| YALE UNIVERSITY SR UNSECURED 04/32 4.701 / DBT (US98459LAD55) | 5.38 | 0.2330 | 0.2330 | ||||||

| US639057AC29 / NatWest Group PLC | 5.35 | 0.87 | 0.2320 | -0.0075 | |||||

| US29003JAC80 / Elmwood CLO 15 Ltd | 5.30 | 0.00 | 0.2296 | -0.0095 | |||||

| US46647PDX15 / JPMorgan Chase & Co | 5.26 | 0.40 | 0.2277 | -0.0085 | |||||

| US76209PAC77 / RGA GLOBAL FUNDING | 5.25 | 0.25 | 0.2274 | -0.0088 | |||||

| US14041NGB10 / COMET 2022-A3 A | 5.21 | -0.10 | 0.2256 | -0.0095 | |||||

| FNMA POOL BL6406 FN 05/27 FIXED 1.63 / ABS-MBS (US3140HYDL99) | 5.16 | 0.94 | 0.2237 | -0.0070 | |||||

| US606822CS14 / MITSUBISHI UFJ FINANCIAL GROUP INC | 5.13 | 0.31 | 0.2223 | -0.0084 | |||||

| US25160PAN78 / Deutsche Bank AG | 5.13 | -0.25 | 0.2221 | -0.0098 | |||||

| US38141GZS64 / GOLDMAN SACHS GROUP INC SR UNSECURED 03/28 VAR | 5.10 | -0.18 | 0.2208 | -0.0095 | |||||

| US232989AC75 / DLLMT_23-1A | 5.09 | -21.20 | 0.2205 | -0.0708 | |||||

| VIRGINIA POWER FUEL SEC SR SECURED 05/33 4.877 / DBT (US92808VAB80) | 5.09 | 0.57 | 0.2203 | -0.0078 | |||||

| BRIGHTHSE FIN GLBL FUND BRIGHTHSE FIN GLBL FUND / DBT (US10921U2J68) | 5.08 | 0.28 | 0.2201 | -0.0085 | |||||

| US14318XAC92 / CarMax Auto Owner Trust 2023-4 | 5.07 | -0.28 | 0.2198 | -0.0097 | |||||

| FNMA POOL MA5670 FN 04/55 FIXED 4 / ABS-MBS (US31418FJQ19) | 5.05 | -1.58 | 0.2189 | -0.0127 | |||||

| HYUNDAI AUTO LEASE SECURITIZAT HALST 2025 B A3 144A / ABS-O (US44935DAD12) | 5.04 | 0.2182 | 0.2182 | ||||||

| US31418ED649 / Fannie Mae Pool | 4.85 | -1.86 | 0.2101 | -0.0128 | |||||

| US31418EEE68 / FANNIE MAE POOL UMBS P#MA4632 3.00000000 | 4.80 | -1.17 | 0.2079 | -0.0111 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 4.79 | 0.91 | 0.2075 | -0.0066 | |||||

| US64035DAC02 / Nelnet Student Loan Trust 2021-A | 4.76 | -1.39 | 0.2061 | -0.0115 | |||||

| US379930AD24 / GM Financial Consumer Automobile Receivables Trust 2023-4 | 4.76 | -0.15 | 0.2060 | -0.0088 | |||||

| US46647PCB04 / JPMorgan Chase & Co | 4.69 | 0.73 | 0.2032 | -0.0068 | |||||

| US30227FAA84 / Extended Stay America Trust | 4.68 | -0.87 | 0.2027 | -0.0102 | |||||

| US00774MAV72 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 4.68 | 0.82 | 0.2027 | -0.0066 | |||||

| US3130ANGM63 / FEDERAL HOME LOAN BANKS 1.05000000 | 4.65 | 0.78 | 0.2013 | -0.0066 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 4.59 | 0.09 | 0.1990 | -0.0080 | |||||

| US06738ECK91 / Barclays PLC | 4.55 | 0.53 | 0.1970 | -0.0070 | |||||

| US61772WAA53 / Morgan Stanley Capital I Trust 2021-230P | 4.52 | -0.96 | 0.1960 | -0.0101 | |||||

| SCULPTOR CLO LTD SCUL 27A A1R 144A / ABS-CBDO (US81124UAW45) | 4.50 | 0.42 | 0.1950 | -0.0072 | |||||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A4A66) | 4.42 | 0.11 | 0.1915 | -0.0076 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 4.39 | 0.1903 | 0.1903 | ||||||

| US3137HAST48 / FHMS K509 A2 | 4.39 | 0.43 | 0.1902 | -0.0070 | |||||

| OCTAGON INVESTMENT PARTNERS 40 OCT40 2019 1A A1RR 144A / ABS-CBDO (US67592BAY48) | 4.38 | -0.46 | 0.1896 | -0.0087 | |||||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2019 15A A1R 144A / ABS-CBDO (US04942MAN48) | 4.34 | -13.05 | 0.1882 | -0.0372 | |||||

| NORTHWESTERN UNIVERSITY UNSECURED 12/35 4.94 / DBT (US668444AT96) | 4.33 | 0.98 | 0.1877 | -0.0059 | |||||

| US46647PAF36 / JPMorgan Chase & Co | 4.24 | 0.55 | 0.1836 | -0.0065 | |||||

| WELLS FARGO COMMERCIAL MORTGAG WFCM 2024 5C2 A2 / ABS-MBS (US95003UAC45) | 4.22 | 0.55 | 0.1827 | -0.0065 | |||||

| US40139LBH50 / Guardian Life Global Funding | 4.19 | 0.46 | 0.1813 | -0.0066 | |||||

| US98164FAD42 / WOART 23-C A3 5.15% 11-15-28 | 4.16 | -5.95 | 0.1802 | -0.0193 | |||||

| SYSTEM ENERGY RESOURCES 1ST REF MORT 12/34 5.3 / DBT (US871911AV54) | 4.15 | 0.1799 | 0.1799 | ||||||

| BIRCH GROVE CLO LTD. BGCLO 19A A1RR 144A / ABS-CBDO (US09075JAU34) | 4.12 | 0.32 | 0.1783 | -0.0067 | |||||

| US902613AS79 / UBS Group AG | 4.11 | 0.20 | 0.1780 | -0.0069 | |||||

| BMO MORTGAGE TRUST BMO 2024 5C5 A2 / ABS-MBS (US05593RAB87) | 4.10 | 0.91 | 0.1778 | -0.0056 | |||||

| US05377RGC25 / Avis Budget Rental Car Funding AESOP LLC | 4.08 | 0.29 | 0.1769 | -0.0067 | |||||

| US05377RGU23 / Avis Budget Rental Car Funding AESOP LLC | 4.05 | -0.05 | 0.1756 | -0.0073 | |||||

| COOPERAT RABOBANK UA/NY 10/29 4.494 / DBT (US21688ABH41) | 4.05 | 1.30 | 0.1753 | -0.0049 | |||||

| FED HM LN PC POOL SD8507 FR 02/55 FIXED 6 / ABS-MBS (US3132DWNY56) | 4.03 | -3.98 | 0.1748 | -0.0147 | |||||

| US539439AQ24 / Lloyds Banking Group PLC | 4.01 | 0.78 | 0.1739 | -0.0057 | |||||

| FREDDIE MAC FHR 5511 FG / ABS-MBS (US3137HKKP89) | 4.00 | -9.07 | 0.1733 | -0.0251 | |||||

| FANNIE MAE FNR 2025 52 FB / ABS-MBS (US3136BWUZ70) | 3.96 | 0.1714 | 0.1714 | ||||||

| US17305EGW93 / CITIBANK CREDIT CARD ISSUANCE TRUST SER 2023-A1 CL A1 REGD 5.23000000 | 3.91 | -0.15 | 0.1695 | -0.0073 | |||||

