Statistik Asas

| Nilai Portfolio | $ 583,704,522 |

| Kedudukan Semasa | 185 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

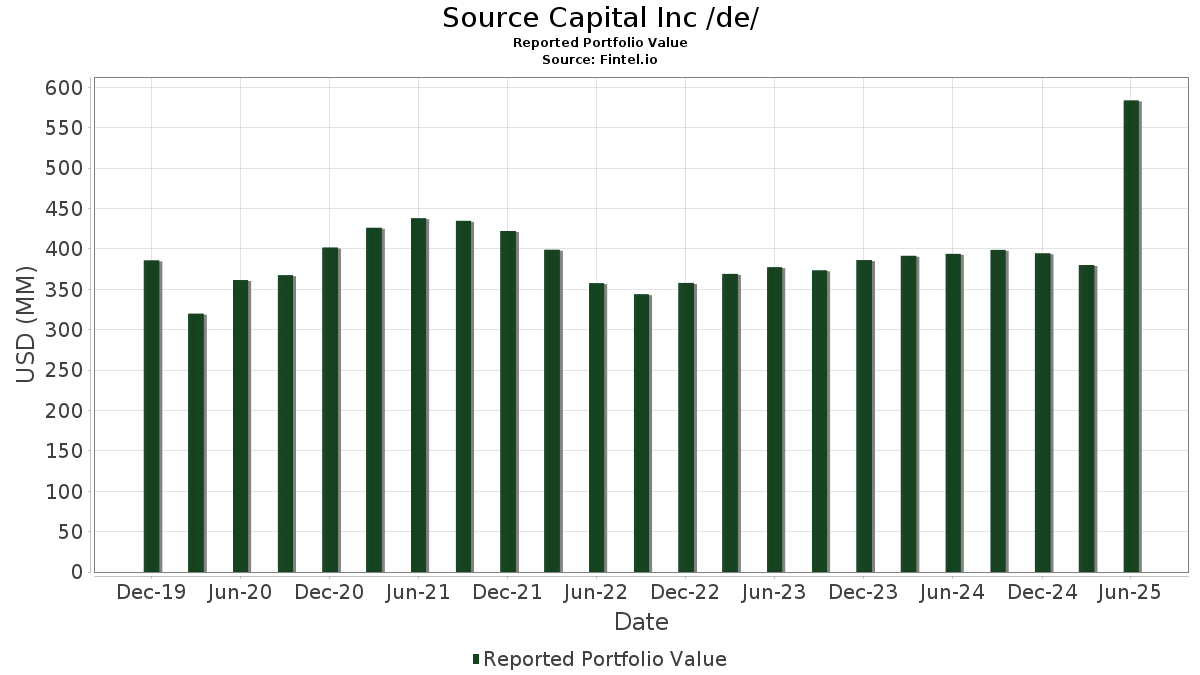

Source Capital Inc /de/ telah mendedahkan 185 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 583,704,522 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Source Capital Inc /de/ ialah Analog Devices, Inc. (US:ADI) , TE Connectivity plc (US:TEL) , Citigroup Inc. (US:C) , Comcast Corporation (US:CMCSA) , and Meta Platforms, Inc. (US:META) . Kedudukan baharu Source Capital Inc /de/ termasuk Fortress Credit Opportunities IX CLO Ltd (KY:US34961MAE75) , CONV. NOTE (US:US94419LAM37) , Midcap Financial Issuer Trust (US:US59567LAA26) , Tidewater, Inc. (US:NO0012952227) , and ABPCI Direct Lending Fund ABS II LLC (US:US00090NAG51) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 20.01 | 5.2953 | 5.2953 | ||

| 20.01 | 5.2953 | 5.2953 | ||

| 19.75 | 5.2248 | 5.2248 | ||

| 19.75 | 5.2248 | 5.2248 | ||

| 18.00 | 4.7614 | 4.7614 | ||

| 18.00 | 4.7614 | 4.7614 | ||

| 13.87 | 3.6689 | 3.6689 | ||

| 13.87 | 3.6689 | 3.6689 | ||

| 8.87 | 2.3467 | 2.3467 | ||

| 8.87 | 2.3467 | 2.3467 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.58 | 0.4178 | -17.0446 | ||

| 0.05 | 3.98 | 1.0521 | -1.0719 | |

| 0.01 | 4.85 | 1.2842 | -0.2271 | |

| 8.75 | 2.3162 | -0.2042 | ||

| 8.75 | 2.3162 | -0.2042 | ||

| 0.22 | 7.69 | 2.0359 | -0.1785 | |

| -0.67 | -0.1768 | -0.1768 | ||

| -0.67 | -0.1768 | -0.1768 | ||

| 0.08 | 5.71 | 1.5118 | -0.1664 | |

| 0.04 | 2.93 | 0.7744 | -0.1569 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-27 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| United States Treasury Bill / DBT (US912797MG92) | 20.01 | 5.2953 | 5.2953 | ||||||

| United States Treasury Bill / DBT (US912797MG92) | 20.01 | 5.2953 | 5.2953 | ||||||

| United States Treasury Bill / DBT (US912797MH75) | 19.75 | 5.2248 | 5.2248 | ||||||

| United States Treasury Bill / DBT (US912797MH75) | 19.75 | 5.2248 | 5.2248 | ||||||

| United States Treasury Bill / DBT (US912797NX17) | 18.00 | 4.7614 | 4.7614 | ||||||

| United States Treasury Bill / DBT (US912797NX17) | 18.00 | 4.7614 | 4.7614 | ||||||

| TIOGA PARTNERS IV LP / / (999999999) | 13.87 | 3.6689 | 3.6689 | ||||||

| TIOGA PARTNERS IV LP / / (999999999) | 13.87 | 3.6689 | 3.6689 | ||||||

| TIDEWATER, Inc. Sr. SEC 11/16/26 8.5 / / DBT (ACI22L8Z7) | 9.84 | -0.14 | 2.6048 | -0.1392 | |||||

| TIDEWATER, Inc. Sr. SEC 11/16/26 8.5 / / DBT (ACI22L8Z7) | 9.84 | -0.14 | 2.6048 | -0.1392 | |||||

| MSD PRIVATE CREDIT OPP FD 2 LP / / (942KWF009) | 9.58 | 1.22 | 2.5348 | -0.0997 | |||||

| MSD PRIVATE CREDIT OPP FD 2 LP / / (942KWF009) | 9.58 | 1.22 | 2.5348 | -0.0997 | |||||

| ADI / Analog Devices, Inc. | 0.04 | 0.00 | 8.88 | 18.04 | 2.3498 | 0.2553 | |||

| FPS Holdco II LLC SOURCE / / (999999999) | 8.87 | 2.3467 | 2.3467 | ||||||

| FPS Holdco II LLC SOURCE / / (999999999) | 8.87 | 2.3467 | 2.3467 | ||||||

| METRO PARTNERS FUND VII, LP / / (942TKW907) | 8.75 | -3.32 | 2.3162 | -0.2042 | |||||

| METRO PARTNERS FUND VII, LP / / (942TKW907) | 8.75 | -3.32 | 2.3162 | -0.2042 | |||||

| EQS Legacy Holdings Term Loan 3/27/2032 / / LON (999999999) | 8.57 | 2.2688 | 2.2688 | ||||||

| EQS Legacy Holdings Term Loan 3/27/2032 / / LON (999999999) | 8.57 | 2.2688 | 2.2688 | ||||||

| TEL / TE Connectivity plc | 0.05 | 0.00 | 8.47 | 19.36 | 2.2398 | 0.2656 | |||

| C / Citigroup Inc. | 0.09 | -6.25 | 7.99 | 12.40 | 2.1151 | 0.1357 | |||

| CMCSA / Comcast Corporation | 0.22 | 0.00 | 7.69 | -3.28 | 2.0359 | -0.1785 | |||

| META / Meta Platforms, Inc. | 0.01 | 0.00 | 7.67 | 28.07 | 2.0284 | 0.3621 | |||

| CLOVER PRIVATE CRED / / (9353JY901) | 6.08 | -0.15 | 1.6083 | -0.0861 | |||||

| CLOVER PRIVATE CRED / / (9353JY901) | 6.08 | -0.15 | 1.6083 | -0.0861 | |||||

| HEIO / Heineken Holding N.V. | 0.08 | 0.00 | 6.00 | 2.99 | 1.5877 | -0.0340 | |||

| Jett Texas LLC SOURCE / / (999999999) | 6.00 | 1.5875 | 1.5875 | ||||||

| Jett Texas LLC SOURCE / / (999999999) | 6.00 | 1.5875 | 1.5875 | ||||||

| SAF / Safran SA | 0.02 | 0.00 | 5.99 | 24.20 | 1.5850 | 0.2425 | |||

| IFF / International Flavors & Fragrances Inc. | 0.08 | 0.00 | 5.71 | -5.24 | 1.5118 | -0.1664 | |||

| GOOGL / Alphabet Inc. | 0.03 | 0.00 | 5.61 | 13.97 | 1.4852 | 0.1142 | |||

| HIG WHITEHORSE DIR LEN 2020 LP / / (936JLN906) | 5.47 | -0.13 | 1.4480 | -0.0772 | |||||

| HIG WHITEHORSE DIR LEN 2020 LP / / (936JLN906) | 5.47 | -0.13 | 1.4480 | -0.0772 | |||||

| US34961MAE75 / Fortress Credit Opportunities IX CLO Ltd | 5.14 | -0.35 | 1.3609 | -0.0758 | |||||

| AON / Aon plc | 0.01 | 0.00 | 4.85 | -10.61 | 1.2842 | -0.2271 | |||

| PRX / Prosus N.V. | 0.09 | 0.00 | 4.84 | 21.45 | 1.2795 | 0.1713 | |||

| 24W5 / Ferguson plc | 0.02 | 0.00 | 4.82 | 35.89 | 1.2766 | 0.2884 | |||

| JDEP / JDE Peet's N.V. | 0.17 | 0.00 | 4.77 | 30.60 | 1.2624 | 0.2455 | |||

| BLUE TORCH CRED OPP FUND II LP / / (942JAU904) | 4.73 | -1.34 | 1.2510 | -0.0829 | |||||

| BLUE TORCH CRED OPP FUND II LP / / (942JAU904) | 4.73 | -1.34 | 1.2510 | -0.0829 | |||||

| Banner Commercial FUNDING LP 5/27/2028 / / DBT (999999999) | 4.67 | 1.2348 | 1.2348 | ||||||

| Banner Commercial FUNDING LP 5/27/2028 / / DBT (999999999) | 4.67 | 1.2348 | 1.2348 | ||||||

| SILVERVIEW SPECIAL SIT LD ONSHORE LP / / (967DPC901) | 4.57 | -2.85 | 1.2087 | -0.1002 | |||||

| SILVERVIEW SPECIAL SIT LD ONSHORE LP / / (967DPC901) | 4.57 | -2.85 | 1.2087 | -0.1002 | |||||

| HOLN / Holcim AG | 0.05 | -25.01 | 3.98 | -47.89 | 1.0521 | -1.0719 | |||

| US94419LAM37 / CONV. NOTE | 3.84 | 0.37 | 1.0156 | -0.0490 | |||||

| 7974 / Nintendo Co., Ltd. | 0.04 | -4.56 | 3.83 | 36.49 | 1.0136 | 0.2322 | |||

| Castlelake Asset LP Based Private Credit / / (999999999) | 3.80 | 1.0060 | 1.0060 | ||||||

| Castlelake Asset LP Based Private Credit / / (999999999) | 3.80 | 1.0060 | 1.0060 | ||||||

| LEALAND FINANCE Co. B.V. SUPER SNR EXIT LC / / LON (935IFTII4) | 3.65 | 0.36 | 0.9663 | -0.0468 | |||||

| LEALAND FINANCE Co. B.V. SUPER SNR EXIT LC / / LON (935IFTII4) | 3.65 | 0.36 | 0.9663 | -0.0468 | |||||

| MSD REAL ESTATE CREDIT OPPS FD / / (966RVUII5) | 3.60 | 0.42 | 0.9524 | -0.0453 | |||||

| HLEND SENIOR NOTES DUE 3/15/2028 / / DBT (952JRDII2) | 3.50 | 0.00 | 0.9260 | -0.0482 | |||||

| HLEND SENIOR NOTES DUE 3/15/2028 / / DBT (952JRDII2) | 3.50 | 0.00 | 0.9260 | -0.0482 | |||||

| GOOG / Alphabet Inc. | 0.02 | 0.00 | 3.50 | 13.53 | 0.9256 | 0.0680 | |||

| Amrize Ltd. / EC (CH1430134226) | 0.07 | 3.45 | 0.9124 | 0.9124 | |||||

| Amrize Ltd. / EC (CH1430134226) | 0.07 | 3.45 | 0.9124 | 0.9124 | |||||

| US59567LAA26 / Midcap Financial Issuer Trust | 3.42 | 3.13 | 0.9056 | -0.0182 | |||||

| ERF / Eurofins Scientific SE | 0.05 | 0.00 | 3.36 | 33.77 | 0.8879 | 0.1897 | |||

| NEBARI NAT RES CREDIT FD I LP / / (966ZTA002) | 3.18 | 0.98 | 0.8423 | -0.0351 | |||||

| NEBARI NAT RES CREDIT FD I LP / / (966ZTA002) | 3.18 | 0.98 | 0.8423 | -0.0351 | |||||

| PINEY LAKE OPPS FUND LP / / (942XPN903) | 3.18 | -2.39 | 0.8421 | -0.0654 | |||||

| PINEY LAKE OPPS FUND LP / / (942XPN903) | 3.18 | -2.39 | 0.8421 | -0.0654 | |||||

| NO0012952227 / Tidewater, Inc. | 3.17 | -0.85 | 0.8384 | -0.0509 | |||||

| GLEN / Glencore plc | 0.80 | 1.75 | 3.12 | 9.39 | 0.8264 | 0.0316 | |||

| Delta Commercial FUNDING LP 12/31/27 / / DBT (999999999) | 3.10 | 0.8202 | 0.8202 | ||||||

| Delta Commercial FUNDING LP 12/31/27 / / DBT (999999999) | 3.10 | 0.8202 | 0.8202 | ||||||

| TREVIAN CAP DEBT FUND LP / / (999999999) | 2.98 | 0.7888 | 0.7888 | ||||||

| TREVIAN CAP DEBT FUND LP / / (999999999) | 2.98 | 0.7888 | 0.7888 | ||||||

| NXPI / NXP Semiconductors N.V. | 0.01 | 0.00 | 2.97 | 14.95 | 0.7854 | 0.0667 | |||

| WFC / Wells Fargo & Company | 0.04 | -21.62 | 2.93 | -12.53 | 0.7744 | -0.1569 | |||

| MTN / Vail Resorts, Inc. | 0.02 | 28.03 | 2.84 | 25.75 | 0.7521 | 0.1228 | |||

| US00090NAG51 / ABPCI Direct Lending Fund ABS II LLC | 2.83 | -5.45 | 0.7490 | -0.0841 | |||||

| AMZN / Amazon.com, Inc. | 0.01 | 0.00 | 2.75 | 15.32 | 0.7269 | 0.0637 | |||

| CFR / Compagnie Financière Richemont SA | 0.01 | 0.00 | 2.75 | 8.96 | 0.7269 | 0.0250 | |||

| US38178XAC74 / GOLUB CAP. PARTNE 4.0115% | 2.62 | -10.78 | 0.6920 | -0.1239 | |||||

| US19260MAA45 / Coinstar Funding LLC Series 2017-1 | 2.61 | 1.12 | 0.6909 | -0.0278 | |||||

| KR7028260008 / Samsung C&T Corp | 0.02 | 0.00 | 2.56 | 50.65 | 0.6762 | 0.2040 | |||

| CHTR / Charter Communications, Inc. | 0.01 | 0.00 | 2.45 | 10.93 | 0.6471 | 0.0334 | |||

| 003550 / LG Corp. | 0.04 | -9.00 | 2.42 | 22.35 | 0.6404 | 0.0897 | |||

| APOLLO DEBT SOLUTION DELAYED DRAW TERM LO / / LON (999999999) | 2.33 | 0.6173 | 0.6173 | ||||||

| APOLLO DEBT SOLUTION DELAYED DRAW TERM LO / / LON (999999999) | 2.33 | 0.6173 | 0.6173 | ||||||

| BH3 DEBT OPPORTUNITY FUND II-PARALLEL LP / / (999999999) | 2.32 | 0.6141 | 0.6141 | ||||||

| BH3 DEBT OPPORTUNITY FUND II-PARALLEL LP / / (999999999) | 2.32 | 0.6141 | 0.6141 | ||||||

| CAPSTONE ACQ HLDGS BANK DEBT 11/12/2029 / / LON (999999999) | 2.29 | 0.6065 | 0.6065 | ||||||

| CAPSTONE ACQ HLDGS BANK DEBT 11/12/2029 / / LON (999999999) | 2.29 | 0.6065 | 0.6065 | ||||||

| RI / Pernod Ricard SA | 0.02 | 0.00 | 2.24 | 0.99 | 0.5935 | -0.0247 | |||

| US00090TAC18 / ABPCI Direct Lending Fund ABS I Ltd | 2.22 | -13.28 | 0.5876 | -0.1250 | |||||

| MAR / Marriott International, Inc. | 0.01 | 0.00 | 2.20 | 14.70 | 0.5822 | 0.0482 | |||

| PHIG / PHI Group, Inc. | 0.08 | 0.00 | 2.07 | 0.00 | 0.5474 | -0.0285 | |||

| KMI / Kinder Morgan, Inc. | 0.07 | -9.93 | 2.07 | -7.18 | 0.5474 | -0.0730 | |||

| POST ROAD SPEC OPP FUND II LP / / (942FPU906) | 1.90 | -1.81 | 0.5033 | -0.0361 | |||||

| POST ROAD SPEC OPP FUND II LP / / (942FPU906) | 1.90 | -1.81 | 0.5033 | -0.0361 | |||||

| US42239PAB58 / Heartland Dental LLC / Heartland Dental Finance Corp | 1.90 | 0.53 | 0.5015 | -0.0234 | |||||

| FBIN / Fortune Brands Innovations, Inc. | 0.04 | 151.68 | 1.86 | 112.96 | 0.4915 | 0.2486 | |||

| US701631AD54 / Parliament Funding | 1.85 | 0.11 | 0.4889 | -0.0247 | |||||

| Oaktree Strategic Credit Fund / DBT (US67403AAB52) | 1.74 | -0.34 | 0.4608 | -0.0256 | |||||

| Oaktree Strategic Credit Fund / DBT (US67403AAB52) | 1.74 | -0.34 | 0.4608 | -0.0256 | |||||

| US19521UAE38 / Cologix Data Centers US Issuer LLC | 1.71 | 3.07 | 0.4534 | -0.0095 | |||||

| 7NX / NEXON Co., Ltd. | 0.08 | -28.06 | 1.64 | 6.86 | 0.4331 | 0.0068 | |||

| NOV / NOV Inc. | 0.13 | 100.89 | 1.64 | 64.09 | 0.4330 | 0.1554 | |||

| SILVERVIEW CREDIT OP ONSHORE FUND LP / / (966LHXII8) | 1.62 | -1.58 | 0.4276 | -0.0296 | |||||

| US61747C5821 / Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio | 1.58 | -97.48 | 0.4178 | -17.0446 | |||||

| US008911BD05 / Air Canada 2020-1 Class C Pass Through Trust | 1.58 | -0.82 | 0.4173 | -0.0253 | |||||

| KMX / CarMax, Inc. | 0.02 | 0.00 | 1.57 | -13.74 | 0.4152 | -0.0912 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.01 | 0.00 | 1.55 | 15.45 | 0.4094 | 0.0363 | |||

| US87240GAG64 / TCP Whitney CLO Ltd | 1.54 | -0.45 | 0.4074 | -0.0231 | |||||

| HWM / Howmet Aerospace Inc. | 0.01 | -32.59 | 1.41 | -3.29 | 0.3736 | -0.0328 | |||

| DE000A30V5R1 / Delivery Hero SE | 1.35 | 7.59 | 0.3563 | 0.0080 | |||||

| US20903XAF06 / Consolidated Communications Inc | 1.30 | 5.80 | 0.3429 | 0.0017 | |||||

| US05609VAQ86 / BX Commercial Mortgage Trust, Series 2021-VOLT, Class F | 1.26 | -2.39 | 0.3345 | -0.0260 | |||||

| WH Borrower LLC / LON (92942LAG6) | 1.21 | 0.17 | 0.3191 | -0.0160 | |||||

| WH Borrower LLC / LON (92942LAG6) | 1.21 | 0.17 | 0.3191 | -0.0160 | |||||

| ICLR / ICON Public Limited Company | 0.01 | 70.91 | 1.20 | 42.04 | 0.3165 | 0.0821 | |||

| EPIC GAMES, INC. PRIVATE COMMON STOCK / / EC (966TDKII3) | 0.00 | 0.00 | 1.16 | 0.00 | 0.3059 | -0.0159 | |||

| US38178HAC25 / Golub Capital Partners ABS Funding 2019-1 Ltd | 1.10 | -1.35 | 0.2912 | -0.0193 | |||||

| US06761EAA38 / Barings Middle Market CLO Ltd 2021-I | 1.04 | -0.10 | 0.2751 | -0.0144 | |||||

| US92243RAE45 / VCP RRL ABS I, LTD | 1.03 | -0.29 | 0.2731 | -0.0152 | |||||

| MCDIF / Mcdermott International Ltd. | 0.08 | 0.00 | 1.02 | -7.70 | 0.2697 | -0.0377 | |||

| SATS / EchoStar Corporation | 1.00 | 0.2638 | 0.2638 | ||||||

| SATS / EchoStar Corporation | 1.00 | 0.2638 | 0.2638 | ||||||

| US25267TAS06 / Diamond Issuer | 0.92 | 1.32 | 0.2444 | -0.0094 | |||||

| UBER / Uber Technologies, Inc. | 0.01 | -15.63 | 0.89 | 8.06 | 0.2342 | 0.0061 | |||

| US44148JAC36 / Hotwire Funding LLC | 0.73 | 0.97 | 0.1935 | -0.0081 | |||||

| XAN5200EAB73 / Lealand Finance Company BV, Term Loan | 0.70 | 9.55 | 0.1854 | 0.0072 | |||||

| LEALAND FINANCE Co. B.V. LETTER OF CREDIT / / LON (935IQZII8) | 0.66 | 16.49 | 0.1739 | 0.0166 | |||||

| LEALAND FINANCE Co. B.V. LETTER OF CREDIT / / LON (935IQZII8) | 0.66 | 16.49 | 0.1739 | 0.0166 | |||||

| AVGO / Broadcom Inc. | 0.00 | -37.57 | 0.62 | 2.66 | 0.1637 | -0.0039 | |||

| DE000A254Y92 / DELIVERY HERO AG | 0.56 | 10.08 | 0.1474 | 0.0065 | |||||

| OCREDIT BDC SENIOR NOTE DDTL / / LON (999999999) | 0.55 | 0.1461 | 0.1461 | ||||||

| OCREDIT BDC SENIOR NOTE DDTL / / LON (999999999) | 0.55 | 0.1461 | 0.1461 | ||||||

| US38177UAC45 / Golub Capital Partners ABS Funding 2020-1 Ltd | 0.54 | -1.81 | 0.1437 | -0.0103 | |||||

| US808513BK01 / Charles Schwab Corp/The | 0.54 | 1.31 | 0.1433 | -0.0055 | |||||

| HPS Corporate Lending Fund / DBT (US40440VAF22) | 0.54 | 0.37 | 0.1421 | -0.0067 | |||||

| HPS Corporate Lending Fund / DBT (US40440VAF22) | 0.54 | 0.37 | 0.1421 | -0.0067 | |||||

| 19 / Swire Pacific Limited | 0.06 | 0.00 | 0.52 | -2.82 | 0.1369 | -0.0113 | |||

| US610331AC44 / Monroe Capital ABS Funding 2021-1 Ltd | 0.51 | -19.69 | 0.1361 | -0.0422 | |||||

| US92243RAC88 / VCP RRL ABS I Ltd | 0.51 | -0.79 | 0.1337 | -0.0081 | |||||

| US35906ABE73 / Frontier Communications Corp | 0.45 | 0.00 | 0.1197 | -0.0063 | |||||

| US91838PAA93 / VT TOPCO INC REGD 144A P/P 8.50000000 | 0.45 | 2.05 | 0.1184 | -0.0038 | |||||

| GPOR / Gulfport Energy Corporation | 0.00 | -41.52 | 0.44 | -36.08 | 0.1173 | -0.0758 | |||

| GPOR / Gulfport Energy Corporation | 0.00 | 0.00 | 0.44 | 0.00 | 0.1173 | 0.0000 | |||

| US30015DAA90 / Evergreen Acqco 1 LP/TVI, Inc. | 0.43 | 0.1129 | 0.1129 | ||||||

| SHD / Shiseido Company, Limited | 0.02 | 0.42 | 0.1102 | 0.1102 | |||||

| US25265LAE02 / Diamond Infrastructure Funding LLC | 0.36 | 0.28 | 0.0959 | -0.0046 | |||||

| US556227AA48 / Eleven Madison Trust 2015-11MD Mortgage Trust | 0.34 | 0.59 | 0.0901 | -0.0042 | |||||

| US28924AAC53 / Elm 2020-4 Trust | 0.32 | -20.80 | 0.0836 | -0.0275 | |||||

| US929043AK39 / VORNADO REALTY LP 2.15% 06/01/2026 | 0.24 | 0.41 | 0.0642 | -0.0030 | |||||

| DHER / Delivery Hero SE | 0.01 | 0.00 | 0.23 | 14.07 | 0.0601 | 0.0046 | |||

| PROP SERIES 2017 1A 5.30% 3/15/2042 / / ABS-CBDO (930RAXII5) | 0.23 | -1.32 | 0.0598 | -0.0039 | |||||

| PROP SERIES 2017 1A 5.30% 3/15/2042 / / ABS-CBDO (930RAXII5) | 0.23 | -1.32 | 0.0598 | -0.0039 | |||||

| US00090TAA51 / ABPCI Direct Lending Fund ABS I Ltd | 0.22 | -13.78 | 0.0581 | -0.0127 | |||||

| CPPTL / Copper Property CTL Pass Through Trust | 0.02 | 0.00 | 0.20 | -4.35 | 0.0526 | -0.0051 | |||

| Windstream Common / / EC (999999999) | 0.01 | 0.18 | 0.0464 | 0.0464 | |||||

| Windstream Common / / EC (999999999) | 0.01 | 0.18 | 0.0464 | 0.0464 | |||||

| US021ESC0175 / ESCROW ALTEGRITY INC COMMON STOCK | 0.14 | 0.00 | 0.16 | -6.32 | 0.0433 | -0.0054 | |||

| MCDERMOTT INTERNATIO Ltd. AI CONTRA CUSIP / / EC (58004K406) | 0.01 | 0.00 | 0.15 | -7.78 | 0.0409 | -0.0057 | |||

| MCDERMOTT INTERNATIO Ltd. AI CONTRA CUSIP / / EC (58004K406) | 0.01 | 0.00 | 0.15 | -7.78 | 0.0409 | -0.0057 | |||

| PCG / PG&E Corporation | 0.01 | 0.00 | 0.13 | -18.71 | 0.0334 | -0.0099 | |||

| US94419LAF85 / CONV. NOTE | 0.12 | 0.88 | 0.0306 | -0.0012 | |||||

| DE000A3H2WQ0 / Delivery Hero SE | 0.11 | 10.42 | 0.0283 | 0.0014 | |||||

| XAN5200EAC56 / McDermott Technology Americas Inc 2020 Make Whole Term Loan | 0.08 | 6.85 | 0.0207 | 0.0003 | |||||

| US808513AR62 / Charles Schwab Corp/The | 0.07 | 1.39 | 0.0194 | -0.0008 | |||||

| US70477BAE20 / Vision Solutions, Inc. 2021 Incremental Term Loan | 0.07 | -1.45 | 0.0180 | -0.0013 | |||||

| US86803YAB92 / Cornerstone OnDemand, Inc., First Lien Initial Term Loan | 0.07 | 8.06 | 0.0178 | 0.0005 | |||||

| US289338AC99 / Elm 2020-3 Trust | 0.04 | -33.90 | 0.0103 | -0.0061 | |||||

| GPOR / Gulfport Energy Corporation | 0.00 | -99.05 | 0.03 | -94.13 | 0.0069 | -0.1103 | |||

| LEALAND REFICAR TERM LOAN / / LON (999999999) | 0.03 | 0.0068 | 0.0068 | ||||||

| LEALAND REFICAR TERM LOAN / / LON (999999999) | 0.03 | 0.0068 | 0.0068 | ||||||

| JAPANESE YEN / / STIV (999999999) | 0.02 | 0.0059 | 0.0059 | ||||||

| JAPANESE YEN / / STIV (999999999) | 0.02 | 0.0059 | 0.0059 | ||||||

| US289338AB17 / ELM 2020-3 TRUST SER 2020-3A CL A2 REGD 144A P/P 2.95400000 | 0.01 | -36.36 | 0.0039 | -0.0023 | |||||

| JPY SPOT FORWARD CONTRACT / / STIV (999999999) | 0.01 | 0.0017 | 0.0017 | ||||||

| JPY SPOT FORWARD CONTRACT / / STIV (999999999) | 0.01 | 0.0017 | 0.0017 | ||||||

| MCDERMOTT INTERNATIO Ltd. QIB/AI CTRACUSIP / / EC (58004K307) | 0.00 | 0.00 | 0.00 | 0.00 | 0.0006 | -0.0001 | |||

| MCDERMOTT INTERNATIO Ltd. QIB/AI CTRACUSIP / / EC (58004K307) | 0.00 | 0.00 | 0.00 | 0.00 | 0.0006 | -0.0001 | |||

| US46611NAJ28 / J.C. Penney Corporation, Inc. 2016 Term Loan B | 0.00 | 0.0000 | -0.0000 | ||||||

| GREAT BRITAIN POUND / / STIV (999999999) | 0.00 | 0.0000 | 0.0000 | ||||||

| GREAT BRITAIN POUND / / STIV (999999999) | 0.00 | 0.0000 | 0.0000 | ||||||

| US715ESC0184 / ESC PERSHING SQUARE | 0.01 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| MRDB.WS / MariaDB plc - Equity Warrant | 0.00 | 0.0000 | 0.0000 | ||||||

| ROSS.WS / Ross Acquisition Corp II - Equity Warrant | 0.00 | 0.0000 | 0.0000 | ||||||

| ELIWQ / Electriq Power Holdings, Inc. - Equity Warrant | 0.00 | 0.0000 | 0.0000 | ||||||

| JPY SPOT FORWARD CONTRACT / / STIV (999999999) | -0.12 | -0.0315 | -0.0315 | ||||||

| JPY SPOT FORWARD CONTRACT / / STIV (999999999) | -0.12 | -0.0315 | -0.0315 | ||||||

| CHF SPOT FORWARD CONTRACT / / STIV (999999999) | -0.67 | -0.1768 | -0.1768 | ||||||

| CHF SPOT FORWARD CONTRACT / / STIV (999999999) | -0.67 | -0.1768 | -0.1768 | ||||||

| LEALAND FINANCE Co. B.V. SENIOR EXIT LC / / LON (589477088) | -0.68 | 6.07 | -0.1804 | -0.0017 | |||||

| LEALAND FINANCE Co. B.V. SENIOR EXIT LC / / LON (589477088) | -0.68 | 6.07 | -0.1804 | -0.0017 |