Statistik Asas

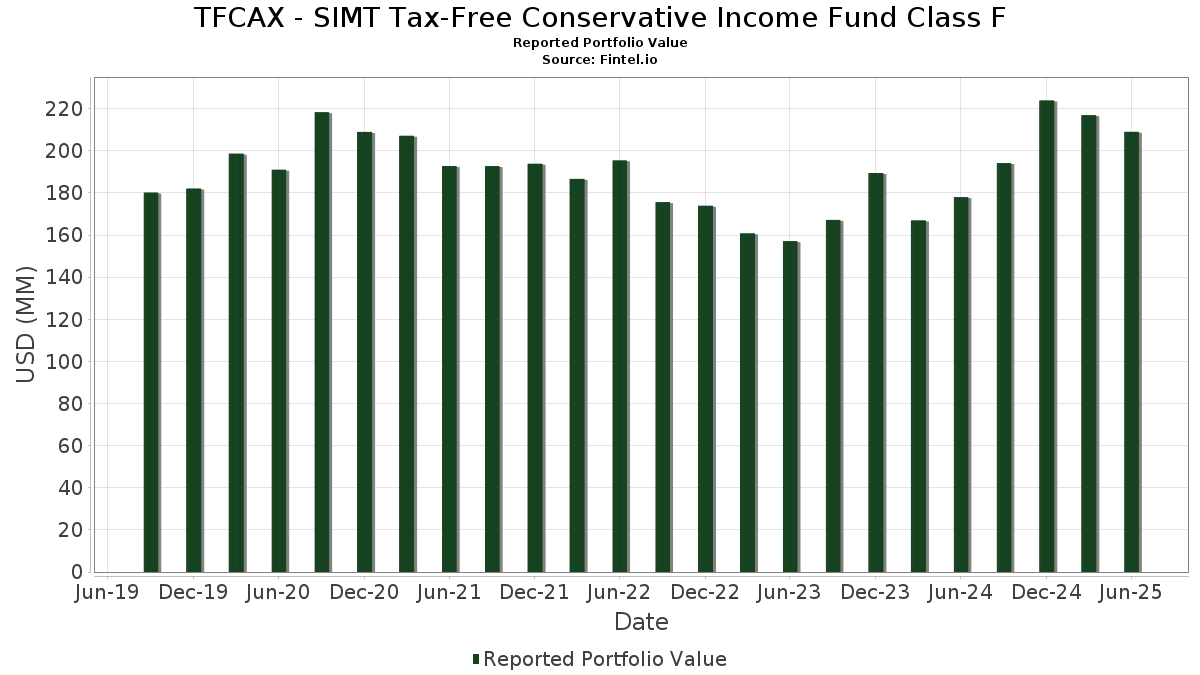

| Nilai Portfolio | $ 209,013,926 |

| Kedudukan Semasa | 95 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

TFCAX - SIMT Tax-Free Conservative Income Fund Class F telah mendedahkan 95 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 209,013,926 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas TFCAX - SIMT Tax-Free Conservative Income Fund Class F ialah IOWA ST FIN AUTH MIDWESTERN ECON DEV REVENUE (US:US46246XAD66) , SAINT LUCIE CNTY FL POLL CONTROL REVENUE DV&DP (US:US792070BH64) , Oregon State Facilities Authority DV&DP (US:US68608JXF38) , NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE (US:US64972GC444) , and Harris County Cultural Education Facilities Finance Corp (US:US414009PV67) . Kedudukan baharu TFCAX - SIMT Tax-Free Conservative Income Fund Class F termasuk IOWA ST FIN AUTH MIDWESTERN ECON DEV REVENUE (US:US46246XAD66) , SAINT LUCIE CNTY FL POLL CONTROL REVENUE DV&DP (US:US792070BH64) , Oregon State Facilities Authority DV&DP (US:US68608JXF38) , NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE (US:US64972GC444) , and Harris County Cultural Education Facilities Finance Corp (US:US414009PV67) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 6.30 | 3.0184 | 2.7515 | ||

| 5.00 | 2.3957 | 2.3957 | ||

| 5.00 | 2.3956 | 2.3956 | ||

| 4.80 | 2.2997 | 2.2997 | ||

| 4.78 | 2.2878 | 2.2878 | ||

| 4.20 | 2.0123 | 2.0123 | ||

| 4.15 | 1.9883 | 1.9883 | ||

| 4.70 | 2.2518 | 1.7261 | ||

| 3.55 | 1.7015 | 1.7015 | ||

| 3.06 | 1.4668 | 1.4668 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 4.67 | 2.2351 | -0.1669 | ||

| 1.75 | 0.8384 | -0.1101 | ||

| 0.88 | 0.4216 | -0.0432 | ||

| 1.03 | 0.4935 | -0.0424 | ||

| 2.75 | 1.3152 | -0.0033 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-28 untuk tempoh pelaporan 2025-06-30. Pelabur ini tidak mendedahkan sekuriti yang dikira dalam saham, jadi lajur berkaitan saham dalam jadual di bawah tidak dimasukkan. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|

| US46246XAD66 / IOWA ST FIN AUTH MIDWESTERN ECON DEV REVENUE | 7.50 | 0.00 | 3.5933 | 0.0364 | ||

| WANAQUE BORO NJ BOROUGH OF WANAQUE NJ / DBT (US933680EQ96) | 7.35 | -0.27 | 3.5225 | 0.0262 | ||

| US792070BH64 / SAINT LUCIE CNTY FL POLL CONTROL REVENUE DV&DP | 7.10 | 0.00 | 3.4017 | 0.0345 | ||

| US68608JXF38 / Oregon State Facilities Authority DV&DP | 6.30 | 950.00 | 3.0184 | 2.7515 | ||

| LINCOLN NEBRASKA ELECTRIC MUNI COMMERCIAL PAPER / DBT (US53427TGY01) | 5.00 | 2.3957 | 2.3957 | |||

| PENNSYLVANIA ST HGR EDUCTNL FA PENNSYLVANIA HIGHER EDUCATIONAL FACILITIES AUTHORI / DBT (US70917TSY81) | 5.00 | 2.3956 | 2.3956 | |||

| US64972GC444 / NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE | 4.80 | 2.2997 | 2.2997 | |||

| US414009PV67 / Harris County Cultural Education Facilities Finance Corp | 4.78 | 2.2878 | 2.2878 | |||

| US362848RR67 / City of Gainesville FL Utilities System Revenue | 4.70 | 370.00 | 2.2518 | 1.7261 | ||

| US64966LCP40 / New York (City of), NY, Series 2013 D4, GO Bonds | 4.67 | -13.61 | 2.2351 | -0.1669 | ||

| US19648FVP60 / COLORADO HEALTH FACS AUTH VAR Due 5/15/2062 | 4.50 | 0.00 | 2.1560 | 0.0218 | ||

| US60528ABX19 / Mississippi Business Finance Corp. (Chevron USA, Inc.), Series 2010 G, RB | 4.23 | 182.00 | 2.0266 | 1.2380 | ||

| ROSWELL GA DEV AUTH REVENUE ROSWELL DEVELOPMENT AUTHORITY / DBT (US77853AAA16) | 4.20 | 2.0123 | 2.0123 | |||

| MASSACHUSETTS BAY TRANSPORTATION A MUNI COMMERCIAL PAPER / DBT (US57559JAY91) | 4.15 | 1.9883 | 1.9883 | |||

| US485106CP13 / KS SPL OBLG VAR-E | 4.10 | 0.00 | 1.9644 | 0.0199 | ||

| US837151WN58 / SC PUB SVC 19A SF WFRN 01-01-36/ML/BUS | 3.90 | 0.00 | 1.8685 | 0.0189 | ||

| SCHODACK NY CENTRL SCH DIST SCHODACK CENTRAL SCHOOL DISTRICT / DBT (US806891KM87) | 3.85 | -0.21 | 1.8451 | 0.0145 | ||

| NORTH CAROLINA ST GRANT ANTICI STATE OF NORTH CAROLINA / DBT (US658268EX17) | 3.55 | 1.7015 | 1.7015 | |||

| US74934RQJ85 / RBC MUNI PRODUCTS INC TRUST | 3.50 | 0.00 | 1.6769 | 0.0170 | ||

| US83756CW353 / SOUTH DAKOTA ST HSG DEV AUTH SOUTH DAKOTA HOUSING DEVELOPMENT AUTHORITY | 3.31 | 0.00 | 1.5859 | 0.0161 | ||

| CLACKAMAS & WASHINGTON CNTYS O CLACKAMAS & WASHINGTON COUNTIES SCHOOL DISTRICT NO / DBT (US178882QL38) | 3.06 | 1.4668 | 1.4668 | |||

| UNIVERSITY OF TEXAS REVENUE FINANC MUNI COMMERCIAL PAPER / DBT (US91514TAF12) | 3.00 | 1.4376 | 1.4376 | |||

| UNIVERSITY OF TEXAS MUNI COMMERICAL PAPER / DBT (US91514CPH87) | 3.00 | 1.4375 | 1.4375 | |||

| AUSTIN TX (CITY OF) MUNI COMMERCIAL PAPER / DBT (US05248NXK17) | 3.00 | 1.4375 | 1.4375 | |||

| UNIVERSITY OF TEXAS MUNI COMMERCIAL PAPER / DBT (US91514CME83) | 3.00 | 0.00 | 1.4373 | 0.0144 | ||

| US837031F323 / SOUTH CAROLINA ST JOBS-ECON DE SOUTH CAROLINA JOBS-ECONOMIC DEVELOPMENT AUTHORITY | 3.00 | 0.00 | 1.4373 | 0.0146 | ||

| US45200F6G90 / ILLINOIS ST FIN AUTH REVENUE | 3.00 | 1.4373 | 1.4373 | |||

| EGG HARBOR TWP NJ TOWNSHIP OF EGG HARBOR NJ / DBT (US282305HW43) | 2.85 | -0.24 | 1.3664 | 0.0108 | ||

| WATERFORD MI SCH DIST WATERFORD SCHOOL DISTRICT/MI / DBT (US941468D317) | 2.85 | -0.45 | 1.3647 | 0.0078 | ||

| US83756CD692 / SOUTH DAKOTA ST HSG DEV AUTH SOUTH DAKOTA HOUSING DEVELOPMENT AUTHORITY | 2.75 | -1.26 | 1.3152 | -0.0033 | ||

| NEW YORK NY CITY OF NEW YORK NY / DBT (US64966SMP82) | 2.70 | 1.2936 | 1.2936 | |||

| MASS WATER RESOURCES AUT MUNI COMMERCIAL PAPER / DBT (US57604YBJ38) | 2.60 | 1.2458 | 1.2458 | |||

| PENNSYLVANIA ST HGR EDUCTNL FA PENNSYLVANIA HIGHER EDUCATIONAL FACILITIES AUTHORI / DBT (US70917TSU69) | 2.60 | 1.2457 | 1.2457 | |||

| US64987DV688 / NEW YORK ST HSG FIN AGY NEW YORK STATE HOUSING FINANCE AGENCY | 2.50 | 0.00 | 1.1978 | 0.0121 | ||

| MET TRANSPRTN AUTH NY REVENUE METROPOLITAN TRANSPORTATION AUTHORITY / DBT (US59261AX281) | 2.50 | 38.89 | 1.1978 | 0.1528 | ||

| US60528ABM53 / Mississippi Business Finance Corp | 2.40 | 328.57 | 1.1499 | 0.8554 | ||

| US97689QNE25 / WISCONSIN ST HSG & ECON DEV AU WISCONSIN HOUSING & ECONOMIC DEVELOPMENT AUTHORITY | 2.32 | 0.00 | 1.1115 | 0.0113 | ||

| US196632BH51 / Colorado Springs (City of), CO, Series 2006 B, VRD RB | 2.30 | 0.00 | 1.1020 | 0.0112 | ||

| WARREN MI CONSOL SCH DIST WARREN CONSOLIDATED SCHOOLS / DBT (US935341S403) | 2.19 | -0.45 | 1.0484 | 0.0059 | ||

| DIST OF COLUMBIA INCOME TAX SE DISTRICT OF COLUMBIA INCOME TAX REVENUE / DBT (US25477GXS91) | 2.04 | 0.9785 | 0.9785 | |||

| US303823LR74 / Fairfax County Industrial Development Authority, Virginia Health Care | 1.96 | 0.00 | 0.9367 | 0.0095 | ||

| US917572TV13 / UTAH ST WTR FIN AGY REVENUE UTAH WATER FINANCE AGENCY | 1.85 | 0.00 | 0.8888 | 0.0090 | ||

| US71884SAC44 / Phoenix Industrial Development Authority, Arizona, Health Care Facilities Revenue Bonds, Mayo Clinic, Series 2014B | 1.80 | 800.00 | 0.8624 | 0.7385 | ||

| US88033SVX97 / TENDER OPTION BOND TRUST RECEIPTS / CTFS VARIOUS STATES | 1.77 | 0.00 | 0.8480 | 0.0086 | ||

| US882723H770 / State of Texas | 1.75 | -12.50 | 0.8384 | -0.1101 | ||

| US46246WAD83 / IOWA ST FIN AUTH POLL CONTROLF IOWA FINANCE AUTHORITY | 1.60 | 0.00 | 0.7666 | 0.0078 | ||

| US93978TTF65 / WASHINGTON ST HSG FIN COMMISSI WASHSG 12/46 ADJUSTABLE VAR | 1.58 | 0.00 | 0.7594 | 0.0077 | ||

| NEW HAMPSHIRE ST HSG FIN AUTH NEW HAMPSHIRE HOUSING FINANCE AUTHORITY / DBT (US64469D4P36) | 1.55 | -0.06 | 0.7426 | 0.0067 | ||

| MESA AZ UTILITY SYS REVENUE CITY OF MESA AZ UTILITY SYSTEM REVENUE / DBT (US5905452S79) | 1.53 | 0.7347 | 0.7347 | |||

| PLANO TX INDEP SCH DIST PLANO INDEPENDENT SCHOOL DISTRICT / DBT (US727199D730) | 1.52 | -0.59 | 0.7282 | 0.0033 | ||

| US790103AG04 / ST JAMES PARISH LA REV VAR-NUCSTEEL LA-SER B-1 | 1.50 | 0.00 | 0.7187 | 0.0073 | ||

| US98521YAA73 / YAVAPAI CNTY AZ INDL DEV AUTH INDUSTRIAL DEVELOPMENT AUTHORITY OF THE COUNTY OF | 1.50 | 0.00 | 0.7187 | 0.0073 | ||

| US20775CZF49 / CT HFA MTG 16B4 Q=WF V7 | 1.41 | 0.00 | 0.6732 | 0.0068 | ||

| US97689QCF19 / WI HSG and EDA HO 2016 C Q=RC V7 | 1.40 | 0.00 | 0.6708 | 0.0068 | ||

| US353187BT38 / FRANKLIN COUNTY OHIO HOSPITAL FACILITIES REVENUE NATIONWIDE CHILDREN'S HOSPITAL | 1.40 | 0.00 | 0.6708 | 0.0068 | ||

| HOUSTON TX INDEP SCH DIST HOUSTON INDEPENDENT SCHOOL DISTRICT / DBT (US442403RD52) | 1.39 | 0.6683 | 0.6683 | |||

| DU PAGE CNTY IL FOREST PRESERV DUPAGE COUNTY FOREST PRESERVE DISTRICT / DBT (US262651VF63) | 1.31 | -0.61 | 0.6267 | 0.0027 | ||

| MAPLEWOOD TWP NJ TOWNSHIP OF MAPLEWOOD NJ / DBT (US565624NG47) | 1.30 | -0.31 | 0.6242 | 0.0046 | ||

| MASSACHUSETTS BAY TRANSPORTATION A MUNI COMMERICAL PAPER / DBT (US57559GBP37) | 1.30 | 0.6228 | 0.6228 | |||

| LEANDER TX INDEP SCH DIST LEANDER INDEPENDENT SCHOOL DISTRICT / DBT (US521841N932) | 1.27 | 0.6070 | 0.6070 | |||

| LA PLATA CNTY CO SCH DIST #9-R DURANGO SCHOOL DISTRICT NO 9-R / DBT (US503768NA73) | 1.26 | -0.55 | 0.6031 | 0.0028 | ||

| COOK CNTY IL CMNTY CONSOL SCHD COOK COUNTY COMMUNITY CONSOLIDATED SCHOOL DISTRICT / DBT (US213669KR40) | 1.25 | -0.48 | 0.5965 | 0.0028 | ||

| KAREGNONDI WTR AUTH MI KAREGNONDI WATER AUTHORITY / DBT (US48563UCB52) | 1.19 | -0.58 | 0.5715 | 0.0026 | ||

| GLENDALE AZ WTR & SWR REVENUE CITY OF GLENDALE AZ WATER & SEWER REVENUE / DBT (US378352RY62) | 1.15 | 0.5511 | 0.5511 | |||

| WYOMING ST CMNTY DEV AUTH HSG WYOMING COMMUNITY DEVELOPMENT AUTHORITY / DBT (US98322QTB31) | 1.11 | 0.00 | 0.5318 | 0.0054 | ||

| LOUISIANA ST PUBLIC FACS AUTH LOUISIANA PUBLIC FACILITIES AUTHORITY / DBT (US546395W675) | 1.10 | 0.00 | 0.5270 | 0.0053 | ||

| US60528ABW36 / MISSISSIPPI ST BUSINESS FIN CO REGD V/R B/E 1.60000000 | 1.10 | 0.00 | 0.5270 | 0.0053 | ||

| US57419PRX95 / MARYLAND ST CMNTY DEV ADMIN DE MARYLAND COMMUNITY DEVELOPMENT ADMINISTRATION | 1.07 | 0.00 | 0.5127 | 0.0052 | ||

| TENNESSEE HSG DEV AGY RSDL FIN TENNESSEE HOUSING DEVELOPMENT AGENCY / DBT (US88046KPP56) | 1.03 | -8.85 | 0.4935 | -0.0424 | ||

| UNIV OF N TEXAS UNIV REVENUE UNIVERSITY OF NORTH TEXAS SYSTEM / DBT (US914729XB93) | 1.02 | 0.4871 | 0.4871 | |||

| HONEOYE FALLS-LIMA NY CENTRL S HONEOYE FALLS-LIMA CENTRAL SCHOOL DISTRICT / DBT (US438209MJ48) | 1.01 | 0.4834 | 0.4834 | |||

| MOUNT HOLLY TWP NJ TOWNSHIP OF MOUNT HOLLY NJ / DBT (US621545HT21) | 1.00 | -0.20 | 0.4797 | 0.0038 | ||

| OSSINING TOWN NY TOWN OF OSSINING NY / DBT (US688562FC60) | 1.00 | -0.40 | 0.4796 | 0.0032 | ||

| UNIVERSITY OF TEXAS MUNI COMMERCIAL PAPER / DBT (US91514YFR99) | 1.00 | 0.4792 | 0.4792 | |||

| UNIVERSITY OF TEXAS MUNI COMMERCIAL PAPER / DBT (US91514CMN82) | 1.00 | 0.10 | 0.4791 | 0.0049 | ||

| JANESVILLE WI SCH DIST JANESVILLE SCHOOL DISTRICT / DBT (US470878NE52) | 0.96 | -0.41 | 0.4614 | 0.0024 | ||

| NEW YORK CITY NY HSG DEV CORP NEW YORK CITY HOUSING DEVELOPMENT CORP / DBT (US64972KKK06) | 0.95 | 0.4552 | 0.4552 | |||

