Statistik Asas

| Nilai Portfolio | $ 1,825,173,670 |

| Kedudukan Semasa | 339 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

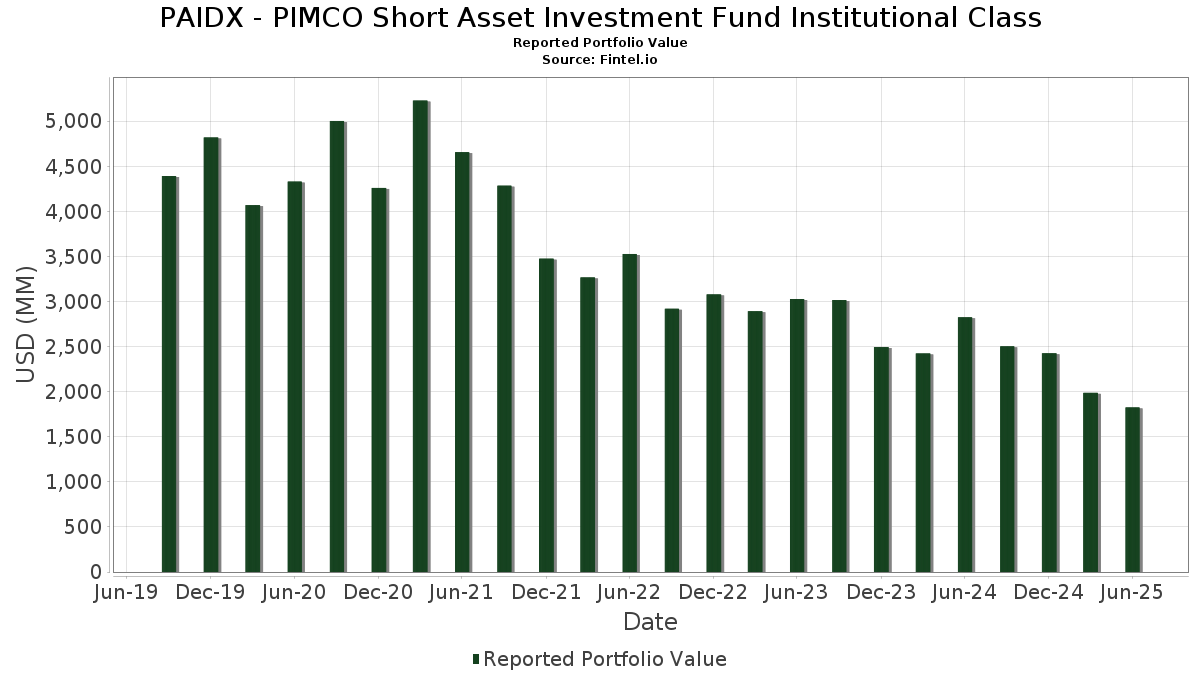

PAIDX - PIMCO Short Asset Investment Fund Institutional Class telah mendedahkan 339 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,825,173,670 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas PAIDX - PIMCO Short Asset Investment Fund Institutional Class ialah PIMCO ST FLOATING NAV PORT IV MUTUAL FUND (US:US72202G3801) , Morgan Stanley (US:US61747YEZ43) , Commonwealth Bank of Australia (AU:US2027A0KG30) , Barclays Bank PLC - Corporate Bond/Note (GB:BACR) , and ABN AMRO Bank NV (NL:US00084DBC39) . Kedudukan baharu PAIDX - PIMCO Short Asset Investment Fund Institutional Class termasuk PIMCO ST FLOATING NAV PORT IV MUTUAL FUND (US:US72202G3801) , Morgan Stanley (US:US61747YEZ43) , Commonwealth Bank of Australia (AU:US2027A0KG30) , Barclays Bank PLC - Corporate Bond/Note (GB:BACR) , and ABN AMRO Bank NV (NL:US00084DBC39) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 40.01 | 2.1795 | 2.1795 | ||

| 23.42 | 1.2758 | 1.2758 | ||

| 21.54 | 1.1734 | 1.1734 | ||

| 19.59 | 1.0672 | 1.0672 | ||

| 18.84 | 1.0262 | 1.0262 | ||

| 18.54 | 1.0097 | 1.0097 | ||

| 18.27 | 0.9951 | 0.9951 | ||

| 17.90 | 0.9750 | 0.9750 | ||

| 19.51 | 1.0629 | 0.9404 | ||

| 16.37 | 0.8915 | 0.8915 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 5.65 | 0.3079 | -0.3193 | ||

| 2.93 | 0.1597 | -0.2607 | ||

| 1.99 | 0.1082 | -0.2204 | ||

| 11.15 | 0.6074 | -0.1768 | ||

| 11.12 | 0.6055 | -0.1540 | ||

| 2.44 | 0.1328 | -0.1525 | ||

| -2.54 | -0.1386 | -0.1386 | ||

| 4.86 | 0.2649 | -0.1234 | ||

| 6.92 | 0.3768 | -0.1112 | ||

| 0.60 | 0.0329 | -0.0923 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-28 untuk tempoh pelaporan 2025-06-30. Pelabur ini tidak mendedahkan sekuriti yang dikira dalam saham, jadi lajur berkaitan saham dalam jadual di bawah tidak dimasukkan. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|

| US72202G3801 / PIMCO ST FLOATING NAV PORT IV MUTUAL FUND | 87.31 | 1.31 | 4.7555 | 0.5079 | ||

| XS0290580595 / GAZPROM (GAZ CAPITAL SA) SR UNSECURED REGS 03/22 6.51 | 40.01 | 2.1795 | 2.1795 | |||

| US61747YEZ43 / Morgan Stanley | 32.03 | -0.05 | 1.7448 | 0.1652 | ||

| US2027A0KG30 / Commonwealth Bank of Australia | 31.65 | -0.05 | 1.7241 | 0.1632 | ||

| COOPERATIEVE RABOBANK UA COOPERATIEVE RABOBANK UA / DBT (US21688ABB70) | 27.05 | -0.19 | 1.4736 | 0.1376 | ||

| BACR / Barclays Bank PLC - Corporate Bond/Note | 23.98 | 0.10 | 1.3064 | 0.1254 | ||

| US00084DBC39 / ABN AMRO Bank NV | 23.42 | 1.2758 | 1.2758 | |||

| TOYOTA LEASE OWNER TRUST TLOT 2025 A A2B 144A / ABS-O (US89239NAC92) | 23.00 | -0.02 | 1.2527 | 0.1189 | ||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 22.48 | 0.00 | 1.2245 | 0.1164 | ||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 22.02 | 0.04 | 1.1993 | 0.1144 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 21.54 | 1.1734 | 1.1734 | |||

| MASTER CREDIT CARD TRUST MCCT 2024 1A A 144A / ABS-MBS (US576339DZ56) | 20.03 | -0.10 | 1.0909 | 0.1027 | ||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 19.59 | 1.0672 | 1.0672 | |||

| US36143L2A26 / GA Global Funding Trust | 19.51 | 685.55 | 1.0629 | 0.9404 | ||

| US86562MCU27 / Sumitomo Mitsui Financial Group Inc | 19.07 | 26.38 | 1.0387 | 0.2950 | ||

| CBRE SVCS INC 07/25 ZCP / DBT (US12610BUQ30) | 18.84 | 1.0262 | 1.0262 | |||

| US62954WAC91 / NTT Finance Corp | 18.54 | 1.0097 | 1.0097 | |||

| US125523CP36 / Cigna Corp | 18.27 | 0.9951 | 0.9951 | |||

| FREDDIE MAC FHR 5472 FA / ABS-MBS (US3137HHEK38) | 18.23 | -3.99 | 0.9931 | 0.0571 | ||

| US44891ACL98 / Hyundai Capital America | 18.01 | 21.42 | 0.9809 | 0.2499 | ||

| REPO BANK AMERICA REPO / RA (000000000) | 17.90 | 0.9750 | 0.9750 | |||

| US842400HW63 / Southern California Edison Co | 17.42 | 816.25 | 0.9488 | 0.8551 | ||

| WELLS FARGO BANK NA WELLS FARGO BANK NA / DBT (US94988J6J16) | 17.14 | -0.10 | 0.9334 | 0.0879 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 01/27 VAR / DBT (US04685A4F53) | 16.65 | 0.06 | 0.9068 | 0.0867 | ||

| US17305EGP43 / Citibank Credit Card Issuance Trust | 16.51 | -0.12 | 0.8992 | 0.0845 | ||

| US24023KAK43 / DBS GROUP HOLDINGS LTD SR UNSECURED 144A 09/25 VAR | 16.51 | -0.08 | 0.8991 | 0.0848 | ||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 16.37 | 0.8915 | 0.8915 | |||

| US845437BS08 / Southwestern Electric Power Co | 16.28 | 0.8870 | 0.8870 | |||

| US75951ACY29 / Reliance Standard Life Global Funding II | 15.74 | 0.8576 | 0.8576 | |||

| US22877LAA52 / CRSNT Trust 2021-MOON | 14.82 | 0.24 | 0.8072 | 0.0785 | ||

| US251526CE71 / DEUTSCHE BANK AG NEW YORK BNCH 2.129%/VAR 11/24/2026 | 14.63 | 0.79 | 0.7967 | 0.0815 | ||

| US38145GAM24 / Goldman Sachs Group Inc/The | 13.52 | -0.27 | 0.7364 | 0.0683 | ||

| US3137H0W535 / FHLMC, Series 5115, Class EM | 13.50 | -3.27 | 0.7355 | 0.0475 | ||

| CNQ / Canadian Natural Resources Limited | 13.04 | 0.7101 | 0.7101 | |||

| US595017BA15 / CORP. NOTE | 12.99 | 0.01 | 0.7073 | 0.0673 | ||

| US05583JAH59 / BPCE SA | 12.81 | 160.41 | 0.6976 | 0.4552 | ||

| US46654PAA49 / JPMCC_21-HTL5 | 12.35 | -0.13 | 0.6724 | 0.0632 | ||

| US928668BL58 / VOLKSWAGEN GROUP AMER FIN LLC 1.25% 11/24/2025 144A | 12.33 | 26.18 | 0.6717 | 0.1900 | ||

| NEW YORK LIFE GLOBAL FDG SR SECURED 144A 06/27 VAR / DBT (US64953BBY39) | 12.33 | 0.6716 | 0.6716 | |||

| US30321L2A99 / F&G Global Funding | 12.28 | 0.6689 | 0.6689 | |||

| DLLAA LLC DLLAA 2025 1A A2 144A / ABS-O (US233249AB70) | 12.03 | 0.02 | 0.6551 | 0.0624 | ||

| US025816CL12 / AMERICAN EXPRESS CO REGD V/R 0.70000300 | 12.02 | -0.05 | 0.6550 | 0.0620 | ||

| US65339KBS87 / NextEra Energy Capital Holdings Inc | 12.02 | -0.26 | 0.6546 | 0.0607 | ||

| US31429KAK97 / Federation des Caisses Desjardins du Quebec | 12.01 | 0.04 | 0.6542 | 0.0625 | ||

| HYUNDAI AUTO LEASE SECURITIZAT HALST 2025 A A2B 144A / ABS-O (US44935WAC10) | 12.00 | 0.02 | 0.6538 | 0.0623 | ||

| CARMAX AUTO OWNER TRUST CARMX 2025 1 A2B / ABS-O (US14319WAC01) | 12.00 | -0.03 | 0.6536 | 0.0620 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 11.99 | 0.6529 | 0.6529 | |||

| GM FINANCIAL AUTOMOBILE LEASIN GMALT 2024 3 A2B / ABS-O (US38012QAC24) | 11.98 | -20.17 | 0.6524 | -0.0872 | ||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 11.66 | 0.6353 | 0.6353 | |||

| US380881FB36 / GCCT 2021-1A A | 11.59 | 0.90 | 0.6311 | 0.0651 | ||

| US46849LUX71 / Jackson National Life Global Funding | 11.55 | -0.13 | 0.6292 | 0.0591 | ||

| FORD CREDIT AUTO OWNER TRUST FORDO 2024 B A2B / ABS-O (US34531QAC33) | 11.15 | -29.92 | 0.6074 | -0.1768 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 11.12 | -27.86 | 0.6055 | -0.1540 | ||

| SBNA AUTO LEASE TRUST SBALT 2024 B A3 144A / ABS-O (US78437VAE02) | 11.09 | -0.13 | 0.6042 | 0.0568 | ||

| US709599BL72 / Penske Truck Leasing Co Lp / PTL Finance Corp | 11.05 | 42.57 | 0.6020 | 0.2199 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 10.53 | -0.10 | 0.5738 | 0.0540 | ||

| US90351DAF42 / UBS Group AG | 10.44 | 0.11 | 0.5686 | 0.0546 | ||

| US29364GAM50 / ENTERGY CORP NEW 0.9% 09/15/2025 | 10.42 | 0.88 | 0.5677 | 0.0585 | ||

| PNC BANK NA SR UNSECURED 01/27 VAR / DBT (US69353RFW34) | 10.41 | -0.10 | 0.5668 | 0.0534 | ||

| US38145GAN07 / Goldman Sachs Group Inc/The | 10.31 | -0.22 | 0.5616 | 0.0523 | ||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 10.29 | 0.5605 | 0.5605 | |||

