Statistik Asas

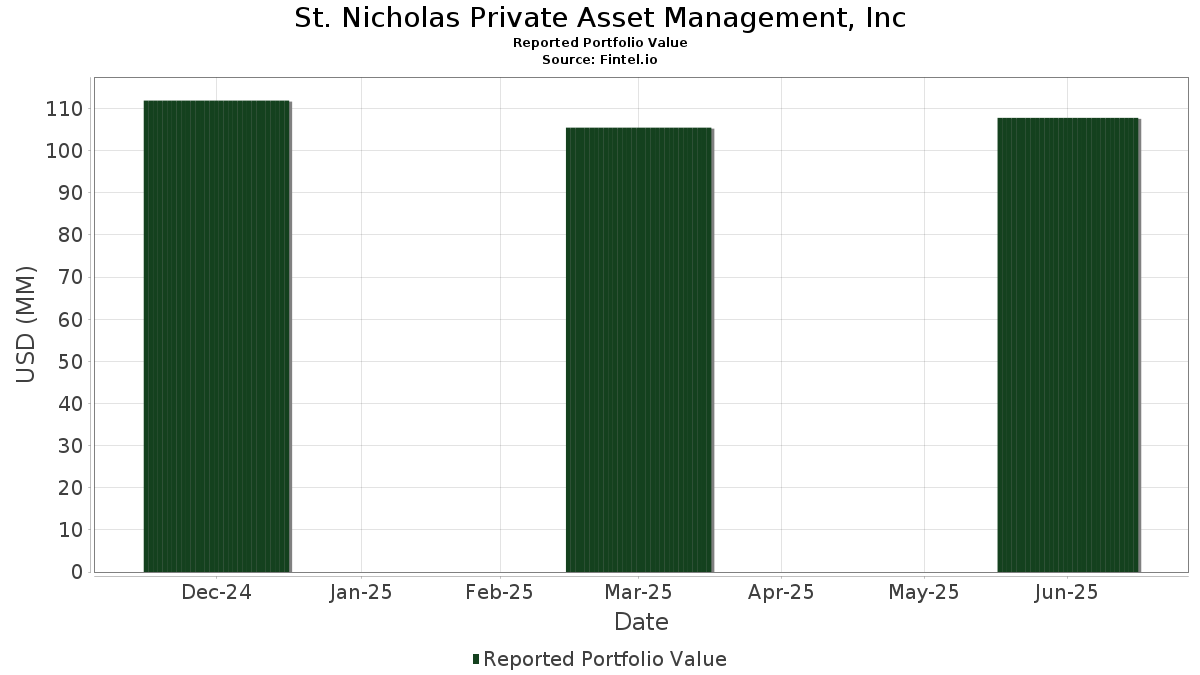

| Nilai Portfolio | $ 107,806,242 |

| Kedudukan Semasa | 36 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

St. Nicholas Private Asset Management, Inc telah mendedahkan 36 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 107,806,242 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas St. Nicholas Private Asset Management, Inc ialah Apple Inc. (US:AAPL) , Mastercard Incorporated (US:MA) , RLI Corp. (US:RLI) , AbbVie Inc. (US:ABBV) , and The Home Depot, Inc. (US:HD) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 5.11 | 4.7378 | 1.4494 | |

| 0.01 | 4.48 | 4.1562 | 1.3679 | |

| 0.03 | 5.65 | 5.2388 | 1.0587 | |

| 0.00 | 3.14 | 2.9159 | 0.5400 | |

| 0.01 | 3.37 | 3.1286 | 0.5329 | |

| 0.00 | 1.91 | 1.7678 | 0.4138 | |

| 0.02 | 3.90 | 3.6177 | 0.4077 | |

| 0.01 | 1.96 | 1.8175 | 0.1535 | |

| 0.01 | 1.31 | 1.2161 | 0.1469 | |

| 0.01 | 2.10 | 1.9439 | 0.1417 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 11.55 | 10.7093 | -1.1030 | |

| 0.10 | 7.40 | 6.8651 | -0.9909 | |

| 0.04 | 6.82 | 6.3303 | -0.9117 | |

| 0.02 | 4.69 | 4.3538 | -0.4652 | |

| 0.06 | 2.49 | 2.3120 | -0.2511 | |

| 0.03 | 2.92 | 2.7055 | -0.2131 | |

| 0.01 | 1.66 | 1.5444 | -0.1693 | |

| 0.01 | 1.91 | 1.7734 | -0.1653 | |

| 0.03 | 4.80 | 4.4493 | -0.1577 | |

| 0.02 | 6.11 | 5.6707 | -0.1299 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-12 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.06 | 0.32 | 11.55 | -7.34 | 10.7093 | -1.1030 | |||