| VERIZON MASTER TRUST VZMT 2024 6 A1A / ABS-O (US92348KDE01) | 3.91 | 0.57 | 0.1694 | -0.0059 | |||||

| CHUBB INA HOLDINGS LLC CHUBB INA HOLDINGS LLC / DBT (US171239AL07) | 3.87 | 0.89 | 0.1675 | -0.0054 | |||||

| PRINCIPAL LFE GLB FND II SECURED 144A 01/28 4.8 / DBT (US74256LFC81) | 3.85 | 0.34 | 0.1667 | -0.0063 | |||||

| US21871XAF69 / CORP. NOTE | 3.82 | 1.33 | 0.1656 | -0.0045 | |||||

| US34535CAA45 / FORDR_23-2 | 3.81 | 0.61 | 0.1653 | -0.0058 | |||||

| US02582JJX90 / American Express Credit Account Master Trust, Series 2022-4, Class A | 3.81 | -0.08 | 0.1649 | -0.0070 | |||||

| US87166PAL58 / SYNIT 23-A2 A 5.74% 10-15-29/26 | 3.77 | -0.19 | 0.1633 | -0.0070 | |||||

| US539439AY57 / LLOYDS BANKING GROUP PLC 5.985000% 08/07/2027 | 3.76 | -0.13 | 0.1628 | -0.0069 | |||||

| JACKSON NATL LIFE GLOBAL SECURED 144A 06/28 4.7 / DBT (US46849CJP77) | 3.72 | 0.1613 | 0.1613 | ||||||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 3 A3 / ABS-O (US43813YAC66) | 3.72 | 0.11 | 0.1612 | -0.0064 | |||||

| US087598AA60 / BETHP 2021 3ML+113 01/15/2035 144A | 3.71 | 0.14 | 0.1606 | -0.0064 | |||||

| PG+E RECOVERY FND LLC SR SECURED 06/35 4.838 / DBT (US71710TAG31) | 3.70 | -7.96 | 0.1602 | -0.0210 | |||||

| SWEPCO STORM RECOVERY FU SR SECURED 09/41 4.88 / DBT (US870696AA94) | 3.68 | -0.49 | 0.1594 | -0.0074 | |||||

| US054980AA58 / BDS 2022-FL11 LLC | 3.68 | -6.03 | 0.1593 | -0.0172 | |||||

| US55284JAA79 / MF1 2022-FL8 Ltd | 3.64 | -12.57 | 0.1579 | -0.0301 | |||||

| US87277JAA97 / TRTX 2022-FL5 Issuer Ltd | 3.63 | -7.98 | 0.1573 | -0.0207 | |||||

| EAI / Entergy Arkansas, LLC - Corporate Bond/Note | 3.61 | 0.1563 | 0.1563 | ||||||

| US210518DV59 / CMS ENERGY CORPORATION | 3.58 | 0.85 | 0.1549 | -0.0051 | |||||

| US67021CAU18 / NSTAR Electric Co | 3.57 | -0.20 | 0.1546 | -0.0067 | |||||

| BMO MORTGAGE TRUST BMO 2024 5C7 A2 / ABS-MBS (US09660WAT80) | 3.56 | 0.71 | 0.1544 | -0.0052 | |||||

| NRUC / National Rural Utilities Cooperative Finance Corporation - Corporate Bond/Note | 3.56 | 0.23 | 0.1542 | -0.0060 | |||||

| US42806MCE75 / HERTZ 23-4 A 144A 6.15% 03-25-30/03-26-29 | 3.55 | 0.71 | 0.1539 | -0.0052 | |||||

| US14044EAD04 / CAPITAL ONE PRIME AUTO RECEIVABLES TRUST 2023-2 5.82% 06/15/2028 | 3.54 | -0.17 | 0.1536 | -0.0066 | |||||

| US225401AU28 / Credit Suisse Group AG | 3.54 | 1.99 | 0.1534 | -0.0032 | |||||

| VERDELITE STATIC CLO LTD BVSTAT 2024 1A A 144A / ABS-CBDO (US92338VAA98) | 3.53 | -5.92 | 0.1528 | -0.0163 | |||||

| US63940NAC48 / NAVSL_17-1A | 3.52 | -1.98 | 0.1525 | -0.0095 | |||||

| PROLOGIS TARGETED US PROLOGIS TARGETED US / DBT (US74350LAA26) | 3.49 | 0.69 | 0.1514 | -0.0052 | |||||

| FLORIDA ST BRD OF ADMIN FIN CO FLSGEN 07/34 FIXED 5.526 / DBT (US341271AH76) | 3.49 | 0.09 | 0.1513 | -0.0061 | |||||

| US61747YED31 / Morgan Stanley | 3.46 | 1.70 | 0.1501 | -0.0036 | |||||

| US12434FAA57 / BX Commercial Mortgage Trust 2021-CIP | 3.39 | -3.84 | 0.1467 | -0.0121 | |||||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 3.38 | 0.65 | 0.1466 | -0.0050 | |||||

| STANFORD UNIVERSITY SR UNSECURED 03/35 4.679 / DBT (US85440KAE47) | 3.38 | 0.39 | 0.1465 | -0.0054 | |||||

| US404280DF39 / HSBC HOLD PLC 4.755 6/28 | 3.36 | 0.42 | 0.1457 | -0.0054 | |||||

| IVW / Meta Platforms, Inc. - Depositary Receipt (Common Stock) | 3.33 | 0.91 | 0.1443 | -0.0046 | |||||

| US36143L2D64 / GA Global Funding Trust | 3.33 | 1.37 | 0.1441 | -0.0039 | |||||

| BARCLAYS COMMERCIAL MORTGAGE S BBCMS 2025 C32 A4 / ABS-MBS (US07337AAC09) | 3.31 | 0.52 | 0.1433 | -0.0051 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 3.30 | 0.12 | 0.1430 | -0.0057 | |||||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 3.28 | 0.1423 | 0.1423 | ||||||

| US78398AAE38 / SFAST 23-1 A4 144A 5.47% 12-20-29/06-21-27 | 3.26 | -0.15 | 0.1412 | -0.0061 | |||||

| US78486BAA26 / STARWOOD COMMERCIAL MORTGAGE T STWD 2021 FL2 A 144A | 3.21 | -27.32 | 0.1391 | -0.0602 | |||||

| US55375KAS50 / MSSG Trust, Series 2017-237P, Class A | 3.20 | 0.60 | 0.1387 | -0.0049 | |||||

| SOUTHERN CALIF GAS CO 1ST MORTGAGE 06/35 5.45 / DBT (US842434DC38) | 3.17 | 0.1372 | 0.1372 | ||||||

| US78398AAD54 / SFS Auto Receivables Securitization Trust, Series 2023-1A, Class A3 | 3.15 | -10.66 | 0.1366 | -0.0226 | |||||

| US86562MDG24 / Sumitomo Mitsui Financial Group, Inc. | 3.12 | 0.39 | 0.1352 | -0.0050 | |||||

| PROTECTIVE LIFE GLOBAL SECURED 144A 01/32 5.432 / DBT (US74368CCB81) | 3.10 | 0.65 | 0.1343 | -0.0046 | |||||

| MUTUAL OF OMAHA GLOBAL MUTUAL OF OMAHA GLOBAL / DBT (US62829D2B56) | 3.09 | 0.13 | 0.1337 | -0.0053 | |||||

| MASSMUTUAL GLOBAL FUNDIN SECURED 144A 01/30 4.95 / DBT (US57629TBV89) | 3.07 | 1.39 | 0.1329 | -0.0036 | |||||

| CARVAL CLO LTD CARVL 2019 2A AR2 144A / ABS-CBDO (US14686WAW10) | 3.06 | -1.07 | 0.1326 | -0.0070 | |||||

| US75513ECT64 / RTX CORP SR UNSEC 5.75% 11-08-26 | 3.06 | 0.03 | 0.1324 | -0.0054 | |||||

| US08162VAC28 / BENCHMARK 2019-B10 Mortgage Trust | 3.06 | -5.71 | 0.1324 | -0.0138 | |||||

