Statistik Asas

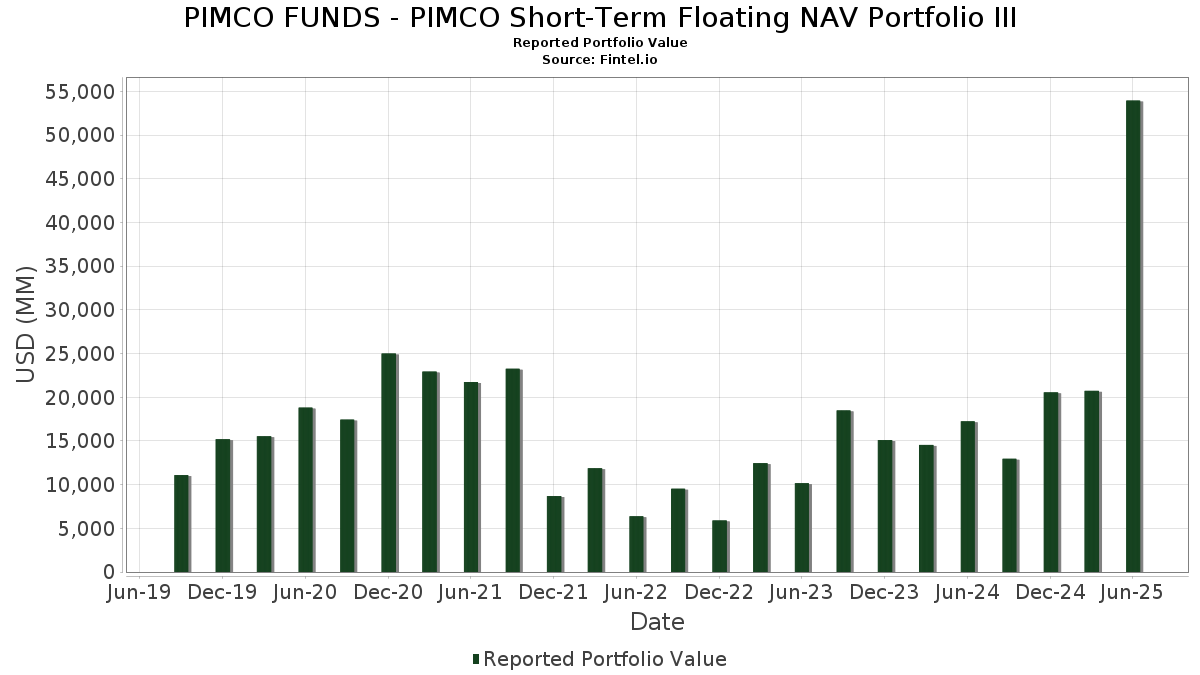

| Nilai Portfolio | $ 53,947,082,602 |

| Kedudukan Semasa | 650 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

PIMCO FUNDS - PIMCO Short-Term Floating NAV Portfolio III telah mendedahkan 650 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 53,947,082,602 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas PIMCO FUNDS - PIMCO Short-Term Floating NAV Portfolio III ialah UNITED STATES TREASURY NOTE 0.75000000 (US:US91282CCW91) , United States Treasury Note/Bond (US:US91282CCZ23) , United States Treasury Note/Bond (US:US9128286S43) , United States Treasury Note/Bond (US:US91282CCF68) , and U.S. Treasury Notes (US:US91282CHM64) . Kedudukan baharu PIMCO FUNDS - PIMCO Short-Term Floating NAV Portfolio III termasuk UNITED STATES TREASURY NOTE 0.75000000 (US:US91282CCW91) , United States Treasury Note/Bond (US:US91282CCZ23) , United States Treasury Note/Bond (US:US9128286S43) , United States Treasury Note/Bond (US:US91282CCF68) , and U.S. Treasury Notes (US:US91282CHM64) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1,505.00 | 4.5675 | 4.5675 | ||

| 1,474.00 | 4.4734 | 4.4734 | ||

| 1,300.00 | 3.9453 | 3.9453 | ||

| 1,300.00 | 3.9453 | 3.9453 | ||

| 1,129.00 | 3.4264 | 3.4264 | ||

| 1,129.00 | 3.4264 | 3.4264 | ||

| 1,129.00 | 3.4264 | 3.4264 | ||

| 1,100.00 | 3.3384 | 3.3384 | ||

| 1,000.00 | 3.0349 | 3.0349 | ||

| 1,000.00 | 3.0349 | 3.0349 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 351.46 | 1.0666 | -1.9991 | ||

| 351.46 | 1.0666 | -1.9991 | ||

| 351.46 | 1.0666 | -1.9991 | ||

| 351.46 | 1.0666 | -1.9991 | ||

| 301.79 | 0.9159 | -0.7565 | ||

| 301.79 | 0.9159 | -0.7565 | ||

| 301.79 | 0.9159 | -0.7565 | ||

| 301.79 | 0.9159 | -0.7565 | ||

| 249.44 | 0.7570 | -0.6253 | ||

| 249.44 | 0.7570 | -0.6253 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-28 untuk tempoh pelaporan 2025-06-30. Pelabur ini tidak mendedahkan sekuriti yang dikira dalam saham, jadi lajur berkaitan saham dalam jadual di bawah tidak dimasukkan. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|

| REPO BANK AMERICA REPO / RA (000000000) | 1,505.00 | 4.5675 | 4.5675 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1,474.00 | 4.4734 | 4.4734 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1,300.00 | 3.9453 | 3.9453 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1,300.00 | 3.9453 | 3.9453 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1,129.00 | 3.4264 | 3.4264 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1,129.00 | 3.4264 | 3.4264 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1,129.00 | 3.4264 | 3.4264 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1,100.00 | 3.3384 | 3.3384 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1,000.00 | 3.0349 | 3.0349 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 1,000.00 | 3.0349 | 3.0349 | |||

| MILLENIUM REPO / RA (000000000) | 950.00 | 2.8831 | 2.8831 | |||

| MILLENIUM REPO / RA (000000000) | 950.00 | 2.8831 | 2.8831 | |||

| MILLENIUM REPO / RA (000000000) | 950.00 | 2.8831 | 2.8831 | |||

| RVPO STATE STREET GLOBAL MARKE USD RVPO FICC SSGM / RA (000000000) | 919.80 | 2.7915 | 2.7915 | |||

| RVPO STATE STREET GLOBAL MARKE USD RVPO FICC SSGM / RA (000000000) | 919.80 | 2.7915 | 2.7915 | |||

| REPO BANK OF MONTREAL ZCP / RA (000000000) | 881.22 | 2.6744 | 2.6744 | |||

| REPO BANK OF MONTREAL ZCP / RA (000000000) | 881.22 | 2.6744 | 2.6744 | |||

| REPO BANK OF MONTREAL ZCP / RA (000000000) | 881.22 | 2.6744 | 2.6744 | |||

| REPO BANK OF MONTREAL ZCP / RA (000000000) | 881.22 | 2.6744 | 2.6744 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 800.00 | 2.4279 | 2.4279 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 800.00 | 2.4279 | 2.4279 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 734.35 | 2.2287 | 2.2287 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 734.35 | 2.2287 | 2.2287 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 734.35 | 2.2287 | 2.2287 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 660.91 | 2.0058 | 2.0058 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 660.91 | 2.0058 | 2.0058 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 660.91 | 2.0058 | 2.0058 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 660.91 | 2.0058 | 2.0058 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 600.00 | 1.8209 | 1.8209 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 600.00 | 1.8209 | 1.8209 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 587.48 | 1.7829 | 1.7829 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 500.00 | 1.5174 | 1.5174 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 484.67 | 1.4709 | 1.4709 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 484.67 | 1.4709 | 1.4709 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 484.67 | 1.4709 | 1.4709 | |||

| US91282CCW91 / UNITED STATES TREASURY NOTE 0.75000000 | 481.97 | 1.4627 | 1.4627 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 400.00 | 1.2140 | 1.2140 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 400.00 | 1.2140 | 1.2140 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 400.00 | 1.2140 | 1.2140 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 400.00 | 1.2140 | 1.2140 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 400.00 | 1.2140 | 1.2140 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 367.17 | 1.1143 | 1.1143 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 367.17 | 1.1143 | 1.1143 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 367.17 | 1.1143 | 1.1143 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 367.17 | 1.1143 | 1.1143 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 367.17 | 1.1143 | 1.1143 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 367.17 | 1.1143 | 1.1143 | |||

