Statistik Asas

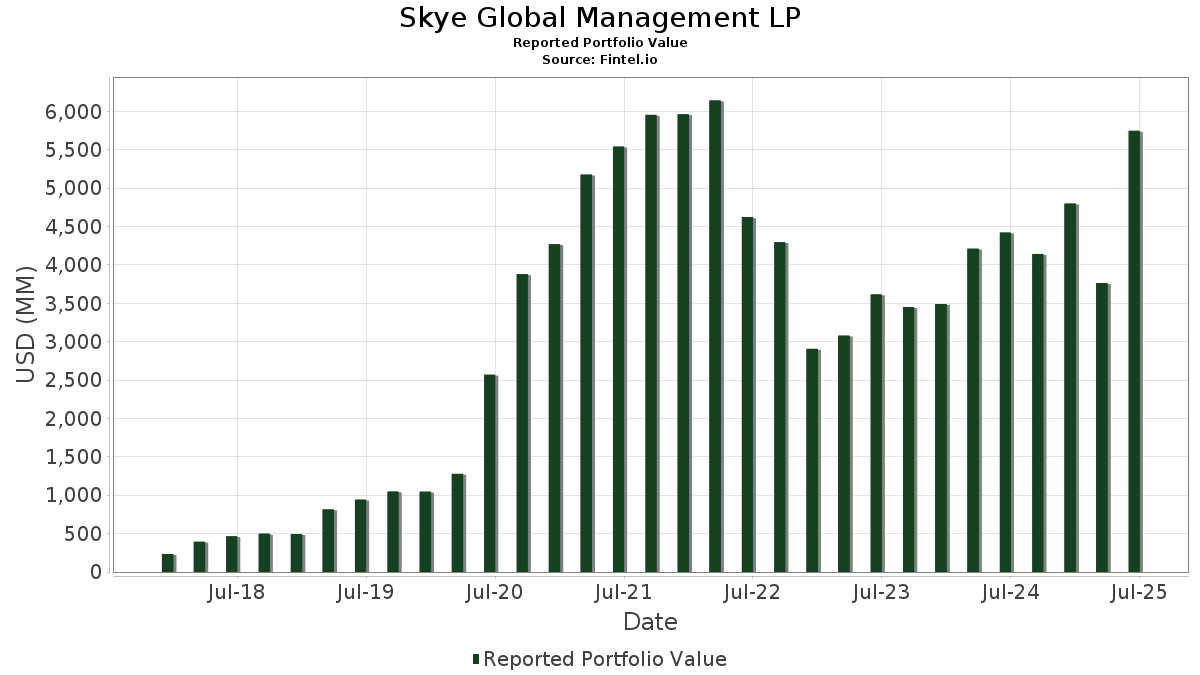

| Nilai Portfolio | $ 5,745,146,948 |

| Kedudukan Semasa | 60 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Skye Global Management LP telah mendedahkan 60 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 5,745,146,948 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Skye Global Management LP ialah Amazon.com, Inc. (US:AMZN) , SPDR S&P 500 ETF (US:SPY) , Microsoft Corporation (US:MSFT) , General Electric Company (US:GE) , and Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) . Kedudukan baharu Skye Global Management LP termasuk SPDR S&P 500 ETF (US:SPY) , Unity Software Inc. (US:U) , Natera, Inc. (US:NTRA) , Core & Main, Inc. (US:CNM) , and Heico Corp. - Class A (US:HEIA) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.68 | 1,037.99 | 18.0672 | 18.0672 | |

| 0.10 | 53.38 | 0.9292 | 0.9292 | |

| 2.03 | 49.08 | 0.8542 | 0.8542 | |

| 0.54 | 190.31 | 3.3125 | 0.5928 | |

| 0.07 | 20.89 | 0.3637 | 0.3637 | |

| 0.71 | 17.28 | 0.3008 | 0.3008 | |

| 0.19 | 15.26 | 0.2656 | 0.2656 | |

| 0.61 | 8.55 | 0.1489 | 0.1208 | |

| 0.03 | 5.77 | 0.1004 | 0.1004 | |

| 0.02 | 20.62 | 0.3590 | 0.0987 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 6.98 | 1,532.22 | 26.6698 | -4.9533 | |

