Statistik Asas

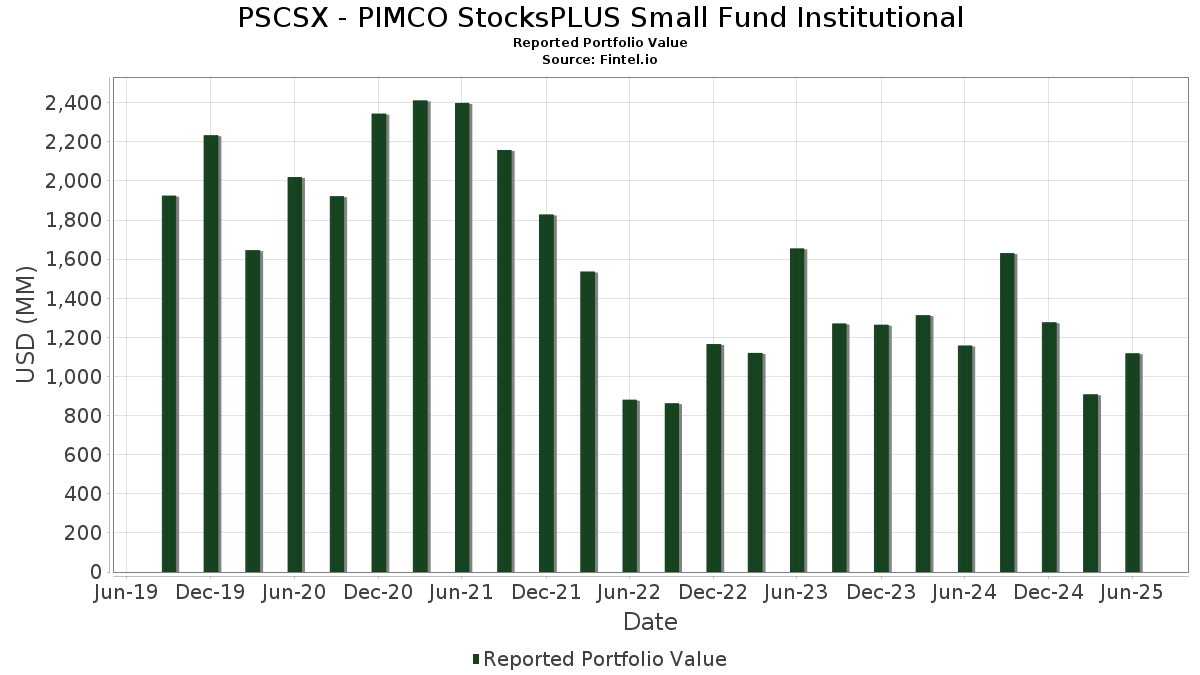

| Nilai Portfolio | $ 1,117,871,489 |

| Kedudukan Semasa | 1,072 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

PSCSX - PIMCO StocksPLUS Small Fund Institutional telah mendedahkan 1,072 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,117,871,489 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas PSCSX - PIMCO StocksPLUS Small Fund Institutional ialah Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , UMBS TBA (US:US01F0406854) , and Uniform Mortgage-Backed Security, TBA (US:US01F0526800) . Kedudukan baharu PSCSX - PIMCO StocksPLUS Small Fund Institutional termasuk Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , UMBS TBA (US:US01F0406854) , and Uniform Mortgage-Backed Security, TBA (US:US01F0526800) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 107.17 | 17.6768 | 13.5991 | ||

| 78.06 | 12.8748 | 10.9426 | ||

| 45.00 | 7.4221 | 7.4221 | ||

| 45.00 | 7.4221 | 7.4221 | ||

| 39.39 | 6.4973 | 6.4973 | ||

| 39.39 | 6.4973 | 6.4973 | ||

| 70.25 | 11.5865 | 6.2036 | ||

| 26.03 | 4.2938 | 4.7977 | ||

| 17.22 | 2.8406 | 2.8406 | ||

| 18.72 | 3.0883 | 2.5245 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -35.83 | -5.9091 | -9.4605 | ||

| -24.82 | -4.0935 | -4.0935 | ||

| 6.54 | 1.0783 | -3.4281 | ||

| 1.91 | 0.3154 | -2.5267 | ||

| 5.82 | 0.9605 | -2.0764 | ||

| 5.82 | 0.9605 | -2.0764 | ||

| 6.47 | 1.0672 | -0.4329 | ||

| -2.74 | -0.4525 | -0.2874 | ||

| -1.73 | -0.2848 | -0.2848 | ||

| -1.73 | -0.2848 | -0.2848 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-29 untuk tempoh pelaporan 2025-06-30. Pelabur ini tidak mendedahkan sekuriti yang dikira dalam saham, jadi lajur berkaitan saham dalam jadual di bawah tidak dimasukkan. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 107.17 | 181.70 | 17.6768 | 13.5991 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 78.06 | 600.52 | 12.8748 | 10.9426 | ||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 70.25 | 39.87 | 11.5865 | 6.2036 | ||

| REPO BANK AMERICA REPO / RA (000000000) | 45.00 | 7.4221 | 7.4221 | |||

| REPO BANK AMERICA REPO / RA (000000000) | 45.00 | 7.4221 | 7.4221 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797NX17) | 39.39 | 6.4973 | 6.4973 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797NX17) | 39.39 | 6.4973 | 6.4973 | |||

| US01F0406854 / UMBS TBA | 26.03 | -423.11 | 4.2938 | 4.7977 | ||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 21.33 | -35.82 | 3.5182 | -0.0439 | ||

| EW / Edwards Lifesciences Corporation | 19.18 | 193.38 | 3.1632 | 2.0849 | ||

| US21H0506806 / GNMA | 18.72 | 255.97 | 3.0883 | 2.5245 | ||

| US01F0306781 / UMBS TBA | 17.22 | 2.8406 | 2.8406 | |||

| US715638BY77 / REPUBLIC OF PERU SR UNSECURED 144A 08/32 6.15 | 14.45 | 6.77 | 2.3840 | 0.0367 | ||

| US01F0506844 / UMBS TBA | 13.95 | 2.3006 | 2.3006 | |||

| US21H0406734 / Ginnie Mae | 10.85 | 1.7899 | 1.7899 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PP64) | 9.58 | 1.5798 | 1.5798 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PP64) | 9.58 | 1.5798 | 1.5798 | |||

| XS2405128823 / Sculptor European CLO V DAC | 8.16 | -4.77 | 1.3455 | -0.1399 | ||

| CITIGROUP REPO REPO 5807 / RA (000000000) | 7.90 | 1.3030 | 1.3030 | |||

| CITIGROUP REPO REPO 5807 / RA (000000000) | 7.90 | 1.3030 | 1.3030 | |||

| RFRF USD SF+26.161/1.0* 9/15/23-7Y* CME / DIR (EZCYB7578GQ7) | 6.97 | -11.83 | 1.1492 | -0.2212 | ||

| RFRF USD SF+26.161/1.0* 9/15/23-7Y* CME / DIR (EZCYB7578GQ7) | 6.97 | -11.83 | 1.1492 | -0.2212 | ||

| XS2326512618 / HARVEST CLO HARVT 21A A1R 144A | 6.93 | 1.57 | 1.1423 | -0.0400 | ||

| RFR USD SOFR/1.75000 06/15/22-30Y CME / DIR (EZ2TNCR649W7) | 6.87 | -2.23 | 1.1338 | -0.0854 | ||

| RFR USD SOFR/1.75000 06/15/22-30Y CME / DIR (EZ2TNCR649W7) | 6.87 | -2.23 | 1.1338 | -0.0854 | ||

| EW / Edwards Lifesciences Corporation | 6.54 | -84.45 | 1.0783 | -3.4281 | ||

| RFR USD SOFR/1.75000 06/15/22-10Y CME / DIR (EZQ6DKJXZ1C9) | 6.47 | -25.21 | 1.0672 | -0.4329 | ||

| US21H0426799 / Ginnie Mae | 6.16 | 1.0153 | 1.0153 | |||

| US55284JAC36 / MF1 2022-FL8 Ltd | 6.09 | -0.59 | 1.0042 | -0.0578 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 5.82 | -66.75 | 0.9605 | -2.0764 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 5.82 | -66.75 | 0.9605 | -2.0764 | ||

| US70069FEM59 / PARK PLACE SECURITIES INC PPSI 2004 WHQ2 M5 | 5.75 | 0.33 | 0.9477 | -0.0454 | ||

| RU20INTR TRS EQUITY SOFR+60 BULLET MBC / DE (000000000) | 5.28 | 0.8704 | 0.8704 | |||

| RU20INTR TRS EQUITY SOFR+60 BULLET MBC / DE (000000000) | 5.28 | 0.8704 | 0.8704 | |||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 5.26 | 0.8669 | 0.8669 | |||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 5.26 | 0.8669 | 0.8669 | |||

| US61753KAA43 / MORGAN STANLEY CAPITAL INC MSAC 2007 HE5 A1 | 5.18 | 0.12 | 0.8548 | -0.0428 | ||

| US17330VAA44 / CMLTI_22-A | 5.00 | -2.21 | 0.8253 | -0.0618 | ||

| US87229WAS08 / TCI SYMPHONY CLO TSYMP 2016 1A BR2 144A | 4.93 | 0.47 | 0.8132 | -0.0378 | ||

| US43710XAE85 / HOME EQUITY LOAN TRUST HELT 2007 FRE1 2AV4 | 4.68 | 0.30 | 0.7717 | -0.0370 | ||

| US04965JAC71 / Atrium Hotel Portfolio Trust 2017-ATRM | 4.45 | -1.00 | 0.7347 | -0.0455 | ||

| XS2310127027 / CORDATUS CLO PLC CORDA 11A AR 144A | 4.44 | -7.00 | 0.7323 | -0.0955 | ||

| FNMA POOL BM7579 FN 10/29 VARIABLE / ABS-MBS (US3140JCM503) | 4.42 | 1.01 | 0.7287 | -0.0298 | ||

| FNMA POOL BM7579 FN 10/29 VARIABLE / ABS-MBS (US3140JCM503) | 4.42 | 1.01 | 0.7287 | -0.0298 | ||

| HERTZ VEHICLE FINANCING LLC HERTZ 2024 1A A 144A / ABS-O (US42806MCK36) | 4.27 | 0.21 | 0.7042 | -0.0346 | ||

| HERTZ VEHICLE FINANCING LLC HERTZ 2024 1A A 144A / ABS-O (US42806MCK36) | 4.27 | 0.21 | 0.7042 | -0.0346 | ||

| XS2310758011 / HARVEST CLO HARVT 20A AR 144A | 4.22 | -0.96 | 0.6958 | -0.0428 | ||

| US48251JAN37 / KKR FINANCIAL CLO LTD KKR 18 BR 144A | 4.21 | 0.14 | 0.6949 | -0.0346 | ||

| XS2683120211 / Avon Finance No.4 PLC | 4.16 | 0.92 | 0.6861 | -0.0285 | ||

| XS2373706519 / Carlyle Euro CLO 2019-2 DAC | 4.06 | 8.40 | 0.6704 | 0.0203 | ||

| TREASURY BILL 08/25 0.00000 / DBT (US912797MG92) | 3.89 | 0.6413 | 0.6413 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797MG92) | 3.89 | 0.6413 | 0.6413 | |||

| US83206NAC11 / SMB PRIVATE EDUCATION LOAN TRU SMB 2022 B B 144A | 3.82 | -3.90 | 0.6298 | -0.0592 | ||

| USP78024AG45 / Peruvian Government International Bond | 3.71 | 7.59 | 0.6126 | 0.0140 | ||