| VERIZON MASTER TRUST VZMT 2024 6 A1B / ABS-O (US92348KDF75) | 10.05 | 0.11 | 0.5477 | 0.0526 | ||

| CARMAX AUTO OWNER TRUST CARMX 2025 2 A2B / ABS-O (US14320AAC53) | 10.04 | 0.5467 | 0.5467 | |||

| TOYOTA AUTO RECEIVABLES OWNER TAOT 2025 B A2B / ABS-O (US89231HAC07) | 10.02 | 0.5457 | 0.5457 | |||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q029 A / ABS-MBS (US3137HHH387) | 10.00 | -0.03 | 0.5447 | 0.0517 | ||

| PACIFIC LIFE GF II SECURED 144A 01/28 VAR / DBT (US6944PL3E70) | 9.99 | -0.27 | 0.5444 | 0.0504 | ||

| US60871RAG56 / Molson Coors Brewing Co | 9.85 | 0.5367 | 0.5367 | |||

| US07274NAJ28 / Bayer US Finance II LLC | 9.85 | 394.73 | 0.5365 | 0.4384 | ||

| FREDDIE MAC FHR 5442 FB / ABS-MBS (US3137HF4U64) | 9.72 | -8.02 | 0.5294 | 0.0085 | ||

| HSBC26C / HSBC Holdings PLC | 9.59 | 220.41 | 0.5224 | 0.3749 | ||

| ARI FLEET LEASE TRUST ARIFL 2025 B A1 144A / ABS-O (US00193GAA94) | 9.59 | 0.5223 | 0.5223 | |||

| US67448DAL47 / Onslow Bay Financial LLC, Series 2022-NQM2, Class A1A | 9.58 | -1.20 | 0.5220 | 0.0439 | ||

| US37940XAE22 / Global Payments Inc | 9.58 | 0.83 | 0.5217 | 0.0535 | ||

| US28622HAA95 / Elevance Health, Inc. | 9.34 | 0.5085 | 0.5085 | |||

| FREDDIE MAC FHR 5508 FC / ABS-MBS (US3137HJGF80) | 9.26 | -4.90 | 0.5047 | 0.0245 | ||

| FREDDIE MAC FHR 5508 AF / ABS-MBS (US3137HJFR38) | 9.20 | -4.63 | 0.5013 | 0.0256 | ||

| US19688GAA13 / COLT 2021-4 MORTGAGE LOAN TRUST COLT 2021-4 A1 | 9.03 | -0.31 | 0.4919 | 0.0454 | ||

| US08576PAH47 / Berry Global Inc | 8.94 | 0.76 | 0.4869 | 0.0496 | ||

| US06051GJK67 / Bank of America Corp | 8.86 | 0.4825 | 0.4825 | |||

| HYUNDAI AUTO LEASE SECURITIZAT HALST 2024 A A3 144A / ABS-O (US448988AD77) | 8.83 | -0.10 | 0.4807 | 0.0453 | ||

| US14318UAD37 / Carmax Auto Owner Trust 2022-4 | 8.66 | -24.03 | 0.4717 | -0.0902 | ||

| NISSAN AUTO LEASE TRUST NALT 2024 B A2B / ABS-O (US65481DAC65) | 8.49 | -13.61 | 0.4623 | -0.0219 | ||

| US67115DAA00 / Onslow Bay Mortgage Loan Trust | 8.46 | -0.99 | 0.4610 | 0.0397 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 2A A3 144A / ABS-O (US78397XAC83) | 8.40 | -0.02 | 0.4578 | 0.0434 | ||

| US67114VAA17 / OBX 2022-NQM1 Trust | 8.27 | -0.80 | 0.4506 | 0.0396 | ||

| US05530QAN07 / BAT International Finance PLC | 8.09 | 0.4409 | 0.4409 | |||

| US65535HAR03 / Nomura Holdings Inc | 8.09 | 0.67 | 0.4404 | 0.0445 | ||

| FANNIE MAE FNR 2024 54 FC / ABS-MBS (US3136BSSC02) | 8.07 | -12.41 | 0.4396 | -0.0145 | ||

| NRUC / National Rural Utilities Cooperative Finance Corporation - Corporate Bond/Note | 8.01 | 0.4361 | 0.4361 | |||

| US25746UCE73 / Dominion Energy Inc | 7.99 | 0.15 | 0.4350 | 0.0419 | ||

| KUBOTA CREDIT OWNER TRUST KCOT 2024 2A A2 144A / ABS-O (US50117DAB29) | 7.92 | -21.20 | 0.4315 | -0.0640 | ||

| US46115HBU05 / INTESA SANPAOLO SPA | 7.68 | 0.4183 | 0.4183 | |||

| ARI FLEET LEASE TRUST ARIFL 2024 B A2 144A / ABS-O (US04033HAB15) | 7.65 | -17.53 | 0.4167 | -0.0405 | ||

| US00774MAS44 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 7.55 | 0.61 | 0.4112 | 0.0414 | ||

| US3136AL2T72 / FANNIE MAE REMICS SER 2014-84 CL BF V/R 2.38150000 | 7.41 | -5.48 | 0.4036 | 0.0172 | ||

| US694308JL21 / PACIFIC GAS and ELECTRIC CO 3.45% 07/01/2025 | 7.30 | 0.40 | 0.3976 | 0.0392 | ||

| US89175MAA18 / Towd Point Mortgage Trust 2018-3 | 7.24 | -5.57 | 0.3941 | 0.0164 | ||

| HARLEY DAVIDSON MOTORCYCLE TRU HDMOT 2024 B A2 / ABS-O (US41284PAB13) | 6.92 | -30.13 | 0.3768 | -0.1112 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 6.90 | 0.3757 | 0.3757 | |||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2024 H07 FC / ABS-MBS (US38383KVE99) | 6.08 | -9.18 | 0.3314 | 0.0012 | ||

| US63942KAA25 / Navient Student Loan Trust | 6.00 | -3.85 | 0.3268 | 0.0193 | ||

| JONES LANG LASALLE FIN BV 4/A2 07/25 ZCP / DBT (US48002AU933) | 5.99 | 0.3264 | 0.3264 | |||

| US49327M3G70 / KeyBank NA/Cleveland, OH | 5.98 | 0.3258 | 0.3258 | |||

| US62954WAJ45 / NTT Finance Corp | 5.88 | 0.3203 | 0.3203 | |||

| FORD CREDIT AUTO LEASE TRUST FORDL 2024 B A2B / ABS-O (US345279AC74) | 5.84 | -25.69 | 0.3183 | -0.0693 | ||

| US682680BD48 / ONEOK Inc | 5.74 | -0.26 | 0.3126 | 0.0290 | ||

| US06675DCG51 / Banque Federative du Credit Mutuel SA | 5.71 | 0.3110 | 0.3110 | |||