| 1.01 | 229.21 | 3.9896 | -2.4339 | |

| 1.01 | 503.38 | 8.7618 | -1.3345 | |

| 0.59 | 110.54 | 1.9240 | -1.1470 | |

| 1.28 | 329.97 | 5.7435 | -1.0758 | |

| 0.29 | 157.28 | 2.7376 | -1.0555 | |

| 0.09 | 83.12 | 1.4469 | -0.9831 | |

| 0.48 | 125.85 | 2.1905 | -0.8973 | |

| 0.12 | 182.48 | 3.1762 | -0.8678 | |

| 0.24 | 118.38 | 2.0604 | -0.8604 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-14 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AMZN / Amazon.com, Inc. | 6.98 | 11.67 | 1,532.22 | 28.77 | 26.6698 | -4.9533 | |||

| SPY / SPDR S&P 500 ETF | Call | 1.68 | 1,037.99 | 18.0672 | 18.0672 | ||||

| MSFT / Microsoft Corporation | 1.01 | 0.00 | 503.38 | 32.50 | 8.7618 | -1.3345 | |||

| GE / General Electric Company | 1.28 | 0.00 | 329.97 | 28.60 | 5.7435 | -1.0758 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 1.01 | -30.49 | 229.21 | -5.17 | 3.9896 | -2.4339 | |||

| V / Visa Inc. | 0.54 | 83.56 | 190.31 | 85.97 | 3.3125 | 0.5928 | |||

| TDG / TransDigm Group Incorporated | 0.12 | 9.09 | 182.48 | 19.92 | 3.1762 | -0.8678 | |||

| MLM / Martin Marietta Materials, Inc. | 0.29 | -4.02 | 157.28 | 10.20 | 2.7376 | -1.0555 | |||

| SPGI / S&P Global Inc. | 0.27 | 13.56 | 141.31 | 17.85 | 2.4597 | -0.7271 | |||

| VMC / Vulcan Materials Company | 0.48 | -3.11 | 125.85 | 8.32 | 2.1905 | -0.8973 | |||

| MCO / Moody's Corporation | 0.24 | 0.00 | 118.38 | 7.71 | 2.0604 | -0.8604 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.43 | 0.00 | 115.19 | 17.05 | 2.0050 | -0.6105 | |||

| WCN / Waste Connections, Inc. | 0.59 | 0.00 | 110.54 | -4.34 | 1.9240 | -1.1470 | |||

| KLAC / KLA Corporation | 0.09 | -31.00 | 83.12 | -9.09 | 1.4469 | -0.9831 | |||

| META / Meta Platforms, Inc. | 0.11 | 11.58 | 78.24 | 42.89 | 1.3618 | -0.0934 | |||

| LRCX / Lam Research Corporation | 0.73 | -27.35 | 70.86 | -2.72 | 1.2335 | -0.7025 | |||

| CASY / Casey's General Stores, Inc. | 0.13 | 0.00 | 64.29 | 17.56 | 1.1191 | -0.3343 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.15 | 54.21 | 59.40 | 25.65 | 1.0339 | -0.2224 | |||

| SHW / The Sherwin-Williams Company | 0.16 | 53.30 | 55.80 | 50.74 | 0.9712 | -0.0125 | |||

| MA / Mastercard Incorporated | 0.10 | 53.38 | 0.9292 | 0.9292 | |||||

| U / Unity Software Inc. | 2.03 | 49.08 | 0.8542 | 0.8542 | |||||

| DHR / Danaher Corporation | 0.18 | 10.64 | 35.95 | 6.61 | 0.6258 | -0.2704 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.45 | 8.04 | 33.33 | -0.84 | 0.5802 | -0.3132 | |||

| UAL / United Airlines Holdings, Inc. | 0.41 | 13.41 | 32.33 | 30.79 | 0.5627 | -0.0942 | |||

| UNP / Union Pacific Corporation | 0.13 | 93.13 | 29.11 | 88.10 | 0.5066 | 0.0954 | |||

| PG / The Procter & Gamble Company | 0.17 | 12.01 | 27.48 | 4.72 | 0.4784 | -0.2191 | |||

| CPNG / Coupang, Inc. | 0.84 | -24.82 | 25.23 | 2.71 | 0.4391 | -0.2137 | |||

| FERG / Ferguson Enterprises Inc. | 0.11 | 7.69 | 24.39 | 46.36 | 0.4245 | -0.0184 | |||

