Statistik Asas

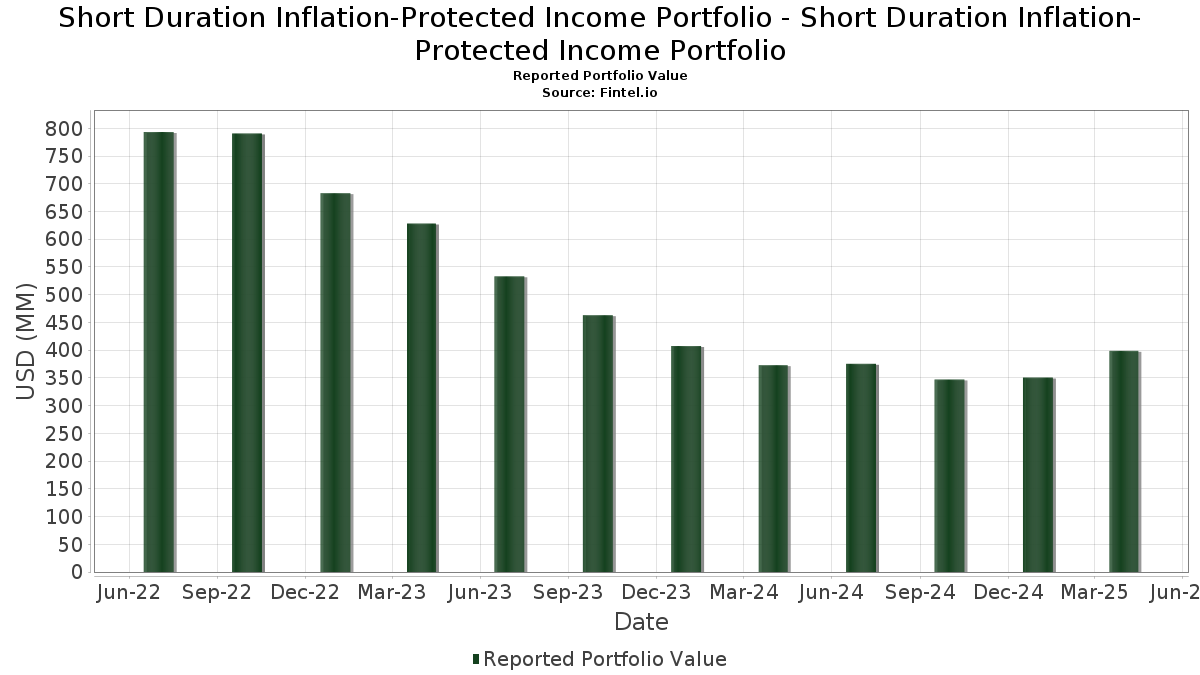

| Nilai Portfolio | $ 398,718,882 |

| Kedudukan Semasa | 45 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Short Duration Inflation-Protected Income Portfolio - Short Duration Inflation-Protected Income Portfolio telah mendedahkan 45 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 398,718,882 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Short Duration Inflation-Protected Income Portfolio - Short Duration Inflation-Protected Income Portfolio ialah United States Treasury Inflation Indexed Bonds (US:US91282CGW55) , United States Treasury Inflation Indexed Bonds (US:US91282CEJ62) , US TREASURY I/L 2.375% 10-15-28 (US:US91282CJH51) , Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 (US:US912810FD55) , and United States Treasury Inflation Indexed Bonds (US:US9128282L36) . Kedudukan baharu Short Duration Inflation-Protected Income Portfolio - Short Duration Inflation-Protected Income Portfolio termasuk United States Treasury Inflation Indexed Bonds (US:US91282CGW55) , United States Treasury Inflation Indexed Bonds (US:US91282CEJ62) , US TREASURY I/L 2.375% 10-15-28 (US:US91282CJH51) , Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 (US:US912810FD55) , and United States Treasury Inflation Indexed Bonds (US:US9128282L36) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 19.82 | 19.82 | 4.9677 | 4.0310 | |

| 23.30 | 5.8400 | 2.8834 | ||

| 11.13 | 2.7888 | 2.3063 | ||

| 8.10 | 2.0300 | 2.0300 | ||

| 0.10 | 4.89 | 1.2251 | 1.2251 | |

| 18.04 | 4.5216 | 1.1087 | ||

| 13.88 | 3.4795 | 1.0395 | ||

| 23.97 | 6.0077 | 0.9427 | ||

| 0.10 | 4.87 | 1.2217 | 0.9176 | |

| 18.52 | 4.6421 | 0.7602 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 6.04 | 1.5150 | -2.3639 | ||

| 21.61 | 5.4161 | -1.7173 | ||

| 18.68 | 4.6808 | -1.1384 | ||

| 13.70 | 3.4350 | -1.1179 | ||

| 20.07 | 5.0316 | -0.7989 | ||

| 13.89 | 3.4817 | -0.3709 | ||

| 13.00 | 3.2590 | -0.3699 | ||

| 10.62 | 2.6619 | -0.2948 | ||

| 21.77 | 5.4571 | -0.2736 | ||

| 9.33 | 2.3377 | -0.2475 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-06-23 untuk tempoh pelaporan 2025-04-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CKL45) | 23.97 | 34.97 | 6.0077 | 0.9427 | |||||

| US91282CGW55 / United States Treasury Inflation Indexed Bonds | 23.30 | 124.77 | 5.8400 | 2.8834 | |||||

| US91282CEJ62 / United States Treasury Inflation Indexed Bonds | 22.28 | 28.74 | 5.5849 | 0.6482 | |||||

| US91282CJH51 / US TREASURY I/L 2.375% 10-15-28 | 21.77 | 8.36 | 5.4571 | -0.2736 | |||||

| US912810FD55 / Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 | 21.61 | -13.60 | 5.4161 | -1.7173 | |||||

| US9128282L36 / United States Treasury Inflation Indexed Bonds | 20.73 | 30.82 | 5.1957 | 0.6763 | |||||

| US912828V491 / United States Treasury Inflation Indexed Bonds | 20.07 | -1.80 | 5.0316 | -0.7989 | |||||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 19.82 | 503.50 | 19.82 | 503.53 | 4.9677 | 4.0310 | |||

| US912810PZ57 / United States Treasury Inflation Indexed Bonds | 18.68 | -8.47 | 4.6808 | -1.1384 | |||||

| US9128283R96 / United States Treasury Inflation Indexed Bonds | 18.52 | 36.08 | 4.6421 | 0.7602 | |||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLV18) | 18.04 | 50.76 | 4.5216 | 1.1087 | |||||

| US91282CFR79 / United States Treasury Inflation Indexed Bonds | 16.27 | 10.23 | 4.0775 | -0.1318 | |||||

| US912810FH69 / Usa Treasury Notes 3 7/8% 30yr Notes 04/15/2029 | 13.89 | 2.84 | 3.4817 | -0.3709 | |||||

| US912828Y388 / United States Treasury Inflation Indexed Bonds | 13.88 | 62.29 | 3.4795 | 1.0395 | |||||

| US91282CDC29 / UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 | 13.70 | -14.15 | 3.4350 | -1.1179 | |||||

| US912810PS15 / United States Treasury Inflation Indexed Bonds | 13.00 | 2.19 | 3.2590 | -0.3699 | |||||

| US912828Z377 / United States Treasury Inflation Indexed Bonds | 11.13 | 557.95 | 2.7888 | 2.3063 | |||||

| US912828S505 / United States Treasury Inflation Indexed Bonds | 10.62 | 2.45 | 2.6619 | -0.2948 | |||||

| EVSD / Morgan Stanley ETF Trust - Eaton Vance Short Duration Income ETF | 0.19 | 43.08 | 9.47 | 44.10 | 2.3734 | 0.4991 | |||

| US912810PV44 / United States Treasury Inflation Indexed Bonds | 9.33 | 2.89 | 2.3377 | -0.2475 | |||||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CNB36) | 8.10 | 2.0300 | 2.0300 | ||||||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 7.56 | 3.70 | 1.8954 | -0.1846 | |||||

| US9128285W63 / United States Treasury Inflation Indexed Bonds | 7.24 | 22.39 | 1.8155 | 0.1275 | |||||

| US91282CCA71 / United States Treasury Inflation Indexed Bonds | 6.04 | -55.56 | 1.5150 | -2.3639 | |||||

| US05609VAG05 / BX Commercial Mortgage Trust 2021-VOLT | 4.95 | -0.44 | 1.2406 | -0.1773 | |||||

| EVTR / Morgan Stanley ETF Trust - Eaton Vance Total Return Bond ETF | 0.10 | 4.89 | 1.2251 | 1.2251 | |||||

| EVSB / Morgan Stanley ETF Trust - Eaton Vance Ultra-Short Income ETF | 0.10 | 357.14 | 4.87 | 357.22 | 1.2217 | 0.9176 | |||

| US912828ZZ63 / United States Treasury Inflation Indexed Bonds | 4.09 | 3.91 | 1.0255 | -0.0976 | |||||

| US30227FAA84 / Extended Stay America Trust | 2.78 | -2.18 | 0.6973 | -0.1139 | |||||

| Long: BEV4L52J9 IRS USD R V 12MUSCPI 1 CCPINFLATIONZERO / Short: BEV4L52J9 IRS USD P F 2.54500 2 CCPINFLATIONZERO / DIR (000000000) | 1.14 | 0.2854 | 0.2854 | ||||||

| Long: BEV53C5Y5 IRS USD R V 12MUSCPI 1 CCPINFLATIONZERO / Short: BEV53C5Y5 IRS USD P F 2.82250 2 CCPINFLATIONZERO / DIR (000000000) | 1.05 | 0.2642 | 0.2642 | ||||||

| US92212KAC09 / Vantage Data Centers LLC | 1.03 | 1.08 | 0.2580 | -0.0325 | |||||

| Long: BEV51CNB7 IRS USD R V 12MUSCPI 1 CCPINFLATIONZERO / Short: BEV51CNB7 IRS USD P F 2.99875 2 CCPINFLATIONZERO / DIR (000000000) | 1.02 | 0.2568 | 0.2568 | ||||||

| US46657FAA30 / JP Morgan Mortgage Trust 2023-HE2 | 0.90 | -13.81 | 0.2255 | -0.0721 | |||||

| US12592XAG16 / COMM 2015-CCRE22 Mortgage Trust | 0.76 | 0.00 | 0.1912 | -0.0265 | |||||

| US19260MAA45 / Coinstar Funding LLC Series 2017-1 | 0.62 | -3.55 | 0.1566 | -0.0281 | |||||

| Long: BEV4Z2GN7 IRS USD R V 12MUSCPI 1 CCPINFLATIONZERO / Short: BEV4Z2GN7 IRS USD P F 3.23900 2 CCPINFLATIONZERO / DIR (000000000) | 0.56 | 0.1409 | 0.1409 | ||||||

| US12626LAY83 / Commercial Mortgage Trust, Series 2013-CR11, Class D | 0.35 | 2.36 | 0.0871 | -0.0097 | |||||

| US85022WAP95 / SpringCastle America Funding LLC | 0.35 | -7.22 | 0.0870 | -0.0197 | |||||

| US501687AA54 / LAD Auto Receivables Trust 2022-1 | 0.18 | -39.31 | 0.0441 | -0.0386 | |||||

| Long: BEV55L8D6 IRS USD R V 12MUSCPI 1 CCPINFLATIONZERO / Short: BEV55L8D6 IRS USD P F 3.60900 2 CCPINFLATIONZERO / DIR (000000000) | 0.11 | 0.0280 | 0.0280 | ||||||

| Long: BMIETKTH8 IRS USD R V 12MUSCPI BMIETKTK1 CCPINFLATIONZERO / Short: BMIETKTH8 IRS USD P F 2.36458 BMIETKTJ4 CCPINFLATIONZERO / DIR (000000000) | 0.07 | 0.0172 | 0.0172 | ||||||

| US55400EAA73 / MVW 2020-1 LLC | 0.02 | -9.09 | 0.0052 | -0.0013 | |||||

| Long: BMIETRFE5 IRS USD R V 12MUSCPI BMIETRFG0 CCPINFLATIONZERO / Short: BMIETRFE5 IRS USD P F 2.51000 BMIETRFF2 CCPINFLATIONZERO / DIR (000000000) | 0.01 | 0.0015 | 0.0015 | ||||||

| Long: BMIEHCL38 IRS USD R V 12MUSCPI BMIEHCL53 CCPINFLATIONZERO / Short: BMIEHCL38 IRS USD P F 2.63850 BMIEHCL46 CCPINFLATIONZERO / DIR (000000000) | -0.08 | -0.0196 | -0.0196 |