| ROYAL BANK OF CANADA REPO REPO / RA (000000000) | 367.17 | 1.1143 | 1.1143 | |||

| US TREASURY N/B 01/27 4.125 / DBT (US91282CMH15) | 351.65 | 1.0672 | 1.0672 | |||

| US TREASURY N/B 07/26 4.375 / DBT (US91282CLB53) | 351.46 | -36.43 | 1.0666 | -1.9991 | ||

| US TREASURY N/B 07/26 4.375 / DBT (US91282CLB53) | 351.46 | -36.43 | 1.0666 | -1.9991 | ||

| US TREASURY N/B 07/26 4.375 / DBT (US91282CLB53) | 351.46 | -36.43 | 1.0666 | -1.9991 | ||

| US TREASURY N/B 07/26 4.375 / DBT (US91282CLB53) | 351.46 | -36.43 | 1.0666 | -1.9991 | ||

| US91282CCZ23 / United States Treasury Note/Bond | 337.20 | 1.0234 | 1.0234 | |||

| US TREASURY N/B 12/26 4.25 / DBT (US91282CME83) | 301.79 | 0.07 | 0.9159 | -0.7565 | ||

| US TREASURY N/B 12/26 4.25 / DBT (US91282CME83) | 301.79 | 0.07 | 0.9159 | -0.7565 | ||

| US TREASURY N/B 12/26 4.25 / DBT (US91282CME83) | 301.79 | 0.07 | 0.9159 | -0.7565 | ||

| US TREASURY N/B 12/26 4.25 / DBT (US91282CME83) | 301.79 | 0.07 | 0.9159 | -0.7565 | ||

| TORONTO DOMINION BANK REPO DUMMY ASSET / RA (000000000) | 301.08 | 0.9137 | 0.9137 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 301.08 | 0.9137 | 0.9137 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 301.08 | 0.9137 | 0.9137 | |||

| TORONTO DOMINION BANK REPO DUMMY ASSET / RA (000000000) | 301.08 | 0.9137 | 0.9137 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 301.08 | 0.9137 | 0.9137 | |||

| US TREASURY N/B 09/26 3.5 / DBT (US91282CLP40) | 298.50 | 0.9059 | 0.9059 | |||

| US TREASURY N/B 09/26 3.5 / DBT (US91282CLP40) | 298.50 | 0.9059 | 0.9059 | |||

| US TREASURY N/B 09/26 3.5 / DBT (US91282CLP40) | 298.50 | 0.9059 | 0.9059 | |||

| US TREASURY N/B 09/26 3.5 / DBT (US91282CLP40) | 298.50 | 0.9059 | 0.9059 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 264.37 | 0.8023 | 0.8023 | |||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 264.37 | 0.8023 | 0.8023 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 264.37 | 0.8023 | 0.8023 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 264.37 | 0.8023 | 0.8023 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 264.37 | 0.8023 | 0.8023 | |||

| MERRILL LYNCH REPO CAD REPO / RA (000000000) | 257.02 | 0.7800 | 0.7800 | |||

| MERRILL LYNCH REPO CAD REPO / RA (000000000) | 257.02 | 0.7800 | 0.7800 | |||

| MERRILL LYNCH REPO CAD REPO / RA (000000000) | 257.02 | 0.7800 | 0.7800 | |||

| MERRILL LYNCH REPO CAD REPO / RA (000000000) | 257.02 | 0.7800 | 0.7800 | |||

| US TREASURY N/B 11/26 4.25 / DBT (US91282CLY56) | 251.33 | 0.7627 | 0.7627 | |||

| US TREASURY N/B 11/26 4.25 / DBT (US91282CLY56) | 251.33 | 0.7627 | 0.7627 | |||

| PARIBAS REPO / RA (000000000) | 251.00 | 0.7618 | 0.7618 | |||

| PARIBAS REPO / RA (000000000) | 251.00 | 0.7618 | 0.7618 | |||

| PARIBAS REPO / RA (000000000) | 251.00 | 0.7618 | 0.7618 | |||

| PARIBAS REPO / RA (000000000) | 251.00 | 0.7618 | 0.7618 | |||

| MORGAN STANLEY REPO 9W08 / RA (000000000) | 250.00 | 0.7587 | 0.7587 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 250.00 | 0.7587 | 0.7587 | |||

| MORGAN STANLEY REPO 9W08 / RA (000000000) | 250.00 | 0.7587 | 0.7587 | |||

| US TREASURY N/B 08/26 3.75 / DBT (US91282CLH24) | 249.44 | 0.07 | 0.7570 | -0.6253 | ||

| US TREASURY N/B 08/26 3.75 / DBT (US91282CLH24) | 249.44 | 0.07 | 0.7570 | -0.6253 | ||

| US TREASURY N/B 08/26 3.75 / DBT (US91282CLH24) | 249.44 | 0.07 | 0.7570 | -0.6253 | ||

| US TREASURY N/B 08/26 3.75 / DBT (US91282CLH24) | 249.44 | 0.07 | 0.7570 | -0.6253 | ||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 242.34 | 0.7355 | 0.7355 | |||

| RVPO CIBC WORLD MKTS INC / RA (000000000) | 242.34 | 0.7355 | 0.7355 | |||

| US TREASURY N/B 02/27 4.125 / DBT (US91282CMP31) | 201.07 | 0.6102 | 0.6102 | |||

| US TREASURY N/B 02/27 4.125 / DBT (US91282CMP31) | 201.07 | 0.6102 | 0.6102 | |||

| US TREASURY N/B 02/27 4.125 / DBT (US91282CMP31) | 201.07 | 0.6102 | 0.6102 | |||

| US TREASURY N/B 02/27 4.125 / DBT (US91282CMP31) | 201.07 | 0.6102 | 0.6102 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 200.00 | 0.6070 | 0.6070 | |||

| US9128286S43 / United States Treasury Note/Bond | 197.23 | 0.5986 | 0.5986 | |||

| US91282CCF68 / United States Treasury Note/Bond | 194.13 | 0.5892 | 0.5892 | |||

| US91282CHM64 / U.S. Treasury Notes | 150.80 | 0.4577 | 0.4577 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 150.00 | 0.4552 | 0.4552 | |||

| US68389XCC74 / Oracle Corp | 127.82 | 108.37 | 0.3879 | 0.0477 | ||

| US05530QAN07 / BAT International Finance PLC | 125.54 | 79.17 | 0.3810 | -0.0076 | ||

| REPO BANK AMERICA REPO / RA (000000000) | 100.00 | 0.3035 | 0.3035 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 100.00 | 0.3035 | 0.3035 | |||

| US694308JP35 / PACIFIC GAS + ELECTRIC 1ST MORTGAGE 01/26 3.15 | 90.83 | 113.67 | 0.2757 | 0.0399 | ||

| US24023KAK43 / DBS GROUP HOLDINGS LTD SR UNSECURED 144A 09/25 VAR | 73.73 | -0.09 | 0.2238 | -0.1855 | ||

| US06051GLE79 / Bank of America Corporation | 68.03 | 4.12 | 0.2065 | -0.1559 | ||

| US06738ECF07 / Barclays PLC | 67.14 | 0.2038 | 0.2038 | |||

| US46647PBA30 / JPMorgan Chase & Co | 63.01 | 0.23 | 0.1912 | -0.1574 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 02/26 VAR / DBT (AU3FN0075313) | 58.41 | 5.30 | 0.1773 | -0.1304 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 02/26 VAR / DBT (AU3FN0075313) | 58.41 | 5.30 | 0.1773 | -0.1304 | ||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 53.29 | 0.1617 | 0.1617 | |||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 53.29 | 0.1617 | 0.1617 | |||

| US61747YEZ43 / Morgan Stanley | 51.85 | -0.05 | 0.1573 | -0.1303 | ||

| US29874QEN07 / European Bank for Reconstruction & Development | 51.26 | 0.02 | 0.1556 | -0.1286 | ||

| COOPERATIEVE RABOBANK UA COOPERATIEVE RABOBANK UA / DBT (US21688ABB70) | 49.90 | 7.82 | 0.1514 | -0.1052 | ||

| COOPERATIEVE RABOBANK UA COOPERATIEVE RABOBANK UA / DBT (US21688ABB70) | 49.90 | 7.82 | 0.1514 | -0.1052 | ||

| COOPERATIEVE RABOBANK UA COOPERATIEVE RABOBANK UA / DBT (US21688ABB70) | 49.90 | 7.82 | 0.1514 | -0.1052 | ||

| COOPERATIEVE RABOBANK UA COOPERATIEVE RABOBANK UA / DBT (US21688ABB70) | 49.90 | 7.82 | 0.1514 | -0.1052 | ||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 45.06 | 0.00 | 0.1368 | -0.1131 | ||

