Statistik Asas

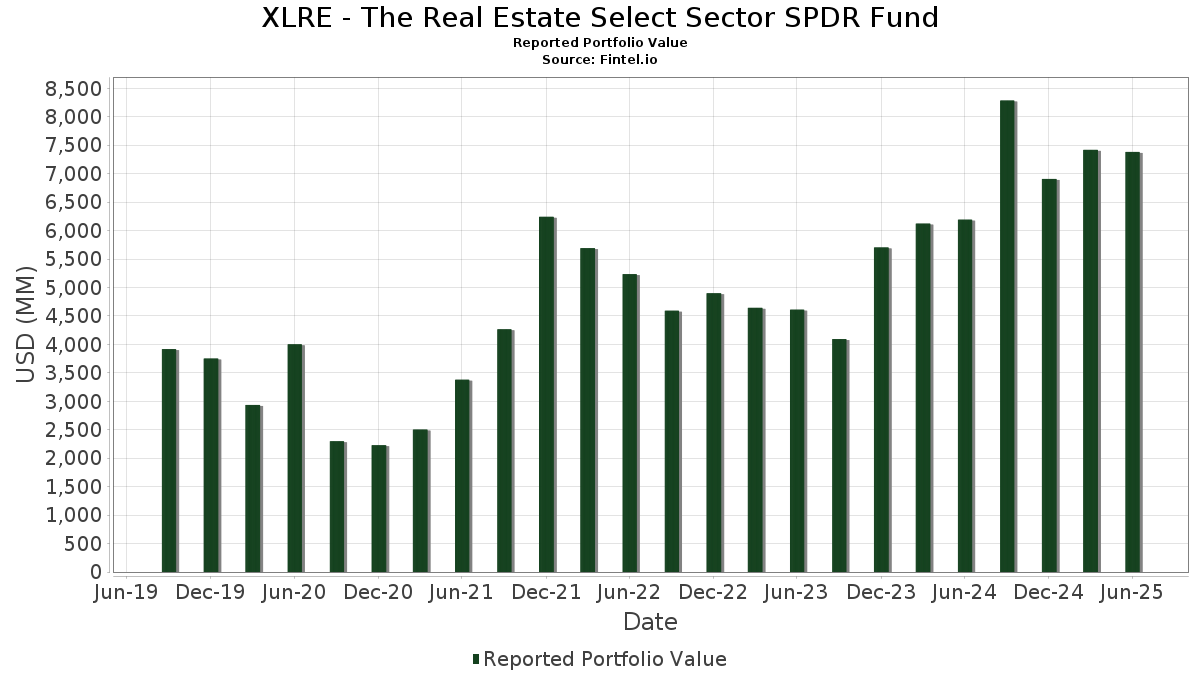

| Nilai Portfolio | $ 7,381,737,695 |

| Kedudukan Semasa | 33 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

XLRE - The Real Estate Select Sector SPDR Fund telah mendedahkan 33 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 7,381,737,695 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas XLRE - The Real Estate Select Sector SPDR Fund ialah American Tower Corporation (US:AMT) , Prologis, Inc. (US:PLD) , Welltower Inc. (US:WELL) , Equinix, Inc. (US:EQIX) , and Digital Realty Trust, Inc. (US:DLR) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.17 | 379.04 | 5.1179 | 0.9319 | |

| 2.03 | 207.85 | 2.8064 | 0.4727 | |

| 2.02 | 282.60 | 3.8157 | 0.2468 | |

| 4.27 | 655.92 | 8.8565 | 0.2399 | |

| 3.22 | 710.61 | 9.5949 | 0.2085 | |

| 0.74 | 173.32 | 2.3402 | 0.1558 | |

| 6.20 | 357.32 | 4.8246 | 0.1374 | |

| 4.76 | 73.17 | 0.9879 | 0.0724 | |

| 2.90 | 232.96 | 3.1455 | 0.0626 | |

| 12.48 | 12.48 | 0.1684 | 0.0261 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 6.37 | 669.93 | 9.0456 | -0.5189 | |

| 1.06 | 76.79 | 1.0368 | -0.2769 | |

| 4.98 | 127.94 | 1.7275 | -0.2344 | |

| 0.80 | 118.98 | 1.6065 | -0.1993 | |

| 4.77 | 83.53 | 1.1279 | -0.1759 | |

| 3.10 | 195.73 | 2.6429 | -0.1324 | |

| 0.98 | 198.73 | 2.6833 | -0.1320 | |

| 2.11 | 338.77 | 4.5742 | -0.1281 | |

| 0.44 | 125.28 | 1.6916 | -0.1243 | |

| 2.35 | 158.50 | 2.1401 | -0.1187 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-28 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AMT / American Tower Corporation | 3.22 | 0.24 | 710.61 | 1.81 | 9.5949 | 0.2085 | |||

| PLD / Prologis, Inc. | 6.37 | 0.18 | 669.93 | -5.80 | 9.0456 | -0.5189 | |||

| WELL / Welltower Inc. | 4.27 | 2.03 | 655.92 | 2.38 | 8.8565 | 0.2399 | |||

| EQIX / Equinix, Inc. | 0.67 | 0.55 | 534.40 | -1.91 | 7.2156 | -0.1109 | |||

| DLR / Digital Realty Trust, Inc. | 2.17 | 0.09 | 379.04 | 21.77 | 5.1179 | 0.9319 | |||

| O / Realty Income Corporation | 6.20 | 3.23 | 357.32 | 2.52 | 4.8246 | 0.1374 | |||

| SPG / Simon Property Group, Inc. | 2.11 | 0.09 | 338.77 | -3.11 | 4.5742 | -0.1281 | |||

| PSA / Public Storage | 1.08 | 0.23 | 318.16 | -1.73 | 4.2959 | -0.0584 | |||

| CCI / Crown Castle Inc. | 2.99 | 0.24 | 307.24 | -1.20 | 4.1484 | -0.0336 | |||

| CBRE / CBRE Group, Inc. | 2.02 | -0.61 | 282.60 | 6.49 | 3.8157 | 0.2468 | |||

| VICI / VICI Properties Inc. | 7.26 | 0.28 | 236.59 | 0.22 | 3.1946 | 0.0196 | |||

| CSGP / CoStar Group, Inc. | 2.90 | 0.15 | 232.96 | 1.62 | 3.1455 | 0.0626 | |||

| EXR / Extra Space Storage Inc. | 1.46 | 0.14 | 214.88 | -0.57 | 2.9014 | -0.0049 | |||

| IRM / Iron Mountain Incorporated | 2.03 | 0.47 | 207.85 | 19.78 | 2.8064 | 0.4727 | |||

| AVB / AvalonBay Communities, Inc. | 0.98 | 0.12 | 198.73 | -5.07 | 2.6833 | -0.1320 | |||

| VTR / Ventas, Inc. | 3.10 | 3.27 | 195.73 | -5.15 | 2.6429 | -0.1324 | |||

| SBAC / SBA Communications Corporation | 0.74 | -0.03 | 173.32 | 6.71 | 2.3402 | 0.1558 | |||

| EQR / Equity Residential | 2.35 | 0.09 | 158.50 | -5.63 | 2.1401 | -0.1187 | |||

| INVH / Invitation Homes Inc. | 3.91 | 0.25 | 128.39 | -5.65 | 1.7336 | -0.0965 | |||

| WY / Weyerhaeuser Company | 4.98 | -0.04 | 127.94 | -12.30 | 1.7275 | -0.2344 | |||

| ESS / Essex Property Trust, Inc. | 0.44 | 0.37 | 125.28 | -7.22 | 1.6916 | -0.1243 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.80 | 0.32 | 118.98 | -11.39 | 1.6065 | -0.1993 | |||

| KIM / Kimco Realty Corporation | 4.65 | -0.52 | 97.65 | -1.55 | 1.3185 | -0.0154 | |||

| UDR / UDR, Inc. | 2.07 | 0.33 | 84.53 | -9.31 | 1.1413 | -0.1122 | |||

| DOC / Healthpeak Properties, Inc. | 4.77 | -0.50 | 83.53 | -13.84 | 1.1279 | -0.1759 | |||

| CPT / Camden Property Trust | 0.73 | 0.34 | 82.68 | -7.54 | 1.1164 | -0.0863 | |||

| REG / Regency Centers Corporation | 1.12 | 0.29 | 79.91 | -3.15 | 1.0790 | -0.0306 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 1.06 | 0.12 | 76.79 | -21.39 | 1.0368 | -0.2769 | |||

| HST / Host Hotels & Resorts, Inc. | 4.76 | -0.57 | 73.17 | 7.48 | 0.9879 | 0.0724 | |||

| BXP / Boston Properties, Inc. | 1.00 | 0.29 | 67.48 | 0.70 | 0.9112 | 0.0100 | |||

| FRT / Federal Realty Investment Trust | 0.53 | 0.68 | 50.64 | -2.23 | 0.6838 | -0.0128 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 12.48 | 17.85 | 12.48 | 17.86 | 0.1684 | 0.0261 | |||

| EMINI S+P REESTATESEP25 / DE (000000000) | -0.24 | -0.0033 | -0.0033 |