| HAMILTON OH CITY OF HAMILTON OH / DBT (US407756P829) | 0.92 | -0.22 | 0.4423 | 0.0033 | ||

| HALEDON NJ BOROUGH OF HALEDON NJ / DBT (US405540EZ45) | 0.90 | -0.22 | 0.4318 | 0.0034 | ||

| US956622P406 / West Virginia Hospital Finance Authority, Revenue Bonds, West Virginia University Health System Obligated Group, Refunding Variable Rate Series 2018C | 0.88 | -10.20 | 0.4216 | -0.0432 | ||

| KENTUCKY ST PUBLIC ENERGY AUTH KENTUCKY PUBLIC ENERGY AUTHORITY / DBT (US74440DFD12) | 0.83 | -0.36 | 0.3976 | 0.0029 | ||

| MANASQUAN NJ BOROUGH OF MANASQUAN NJ / DBT (US561773BN16) | 0.80 | -0.25 | 0.3840 | 0.0028 | ||

| POMPTON LAKES BORO NJ BOROUGH OF POMPTON LAKES NJ / DBT (US732233DB43) | 0.71 | 0.3380 | 0.3380 | |||

| ESSEX CNTY NJ IMPT AUTH ESSEX COUNTY IMPROVEMENT AUTHORITY / DBT (US296807MM90) | 0.66 | 0.3160 | 0.3160 | |||

| NEW MEXICO ST MTGE FIN AUTH MF NEW MEXICO MORTGAGE FINANCE AUTHORITY / DBT (US64719HEP10) | 0.64 | 0.3068 | 0.3068 | |||

| MIAMISBURG OH CITY OF MIAMISBURG OH / DBT (US593864MK43) | 0.60 | -0.33 | 0.2884 | 0.0023 | ||

| NEW HAMPSHIRE ST STATE OF NEW HAMPSHIRE / DBT (US64468FCA30) | 0.55 | 0.2631 | 0.2631 | |||

| US677632N986 / OHIO ST UNIV OHIO STATE UNIVERSITY/THE | 0.47 | 0.00 | 0.2276 | 0.0023 | ||

| US88035DJD84 / TENDER OPTION BOND TRUST RECEI TENDER OPTION BOND TRUST RECEIPTS/CERTIFICATES | 0.40 | 0.00 | 0.1916 | 0.0019 | ||

| CONROE TX INDEP SCH DIST CONROE INDEPENDENT SCHOOL DISTRICT / DBT (US2084184R15) | 0.38 | -0.52 | 0.1822 | 0.0010 | ||

| BUCKEYE AZ EXCISE TAX REVENUE CITY OF BUCKEYE AZ EXCISE TAX REVENUE / DBT (US118087DV48) | 0.36 | 0.1715 | 0.1715 | |||

| US018106JW57 / ALLEN TX INDEP SCH DIST | 0.32 | -0.31 | 0.1529 | 0.0007 | ||

| PENNSYLVANIA ST HSG FIN AGY SF PENNSYLVANIA HOUSING FINANCE AGENCY / DBT (US70879QS612) | 0.25 | 0.1215 | 0.1215 | |||

| PORT WASHINGTON-SAUKVILLE WI S PORT WASHINGTON-SAUKVILLE SCHOOL DISTRICT/WI / DBT (US735587JQ11) | 0.20 | 0.0973 | 0.0973 | |||

| US88034UNN45 / TENDER OPTION BOND TRUST RECEI TENDER OPTION BOND TRUST RECEIPTS/CERTIFICATES | 0.10 | 0.00 | 0.0455 | 0.0005 |