| US05609CAA53 / BX Commercial Mortgage Trust 2021-21M | 5.65 | -55.58 | 0.3079 | -0.3193 | ||

| US928668BY79 / Volkswagen Group of America Finance LLC | 5.63 | -0.09 | 0.3068 | 0.0289 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2020 H01 FM / ABS-MBS (US38380LX654) | 5.42 | -15.17 | 0.2950 | -0.0197 | ||

| BMW VEHICLE LEASE TRUST BMWLT 2024 2 A2B / ABS-O (US05613MAC38) | 5.31 | -23.22 | 0.2892 | -0.0517 | ||

| SOUND POINT CLO LTD SNDPT 2020 3A A1R 144A / ABS-CBDO (US83615CAL00) | 5.25 | -10.40 | 0.2857 | -0.0028 | ||

| US86563VBF58 / Sumitomo Mitsui Trust Bank Ltd | 5.23 | 0.2848 | 0.2848 | |||

| US05401AAK79 / Avolon Holdings Funding Ltd | 5.21 | -0.27 | 0.2837 | 0.0263 | ||

| US05571AAN54 / BPCE SA REGD V/R 144A P/P 6.30469100 | 5.16 | 7.05 | 0.2811 | 0.0435 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2018 H08 LF / ABS-MBS (US38380LED10) | 5.15 | -14.08 | 0.2803 | -0.0149 | ||

| US22822VAS07 / CROWN CASTLE INTL CORP 1.35% 07/15/2025 | 5.14 | 458.37 | 0.2798 | 0.2345 | ||

| US55821UAA25 / Madison Park Funding XLVIII Ltd | 5.05 | -2.49 | 0.2749 | 0.0197 | ||

| HYUNDAI AUTO LEASE SECURITIZAT HALST 2025 B A2B 144A / ABS-O (US44935DAC39) | 5.02 | 0.2734 | 0.2734 | |||

| US225401AY40 / Credit Suisse Group AG | 5.00 | -0.32 | 0.2726 | 0.0252 | ||

| US23636AAZ49 / Danske Bank A/S | 4.97 | 0.2707 | 0.2707 | |||

| FREDDIE MAC FHR 5510 FA / ABS-MBS (US3137HJMM67) | 4.95 | -5.40 | 0.2694 | 0.0117 | ||

| USAA AUTO OWNER TRUST USAOT 2024 A A2 144A / ABS-O (US90327VAB45) | 4.86 | -38.27 | 0.2649 | -0.1234 | ||

| US03027XAJ90 / American Tower Co Bond | 4.66 | 0.2538 | 0.2538 | |||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 4.55 | 0.2481 | 0.2481 | |||

| US62947QBB32 / NXP BV / NXP Funding LLC | 4.32 | 0.2354 | 0.2354 | |||

| PROTECTIVE LIFE GLOBAL SECURED 144A 07/26 VAR / DBT (US743672AG20) | 4.31 | -0.02 | 0.2345 | 0.0222 | ||

| US682680BA09 / ONEOK Inc | 4.30 | 0.56 | 0.2342 | 0.0235 | ||

| US3137FJG520 / FREDDIE MAC FHR 4842 FW | 4.30 | -5.66 | 0.2341 | 0.0095 | ||

| US3136B9TM97 / Fannie Mae REMICS | 4.28 | -5.08 | 0.2333 | 0.0109 | ||

| NORTHWOODS CAPITAL LTD WOODS 2018 14BA AR 144A / ABS-CBDO (US66860CAL72) | 4.16 | -10.24 | 0.2267 | -0.0018 | ||

| GOLUB CAPITAL PARTNERS STATIC GOST 2024 1A A1 144A / ABS-CBDO (US381929AA67) | 4.05 | -6.46 | 0.2207 | 0.0072 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2018 H01 FA / ABS-MBS (US38375U3L29) | 4.05 | -6.57 | 0.2206 | 0.0070 | ||

| STELLANTIS FINANCIAL UNDERWRIT SFUEL 2025 AA A2 144A / ABS-O (US858928AB07) | 4.01 | 0.2185 | 0.2185 | |||

| US30321L2E12 / F&G Global Funding | 4.00 | 0.00 | 0.2179 | 0.0207 | ||

| US576339DJ15 / MASTER CR CARD TR II 23-2A A SOFR30A+85 01/21/2027 144A | 4.00 | -0.17 | 0.2178 | 0.0203 | ||

| FREDDIE MAC FHR 5500 QF / ABS-MBS (US3137HJBW68) | 3.99 | -8.75 | 0.2171 | 0.0018 | ||

| US025537AR24 / American Electric Power Co Inc | 3.98 | 62.84 | 0.2170 | 0.0964 | ||

| JOHN DEERE CAPITAL CORP SR UNSECURED 10/25 VAR / DBT (US24422EXJ36) | 3.90 | -0.05 | 0.2126 | 0.0201 | ||

| US345397XL24 / FORD MOTOR CREDIT CO LLC | 3.90 | 0.49 | 0.2122 | 0.0211 | ||

| US38381WUF30 / GOVERNMENT NATIONAL MORTGAGE A GNR 2019 78 FJ | 3.82 | -0.86 | 0.2080 | 0.0181 | ||

| SBNA AUTO LEASE TRUST SBALT 2025 A A2 144A / ABS-O (US78437KAB08) | 3.80 | 0.03 | 0.2071 | 0.0197 | ||

| US46849LSQ58 / Jackson National Life Global Funding | 3.80 | 0.2069 | 0.2069 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 3.69 | 0.2009 | 0.2009 | |||

| US92331EAF34 / XXIX Venture Limited | 3.60 | -37.58 | 0.1962 | -0.0882 | ||

| US3622ABBY71 / GNMA II POOL 785555 G2 06/71 FLOATING VAR | 3.55 | -12.50 | 0.1933 | -0.0066 | ||

| US3136B5K957 / Fannie Mae REMICS | 3.53 | -3.10 | 0.1922 | 0.0127 | ||

| US89179YAR45 / TOWD POINT MORTGAGE TRUST 2021-1 VAR 11/25/2061 144A | 3.52 | -5.38 | 0.1917 | 0.0084 | ||

| DLLAD LLC DLLAD 2024 1A A2 144A / ABS-O (US23346MAB28) | 3.50 | -17.96 | 0.1906 | -0.0196 | ||

| CROWN POINT CLO 7, LTD CRNPT 2018 7A AR 144A / ABS-CBDO (US22846MAJ27) | 3.48 | -32.08 | 0.1894 | -0.0629 | ||

| US78016EZR16 / Royal Bank of Canada | 3.31 | -0.06 | 0.1802 | 0.0171 | ||

| US12481QAC96 / CBAM 2018-5 Ltd | 3.21 | -24.46 | 0.1748 | -0.0346 | ||

| US06428AAC27 / BANK OF AMERICA AUTO TRUST 2023-1 BAAT 2023-1A A3 | 3.14 | 0.1708 | 0.1708 | |||

| US63935BAA17 / Navient Private Education Refi Loan Trust 2020-H | 3.11 | -8.68 | 0.1691 | 0.0015 | ||

| US14319BAC63 / Carmax Auto Owner Trust | 3.10 | 0.1688 | 0.1688 | |||

| US23329PAF71 / DNB Bank ASA | 3.02 | 0.87 | 0.1646 | 0.0169 | ||

| US25160PAJ66 / Deutsche Bank AG/New York NY | 3.00 | 0.1635 | 0.1635 | |||

| US21688AAX00 / COOPERATIEVE RABOBANK UA/NY | 3.00 | -0.13 | 0.1634 | 0.0153 | ||

| US98164QAD07 / WOART 2023-B A3 | 2.99 | -19.74 | 0.1628 | -0.0207 | ||

| US12635FAT12 / CSAIL 2015-C3 Commercial Mortgage Trust | 2.93 | -65.63 | 0.1597 | -0.2607 | ||

| US65535HBG39 / Nomura Holdings Inc | 2.92 | 0.1588 | 0.1588 | |||

| US31680EAD31 / Fifth Third Auto Trust 2023-1 | 2.87 | -7.99 | 0.1563 | 0.0026 | ||

| US48250LAW90 / KKR FINANCIAL CLO LTD 07/30 1 | 2.84 | -38.68 | 0.1546 | -0.0735 | ||

| US3137F8NS89 / FREDDIE MAC FHR 5068 AB | 2.76 | -3.70 | 0.1501 | 0.0091 | ||

| ANZ / ANZ Group Holdings Limited | 2.67 | -0.11 | 0.1457 | 0.0137 | ||

| CREDIT AGRICOLE / DBT (US22532XWY02) | 2.65 | -0.11 | 0.1443 | 0.0136 | ||

| US87264ABR59 / T-MOBILE USA INC 2.25% 02/15/2026 | 2.64 | 0.1438 | 0.1438 | |||

| US61690U7X23 / Morgan Stanley Bank NA | 2.59 | -0.27 | 0.1411 | 0.0131 | ||

| US20048GAA40 / COMM 2019-521F Mortgage Trust | 2.58 | 2.79 | 0.1406 | 0.0168 | ||

| US205887CB65 / Conagra Brands Inc | 2.46 | 0.1339 | 0.1339 | |||

| US500945AB61 / Kubota Credit Owner Trust 2023-2 | 2.44 | -57.89 | 0.1328 | -0.1525 | ||

| US042853AA99 / Arroyo Mortgage Trust 2021-1R | 2.40 | -6.69 | 0.1307 | 0.0040 | ||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUF79) | 2.40 | 0.1305 | 0.1305 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVE00) | 2.39 | 0.1299 | 0.1299 | |||

| SPACE COAST CREDIT UNION SCCU 2024 1A A2 144A / ABS-O (US78436RAC43) | 2.37 | -31.72 | 0.1292 | -0.0421 | ||

| USU5876JAH87 / MERCEDES BENZ FIN NA COMPANY GUAR REGS 08/25 VAR | 2.30 | 0.1253 | 0.1253 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVF74) | 2.29 | 0.1245 | 0.1245 | |||

| US87124VAF67 / Sydney Airport Finance Co Pty Ltd | 2.28 | 0.1243 | 0.1243 | |||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 2A A2 144A / ABS-O (US78397XAB01) | 2.27 | -42.36 | 0.1236 | -0.0704 | ||

| US233258AC69 / DLLAD 2023-1 LLC | 2.26 | -12.44 | 0.1230 | -0.0041 | ||

| US02557TAD19 / American Electric Power Co Inc | 2.20 | -0.27 | 0.1199 | 0.0111 | ||

| BANQUE FED CRED MUTUEL REGS 07/26 VAR / DBT (USF0803NAF99) | 2.02 | 0.1099 | 0.1099 | |||

| US89233FHN15 / Toyota Motor Credit Corporation | 2.00 | 0.00 | 0.1092 | 0.0104 | ||

| US404119BT57 / HCA Inc | 2.00 | 0.1091 | 0.1091 | |||

| PACIFIC LIFE GF II SECURED 144A 02/27 VAR / DBT (US6944PL3G29) | 2.00 | 0.05 | 0.1090 | 0.0104 | ||

| US380881FP22 / Golden Credit Card Trust | 2.00 | 0.10 | 0.1089 | 0.0104 | ||

| BMW VEHICLE LEASE TRUST BMWLT 2024 1 A2B / ABS-O (US05611UAC71) | 1.99 | -70.22 | 0.1082 | -0.2204 | ||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/26 5.4 / DBT (US928668CE07) | 1.97 | 0.1073 | 0.1073 | |||

| US05369AAK79 / Aviation Capital Group LLC | 1.97 | 0.77 | 0.1072 | 0.0109 | ||

| US14889DAJ72 / Catamaran CLO 2014-1 Ltd | 1.96 | -38.58 | 0.1068 | -0.0506 | ||

| US817826AC47 / 7-Eleven Inc | 1.96 | 1.03 | 0.1065 | 0.0111 | ||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2017 H02 FH / ABS-MBS (US38375UYK05) | 1.95 | -14.62 | 0.1063 | -0.0063 | ||

| JP MORGAN MORTGAGE TRUST JPMMT 2024 9 A11 144A / ABS-MBS (US46593DAX57) | 1.95 | -9.57 | 0.1061 | -0.0001 | ||

| VOLKSWAGEN AUTO LEASE TRUST VWALT 2024 A A2B / ABS-O (US92866EAC30) | 1.90 | -26.33 | 0.1033 | -0.0236 | ||

| US125523BZ27 / Cigna Corp. | 1.84 | 0.1000 | 0.1000 | |||

| US3137FN6L95 / FREDDIE MAC FHR 4904 FA | 1.83 | -4.64 | 0.0997 | 0.0051 | ||

| US3138ENEW53 / Fannie Mae Pool | 1.81 | -5.04 | 0.0986 | 0.0046 | ||

| BAYER US FINANCE II LLC COMPANY GUAR REGS 12/25 4.25 / DBT (USU07265AE85) | 1.75 | 0.0951 | 0.0951 | |||

| US87264ABZ75 / T-Mobile USA Inc | 1.72 | 0.0939 | 0.0939 | |||

| US58770AAC71 / Mercedes-Benz Auto Receivables Trust 2023-1 | 1.70 | -22.69 | 0.0928 | -0.0158 | ||