| US251526CK32 / DEUTSCHE BANK AG NEW YORK BNCH 3.035/VAR 05/28/2032 | 3.05 | 2.49 | 0.1322 | -0.0021 | |||||

| SAMMONS FINANCIAL GLOBAL SECURED 144A 06/30 4.95 / DBT (US79587J2C65) | 3.03 | 0.1315 | 0.1315 | ||||||

| BENCHMARK MORTGAGE TRUST BMARK 2025 V14 A4 / ABS-MBS (US08164BAD29) | 2.92 | 0.93 | 0.1265 | -0.0040 | |||||

| US06051GJS93 / Bank of America Corp | 2.92 | 0.83 | 0.1264 | -0.0041 | |||||

| CMCS34 / Comcast Corporation - Depositary Receipt (Common Stock) | 2.89 | 0.87 | 0.1252 | -0.0040 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 2.87 | 0.88 | 0.1245 | -0.0040 | |||||

| WELLS FARGO COMMERCIAL MORTGAG WFCM 2024 5C2 A3 / ABS-MBS (US95003UAD28) | 2.83 | 0.57 | 0.1226 | -0.0043 | |||||

| US694308KC03 / Pacific Gas and Electric Co | 2.82 | 0.25 | 0.1220 | -0.0047 | |||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 2.81 | 0.65 | 0.1216 | -0.0042 | |||||

| US55953WAA80 / Magnetite XXXII Ltd., Series 2022-32A, Class A | 2.80 | 0.00 | 0.1214 | -0.0050 | |||||

| ANCHORAGE CAPITAL CLO LTD ANCHC 2021 21A AR 144A / ABS-CBDO (US03331KAJ88) | 2.80 | 0.54 | 0.1213 | -0.0043 | |||||

| NATIONAL SECS CLEARING SR UNSECURED 144A 05/30 4.7 / DBT (US637639AQ81) | 2.75 | 0.1190 | 0.1190 | ||||||

| US3137HAMP89 / FHLMC Multifamily Structured Pass-Through Certificates, Series KJ47, Class A2 | 2.72 | 0.44 | 0.1177 | -0.0043 | |||||

| US03027XCE85 / American Tower Corp. | 2.71 | 0.67 | 0.1176 | -0.0040 | |||||

| FREDDIE MAC FHR 5439 FK / ABS-MBS (US3137HF3S28) | 2.71 | -8.52 | 0.1173 | -0.0162 | |||||

| TVC / Tennessee Valley Authority - Preferred Stock | 2.69 | 0.30 | 0.1163 | -0.0044 | |||||

| US647622AA79 / New Orleans Hotel Trust 2019-HNLA | 2.68 | 0.41 | 0.1161 | -0.0043 | |||||

| US46645WAU71 / JP Morgan Chase Commercial Mortgage Securities Trust 2018-WPT | 2.66 | 0.95 | 0.1153 | -0.0036 | |||||

| US29250NBW48 / ENBRIDGE INC 5.9% 11/15/2026 | 2.65 | -0.26 | 0.1147 | -0.0050 | |||||

| DTE ELECTRIC CO GENL REF MOR 05/27 4.25 / DBT (US23338VAW63) | 2.60 | 0.1129 | 0.1129 | ||||||

| MADISON PARK FUNDING LTD MDPK 2021 49A AR 144A / ABS-CBDO (US55820VAL71) | 2.60 | 0.23 | 0.1125 | -0.0044 | |||||

| T MOBILE USA INC T MOBILE USA INC / DBT (US87264ADL61) | 2.58 | 1.14 | 0.1119 | -0.0033 | |||||

| US69291QAA31 / PFP III PFP 2022 9 A 144A | 2.58 | -21.87 | 0.1116 | -0.0371 | |||||

| NLG GLOBAL FUNDING SECURED 144A 01/30 5.4 / DBT (US62915W2A05) | 2.57 | 1.10 | 0.1116 | -0.0033 | |||||

| BENCHMARK MORTGAGE TRUST BMARK 2025 V14 A3 / ABS-MBS (US08164BAC46) | 2.56 | 0.99 | 0.1108 | -0.0034 | |||||

| ATHENE GLOBAL FUNDING SECURED 144A 01/30 5.38 / DBT (US04685A4G37) | 2.56 | 0.79 | 0.1108 | -0.0036 | |||||

| US55285BAA35 / MF1 2022-FL10 LLC MF1 2022-FL10 A | 2.55 | -5.66 | 0.1105 | -0.0115 | |||||

| US78486EAA64 / STWD 2021-LIH Mortgage Trust | 2.54 | 0.47 | 0.1101 | -0.0040 | |||||

| US06675FBA49 / Banque Federative du Credit Mutuel SA | 2.54 | -0.12 | 0.1100 | -0.0046 | |||||

| US3137HAMH63 / Freddie Mac Multifamily Structured Pass Through Certificates | 2.54 | 0.48 | 0.1099 | -0.0040 | |||||

| US404280CC17 / HSBC Holdings PLC | 2.53 | 1.16 | 0.1097 | -0.0032 | |||||

| US86944BAG86 / Sutter Health | 2.53 | 1.77 | 0.1096 | -0.0025 | |||||

| US3138LMVK66 / FANNIE MAE POOL UMBS P#AN8717 3.02000000 | 2.53 | 0.88 | 0.1096 | -0.0035 | |||||

| PACIFIC LIFE GF II SECURED 144A 08/29 4.5 / DBT (US6944PL3C15) | 2.51 | 0.84 | 0.1089 | -0.0035 | |||||

| VERIZON MASTER TRUST VZMT 2024 7 A 144A / ABS-O (US92348KDJ97) | 2.51 | 0.76 | 0.1087 | -0.0036 | |||||

| APIDOS CLO LTD APID 2012 11A AR4 144A / ABS-CBDO (US03763YBY14) | 2.50 | -0.04 | 0.1083 | -0.0045 | |||||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 2.49 | 0.1081 | 0.1081 | ||||||

| US78449QAB32 / SMB PRIVATE EDUCATION LOAN TRUST 2018-C SMB 2018-C A2A | 2.49 | -14.13 | 0.1077 | -0.0229 | |||||

| US91412HGF47 / UNIV OF CALIFORNIA CA REVENUES | 2.48 | 1.18 | 0.1075 | -0.0031 | |||||

| US3132XGVW39 / FED HM LN PC POOL WN2428 FR 04/28 FIXED 4.84 | 2.48 | 0.16 | 0.1075 | -0.0043 | |||||

| US9698878G68 / WILLIAMSON CNTY TX | 2.45 | 0.91 | 0.1061 | -0.0033 | |||||

| US90276YAC75 / UBS Commercial Mortgage Trust 2019-C16 | 2.39 | -5.08 | 0.1037 | -0.0101 | |||||

| US78473JAA07 / SREIT Trust 2021-IND | 2.39 | 0.63 | 0.1037 | -0.0036 | |||||

| TRANS ALLEGHENY INTERSTA SR UNSECURED 144A 01/31 5 / DBT (US893045AF16) | 2.34 | 0.1014 | 0.1014 | ||||||

| US403950AA61 / HGI CRE CLO 2021-FL3 Ltd | 2.33 | 0.22 | 0.1008 | -0.0039 | |||||

| US007944AF80 / Adventist Health System/West | 2.32 | 0.65 | 0.1007 | -0.0035 | |||||

| US09261BAC46 / Blackstone Holdings Finance Co. LLC | 2.30 | 1.14 | 0.0998 | -0.0029 | |||||

| DRYDEN SENIOR LOAN FUND DRSLF 2021 95A AR 144A / ABS-CBDO (US262487AJ07) | 2.29 | -0.22 | 0.0994 | -0.0043 | |||||

| AMEREN MISSOURI SEC FU I SR SECURED 10/41 4.85 / DBT (US023940AA78) | 2.28 | -0.35 | 0.0989 | -0.0045 | |||||

| US065403BA45 / BANK 2019-BNK17 | 2.26 | -5.36 | 0.0980 | -0.0098 | |||||

| BARCLAYS COMMERCIAL MORTGAGE S BBCMS 2024 5C31 A2 / ABS-MBS (US07336YAB11) | 2.26 | 0.85 | 0.0977 | -0.0032 | |||||

| BANQUE FED CRED MUTUEL BANQUE FED CRED MUTUEL / DBT (US06675DCM20) | 2.24 | 0.27 | 0.0971 | -0.0037 | |||||

| US30326MAA36 / FS RIALTO | 2.20 | -2.01 | 0.0952 | -0.0060 | |||||

| US748149AJ05 / Province of Quebec Canada | 2.17 | 0.46 | 0.0941 | -0.0034 | |||||

| US477143AH41 / JetBlue 2019-1 Class AA Pass Through Trust | 2.15 | -2.27 | 0.0933 | -0.0061 | |||||

| GREYSTONE COMMERCIAL REAL ESTA GSTNE 2025 FL4 A 144A / ABS-CBDO (US39810MAA71) | 2.15 | 0.0933 | 0.0933 | ||||||

| US54627RAN08 / Louisiana Local Government Environmental Facilities & Community Development Auth | 2.14 | 0.66 | 0.0928 | -0.0032 | |||||

| US842400HU08 / Southern California Edison Co | 2.13 | 0.09 | 0.0922 | -0.0037 | |||||

| EQUITABLE AMERICA GLOBAL SECURED 144A 06/30 4.95 / DBT (US29446Q2B87) | 2.12 | 0.0920 | 0.0920 | ||||||

| TRALEE CLO LTD TRAL 2018 5A A1RR 144A / ABS-CBDO (US89300JBA51) | 2.10 | 0.14 | 0.0911 | -0.0036 | |||||

| US00138CAV00 / Corebridge Global Funding | 2.09 | 0.43 | 0.0906 | -0.0033 | |||||

| US26829XAB73 / ECMC Group Student Loan Trust | 2.08 | -1.79 | 0.0902 | -0.0054 | |||||

| US07335YAA47 / BDS 2021-FL10 LTD / BDS 2021-FL10 LLC 1ML+135 12/18/2036 144A | 2.08 | -18.07 | 0.0900 | -0.0244 | |||||

| RGA GLOBAL FUNDING SECURED 144A 05/29 5.448 / DBT (US76209PAE34) | 2.07 | 0.63 | 0.0895 | -0.0031 | |||||

| US06540BBA61 / BANK BANK 2019 BN21 ASB | 2.06 | -4.80 | 0.0894 | -0.0084 | |||||

| US00130HCH66 / AES Corp/The | 2.04 | 0.44 | 0.0886 | -0.0032 | |||||

| BANK OF AMERICA AUTO TRUST BAAT 2023 2A A4 144A / ABS-O (US06054YAD94) | 2.04 | -0.15 | 0.0885 | -0.0038 | |||||

| BMO MORTGAGE TRUST BMO 2024 5C8 A2 / ABS-MBS (US09661XAB47) | 2.04 | 0.89 | 0.0884 | -0.0028 | |||||

| US66815L2M02 / Northwestern Mutual Global Funding | 2.04 | 0.59 | 0.0884 | -0.0031 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 2.03 | 0.00 | 0.0881 | -0.0036 | |||||

| NWE / NorthWestern Energy Group, Inc. | 2.03 | 0.84 | 0.0881 | -0.0029 | |||||

| MARS INC SR UNSECURED 144A 03/28 4.6 / DBT (US571676AX38) | 2.02 | 0.40 | 0.0874 | -0.0032 | |||||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2025 A A1A 144A / ABS-O (US83207EAA47) | 2.00 | 0.0866 | 0.0866 | ||||||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2021 18A A1R 144A / ABS-CBDO (US04943EAQ44) | 2.00 | -0.10 | 0.0866 | -0.0036 | |||||

| US06051GHM42 / Bank of America Corp | 1.99 | 0.86 | 0.0864 | -0.0028 | |||||

| MADISON PARK FUNDING LTD MDPK 2019 36A A1RR 144A / ABS-CBDO (US55819PBE88) | 1.99 | 0.10 | 0.0863 | -0.0035 | |||||

| US065402BA61 / BANK BANK 2019 BN18 ASB | 1.99 | -5.29 | 0.0861 | -0.0086 | |||||

| US59333NS877 / MIAMI DADE CNTY FL SPL OBLIG MIAGEN 10/25 FIXED 1.154 | 1.98 | 0.71 | 0.0860 | -0.0029 | |||||

| US43300LAA89 / Hilton USA Trust 2016-HHV | 1.97 | 0.36 | 0.0852 | -0.0032 | |||||

| US78448YAB74 / SMB PRIVATE EDUCATION LOAN TRUST | 1.97 | -3.77 | 0.0851 | -0.0070 | |||||

| US404119CH01 / HCA Inc | 1.96 | 0.82 | 0.0849 | -0.0028 | |||||

| US17326FAE79 / CITIGROUP COML MTG TR 2017-C4 3.297% 10/12/2050 | 1.94 | -10.30 | 0.0841 | -0.0135 | |||||

| US46648KAU07 / JPMDB COMMERCIAL MORTGAGE SECURITIES TRUST 2017-C7 JPMDB 2017-C7 A5 | 1.94 | 0.94 | 0.0841 | -0.0027 | |||||

| WOODSIDE FINANCE LTD WOODSIDE FINANCE LTD / DBT (US980236AR40) | 1.94 | -0.21 | 0.0840 | -0.0036 | |||||

| US53948HAA41 / LoanCore 2021-CRE6 Issuer Ltd | 1.94 | -8.68 | 0.0839 | -0.0118 | |||||

| US38122NC676 / GOLDEN ST TOBACCO SEC CORP TAXABLE ST APPROP 21A-1 2.332% 06-01-27 | 1.92 | 0.0832 | 0.0832 | ||||||

| US78457JAA07 / SMRT, Series 2022-MINI, Class A | 1.92 | 0.37 | 0.0832 | -0.0031 | |||||

| US53946PAA84 / LoanCore 2022-CRE7 Issuer Ltd | 1.89 | -5.51 | 0.0818 | -0.0083 | |||||

| US68607DVD47 / State of Oregon Department of Transportation | 1.88 | 1.46 | 0.0815 | -0.0021 | |||||

| FANNIE MAE FNR 2024 104 FA / ABS-MBS (US3136BUEQ99) | 1.87 | -4.25 | 0.0811 | -0.0071 | |||||

| US03880RAA77 / Arbor Realty Collateralized Loan Obligation Ltd | 1.87 | -15.77 | 0.0810 | -0.0191 | |||||

| US44236PLT39 / HOUSTON TX CMNTY CLG HOUHGR 02/29 FIXED 5 | 1.86 | 0.59 | 0.0807 | -0.0029 | |||||

| US682439AC85 / 1166 AVENUE OF THE AMERICAS CO AACMT 2005 C6A A2 144A | 1.85 | -6.79 | 0.0803 | -0.0094 | |||||

| US04002VAA98 / AREIT Trust, Series 2022-CRE6, Class A | 1.85 | -0.22 | 0.0802 | -0.0035 | |||||

| US68235PAN87 / ONE Gas Inc | 1.84 | 0.33 | 0.0799 | -0.0030 | |||||

| US3128MJ5C09 / Freddie Mac Gold Pool | 1.83 | -1.61 | 0.0795 | -0.0046 | |||||

| US06738EBD67 / Barclays PLC | 1.82 | 0.72 | 0.0788 | -0.0027 | |||||

| US125094BE13 / CDP Financial Inc | 1.82 | 0.78 | 0.0788 | -0.0026 | |||||

| PROTECTIVE LIFE GLOBAL PROTECTIVE LIFE GLOBAL / DBT (US74368CBX11) | 1.82 | 0.06 | 0.0788 | -0.0032 | |||||

| US78445QAE17 / SLM Private Education Loan Trust 2010-C | 1.76 | -3.88 | 0.0763 | -0.0064 | |||||

| AU3FN0029609 / AAI Ltd | 1.75 | 1.10 | 0.0758 | -0.0023 | |||||

| FNMA POOL BZ3406 FN 03/30 FIXED 4.32 / ABS-MBS (US3140NXYC15) | 1.71 | 0.65 | 0.0741 | -0.0026 | |||||

| JACKSON NATL LIFE GLOBAL SECURED 144A 10/29 4.6 / DBT (US46849LVB43) | 1.70 | 0.95 | 0.0736 | -0.0023 | |||||

| US78432WAA18 / SFO Commercial Mortgage Trust 2021-555 | 1.69 | 1.01 | 0.0734 | -0.0023 | |||||

| CHESAPEAKE FUNDING II LLC CFII 2024 1A A1 144A / ABS-O (US165183DE19) | 1.67 | -11.65 | 0.0723 | -0.0129 | |||||

| FREDDIE MAC FHR 5440 F / ABS-MBS (US3137HDY795) | 1.62 | -9.83 | 0.0704 | -0.0109 | |||||

| US694308KF34 / Pacific Gas and Electric Co | 1.62 | 0.19 | 0.0702 | -0.0028 | |||||

| SRG / Snam S.p.A. | 1.61 | 0.0699 | 0.0699 | ||||||

| EQUITABLE AMERICA GLOBAL SECURED 144A 06/28 4.65 / DBT (US29446Q2A05) | 1.61 | 0.0697 | 0.0697 | ||||||

| US3136BCVD95 / FANNIE MAE FNR 2020 77 DP | 1.58 | -0.63 | 0.0686 | -0.0033 | |||||

| US26829GAA67 / ECMC Group Student Loan Trust 2018-2 | 1.57 | -1.75 | 0.0680 | -0.0041 | |||||

| US3128MJ5Z93 / FED HM LN PC POOL G08863 FG 02/49 FIXED 4.5 | 1.54 | -3.14 | 0.0669 | -0.0050 | |||||

| US303901BL51 / Fairfax Financial Holdings Ltd. | 1.54 | 0.59 | 0.0668 | -0.0023 | |||||

| NORTHWESTERN MUTUAL GLBL SECURED 144A 01/30 4.96 / DBT (US66815L2U28) | 1.53 | 0.66 | 0.0664 | -0.0023 | |||||

| FNMA POOL BZ3419 FN 03/30 FIXED 4.32 / ABS-MBS (US3140NXYR83) | 1.53 | 0.59 | 0.0663 | -0.0023 | |||||

| CMS.PRB / Consumers Energy Company - Preferred Stock | 1.52 | 1.00 | 0.0660 | -0.0020 | |||||

| SAMMONS FINANCIAL GLOBAL SECURED 144A 01/28 5.05 / DBT (US79587J2B82) | 1.52 | 0.26 | 0.0660 | -0.0025 | |||||

| US05583JAN28 / BPCE SA | 1.51 | -0.20 | 0.0654 | -0.0028 | |||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 1.50 | 0.0652 | 0.0652 | ||||||

| ELEVATION CLO LTD AWPT 2022 16A A1AR 144A / ABS-CBDO (US28623YAU73) | 1.50 | 0.67 | 0.0651 | -0.0022 | |||||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2022 2A A1R 144A / ABS-CBDO (US05682GAQ10) | 1.50 | 0.0650 | 0.0650 | ||||||

| FANNIE MAE FNR 2024 77 DF / ABS-MBS (US3136BTWY58) | 1.49 | 0.0646 | 0.0646 | ||||||

| US89240HAD70 / Toyota Lease Owner Trust, Series 2023-B, Class A3 | 1.45 | -27.75 | 0.0630 | -0.0278 | |||||

| US055984AA69 / BSPRT ISSUER, LTD. BSPRT 2022 FL9 A 144A | 1.40 | -32.29 | 0.0608 | -0.0327 | |||||

| FNMA POOL BZ3405 FN 03/30 FIXED 4.32 / ABS-MBS (US3140NXYB32) | 1.38 | 0.66 | 0.0596 | -0.0021 | |||||

| US3140X6Z464 / Fannie Mae Pool | 1.37 | -4.86 | 0.0594 | -0.0056 | |||||

| MARATHON CLO LTD MCLO 2019 1A AAR2 144A / ABS-CBDO (US56579ABJ88) | 1.37 | -7.95 | 0.0592 | -0.0078 | |||||

| US80317LAJ26 / Saranac Clo VI Ltd | 1.35 | -14.32 | 0.0586 | -0.0126 | |||||

| CARMAX AUTO OWNER TRUST CARMX 2024 1 A2A / ABS-O (US14318WAB37) | 1.35 | -44.72 | 0.0585 | -0.0517 | |||||

| US05610AAW80 / BX Trust, Series 2022-FOX2, Class A2 | 1.35 | -6.21 | 0.0583 | -0.0064 | |||||

| US38376RTJ58 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 H09 FB | 1.32 | -18.16 | 0.0570 | -0.0155 | |||||

| HSBC26C / HSBC Holdings PLC | 1.30 | 0.08 | 0.0563 | -0.0022 | |||||

| OHIO EDISON CO SR UNSECURED 144A 12/29 4.95 / DBT (US677347CJ38) | 1.27 | 0.0549 | 0.0549 | ||||||

| US3133KYXC82 / UMBS, 20 Year | 1.21 | -1.71 | 0.0524 | -0.0031 | |||||

| VOYA CLO LTD VOYA 2017 3A A1RR 144A / ABS-CBDO (US92915QBG73) | 1.20 | -0.33 | 0.0518 | -0.0023 | |||||

| US3137FQHG16 / FREDDIE MAC FHR 4936 AP | 1.19 | -4.42 | 0.0515 | -0.0046 | |||||

| US12551YAA10 / CIFC 2018-3A A | 1.19 | -17.42 | 0.0514 | -0.0134 | |||||

| US3136B45C86 / FANNIE MAE FNR 2019 33 FB | 1.18 | -3.77 | 0.0509 | -0.0042 | |||||

| US6944PL2E89 / PACIFIC LIFE GLOBAL FUNDING II | 1.17 | 0.77 | 0.0508 | -0.0017 | |||||

| US24703TAD81 / CORP. NOTE | 1.17 | -0.34 | 0.0505 | -0.0023 | |||||

| US38382A5Y79 / Ginnie Mae REMICS | 1.16 | -2.27 | 0.0503 | -0.0033 | |||||

| FNMA POOL FS8865 FN 02/35 FIXED VAR / ABS-MBS (US3140XQZ753) | 1.14 | -6.46 | 0.0496 | -0.0056 | |||||

| US90276XAS45 / UBS COMMERCIAL MORTGAGE TRUST UBSCM 2018 C11 ASB | 1.14 | -8.79 | 0.0495 | -0.0070 | |||||

| FCT / Fincantieri S.p.A. | 1.14 | 1.42 | 0.0494 | -0.0013 | |||||

| US07336CAA18 / BDS 2022-FL12 LLC | 1.14 | -27.81 | 0.0493 | -0.0218 | |||||

| US90276GAQ55 / UBS Commercial Mortgage Trust 2017-C3 | 1.12 | -11.13 | 0.0485 | -0.0083 | |||||

| WEIR GROUP INC COMPANY GUAR 144A 05/30 5.35 / DBT (US94877DAA28) | 1.12 | 0.0483 | 0.0483 | ||||||

| US50200YAQ17 / LCM LTD PARTNERSHIP LCM 30A AR 144A | 1.08 | -20.82 | 0.0467 | -0.0147 | |||||

| US67113DAW48 / OZLM XXIV Ltd | 1.07 | -23.57 | 0.0463 | -0.0167 | |||||

| BAM.26 / Brookfield Finance Inc | 1.07 | 0.09 | 0.0463 | -0.0018 | |||||

| US90931GAA76 / United Airlines 2020-1 Class A Pass Through Trust | 1.06 | -6.55 | 0.0457 | -0.0052 | |||||

| US90931EAA29 / United Airlines Pass Through Trust, Series 2019-1, Class A | 1.05 | -0.28 | 0.0456 | -0.0020 | |||||

| US90932MAA36 / United Airlines 2019-2 Class A Pass Through Trust | 1.05 | -3.86 | 0.0453 | -0.0038 | |||||

| US46645WAA18 / JP Morgan Chase Commercial Mortgage Securities Trust 2018-WPT | 1.05 | -0.76 | 0.0453 | -0.0022 | |||||

| BMO MORTGAGE TRUST BMO 2024 5C7 A3 / ABS-MBS (US09660WAU53) | 1.03 | 0.68 | 0.0447 | -0.0015 | |||||

| CNO GLOBAL FUNDING CNO GLOBAL FUNDING / DBT (US18977W2D15) | 1.03 | 0.20 | 0.0445 | -0.0018 | |||||

| US63939KAC36 / Navient Private Education Loan Trust, Series 2015-BA, Class A3 | 1.02 | -11.61 | 0.0442 | -0.0079 | |||||

| US00138CAU27 / Corebridge Global Funding | 1.01 | -0.30 | 0.0439 | -0.0019 | |||||

| ANTX / AN2 Therapeutics, Inc. | 1.01 | 0.70 | 0.0439 | -0.0015 | |||||

| US87167WAC91 / ABS FLOAT SER.2021-25A CL.A | 1.00 | 0.40 | 0.0434 | -0.0016 | |||||

| US606822CE28 / Mitsubishi UFJ Financial Group, Inc. | 0.99 | 0.30 | 0.0431 | -0.0016 | |||||

| US40414LAQ23 / HCP Inc | 0.99 | 0.51 | 0.0428 | -0.0016 | |||||

| US61761J3R84 / Morgan Stanley | 0.99 | 0.51 | 0.0428 | -0.0015 | |||||

| US80282KAZ93 / Santander Holdings USA Inc | 0.98 | 0.72 | 0.0427 | -0.0014 | |||||

| US38376RUH73 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 H10 FA | 0.98 | -17.74 | 0.0426 | -0.0113 | |||||

| US14040HDB87 / Capital One Financial Corp | 0.98 | -0.30 | 0.0425 | -0.0019 | |||||

| US62878U2A90 / NBN Co Ltd | 0.98 | 0.72 | 0.0423 | -0.0014 | |||||

| US80281LAQ86 / Santander UK Group Holdings PLC | 0.97 | 0.83 | 0.0421 | -0.0014 | |||||

| US26833BAB99 / ECMC GROUP STUDENT LOAN TRUST ECMC 2020 3A A1B 144A | 0.95 | -1.86 | 0.0412 | -0.0025 | |||||

| US26828HAA59 / ECMC Group Student Loan Trust 2018-1 | 0.94 | -1.46 | 0.0409 | -0.0023 | |||||

| FANNIE MAE FNR 2025 16 FA / ABS-MBS (US3136BU5D84) | 0.94 | -5.53 | 0.0407 | -0.0041 | |||||

| US023770AA81 / American Airlin Bond | 0.93 | -4.34 | 0.0401 | -0.0035 | |||||

| FLATIRON CLO LTD FLAT 2019 1A AR2 144A / ABS-CBDO (US33883JAW18) | 0.92 | -8.30 | 0.0397 | -0.0054 | |||||

| US74977RDR21 / Cooperatieve Rabobank UA | 0.91 | 0.67 | 0.0392 | -0.0013 | |||||

| US025816DL03 / American Express Co | 0.91 | -0.33 | 0.0392 | -0.0018 | |||||

| US65535HBA68 / Nomura Holdings Inc | 0.89 | 1.49 | 0.0384 | -0.0010 | |||||

| US64129KBE64 / Neuberger Berman CLO XV | 0.88 | -21.61 | 0.0381 | -0.0125 | |||||

| US06054AAW99 / BANC OF AMERICA COMMERCIAL MORTGAGE TRUST 3.441% 09/15/2048 2015-UBS7 A3 | 0.85 | -55.33 | 0.0367 | -0.0488 | |||||

| MNSH / MNSN Holdings Inc. | 0.00 | 0.00 | 0.84 | 8.21 | 0.0366 | 0.0014 | |||

| US90276VAC37 / UBS Commercial Mortgage Trust 2018-C8 | 0.82 | -8.05 | 0.0356 | -0.0047 | |||||

| VZ / Verizon Communications Inc. - Depositary Receipt (Common Stock) | 0.82 | 0.0354 | 0.0354 | ||||||

| US12595VAB36 / COMM Mortgage Trust | 0.81 | -2.76 | 0.0351 | -0.0025 | |||||

| US05369AAD37 / Aviation Capital Group LLC | 0.80 | 0.25 | 0.0346 | -0.0013 | |||||

| US92940PAE43 / WRKCo Inc | 0.79 | 1.02 | 0.0342 | -0.0010 | |||||

| US3137F66L68 / FREDDIE MAC FHR 5042 CA | 0.78 | -8.53 | 0.0339 | -0.0047 | |||||

| US88880LAH69 / TOBACCO SETTLEMENT FIN AUTH WV ASSET BACKED | 0.78 | 0.90 | 0.0338 | -0.0011 | |||||

| FED HM LN PC POOL SB1240 FR 12/32 FIXED 2.5 / ABS-MBS (US3132CXLV28) | 0.78 | -5.90 | 0.0338 | -0.0036 | |||||

| US92331AAU88 / Venture XXVIII CLO Ltd | 0.78 | -41.95 | 0.0338 | -0.0268 | |||||

| US571903BH57 / Marriott International Inc/MD | 0.77 | 2.54 | 0.0332 | -0.0005 | |||||

| US06540RAD61 / BANK 2017-BNK9 | 0.74 | 0.96 | 0.0320 | -0.0010 | |||||

| US38378U8L44 / Government National Mortgage Association | 0.73 | -9.63 | 0.0317 | -0.0048 | |||||

| US38376RJR84 / GOVERNMENT NATIONAL MORTGAGE A GNR 2015 H26 FA | 0.73 | -16.09 | 0.0314 | -0.0076 | |||||

| US31397QWM67 / Fannie Mae REMICS | 0.71 | -1.94 | 0.0306 | -0.0019 | |||||

| US63942TAA34 / NAVIENT STUDENT LOAN TRUST 23-BA A1A 6.48% 03/15/2072 144A | 0.70 | -10.80 | 0.0304 | -0.0051 | |||||

| US71951QAA04 / Physicians Realty L.P. | 0.70 | 0.29 | 0.0303 | -0.0012 | |||||

| US980236AP83 / Woodside Finance Ltd | 0.68 | 0.59 | 0.0296 | -0.0010 | |||||

| RFR USD SOFR/3.00000 02/12/25-30Y LCH / DIR (EZ5QDLRMVJ80) | 0.68 | 15.70 | 0.0294 | 0.0030 | |||||

| US59333NS950 / MIAMI DADE CNTY FL SPL OBLIG MIAGEN 10/26 FIXED 1.471 | 0.68 | 0.89 | 0.0293 | -0.0010 | |||||

| R1IN34 / Realty Income Corporation - Depositary Receipt (Common Stock) | 0.67 | 1.52 | 0.0290 | -0.0007 | |||||

| US83206NAB38 / SMB PRIVATE EDUCATION LOAN TRUST 2022-B SER 2022-B CL A1B V/R REGD 144A P/P 1.83000000 | 0.64 | -5.01 | 0.0279 | -0.0027 | |||||

| US26828VAA44 / ECMC Group Student Loan Trust 2017-2 | 0.62 | -1.43 | 0.0270 | -0.0015 | |||||

| US22003BAP13 / CORPORATE OFFICE PPTYS LP 2.9% 12/01/2033 | 0.62 | 1.32 | 0.0267 | -0.0007 | |||||

| MAGNETITE CLO LTD MAGNE 2015 12A AR4 144A / ABS-CBDO (US55953HBD44) | 0.62 | -34.01 | 0.0267 | -0.0154 | |||||

| US61690YBS00 / Morgan Stanley Capital I Trust 2016-BNK2 | 0.61 | -18.93 | 0.0264 | -0.0075 | |||||

| US38375UYN44 / Government National Mortgage Association | 0.61 | -13.76 | 0.0264 | -0.0055 | |||||

| US303901BB79 / Fairfax Financial Holdings Ltd | 0.61 | 0.67 | 0.0262 | -0.0009 | |||||

| US00500RAA32 / ACREC 2021-FL1 Ltd | 0.60 | -4.16 | 0.0260 | -0.0022 | |||||

| US38375UVD98 / GOVERNMENT NATIONAL MORTGAGE A GNR 2015 H08 FD | 0.60 | -17.99 | 0.0259 | -0.0070 | |||||

| US29444UBE55 / Equinix, Inc. | 0.57 | 1.43 | 0.0247 | -0.0007 | |||||

| US3137BTTH46 / FREDDIE MAC FHR 4637 WF | 0.56 | -4.95 | 0.0242 | -0.0023 | |||||

| US977100HN95 / WISCONSIN ST GEN FUND ANNUAL A WISGEN 05/29 FIXED 1.486 | 0.54 | 1.12 | 0.0236 | -0.0007 | |||||

| US31418DKK71 / Fannie Mae Pool | 0.53 | -3.45 | 0.0231 | -0.0018 | |||||

| US056162AN09 / BABSN 2015-IA AR | 0.53 | -30.94 | 0.0229 | -0.0117 | |||||

| US48252KAA79 / KKR CLO 21 Ltd | 0.51 | -26.12 | 0.0222 | -0.0091 | |||||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 0.51 | 0.0222 | 0.0222 | ||||||

| US17326DAE22 / CITIGROUP COMMERCIAL MORTGAGE CGCMT 2017 P8 AAB | 0.51 | -12.71 | 0.0220 | -0.0043 | |||||

| US95001ABB17 / Wells Fargo Commercial Mortgage Trust 2017-C41 | 0.49 | -12.10 | 0.0214 | -0.0039 | |||||

| US00774MAE57 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.49 | 0.61 | 0.0213 | -0.0007 | |||||

| US80282KBC99 / Santander Holdings USA Inc | 0.48 | 1.04 | 0.0210 | -0.0006 | |||||

| US07332VBB09 / BBCMS MORTGAGE TRUST 2017-C1 | 0.48 | -14.82 | 0.0207 | -0.0046 | |||||

| US46648KAV89 / JPMDB COML MTG SECS TR 2017-C7 3.2419% 10/15/2050 | 0.47 | -11.20 | 0.0203 | -0.0035 | |||||

| US88880LAL71 / Tobacco Settlement Finance Authority | 0.46 | 0.0201 | 0.0201 | ||||||

| US3136ATY731 / FANNIE MAE FNR 2016 76 CF | 0.46 | -3.14 | 0.0200 | -0.0015 | |||||

| US303075AB13 / FactSet Research Systems Inc | 0.46 | 1.33 | 0.0198 | -0.0006 | |||||

| US759509AG74 / Reliance Steel & Aluminum Co. | 0.44 | 2.07 | 0.0192 | -0.0004 | |||||

| US37940XAH52 / Global Payments Inc | 0.44 | 0.91 | 0.0192 | -0.0006 | |||||

| US3128MJ4W71 / Federal Home Loan Mortgage Corp. | 0.44 | -1.80 | 0.0189 | -0.0011 | |||||

| US31418CZJ60 / Fannie Mae Pool | 0.41 | -3.29 | 0.0179 | -0.0013 | |||||

| US31351DDT54 / Freddie Mac Strips | 0.41 | -5.73 | 0.0178 | -0.0018 | |||||

| US3137FCHE71 / FREDDIE MAC FHR 4736 CD | 0.40 | -4.74 | 0.0175 | -0.0016 | |||||

| US05609CAA53 / BX Commercial Mortgage Trust 2021-21M | 0.39 | -55.63 | 0.0168 | -0.0225 | |||||

| US3137F7YY55 / FREDDIE MAC FHR 5051 MA | 0.38 | -5.21 | 0.0166 | -0.0017 | |||||

| US14315LAA26 / Carlyle Global Market Strategies CLO 2014-3-R Ltd | 0.38 | -40.16 | 0.0163 | -0.0121 | |||||

| US3136AUH536 / FANNIE MAE FNR 2016 100 WF | 0.38 | -2.85 | 0.0163 | -0.0012 | |||||

| US95001NAW83 / Wells Fargo Commercial Mortgage Trust 2018-C45 | 0.35 | -7.11 | 0.0153 | -0.0019 | |||||

| US38376RDB96 / Government National Mortgage Association Series 2015-H15 Class FC | 0.35 | -3.85 | 0.0152 | -0.0012 | |||||

| US04942VAW46 / Atlas Senior Loan Fund XIII, Series 2019-13A, Class A1NR | 0.35 | -34.03 | 0.0150 | -0.0087 | |||||

| US3136AUTX94 / FANNIE MAE FNR 2016 88 AF | 0.34 | -6.61 | 0.0147 | -0.0017 | |||||

| US46188BAC63 / INVITATION HOMES OP REGD 2.70000000 | 0.33 | 1.54 | 0.0143 | -0.0004 | |||||

| US3137F7TN55 / FREDDIE MAC FHR 5050 YA | 0.33 | -8.08 | 0.0143 | -0.0019 | |||||

| US65023PAN06 / NBCLO 2017-1A A1R 144A FRN (L+97) 07-25-30 | 0.31 | -15.11 | 0.0134 | -0.0030 | |||||

| US38376RY269 / GNMA, Series 2017-H07, Class FG | 0.30 | -11.37 | 0.0132 | -0.0023 | |||||

| US38376RCB06 / GNMA, Series 2015-H14, Class FA | 0.30 | -13.58 | 0.0130 | -0.0026 | |||||

| US80282KAP12 / Santander Holdings USA Inc | 0.30 | 0.67 | 0.0130 | -0.0005 | |||||

| US759351AM18 / Reinsurance Group of America Inc | 0.30 | 0.34 | 0.0129 | -0.0005 | |||||

| US80281LAG05 / Santander UK Group Holdings PLC | 0.29 | 1.03 | 0.0127 | -0.0004 | |||||

| US90932JAA07 / United Airlines 2019-2 Class AA Pass Through Trust | 0.27 | -2.52 | 0.0118 | -0.0008 | |||||

| US88880LAN38 / TOBACCO SETTLEMENT FIN AUTH WV TOBGEN 06/31 FIXED 2.951 | 0.27 | 1.50 | 0.0117 | -0.0003 | |||||

| US38376RHB50 / GOVERNMENT NATIONAL MORTGAGE A GNR 2015 H22 FD | 0.26 | -13.44 | 0.0115 | -0.0023 | |||||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | 0.21 | 0.0093 | 0.0093 | ||||||

| US78486LAA08 / SURA Asset Management SA | 0.21 | -79.30 | 0.0090 | -0.0360 | |||||

| US38380LMV26 / GNMA, Series 2018-H18, Class FC | 0.18 | -19.35 | 0.0076 | -0.0022 | |||||

| US31418EGF16 / Fannie Mae Pool | 0.17 | -1.69 | 0.0076 | -0.0004 | |||||

| US084659AV35 / Berkshire Hathaway Energy Co | 0.16 | 1.27 | 0.0069 | -0.0002 | |||||

| US38376RDE36 / GNMA, Series 2015-H15, Class FJ | 0.15 | -13.95 | 0.0064 | -0.0013 | |||||

| US3140JGZ324 / FNMA POOL BN0761 FN 01/49 FIXED 4.5 | 0.14 | -0.69 | 0.0063 | -0.0003 | |||||

| US233262AC89 / DLLAD 2021-1 LLC | 0.14 | -67.07 | 0.0059 | -0.0127 | |||||

| US04942JAC53 / Atlas Senior Loan Fund X Ltd | 0.12 | -62.22 | 0.0052 | -0.0090 | |||||

| US95000GAZ72 / WELLS FARGO COMMERCIAL MORTGAGE TRUST 2016-BNK1 SER 2016-BNK1 CL ASB REGD 2.51400000 | 0.11 | -42.27 | 0.0049 | -0.0039 | |||||

| US61767FAY79 / MORGAN STANLEY CAPITAL I TRUST 2016-UB11 MSC 2016-UB11 ASB | 0.10 | -25.76 | 0.0043 | -0.0017 | |||||

| US95000DBE04 / WELLS FARGO COMMERCIAL MORTGAG WFCM 2016 C34 ASB | 0.10 | -35.76 | 0.0042 | -0.0026 | |||||

| US38141GYG36 / Goldman Sachs Group Inc/The | 0.10 | 1.05 | 0.0042 | -0.0001 | |||||

| US69702HAA68 / Palmer Square Loan Funding Ltd | 0.09 | -58.41 | 0.0041 | -0.0061 | |||||

| RFR USD SOFR/3.30000 12/02/24-4Y* CME / DIR (EZ2F419XN3M4) | 0.09 | -49.44 | 0.0039 | -0.0042 | |||||

| RFR USD SOFR/3.30000 12/02/24-7Y* CME / DIR (EZKHRJGZF457) | 0.07 | -61.58 | 0.0030 | -0.0050 | |||||

| US38375B4Y56 / GNMA, Series 2013-H16, Class FA | 0.06 | -13.51 | 0.0028 | -0.0006 | |||||

| US38376RMX16 / GNMA_15-H31 | 0.05 | 0.00 | 0.0024 | -0.0001 | |||||

| US3128S5V351 / FED HM LN PC POOL 1Q1534 FH 06/37 FLOATING VAR | 0.05 | -3.92 | 0.0021 | -0.0002 | |||||

| US3138EP2Y90 / Fannie Mae Pool | 0.04 | -2.44 | 0.0017 | -0.0002 | |||||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | 0.04 | 0.0015 | 0.0015 | ||||||

| US34706CAA71 / FORT CRE 2022-FL3 ISSUER LLC SER 2022-FL3 CL A V/R REGD 144A P/P 1.90000000 | 0.03 | -93.75 | 0.0014 | -0.0217 | |||||

| VERIZON COMMUNICATIONS INC SNR S* ICE / DCR (EZKBMTL78RT9) | 0.03 | 6.90 | 0.0014 | 0.0000 | |||||

| US31396V5C86 / FANNIE MAE REMICS SER 2007-50 CL FN V/R 1.94800000 | 0.03 | -3.23 | 0.0013 | -0.0001 | |||||

| US914440KJ07 / UNIV OF MASSACHUSETTS MA BLDG UMAFAC 05/29 FIXED 6.423 | 0.03 | -14.29 | 0.0013 | -0.0003 | |||||

| US12594CBD11 / COMM 2016-DC2 Mortgage Trust | 0.03 | -80.92 | 0.0011 | -0.0048 | |||||

| US31405MA645 / FANNIE MAE POOL FN 793029 | 0.02 | -4.17 | 0.0010 | -0.0001 | |||||

| US3132XGU950 / FREDDIE MAC POOL UMBS P#WN2407 4.38000000 | 0.02 | 4.55 | 0.0010 | -0.0000 | |||||

| RFR USD SOFR/3.32826 09/03/24-7Y* CME / DIR (EZPDSL9DRNN3) | 0.02 | -71.79 | 0.0010 | -0.0026 | |||||

| US31415XH794 / Fannie Mae Pool | 0.02 | 0.00 | 0.0007 | -0.0000 | |||||

| US12637UAX72 / CSAIL 2016-C7 Commercial Mortgage Trust | 0.02 | -95.84 | 0.0007 | -0.0156 | |||||

| RFR USD SOFR/3.43091 09/03/24-7Y* LCH / DIR (EZPDSL9DRNN3) | 0.01 | -84.62 | 0.0006 | -0.0030 | |||||

| US31407VSL08 / FNMA POOL 842123 FN 10/35 FIXED 5.5 | 0.01 | 0.00 | 0.0005 | -0.0000 | |||||

| US31407FHW32 / FNMA POOL 829245 FN 08/35 FIXED 5.5 | 0.01 | -9.09 | 0.0005 | -0.0000 | |||||

| RFR USD SOFR/3.51042 09/03/24-4Y* LCH / DIR (EZ4809P3F712) | 0.01 | -81.63 | 0.0004 | -0.0018 | |||||

| RFR USD SOFR/3.51453 09/03/24-4Y* LCH / DIR (EZ4809P3F712) | 0.01 | -81.63 | 0.0004 | -0.0018 | |||||

| BOEING CO/THE SNR S* ICE / DCR (EZC4SH442RJ4) | 0.01 | -11.11 | 0.0004 | -0.0000 | |||||

| US31410KKX18 / Fannie Mae Pool | 0.01 | 0.00 | 0.0004 | -0.0000 | |||||

| US31410KJ541 / Fannie Mae Pool | 0.01 | 0.00 | 0.0003 | -0.0000 | |||||

| US31416LJK35 / FNMA POOL AA2965 FN 04/39 FIXED 5.5 | 0.01 | 0.00 | 0.0003 | -0.0000 | |||||

| MNSH / MNSN Holdings Inc. | 0.00 | 0.00 | 0.01 | -16.67 | 0.0002 | -0.0000 | |||

| US31417FBW77 / FNMA POOL AB8152 FN 02/38 FIXED 5.5 | 0.00 | 0.00 | 0.0002 | -0.0000 | |||||

| US31415P3Y25 / Fannie Mae Pool | 0.00 | 0.00 | 0.0001 | -0.0000 | |||||

| US31407W5B56 / FNMA POOL 843342 FN 10/35 FIXED 5.5 | 0.00 | 0.00 | 0.0001 | -0.0000 | |||||

| US31416VSW53 / FNMA POOL AB0532 FN 12/38 FIXED 5.5 | 0.00 | 0.00 | 0.0001 | -0.0000 | |||||

| US38376RRJ76 / Government National Mortgage Association | 0.00 | 0.00 | 0.0001 | -0.0000 | |||||

| US31371MLB18 / FNMA POOL 256022 FN 12/35 FIXED 5.5 | 0.00 | 0.00 | 0.0001 | -0.0000 | |||||

| US31408DF902 / FNMA POOL 848092 FN 10/35 FIXED 5.5 | 0.00 | 0.0000 | -0.0000 | ||||||

| US31407D4Q50 / FNMA POOL 828031 FN 07/35 FIXED 5.5 | 0.00 | 0.0000 | -0.0000 | ||||||

| US31376KGC45 / FNMA POOL 357595 FN 07/34 FIXED 5.5 | 0.00 | 0.0000 | -0.0000 | ||||||

| RFR USD SOFR/3.62000 02/14/25-5Y LCH / DIR (EZMDBB3P1KY1) | -0.09 | -374.19 | -0.0037 | -0.0052 | |||||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | -0.20 | -0.0087 | -0.0087 | ||||||

| RFR USD SOFR/4.01150 02/14/25-10Y LCH / DIR (EZSQMTV543V9) | -0.20 | 32.47 | -0.0088 | -0.0019 | |||||

| RFR USD SOFR/3.62000 09/02/25-4Y* LCH / DIR (EZNQ4Z4QT3L7) | -0.68 | -0.0293 | -0.0293 | ||||||

| RFR USD SOFR/3.75000 09/02/25-7Y* LCH / DIR (000000000) | -0.90 | -0.0389 | -0.0389 |