| US17329T1613 / Citigroup Global Markets Holdings, Inc. into Bristol Myers Squibb Co. | 45.06 | 0.00 | 0.1368 | -0.1131 | ||

| US17327CAM55 / Citigroup Inc | 44.59 | 0.93 | 0.1353 | -0.1097 | ||

| PROTECTIVE LIFE GLOBAL SECURED 144A 07/26 VAR / DBT (US743672AG20) | 43.85 | -0.03 | 0.1331 | -0.1102 | ||

| PROTECTIVE LIFE GLOBAL SECURED 144A 07/26 VAR / DBT (US743672AG20) | 43.85 | -0.03 | 0.1331 | -0.1102 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 40.51 | 0.1229 | 0.1229 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 40.51 | 0.1229 | 0.1229 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 40.51 | 0.1229 | 0.1229 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 40.51 | 0.1229 | 0.1229 | |||

| VOLKSWAGEN GROUP OF AM / DBT (US92866BU298) | 40.19 | 0.1220 | 0.1220 | |||

| US98956PAS11 / Zimmer Biomet Holdings Inc | 37.39 | 0.38 | 0.1135 | -0.0931 | ||

| RVPO BANK OF NOVA SCOTIA / RA (000000000) | 36.72 | 0.1114 | 0.1114 | |||

| L BANK BW FOERDERBANK L BANK BW FOERDERBANK / DBT (XS2816702984) | 35.03 | -0.15 | 0.1063 | -0.0882 | ||

| L BANK BW FOERDERBANK L BANK BW FOERDERBANK / DBT (XS2816702984) | 35.03 | -0.15 | 0.1063 | -0.0882 | ||

| L BANK BW FOERDERBANK L BANK BW FOERDERBANK / DBT (XS2816702984) | 35.03 | -0.15 | 0.1063 | -0.0882 | ||

| L BANK BW FOERDERBANK L BANK BW FOERDERBANK / DBT (XS2816702984) | 35.03 | -0.15 | 0.1063 | -0.0882 | ||

| CITIBANK NA SR UNSECURED 08/26 VAR / DBT (US17325FBH01) | 33.59 | -0.15 | 0.1019 | -0.0846 | ||

| CITIBANK NA SR UNSECURED 08/26 VAR / DBT (US17325FBH01) | 33.59 | -0.15 | 0.1019 | -0.0846 | ||

| CITIBANK NA SR UNSECURED 08/26 VAR / DBT (US17325FBH01) | 33.59 | -0.15 | 0.1019 | -0.0846 | ||

| J P MORGAN TERM REPO / RA (000000000) | 33.20 | 0.1008 | 0.1008 | |||

| J P MORGAN TERM REPO / RA (000000000) | 33.20 | 0.1008 | 0.1008 | |||

| J P MORGAN TERM REPO / RA (000000000) | 33.20 | 0.1008 | 0.1008 | |||

| J P MORGAN TERM REPO / RA (000000000) | 33.20 | 0.1008 | 0.1008 | |||

| US89233FHN15 / Toyota Motor Credit Corporation | 32.54 | 0.12 | 0.0988 | -0.0815 | ||

| US89233FHN15 / Toyota Motor Credit Corporation | 32.54 | 0.12 | 0.0988 | -0.0815 | ||

| US89233FHN15 / Toyota Motor Credit Corporation | 32.54 | 0.12 | 0.0988 | -0.0815 | ||

| US89233FHN15 / Toyota Motor Credit Corporation | 32.54 | 0.12 | 0.0988 | -0.0815 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 08/26 VAR / DBT (US04685A4B40) | 32.13 | 0.01 | 0.0975 | -0.0807 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 08/26 VAR / DBT (US04685A4B40) | 32.13 | 0.01 | 0.0975 | -0.0807 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 08/26 VAR / DBT (US04685A4B40) | 32.13 | 0.01 | 0.0975 | -0.0807 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 08/26 VAR / DBT (US04685A4B40) | 32.13 | 0.01 | 0.0975 | -0.0807 | ||

| HSBC26C / HSBC Holdings PLC | 31.97 | 0.12 | 0.0970 | -0.0801 | ||

| ING BANK (AUSTRALIA) LTD COVERED 12/25 VAR / DBT (AU3FN0074175) | 29.11 | 5.20 | 0.0883 | -0.0651 | ||

| ING BANK (AUSTRALIA) LTD COVERED 12/25 VAR / DBT (AU3FN0074175) | 29.11 | 5.20 | 0.0883 | -0.0651 | ||

| ING BANK (AUSTRALIA) LTD COVERED 12/25 VAR / DBT (AU3FN0074175) | 29.11 | 5.20 | 0.0883 | -0.0651 | ||

| ING BANK (AUSTRALIA) LTD COVERED 12/25 VAR / DBT (AU3FN0074175) | 29.11 | 5.20 | 0.0883 | -0.0651 | ||

| D05 / DBS Group Holdings Ltd | 29.01 | -0.09 | 0.0880 | -0.0730 | ||

| D05 / DBS Group Holdings Ltd | 29.01 | -0.09 | 0.0880 | -0.0730 | ||

| D05 / DBS Group Holdings Ltd | 29.01 | -0.09 | 0.0880 | -0.0730 | ||

| US845437BS08 / Southwestern Electric Power Co | 28.63 | 52.46 | 0.0869 | -0.0172 | ||

| US06738EBZ79 / Barclays PLC | 27.73 | 19.31 | 0.0842 | -0.0447 | ||

| MUFG BK LTD 12/25 VAR / DBT (US55381BFG86) | 26.60 | 0.02 | 0.0807 | -0.0668 | ||

| MUFG BK LTD 12/25 VAR / DBT (US55381BFG86) | 26.60 | 0.02 | 0.0807 | -0.0668 | ||

| MUFG BK LTD 12/25 VAR / DBT (US55381BFG86) | 26.60 | 0.02 | 0.0807 | -0.0668 | ||

| MUFG BK LTD 12/25 VAR / DBT (US55381BFG86) | 26.60 | 0.02 | 0.0807 | -0.0668 | ||

| ATHENE GLOBAL FUNDING ATHENE GLOBAL FUNDING / DBT (US04685A3S83) | 25.38 | -0.32 | 0.0770 | -0.0642 | ||

| BACR / Barclays Bank PLC - Corporate Bond/Note | 24.28 | 0.09 | 0.0737 | -0.0608 | ||

| US06428CAD65 / Bank of America NA | 23.12 | -0.09 | 0.0702 | -0.0582 | ||

| US74460WAJ62 / VAR.RT. CORP. BONDS | 22.79 | -0.09 | 0.0692 | -0.0573 | ||

| ARI FLEET LEASE TRUST ARIFL 2025 B A1 144A / ABS-O (US00193GAA94) | 21.92 | 0.0665 | 0.0665 | |||

| ARI FLEET LEASE TRUST ARIFL 2025 B A1 144A / ABS-O (US00193GAA94) | 21.92 | 0.0665 | 0.0665 | |||

| ARI FLEET LEASE TRUST ARIFL 2025 B A1 144A / ABS-O (US00193GAA94) | 21.92 | 0.0665 | 0.0665 | |||

| ARI FLEET LEASE TRUST ARIFL 2025 B A1 144A / ABS-O (US00193GAA94) | 21.92 | 0.0665 | 0.0665 | |||

| US78016EZP59 / Royal Bank of Canada | 21.80 | -0.04 | 0.0662 | -0.0548 | ||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 20.71 | 164.72 | 0.0629 | 0.0195 | ||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 20.71 | 164.72 | 0.0629 | 0.0195 | ||

| US21688AAX00 / COOPERATIEVE RABOBANK UA/NY | 20.61 | -0.14 | 0.0626 | -0.0519 | ||

| US55336VBR06 / MPLX LP | 20.22 | 0.70 | 0.0614 | -0.0500 | ||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 20.10 | 0.0610 | 0.0610 | |||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 20.10 | 0.0610 | 0.0610 | |||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 20.10 | 0.0610 | 0.0610 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 20.09 | 0.0610 | 0.0610 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 20.09 | 0.0610 | 0.0610 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 20.09 | 0.0610 | 0.0610 | |||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 19.88 | 28.43 | 0.0603 | -0.0255 | ||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 19.88 | 28.43 | 0.0603 | -0.0255 | ||

| US639057AG33 / NatWest Group PLC | 19.78 | 83.53 | 0.0600 | 0.0003 | ||

| US694308HP52 / PACIFIC GAS + ELECTRIC SR UNSECURED 03/26 2.95 | 18.21 | 138.91 | 0.0553 | 0.0130 | ||

| US04517PBE16 / Asian Development Bank | 17.54 | -0.18 | 0.0532 | -0.0442 | ||

| US02209SBC61 / Altria Group, Inc. | 15.68 | 0.03 | 0.0476 | -0.0393 | ||

| SUMITOMO MITSUI BKG CORP 12/25 VAR / DBT (US86565GLG37) | 15.40 | 0.02 | 0.0467 | -0.0387 | ||

| US80281LAS43 / SANTANDER UK GROUP HOLDINGS PLC | 15.37 | 0.0466 | 0.0466 | |||

| KFW GOVT GUARANT REGS 10/26 VAR / DBT (XS2710913380) | 15.16 | 0.0460 | 0.0460 | |||

| KFW GOVT GUARANT REGS 10/26 VAR / DBT (XS2710913380) | 15.16 | 0.0460 | 0.0460 | |||

| KFW GOVT GUARANT REGS 10/26 VAR / DBT (XS2710913380) | 15.16 | 0.0460 | 0.0460 | |||

| KFW GOVT GUARANT REGS 10/26 VAR / DBT (XS2710913380) | 15.16 | 0.0460 | 0.0460 | |||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 14.68 | 0.0446 | 0.0446 | |||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 14.68 | 0.0446 | 0.0446 | |||

| US38145GAM24 / Goldman Sachs Group Inc/The | 14.13 | 0.0429 | 0.0429 | |||

| US37940XAE22 / Global Payments Inc | 13.38 | 0.83 | 0.0406 | -0.0330 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 11/25 VAR / DBT (AU3FN0073045) | 13.33 | 5.19 | 0.0405 | -0.0298 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 11/25 VAR / DBT (AU3FN0073045) | 13.33 | 5.19 | 0.0405 | -0.0298 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 11/25 VAR / DBT (AU3FN0073045) | 13.33 | 5.19 | 0.0405 | -0.0298 | ||

| SUMITOMO MITSUI SYD CERT OF DEPO 11/25 VAR / DBT (AU3FN0073045) | 13.33 | 5.19 | 0.0405 | -0.0298 | ||

| GPJA / Georgia Power Company - Preferred Security | 13.06 | -0.17 | 0.0396 | -0.0329 | ||

| GPJA / Georgia Power Company - Preferred Security | 13.06 | -0.17 | 0.0396 | -0.0329 | ||

| US962166CC62 / WEYERHAEUSER COMPANY | 13.05 | 41.61 | 0.0396 | -0.0115 | ||

| NEW YORK LIFE GLOBAL FDG SECURED 144A 01/26 VAR / DBT (US64953BBK35) | 13.03 | -0.07 | 0.0395 | -0.0328 | ||

| MUFG BANK LTD SYDNEY CERT OF DEPO 02/26 VAR / DBT (AU3FN0075198) | 13.01 | 5.29 | 0.0395 | -0.0290 | ||

| MUFG BANK LTD SYDNEY CERT OF DEPO 02/26 VAR / DBT (AU3FN0075198) | 13.01 | 5.29 | 0.0395 | -0.0290 | ||

| MUFG BANK LTD SYDNEY CERT OF DEPO 02/26 VAR / DBT (AU3FN0075198) | 13.01 | 5.29 | 0.0395 | -0.0290 | ||

| MUFG BANK LTD SYDNEY CERT OF DEPO 02/26 VAR / DBT (AU3FN0075198) | 13.01 | 5.29 | 0.0395 | -0.0290 | ||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 2 A1 144A / ABS-O (US29375TAA07) | 12.95 | 0.0393 | 0.0393 | |||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 2 A1 144A / ABS-O (US29375TAA07) | 12.95 | 0.0393 | 0.0393 | |||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 2 A1 144A / ABS-O (US29375TAA07) | 12.95 | 0.0393 | 0.0393 | |||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 2 A1 144A / ABS-O (US29375TAA07) | 12.95 | 0.0393 | 0.0393 | |||

| US06368LWT96 / Bank of Montreal | 12.71 | -0.36 | 0.0386 | -0.0322 | ||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PP64) | 12.61 | 0.0383 | 0.0383 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PP64) | 12.61 | 0.0383 | 0.0383 | |||

| AU3FN0058608 / UBS AG AUSTRALIA SR UNSECURED REGS 02/26 VAR | 12.58 | 5.38 | 0.0382 | -0.0280 | ||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PN17) | 12.42 | 0.0377 | 0.0377 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PN17) | 12.42 | 0.0377 | 0.0377 | |||

| US89114TZD70 / Toronto-Dominion Bank/The | 10.48 | 0.0318 | 0.0318 | |||

| US65339KBS87 / NextEra Energy Capital Holdings Inc | 10.39 | -0.27 | 0.0315 | -0.0262 | ||

| AU3FN0055299 / UBS AG AUSTRALIA | 10.21 | 5.23 | 0.0310 | -0.0228 | ||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 10.13 | 65.70 | 0.0307 | -0.0032 | ||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 10.13 | 65.70 | 0.0307 | -0.0032 | ||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 10.13 | 65.70 | 0.0307 | -0.0032 | ||

| US24422EWU99 / DEERE JOHN CAPITAL CORP FRN SOFR+57 03/03/2026 | 9.75 | -0.15 | 0.0296 | -0.0246 | ||

| US345397XL24 / FORD MOTOR CREDIT CO LLC | 9.59 | 0.47 | 0.0291 | -0.0238 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 9.49 | 166.31 | 0.0288 | 0.0090 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 9.49 | 166.31 | 0.0288 | 0.0090 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 9.49 | 166.31 | 0.0288 | 0.0090 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 9.49 | 166.31 | 0.0288 | 0.0090 | ||

| US87264ABR59 / T-MOBILE USA INC 2.25% 02/15/2026 | 8.52 | 0.0259 | 0.0259 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 8.48 | 0.0257 | 0.0257 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 8.48 | 0.0257 | 0.0257 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 8.48 | 0.0257 | 0.0257 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 8.48 | 0.0257 | 0.0257 | |||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 8.44 | 5.16 | 0.0256 | -0.0189 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 8.44 | 5.16 | 0.0256 | -0.0189 | ||

| AU3CB0273407 / UBS AG/Australia | 8.43 | 6.25 | 0.0256 | -0.0184 | ||

| US38145GAN07 / Goldman Sachs Group Inc/The | 8.16 | 0.0248 | 0.0248 | |||

| US25160PAJ66 / Deutsche Bank AG/New York NY | 7.80 | -0.28 | 0.0237 | -0.0197 | ||

| US29273RBG39 / Energy Transfer Partners LP | 7.77 | 0.03 | 0.0236 | -0.0195 | ||

| US63906EB929 / NatWest Markets PLC | 7.74 | 5.25 | 0.0235 | -0.0173 | ||

| US63906EB929 / NatWest Markets PLC | 7.74 | 5.25 | 0.0235 | -0.0173 | ||

| WELLS FARGO BANK NA WELLS FARGO BANK NA / DBT (US94988J6J16) | 7.29 | 48.22 | 0.0221 | -0.0051 | ||

| WELLS FARGO BANK NA WELLS FARGO BANK NA / DBT (US94988J6J16) | 7.29 | 48.22 | 0.0221 | -0.0051 | ||

| WELLS FARGO BANK NA WELLS FARGO BANK NA / DBT (US94988J6J16) | 7.29 | 48.22 | 0.0221 | -0.0051 | ||

| WELLS FARGO BANK NA WELLS FARGO BANK NA / DBT (US94988J6J16) | 7.29 | 48.22 | 0.0221 | -0.0051 | ||

| US87264ABU88 / T-Mobile USA Inc | 7.15 | 102.38 | 0.0217 | 0.0021 | ||

| US172967NX53 / Citigroup, Inc. | 7.09 | -0.25 | 0.0215 | -0.0179 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 6.90 | 14.93 | 0.0210 | -0.0124 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 6.88 | 0.0209 | 0.0209 | |||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 6.88 | 0.0209 | 0.0209 | |||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 6.88 | 0.0209 | 0.0209 | |||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 6.88 | 0.0209 | 0.0209 | |||

| CITIBANK NA CITIBANK NA / DBT (US17325FBE79) | 6.83 | 6.38 | 0.0207 | -0.0149 | ||

| CITIBANK NA CITIBANK NA / DBT (US17325FBE79) | 6.83 | 6.38 | 0.0207 | -0.0149 | ||

| US6935A2K126 / PPL ELECTRIC UTILITIES | 6.69 | 0.0203 | 0.0203 | |||

| US6935A2K126 / PPL ELECTRIC UTILITIES | 6.69 | 0.0203 | 0.0203 | |||

| US6935A2K126 / PPL ELECTRIC UTILITIES | 6.69 | 0.0203 | 0.0203 | |||

| MIZUHO BANK LTD/SYDNEY CERT OF DEPO 08/25 VAR / DBT (AU3FN0070918) | 6.65 | 5.19 | 0.0202 | -0.0149 | ||

| MIZUHO BANK LTD/SYDNEY CERT OF DEPO 08/25 VAR / DBT (AU3FN0070918) | 6.65 | 5.19 | 0.0202 | -0.0149 | ||

| US62954WAJ45 / NTT Finance Corp | 6.61 | 0.08 | 0.0201 | -0.0166 | ||

| TOYOTA LEASE OWNER TRUST TLOT 2025 A A1 144A / ABS-O (US89239NAA37) | 6.57 | -82.54 | 0.0199 | -0.1888 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 6.55 | 5.19 | 0.0199 | -0.0147 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 6.55 | 5.19 | 0.0199 | -0.0147 | ||

| AU3CB0276509 / NBN Co. Ltd. | 6.50 | 6.38 | 0.0197 | -0.0142 | ||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 6.46 | -0.20 | 0.0196 | -0.0163 | ||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 6.46 | -0.20 | 0.0196 | -0.0163 | ||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 6.46 | -0.20 | 0.0196 | -0.0163 | ||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 6.46 | -0.20 | 0.0196 | -0.0163 | ||

| US46647PBW59 / JPMorgan Chase & Co | 6.37 | 0.87 | 0.0193 | -0.0157 | ||

| US744573AP19 / Public Service Enterprise Group Inc | 6.35 | 0.97 | 0.0193 | -0.0156 | ||

| US961214FM04 / WESTPAC BANKING CORP FRN SOFR+ 11/17/2025 | 6.30 | -0.13 | 0.0191 | -0.0159 | ||

| US2027A0KE81 / COMMONWEALTH BANK OF AUSTRALIA | 6.22 | -0.03 | 0.0189 | -0.0156 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 6.02 | -0.15 | 0.0183 | -0.0152 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 6.02 | -0.15 | 0.0183 | -0.0152 | ||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 6.02 | -0.15 | 0.0183 | -0.0152 | ||

| US718172CY31 / Philip Morris International Inc | 5.81 | 0.0176 | 0.0176 | |||

| US06368LWV43 / Bank of Montreal | 5.79 | -0.21 | 0.0176 | -0.0146 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 5.69 | 0.0173 | 0.0173 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 5.69 | 0.0173 | 0.0173 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 5.69 | 0.0173 | 0.0173 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 5.69 | 0.0173 | 0.0173 | |||

| US24703TAD81 / CORP. NOTE | 5.65 | 0.0172 | 0.0172 | |||

| TRS P SOFRRATE+8/91282CME8 MYC / DCR (000000000) | 5.58 | 0.0169 | 0.0169 | |||

| US78016EZR16 / Royal Bank of Canada | 5.15 | -0.04 | 0.0156 | -0.0129 | ||

| US775109BE00 / Rogers Communications Inc | 5.12 | 0.43 | 0.0155 | -0.0127 | ||

| US874054AJ85 / Take-Two Interactive Software Inc | 5.11 | 27.23 | 0.0155 | -0.0068 | ||

| US928668BU57 / Volkswagen Group of America, Inc. | 5.01 | -0.28 | 0.0152 | -0.0127 | ||

| US06051GLA57 / Bank of America Corp. | 4.97 | -0.04 | 0.0151 | -0.0125 | ||

| US22822VAB71 / Crown Castle International Corp | 4.81 | 0.0146 | 0.0146 | |||

| US02665WES61 / American Honda Finance Corp. | 4.77 | -0.06 | 0.0145 | -0.0120 | ||

| US60871RAG56 / Molson Coors Brewing Co | 4.74 | 0.0144 | 0.0144 | |||

| US92939UAK25 / WEC Energy Group Inc | 4.35 | 0.0132 | 0.0132 | |||

| US17325FAZ18 / Citibank NA | 4.23 | 134.39 | 0.0128 | 0.0028 | ||

| US21684AAC09 / Cooperatieve Rabobank UA | 4.16 | 0.0126 | 0.0126 | |||

| US19767QAQ82 / Columbia/hca 7.58% Senior Notes 09/15/25 | 4.12 | -0.63 | 0.0125 | -0.0105 | ||

| US2027A0KG30 / Commonwealth Bank of Australia | 4.08 | -0.05 | 0.0124 | -0.0102 | ||

| CPPIB CAPITAL INC COMPANY GUAR 144A 07/26 VAR / DBT (US22411VBB36) | 4.01 | 0.05 | 0.0122 | -0.0101 | ||

| CPPIB CAPITAL INC COMPANY GUAR 144A 07/26 VAR / DBT (US22411VBB36) | 4.01 | 0.05 | 0.0122 | -0.0101 | ||

| CPPIB CAPITAL INC COMPANY GUAR 144A 07/26 VAR / DBT (US22411VBB36) | 4.01 | 0.05 | 0.0122 | -0.0101 | ||

| HCA INC DISC COML PAPER 4/A2 Y 07/25 ZCP / DBT (US40412BUP65) | 3.99 | 0.0121 | 0.0121 | |||

| HCA INC DISC COML PAPER 4/A2 Y 07/25 ZCP / DBT (US40412BUP65) | 3.99 | 0.0121 | 0.0121 | |||

| HCA INC DISC COML PAPER 4/A2 Y 07/25 ZCP / DBT (US40412BUP65) | 3.99 | 0.0121 | 0.0121 | |||

| HCA INC DISC COML PAPER 4/A2 Y 07/25 ZCP / DBT (US40412BUP65) | 3.99 | 0.0121 | 0.0121 | |||

| US573874AC88 / Marvell Technology Inc | 3.92 | 0.72 | 0.0119 | -0.0097 | ||

| LLOYDS BANK PLC SR UNSECURED REGS 08/25 4.25 / DBT (AU3CB0232346) | 3.83 | 5.45 | 0.0116 | -0.0085 | ||

| LLOYDS BANK PLC SR UNSECURED REGS 08/25 4.25 / DBT (AU3CB0232346) | 3.83 | 5.45 | 0.0116 | -0.0085 | ||

| LLOYDS BANK PLC SR UNSECURED REGS 08/25 4.25 / DBT (AU3CB0232346) | 3.83 | 5.45 | 0.0116 | -0.0085 | ||

| LLOYDS BANK PLC SR UNSECURED REGS 08/25 4.25 / DBT (AU3CB0232346) | 3.83 | 5.45 | 0.0116 | -0.0085 | ||

| US07274NAJ28 / Bayer US Finance II LLC | 3.79 | 0.16 | 0.0115 | -0.0095 | ||

| HSBC26D / HSBC Holdings PLC | 3.71 | 309.94 | 0.0113 | 0.0062 | ||

| US53944YAT01 / Lloyds Banking Group PLC | 3.50 | 0.00 | 0.0106 | -0.0088 | ||

| CNRCN / Canadian National Railway Co | 3.48 | 0.0106 | 0.0106 | |||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 3.38 | 0.0103 | 0.0103 | |||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 3.38 | 0.0103 | 0.0103 | |||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 3.38 | 0.0103 | 0.0103 | |||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 3.38 | 0.0103 | 0.0103 | |||

| US38141GXM13 / Goldman Sachs Group Inc/The | 3.27 | 0.0099 | 0.0099 | |||

| XS2408621238 / Kommunalbanken AS | 3.22 | -0.22 | 0.0098 | -0.0081 | ||

| US902674ZX12 / UBS AG | 3.19 | 7.71 | 0.0097 | -0.0067 | ||

| US025816CL12 / AMERICAN EXPRESS CO REGD V/R 0.70000300 | 3.11 | 0.0094 | 0.0094 | |||

| US225401AY40 / Credit Suisse Group AG | 3.10 | -0.32 | 0.0094 | -0.0078 | ||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 3.05 | 0.0093 | 0.0093 | |||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 3.05 | 0.0093 | 0.0093 | |||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 3.05 | 0.0093 | 0.0093 | |||