| BANQUE FED CRED MUTUEL SR UNSECURED REGS 07/25 4.524 / DBT (USF0803NAC68) | 1.70 | 0.00 | 0.0928 | 0.0088 | ||

| HARLEY DAVIDSON MOTORCYCLE TRU HDMOT 2024 A A2 / ABS-O (US412922AB25) | 1.66 | -49.92 | 0.0904 | -0.0729 | ||

| US3136BBGN69 / Fannie Mae REMICS | 1.62 | -6.41 | 0.0884 | 0.0029 | ||

| US55284AAA60 / MF1 2021-FL7 Ltd | 1.59 | -36.22 | 0.0867 | -0.0363 | ||

| US62954HAZ10 / NXP BV / NXP Funding LLC / NXP USA Inc | 1.59 | 0.0867 | 0.0867 | |||

| US05592XAD21 / BMW Vehicle Owner Trust, Series 2023-A, Class A3 | 1.59 | -20.35 | 0.0866 | -0.0118 | ||

| US69343VAA08 / PHEAA Student Loan Trust 2016-2 | 1.58 | -3.54 | 0.0861 | 0.0053 | ||

| ALLY AUTO RECEIVABLES TRUST ALLYA 2024 2 A2 / ABS-O (US02007NAB47) | 1.51 | -38.65 | 0.0820 | -0.0389 | ||

| US00774MAG06 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 1.50 | 0.07 | 0.0816 | 0.0078 | ||

| US33938XAC92 / Flex Ltd | 1.50 | 0.0816 | 0.0816 | |||

| US74460WAJ62 / VAR.RT. CORP. BONDS | 1.48 | -0.07 | 0.0805 | 0.0076 | ||

| US775109BE00 / Rogers Communications Inc | 1.42 | 0.43 | 0.0771 | 0.0076 | ||

| US7425APAB16 / Principal Life Global Funding II | 1.39 | 26.81 | 0.0755 | 0.0216 | ||

| US55317WAB72 / MMAF Equipment Finance LLC 2023-A | 1.37 | -32.55 | 0.0746 | -0.0255 | ||

| US3136ALXW66 / FANNIE MAE FNR 2014 69 AF | 1.36 | -3.88 | 0.0743 | 0.0043 | ||

| US38376WE683 / GOVERNMENT NATIONAL MORTGAGE A GNR 2010 35 AF | 1.35 | -2.96 | 0.0733 | 0.0049 | ||

| KIAMTR / Kia Corp | 1.34 | 0.0728 | 0.0728 | |||

| US552751AA74 / MFA 2020-NQM2 TRUST SER 2020-NQM2 CL A1 V/R REGD 144A P/P 1.38100000 | 1.32 | -20.79 | 0.0721 | -0.0102 | ||

| US3136AP3D21 / FANNIE MAE FNR 2015 64 FK | 1.31 | -4.86 | 0.0715 | 0.0035 | ||

| US64034QAB41 / Nelnet Student Loan Trust | 1.31 | -7.25 | 0.0711 | 0.0017 | ||

| US38376RC539 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 H23 PT | 1.29 | -20.48 | 0.0702 | -0.0097 | ||

| US38381VSW18 / GOVERNMENT NATIONAL MORTGAGE A GNR 2019 57 EF | 1.26 | -2.78 | 0.0686 | 0.0048 | ||

| US63941HAA05 / Navient Private Education Refi Loan Trust 2020-D | 1.25 | -6.97 | 0.0683 | 0.0019 | ||

| MERCEDES BENZ FIN NA MERCEDES BENZ FIN NA / DBT (US58769JAN72) | 1.25 | 0.0682 | 0.0682 | |||

| BMW US CAPITAL LLC COMPANY GUAR REGS 08/25 VAR / DBT (USU09513JP55) | 1.25 | 24.88 | 0.0681 | 0.0187 | ||

| CHASE AUTO OWNER TRUST CHAOT 2024 2A A2 144A / ABS-O (US16144CAB28) | 1.24 | -45.20 | 0.0678 | -0.0441 | ||

| CHASE AUTO OWNER TRUST CHAOT 2024 5A A2 144A / ABS-O (US16144QAB14) | 1.20 | -29.06 | 0.0655 | -0.0180 | ||

| US694308HP52 / PACIFIC GAS + ELECTRIC SR UNSECURED 03/26 2.95 | 1.18 | 0.51 | 0.0645 | 0.0064 | ||

| US05565ECD58 / BMW US Capital LLC | 1.18 | 0.0642 | 0.0642 | |||

| US98978VAU70 / Zoetis Inc | 1.12 | 459.50 | 0.0610 | 0.0511 | ||

| US694308JP35 / PACIFIC GAS + ELECTRIC 1ST MORTGAGE 01/26 3.15 | 1.10 | 123.94 | 0.0602 | 0.0358 | ||

| US03027XBL38 / American Tower Corp | 1.08 | 0.0590 | 0.0590 | |||

| US50200YAQ17 / LCM LTD PARTNERSHIP LCM 30A AR 144A | 1.08 | -20.82 | 0.0587 | -0.0083 | ||

| US06368LWV43 / Bank of Montreal | 1.08 | -0.19 | 0.0587 | 0.0055 | ||

| US38376XJP96 / GOVERNMENT NATIONAL MORTGAGE A GNR 2010 37 FG | 1.05 | -2.59 | 0.0574 | 0.0040 | ||

| US718172BQ16 / Philip Morris International Inc | 1.04 | 0.0568 | 0.0568 | |||

| US29278GAZ19 / Enel Finance International NV | 1.01 | -0.40 | 0.0548 | 0.0050 | ||

| US38376YGD76 / GOVERNMENT NATIONAL MORTGAGE A GNR 2010 50 GF | 1.00 | -3.09 | 0.0547 | 0.0036 | ||

| HSBC26D / HSBC Holdings PLC | 1.00 | 0.0546 | 0.0546 | |||

| US00130HCE36 / CORP. NOTE | 0.98 | 0.0534 | 0.0534 | |||

| JACKSON NATL LIFE GLOBAL JACKSON NATL LIFE GLOBAL / DBT (US46849LUZ20) | 0.98 | 0.0533 | 0.0533 | |||

| WORLD OMNI AUTOMOBILE LEASE SE WOLS 2024 A A2B / ABS-O (US981946AC04) | 0.97 | -28.77 | 0.0530 | -0.0143 | ||

| 3 MONTH SOFR FUT MAR26 XCME 20260616 / DIR (000000000) | 0.97 | 0.0529 | 0.0529 | |||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/26 VAR / DBT (US928668CD24) | 0.96 | 0.00 | 0.0520 | 0.0049 | ||

| US78443CBV54 / SLM PRIVATE CREDIT STUDENT LOAN TRUST 2005-A SLMA 2005-A A4 | 0.94 | -6.02 | 0.0510 | 0.0018 | ||

| US63942MAA80 / Navient Private Education Refi Loan Trust 2022-A | 0.90 | -2.81 | 0.0490 | 0.0034 | ||

| US98978VAK98 / Zoetis, Inc. | 0.87 | -49.09 | 0.0471 | -0.0366 | ||

| SBNA AUTO LEASE TRUST SBALT 2024 C A2 144A / ABS-O (US78398DAB38) | 0.85 | -48.42 | 0.0464 | -0.0350 | ||

| US3137BFMR96 / Freddie Mac REMICS | 0.83 | -5.70 | 0.0451 | 0.0018 | ||

| MAGNETITE CLO LTD MAGNE 2015 12A AR4 144A / ABS-CBDO (US55953HBD44) | 0.73 | -34.05 | 0.0399 | -0.0148 | ||

| RFR USD SOFR/3.25000 06/18/25-5Y LCH / DIR (EZH1N8KH2K02) | 0.73 | 0.0398 | 0.0398 | |||

| CARVANA AUTO RECEIVABLES TRUST CRVNA 2024 P1 A2 144A / ABS-O (US14688NAB55) | 0.72 | -51.83 | 0.0395 | -0.0347 | ||

| US126117AT75 / CNA Financial Corp | 0.70 | 0.0381 | 0.0381 | |||

| USU6379HAC35 / NAVIENT PRIVATE EDUCATION LOAN TRUST 2018-B SER 2018-BX CL A2B V/R REGD REG S 5.40443000 | 0.69 | -25.32 | 0.0378 | -0.0080 | ||

| US36262RAJ68 / GS MORTGAGE BACKED SECURITIES 01/52 1 | 0.67 | -1.76 | 0.0365 | 0.0029 | ||

| US38376R6V36 / Government National Mortgage Association | 0.64 | -8.53 | 0.0351 | 0.0004 | ||

| US262431AH22 / Dryden 50 Senior Loan Fund 0.00 | 0.64 | -14.19 | 0.0349 | -0.0019 | ||

| CARMAX AUTO OWNER TRUST CARMX 2024 2 A2A / ABS-O (US14319EAC03) | 0.63 | -36.11 | 0.0342 | -0.0142 | ||

| US438123AB76 / HAROT 2023-4 5.87% 06/22/2026 | 0.60 | -76.24 | 0.0329 | -0.0923 | ||

| US92331AAW45 / Venture XXVIII CLO Ltd | 0.57 | -41.99 | 0.0308 | -0.0172 | ||

| US14318DAC39 / CarMax Auto Owner Trust | 0.55 | -22.07 | 0.0300 | -0.0048 | ||

| US38376TX986 / GOVERNMENT NATIONAL MORTGAGE A GNR 2010 4 FM | 0.55 | -2.83 | 0.0299 | 0.0020 | ||

| TESLA AUTO LEASE TRUST TESLA 2024 A A2B 144A / ABS-O (US88166VAC00) | 0.54 | -70.73 | 0.0296 | -0.0619 | ||

| RFR USD SOFR/4.10000 02/11/25-1Y LCH / DIR (EZR57YL70MG8) | 0.54 | -1,206.12 | 0.0296 | 0.0320 | ||

| ACA / Crédit Agricole S.A. | 0.54 | 0.0294 | 0.0294 | |||

| US05252ADG31 / Australia & New Zealand Banking Group Ltd | 0.53 | 0.00 | 0.0286 | 0.0027 | ||

| US89177HAA05 / Towd Point Mortgage Trust, Series 2019-HY2, Class A1 | 0.52 | -7.16 | 0.0283 | 0.0007 | ||

| HYUNDAI CAPITAL AMERICA SR UNSECURED REGS 11/25 VAR / DBT (US44891CCS08) | 0.50 | 0.0273 | 0.0273 | |||

| US38141GXN95 / Goldman Sachs Group Inc/The | 0.50 | -0.20 | 0.0273 | 0.0026 | ||

| US38375UG536 / Government National Mortgage Association | 0.47 | -10.42 | 0.0258 | -0.0002 | ||

| US87229WAQ42 / TCI-Symphony CLO Ltd., Series 2016-1A, Class AR2 | 0.47 | -5.78 | 0.0258 | 0.0010 | ||

| US05401AAM36 / Avolon Holdings Funding Ltd | 0.47 | -59.69 | 0.0257 | -0.0320 | ||

| US74982WAA45 / RACEP 15-9A A1A2 CLO 144A FRN (L+94) 10-15-30 | 0.47 | -44.30 | 0.0255 | -0.0160 | ||

| US025816DD86 / American Express Co | 0.47 | -0.21 | 0.0254 | 0.0024 | ||

| US80317LAJ26 / Saranac Clo VI Ltd | 0.45 | -14.45 | 0.0246 | -0.0014 | ||

| US38376WXM27 / GOVERNMENT NATIONAL MORTGAGE A GNR 2010 15 AF | 0.44 | -2.67 | 0.0238 | 0.0017 | ||

| US3137FAWH71 / FREDDIE MAC FHR 4722 FA | 0.40 | -4.76 | 0.0218 | 0.0011 | ||

| 317U8CNA1 PIMCO SWAPTION 3.6 CALL USD 20250812 / DIR (000000000) | 0.39 | 0.0214 | 0.0214 | |||

| US63940YAB20 / Navient Private Education Refi Loan Trust 2019-C | 0.38 | -13.54 | 0.0209 | -0.0010 | ||

| US3137BLN539 / FREDDIE MAC FHR 4521 AF | 0.38 | -6.86 | 0.0207 | 0.0006 | ||

| US12666DAB73 / CNH Equipment Trust, Series 2023-B, Class A2 | 0.36 | -69.11 | 0.0198 | -0.0380 | ||

| US38375KCC45 / GOVERNMENT NATIONAL MORTGAGE A GNR 2007 26 FJ | 0.34 | -6.06 | 0.0186 | 0.0007 | ||

| US31397JYP38 / FREDDIE MAC FHR 3339 FL | 0.33 | -1.76 | 0.0182 | 0.0014 | ||

| US31397KGG04 / Freddie Mac REMICS | 0.30 | -1.95 | 0.0164 | 0.0013 | ||

| US65535HAW97 / Nomura Holdings Inc | 0.29 | 0.0159 | 0.0159 | |||

| US29278GAM06 / Enel Finance International NV | 0.29 | 0.0159 | 0.0159 | |||

| US38376RFG65 / GNMA, Series 2015-H20, Class FA | 0.29 | -15.16 | 0.0159 | -0.0011 | ||

| US38380ANR40 / GOVERNMENT NATIONAL MORTGAGE A GNR 2016 117 FA | 0.28 | -2.76 | 0.0154 | 0.0011 | ||

| US38375UNP11 / GNMA, Series 2014-H17, Class FC | 0.28 | -14.06 | 0.0150 | -0.0008 | ||