| KVUE / Kenvue Inc. | 1.05 | 61.16 | 22.06 | 40.67 | 0.3840 | -0.0328 | |||

| AXP / American Express Company | 0.07 | 20.89 | 0.3637 | 0.3637 | |||||

| NFLX / Netflix, Inc. | 0.02 | 46.67 | 20.62 | 110.62 | 0.3590 | 0.0987 | |||

| FER / Ferrovial SE | 0.32 | 18.43 | 17.38 | 41.23 | 0.3026 | -0.0245 | |||

| U / Unity Software Inc. | Call | 0.71 | 17.28 | 0.3008 | 0.3008 | ||||

| CP / Canadian Pacific Kansas City Limited | 0.19 | 15.26 | 0.2656 | 0.2656 | |||||

| DAL / Delta Air Lines, Inc. | 0.27 | 8.07 | 13.50 | 21.90 | 0.2350 | -0.0593 | |||

| SPOT / Spotify Technology S.A. | 0.02 | 33.33 | 12.89 | 86.02 | 0.2244 | 0.0402 | |||

| RSG / Republic Services, Inc. | 0.05 | 92.06 | 11.94 | 95.59 | 0.2078 | 0.0456 | |||

| PRM / Perimeter Solutions, Inc. | 0.61 | 485.24 | 8.55 | 709.18 | 0.1489 | 0.1208 | |||

| SHOP / Shopify Inc. | 0.07 | 103.87 | 7.90 | 146.29 | 0.1375 | 0.0523 | |||

| AAPL / Apple Inc. | 0.03 | 220.00 | 6.89 | 195.58 | 0.1200 | 0.0580 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -84.25 | 6.59 | -78.90 | 0.1146 | -0.7149 | |||

| DE / Deere & Company | 0.01 | 140.00 | 6.41 | 159.98 | 0.1115 | 0.0460 | |||

| LPX / Louisiana-Pacific Corporation | 0.07 | 4.92 | 5.86 | -1.91 | 0.1021 | -0.0568 | |||

| WM / Waste Management, Inc. | 0.03 | 5.77 | 0.1004 | 0.1004 | |||||

| GRND / Grindr Inc. | 0.25 | -52.26 | 5.77 | -39.46 | 0.1004 | -0.1527 | |||

| AXON / Axon Enterprise, Inc. | 0.01 | -1.56 | 5.22 | 54.96 | 0.0908 | 0.0013 | |||

| WMT / Walmart Inc. | 0.05 | 4.73 | 0.0824 | 0.0824 | |||||

| ICE / Intercontinental Exchange, Inc. | 0.03 | 200.00 | 4.62 | 219.05 | 0.0805 | 0.0420 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 4.36 | 4.66 | 0.0758 | -0.0348 | |||

| NTRA / Natera, Inc. | 0.03 | 4.26 | 0.0741 | 0.0741 | |||||

| DASH / DoorDash, Inc. | 0.01 | 3.11 | 0.0541 | 0.0541 | |||||

| QXO / QXO, Inc. | 0.13 | 401.98 | 2.72 | 698.83 | 0.0474 | 0.0384 | |||

| CNM / Core & Main, Inc. | 0.04 | 2.29 | 0.0399 | 0.0399 | |||||

| HEIA / Heico Corp. - Class A | 0.01 | 2.17 | 0.0378 | 0.0378 | |||||

| STE / STERIS plc | 0.01 | 2.02 | 0.0351 | 0.0351 | |||||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 0.01 | 2.02 | 0.0351 | 0.0351 | |||||

| LOAR / Loar Holdings Inc. | 0.02 | 0.00 | 1.81 | 21.98 | 0.0315 | -0.0079 | |||

| VIK / Viking Holdings Ltd | 0.03 | 1.79 | 0.0312 | 0.0312 | |||||

| FIX / Comfort Systems USA, Inc. | 0.00 | -50.00 | 1.35 | -16.81 | 0.0235 | -0.0197 | |||

| KNF / Knife River Corporation | 0.01 | 1.03 | 0.0179 | 0.0179 | |||||

| ONTO / Onto Innovation Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMAT / Applied Materials, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CMG / Chipotle Mexican Grill, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WMB / The Williams Companies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HII / Huntington Ingalls Industries, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PRMB / Primo Brands Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KMI / Kinder Morgan, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |