Statistik Asas

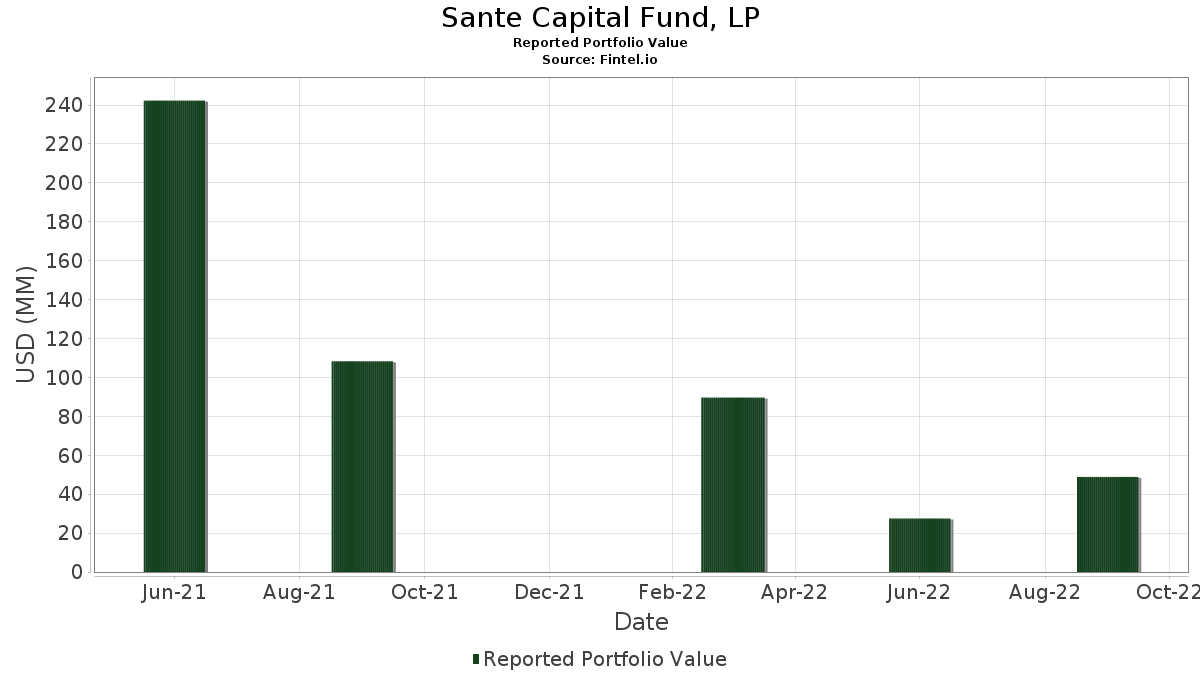

| Nilai Portfolio | $ 48,875,000 |

| Kedudukan Semasa | 67 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Sante Capital Fund, LP telah mendedahkan 67 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 48,875,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Sante Capital Fund, LP ialah Amgen Inc. (US:AMGN) , Johnson & Johnson (US:JNJ) , Constellation Brands, Inc. (US:STZ) , Hormel Foods Corporation (US:HRL) , and General Mills, Inc. (US:GIS) . Kedudukan baharu Sante Capital Fund, LP termasuk Johnson & Johnson (US:JNJ) , Constellation Brands, Inc. (US:STZ) , Hormel Foods Corporation (US:HRL) , General Mills, Inc. (US:GIS) , and AbbVie Inc. (US:ABBV) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 2.35 | 4.8143 | 4.8143 | |

| 0.01 | 2.18 | 4.4522 | 4.4522 | |

| 0.01 | 1.45 | 2.9749 | 2.9749 | |

| 0.03 | 1.40 | 2.8604 | 2.8604 | |

| 0.02 | 1.37 | 2.8031 | 2.8031 | |

| 0.01 | 1.36 | 2.7887 | 2.7887 | |

| 0.01 | 1.18 | 2.4164 | 2.4164 | |

| 0.03 | 1.15 | 2.3488 | 2.3488 | |

| 0.00 | 1.07 | 2.1852 | 2.1852 | |

| 0.02 | 1.03 | 2.1095 | 2.1095 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -10.1174 | ||

| 0.00 | 0.00 | -6.3620 | ||

| 0.01 | 0.89 | 1.8271 | -5.9164 | |

| 0.00 | 0.00 | -5.1950 | ||

| 0.03 | 1.10 | 2.2547 | -4.9652 | |

| 0.00 | 0.00 | -4.8460 | ||

| 0.01 | 0.66 | 1.3463 | -4.6522 | |

| 0.01 | 0.80 | 1.6450 | -4.0735 | |

| 0.00 | 0.51 | 1.0353 | -3.3200 | |

| 0.01 | 0.69 | 1.4138 | -3.0941 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2022-11-14 untuk tempoh pelaporan 2022-09-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AMGN / Amgen Inc. | 0.01 | 2.35 | 4.8143 | 4.8143 | |||||

| JNJ / Johnson & Johnson | 0.01 | 2.18 | 4.4522 | 4.4522 | |||||

| STZ / Constellation Brands, Inc. | 0.01 | 1.45 | 2.9749 | 2.9749 | |||||

| HRL / Hormel Foods Corporation | 0.03 | 1.40 | 2.8604 | 2.8604 | |||||

| GIS / General Mills, Inc. | 0.02 | 1.37 | 2.8031 | 2.8031 | |||||

| ABBV / AbbVie Inc. | 0.01 | 1.36 | 2.7887 | 2.7887 | |||||

| HSY / The Hershey Company | 0.01 | 1.18 | 2.4164 | 2.4164 | |||||

| PFE / Pfizer Inc. | 0.03 | 1.15 | 2.3488 | 2.3488 | |||||

| MO / Altria Group, Inc. | 0.03 | -42.60 | 1.10 | -44.51 | 2.2547 | -4.9652 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 1.07 | 2.1852 | 2.1852 | |||||

| BF.B / Brown-Forman Corporation | 0.02 | 1.03 | 2.1095 | 2.1095 | |||||

| MKC / McCormick & Company, Incorporated | 0.01 | 1.01 | 2.0726 | 2.0726 | |||||

| KR / The Kroger Co. | 0.02 | 0.98 | 2.0133 | 2.0133 | |||||

| PM / Philip Morris International Inc. | 0.01 | 0.95 | 1.9519 | 1.9519 | |||||

| WMT / Walmart Inc. | 0.01 | 0.93 | 1.8967 | 1.8967 | |||||

| WELL / Welltower Inc. | 0.01 | 0.93 | 1.8967 | 1.8967 | |||||

| D / Dominion Energy, Inc. | 0.01 | 0.92 | 1.8905 | 1.8905 | |||||

| DTE / DTE Energy Company | 0.01 | -53.81 | 0.89 | -58.08 | 1.8271 | -5.9164 | |||

| TSN / Tyson Foods, Inc. | 0.01 | 0.88 | 1.8046 | 1.8046 | |||||

| SYY / Sysco Corporation | 0.01 | 0.86 | 1.7616 | 1.7616 | |||||

| VZ / Verizon Communications Inc. | 0.02 | 0.81 | 1.6614 | 1.6614 | |||||

| XEL / Xcel Energy Inc. | 0.01 | -43.53 | 0.80 | -48.89 | 1.6450 | -4.0735 | |||

| RTX / RTX Corporation | 0.01 | 0.80 | 1.6266 | 1.6266 | |||||

| SO / The Southern Company | 0.01 | 0.74 | 1.5079 | 1.5079 | |||||

| ED / Consolidated Edison, Inc. | 0.01 | 0.74 | 1.5079 | 1.5079 | |||||

| CNP / CenterPoint Energy, Inc. | 0.03 | -7.11 | 0.71 | -11.54 | 1.4588 | -1.4713 | |||

| CMS / CMS Energy Corporation | 0.01 | 0.71 | 1.4547 | 1.4547 | |||||

| MDLZ / Mondelez International, Inc. | 0.01 | 1.33 | 0.71 | -10.52 | 1.4445 | -1.4239 | |||

| ES / Eversource Energy | 0.01 | -39.60 | 0.69 | -44.27 | 1.4138 | -3.0941 | |||

| DOW / Dow Inc. | 0.02 | 0.69 | 1.4015 | 1.4015 | |||||

| EQR / Equity Residential | 0.01 | 0.67 | 1.3790 | 1.3790 | |||||

| AEP / American Electric Power Company, Inc. | 0.01 | 0.67 | 1.3708 | 1.3708 | |||||

| PEG / Public Service Enterprise Group Incorporated | 0.01 | -55.10 | 0.66 | -60.12 | 1.3463 | -4.6522 | |||

| ETR / Entergy Corporation | 0.01 | -38.94 | 0.64 | -45.46 | 1.3156 | -2.9706 | |||

| T / AT&T Inc. | 0.04 | 0.64 | 1.3115 | 1.3115 | |||||

| ZTS / Zoetis Inc. | 0.00 | 0.62 | 1.2624 | 1.2624 | |||||

| NEE.PRN / NextEra Energy Capital Holdings, Inc. - Corporate Bond/Note | 0.01 | -32.00 | 0.59 | -31.16 | 1.2072 | -1.9084 | |||

| V / Visa Inc. | 0.00 | 0.59 | 1.2010 | 1.2010 | |||||

| AVB / AvalonBay Communities, Inc. | 0.00 | 0.58 | 1.1826 | 1.1826 | |||||

| EXC / Exelon Corporation | 0.02 | 0.40 | 0.57 | -17.03 | 1.1662 | -1.3313 | |||

| LYB / LyondellBasell Industries N.V. | 0.01 | 0.56 | 1.1376 | 1.1376 | |||||

| INVH / Invitation Homes Inc. | 0.02 | 0.55 | 1.1294 | 1.1294 | |||||

| PSA / Public Storage | 0.00 | -14.19 | 0.55 | -19.65 | 1.1294 | -1.3681 | |||

| CCI / Crown Castle Inc. | 0.00 | 0.55 | 1.1212 | 1.1212 | |||||

| O / Realty Income Corporation | 0.01 | 0.52 | 1.0680 | 1.0680 | |||||

| FE / FirstEnergy Corp. | 0.01 | 0.51 | 1.0517 | 1.0517 | |||||

| AWK / American Water Works Company, Inc. | 0.00 | -51.70 | 0.51 | -57.76 | 1.0353 | -3.3200 | |||

| WEC / WEC Energy Group, Inc. | 0.01 | 0.50 | 1.0292 | 1.0292 | |||||

| IT / Gartner, Inc. | 0.00 | 0.50 | 1.0230 | 1.0230 | |||||

| ARE / Alexandria Real Estate Equities, Inc. | 0.00 | 0.45 | 0.9146 | 0.9146 | |||||

| DUK / Duke Energy Corporation | 0.00 | 0.44 | 0.9043 | 0.9043 | |||||

| VMW / Vmware Inc. - Class A | 0.00 | -7.83 | 0.44 | -13.75 | 0.8982 | -0.9522 | |||

| DRE / Duke Realty Corporation - Preferred Security | 0.01 | 0.43 | 0.8757 | 0.8757 | |||||

| AMT / American Tower Corporation | 0.00 | 0.43 | 0.8716 | 0.8716 | |||||

| AEE / Ameren Corporation | 0.01 | 0.41 | 0.8471 | 0.8471 | |||||

| EXR / Extra Space Storage Inc. | 0.00 | 0.41 | 0.8368 | 0.8368 | |||||

| SBAC / SBA Communications Corporation | 0.00 | 0.40 | 0.8205 | 0.8205 | |||||

| PPL / PPL Corporation | 0.02 | 0.38 | 0.7795 | 0.7795 | |||||

| AJG / Arthur J. Gallagher & Co. | 0.00 | 0.37 | 0.7611 | 0.7611 | |||||

| SRE / Sempra | 0.00 | 0.36 | 0.7366 | 0.7366 | |||||

| EL / The Estée Lauder Companies Inc. | 0.00 | 0.35 | 0.7141 | 0.7141 | |||||

| EIX / Edison International | 0.01 | -63.47 | 0.33 | -67.32 | 0.6772 | -3.0055 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 0.31 | 0.6384 | 0.6384 | |||||

| CBRE / CBRE Group, Inc. | 0.00 | 0.28 | 0.5729 | 0.5729 | |||||

| CEG / Constellation Energy Corporation | 0.00 | 0.26 | 0.5402 | 0.5402 | |||||

| DLR / Digital Realty Trust, Inc. | 0.00 | 0.24 | 0.4890 | 0.4890 | |||||

| PLD / Prologis, Inc. | 0.00 | 0.20 | 0.4092 | 0.4092 | |||||

| DLTR / Dollar Tree, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.7557 | ||||

| WAT / Waters Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -2.0213 | ||||

| EW / Edwards Lifesciences Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.5269 | ||||

| WBT / Welbilt Inc | 0.00 | -100.00 | 0.00 | -100.00 | -1.2215 | ||||

| AVTR.PRA / Avantor, Inc. Series A Mandatory Convertible Preferred Stock | 0.00 | -100.00 | 0.00 | -100.00 | -1.7377 | ||||

| KMB / Kimberly-Clark Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -10.1174 | ||||

| SUI / Sun Communities, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.7593 | ||||

| CHD / Church & Dwight Co., Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -4.8460 | ||||

| IQV / IQVIA Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0543 | ||||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.2436 | ||||

| PEP / PepsiCo, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -6.3620 | ||||

| PG / The Procter & Gamble Company | 0.00 | -100.00 | 0.00 | -100.00 | -5.1950 | ||||

| MTD / Mettler-Toledo International Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8870 |