| PENSKE TRUCK LEASING/PTL SR UNSECURED REGS 11/25 1.2 / DBT (USU71000BC33) | 0.27 | 0.0147 | 0.0147 | |||

| US22616CAJ27 / Crestline Denali CLO XV Ltd | 0.25 | -82.75 | 0.0137 | -0.0580 | ||

| AU3FN0029609 / AAI Ltd | 0.25 | 0.0136 | 0.0136 | |||

| US3136A8JQ49 / FANNIE MAE FNR 2012 93 CF | 0.25 | -6.44 | 0.0135 | 0.0004 | ||

| US31396VWM61 / FANNIE MAE FNR 2007 44 FK | 0.25 | -2.00 | 0.0134 | 0.0010 | ||

| US3136B5SR71 / FANNIE MAE FNR 2019 41 FC | 0.23 | -3.40 | 0.0124 | 0.0008 | ||

| US3136A3D248 / Federal National Mortgage Assoication Series 12-9 Class FC | 0.22 | -4.33 | 0.0121 | 0.0006 | ||

| US80281LAS43 / SANTANDER UK GROUP HOLDINGS PLC | 0.20 | -0.50 | 0.0110 | 0.0010 | ||

| US06368FAD15 / Bank of Montreal | 0.20 | 0.00 | 0.0106 | 0.0010 | ||

| US3137AJZ315 / FREDDIE MAC FHR 3977 FB | 0.19 | -3.00 | 0.0106 | 0.0007 | ||

| US80281LAQ86 / Santander UK Group Holdings PLC | 0.19 | 1.04 | 0.0106 | 0.0011 | ||

| US89233FHN15 / Toyota Motor Credit Corporation | 0.19 | 0.0105 | 0.0105 | |||

| US31395DE474 / FANNIE MAE FNR 2006 43 JF | 0.18 | -6.22 | 0.0099 | 0.0003 | ||

| US962166CC62 / WEYERHAEUSER COMPANY | 0.18 | 0.0098 | 0.0098 | |||

| US3136A3RV54 / SINGLE FAMILY ARM | 0.18 | -4.37 | 0.0096 | 0.0005 | ||

| US3137B5QC03 / FHR 4263 FB 11/43 | 0.17 | -3.93 | 0.0093 | 0.0005 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0.16 | 0.0087 | 0.0087 | |||

| US12551JAL08 / CIFC FUNDING LTD CIFC 2017 4A A1R 144A | 0.15 | -23.38 | 0.0084 | -0.0015 | ||

| US58769JAH05 / Mercedes-Benz Finance North America LLC | 0.15 | 0.0082 | 0.0082 | |||

| US31397JX824 / FREDDIE MAC FHR 3344 FL | 0.15 | -3.97 | 0.0080 | 0.0005 | ||

| US31397GTW05 / FREDDIE MAC FHR 3305 KF | 0.14 | -2.72 | 0.0078 | 0.0006 | ||

| US65535HBE80 / Nomura Holdings Inc | 0.14 | 0.00 | 0.0074 | 0.0007 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 0.12 | 36.26 | 0.0068 | 0.0023 | ||

| US38375BQS42 / GNMA, Series 2012-H08, Class FC | 0.09 | -9.47 | 0.0047 | 0.0000 | ||

| US31339MXK97 / Freddie Mac REMICs | 0.09 | -4.44 | 0.0047 | 0.0002 | ||

| US3136AEHA87 / Fannie Mae REMICS | 0.08 | -3.45 | 0.0046 | 0.0003 | ||

| US31393QMP45 / Freddie Mac REMICS | 0.08 | -5.06 | 0.0041 | 0.0002 | ||

| US38375U3U28 / GOVERNMENT NATIONAL MORTGAGE A GNR 2018 H01 FC | 0.06 | -11.29 | 0.0030 | -0.0001 | ||

| US3136A1KL89 / FANNIE MAE FNR 2011 99 GF | 0.05 | -7.02 | 0.0029 | 0.0001 | ||

| US3137A7Q943 / FREDDIE MAC FHR 3826 AF | 0.05 | -2.08 | 0.0026 | 0.0002 | ||

| US38375BKD37 / Government National Mortgage Association | 0.04 | -14.89 | 0.0022 | -0.0001 | ||

| US3137AHC300 / FREDDIE MAC FHR 3957 FA | 0.04 | 0.00 | 0.0020 | 0.0002 | ||

| US31395NWK98 / FANNIE MAE FNR 2006 56 PF | 0.04 | -5.26 | 0.0020 | 0.0001 | ||

| US31397PHA12 / Freddie Mac REMICS | 0.04 | 0.00 | 0.0020 | 0.0001 | ||

| US31398RV365 / Fannie Mae REMICS | 0.03 | -5.88 | 0.0018 | 0.0001 | ||

| US3136A4CH09 / FANNIE MAE FNR 2012 27 FC | 0.03 | 0.00 | 0.0016 | 0.0001 | ||

| US31397YPE58 / FREDDIE MAC FHR 3505 FA | 0.02 | -4.55 | 0.0012 | 0.0001 | ||

| US38376RKZ81 / Government National Mortgage Association | 0.02 | -5.00 | 0.0011 | 0.0001 | ||

| US3137A9YG56 / FREDDIE MAC REMICS FHR 3838 FG | 0.02 | -11.76 | 0.0008 | -0.0000 | ||

| US3137AER982 / FREDDIE MAC FHR 3913 FA | 0.01 | -14.29 | 0.0004 | 0.0000 | ||

| US31395BZF39 / FNMA, REMIC, Series 2006-27, Class BF | 0.00 | -25.00 | 0.0002 | 0.0000 | ||

| US38376RRJ76 / Government National Mortgage Association | 0.00 | 0.00 | 0.0001 | 0.0000 | ||

| US38376RMB95 / GNMA, Series 2015-H29, Class FA | 0.00 | -50.00 | 0.0001 | -0.0000 | ||

| 317U8CMA2 PIMCO SWAPTION 4.6 PUT USD 20250812 / DIR (EZDZRNFWMZT1) | 0.00 | -100.00 | 0.0000 | -0.0045 | ||

| 317U79UA1 PIMCO SWAPTION 5.4 PUT USD 20250926 / DIR (EZMGDQQCNYM0) | 0.00 | -100.00 | 0.0000 | -0.0001 | ||

| US 10YR NOTE (CBT)SEP25 XCBT 20250919 / DIR (000000000) | -0.14 | -0.0075 | -0.0075 | |||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | -0.17 | -0.0094 | -0.0094 | |||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | -0.37 | -0.0201 | -0.0201 | |||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | -1.58 | -0.0861 | -0.0861 | |||

| RFR USD SOFR/3.62000 09/02/25-4Y* LCH / DIR (EZNQ4Z4QT3L7) | -2.54 | -0.1386 | -0.1386 |