Statistik Asas

| Nilai Portfolio | $ 687,938,614 |

| Kedudukan Semasa | 57 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

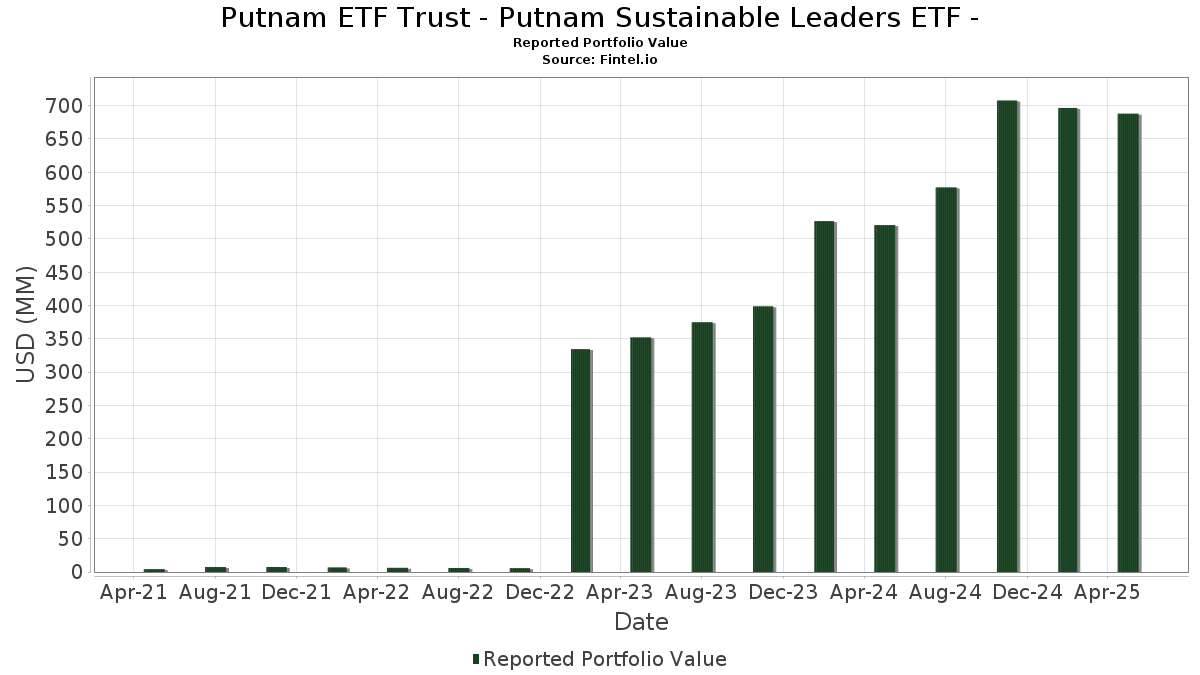

Putnam ETF Trust - Putnam Sustainable Leaders ETF - telah mendedahkan 57 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 687,938,614 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Putnam ETF Trust - Putnam Sustainable Leaders ETF - ialah Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , NVIDIA Corporation (US:NVDA) , and Broadcom Inc. (US:AVGO) . Kedudukan baharu Putnam ETF Trust - Putnam Sustainable Leaders ETF - termasuk Republic Services, Inc. (DE:RPU) , Keurig Dr Pepper Inc. (US:KDP) , Costco Wholesale Corporation (US:COST) , D.R. Horton, Inc. (US:DHI) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 11.28 | 1.6382 | 1.6382 | |

| 0.20 | 41.08 | 5.9685 | 1.5546 | |

| 0.13 | 61.45 | 8.9271 | 1.2982 | |

| 22.69 | 22.69 | 3.2963 | 1.1597 | |

| 0.19 | 6.43 | 0.9335 | 0.9335 | |

| 0.01 | 5.37 | 0.7808 | 0.7808 | |

| 0.10 | 24.24 | 3.5215 | 0.7508 | |

| 0.04 | 5.11 | 0.7422 | 0.7422 | |

| 0.05 | 14.27 | 2.0736 | 0.7026 | |

| 0.21 | 13.65 | 1.9832 | 0.5589 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.25 | 49.84 | 7.2408 | -2.1926 | |

| 0.00 | 0.00 | -1.6835 | ||

| 0.08 | 5.80 | 0.8428 | -1.0052 | |

| 0.06 | 5.55 | 0.8057 | -0.7932 | |

| 0.28 | 12.33 | 1.7917 | -0.6518 | |

| 0.02 | 13.44 | 1.9532 | -0.5904 | |

| 0.02 | 6.92 | 1.0054 | -0.4952 | |

| 0.04 | 5.27 | 0.7659 | -0.4694 | |

| 0.08 | 4.06 | 0.5893 | -0.4160 | |

| 0.00 | 0.00 | -0.4095 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-07-09 untuk tempoh pelaporan 2025-05-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.13 | -0.35 | 61.45 | 15.56 | 8.9271 | 1.2982 | |||

| AAPL / Apple Inc. | 0.25 | -8.73 | 49.84 | -24.20 | 7.2408 | -2.1926 | |||

| AMZN / Amazon.com, Inc. | 0.20 | 38.27 | 41.08 | 33.53 | 5.9685 | 1.5546 | |||

| NVDA / NVIDIA Corporation | 0.27 | -10.26 | 36.50 | -2.93 | 5.3027 | -0.0916 | |||

| AVGO / Broadcom Inc. | 0.10 | 3.40 | 24.24 | 25.51 | 3.5215 | 0.7508 | |||

| US74680A8696 / SHORT TERM INV FUND | 22.69 | 52.35 | 22.69 | 52.35 | 3.2963 | 1.1597 | |||

| JPM / JPMorgan Chase & Co. | 0.07 | 16.10 | 19.59 | 15.81 | 2.8461 | 0.4193 | |||

| MA / Mastercard Incorporated | 0.03 | 3.55 | 18.98 | 5.22 | 2.7574 | 0.1695 | |||

| WMT / Walmart Inc. | 0.17 | 5.08 | 16.37 | 5.19 | 2.3790 | 0.1457 | |||

| CEG / Constellation Energy Corporation | 0.05 | 22.23 | 14.27 | 49.35 | 2.0736 | 0.7026 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.21 | 21.91 | 13.65 | 37.50 | 1.9832 | 0.5589 | |||

| LLY / Eli Lilly and Company | 0.02 | -5.36 | 13.44 | -24.17 | 1.9532 | -0.5904 | |||

| BSX / Boston Scientific Corporation | 0.12 | -16.58 | 12.79 | -15.40 | 1.8585 | -0.3109 | |||

| ROP / Roper Technologies, Inc. | 0.02 | -10.21 | 12.64 | -12.39 | 1.8369 | -0.2336 | |||

| DIS / The Walt Disney Company | 0.11 | 31.58 | 12.54 | 30.71 | 1.8217 | 0.4453 | |||

| BAC / Bank of America Corporation | 0.28 | -24.36 | 12.33 | -27.59 | 1.7917 | -0.6518 | |||

| CRM / Salesforce, Inc. | 0.05 | 2.26 | 12.25 | -8.89 | 1.7795 | -0.1492 | |||

| HD / The Home Depot, Inc. | 0.03 | -7.51 | 12.03 | -14.11 | 1.7473 | -0.2617 | |||

| NEE / NextEra Energy, Inc. | 0.17 | 18.39 | 11.92 | 19.19 | 1.7318 | 0.2969 | |||

| KR / The Kroger Co. | 0.17 | 36.28 | 11.64 | 43.46 | 1.6916 | 0.5271 | |||

| RPU / Republic Services, Inc. | 0.04 | 11.28 | 1.6382 | 1.6382 | |||||

| HLT / Hilton Worldwide Holdings Inc. | 0.05 | -4.86 | 11.21 | -10.79 | 1.6282 | -0.1741 | |||

| LIN / Linde plc | 0.02 | 40.22 | 10.86 | 40.39 | 1.5771 | 0.4677 | |||

| COF / Capital One Financial Corporation | 0.05 | -18.06 | 10.14 | -22.72 | 1.4728 | -0.4092 | |||

| PLD / Prologis, Inc. | 0.09 | 2.81 | 10.07 | -9.90 | 1.4624 | -0.1404 | |||

| MDT / Medtronic plc | 0.12 | 54.88 | 9.91 | 39.67 | 1.4395 | 0.4216 | |||

| ISRG / Intuitive Surgical, Inc. | 0.02 | -18.12 | 9.69 | -21.09 | 1.4078 | -0.3540 | |||

| BLL / Ball Corp. | 0.18 | 53.58 | 9.64 | 56.18 | 1.4002 | 0.5148 | |||

| IR / Ingersoll Rand Inc. | 0.10 | 7.82 | 8.48 | 3.82 | 1.2322 | 0.0602 | |||

| ACN / Accenture plc | 0.03 | 32.42 | 8.27 | 20.39 | 1.2010 | 0.2158 | |||

| STX / Seagate Technology Holdings plc | 0.07 | -6.50 | 8.06 | 8.20 | 1.1717 | 0.1024 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.16 | 7.73 | 7.97 | -0.04 | 1.1575 | 0.0141 | |||

| NOW / ServiceNow, Inc. | 0.01 | 5.66 | 7.46 | 14.90 | 1.0832 | 0.1523 | |||

| AMT / American Tower Corporation | 0.03 | -7.31 | 7.34 | -4.81 | 1.0667 | -0.0227 | |||

| KKR / KKR & Co. Inc. | 0.06 | 28.18 | 7.26 | 14.83 | 1.0543 | 0.1476 | |||

| AMAT / Applied Materials, Inc. | 0.05 | 32.33 | 7.06 | 31.23 | 1.0250 | 0.2536 | |||

| CDNS / Cadence Design Systems, Inc. | 0.02 | -22.28 | 7.05 | -10.94 | 1.0236 | -0.1112 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.02 | -13.12 | 6.92 | -33.84 | 1.0054 | -0.4952 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.09 | -8.31 | 6.79 | -12.38 | 0.9864 | -0.1253 | |||

| MTD / Mettler-Toledo International Inc. | 0.01 | 2.32 | 6.76 | -7.10 | 0.9827 | -0.0619 | |||

| KDP / Keurig Dr Pepper Inc. | 0.19 | 6.43 | 0.9335 | 0.9335 | |||||

| CRH / CRH plc | 0.07 | -11.52 | 6.36 | -21.33 | 0.9241 | -0.2358 | |||

| CP / Canadian Pacific Kansas City Limited | 0.08 | 58.83 | 6.15 | 66.45 | 0.8932 | 0.3632 | |||

| MRVL / Marvell Technology, Inc. | 0.10 | 97.00 | 5.95 | 29.13 | 0.8649 | 0.2035 | |||

| FTV / Fortive Corporation | 0.08 | -48.97 | 5.80 | -54.96 | 0.8428 | -1.0052 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | 43.25 | 5.55 | 48.86 | 0.8070 | 0.2716 | |||

| OTIS / Otis Worldwide Corporation | 0.06 | -47.93 | 5.55 | -50.24 | 0.8057 | -0.7932 | |||

| MSCI / MSCI Inc. | 0.01 | 139.27 | 5.46 | 128.62 | 0.7938 | 0.4508 | |||

| COST / Costco Wholesale Corporation | 0.01 | 5.37 | 0.7808 | 0.7808 | |||||

| QCOM / QUALCOMM Incorporated | 0.04 | -33.72 | 5.27 | -38.77 | 0.7659 | -0.4694 | |||

| DHI / D.R. Horton, Inc. | 0.04 | 5.11 | 0.7422 | 0.7422 | |||||

| FSV / FirstService Corporation | 0.03 | 9.32 | 4.70 | 8.70 | 0.6828 | 0.0624 | |||

| TPG / TPG Inc. | 0.08 | -33.66 | 4.06 | -42.12 | 0.5893 | -0.4160 | |||

| ONON / On Holding AG | 0.06 | 11.14 | 3.69 | 36.15 | 0.5363 | 0.1473 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.01 | 8.67 | 3.56 | -23.75 | 0.5178 | -0.1528 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.08 | -23.53 | 3.42 | -16.52 | 0.4964 | -0.0909 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.06 | -20.07 | 3.06 | -27.54 | 0.4438 | -0.1612 | |||

| VEEV / Veeva Systems Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4095 | ||||

| TSLA / Tesla, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.6835 |