| ATHENE GLOBAL FUNDING SECURED 144A 07/26 VAR / DBT (US04685A4J75) | 3.05 | 0.0093 | 0.0093 | |||

| US404119BS74 / Hca Inc Bond | 3.00 | -0.30 | 0.0091 | -0.0076 | ||

| AU3FN0056446 / SHINHAN BANK SR UNSECURED REGS 09/25 VAR | 2.96 | 5.22 | 0.0090 | -0.0066 | ||

| XS1395052639 / Standard Chartered PLC | 2.84 | 0.04 | 0.0086 | -0.0071 | ||

| US62954WAC91 / NTT Finance Corp | 2.82 | 0.0086 | 0.0086 | |||

| US00138CAN83 / AIG GLOBAL FUNDING | 2.78 | 0.91 | 0.0084 | -0.0068 | ||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 2.62 | 0.89 | 0.0080 | -0.0065 | ||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 2.62 | 0.89 | 0.0080 | -0.0065 | ||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 2.62 | 0.89 | 0.0080 | -0.0065 | ||

| US21688AAW27 / Cooperatieve Rabobank UA | 2.50 | 0.0076 | 0.0076 | |||

| HARLEY DAVIDSON FND CP / DBT (US41282JUM16) | 2.49 | 0.0076 | 0.0076 | |||

| HARLEY DAVIDSON FND CP / DBT (US41282JUM16) | 2.49 | 0.0076 | 0.0076 | |||

| HARLEY DAVIDSON FND CP / DBT (US41282JUM16) | 2.49 | 0.0076 | 0.0076 | |||

| HARLEY DAVIDSON FND CP / DBT (US41282JUM16) | 2.49 | 0.0076 | 0.0076 | |||

| US23341CAC73 / DNB Bank ASA | 2.46 | -0.20 | 0.0075 | -0.0062 | ||

| VW CR INC / DBT (US91842JU988) | 2.40 | 0.0073 | 0.0073 | |||

| VW CR INC / DBT (US91842JU988) | 2.40 | 0.0073 | 0.0073 | |||

| VW CR INC / DBT (US91842JU988) | 2.40 | 0.0073 | 0.0073 | |||

| VW CR INC / DBT (US91842JU988) | 2.40 | 0.0073 | 0.0073 | |||

| US36143L2A26 / GA Global Funding Trust | 2.38 | 0.0072 | 0.0072 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | 2.17 | 0.0066 | 0.0066 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | 2.17 | 0.0066 | 0.0066 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | 2.17 | 0.0066 | 0.0066 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | 2.17 | 0.0066 | 0.0066 | |||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 2.12 | 0.0064 | 0.0064 | |||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 2.12 | 0.0064 | 0.0064 | |||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 2.12 | 0.0064 | 0.0064 | |||

| US25179MAV54 / Devon Energy Corp Bond | 2.11 | 0.0064 | 0.0064 | |||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 2.06 | 5.22 | 0.0062 | -0.0046 | ||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 2.06 | 5.22 | 0.0062 | -0.0046 | ||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 2.06 | 5.22 | 0.0062 | -0.0046 | ||

| US46115HBU05 / INTESA SANPAOLO SPA | 2.02 | -0.49 | 0.0061 | -0.0051 | ||

| US46849LUX71 / Jackson National Life Global Funding | 2.01 | 0.0061 | 0.0061 | |||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/26 VAR / DBT (US928668CD24) | 2.00 | 0.0061 | 0.0061 | |||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/26 VAR / DBT (US928668CD24) | 2.00 | 0.0061 | 0.0061 | |||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/26 VAR / DBT (US928668CD24) | 2.00 | 0.0061 | 0.0061 | |||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 03/26 VAR / DBT (US928668CD24) | 2.00 | 0.0061 | 0.0061 | |||

| ATHENE GLOBAL FUNDING SR SECURED 144A 05/26 5.62 / DBT (US04685A3V13) | 1.97 | 0.0060 | 0.0060 | |||

| ATHENE GLOBAL FUNDING SR SECURED 144A 05/26 5.62 / DBT (US04685A3V13) | 1.97 | 0.0060 | 0.0060 | |||

| US65535HAR03 / Nomura Holdings Inc | 1.97 | 0.67 | 0.0060 | -0.0049 | ||

| US03027XBB55 / American Tower Corp | 1.89 | 0.0057 | 0.0057 | |||

| US02665WEE75 / American Honda Finance Corp | 1.86 | 0.0056 | 0.0056 | |||

| US638602BP66 / Nationwide Building Society | 1.80 | 0.17 | 0.0055 | -0.0045 | ||

| US855244AK58 / Starbucks Corp | 1.77 | 0.0054 | 0.0054 | |||

| US125523CP36 / Cigna Corp | 1.75 | 0.0053 | 0.0053 | |||

| CA14913LAA85 / CATERP FIN S LTD | 1.75 | -0.06 | 0.0053 | -0.0044 | ||

| CA14913LAA85 / CATERP FIN S LTD | 1.75 | -0.06 | 0.0053 | -0.0044 | ||

| CA14913LAA85 / CATERP FIN S LTD | 1.75 | -0.06 | 0.0053 | -0.0044 | ||

| CA14913LAA85 / CATERP FIN S LTD | 1.75 | -0.06 | 0.0053 | -0.0044 | ||

| US05252ADG31 / Australia & New Zealand Banking Group Ltd | 1.70 | -0.12 | 0.0052 | -0.0043 | ||

| US38141GXN95 / Goldman Sachs Group Inc/The | 1.70 | 0.0052 | 0.0052 | |||

| US04685A2U49 / Athene Global Funding | 1.67 | 0.0051 | 0.0051 | |||

| US25466AAE10 / Discover Bank 2.0% 02/21/18 Bond | 1.65 | 0.0050 | 0.0050 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PG65) | 1.53 | 0.0046 | 0.0046 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PG65) | 1.53 | 0.0046 | 0.0046 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PG65) | 1.53 | 0.0046 | 0.0046 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PG65) | 1.53 | 0.0046 | 0.0046 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | 1.43 | 0.0043 | 0.0043 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | 1.43 | 0.0043 | 0.0043 | |||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 1 A1 144A / ABS-O (US29390HAA77) | 1.39 | -38.24 | 0.0042 | -0.0083 | ||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 1 A1 144A / ABS-O (US29390HAA77) | 1.39 | -38.24 | 0.0042 | -0.0083 | ||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 1 A1 144A / ABS-O (US29390HAA77) | 1.39 | -38.24 | 0.0042 | -0.0083 | ||

| ENTERPRISE FLEET FINANCING LLC EFF 2025 1 A1 144A / ABS-O (US29390HAA77) | 1.39 | -38.24 | 0.0042 | -0.0083 | ||

| US06051GJQ38 / Bank of America Corp | 1.32 | 0.0040 | 0.0040 | |||

| US902613AU26 / UBS Group AG | 1.31 | -0.23 | 0.0040 | -0.0033 | ||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 1.30 | 0.0039 | 0.0039 | |||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 1.30 | 0.0039 | 0.0039 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 1.30 | 0.0039 | 0.0039 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 1.30 | 0.0039 | 0.0039 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 1.30 | 0.0039 | 0.0039 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 1.30 | 0.0039 | 0.0039 | |||

| US02557TAD19 / American Electric Power Co Inc | 1.27 | -0.24 | 0.0039 | -0.0032 | ||

| ANZ / ANZ Group Holdings Limited | 1.24 | -0.08 | 0.0038 | -0.0031 | ||

| ANZ / ANZ Group Holdings Limited | 1.24 | -0.08 | 0.0038 | -0.0031 | ||

| ANZ / ANZ Group Holdings Limited | 1.24 | -0.08 | 0.0038 | -0.0031 | ||

| ANZ / ANZ Group Holdings Limited | 1.24 | -0.08 | 0.0038 | -0.0031 | ||

| US709599BL72 / Penske Truck Leasing Co Lp / PTL Finance Corp | 1.23 | 0.0037 | 0.0037 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797MG92) | 1.22 | 0.0037 | 0.0037 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797MG92) | 1.22 | 0.0037 | 0.0037 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797MG92) | 1.22 | 0.0037 | 0.0037 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797MG92) | 1.22 | 0.0037 | 0.0037 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 1.18 | 0.0036 | 0.0036 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 1.18 | 0.0036 | 0.0036 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PU59) | 1.10 | 0.0033 | 0.0033 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PU59) | 1.10 | 0.0033 | 0.0033 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PU59) | 1.10 | 0.0033 | 0.0033 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797PU59) | 1.10 | 0.0033 | 0.0033 | |||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 1.06 | 580.65 | 0.0032 | 0.0023 | ||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 1.06 | 580.65 | 0.0032 | 0.0023 | ||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 1.06 | 580.65 | 0.0032 | 0.0023 | ||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 1.06 | 580.65 | 0.0032 | 0.0023 | ||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 1.04 | 0.0031 | 0.0031 | |||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 1.04 | 0.0031 | 0.0031 | |||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 1.04 | 0.0031 | 0.0031 | |||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 1.04 | 0.0031 | 0.0031 | |||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 1.04 | -0.38 | 0.0031 | -0.0026 | ||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 1.04 | -0.38 | 0.0031 | -0.0026 | ||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 1.04 | -0.38 | 0.0031 | -0.0026 | ||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 1.04 | -0.38 | 0.0031 | -0.0026 | ||

| TREASURY BILL 09/25 0.00000 / DBT (US912797QU41) | 1.03 | 0.0031 | 0.0031 | |||

| TREASURY BILL 09/25 0.00000 / DBT (US912797QU41) | 1.03 | 0.0031 | 0.0031 | |||

| TREASURY BILL 09/25 0.00000 / DBT (US912797QU41) | 1.03 | 0.0031 | 0.0031 | |||

| US020002BH30 / Allstate Corp/The | 1.00 | 0.91 | 0.0030 | -0.0025 | ||

| US0641593V62 / Bank of Nova Scotia/The | 1.00 | 0.00 | 0.0030 | -0.0025 | ||

| US313385HP48 / Federal Home Loan Bank Discount Notes | 0.90 | 0.0027 | 0.0027 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0.90 | 0.0027 | 0.0027 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0.90 | 0.0027 | 0.0027 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0.90 | 0.0027 | 0.0027 | |||

| US05565ECD58 / BMW US Capital LLC | 0.89 | -0.11 | 0.0027 | -0.0022 | ||

| US75513ECQ26 / Raytheon Technologies Corp | 0.85 | 0.0026 | 0.0026 | |||

| CA14913LAA85 / CATERP FIN S LTD | 0.83 | -0.12 | 0.0025 | -0.0021 | ||

| CA14913LAA85 / CATERP FIN S LTD | 0.83 | -0.12 | 0.0025 | -0.0021 | ||

| CA14913LAA85 / CATERP FIN S LTD | 0.83 | -0.12 | 0.0025 | -0.0021 | ||

| CA14913LAA85 / CATERP FIN S LTD | 0.83 | -0.12 | 0.0025 | -0.0021 | ||

| NAB / National Australia Bank Limited | 0.80 | 0.0024 | 0.0024 | |||

| NAB / National Australia Bank Limited | 0.80 | 0.0024 | 0.0024 | |||

| US13607HVE97 / Canadian Imperial Bank of Commerce | 0.78 | 0.0024 | 0.0024 | |||

| LAD AUTO RECEIVABLES TRUST LADAR 2025 1A A1 144A / ABS-O (US505712AA70) | 0.76 | -89.89 | 0.0023 | -0.0392 | ||

| LAD AUTO RECEIVABLES TRUST LADAR 2025 1A A1 144A / ABS-O (US505712AA70) | 0.76 | -89.89 | 0.0023 | -0.0392 | ||

| LAD AUTO RECEIVABLES TRUST LADAR 2025 1A A1 144A / ABS-O (US505712AA70) | 0.76 | -89.89 | 0.0023 | -0.0392 | ||

| US03027XAJ90 / American Tower Co Bond | 0.72 | 0.0022 | 0.0022 | |||

| US6944PL2G38 / PACIFIC LIFE GF II REGD V/R 144A P/P 0.00000000 | 0.70 | 0.00 | 0.0021 | -0.0018 | ||

| US404119BT57 / HCA Inc | 0.70 | 0.0021 | 0.0021 | |||

| US20600GU123 / Conagra Foods, Inc. | 0.70 | 0.0021 | 0.0021 | |||

| US928668AT93 / VOLKSWAGEN GROUP AMERICA COMPANY GUAR 144A 11/25 4.625 | 0.70 | 0.14 | 0.0021 | -0.0018 | ||

| US26441CBJ36 / Duke Energy Corp. | 0.67 | 0.90 | 0.0020 | -0.0017 | ||

| BMW US CAPITAL LLC BMW US CAPITAL LLC / DBT (US05565ECN31) | 0.66 | 0.31 | 0.0020 | -0.0016 | ||

| BMW US CAPITAL LLC BMW US CAPITAL LLC / DBT (US05565ECN31) | 0.66 | 0.31 | 0.0020 | -0.0016 | ||

| BMW US CAPITAL LLC BMW US CAPITAL LLC / DBT (US05565ECN31) | 0.66 | 0.31 | 0.0020 | -0.0016 | ||

| BMW US CAPITAL LLC BMW US CAPITAL LLC / DBT (US05565ECN31) | 0.66 | 0.31 | 0.0020 | -0.0016 | ||

| US928668BL58 / VOLKSWAGEN GROUP AMER FIN LLC 1.25% 11/24/2025 144A | 0.63 | 0.96 | 0.0019 | -0.0016 | ||

| US25746UCE73 / Dominion Energy Inc | 0.63 | 0.0019 | 0.0019 | |||

| US05523UAP57 / BAE Systems Holdings, Inc. | 0.60 | 0.0018 | 0.0018 | |||

| US842400GN73 / Southern California Edison Co | 0.60 | 0.34 | 0.0018 | -0.0015 | ||

| US205887CB65 / Conagra Brands Inc | 0.58 | 0.00 | 0.0017 | -0.0014 | ||

| US406216BG59 / Halliburton Co Bond | 0.54 | 0.00 | 0.0016 | -0.0014 | ||

| US17325FBD96 / Citibank NA | 0.50 | 0.0015 | 0.0015 | |||

| US06428CAB00 / Bank of America NA | 0.50 | 0.0015 | 0.0015 | |||

| US713448FP87 / PepsiCo, Inc. | 0.50 | 0.00 | 0.0015 | -0.0013 | ||

| US3130AK6H44 / Federal Home Loan Banks | 0.50 | 0.0015 | 0.0015 | |||

| US3130AK6H44 / Federal Home Loan Banks | 0.50 | 0.0015 | 0.0015 | |||

| NAB / National Australia Bank Limited | 0.46 | 0.0014 | 0.0014 | |||

| NAB / National Australia Bank Limited | 0.46 | 0.0014 | 0.0014 | |||

| US89236TLA15 / TOYOTA MOTOR CREDIT CORP | 0.40 | 0.0012 | 0.0012 | |||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0.35 | 0.00 | 0.0011 | -0.0009 | ||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0.35 | 0.00 | 0.0011 | -0.0009 | ||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0.35 | 0.00 | 0.0011 | -0.0009 | ||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0.35 | 0.00 | 0.0011 | -0.0009 | ||

| US94988J6C62 / Wells Fargo Bank NA | 0.25 | 0.00 | 0.0008 | -0.0006 | ||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR REGS 11/25 1.25 / DBT (USU9273ADE20) | 0.25 | 0.82 | 0.0007 | -0.0006 | ||

| VOLKSWAGEN GROUP AMERICA COMPANY GUAR REGS 11/25 1.25 / DBT (USU9273ADE20) | 0.25 | 0.82 | 0.0007 | -0.0006 | ||

| US44891ACS42 / Hyundai Capital America | 0.20 | 0.0006 | 0.0006 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0.18 | 0.0005 | 0.0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0.18 | 0.0005 | 0.0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0.18 | 0.0005 | 0.0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0.16 | 0.0005 | 0.0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0.16 | 0.0005 | 0.0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0.16 | 0.0005 | 0.0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0.16 | 0.0005 | 0.0005 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0.16 | 0.0005 | 0.0005 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.13 | 0.0004 | 0.0004 | |||

| US46625HQW33 / JPMorgan Chase & Co. | 0.11 | 0.93 | 0.0003 | -0.0003 | ||

| US595017BA15 / CORP. NOTE | 0.10 | 0.00 | 0.0003 | -0.0003 | ||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0.05 | 0.0002 | 0.0002 | |||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0.05 | 0.0002 | 0.0002 | |||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0.05 | 0.0002 | 0.0002 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.05 | 0.0001 | 0.0001 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0001 | 0.0001 | |||

| BOUGHT DKK SOLD USD 20250804 / DFE (000000000) | 0.02 | 0.0001 | 0.0001 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.02 | 0.0001 | 0.0001 | |||

| BOUGHT CAD SOLD USD 20250805 / DFE (000000000) | 0.02 | 0.0001 | 0.0001 | |||

| BOUGHT CAD SOLD USD 20250805 / DFE (000000000) | 0.02 | 0.0001 | 0.0001 | |||

| BOUGHT CAD SOLD USD 20250805 / DFE (000000000) | 0.02 | 0.0001 | 0.0001 | |||

| BOUGHT DKK SOLD USD 20250804 / DFE (000000000) | 0.02 | 0.0001 | 0.0001 | |||

| BOUGHT DKK SOLD USD 20250804 / DFE (000000000) | 0.02 | 0.0001 | 0.0001 | |||

| BOUGHT DKK SOLD USD 20250804 / DFE (000000000) | 0.02 | 0.0001 | 0.0001 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0001 | 0.0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0001 | 0.0001 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0000 | 0.0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0000 | -0.0000 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0000 | -0.0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | -0.01 | -0.0000 | -0.0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | -0.01 | -0.0000 | -0.0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | -0.01 | -0.0000 | -0.0000 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | -0.01 | -0.0000 | -0.0000 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.01 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.02 | -0.0001 | -0.0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.02 | -0.0001 | -0.0001 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0.02 | -0.0001 | -0.0001 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0.02 | -0.0001 | -0.0001 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0.02 | -0.0001 | -0.0001 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0.02 | -0.0001 | -0.0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.03 | -0.0001 | -0.0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.03 | -0.0001 | -0.0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.04 | -0.0001 | -0.0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.04 | -0.0001 | -0.0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.04 | -0.0001 | -0.0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.04 | -0.0001 | -0.0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.04 | -0.0001 | -0.0001 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.05 | -0.0001 | -0.0001 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.05 | -0.0001 | -0.0001 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.05 | -0.0001 | -0.0001 | |||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0.05 | -0.0001 | -0.0001 | |||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0.06 | -0.0002 | -0.0002 | |||

| SOLD CAD BOUGHT USD 20250711 / DFE (000000000) | -0.07 | -0.0002 | -0.0002 | |||

| SOLD CAD BOUGHT USD 20250711 / DFE (000000000) | -0.07 | -0.0002 | -0.0002 | |||

| SOLD CAD BOUGHT USD 20250711 / DFE (000000000) | -0.07 | -0.0002 | -0.0002 | |||

| SOLD CAD BOUGHT USD 20250711 / DFE (000000000) | -0.07 | -0.0002 | -0.0002 | |||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | -0.13 | -0.0004 | -0.0004 | |||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | -0.13 | -0.0004 | -0.0004 | |||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | -0.13 | -0.0004 | -0.0004 | |||

| TRS P SOFRRATE+9/91282CMP3 MYC / DCR (000000000) | -0.13 | -0.0004 | -0.0004 | |||

| TRS P SOFRRATE+9/91282CMP3 MYC / DCR (000000000) | -0.13 | -0.0004 | -0.0004 | |||

| TRS P SOFRRATE+9/91282CMP3 MYC / DCR (000000000) | -0.13 | -0.0004 | -0.0004 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | -0.14 | -0.0004 | -0.0004 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | -0.14 | -0.0004 | -0.0004 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | -0.14 | -0.0004 | -0.0004 | |||

| TRS P SOFRRATE+8/9128286S4 MYC / DCR (000000000) | -0.16 | -0.0005 | -0.0005 | |||

| TRS P SOFRRATE+8/9128286S4 MYC / DCR (000000000) | -0.16 | -0.0005 | -0.0005 | |||

| TRS P SOFRRATE+8/91282CCF6 MYC / DCR (000000000) | -0.19 | -0.0006 | -0.0006 | |||

| TRS P SOFRRATE+8/91282CCF6 MYC / DCR (000000000) | -0.19 | -0.0006 | -0.0006 | |||

| TRS P SOFRRATE+8/91282CHM6 MYC / DCR (000000000) | -0.20 | -0.0006 | -0.0006 | |||

| TRS P SOFRRATE+8/91282CLY5 MYC / DCR (000000000) | -0.22 | -0.0007 | -0.0007 | |||

| TRS P SOFRRATE+8/91282CLY5 MYC / DCR (000000000) | -0.22 | -0.0007 | -0.0007 | |||

| TRS P SOFRRATE+8/91282CLY5 MYC / DCR (000000000) | -0.22 | -0.0007 | -0.0007 | |||

| TRS P SOFRRATE+8/91282CLY5 MYC / DCR (000000000) | -0.22 | -0.0007 | -0.0007 | |||

| TRS P SOFRRATE+9/91282CLY5 MYC / DCR (000000000) | -0.22 | -0.0007 | -0.0007 | |||

| TRS P SOFRRATE+9/91282CLY5 MYC / DCR (000000000) | -0.22 | -0.0007 | -0.0007 | |||

| TRS P SOFRRATE+9/91282CLY5 MYC / DCR (000000000) | -0.22 | -0.0007 | -0.0007 | |||

| TRS P SOFRRATE+9/91282CLY5 MYC / DCR (000000000) | -0.22 | -0.0007 | -0.0007 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | -0.27 | -0.0008 | -0.0008 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | -0.27 | -0.0008 | -0.0008 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | -0.27 | -0.0008 | -0.0008 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | -0.27 | -0.0008 | -0.0008 | |||

| TRS P SOFRRATE+9/91282CMH1 MYC / DCR (000000000) | -0.27 | -0.0008 | -0.0008 | |||

| TRS P SOFRRATE+8/91282CLB5 MYC / DCR (000000000) | -0.31 | -0.0009 | -0.0009 | |||

| TRS P SOFRRATE+8/91282CLH2 MYC / DCR (000000000) | -0.35 | -0.0011 | -0.0011 | |||

| TRS P SOFRRATE+8/91282CLP4 MYC / DCR (000000000) | -0.39 | -0.0012 | -0.0012 | |||

| TRS P SOFRRATE+8/91282CLP4 MYC / DCR (000000000) | -0.39 | -0.0012 | -0.0012 | |||

| TRS P SOFRRATE+8/91282CLP4 MYC / DCR (000000000) | -0.39 | -0.0012 | -0.0012 | |||

| TRS P SOFRRATE+8/91282CLP4 MYC / DCR (000000000) | -0.39 | -0.0012 | -0.0012 | |||

| TRS P SOFRRATE+9/91282CCZ2 MYC / DCR (000000000) | -0.64 | -0.0019 | -0.0019 | |||

| TRS P SOFRRATE+9/91282CCW9 MYC / DCR (000000000) | -0.88 | -0.0027 | -0.0027 | |||

| TRS P SOFRRATE+9/91282CCW9 MYC / DCR (000000000) | -0.88 | -0.0027 | -0.0027 | |||

| TRS P SOFRRATE+9/91282CCW9 MYC / DCR (000000000) | -0.88 | -0.0027 | -0.0027 | |||

| TRS P SOFRRATE+9/91282CCW9 MYC / DCR (000000000) | -0.88 | -0.0027 | -0.0027 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | -1.01 | -0.0031 | -0.0031 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | -1.01 | -0.0031 | -0.0031 | |||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | -1.18 | -0.0036 | -0.0036 | |||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | -1.18 | -0.0036 | -0.0036 | |||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | -1.18 | -0.0036 | -0.0036 | |||

| SOLD AUD BOUGHT USD 20250805 / DFE (000000000) | -1.18 | -0.0036 | -0.0036 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | -1.73 | -0.0053 | -0.0053 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | -1.73 | -0.0053 | -0.0053 | |||

| SOLD CAD BOUGHT USD 20250708 / DFE (000000000) | -2.13 | -0.0065 | -0.0065 | |||

| SOLD CAD BOUGHT USD 20250707 / DFE (000000000) | -2.16 | -0.0065 | -0.0065 | |||

| SOLD CAD BOUGHT USD 20250707 / DFE (000000000) | -2.16 | -0.0065 | -0.0065 | |||

| SOLD CAD BOUGHT USD 20250708 / DFE (000000000) | -2.38 | -0.0072 | -0.0072 | |||

| SOLD CAD BOUGHT USD 20250708 / DFE (000000000) | -2.38 | -0.0072 | -0.0072 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | -3.58 | -0.0109 | -0.0109 | |||

| SOLD CAD BOUGHT USD 20250703 / DFE (000000000) | -3.58 | -0.0109 | -0.0109 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -3.83 | -0.0116 | -0.0116 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -3.83 | -0.0116 | -0.0116 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -3.83 | -0.0116 | -0.0116 |