| ZAG000125980 / Republic of South Africa Government Bond | 3.57 | 8.31 | 0.5889 | 0.0172 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 3.53 | 1.09 | 0.5826 | -0.0233 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 3.53 | 1.09 | 0.5826 | -0.0233 | ||

| XS2309452766 / GRIFFITH PARK CLO GRIPK 1A A1RA 144A | 3.51 | -14.96 | 0.5793 | -0.1370 | ||

| 01626P148 / Alimentation Couche-Tard Inc | 3.34 | 0.5504 | 0.5504 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 3.34 | 0.5504 | 0.5504 | |||

| US74143JAA97 / PRET 2021-RN3 LLC | 3.31 | -4.09 | 0.5454 | -0.0525 | ||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8A11) | 3.23 | 0.19 | 0.5322 | -0.0263 | ||

| MORGAN STANLEY BANK NA MORGAN STANLEY BANK NA / DBT (US61690U8A11) | 3.23 | 0.19 | 0.5322 | -0.0263 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 3.23 | 0.5321 | 0.5321 | |||

| US62956BAA70 / NYMT Loan Trust 2022-SP1 | 3.11 | -1.93 | 0.5125 | -0.0369 | ||

| XS2357554679 / SEGOVIA EUROPEAN CLO 6 2019 SEGOV 2019 6A AR 144A | 3.10 | 8.95 | 0.5119 | 0.0179 | ||

| US55379AAC80 / M360 2021-CRE3 Ltd | 3.05 | -0.07 | 0.5028 | -0.0261 | ||

| JP MORGAN REREMIC JPMRR 2015 3 1A4 144A / ABS-MBS (US46644NAD66) | 3.02 | 3.67 | 0.4984 | -0.0069 | ||

| JP MORGAN REREMIC JPMRR 2015 3 1A4 144A / ABS-MBS (US46644NAD66) | 3.02 | 3.67 | 0.4984 | -0.0069 | ||

| FCT / Fincantieri S.p.A. | 3.01 | 9.88 | 0.4971 | 0.0215 | ||

| FCT / Fincantieri S.p.A. | 3.01 | 9.88 | 0.4971 | 0.0215 | ||

| CBRE SVCS INC / DBT (US12610BUA87) | 2.97 | 0.4892 | 0.4892 | |||

| CBRE SVCS INC / DBT (US12610BUA87) | 2.97 | 0.4892 | 0.4892 | |||

| US69363JAA25 / PRET 2022-RN1 LLC | 2.95 | -2.54 | 0.4864 | -0.0383 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 2.95 | 0.4863 | 0.4863 | |||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 2.95 | 0.4863 | 0.4863 | |||

| JONES LANG LASALLE FIN BV 4/A2 07/25 ZCP / DBT (US48002AU933) | 2.93 | 0.4827 | 0.4827 | |||

| JONES LANG LASALLE FIN BV 4/A2 07/25 ZCP / DBT (US48002AU933) | 2.93 | 0.4827 | 0.4827 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 2.92 | 0.4823 | 0.4823 | |||

| HOLCIM FIN US LLC 07/25 ZCP / DBT (US43475FUG52) | 2.92 | 0.4823 | 0.4823 | |||

| BACARDI MARTINI B V / DBT (US05634EUA80) | 2.90 | 0.4777 | 0.4777 | |||

| BACARDI MARTINI B V / DBT (US05634EUA80) | 2.90 | 0.4777 | 0.4777 | |||

| US525931AB72 / Lendbuzz Securitization Trust 2023-3 | 2.87 | 0.4740 | 0.4740 | |||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 2.87 | 0.4732 | 0.4732 | |||

| DE000DL19VP0 / DEUTSCHE BANK AG SR UNSECURED REGS 09/26 VAR | 2.82 | 9.47 | 0.4654 | 0.0184 | ||

| FANNIE MAE FNR 2024 77 FM / ABS-MBS (US3136BTRF25) | 2.78 | -13.32 | 0.4584 | -0.0976 | ||

| FANNIE MAE FNR 2024 77 FM / ABS-MBS (US3136BTRF25) | 2.78 | -13.32 | 0.4584 | -0.0976 | ||

| US25466AAP66 / Discover Bank | 2.71 | 1.42 | 0.4477 | -0.0164 | ||

| US780097BG51 / NatWest Group PLC | 2.71 | 0.82 | 0.4464 | -0.0192 | ||

| US86361HAB06 / STRUCTURED ASSET MORTGAGE INVE SAMI 2006 AR7 A1BG | 2.70 | -2.35 | 0.4449 | -0.0341 | ||

| XS2305240843 / EURO GALAXY CLO DAC EGLXY 2013 3A ARRR 144A | 2.69 | 8.80 | 0.4443 | 0.0149 | ||

| US00703RAE09 / ADJUSTABLE RATE MORTGAGE TRUST ARMT 2007 3 2A1 144A | 2.69 | -2.47 | 0.4437 | -0.0346 | ||

| TOWD POINT MORTGAGE FUNDING TPMF 2024 GR6A A1 144A / ABS-MBS (XS2799791848) | 2.66 | -0.49 | 0.4383 | -0.0248 | ||

| TOWD POINT MORTGAGE FUNDING TPMF 2024 GR6A A1 144A / ABS-MBS (XS2799791848) | 2.66 | -0.49 | 0.4383 | -0.0248 | ||

| US31418CU779 / FANNIE MAE 3.50% 03/01/2048 FNMA | 2.60 | -2.14 | 0.4291 | -0.0318 | ||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 2.55 | 0.39 | 0.4211 | -0.0197 | ||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 2.55 | 0.39 | 0.4211 | -0.0197 | ||

| US74923LAA08 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2007 QO4 A1 | 2.55 | -0.31 | 0.4200 | -0.0229 | ||

| E1SE34 / Eversource Energy - Depositary Receipt (Common Stock) | 2.53 | 1.20 | 0.4167 | -0.0162 | ||

| E1SE34 / Eversource Energy - Depositary Receipt (Common Stock) | 2.53 | 1.20 | 0.4167 | -0.0162 | ||

| US59022QAC69 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2006 HE5 A2B | 2.47 | -1.32 | 0.4078 | -0.0268 | ||

| US05377RHL15 / Avis Budget Rental Car Funding AESOP LLC | 2.47 | 0.20 | 0.4071 | -0.0201 | ||

| 5831 / Shizuoka Financial Group,Inc. | 2.42 | 0.3999 | 0.3999 | |||

| 5831 / Shizuoka Financial Group,Inc. | 2.42 | 0.3999 | 0.3999 | |||

| US55285BAA35 / MF1 2022-FL10 LLC MF1 2022-FL10 A | 2.39 | -5.68 | 0.3945 | -0.0451 | ||

| XS2304369759 / BLACKROCK EUROPEAN CLO DAC BECLO 7A AR 144A | 2.34 | 0.77 | 0.3866 | -0.0167 | ||

| US3622M8AE61 / GSAMP TRUST GSAMP 2006 HE8 A2D | 2.32 | 0.61 | 0.3831 | -0.0173 | ||

| US3140GVZY43 / Fannie Mae Pool | 2.29 | -1.42 | 0.3783 | -0.0252 | ||

| XS2326485898 / BAIN CAPITAL EURO CLO BCCE 2018 2A AR 144A | 2.28 | -10.11 | 0.3753 | -0.0637 | ||

| US83612JAD63 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2006 EQ1 A4 | 2.27 | -3.65 | 0.3744 | -0.0341 | ||

| US64828XAA19 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2020-RPL1 SER 2020-RPL1 CL A1 V/R REGD 144A P/P 2.75000000 | 2.27 | -4.10 | 0.3741 | -0.0361 | ||

| US76112BRR32 / RESIDENTIAL ASSET MORTGAGE PRO RAMP 2005 EFC1 M6 | 2.22 | -0.63 | 0.3662 | -0.0212 | ||

| US55275NAE13 / MARM 2006-0A2 2A1 | 2.21 | 7.35 | 0.3637 | 0.0074 | ||

| US92539AAA25 / Verus Securitization Trust 2022-6 | 2.20 | -3.09 | 0.3626 | -0.0308 | ||

| US12661GAA76 / CSMC 2021-RPL3 Trust | 2.20 | -3.35 | 0.3622 | -0.0317 | ||

| JACKSON NATL LIFE GLOBAL JACKSON NATL LIFE GLOBAL / DBT (US46849LUZ20) | 2.12 | -0.05 | 0.3493 | -0.0183 | ||

| US16165AAD63 / CHASEFLEX TRUST CFLX 2007 3 2A1 | 2.11 | -0.38 | 0.3476 | -0.0193 | ||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 2.10 | 0.3469 | 0.3469 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 2.10 | 0.3469 | 0.3469 | |||

| MX0SGO0000M6 / Mexican Udibonos | 2.09 | 12.04 | 0.3440 | 0.0212 | ||

| CNQ / Canadian Natural Resources Limited | 2.06 | 0.3398 | 0.3398 | |||

| CNQ / Canadian Natural Resources Limited | 2.06 | 0.3398 | 0.3398 | |||

| ENBRIDGE (US) INC / DBT (US29251UUB24) | 2.06 | 0.3393 | 0.3393 | |||

| ENBRIDGE (US) INC / DBT (US29251UUB24) | 2.06 | 0.3393 | 0.3393 | |||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 2.03 | 1.30 | 0.3341 | -0.0127 | ||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 2.03 | 1.30 | 0.3341 | -0.0127 | ||

| US456606GY22 / INDYMAC RESIDENTIAL ASSET BACK INABS 2005 B M6 | 1.97 | 0.41 | 0.3252 | -0.0153 | ||

| FNMA POOL BZ1029 FN 06/29 FIXED 4.93 / ABS-MBS (US3140NVEB95) | 1.95 | 0.26 | 0.3215 | -0.0156 | ||

| FNMA POOL BZ1029 FN 06/29 FIXED 4.93 / ABS-MBS (US3140NVEB95) | 1.95 | 0.26 | 0.3215 | -0.0156 | ||

| US61747YEC57 / Morgan Stanley | 1.94 | 0.94 | 0.3201 | -0.0134 | ||

| FED HM LN PC POOL RJ0136 FR 12/53 FIXED 4.5 / ABS-MBS (US3142GQEJ75) | 1.91 | -0.42 | 0.3158 | -0.0176 | ||

| FED HM LN PC POOL RJ0136 FR 12/53 FIXED 4.5 / ABS-MBS (US3142GQEJ75) | 1.91 | -0.42 | 0.3158 | -0.0176 | ||

| US01F0426811 / UMBS TBA | 1.91 | -93.88 | 0.3154 | -2.5267 | ||

| US03512TAF84 / AngloGold Ashanti Holdings PLC | 1.91 | 1.17 | 0.3150 | -0.0123 | ||

| FED HM LN PC POOL QE8001 FR 08/52 FIXED 4.5 / ABS-MBS (US3133BH3J35) | 1.90 | -1.50 | 0.3139 | -0.0211 | ||

| FED HM LN PC POOL QE8001 FR 08/52 FIXED 4.5 / ABS-MBS (US3133BH3J35) | 1.90 | -1.50 | 0.3139 | -0.0211 | ||

| US912810RR14 / United States Treasury Inflation Indexed Bonds | 1.89 | -2.98 | 0.3116 | -0.0261 | ||

| XS2350603374 / CAIRN CLO BV CRNCL 2018 10A AR 144A | 1.88 | -6.22 | 0.3109 | -0.0375 | ||

| US23244GAD43 / Alternative Loan Trust 2006-OA18 | 1.88 | -3.25 | 0.3093 | -0.0268 | ||

| US12667AAD81 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 12 2A3 | 1.87 | -3.90 | 0.3091 | -0.0290 | ||

| US81879MAV19 / SG MORTGAGE SECURITIES TRUST SGMS 2006 FRE1 A2B | 1.87 | 0.27 | 0.3089 | -0.0149 | ||

| US55275NAA90 / MASTR Adjustable Rate Mortgages Trust 2006-OA2 | 1.85 | 0.16 | 0.3050 | -0.0151 | ||

| US362334FK51 / GSAA Home Equity Trust 2006-4 | 1.82 | -1.62 | 0.3010 | -0.0206 | ||

| XS2305369709 / CORDATUS CLO PLC CORDA 7A ARR 144A | 1.82 | -8.22 | 0.3002 | -0.0436 | ||

| PAGAYA POINT OF SALE HOLDINGS POSH 2025 1 A 144A / ABS-O (US694952AA06) | 1.81 | 0.2988 | 0.2988 | |||

| PAGAYA POINT OF SALE HOLDINGS POSH 2025 1 A 144A / ABS-O (US694952AA06) | 1.81 | 0.2988 | 0.2988 | |||

| US925650AB99 / VICI Properties LP | 1.81 | 0.50 | 0.2986 | -0.0137 | ||

| SMB PRIVATE EDUCATION LOAN TRU SMB 2024 C A1A 144A / ABS-O (US83206EAA55) | 1.78 | -3.11 | 0.2934 | -0.0249 | ||

| US65535HAQ20 / Nomura Holdings Inc | 1.78 | 1.31 | 0.2929 | -0.0110 | ||

| US73316MAE75 / POPULAR ABS MORTGAGE PASS THRO POPLR 2006 C M1 | 1.75 | -2.24 | 0.2883 | -0.0216 | ||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 1.69 | 0.2786 | 0.2786 | |||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 1.69 | 0.2786 | 0.2786 | |||

| US05541YAG52 / BCAP LLC TRUST BCAP 2012 RR11 4A3 144A | 1.69 | -1.81 | 0.2781 | -0.0197 | ||

| US25466AAJ07 / Discover Bank | 1.68 | 0.60 | 0.2774 | -0.0125 | ||

| E-MINI RUSS 2000 SEP25 XCME 20250919 / DE (000000000) | 1.65 | 0.2721 | 0.2721 | |||

| E-MINI RUSS 2000 SEP25 XCME 20250919 / DE (000000000) | 1.65 | 0.2721 | 0.2721 | |||

| PEP01000C5I0 / BONOS DE TESORERIA | 1.63 | 7.16 | 0.2693 | 0.0051 | ||

| XS2303818954 / TAURUS CMBS TAURS 2021 UK1A A 144A | 1.63 | 6.32 | 0.2692 | 0.0031 | ||

| SPACE COAST CREDIT UNION SCCU 2024 1A A3 144A / ABS-O (US78436RAE09) | 1.61 | -0.31 | 0.2655 | -0.0144 | ||

| SPACE COAST CREDIT UNION SCCU 2024 1A A3 144A / ABS-O (US78436RAE09) | 1.61 | -0.31 | 0.2655 | -0.0144 | ||

| ARES STRATEGIC INCOME FU SR UNSECURED 144A 09/28 5.45 / DBT (US04020EAL11) | 1.60 | 0.2641 | 0.2641 | |||

| ARES STRATEGIC INCOME FU SR UNSECURED 144A 09/28 5.45 / DBT (US04020EAL11) | 1.60 | 0.2641 | 0.2641 | |||

| XS2307740642 / JUBILEE CDO BV JUBIL 2016 17A A2RR 144A | 1.60 | 8.43 | 0.2632 | 0.0081 | ||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 1.59 | 0.2614 | 0.2614 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 1.59 | 0.2614 | 0.2614 | |||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1.55 | 0.91 | 0.2560 | -0.0107 | ||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1.55 | 0.91 | 0.2560 | -0.0107 | ||

| US542514NE09 / LONG BEACH MORTGAGE LOAN TRUST LBMLT 2005 WL2 M4 | 1.54 | -1.41 | 0.2542 | -0.0168 | ||

| SAGB / Republic of South Africa Government Bond | 1.54 | 6.29 | 0.2538 | 0.0027 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 1.52 | 0.33 | 0.2500 | -0.0119 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 1.52 | 0.33 | 0.2500 | -0.0119 | ||

| RFR USD SOFR/3.50000 12/18/24-30Y CME / DIR (EZ4089K4KC85) | 1.51 | -7.57 | 0.2496 | -0.0344 | ||

| US83611MGJ18 / Soundview Home Loan Trust | 1.51 | -4.37 | 0.2492 | -0.0246 | ||

| US68400DAE40 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2007 1 2A3 | 1.49 | -1.46 | 0.2452 | -0.0164 | ||

| US02660KAA07 / American Home Mortgage Assets Trust 2006-5 | 1.47 | -2.59 | 0.2418 | -0.0190 | ||

| XS2304366656 / HARVEST CLO HARVT 16A ARR 144A | 1.41 | -6.80 | 0.2327 | -0.0299 | ||

| US93364CAA62 / WaMu Mortgage Pass-Through Certificates Series 2007-OA4 Trust | 1.40 | -4.25 | 0.2303 | -0.0226 | ||

| US90276UAU51 / UBS COMMERCIAL MORTGAGE TRUST UBSCM 2017 C6 ASB | 1.39 | -11.84 | 0.2285 | -0.0440 | ||

| US813765AC80 / SECURITIZED ASSET BACKED RECEI SABR 2006 FR3 A3 | 1.38 | -1.78 | 0.2280 | -0.0161 | ||

| US68403KAB17 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2007 6 2A2 | 1.38 | 0.51 | 0.2275 | -0.0105 | ||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PN17) | 1.36 | 0.2251 | 0.2251 | |||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PN17) | 1.36 | 0.2251 | 0.2251 | |||

| US07386HYH82 / BEAR STEARNS ALT A TRUST BALTA 2005 9 26A1 | 1.35 | -0.37 | 0.2234 | -0.0124 | ||

| GREENSKY HOME IMPROVEMENT ISSU GSKY 2024 1 A3 144A / ABS-O (US39571MAC29) | 1.33 | 0.91 | 0.2197 | -0.0092 | ||

| GREENSKY HOME IMPROVEMENT ISSU GSKY 2024 1 A3 144A / ABS-O (US39571MAC29) | 1.33 | 0.91 | 0.2197 | -0.0092 | ||

| ZAG000077470 / Republic of South Africa Government Bond | 1.31 | 7.30 | 0.2160 | 0.0043 | ||

| US25151YAG44 / DEUTSCHE ALT A SECURITIES INC DBALT 2007 1 1A4B | 1.30 | -1.14 | 0.2151 | -0.0138 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 1.30 | 0.2145 | 0.2145 | |||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 1.30 | 0.2145 | 0.2145 | |||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 1.29 | -2.85 | 0.2134 | -0.0175 | ||

| ACHV ABS TRUST ACHV 2024 2PL B 144A / ABS-O (US00092HAB78) | 1.29 | -18.33 | 0.2125 | -0.0610 | ||

| XS2350015942 / CARLYLE GLOBAL MARKET STRATEGI CGMSE 2017 3A A1R 144A | 1.28 | -11.54 | 0.2112 | -0.0398 | ||

| US92922F5Y09 / WAMU MORTGAGE PASS THROUGH CER WAMU 2005 AR15 A1B4 | 1.26 | -1.10 | 0.2082 | -0.0133 | ||

| US64830NAA90 / New Residential Mortgage Loan Trust 2019-RPL3 | 1.25 | -5.29 | 0.2069 | -0.0228 | ||

| US06738ECE32 / Barclays PLC | 1.25 | 1.63 | 0.2060 | -0.0070 | ||

| US83406TAB89 / SoFi Professional Loan Program 2020-ATrust | 1.23 | -7.26 | 0.2023 | -0.0270 | ||

| TRINITY SQUARE TRINI 2021 1A AR 144A / ABS-MBS (XS2783078087) | 1.22 | 0.66 | 0.2011 | -0.0090 | ||

| TRINITY SQUARE TRINI 2021 1A AR 144A / ABS-MBS (XS2783078087) | 1.22 | 0.66 | 0.2011 | -0.0090 | ||

| BOUGHT BRL SOLD USD 20251002 / DFE (000000000) | 1.19 | 0.1967 | 0.1967 | |||

| BOUGHT BRL SOLD USD 20251002 / DFE (000000000) | 1.19 | 0.1967 | 0.1967 | |||

| US71429MAC91 / Perrigo Finance Unlimited Co | 1.18 | 2.88 | 0.1947 | -0.0042 | ||

| US225401AU28 / Credit Suisse Group AG | 1.18 | 1.99 | 0.1947 | -0.0060 | ||

| US65535HAS85 / Nomura Holdings Inc | 1.18 | 1.73 | 0.1946 | -0.0065 | ||

| US55336VBQ23 / MPLX LP | 1.18 | 1.64 | 0.1941 | -0.0067 | ||

| US694308JM04 / PACIFIC GAS and ELECTRIC CO 4.55% 07/01/2030 | 1.17 | 0.86 | 0.1933 | -0.0082 | ||

| US00075WAA71 / ASSET BACKED FUNDING CERTIFICA ABFC 2006 HE1 A1 | 1.16 | -0.94 | 0.1920 | -0.0116 | ||

| US75971EAF34 / RENAISSANCE HOME EQUITY LOAN T RAMC 2006 3 AF3 | 1.16 | -1.94 | 0.1914 | -0.0138 | ||

| US61752JAA88 / MORGAN STANLEY MORTGAGE LOAN T MSM 2007 1XS 1A1 | 1.13 | -0.97 | 0.1856 | -0.0114 | ||

| US126670TW86 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 1 MV1 | 1.10 | -4.26 | 0.1817 | -0.0178 | ||

| US542514RH93 / Long Beach Mortgage Loan Trust 2006-1 | 1.08 | -5.17 | 0.1785 | -0.0195 | ||

| US17311BAS25 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 AMC1 A1 144A | 1.08 | -0.92 | 0.1778 | -0.0109 | ||

| US57643BAA61 / Mastr Specialized Loan Trust | 1.08 | -2.71 | 0.1774 | -0.0143 | ||

| SPACE COAST CREDIT UNION SCCU 2024 1A A2 144A / ABS-O (US78436RAC43) | 1.07 | -31.72 | 0.1772 | -0.0957 | ||

| SPACE COAST CREDIT UNION SCCU 2024 1A A2 144A / ABS-O (US78436RAC43) | 1.07 | -31.72 | 0.1772 | -0.0957 | ||

| US3622EBAB42 / GSAA HOME EQUITY TRUST GSAA 2007 4 A2 | 1.07 | -2.45 | 0.1770 | -0.0139 | ||

| US06051GJS93 / Bank of America Corp | 1.07 | 0.85 | 0.1764 | -0.0075 | ||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 1.07 | 0.95 | 0.1761 | -0.0074 | ||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 1.07 | 0.95 | 0.1761 | -0.0074 | ||

| XS1794675931 / Fairfax Financial Holdings Ltd | 1.05 | 10.02 | 0.1740 | 0.0078 | ||

| US74143FAA75 / PRET_21-RN2 | 1.05 | -8.33 | 0.1725 | -0.0252 | ||

| US69380GAA76 / PRKCM 2023-AFC4 TRUST SER 2023-AFC4 CL A1 S/UP REGD 144A P/P 7.22500000 | 1.03 | -7.81 | 0.1695 | -0.0236 | ||

| US02150XAA90 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2007 HY8C A1 | 1.02 | -2.85 | 0.1689 | -0.0139 | ||