| MA / Mastercard Incorporated | 0.02 | -1.18 | 9.84 | 1.31 | 9.1281 | -0.0803 | |||

| RLI / RLI Corp. | 0.10 | -0.66 | 7.40 | -10.69 | 6.8651 | -0.9909 | |||

| ABBV / AbbVie Inc. | 0.04 | 0.84 | 6.82 | -10.67 | 6.3303 | -0.9117 | |||

| HD / The Home Depot, Inc. | 0.02 | -0.13 | 6.11 | -0.08 | 5.6707 | -0.1299 | |||

| AMZN / Amazon.com, Inc. | 0.03 | 11.08 | 5.65 | 28.08 | 5.2388 | 1.0587 | |||

| NVDA / NVIDIA Corporation | 0.03 | 1.01 | 5.11 | 47.26 | 4.7378 | 1.4494 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.03 | 0.62 | 4.80 | -1.30 | 4.4493 | -0.1577 | |||

| MCD / McDonald's Corporation | 0.02 | -1.28 | 4.69 | -7.67 | 4.3538 | -0.4652 | |||

| MSFT / Microsoft Corporation | 0.01 | 14.97 | 4.48 | 52.33 | 4.1562 | 1.3679 | |||

| GOOGL / Alphabet Inc. | 0.02 | 1.07 | 3.90 | 15.21 | 3.6177 | 0.4077 | |||

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.01 | 0.73 | 3.37 | 23.20 | 3.1286 | 0.5329 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -0.18 | 3.14 | 25.42 | 2.9159 | 0.5400 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.03 | 1,405.86 | 2.92 | -5.26 | 2.7055 | -0.2131 | |||

| NSC / Norfolk Southern Corporation | 0.01 | 0.00 | 2.69 | 8.08 | 2.4954 | 0.1355 | |||

| COST / Costco Wholesale Corporation | 0.00 | 3.28 | 2.68 | 8.11 | 2.4866 | 0.1357 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.03 | 0.00 | 2.68 | 2.29 | 2.4823 | 0.0020 | |||

| VZ / Verizon Communications Inc. | 0.06 | -3.36 | 2.49 | -7.81 | 2.3120 | -0.2511 | |||

| RTX / RTX Corporation | 0.01 | 0.00 | 2.10 | 10.21 | 1.9439 | 0.1417 | |||

| PM / Philip Morris International Inc. | 0.01 | -2.71 | 1.96 | 11.62 | 1.8175 | 0.1535 | |||

| PG / The Procter & Gamble Company | 0.01 | 0.00 | 1.91 | -6.55 | 1.7734 | -0.1653 | |||

| META / Meta Platforms, Inc. | 0.00 | 4.20 | 1.91 | 33.40 | 1.7678 | 0.4138 | |||

| JNJ / Johnson & Johnson | 0.01 | 0.00 | 1.66 | -7.91 | 1.5444 | -0.1693 | |||

| WCC / WESCO International, Inc. | 0.01 | -2.52 | 1.31 | 16.33 | 1.2161 | 0.1469 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.01 | 0.00 | 1.16 | 3.57 | 1.0771 | 0.0142 | |||

| SCHX / Schwab Strategic Trust - Schwab U.S. Large-Cap ETF | 0.04 | 0.29 | 1.06 | 11.04 | 0.9802 | 0.0777 | |||

| MIDD / The Middleby Corporation | 0.01 | -3.92 | 1.02 | -8.90 | 0.9500 | -0.1165 | |||

| SHW / The Sherwin-Williams Company | 0.00 | 2.86 | 0.83 | 1.22 | 0.7673 | -0.0080 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.63 | 1.29 | 0.5846 | -0.0052 | |||

| MRK / Merck & Co., Inc. | 0.01 | -0.02 | 0.42 | -11.81 | 0.3878 | -0.0617 | |||

| SCHW / The Charles Schwab Corporation | 0.00 | 0.00 | 0.30 | 16.54 | 0.2818 | 0.0347 | |||

| MLM / Martin Marietta Materials, Inc. | 0.00 | -0.20 | 0.27 | 14.83 | 0.2515 | 0.0272 | |||

| HON / Honeywell International Inc. | 0.00 | 0.00 | 0.26 | 9.91 | 0.2372 | 0.0168 | |||

| COP / ConocoPhillips | 0.00 | 0.00 | 0.25 | -14.48 | 0.2360 | -0.0463 | |||

| BIV / Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF | 0.00 | -1.35 | 0.22 | 0.00 | 0.2051 | -0.0053 | |||

| MDLZ / Mondelez International, Inc. | 0.00 | 0.00 | 0.21 | -0.47 | 0.1948 | -0.0055 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SAIA / Saia, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |