Statistik Asas

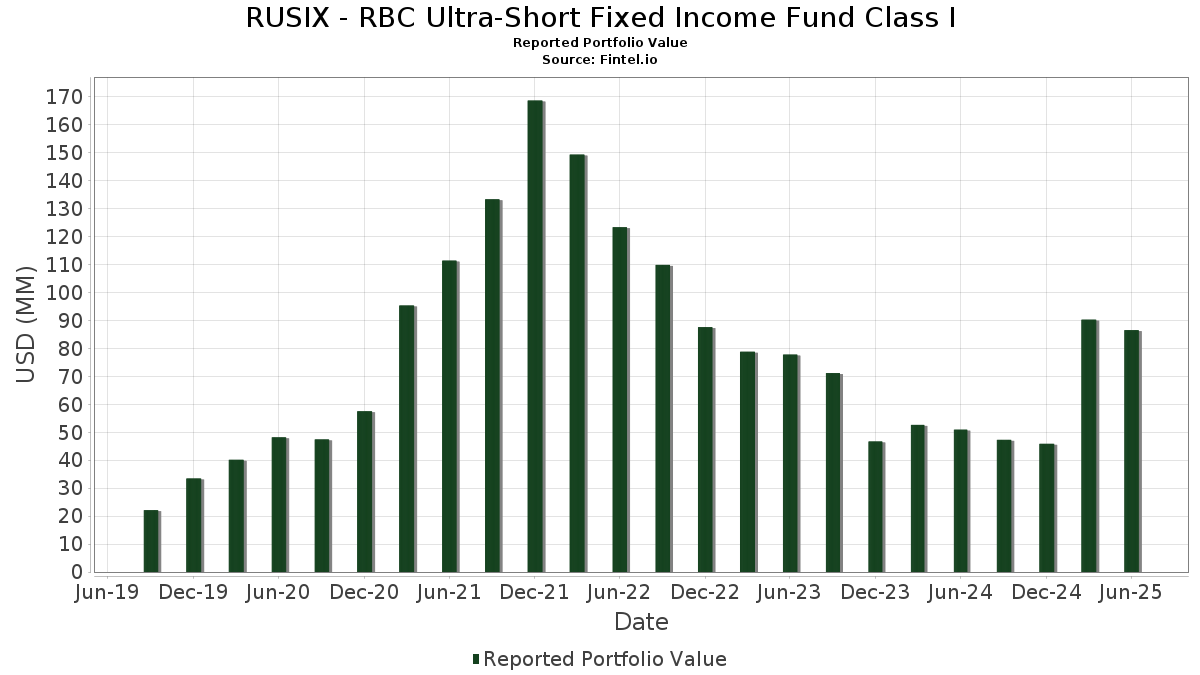

| Nilai Portfolio | $ 86,520,625 |

| Kedudukan Semasa | 151 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

RUSIX - RBC Ultra-Short Fixed Income Fund Class I telah mendedahkan 151 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 86,520,625 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas RUSIX - RBC Ultra-Short Fixed Income Fund Class I ialah Rbc Funds Trust - American Century US Gov Money Market Fund RBC Institutional Cl 1 (US:TUGXX) , Bank of America Corporation (US:US06051GLE79) , Charles Schwab Corp/The (US:US808513BZ79) , WELLS FARGO & COMPANY REGD V/R MTN 3.52600000 (US:US95000U2V48) , and UBS Group AG (CH:US902613AS79) . Kedudukan baharu RUSIX - RBC Ultra-Short Fixed Income Fund Class I termasuk Bank of America Corporation (US:US06051GLE79) , Charles Schwab Corp/The (US:US808513BZ79) , WELLS FARGO & COMPANY REGD V/R MTN 3.52600000 (US:US95000U2V48) , UBS Group AG (CH:US902613AS79) , and Citigroup Inc (US:US172967MZ11) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.50 | 2.8813 | 2.8813 | ||

| 1.99 | 2.2995 | 2.2995 | ||

| 1.75 | 2.0181 | 2.0181 | ||

| 1.75 | 2.0153 | 2.0153 | ||

| 1.00 | 1.1545 | 1.1545 | ||

| 1.00 | 1.1533 | 1.1533 | ||

| 1.00 | 1.1533 | 1.1533 | ||

| 1.00 | 1.1523 | 1.1523 | ||

| 1.00 | 1.1521 | 1.1521 | ||

| 1.00 | 1.1508 | 1.1508 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.15 | 0.1783 | -0.6198 | ||

| 0.21 | 0.2398 | -0.5335 | ||

| 0.25 | 0.2878 | -0.4007 | ||

| 0.26 | 0.2993 | -0.3904 | ||

| 0.22 | 0.2488 | -0.3804 | ||

| 0.09 | 0.1021 | -0.2483 | ||

| 0.21 | 0.2430 | -0.2473 | ||

| 0.58 | 0.6700 | -0.2058 | ||

| 0.08 | 0.0963 | -0.2038 | ||

| 0.32 | 0.3745 | -0.1802 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-25 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| United States Treasury Bill / DBT (US912797PZ47) | 2.50 | 2.8813 | 2.8813 | ||||||

| TUGXX / Rbc Funds Trust - American Century US Gov Money Market Fund RBC Institutional Cl 1 | 2.27 | 48.40 | 2.27 | 48.47 | 2.6223 | 0.9256 | |||

| United States Treasury Bill / DBT (US912797QC43) | 1.99 | 2.2995 | 2.2995 | ||||||

| United States Treasury Bill / DBT (US912797NX17) | 1.75 | 2.0181 | 2.0181 | ||||||

| United States Treasury Bill / DBT (US912797QA86) | 1.75 | 2.0153 | 2.0153 | ||||||

| US06051GLE79 / Bank of America Corporation | 1.50 | -0.07 | 1.7352 | 0.0682 | |||||

| US808513BZ79 / Charles Schwab Corp/The | 1.31 | -0.15 | 1.5157 | 0.0571 | |||||

| US95000U2V48 / WELLS FARGO & COMPANY REGD V/R MTN 3.52600000 | 1.15 | 0.70 | 1.3317 | 0.0622 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 1.00 | -0.10 | 1.1560 | 0.0444 | |||||

| US902613AS79 / UBS Group AG | 1.00 | 0.20 | 1.1555 | 0.0483 | |||||

| Hyundai Capital America / DBT (US44891ADY01) | 1.00 | 1.1545 | 1.1545 | ||||||

| US172967MZ11 / Citigroup Inc | 1.00 | -0.10 | 1.1542 | 0.0450 | |||||

| US53944YAT01 / Lloyds Banking Group PLC | 1.00 | 0.00 | 1.1533 | 0.0465 | |||||

| CENTERPOINT ENERGY INC 0.0 01JUL25 / DBT (000000000) | 1.00 | 1.1533 | 1.1533 | ||||||

| KEURIG DR PEPP 07/01/2025 / DBT (000000000) | 1.00 | 1.1533 | 1.1533 | ||||||

| FISERV INC DIS 07/08/2021 / DBT (US33774KU818) | 1.00 | 1.1523 | 1.1523 | ||||||

| SOUTHERN PWR CO DISC CO 0.0 09JUL25 / DBT (000000000) | 1.00 | 1.1521 | 1.1521 | ||||||

| ALEXANDRIA REAL ESTATE 0.00 18JUL25 / DBT (000000000) | 1.00 | 1.1508 | 1.1508 | ||||||

| ALIMENTATION COUCHE-TA 0.00 18JUL25 / DBT (000000000) | 1.00 | 1.1507 | 1.1507 | ||||||

| US95000U2F97 / Wells Fargo & Co | 0.99 | 0.41 | 1.1395 | 0.0501 | |||||

| US87264ABR59 / T-MOBILE USA INC 2.25% 02/15/2026 | 0.98 | 0.51 | 1.1359 | 0.0507 | |||||

| US26441CAS44 / Duke Energy Corp. | 0.98 | 0.82 | 1.1319 | 0.0532 | |||||

| US04685A2K66 / Athene Global Funding | 0.98 | 0.62 | 1.1299 | 0.0518 | |||||

| US46647PBW59 / JPMorgan Chase & Co | 0.98 | 0.93 | 1.1297 | 0.0546 | |||||

| US61772BAB99 / Morgan Stanley | 0.98 | 0.72 | 1.1257 | 0.0533 | |||||

| US404280CM98 / HSBC Holdings PLC | 0.97 | 0.72 | 1.1229 | 0.0529 | |||||

| US172967NA50 / Citigroup Inc | 0.97 | 0.83 | 1.1208 | 0.0542 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 0.92 | 1.0580 | 1.0580 | ||||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.91 | 1.0467 | 1.0467 | ||||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0.90 | 1.0402 | 1.0402 | ||||||

| Mars Inc / DBT (US571676AW54) | 0.86 | 0.23 | 0.9961 | 0.0416 | |||||

| US37045XDQ60 / General Motors Financial Co., Inc. | 0.86 | -0.35 | 0.9952 | 0.0369 | |||||

| US14317JAH05 / CarMax Auto Owner Trust 2021-4 | 0.86 | 0.82 | 0.9886 | 0.0465 | |||||

| HOMES 2025-AFC2 TRUST / ABS-MBS (US43761YAA29) | 0.84 | 0.9695 | 0.9695 | ||||||

| Amur Equipment Finance Receivables XI LLC / ABS-O (US03236XAD93) | 0.84 | 0.9634 | 0.9634 | ||||||

| US02008NAD93 / ALLY AUTO RECEIVABLES TR 2023-A C 6.08% 01/17/2034 144A | 0.83 | 0.9531 | 0.9531 | ||||||

| US30166AAF12 / EART_21-3A | 0.82 | 0.9431 | 0.9431 | ||||||

| US65535HBE80 / Nomura Holdings Inc | 0.78 | 0.00 | 0.8939 | 0.0351 | |||||

| US30168CAF59 / Exeter Automobile Receivables Trust 2023-2 | 0.76 | 0.39 | 0.8804 | 0.0383 | |||||

| Navistar Financial Dealer Note Master Owner Trust / ABS-O (US63938PBW86) | 0.76 | 141.53 | 0.8720 | 0.1954 | |||||

| US98163HAF64 / World Omni Select Auto Trust 2021-A | 0.75 | 0.8676 | 0.8676 | ||||||

| R1IN34 / Realty Income Corporation - Depositary Receipt (Common Stock) | 0.75 | 0.27 | 0.8670 | 0.0368 | |||||

| US362548AE98 / GM Financial Automobile Leasing Trust 2023-2 | 0.75 | -0.13 | 0.8658 | 0.0336 | |||||

| US17401QAU58 / Citizens Bank, N.A. | 0.75 | 0.13 | 0.8597 | 0.0354 | |||||

| US80286MAE84 / Santander Drive Auto Receivables Trust 2022-2 | 0.74 | 0.8591 | 0.8591 | ||||||

| US38141GXM13 / Goldman Sachs Group Inc/The | 0.74 | 0.96 | 0.8517 | 0.0411 | |||||

| US501044DE89 / Kroger Co. (The) | 0.73 | 0.69 | 0.8477 | 0.0401 | |||||

| US802927AE37 / SDART_23-4 | 0.73 | 0.8468 | 0.8468 | ||||||

| US00774MAV72 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.73 | 0.83 | 0.8429 | 0.0401 | |||||

| US44933LAF04 / Hyundai Auto Receivables Trust | 0.70 | 0.87 | 0.8044 | 0.0390 | |||||

| US98163KAD46 / WOART_21-D-A4 1.1 11/15/2027 | 0.69 | -6.79 | 0.7921 | -0.0235 | |||||

| Hyundai Capital America / DBT (US44891ADU88) | 0.66 | 0.7598 | 0.7598 | ||||||

| US43815PAD15 / Honda Auto Receivables 2022-2 Owner Trust | 0.65 | 0.15 | 0.7466 | 0.0310 | |||||

| DLLMT 2024-1 LLC / ABS-O (US23347AAC53) | 0.63 | -16.78 | 0.7213 | -0.1111 | |||||

| Hyundai Auto Lease Securitization Trust 2024-B / ABS-O (US44934FAF27) | 0.61 | -0.16 | 0.7008 | 0.0271 | |||||

| GMF Floorplan Owner Revolving Trust / ABS-O (US361886DM30) | 0.60 | 0.17 | 0.6952 | 0.0293 | |||||

| Volkswagen Auto Lease Trust 2024-A / ABS-O (US92866EAB56) | 0.58 | -26.58 | 0.6700 | -0.2058 | |||||

| US55279HAV24 / Manufacturers & Traders Trust Company | 0.57 | 0.00 | 0.6630 | 0.0264 | |||||

| US49327M3E23 / KeyBank NA/Cleveland OH | 0.57 | 0.17 | 0.6623 | 0.0275 | |||||

| GPJA / Georgia Power Company - Preferred Security | 0.57 | -0.35 | 0.6561 | 0.0247 | |||||

| Lendbuzz Securitization Trust 2025-2 / ABS-O (US52611JAB61) | 0.55 | 0.6361 | 0.6361 | ||||||

| US38145GAM24 / Goldman Sachs Group Inc/The | 0.55 | -0.36 | 0.6352 | 0.0236 | |||||

| PNC Bank NA / DBT (US69353RFY99) | 0.54 | 0.6234 | 0.6234 | ||||||

| US34528QHS66 / Ford Credit Floorplan Master Owner Trust A | 0.53 | 0.19 | 0.6095 | 0.0255 | |||||

| Met Tower Global Funding / DBT (US58989V2J25) | 0.51 | 0.59 | 0.5908 | 0.0267 | |||||

| ARI Fleet Lease Trust 2023-A / ABS-O (US00218GAE26) | 0.51 | -0.20 | 0.5865 | 0.0223 | |||||

| US24703GAF19 / Dell Equipment Finance Trust 2023-2 | 0.50 | -0.40 | 0.5821 | 0.0210 | |||||

| US670855AA38 / OBX Trust | 0.50 | 0.5806 | 0.5806 | ||||||

| US404121AH82 / HCA Inc | 0.50 | 0.00 | 0.5797 | 0.0230 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0.50 | 0.20 | 0.5797 | 0.0238 | |||||

| US89233FHN15 / Toyota Motor Credit Corporation | 0.50 | 0.00 | 0.5788 | 0.0233 | |||||

| US61747YEZ43 / Morgan Stanley | 0.50 | 0.00 | 0.5784 | 0.0227 | |||||

| US06738EBZ79 / Barclays PLC | 0.50 | 0.00 | 0.5770 | 0.0224 | |||||

| US362541AG93 / GM Financial Automobile Leasing Trust 2023-1 | 0.50 | 0.00 | 0.5769 | 0.0221 | |||||

| SBNA Auto Receivables Trust 2025-SF1 / ABS-O (US78437XAB29) | 0.50 | 0.5768 | 0.5768 | ||||||

| US92348KBK88 / VERIZON MASTER TRUST | 0.50 | -0.20 | 0.5766 | 0.0225 | |||||

| HSBC26C / HSBC Holdings PLC | 0.50 | 0.20 | 0.5762 | 0.0237 | |||||

| US60700KAE29 / MMAF 2020-BA A5 | 0.50 | 1.02 | 0.5741 | 0.0283 | |||||

| HCA Inc / DBT (US404119CY34) | 0.49 | 0.61 | 0.5675 | 0.0260 | |||||

| US34528QHR83 / Ford Credit Floorplan Master Owner Trust A | 0.49 | 1.04 | 0.5608 | 0.0272 | |||||

| Tricolor Auto Securitization Trust 2024-3 / ABS-O (US89617AAC99) | 0.48 | 0.21 | 0.5590 | 0.0234 | |||||

| New York Life Global Funding / DBT (US64952WFJ71) | 0.47 | 0.43 | 0.5446 | 0.0237 | |||||

| OBX 2025-NQM11 TRUST / ABS-MBS (US67449BAA17) | 0.47 | 0.5432 | 0.5432 | ||||||

| Volkswagen Group of America Finance LLC / DBT (US928668CK66) | 0.45 | 0.00 | 0.5200 | 0.0209 | |||||

| US88167PAE88 / Tesla Auto Lease Trust 2023-A | 0.45 | -0.44 | 0.5198 | 0.0188 | |||||

| US403951AE66 / Hpefs Equipment Trust 2022-3 | 0.44 | -21.04 | 0.5069 | -0.1097 | |||||

| DGZ / DB Gold Short ETN | 0.44 | 0.23 | 0.5043 | 0.0209 | |||||

| US50168BAE83 / LADAR 23-3 C 144A 6.43% 12-15-28/26 | 0.43 | -0.23 | 0.5000 | 0.0189 | |||||

| Volkswagen Group of America Finance LLC / DBT (US928668CE07) | 0.43 | -0.23 | 0.4921 | 0.0181 | |||||

| Verizon Master Trust / ABS-O (US92348KCP66) | 0.43 | 0.4912 | 0.4912 | ||||||

| Volvo Financial Equipment LLC Series 2024-1 / ABS-O (US92887QAB32) | 0.42 | -6.67 | 0.4853 | -0.0132 | |||||

| Kubota Credit Owner Trust 2025-2 / ABS-O (US50117LAB45) | 0.41 | 0.4740 | 0.4740 | ||||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.41 | 0.25 | 0.4679 | 0.0196 | |||||

| Exeter Automobile Receivables Trust 2024-4 / ABS-O (US30166UAE01) | 0.40 | 0.00 | 0.4660 | 0.0183 | |||||

| Marlette Funding Trust 2024-1 / ABS-O (US57108VAB80) | 0.40 | -0.25 | 0.4643 | 0.0171 | |||||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 0.40 | -0.25 | 0.4610 | 0.0179 | |||||

| US88167QAE61 / Tesla Auto Lease Trust 2023-B | 0.40 | -0.50 | 0.4578 | 0.0161 | |||||

| US55316EAE23 / MMAF Equipment Finance LLC 2019-B | 0.39 | 0.4543 | 0.4543 | ||||||

| US03236VAC54 / Amur Equipment Finance Receivables X LLC | 0.39 | -2.53 | 0.4457 | 0.0070 | |||||

| ARI Fleet Lease Trust 2025-A / ABS-O (US04033CAB28) | 0.38 | 0.27 | 0.4329 | 0.0182 | |||||

| US233869AD85 / Daimler Trucks Retail Trust 2022-1 | 0.36 | -0.28 | 0.4101 | 0.0158 | |||||

| US22535WAH07 / Credit Agricole SA | 0.35 | 0.86 | 0.4074 | 0.0196 | |||||

| US80287FAD42 / SDART 22-7 B 5.95% 01-17-28/01-15-26 | 0.34 | -31.54 | 0.3959 | -0.1599 | |||||

| US23345RAE62 / DT Auto Owner Trust, Series 2022-3A, Class C | 0.34 | -33.33 | 0.3878 | -0.1709 | |||||

| US362541AF11 / GM Financial Automobile Leasing Trust 2023-1 | 0.32 | -35.20 | 0.3745 | -0.1802 | |||||

| SOLV / Solventum Corporation | 0.32 | 0.00 | 0.3742 | 0.0150 | |||||

| US345340AB96 / Ford Credit Auto Owner Trust 2021-REV1 | 0.32 | 0.63 | 0.3711 | 0.0173 | |||||

| US38013JAD54 / GM Financial Consumer Automobile Receivables Trust, Series 2023-1, Class A3 | 0.32 | -21.13 | 0.3704 | -0.0813 | |||||

| US30167JAF12 / Exeter Automobile Receivables Trust | 0.32 | -20.45 | 0.3644 | -0.0748 | |||||

| Hyundai Capital America / DBT (US44891ACX37) | 0.30 | 0.33 | 0.3499 | 0.0144 | |||||

| BMW US Capital LLC / DBT (US05565ECP88) | 0.29 | 0.34 | 0.3357 | 0.0139 | |||||

| US43815BAD29 / HAROT 2022-1 A4 | 0.29 | 0.70 | 0.3328 | 0.0154 | |||||

| Upstart Securitization Trust / ABS-O (US91684NAA90) | 0.29 | -17.05 | 0.3320 | -0.0513 | |||||

| Consolidated Edison Co of New York Inc / DBT (US209111GL10) | 0.28 | -0.35 | 0.3283 | 0.0120 | |||||

| US30168AAE29 / Exeter Automobile Receivables Trust 2022-6 | 0.28 | -16.72 | 0.3279 | -0.0508 | |||||

| US92538LAD38 / VERUS_20-4 | 0.28 | -0.36 | 0.3232 | 0.0111 | |||||

| Santander Drive Auto Receivables Trust 2024-5 / ABS-O (US802920AE83) | 0.28 | 0.00 | 0.3176 | 0.0126 | |||||

| US03065UAB52 / Americredit Automobile Receivables Trust 2023-2 | 0.26 | -58.36 | 0.2993 | -0.3904 | |||||

| Exeter Automobile Receivables Trust 2024-3 / ABS-O (US30165AAD72) | 0.25 | 0.00 | 0.2901 | 0.0113 | |||||

| US14317CAG78 / CarMax Auto Owner Trust | 0.25 | 0.81 | 0.2879 | 0.0139 | |||||

| US05377RDV33 / AVIS BUDGET RENTAL CAR FUNDING AESOP LLC | 0.25 | -59.90 | 0.2878 | -0.4007 | |||||

| US14318UAD37 / Carmax Auto Owner Trust 2022-4 | 0.25 | -23.84 | 0.2838 | -0.0749 | |||||

| World Omni Select Auto Trust 2024-A / ABS-O (US98164LAD10) | 0.23 | 0.00 | 0.2608 | 0.0098 | |||||

| US96042VAG41 / Westlake Automobile Receivables Trust 2022-2 | 0.22 | 0.00 | 0.2543 | 0.0097 | |||||

| US96041AAC09 / WESTLAKE AUTOMOBILE RECEIVABLES TRUST 2023-4 SER 2023-4A CL A2 REGD 144A P/P 6.23000000 | 0.22 | -62.15 | 0.2488 | -0.3804 | |||||

| US345286AF56 / Ford Credit Auto Owner Trust 2022-A | 0.21 | 0.95 | 0.2450 | 0.0114 | |||||

| US14686RAA05 / Carvana Auto Receivables Trust 2023-N3 | 0.21 | -52.49 | 0.2430 | -0.2473 | |||||

| US40443DAC65 / HPEFS Equipment Trust 2023-1 | 0.21 | -70.34 | 0.2398 | -0.5335 | |||||

| Carmax Select Receivables Trust 2024-A / ABS-O (US14319FAD50) | 0.20 | 0.00 | 0.2332 | 0.0092 | |||||

| Exeter Automobile Receivables Trust 2024-5 / ABS-O (US30165BAE39) | 0.17 | 0.00 | 0.1958 | 0.0085 | |||||

| Lendbuzz Securitization Trust 2024-2 / ABS-O (US525920AB00) | 0.17 | -16.34 | 0.1955 | -0.0292 | |||||

| US50117EAC84 / KUBOTA CREDIT OWNER TRUST | 0.17 | -39.93 | 0.1935 | -0.1145 | |||||

| US958102AM75 / Western Digital Corp 4.75% 02/15/2026 Bond | 0.15 | -78.61 | 0.1783 | -0.6198 | |||||

| Daimler Truck Finance North America LLC / DBT (US233853AY62) | 0.15 | 0.66 | 0.1755 | 0.0076 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.15 | 0.00 | 0.1749 | 0.0073 | |||||

| ACM Auto Trust 2024-2 / ABS-O (US00461WAA99) | 0.14 | -31.82 | 0.1562 | -0.0639 | |||||

| Affirm Asset Securitization Trust 2024-X2 / ABS-O (US00833QAC96) | 0.13 | 0.00 | 0.1446 | 0.0057 | |||||

| US30166BAE20 / Exeter Automobile Receivables Trust 2022-4 | 0.12 | -49.15 | 0.1376 | -0.1223 | |||||

| C1MA34 / Comerica Incorporated - Depositary Receipt (Common Stock) | 0.11 | 0.90 | 0.1299 | 0.0061 | |||||

| US881943AB00 / Tesla Electric Vehicle Trust 2023-1 | 0.11 | -40.98 | 0.1250 | -0.0787 | |||||

| US80286XAF15 / Santander Drive Auto Receivables Trust 2021-2 | 0.11 | -53.30 | 0.1231 | -0.1284 | |||||

| Freddie Mac STACR REMIC Trust 2024-DNA2 / ABS-MBS (US35564NDA81) | 0.10 | 1.01 | 0.1159 | 0.0052 | |||||

| HPEFS Equipment Trust 2024-1 / ABS-O (US403963AB73) | 0.09 | -72.15 | 0.1021 | -0.2483 | |||||

| US14317HAC51 / CARMAX AUTO OWNER TRUST 2022 2 | 0.09 | -39.31 | 0.1016 | -0.0600 | |||||

| US40441RAF01 / HPEFS Equipment Trust | 0.08 | -69.26 | 0.0963 | -0.2038 | |||||

| Dell Equipment Finance Trust 2024-1 / ABS-O (US24702GAC96) | 0.08 | -35.54 | 0.0909 | -0.0440 | |||||

| US57109RAB69 / Marlette Funding Trust 2023-3 | 0.07 | -58.12 | 0.0784 | -0.0996 | |||||

| US23292HAB78 / DLLAA 2023-1 LLC | 0.04 | -68.25 | 0.0464 | -0.0938 | |||||

| US52607KAA16 / Lendbuzz Securitization Trust 2022-1 | 0.04 | -21.28 | 0.0434 | -0.0092 | |||||

| US14317CAC64 / CarMax Auto Owner Trust | 0.03 | -46.43 | 0.0349 | -0.0274 | |||||

| US233262AC89 / DLLAD 2021-1 LLC | 0.02 | -68.42 | 0.0218 | -0.0414 |