| US06051GLG28 / Bank of America Corp | 1.02 | 0.59 | 0.1686 | -0.0076 | ||

| STRATTON MORTGAGE FUNDING PLC STRA 2024 1A A 144A / ABS-MBS (XS2728570248) | 1.02 | 0.20 | 0.1683 | -0.0083 | ||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 1.02 | 50.30 | 0.1676 | 0.0503 | ||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 1.02 | 50.30 | 0.1676 | 0.0503 | ||

| CPPIB CAPITAL INC COMPANY GUAR REGS 06/34 4.3 / DBT (CA12593CAY71) | 1.00 | 4.08 | 0.1642 | -0.0017 | ||

| CPPIB CAPITAL INC COMPANY GUAR REGS 06/34 4.3 / DBT (CA12593CAY71) | 1.00 | 4.08 | 0.1642 | -0.0017 | ||

| US525161AN53 / LEHMAN XS TRUST LXS 2006 GP4 3A5 | 0.98 | -2.01 | 0.1610 | -0.0118 | ||

| US61750MAE57 / MSAC 2006-HE7 A2C | 0.96 | -2.83 | 0.1587 | -0.0129 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.96 | 0.1586 | 0.1586 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.96 | 0.1586 | 0.1586 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.96 | 0.1586 | 0.1586 | |||

| US00774MAW55 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.95 | 1.38 | 0.1572 | -0.0058 | ||

| US86359DEX12 / Structured Asset Securities Corp | 0.95 | -0.52 | 0.1570 | -0.0091 | ||

| US694308JW85 / Pacific Gas and Electric Co | 0.95 | 0.96 | 0.1567 | -0.0064 | ||

| US00774MAX39 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.91 | 2.26 | 0.1495 | -0.0042 | ||

| US81375WGF77 / SECURITIZED ASSET BACKED RECEI SABR 2005 HE1 M1 | 0.90 | -3.76 | 0.1479 | -0.0136 | ||

| US3132XWE647 / Freddie Mac Gold Pool | 0.88 | -1.01 | 0.1450 | -0.0090 | ||

| US02150MAA36 / Alternative Loan Trust 2007-13 | 0.88 | -2.13 | 0.1445 | -0.0106 | ||

| US23371DAG97 / DAE Funding LLC | 0.87 | 0.93 | 0.1429 | -0.0059 | ||

| TRT061124T11 / Turkey Government Bond | 0.86 | -2.28 | 0.1414 | -0.0107 | ||

| TRT061124T11 / Turkey Government Bond | 0.86 | -2.28 | 0.1414 | -0.0107 | ||

| XS2326513269 / HARVEST CLO HARVT 21A A2R 144A | 0.85 | 1.92 | 0.1402 | -0.0045 | ||

| US83613DAA46 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2007 OPT2 1A1 | 0.84 | -1.53 | 0.1382 | -0.0094 | ||

| R2037 / South Africa - Sovereign or Government Agency Debt | 0.84 | 8.30 | 0.1379 | 0.0042 | ||

| US46644NAG97 / JP MORGAN REREMIC JPMRR 2015 3 1A7 144A | 0.83 | -14.08 | 0.1370 | -0.0305 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.81 | 0.37 | 0.1330 | -0.0063 | ||

| US31659TDV44 / Fieldstone Mortgage Investment Trust | 0.80 | -14.93 | 0.1317 | -0.0310 | ||

| US68402CAA27 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2006 2 1A1 | 0.79 | -1.75 | 0.1298 | -0.0092 | ||

| US05401AAJ07 / Avolon Holdings Funding Ltd | 0.78 | 0.65 | 0.1287 | -0.0059 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP BPS / DCR (EZ2BLZ4YH9B3) | 0.77 | 0.1269 | 0.1269 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.76 | 0.1246 | 0.1246 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.76 | 0.1246 | 0.1246 | |||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0.75 | 0.1237 | 0.1237 | |||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0.75 | 0.1237 | 0.1237 | |||

| R2032 / South Africa - Corporate Bond/Note | 0.74 | 7.51 | 0.1228 | 0.0027 | ||

| US68402BAA44 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2007 3 1A1 | 0.74 | -1.47 | 0.1216 | -0.0081 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVF74) | 0.74 | 0.1213 | 0.1213 | |||

| US36242DRX39 / GSAMP Trust 2005-HE1 | 0.71 | -0.97 | 0.1173 | -0.0072 | ||

| IRS AUD 4.50000 09/20/23-10Y LCH / DIR (EZGXS4F4YYN6) | 0.68 | 100.00 | 0.1129 | 0.0536 | ||

| IRS AUD 4.50000 09/20/23-10Y LCH / DIR (EZGXS4F4YYN6) | 0.68 | 100.00 | 0.1129 | 0.0536 | ||

| US68403HAA05 / Option One Mortgage Loan Trust, Series 2007-5, Class 1A1 | 0.68 | -1.88 | 0.1123 | -0.0079 | ||

| US12566VAJ17 / CITIMORTGAGE ALTERNATIVE LOAN CMALT 2007 A4 1A9 | 0.67 | -4.68 | 0.1108 | -0.0115 | ||

| US35729PPX23 / FHLT 2006-2 2A3 | 0.67 | -3.60 | 0.1106 | -0.0101 | ||

| MX0SGO0000K0 / Mexican Udibonos | 0.64 | 11.73 | 0.1053 | 0.0061 | ||

| US92922F4C97 / WaMu Mortgage Pass-Through Certificates Trust, Series 2005-AR14, Class 1A3 | 0.64 | -1.24 | 0.1050 | -0.0066 | ||

| US41282JV408 / HARLEY-DAVIDSON FDG CORP COMMERCIAL PAPER (ISITC) | 0.63 | 0.1034 | 0.1034 | |||

| US46630GAR65 / JP Morgan Mortgage Trust, Series 2007-A1, Class 5A1 | 0.62 | -4.18 | 0.1021 | -0.0100 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.61 | 0.66 | 0.1000 | -0.0046 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.61 | 0.66 | 0.1000 | -0.0046 | ||

| US126670KK30 / Countrywide Asset-Backed Certificates, Series 2005-AB4, Class 2A1 | 0.60 | -0.99 | 0.0993 | -0.0061 | ||

| PROLOGIS LP SR UNSECURED 01/35 5 / DBT (US74340XCN93) | 0.60 | 0.84 | 0.0990 | -0.0043 | ||

| PROLOGIS LP SR UNSECURED 01/35 5 / DBT (US74340XCN93) | 0.60 | 0.84 | 0.0990 | -0.0043 | ||

| FANNIE MAE FNR 2025 54 FM / ABS-MBS (US3136BWNW23) | 0.60 | 0.0990 | 0.0990 | |||

| RFR USD SOFR/3.80902 12/02/24-7Y* LCH / DIR (EZQXPTG0Q2X2) | 0.58 | 237.79 | 0.0959 | 0.0660 | ||

| RFR USD SOFR/3.80902 12/02/24-7Y* LCH / DIR (EZQXPTG0Q2X2) | 0.58 | 237.79 | 0.0959 | 0.0660 | ||

| US68403FAA49 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2007 4 1A1 | 0.58 | -1.69 | 0.0958 | -0.0067 | ||

| US23246BAK70 / Countrywide Asset-Backed Certificates | 0.57 | -2.71 | 0.0948 | -0.0076 | ||

| US41162DAA72 / HarborView Mortgage Loan Trust 2006-12 | 0.55 | -1.26 | 0.0905 | -0.0059 | ||

| US23243HAA95 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 24 1A | 0.54 | -5.92 | 0.0892 | -0.0105 | ||

| US61915YAA91 / MORTGAGEIT TRUST MHL 2007 1 1A1 | 0.52 | -1.52 | 0.0855 | -0.0057 | ||

| US76088LAA61 / RPM_21-2A | 0.52 | -13.42 | 0.0852 | -0.0182 | ||

| US52520QAB05 / LEHMAN MORTGAGE TRUST LMT 2006 7 1A2 | 0.51 | -0.39 | 0.0843 | -0.0048 | ||

| US12668HAA86 / COUNTRYWIDE ASSET BACKED SECURITIES | 0.51 | -1.74 | 0.0840 | -0.0059 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A3 144A / ABS-O (US17331QAD88) | 0.50 | -0.20 | 0.0829 | -0.0044 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A3 144A / ABS-O (US17331QAD88) | 0.50 | -0.20 | 0.0829 | -0.0044 | ||

| US86363WAC38 / STRUCTURED ASSET SECURITIES CO SASC 2007 BC3 1A3 | 0.50 | -5.85 | 0.0824 | -0.0096 | ||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | 0.50 | 0.0818 | 0.0818 | |||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | 0.50 | 0.0818 | 0.0818 | |||

| FREDDIE MAC FHR 5549 BF / ABS-MBS (US3137HLS527) | 0.49 | 0.0816 | 0.0816 | |||

| US83207DAB47 / SMB 23-C A1B 144A (SOFR30A+155) FRN 11-15-52/10-17-33 | 0.46 | -5.92 | 0.0761 | -0.0089 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP GST / DCR (EZ2BLZ4YH9B3) | 0.45 | 0.0740 | 0.0740 | |||

| CDX ITRAXX XOV42 5Y 35-100% SP GST / DCR (EZ2BLZ4YH9B3) | 0.45 | 0.0740 | 0.0740 | |||

| US842400HT35 / Southern California Edison Co | 0.44 | 0.00 | 0.0720 | -0.0037 | ||

| US694308JF52 / Pacific Gas and Electric Co | 0.43 | 0.93 | 0.0717 | -0.0030 | ||

| MX0SGO0000F0 / Mexican Udibonos | 0.43 | 11.46 | 0.0707 | 0.0040 | ||

| US3140H37E09 / Fannie Mae Pool | 0.43 | -1.84 | 0.0705 | -0.0051 | ||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 0.43 | 1.43 | 0.0701 | -0.0025 | ||

| US76089EAA10 / RESEARCH DRIVEN PAGAYA MOTOR A RPM 2022 1A A 144A | 0.41 | -12.10 | 0.0683 | -0.0134 | ||

| GA GLOBAL FUNDING TRUST SR SECURED 144A 04/32 5.5 / DBT (US36143L2T17) | 0.41 | 0.74 | 0.0671 | -0.0028 | ||

| GA GLOBAL FUNDING TRUST SR SECURED 144A 04/32 5.5 / DBT (US36143L2T17) | 0.41 | 0.74 | 0.0671 | -0.0028 | ||

| EXTRA SPACE STORAGE LP COMPANY GUAR 06/35 5.4 / DBT (US30225VAU17) | 0.40 | 1.26 | 0.0664 | -0.0026 | ||

| UNITED AIR 2024 1 AA PTT PASS THRU CE 08/38 5.45 / DBT (US90932WAA18) | 0.40 | 0.00 | 0.0662 | -0.0033 | ||

| UNITED AIR 2024 1 AA PTT PASS THRU CE 08/38 5.45 / DBT (US90932WAA18) | 0.40 | 0.00 | 0.0662 | -0.0033 | ||

| US76088TAA97 / RPM 22-3 A 144A 5.38% 11-25-30 | 0.40 | -43.82 | 0.0661 | -0.0574 | ||

| RFR USD SOFR/3.70000 02/20/24-25Y LCH / DIR (EZRM7DK4X894) | 0.40 | 55.04 | 0.0661 | 0.0212 | ||

| RFR USD SOFR/3.70000 02/20/24-25Y LCH / DIR (EZRM7DK4X894) | 0.40 | 55.04 | 0.0661 | 0.0212 | ||

| US12667GYQ09 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 28CB 3A7 | 0.40 | -5.88 | 0.0660 | -0.0078 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 2A ARV 144A / ABS-CBDO (US03329LAS07) | 0.39 | 1.03 | 0.0648 | -0.0025 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 2A ARV 144A / ABS-CBDO (US03329LAS07) | 0.39 | 1.03 | 0.0648 | -0.0025 | ||

| US84751PKW85 / SPECIALTY UNDERWRITING + RESID SURF 2006 AB1 A4 | 0.39 | -1.75 | 0.0648 | -0.0045 | ||

| US12544HAY62 / COUNTRYWIDE HOME LOANS CWHL 2007 HY7 A1 | 0.39 | 0.52 | 0.0645 | -0.0029 | ||

| ROMARK CREDIT FUNDING, LTD. RCF 2021 2A A 144A / ABS-CBDO (US77588JAA43) | 0.38 | 1.08 | 0.0620 | -0.0025 | ||

| ROMARK CREDIT FUNDING, LTD. RCF 2021 2A A 144A / ABS-CBDO (US77588JAA43) | 0.38 | 1.08 | 0.0620 | -0.0025 | ||

| CDX HY44 5Y ICE / DCR (000000000) | 0.37 | 0.0608 | 0.0608 | |||

| US92927XAE40 / WAMU MORTGAGE PASS THROUGH CER WAMU 2007 HY6 2A3 | 0.36 | -1.90 | 0.0596 | -0.0043 | ||

| US68233JCD46 / Oncor Electric Delivery Co LLC | 0.35 | -0.56 | 0.0583 | -0.0034 | ||

| US81377AAE29 / SECURITIZED ASSET BACKED RECEI SABR 2006 HE2 A2D | 0.34 | -0.58 | 0.0568 | -0.0033 | ||

| US64032PAA03 / Nelnet Student Loan Trust, Series 2023-AA, Class AFL | 0.34 | -8.17 | 0.0556 | -0.0082 | ||

| US48251JAL70 / KKR CLO 18 Ltd | 0.34 | -32.60 | 0.0556 | -0.0311 | ||

| 952NPG006 / CREDIT SUISSE GROUP AG JR SUB 144A | 0.34 | 0.00 | 0.0554 | -0.0028 | ||

| US02149FAM68 / Alternative Loan Trust 2006-43CB | 0.33 | -1.51 | 0.0538 | -0.0037 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2018 6A A 144A / ABS-CBDO (US03330LAA61) | 0.32 | -6.90 | 0.0536 | -0.0068 | ||

| 317U7IQA6 PIMCO SWAPTION 3.75 CALL USD 2025103 / DIR (000000000) | 0.31 | 0.0515 | 0.0515 | |||

| 317U7IQA6 PIMCO SWAPTION 3.75 CALL USD 2025103 / DIR (000000000) | 0.31 | 0.0515 | 0.0515 | |||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0.31 | 0.99 | 0.0505 | -0.0021 | ||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0.31 | 0.99 | 0.0505 | -0.0021 | ||

| US404280DZ92 / HSBC HOLDINGS PLC REGD V/R 5.88700000 | 0.30 | 0.00 | 0.0502 | -0.0027 | ||

| CARVANA AUTO RECEIVABLES TRUST CRVNA 2023 P5 A3 144A / ABS-O (US14687RAC51) | 0.30 | -0.33 | 0.0499 | -0.0028 | ||

| CARVANA AUTO RECEIVABLES TRUST CRVNA 2023 P5 A3 144A / ABS-O (US14687RAC51) | 0.30 | -0.33 | 0.0499 | -0.0028 | ||

| US61748HMZ19 / MORGAN STANLEY MORTGAGE LOAN T MSM 2005 6AR 1M4 | 0.30 | -47.66 | 0.0499 | -0.0502 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.30 | 1.01 | 0.0496 | -0.0019 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.30 | 1.01 | 0.0496 | -0.0019 | ||

| US31418CS476 / Fannie Mae Pool | 0.29 | -1.67 | 0.0486 | -0.0034 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.29 | 0.0479 | 0.0479 | |||

| US64032PAB85 / Nelnet Student Loan Trust 2023-A | 0.28 | -8.09 | 0.0469 | -0.0068 | ||

| US03330EAJ38 / Anchorage Credit Funding 3 Ltd. | 0.28 | 0.71 | 0.0469 | -0.0020 | ||

| US03290AAA88 / Anchorage Credit Funding Ltd. | 0.28 | 1.08 | 0.0465 | -0.0018 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0.28 | -4.44 | 0.0462 | -0.0047 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0.28 | -4.44 | 0.0462 | -0.0047 | ||

| US31418CUA07 / Fannie Mae Pool | 0.27 | -1.81 | 0.0448 | -0.0031 | ||

| US715638BE14 / Peruvian Government International Bond | 0.27 | -15.62 | 0.0446 | -0.0109 | ||

| TRICOLOR AUTO SECURITIZATION T TAST 2024 1A A 144A / ABS-O (US89616LAA08) | 0.26 | -43.41 | 0.0433 | -0.0370 | ||

| TRICOLOR AUTO SECURITIZATION T TAST 2024 1A A 144A / ABS-O (US89616LAA08) | 0.26 | -43.41 | 0.0433 | -0.0370 | ||

| US91680UAA79 / Upstart Pass-Through Trust Series | 0.26 | -43.08 | 0.0421 | -0.0356 | ||

| US38380VEU17 / GOVERNMENT NATIONAL MORTGAGE A GNR 2018 19 WF | 0.25 | -3.44 | 0.0418 | -0.0037 | ||

| US57643AAA88 / MASTR SPECIALIZED LOAN TRUST SER 2006-2 CL A V/R REGD 144A P/P 2.27838000 | 0.25 | -8.89 | 0.0407 | -0.0061 | ||

| US751152AB50 / RALI 2006 QA7 2A1 | 0.24 | -3.56 | 0.0403 | -0.0037 | ||

| US75575WAA45 / Ready Capital Mortgage Financing 2021-FL7 LLC | 0.24 | -36.34 | 0.0396 | -0.0259 | ||

| 952NPKII9 / CREDIT SUISSE GROUP AG COCO JR SUB 144A | 0.24 | 0.00 | 0.0396 | -0.0020 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2019 7A A 144A / ABS-CBDO (US03331FAA84) | 0.24 | -14.34 | 0.0396 | -0.0089 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2019 7A A 144A / ABS-CBDO (US03331FAA84) | 0.24 | -14.34 | 0.0396 | -0.0089 | ||

| CDX HY43 5Y ICE / DCR (EZ4J83TSRL27) | 0.24 | -40.40 | 0.0395 | -0.0302 | ||

| CDX HY43 5Y ICE / DCR (EZ4J83TSRL27) | 0.24 | -40.40 | 0.0395 | -0.0302 | ||

| US14686RAA05 / Carvana Auto Receivables Trust 2023-N3 | 0.24 | -52.49 | 0.0395 | -0.0478 | ||

| US07388HAP47 / Bear Stearns Asset-Backed Securities I Trust, Series 2006-HE7, Class 2A2 | 0.23 | -3.35 | 0.0382 | -0.0034 | ||

| US3140H1FD75 / FNMA POOL BJ0163 FN 12/47 FIXED 3.5 | 0.23 | -0.43 | 0.0381 | -0.0022 | ||

| US31418CYL26 / Federal National Mortgage Association | 0.22 | -2.19 | 0.0368 | -0.0028 | ||

| M+T BANK AUTO RECEIVABLES TRUS MTBAT 2024 1A A2 144A / ABS-O (US55286TAB17) | 0.22 | -36.55 | 0.0358 | -0.0235 | ||

| M+T BANK AUTO RECEIVABLES TRUS MTBAT 2024 1A A2 144A / ABS-O (US55286TAB17) | 0.22 | -36.55 | 0.0358 | -0.0235 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.21 | 0.49 | 0.0340 | -0.0016 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.21 | 0.49 | 0.0340 | -0.0016 | ||

| US83612PAA84 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2007 1 1A1 | 0.21 | -4.21 | 0.0339 | -0.0032 | ||

| US07274EAH62 / Bayer US Finance LLC | 0.20 | 0.00 | 0.0335 | -0.0018 | ||

| US345397D260 / Ford Motor Credit Co LLC | 0.20 | -0.49 | 0.0334 | -0.0018 | ||

| US345397C437 / Ford Motor Credit Co LLC | 0.20 | -0.50 | 0.0333 | -0.0018 | ||

| GLP CAPITAL LP / FIN II GLP CAPITAL LP / FIN II / DBT (US361841AT63) | 0.20 | 1.53 | 0.0329 | -0.0012 | ||

| US45262BAB99 / IMPERIAL BRANDS FIN PLC REGD 144A P/P 3.50000000 | 0.20 | 0.00 | 0.0326 | -0.0016 | ||

| US31418CZG22 / Federal National Mortgage Association | 0.20 | -1.51 | 0.0324 | -0.0023 | ||

| US924933AA27 / Veros Auto Receivables Trust, Series 2023-1, Class A | 0.19 | -65.96 | 0.0318 | -0.0661 | ||

| RU20INTR TRS EQUITY SOFR+25 BPS / DE (000000000) | 0.19 | 0.0310 | 0.0310 | |||

| RU20INTR TRS EQUITY SOFR+25 BPS / DE (000000000) | 0.19 | 0.0310 | 0.0310 | |||

| US345397B512 / Ford Motor Credit Co LLC | 0.19 | 1.08 | 0.0309 | -0.0012 | ||

| RU20INTR TRS EQUITY SOFR+16 BPS / DE (000000000) | 0.19 | 0.0306 | 0.0306 | |||

| US404280CH04 / HSBC Holdings PLC | 0.18 | 1.68 | 0.0302 | -0.0010 | ||

| TREASURY BILL 07/25 0.00000 / DBT (US912797LW51) | 0.17 | 0.0274 | 0.0274 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797LW51) | 0.17 | 0.0274 | 0.0274 | |||

| US41162DAF69 / HarborView Mortgage Loan Trust 2006-12 | 0.16 | -3.55 | 0.0269 | -0.0025 | ||

| RU20INTR TRS EQUITY SOFR+33 BPS / DE (000000000) | 0.16 | 0.0268 | 0.0268 | |||

| INF SWAP US IT 2.371 04/10/25-10Y LCH / DIR (EZXLF5NS1H20) | 0.15 | 0.0250 | 0.0250 | |||

| US31418CXM18 / Fannie Mae Pool | 0.15 | -1.96 | 0.0248 | -0.0017 | ||

| PROLOGIS LP SR UNSECURED 02/33 4.2 / DBT (CA74340XCP48) | 0.15 | 5.76 | 0.0244 | 0.0002 | ||

| PROLOGIS LP SR UNSECURED 02/33 4.2 / DBT (CA74340XCP48) | 0.15 | 5.76 | 0.0244 | 0.0002 | ||

| RU20INTR TRS EQUITY SOFR+37 MBC / DE (000000000) | 0.14 | 0.0231 | 0.0231 | |||

| RU20INTR TRS EQUITY SOFR+37 MBC / DE (000000000) | 0.14 | 0.0231 | 0.0231 | |||

| US68403FAE60 / Option One Mortgage Loan Trust 2007-4 | 0.14 | -0.71 | 0.0231 | -0.0014 | ||

| US797440BY99 / SAN DIEGO GAS & ELECTRIC CO | 0.13 | -1.47 | 0.0222 | -0.0014 | ||

| US17309QAF19 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2006 WFH3 M2 | 0.13 | -28.49 | 0.0221 | -0.0102 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A2A 144A / ABS-O (US17331QAB23) | 0.12 | -57.53 | 0.0206 | -0.0301 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A2A 144A / ABS-O (US17331QAB23) | 0.12 | -57.53 | 0.0206 | -0.0301 | ||

| US41162GAA04 / HarborView Mortgage Loan Trust 2006-11 | 0.12 | -0.81 | 0.0204 | -0.0013 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.12 | 0.0200 | 0.0200 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.12 | 0.0200 | 0.0200 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.12 | 0.0200 | 0.0200 | |||

| BOUGHT PEN SOLD USD 20250703 / DFE (000000000) | 0.12 | 0.0199 | 0.0199 | |||

| US456606FA54 / INDYMAC HOME EQUITY LOAN ASSET INHEL 2004 B M1 | 0.11 | -3.64 | 0.0176 | -0.0016 | ||

| RFR USD SOFR/3.50000 12/20/23-10Y CME / DIR (EZ4G8FZQ8LF2) | 0.11 | -34.78 | 0.0174 | -0.0106 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0.10 | -1.00 | 0.0164 | -0.0010 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0.10 | -1.00 | 0.0164 | -0.0010 | ||

| US933637AE07 / WAMU MORTGAGE PASS THROUGH CER WAMU 2006 AR18 2A3 | 0.10 | -6.73 | 0.0161 | -0.0019 | ||

| US83162CSG95 / Small Business Administration Participation Certs | 0.10 | 0.00 | 0.0160 | -0.0008 | ||

| US694308HW04 / PACIFIC GAS + ELECTRIC SR UNSECURED 12/27 3.3 | 0.10 | 1.05 | 0.0160 | -0.0007 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.10 | 0.0157 | 0.0157 | |||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0.09 | 0.0149 | 0.0149 | |||

| RFR USD SOFR/4.0535* 09/02/25-27Y* LCH / DIR (EZRQXB0T6JR0) | 0.09 | 0.0147 | 0.0147 | |||

| RFR USD SOFR/4.0535* 09/02/25-27Y* LCH / DIR (EZRQXB0T6JR0) | 0.09 | 0.0147 | 0.0147 | |||

| 952NPL005 / CREDIT SUISSE GROUP AG COCO JR SUB 144A | 0.09 | 0.00 | 0.0143 | -0.0007 | ||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0.09 | 0.0142 | 0.0142 | |||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0.09 | 0.0142 | 0.0142 | |||

| US3138EGE266 / FNMA POOL AL0152 FN 06/40 FIXED VAR | 0.08 | -2.33 | 0.0139 | -0.0011 | ||

| US12669WAA45 / Countrywide Asset-Backed Certificates | 0.08 | -2.35 | 0.0138 | -0.0011 | ||

| US07386HXZ99 / BEAR STEARNS ALT A TRUST BALTA 2005 9 21A1 | 0.08 | -1.27 | 0.0130 | -0.0008 | ||

| BOUGHT TWD SOLD USD 20250709 / DFE (000000000) | 0.08 | 0.0130 | 0.0130 | |||

| BOUGHT TWD SOLD USD 20250709 / DFE (000000000) | 0.08 | 0.0130 | 0.0130 | |||

| RFR USD SOFR/3.84199 12/02/24-4Y* LCH / DIR (EZSGM4VHBMV4) | 0.08 | 105.41 | 0.0126 | 0.0061 | ||

| RFR USD SOFR/3.84199 12/02/24-4Y* LCH / DIR (EZSGM4VHBMV4) | 0.08 | 105.41 | 0.0126 | 0.0061 | ||

| US88339FAA12 / Theorem Funding Trust 2022-2 | 0.08 | -67.93 | 0.0126 | -0.0287 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.07 | 0.0122 | 0.0122 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.07 | 0.0117 | 0.0117 | |||

| RFR USD SOFR/3.50000 12/20/23-7Y CME / DIR (EZPR4RDSDSJ6) | 0.07 | -78.96 | 0.0115 | -0.0455 | ||

| RFR USD SOFR/3.50000 12/20/23-7Y CME / DIR (EZPR4RDSDSJ6) | 0.07 | -78.96 | 0.0115 | -0.0455 | ||

| US31413UKP39 / FANNIE MAE POOL UMBS P#955802 6.00000000 | 0.05 | -1.85 | 0.0088 | -0.0006 | ||

| BOUGHT PEN SOLD USD 20251031 / DFE (000000000) | 0.05 | 0.0085 | 0.0085 | |||

| BOUGHT PEN SOLD USD 20251031 / DFE (000000000) | 0.05 | 0.0085 | 0.0085 | |||

| US76113AAH41 / RESIDENTIAL ASSET SECURITIES C RASC 2006 KS1 M2 | 0.05 | -25.00 | 0.0085 | -0.0034 | ||

| US83162CRY11 / United States Small Business Administration | 0.05 | -1.96 | 0.0084 | -0.0005 | ||

| US17312GAA94 / Citigroup Mortgage Loan Trust Series 2007 AHL3 | 0.05 | 0.00 | 0.0081 | -0.0005 | ||

| ZCS BRL 13.3537 05/12/25-01/02/29 CME / DIR (EZSPJ72GL6V3) | 0.05 | 0.0081 | 0.0081 | |||

| US23292HAB78 / DLLAA 2023-1 LLC | 0.05 | -68.21 | 0.0080 | -0.0184 | ||

| US31410KBF03 / FNMA POOL 889338 FN 12/37 FIXED VAR | 0.05 | -4.08 | 0.0078 | -0.0008 | ||

| US949789AA94 / Wells Fargo Mortgage Backed Securities 2006-AR19 Trust | 0.05 | -2.13 | 0.0077 | -0.0006 | ||

| US3138EKW351 / Fannie Mae Pool | 0.05 | -4.17 | 0.0077 | -0.0006 | ||

| US93362FAJ21 / WAMU MORTGAGE PASS THROUGH CER WAMU 2006 AR8 3A1 | 0.05 | 0.00 | 0.0076 | -0.0004 | ||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.04 | 0.0071 | 0.0071 | |||

| US863579PM41 / Structured Adjustable Rate Mortgage Loan Trust | 0.04 | -2.50 | 0.0065 | -0.0004 | ||

| US ULTRA BOND CBT SEP25 XCBT 20250919 / DIR (000000000) | 0.04 | 0.0065 | 0.0065 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.04 | 0.0065 | 0.0065 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.04 | 0.0064 | 0.0064 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.04 | 0.0064 | 0.0064 | |||

| US31413TJV52 / FNMA POOL 954876 FN 11/37 FIXED 6 | 0.04 | 0.00 | 0.0062 | -0.0004 | ||

| 952NPH004 / CREDIT SUISSE GROUP AG COCO JR SUB 144A | 0.04 | 0.00 | 0.0059 | -0.0003 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.04 | 0.0058 | 0.0058 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.04 | 0.0058 | 0.0058 | |||

| US17307G3C01 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2006 AR1 2A1 | 0.03 | -8.11 | 0.0056 | -0.0009 | ||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0.03 | 0.0055 | 0.0055 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0.03 | 0.0055 | 0.0055 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.03 | 0.0054 | 0.0054 | |||

| US59020UH324 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2005 A7 2A1 | 0.03 | 0.00 | 0.0050 | -0.0003 | ||

| US36297AZ551 / GNMA POOL 706464 GN 12/38 FIXED 6 | 0.03 | 0.00 | 0.0047 | -0.0003 | ||

| CDX IG36 5Y ICE / DCR (EZ4XF9Q05P43) | 0.03 | -12.90 | 0.0045 | -0.0009 | ||

| CDX IG36 5Y ICE / DCR (EZ4XF9Q05P43) | 0.03 | -12.90 | 0.0045 | -0.0009 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.03 | 0.0045 | 0.0045 | |||

| US02150PAB40 / Alternative Loan Trust 2007-OA6 | 0.03 | 0.00 | 0.0045 | -0.0003 | ||

| US055682AC21 / BNC MORTGAGE LOAN TRUST BNCMT 2006 1 A3 | 0.03 | -67.09 | 0.0044 | -0.0093 | ||

| EZY2QJ3Z39M5 / CDX IG40 5Y ICE | 0.03 | 8.33 | 0.0044 | 0.0002 | ||

| US31413LTD19 / FNMA POOL 948848 FN 08/37 FIXED 6 | 0.03 | -3.70 | 0.0044 | -0.0004 | ||

| ZCS BRL 13.2914 05/08/25-01/02/29 CME / DIR (EZYLW2ZWVNG8) | 0.03 | 0.0044 | 0.0044 | |||

| ZCS BRL 13.2914 05/08/25-01/02/29 CME / DIR (EZYLW2ZWVNG8) | 0.03 | 0.0044 | 0.0044 | |||

| ZCS BRL 13.2914 05/08/25-01/02/29 CME / DIR (EZYLW2ZWVNG8) | 0.03 | 0.0044 | 0.0044 | |||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0.03 | 0.0042 | 0.0042 | |||

| US35729QAC24 / Fremont Home Loan Trust 2006-B | 0.02 | -4.00 | 0.0041 | -0.0003 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.02 | 0.0039 | 0.0039 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0039 | 0.0039 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0.02 | 0.0038 | 0.0038 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0.02 | 0.0038 | 0.0038 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0.02 | 0.0038 | 0.0038 | |||

| RFR USD SOFR/4.09000 01/22/25-10Y LCH / DIR (EZFR659WJHH9) | 0.02 | 27.78 | 0.0038 | 0.0006 | ||

| RFR USD SOFR/4.09000 01/22/25-10Y LCH / DIR (EZFR659WJHH9) | 0.02 | 27.78 | 0.0038 | 0.0006 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0038 | 0.0038 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.02 | 0.0038 | 0.0038 | |||

| US31394FAF27 / FANNIE MAE FNR 2005 75 AF | 0.02 | -8.70 | 0.0036 | -0.0005 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.02 | 0.0035 | 0.0035 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.02 | 0.0034 | 0.0034 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.02 | 0.0034 | 0.0034 | |||

| US93363TAB89 / WaMu Mortgage Pass-Through Certificates Series 2006-AR11 Trust | 0.02 | 0.00 | 0.0033 | -0.0002 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.02 | 0.0032 | 0.0032 | |||

| EZBXJKS0JJY3 / BRITISH TELECOMMUNICATIONS PL SNR SE ICE | 0.02 | 6.25 | 0.0029 | 0.0001 | ||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0.02 | 0.0027 | 0.0027 | |||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0.02 | 0.0027 | 0.0027 | |||

| BOUGHT TRY SOLD USD 20250729 / DFE (000000000) | 0.02 | 0.0026 | 0.0026 | |||

| BOUGHT TRY SOLD USD 20250729 / DFE (000000000) | 0.02 | 0.0026 | 0.0026 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.01 | 0.0024 | 0.0024 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.01 | 0.0024 | 0.0024 | |||

| US93363RAB24 / WaMu Mortgage Pass-Through Certificates Series 2006-AR13 Trust | 0.01 | 0.00 | 0.0024 | -0.0001 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.01 | 0.0023 | 0.0023 | |||

| GOLDMAN SACHS GROUP INC SNR S* ICE / DCR (EZC75LZ075F3) | 0.01 | 0.0023 | 0.0023 | |||

| GOLDMAN SACHS GROUP INC SNR S* ICE / DCR (EZC75LZ075F3) | 0.01 | 0.0023 | 0.0023 | |||

| CDX EM34 ICE / DCR (EZS59H4VYXZ5) | 0.01 | 333.33 | 0.0022 | 0.0016 | ||

| CDX EM34 ICE / DCR (EZS59H4VYXZ5) | 0.01 | 333.33 | 0.0022 | 0.0016 | ||

| EZZVSNMRWDZ0 / GENERAL ELECTRIC COMPANY SNR S* ICE | 0.01 | -20.00 | 0.0021 | -0.0007 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.01 | 0.0021 | 0.0021 | |||

| RFR GBP SONIO/4.32000 10/20/23-10Y LCH / DIR (EZ49Z4HPK8R0) | 0.01 | 120.00 | 0.0020 | 0.0011 | ||

| RFR GBP SONIO/4.32000 10/20/23-10Y LCH / DIR (EZ49Z4HPK8R0) | 0.01 | 120.00 | 0.0020 | 0.0011 | ||

| RFR USD SOFR/3.93300 01/06/25-10Y LCH / DIR (EZK6LHB5L486) | 0.01 | 57.14 | 0.0019 | 0.0006 | ||

| RFR USD SOFR/3.93300 01/06/25-10Y LCH / DIR (EZK6LHB5L486) | 0.01 | 57.14 | 0.0019 | 0.0006 | ||

| US31410GGE70 / FNMA POOL 888597 FN 07/37 FIXED VAR | 0.01 | -15.38 | 0.0019 | -0.0004 | ||

| RFR USD SOFR/3.86000 11/14/24-10Y LCH / DIR (EZCMSCQLNL34) | 0.01 | 120.00 | 0.0019 | 0.0009 | ||

| RFR USD SOFR/3.86000 11/14/24-10Y LCH / DIR (EZCMSCQLNL34) | 0.01 | 120.00 | 0.0019 | 0.0009 | ||

| INF SWAP US IT 2.58125 05/16/25-5Y LCH / DIR (EZ4DL37DCX93) | 0.01 | 0.0019 | 0.0019 | |||

| INF SWAP US IT 2.58125 05/16/25-5Y LCH / DIR (EZ4DL37DCX93) | 0.01 | 0.0019 | 0.0019 | |||

| US31413NVK89 / FNMA POOL 950718 FN 10/37 FIXED 6 | 0.01 | -8.33 | 0.0018 | -0.0002 | ||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0018 | 0.0018 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0018 | 0.0018 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0018 | 0.0018 | |||

| US31376KTB25 / FNMA POOL 357946 FN 09/35 FIXED 6 | 0.01 | 0.00 | 0.0018 | -0.0001 | ||

| RFR USD SOFR/3.88000 01/13/25-10Y LCH / DIR (EZB2C5X6RDC5) | 0.01 | 66.67 | 0.0017 | 0.0007 | ||

| RFR USD SOFR/3.88000 01/13/25-10Y LCH / DIR (EZB2C5X6RDC5) | 0.01 | 66.67 | 0.0017 | 0.0007 | ||

| RFR USD SOFR/4.10000 01/21/25-10Y LCH / DIR (EZ7J947QTC64) | 0.01 | 25.00 | 0.0017 | 0.0003 | ||

| RFR USD SOFR/4.10000 01/21/25-10Y LCH / DIR (EZ7J947QTC64) | 0.01 | 25.00 | 0.0017 | 0.0003 | ||

| RFR USD SOFR/3.90000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0.01 | 400.00 | 0.0017 | 0.0012 | ||

| US31397KZG92 / FREDDIE MAC FHR 3376 FD | 0.01 | -10.00 | 0.0016 | -0.0002 | ||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0016 | 0.0016 | |||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0016 | 0.0016 | |||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0016 | 0.0016 | |||

| US126694JR04 / CHL Mortgage Pass-Through Trust, Series 2005-24, Class A1 | 0.01 | 0.00 | 0.0016 | -0.0001 | ||

| EZGYTWKCT097 / CDX IG37 5Y ICE | 0.01 | -10.00 | 0.0016 | -0.0002 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.01 | 0.0014 | 0.0014 | |||

| US31396WLX29 / Fannie Mae REMICS | 0.01 | 0.00 | 0.0014 | -0.0001 | ||

| US46628KAT79 / JP Morgan Mortgage Trust, Series 2006-A3, Class 6A1 | 0.01 | 0.00 | 0.0014 | -0.0001 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0014 | 0.0014 | |||

| US46629QAW69 / J.P. Morgan Mortgage Acquisition Trust 2006-Ch2 | 0.01 | -11.11 | 0.0013 | -0.0003 | ||

| BOUGHT PEN SOLD USD 20250730 / DFE (000000000) | 0.01 | 0.0013 | 0.0013 | |||

| BOUGHT PEN SOLD USD 20250730 / DFE (000000000) | 0.01 | 0.0013 | 0.0013 | |||

| US23245PAA93 / ALTERNATIVE LOAN TRUST 2006-OA22 | 0.01 | -12.50 | 0.0013 | -0.0001 | ||

| RFR USD SOFR/4.01500 12/30/24-10Y LCH / DIR (EZVY5NK4YWD2) | 0.01 | 40.00 | 0.0013 | 0.0003 | ||

| RFR USD SOFR/3.86600 11/14/24-10Y LCH / DIR (EZCMSCQLNL34) | 0.01 | 40.00 | 0.0013 | 0.0003 | ||

| RFR USD SOFR/3.86600 11/14/24-10Y LCH / DIR (EZCMSCQLNL34) | 0.01 | 40.00 | 0.0013 | 0.0003 | ||

| US31411EUF23 / FNMA POOL 906082 FN 01/37 FIXED 6 | 0.01 | -12.50 | 0.0013 | -0.0001 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.01 | 0.0013 | 0.0013 | |||

| TRT061124T11 / Turkey Government Bond | 0.01 | 0.00 | 0.0012 | -0.0001 | ||

| TRT061124T11 / Turkey Government Bond | 0.01 | 0.00 | 0.0012 | -0.0001 | ||

| TRT061124T11 / Turkey Government Bond | 0.01 | 0.00 | 0.0012 | -0.0001 | ||

| TRT061124T11 / Turkey Government Bond | 0.01 | 0.00 | 0.0012 | -0.0001 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.01 | 0.0012 | 0.0012 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.01 | 0.0012 | 0.0012 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.01 | 0.0012 | 0.0012 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.01 | 0.0012 | 0.0012 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0.01 | 0.0012 | 0.0012 | |||

| US933638AB41 / WaMu Mortgage Pass-Through Certificates Series 2006-AR19 Trust | 0.01 | 0.00 | 0.0012 | -0.0001 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.01 | 0.0012 | 0.0012 | |||

| RFR USD SOFR/3.79250 11/19/24-10Y LCH / DIR (EZVRNR667250) | 0.01 | 0.0012 | 0.0011 | |||

| RFR USD SOFR/3.79250 11/19/24-10Y LCH / DIR (EZVRNR667250) | 0.01 | 0.0012 | 0.0011 | |||

| EZGB6C4Y7HX0 / CDX HY40 5Y ICE | 0.01 | 20.00 | 0.0011 | 0.0001 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0.01 | 0.0011 | 0.0011 | |||

| US31414G6Q73 / FNMA POOL 966279 FN 12/37 FIXED 6 | 0.01 | 0.00 | 0.0011 | -0.0001 | ||

| RFR USD SOFR/3.89600 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0.01 | 200.00 | 0.0011 | 0.0006 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.01 | 0.0011 | 0.0011 | |||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0.01 | 0.0010 | 0.0010 | |||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0.01 | 0.0010 | 0.0010 | |||

| US17307GWE42 / Citigroup Mortgage Loan Trust Inc | 0.01 | 0.00 | 0.0010 | -0.0002 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.01 | 0.0010 | 0.0010 | |||

| EZG3MM4J6J03 / CDX IG38 5Y ICE | 0.01 | 0.00 | 0.0010 | -0.0001 | ||

| PEMEX LCDS SP DUB / DCR (000000000) | 0.01 | 0.0010 | 0.0010 | |||

| PEMEX LCDS SP DUB / DCR (000000000) | 0.01 | 0.0010 | 0.0010 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0010 | 0.0010 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0010 | 0.0010 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0010 | 0.0010 | |||

| BOUGHT KRW SOLD USD 20250710 / DFE (000000000) | 0.01 | 0.0010 | 0.0010 | |||

| RFR USD SOFR/3.84000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0.01 | 150.00 | 0.0010 | 0.0005 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.01 | 0.0010 | 0.0010 | |||

| IRS EUR 2.40000 02/12/25-10Y LCH / DIR (EZNHC24BF987) | 0.01 | -28.57 | 0.0009 | -0.0003 | ||

| IRS EUR 2.40000 02/12/25-10Y LCH / DIR (EZNHC24BF987) | 0.01 | -28.57 | 0.0009 | -0.0003 | ||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0009 | 0.0009 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0009 | 0.0009 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.01 | 0.0009 | 0.0009 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.01 | 0.0009 | 0.0009 | |||

| EZLWQ22MVSP2 / CDX IG39 5Y ICE | 0.01 | 0.00 | 0.0009 | -0.0000 | ||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.01 | 0.0008 | 0.0008 | |||

| RFR USD SOFR/3.89000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0.00 | 100.00 | 0.0008 | 0.0003 | ||

| RFR USD SOFR/3.89000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0.00 | 100.00 | 0.0008 | 0.0003 | ||

| RFR GBP SONIO/3.70000 03/28/24-10Y LCH / DIR (EZFCF73KNS79) | 0.00 | -50.00 | 0.0008 | -0.0006 | ||

| RFR USD SOFR/3.75000 05/07/25-10Y LCH / DIR (EZ61ZS50J0P1) | 0.00 | 0.0007 | 0.0007 | |||

| RFR USD SOFR/3.75000 05/07/25-10Y LCH / DIR (EZ61ZS50J0P1) | 0.00 | 0.0007 | 0.0007 | |||

| US466247ZP16 / J.P. Morgan Mortgage Trust 2005-A1 | 0.00 | 0.00 | 0.0007 | -0.0000 | ||

| CDX IG35 5Y ICE / DCR (EZ5S2GTXSW84) | 0.00 | -20.00 | 0.0007 | -0.0003 | ||

| US31396WTU08 / Fannie Mae REMICS | 0.00 | -25.00 | 0.0007 | -0.0001 | ||

| RFR USD SOFR/3.86500 11/20/24-10Y LCH / DIR (EZZQZ45304B1) | 0.00 | 50.00 | 0.0007 | 0.0003 | ||

| RFR USD SOFR/3.86500 11/20/24-10Y LCH / DIR (EZZQZ45304B1) | 0.00 | 50.00 | 0.0007 | 0.0003 | ||

| US31386TNA96 / FNMA POOL 572885 FN 04/31 FIXED 7.5 | 0.00 | 0.00 | 0.0006 | -0.0001 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0006 | 0.0006 | |||

| VOLKSWAGEN INTERNATIONAL FINA SNR SE ICE / DCR (EZ7728G77FY7) | 0.00 | 0.0006 | 0.0006 | |||

| VOLKSWAGEN INTERNATIONAL FINA SNR SE ICE / DCR (EZ7728G77FY7) | 0.00 | 0.0006 | 0.0006 | |||

| US83162CRL99 / United States Small Business Administration | 0.00 | -25.00 | 0.0006 | -0.0002 | ||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0006 | 0.0006 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0006 | 0.0006 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0006 | 0.0006 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0006 | 0.0006 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| RFR USD SOFR/3.98235 12/02/24-2Y* LCH / DIR (EZ1P2MZR4KH2) | 0.00 | -50.00 | 0.0005 | -0.0006 | ||

| RFR USD SOFR/3.98235 12/02/24-2Y* LCH / DIR (EZ1P2MZR4KH2) | 0.00 | -50.00 | 0.0005 | -0.0006 | ||

| US31415WZZ93 / Fannie Mae Pool | 0.00 | 0.00 | 0.0005 | -0.0001 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | |||

| US1248RHAA57 / Credit-Based Asset Servicing and Securitization LL | 0.00 | -33.33 | 0.0005 | -0.0000 | ||

| US12668BDE02 / Alternative Loan Trust, Series 2005-76, Class 2A1 | 0.00 | -33.33 | 0.0005 | -0.0000 | ||

| IRS EUR 2.45000 05/05/25-10Y LCH / DIR (EZCDFQCSBVM0) | 0.00 | 0.0005 | 0.0005 | |||

| EZW8XKN63668 / GENERAL ELECTRIC COMPANY SNR S* ICE | 0.00 | -33.33 | 0.0004 | -0.0001 | ||

| BOUGHT TRY SOLD USD 20250724 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| BOUGHT TRY SOLD USD 20250724 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| US31410GRM77 / UMBS, 30 Year | 0.00 | 0.00 | 0.0004 | -0.0000 | ||

| ZCS BRL 13.32 05/08/25-01/02/29 CME / DIR (EZYLW2ZWVNG8) | 0.00 | 0.0004 | 0.0004 | |||

| RFR USD SOFR/3.97000 01/15/25-10Y LCH / DIR (EZZWCBP8MVY9) | 0.00 | -84.62 | 0.0004 | -0.0020 | ||

| RFR USD SOFR/3.97000 01/15/25-10Y LCH / DIR (EZZWCBP8MVY9) | 0.00 | -84.62 | 0.0004 | -0.0020 | ||

| RFR USD SOFR/3.97000 01/15/25-10Y LCH / DIR (EZZWCBP8MVY9) | 0.00 | -84.62 | 0.0004 | -0.0020 | ||

| IRS EUR 2.39000 10/01/24-10Y LCH / DIR (EZHK1QM5FKM1) | 0.00 | -84.62 | 0.0004 | -0.0019 | ||

| IRS EUR 2.39000 10/01/24-10Y LCH / DIR (EZHK1QM5FKM1) | 0.00 | -84.62 | 0.0004 | -0.0019 | ||

| EZG1MXP5KL27 / CDX IG41 5Y ICE | 0.00 | 100.00 | 0.0004 | 0.0000 | ||

| BOUGHT TRY SOLD USD 20251217 / DFE (000000000) | 0.00 | 0.0004 | 0.0004 | |||

| EZF7Y38CZFL5 / CDX EM38 ICE | 0.00 | -150.00 | 0.0003 | 0.0010 | ||

| BOUGHT NZD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | |||

| BOUGHT NZD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | |||

| US31413N2Y00 / FNMA POOL 950891 FN 10/37 FIXED 6 | 0.00 | 0.00 | 0.0003 | -0.0000 | ||

| BARCLAYS BANK PLC SNR SE ICE / DCR (EZB88Z42LS80) | 0.00 | -50.00 | 0.0003 | -0.0001 | ||

| US31292K2G14 / Freddie Mac Gold Pool | 0.00 | 0.00 | 0.0003 | -0.0000 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | |||

| US83611DAA63 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2006 NLC1 A1 144A | 0.00 | 0.00 | 0.0003 | -0.0000 | ||

| US31410PAD50 / FNMA POOL 892904 FN 08/36 FIXED 6 | 0.00 | 0.00 | 0.0003 | -0.0000 | ||

| US31371HYB85 / FNMA 7.50% 10/29 #252806 | 0.00 | 0.00 | 0.0003 | -0.0000 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | |||

| US12669F6Z19 / CWMBS, Inc. | 0.00 | 0.00 | 0.0003 | -0.0000 | ||

| IRS EUR 2.53000 04/23/25-10Y LCH / DIR (EZP376MT1B98) | 0.00 | 0.0003 | 0.0003 | |||

| IRS EUR 2.53000 04/23/25-10Y LCH / DIR (EZP376MT1B98) | 0.00 | 0.0003 | 0.0003 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| US173145AA17 / Citigroup Mortgage Loan Trust 2008-RR1 | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| IRS EUR 2.52000 04/09/25-10Y LCH / DIR (EZTHL4ZCB733) | 0.00 | 0.0002 | 0.0002 | |||

| IRS EUR 2.52000 04/09/25-10Y LCH / DIR (EZTHL4ZCB733) | 0.00 | 0.0002 | 0.0002 | |||

| RFR USD SOFR/3.23200 09/10/24-10Y LCH / DIR (EZ7VRSSQ00Z9) | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| RFR USD SOFR/3.23200 09/10/24-10Y LCH / DIR (EZ7VRSSQ00Z9) | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| US3138A2NX38 / Fannie Mae Pool | 0.00 | 0.00 | 0.0002 | -0.0001 | ||

| US31409CZS78 / FNMA POOL 867553 FN 02/36 FIXED 6 | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| US31409XTB54 / FNMA POOL 881746 FN 04/36 FIXED 6 | 0.00 | 0.00 | 0.0002 | -0.0000 | ||

| RFR USD SOFR/3.59500 08/19/24-10Y LCH / DIR (EZN7CQ0TS3K8) | 0.00 | 0.00 | 0.0002 | -0.0001 | ||

| RFR USD SOFR/3.59500 08/19/24-10Y LCH / DIR (EZN7CQ0TS3K8) | 0.00 | 0.00 | 0.0002 | -0.0001 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| IRS EUR 2.55000 04/16/25-10Y LCH / DIR (EZ15F0SX71M6) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | |||

| US61749KAB98 / Morgan Stanley ABS Capital I Inc Trust 2006-WMC2 | 0.00 | 0.0002 | -0.0000 | |||

| US362341XG98 / GSR Mortgage Loan Trust 2005-AR7 | 0.00 | 0.0001 | -0.0000 | |||

| US31387DNE57 / Fannie Mae Pool | 0.00 | 0.0001 | -0.0000 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT TRY SOLD USD 20250701 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT TRY SOLD USD 20250701 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| IRS EUR 2.61000 03/24/25-10Y LCH / DIR (EZPS73SKDR02) | 0.00 | -100.00 | 0.0001 | 0.0003 | ||

| IRS EUR 2.61000 03/24/25-10Y LCH / DIR (EZPS73SKDR02) | 0.00 | -100.00 | 0.0001 | 0.0003 | ||

| US3138A7W536 / Fannie Mae Pool | 0.00 | -100.00 | 0.0001 | -0.0001 | ||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| BNP PARIBAS SNR SE ICE / DCR (EZ7F30D5N508) | 0.00 | 0.0001 | -0.0000 | |||

| BNP PARIBAS SNR SE ICE / DCR (EZ7F30D5N508) | 0.00 | 0.0001 | -0.0000 | |||

| EZYP3FB7TK33 / CDX EM35 ICE | 0.00 | 0.0001 | 0.0000 | |||

| US31384HQH92 / FNMA 7.50% 12/29 #524356 | 0.00 | 0.0001 | -0.0000 | |||

| US31389ERT46 / FNMA POOL 623398 FN 01/32 FIXED 7.5 | 0.00 | 0.0001 | -0.0000 | |||

| BOUGHT PEN SOLD USD 20250825 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| US466247LZ44 / JP MORGAN MORTGAGE TRUST 2005-A1 SER 2005-A1 CL 6T1 V/R REGD 4.64499200 | 0.00 | 0.0001 | -0.0000 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | |||

| SOLD HKD BOUGHT USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| SOLD HKD BOUGHT USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT TRY SOLD USD 20250807 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT TRY SOLD USD 20250807 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| US12669GHG91 / COUNTRYWIDE HOME LOANS CWHL 2004 HYB9 1A1 | 0.00 | 0.0000 | -0.0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT PEN SOLD USD 20250707 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| US31386T6B65 / FNMA POOL 573366 FN 04/31 FIXED 7.5 | 0.00 | 0.0000 | -0.0000 | |||

| BOUGHT DKK SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT DKK SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT KRW SOLD USD 20250708 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT KRW SOLD USD 20250708 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| US31385HX989 / FNMA 7.50% 11/31 #545304 | 0.00 | 0.0000 | -0.0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| US36829JAA97 / GE WMC MORTGAGE SECURITIES LLC GEWMC 2006 1 A2A | 0.00 | 0.0000 | -0.0000 | |||

| BOUGHT NOK SOLD USD 20250702 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| US31371HNH74 / FNMA 7.50% 5/29 #252492 | 0.00 | 0.0000 | -0.0000 | |||

| US31382UET97 / FNMA POOL 492546 FN 02/28 FIXED 7.5 | 0.00 | 0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| EZ6N5RTF6TW5 / CDX EM39 ICE | 0.00 | 0.0000 | 0.0001 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| SOLD SEK BOUGHT USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| SOLD SEK BOUGHT USD 20250804 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| 317U7ICA1 PIMCO SWAPTION 6.05 PUT USD 20251030 / DIR (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| 317U7ICA1 PIMCO SWAPTION 6.05 PUT USD 20251030 / DIR (000000000) | 0.00 | 0.0000 | 0.0000 | |||

| WMT / Walmart Inc. | 0.00 | -100.00 | -0.0111 | |||

| V / Visa Inc. | 0.00 | -100.00 | -0.0441 | |||

| CRM / Salesforce, Inc. | 0.00 | -100.00 | -0.0338 | |||

| BOUGHT SEK SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT SEK SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 31750QMB2 PIMCO CDSOPT PUT USD 0.9 20250716 / DCR (EZ967XY50V92) | -0.00 | -100.00 | -0.0000 | 0.0003 | ||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| 31750QMA4 PIMCO CDSOPT PUT USD 1.0 20250716 / DCR (EZ967XY50V92) | -0.00 | -100.00 | -0.0000 | 0.0003 | ||

| 31750QN05 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | -0.00 | -100.00 | -0.0000 | 0.0003 | ||

| 31750QN05 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | -0.00 | -100.00 | -0.0000 | 0.0003 | ||

| 31750QN05 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | -0.00 | -100.00 | -0.0000 | 0.0003 | ||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD NOK BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD NOK BOUGHT USD 20250804 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| INF SWAP US IT 2.5025 03/25/25-5Y LCH / DIR (EZCD1478Q5K2) | -0.00 | -0.0000 | -0.0001 | |||

| INF SWAP US IT 2.5025 03/25/25-5Y LCH / DIR (EZCD1478Q5K2) | -0.00 | -0.0000 | -0.0001 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD TWD BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD TRY BOUGHT USD 20250729 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD TRY BOUGHT USD 20250729 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD TRY BOUGHT USD 20250728 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD TRY BOUGHT USD 20250728 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD TRY BOUGHT USD 20250717 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | |||

| SOLD TRY BOUGHT USD 20250701 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD TRY BOUGHT USD 20250701 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD KRW BOUGHT USD 20250714 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOFTBANK GROUP CORP SNR JP SP GST / DCR (EZ1K1NTX2WN0) | -0.00 | -0.0001 | -0.0000 | |||

| SOFTBANK GROUP CORP SNR JP SP GST / DCR (EZ1K1NTX2WN0) | -0.00 | -0.0001 | -0.0000 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD KRW BOUGHT USD 20250708 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD KRW BOUGHT USD 20250708 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD NOK BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD NOK BOUGHT USD 20250702 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| IRS EUR 2.28000 03/04/25-5Y LCH / DIR (EZQH3P2675Q7) | -0.00 | -100.00 | -0.0001 | -0.0006 | ||

| IRS EUR 2.28000 03/04/25-5Y LCH / DIR (EZQH3P2675Q7) | -0.00 | -100.00 | -0.0001 | -0.0006 | ||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD ILS BOUGHT USD 20250709 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||

| SOLD ILS BOUGHT USD 20250709 / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | |||