Statistik Asas

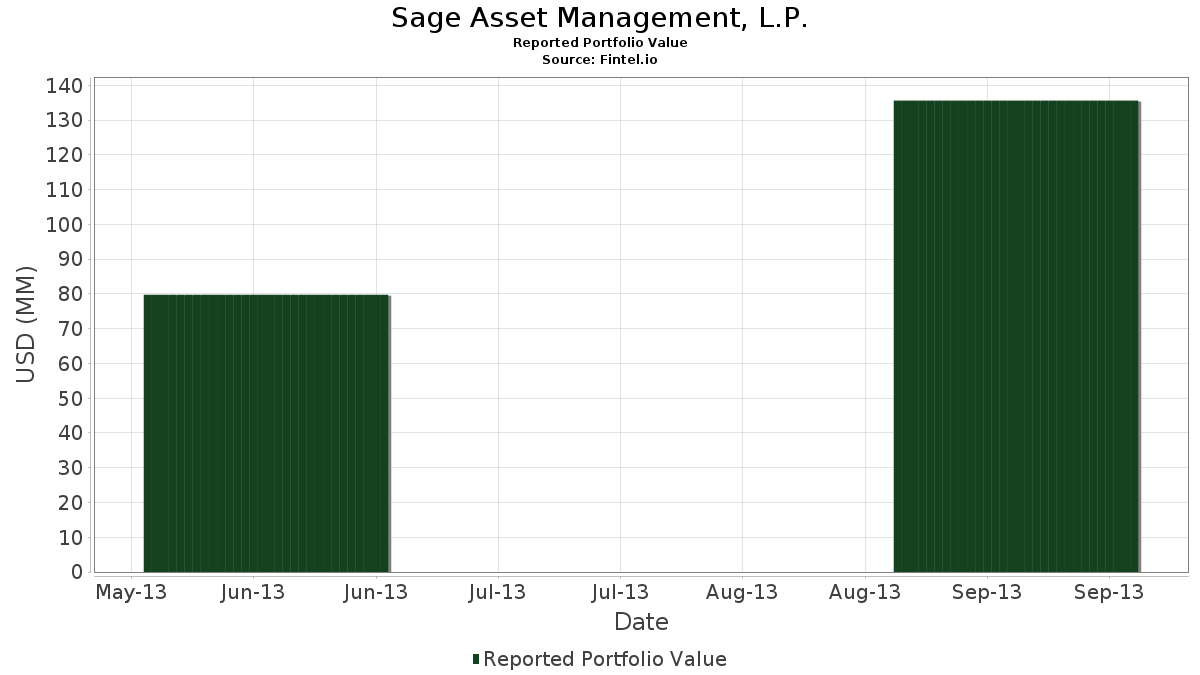

| Nilai Portfolio | $ 135,642,000 |

| Kedudukan Semasa | 38 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Sage Asset Management, L.P. telah mendedahkan 38 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 135,642,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Sage Asset Management, L.P. ialah iShares Trust - iShares Russell 2000 ETF (US:IWM) , Cobalt Intl Energy Inc (US:CIEIQ) , SPDR S&P 500 ETF (US:SPY) , United Rentals, Inc. (US:URI) , and Canadian Pacific Kansas City Limited (US:CP) . Kedudukan baharu Sage Asset Management, L.P. termasuk iShares Trust - iShares Russell 2000 ETF (US:IWM) , SPDR S&P 500 ETF (US:SPY) , eBay Inc. (US:EBAY) , Expedia Group, Inc. (US:EXPE) , and Yum! Brands, Inc. (US:YUM) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.44 | 46.91 | 34.5822 | 34.5822 | |

| 0.21 | 5.11 | 3.7636 | 3.7636 | |

| 0.03 | 4.20 | 3.0964 | 3.0964 | |

| 0.07 | 3.79 | 2.7971 | 2.7971 | |

| 0.03 | 3.77 | 2.7816 | 2.7816 | |

| 0.10 | 3.74 | 2.7602 | 2.7602 | |

| 0.15 | 3.65 | 2.6946 | 2.6946 | |

| 0.05 | 3.65 | 2.6916 | 2.6916 | |

| 0.06 | 3.51 | 2.5906 | 2.5906 | |

| 0.03 | 3.41 | 2.5118 | 2.5118 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -3.3921 | ||

| 0.00 | 0.00 | -3.0637 | ||

| 0.00 | 0.00 | -2.8995 | ||

| 0.00 | 0.00 | -1.9455 | ||

| 0.00 | 0.00 | -1.6234 | ||

| 0.00 | 0.00 | -1.4779 | ||

| 0.06 | 2.73 | 2.0149 | -1.4525 | |

| 0.00 | 0.00 | -1.1445 | ||

| 0.00 | 0.00 | -1.0028 | ||

| 0.04 | 2.03 | 1.4973 | -0.7428 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2013-11-13 untuk tempoh pelaporan 2013-09-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IWM / iShares Trust - iShares Russell 2000 ETF | Put | 0.44 | 46.91 | 34.5822 | 34.5822 | ||||

| CIEIQ / Cobalt Intl Energy Inc | 0.21 | 9.90 | 5.11 | 2.82 | 3.7636 | 3.7636 | |||

| SPY / SPDR S&P 500 ETF | Put | 0.03 | 4.20 | 3.0964 | 3.0964 | ||||

| URI / United Rentals, Inc. | 0.07 | -26.37 | 3.79 | -14.01 | 2.7971 | 2.7971 | |||

| CP / Canadian Pacific Kansas City Limited | 0.03 | 8.28 | 3.77 | 10.00 | 2.7816 | 2.7816 | |||

| GM / General Motors Company | 0.10 | 24.08 | 3.74 | 33.95 | 2.7602 | 2.7602 | |||

| CIEIQ / Cobalt Intl Energy Inc | Call | 0.15 | 635.00 | 3.65 | 588.32 | 2.6946 | 2.6946 | ||

| HD / The Home Depot, Inc. | 0.05 | 83.04 | 3.65 | 79.23 | 2.6916 | 2.6916 | |||

| CAM / Cameron International Corporation | 0.06 | 117.33 | 3.51 | 107.44 | 2.5906 | 2.5906 | |||

| KSU / Kansas City Southern | 0.03 | 36.62 | 3.41 | 41.02 | 2.5118 | 2.5118 | |||

| KBR / KBR, Inc. | 0.10 | 45.87 | 3.29 | 46.46 | 2.4218 | 2.4218 | |||

| GOOGL / Alphabet Inc. | 0.00 | 23.16 | 3.21 | 22.53 | 2.3658 | 2.3658 | |||

| AABA / Altaba Inc | 0.09 | 30.34 | 3.13 | 72.06 | 2.3112 | 2.3112 | |||

| EBAY / eBay Inc. | Call | 0.05 | 2.79 | 2.0569 | 2.0569 | ||||

| HAL / Halliburton Company | 0.06 | -14.40 | 2.73 | -1.19 | 2.0149 | -1.4525 | |||

| C / Citigroup Inc. | 0.06 | 28.01 | 2.70 | 29.44 | 1.9935 | 1.9935 | |||

| EXPE / Expedia Group, Inc. | 0.05 | 2.69 | 1.9846 | 1.9846 | |||||

| QLTY / The 2023 ETF Series Trust II - GMO U.S. Quality ETF | 0.29 | 25.17 | 2.67 | 30.81 | 1.9721 | -0.5914 | |||

| IP / International Paper Company | 0.06 | -15.77 | 2.50 | -14.85 | 1.8431 | 1.8431 | |||

| YUM / Yum! Brands, Inc. | 0.03 | 2.39 | 1.7635 | 1.7635 | |||||

| UAL / United Airlines Holdings, Inc. | 0.07 | 87.21 | 2.14 | 83.82 | 1.5747 | 1.5747 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.04 | 2.09 | 1.5430 | 1.5430 | |||||

| AAPL / Apple Inc. | 0.00 | 2.07 | 1.5268 | 1.5268 | |||||

| CLR / Continental Resources Inc (OKLA) | 0.02 | 2.05 | 1.5106 | 1.5106 | |||||

| EBAY / eBay Inc. | 0.04 | 5.35 | 2.03 | 13.65 | 1.4973 | -0.7428 | |||

| AXL / American Axle & Manufacturing Holdings, Inc. | 0.10 | -25.58 | 1.96 | -21.23 | 1.4442 | 1.4442 | |||

| RHT / Red Hat, Inc. | Put | 0.04 | 1.94 | 1.4288 | 1.4288 | ||||

| CSIQ / Canadian Solar Inc. | 0.11 | 1.90 | 1.3978 | 1.3978 | |||||

| RAMP / LiveRamp Holdings, Inc. | 0.06 | 1.71 | 1.2621 | 1.2621 | |||||

| MS / Morgan Stanley | 0.06 | -19.22 | 1.61 | -10.88 | 1.1899 | 1.1899 | |||

| US2655041000 / Dunkin' Brands Group, Inc. | 0.03 | -52.09 | 1.35 | -49.36 | 0.9960 | 0.9960 | |||

| DAL / Delta Air Lines, Inc. | 0.05 | -67.70 | 1.13 | -59.26 | 0.8316 | 0.8316 | |||

| EWW / iShares, Inc. - iShares MSCI Mexico ETF | 0.02 | 1.08 | 0.7962 | 0.7962 | |||||

| FLTX / FleetMatics Group Ltd. | 0.02 | 0.77 | 0.5647 | 0.5647 | |||||

| META / Meta Platforms, Inc. | 0.01 | 0.70 | 0.5146 | 0.5146 | |||||

| STLY / HG Holdings, Inc. | 0.14 | -7.80 | 0.53 | -14.47 | 0.3878 | -0.3832 | |||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 0.01 | 0.42 | 0.3104 | 0.3104 | |||||

| ULH / Universal Logistics Holdings, Inc. | 0.01 | 0.31 | 0.2263 | 0.2263 | |||||

| CSCO / Cisco Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1445 | ||||

| / Gulfport Energy Corp. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| EPAM / EPAM Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| JBHT / J.B. Hunt Transport Services, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| KO / The Coca-Cola Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.9455 | ||||

| LEN / Lennar Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| MU / Micron Technology, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| QCOM / QUALCOMM Incorporated | Call | 0.00 | -100.00 | 0.00 | -100.00 | -3.0637 | |||

| FRC / First Republic Bank | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| SNDK / Sandisk Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| SPF / | 0.00 | -100.00 | 0.00 | -100.00 | -3.3921 | ||||

| SUNE / SUNation Energy Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.6234 | ||||

| TRN / Trinity Industries, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.8995 | ||||

| 09746Y105 / Boise, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.4779 | ||||

| AMT / American Tower Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| ZNGA / Zynga Inc - Class A | 0.00 | -100.00 | 0.00 | -100.00 | -1.0028 |