Statistik Asas

| Nilai Portfolio | $ 986,165,320 |

| Kedudukan Semasa | 87 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

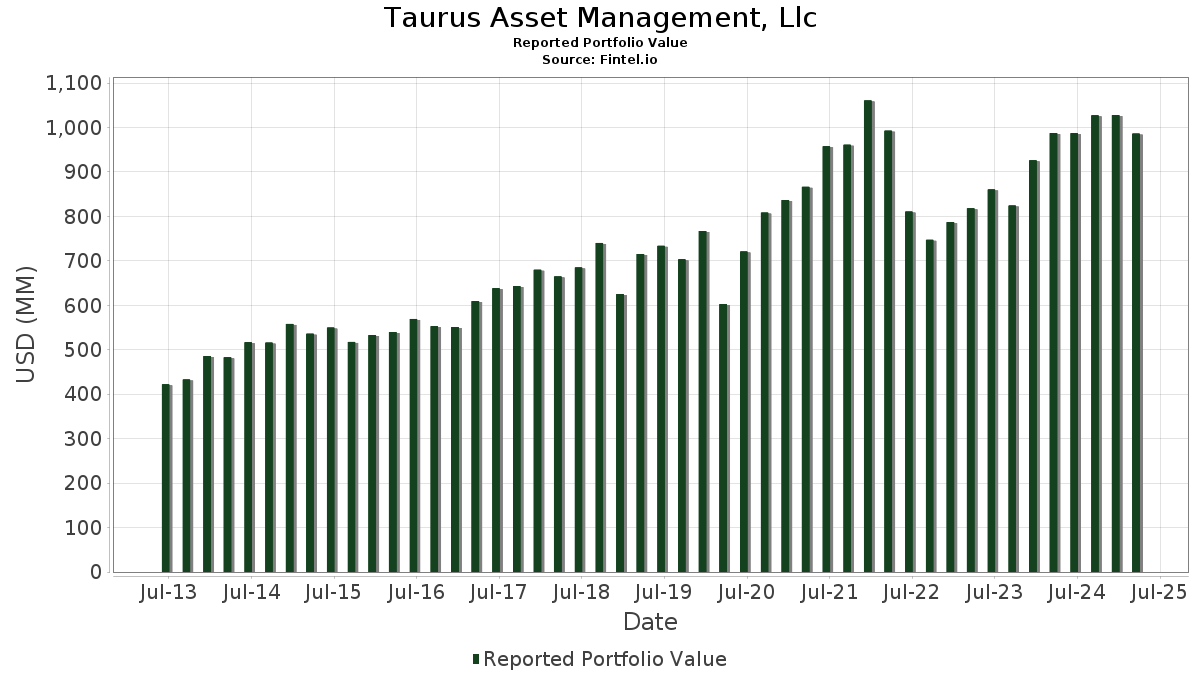

Taurus Asset Management, Llc telah mendedahkan 87 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 986,165,320 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Taurus Asset Management, Llc ialah Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , JPMorgan Chase & Co. (US:JPM) , Amazon.com, Inc. (US:AMZN) , and Visa Inc. (US:V) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 15.36 | 1.5580 | 1.4469 | |

| 0.07 | 12.50 | 1.2673 | 1.2263 | |

| 0.04 | 24.88 | 2.5227 | 0.8457 | |

| 0.12 | 41.40 | 4.1984 | 0.5040 | |

| 0.37 | 26.75 | 2.7128 | 0.3892 | |

| 0.05 | 25.41 | 2.5766 | 0.3359 | |

| 0.13 | 19.62 | 1.9891 | 0.2940 | |

| 0.20 | 49.90 | 5.0602 | 0.2594 | |

| 0.07 | 21.16 | 2.1460 | 0.2177 | |

| 0.02 | 13.45 | 1.3640 | 0.2030 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 3.21 | 0.3255 | -1.3851 | |

| 0.25 | 39.07 | 3.9621 | -0.7087 | |

| 0.32 | 71.23 | 7.2228 | -0.6915 | |

| 0.24 | 46.54 | 4.7193 | -0.6148 | |

| 0.14 | 20.55 | 2.0833 | -0.5821 | |

| 0.09 | 25.31 | 2.5664 | -0.5266 | |

| 0.01 | 2.21 | 0.2239 | -0.4557 | |

| 0.19 | 69.93 | 7.0911 | -0.4169 | |

| 0.02 | 14.13 | 1.4330 | -0.3782 | |

| 0.15 | 30.68 | 3.1114 | -0.1813 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-05-13 untuk tempoh pelaporan 2025-03-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.32 | -1.29 | 71.23 | -12.44 | 7.2228 | -0.6915 | |||

| MSFT / Microsoft Corporation | 0.19 | 1.75 | 69.93 | -9.38 | 7.0911 | -0.4169 | |||

| JPM / JPMorgan Chase & Co. | 0.20 | -1.17 | 49.90 | 1.13 | 5.0602 | 0.2594 | |||

| AMZN / Amazon.com, Inc. | 0.24 | -2.11 | 46.54 | -15.11 | 4.7193 | -0.6148 | |||

| V / Visa Inc. | 0.12 | -1.67 | 41.40 | 9.04 | 4.1984 | 0.5040 | |||

| GOOG / Alphabet Inc. | 0.25 | -0.79 | 39.07 | -18.61 | 3.9621 | -0.7087 | |||

| INTU / Intuit Inc. | 0.05 | 3.22 | 32.88 | 0.84 | 3.3340 | 0.1617 | |||

| DHR / Danaher Corporation | 0.15 | 1.52 | 30.68 | -9.33 | 3.1114 | -0.1813 | |||

| SPY / SPDR S&P 500 ETF | 0.05 | 7.01 | 28.40 | 2.13 | 2.8803 | 0.1744 | |||

| KO / The Coca-Cola Company | 0.37 | -2.62 | 26.75 | 12.02 | 2.7128 | 0.3892 | |||

| COST / Costco Wholesale Corporation | 0.03 | -0.95 | 26.71 | 2.24 | 2.7087 | 0.1668 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.05 | -0.94 | 25.78 | -5.25 | 2.6140 | -0.0329 | |||

| CHD / Church & Dwight Co., Inc. | 0.23 | -6.42 | 25.69 | -1.62 | 2.6047 | 0.0645 | |||

| LIN / Linde plc | 0.05 | -0.80 | 25.41 | 10.33 | 2.5766 | 0.3359 | |||

| CRM / Salesforce, Inc. | 0.09 | -0.82 | 25.31 | -20.39 | 2.5664 | -0.5266 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.04 | 50.97 | 24.88 | 44.34 | 2.5227 | 0.8457 | |||

| BAC / Bank of America Corporation | 0.52 | -0.46 | 21.57 | -5.49 | 2.1874 | -0.0332 | |||

| APH / Amphenol Corporation | 0.33 | -1.44 | 21.50 | -6.92 | 2.1803 | -0.0671 | |||

| MCD / McDonald's Corporation | 0.07 | -0.91 | 21.16 | 6.78 | 2.1460 | 0.2177 | |||

| GTLS / Chart Industries, Inc. | 0.14 | -0.86 | 20.55 | -25.00 | 2.0833 | -0.5821 | |||

| MMM / 3M Company | 0.13 | -1.04 | 19.62 | 12.58 | 1.9891 | 0.2940 | |||

| AME / AMETEK, Inc. | 0.11 | -1.40 | 19.45 | -5.84 | 1.9723 | -0.0374 | |||

| HD / The Home Depot, Inc. | 0.05 | -1.87 | 19.18 | -7.55 | 1.9450 | -0.0735 | |||

| NEE / NextEra Energy, Inc. | 0.25 | -1.20 | 17.38 | -2.30 | 1.7623 | 0.0315 | |||

| MDLZ / Mondelez International, Inc. | 0.25 | -8.43 | 17.21 | 4.02 | 1.7447 | 0.1354 | |||

| COO / The Cooper Companies, Inc. | 0.19 | 1.94 | 16.18 | -6.47 | 1.6410 | -0.0423 | |||

| META / Meta Platforms, Inc. | 0.03 | 1,267.03 | 15.36 | 1,246.54 | 1.5580 | 1.4469 | |||

| DIS / The Walt Disney Company | 0.15 | -0.07 | 14.85 | -11.42 | 1.5062 | -0.1252 | |||

| TXN / Texas Instruments Incorporated | 0.08 | -2.87 | 14.52 | -6.92 | 1.4722 | -0.0453 | |||

| NOW / ServiceNow, Inc. | 0.02 | 1.08 | 14.13 | -24.09 | 1.4330 | -0.3782 | |||

| NKE / NIKE, Inc. | 0.21 | 3.90 | 13.57 | -12.84 | 1.3761 | -0.1388 | |||

| ROP / Roper Technologies, Inc. | 0.02 | -0.61 | 13.45 | 12.73 | 1.3640 | 0.2030 | |||

| AVGO / Broadcom Inc. | 0.07 | 4,001.37 | 12.50 | 2,868.41 | 1.2673 | 1.2263 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.06 | 0.60 | 10.73 | -5.64 | 1.0883 | -0.0184 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.02 | -2.42 | 10.60 | -13.12 | 1.0747 | -0.1122 | |||

| UNP / Union Pacific Corporation | 0.04 | 3.57 | 10.41 | 7.30 | 1.0556 | 0.1117 | |||

| EOG / EOG Resources, Inc. | 0.07 | -8.59 | 8.80 | -4.38 | 0.8927 | -0.0030 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.06 | 0.36 | 6.03 | -19.01 | 0.6119 | -0.1129 | |||

| PEP / PepsiCo, Inc. | 0.04 | -0.36 | 5.62 | -1.75 | 0.5702 | 0.0134 | |||

| JNJ / Johnson & Johnson | 0.03 | -2.19 | 5.20 | 12.18 | 0.5269 | 0.0762 | |||

| AXP / American Express Company | 0.01 | -2.07 | 3.82 | -11.23 | 0.3874 | -0.0313 | |||

| XOM / Exxon Mobil Corporation | 0.03 | 0.00 | 3.41 | 10.55 | 0.3454 | 0.0457 | |||

| AMD / Advanced Micro Devices, Inc. | 0.03 | -78.53 | 3.21 | -81.74 | 0.3255 | -1.3851 | |||

| VLTO / Veralto Corporation | 0.03 | -12.11 | 2.87 | -15.93 | 0.2907 | -0.0410 | |||

| ACN / Accenture plc | 0.01 | -64.37 | 2.21 | -68.40 | 0.2239 | -0.4557 | |||

| SBUX / Starbucks Corporation | 0.02 | -0.46 | 2.14 | 7.01 | 0.2168 | 0.0224 | |||

| LLY / Eli Lilly and Company | 0.00 | -1.65 | 1.97 | 5.23 | 0.2000 | 0.0176 | |||

| CVX / Chevron Corporation | 0.01 | -8.07 | 1.79 | 6.19 | 0.1811 | 0.0175 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 1.60 | 17.27 | 0.1619 | 0.0294 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.01 | -2.28 | 1.57 | -0.63 | 0.1588 | 0.0054 | |||

| ABT / Abbott Laboratories | 0.01 | 0.00 | 1.44 | 17.32 | 0.1456 | 0.0265 | |||

| ABBV / AbbVie Inc. | 0.01 | -0.40 | 1.29 | 17.49 | 0.1308 | 0.0239 | |||

| GOOGL / Alphabet Inc. | 0.01 | -0.80 | 1.16 | -18.92 | 0.1173 | -0.0216 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 1.04 | -9.08 | 0.1056 | -0.0058 | |||

| PFE / Pfizer Inc. | 0.04 | -5.74 | 1.03 | -9.93 | 0.1040 | -0.0068 | |||

| BSX / Boston Scientific Corporation | 0.01 | 0.00 | 1.01 | 12.88 | 0.1023 | 0.0154 | |||

| CL / Colgate-Palmolive Company | 0.01 | -7.75 | 1.00 | -4.92 | 0.1018 | -0.0009 | |||

| PM / Philip Morris International Inc. | 0.01 | -3.07 | 1.00 | 27.88 | 0.1015 | 0.0253 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.96 | 4.00 | 0.0975 | 0.0076 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -9.66 | 0.89 | -13.77 | 0.0902 | -0.0102 | |||

| WSM / Williams-Sonoma, Inc. | 0.01 | 0.00 | 0.79 | -14.59 | 0.0802 | -0.0099 | |||

| YUM / Yum! Brands, Inc. | 0.00 | 0.00 | 0.76 | 17.39 | 0.0767 | 0.0140 | |||

| MO / Altria Group, Inc. | 0.01 | -2.57 | 0.68 | 11.78 | 0.0693 | 0.0098 | |||

| ADI / Analog Devices, Inc. | 0.00 | 0.00 | 0.55 | -5.00 | 0.0559 | -0.0006 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -8.89 | 0.55 | 7.07 | 0.0554 | 0.0057 | |||

| GE / General Electric Company | 0.00 | 0.00 | 0.53 | 19.86 | 0.0539 | 0.0108 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 0.00 | 0.51 | 1.58 | 0.0522 | 0.0029 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.00 | 0.50 | -5.49 | 0.0506 | -0.0008 | |||

| AMGN / Amgen Inc. | 0.00 | -1.67 | 0.46 | 17.69 | 0.0466 | 0.0086 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 0.43 | 1.90 | 0.0436 | 0.0026 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.00 | 0.42 | -4.55 | 0.0427 | -0.0002 | |||

| RTX / RTX Corporation | 0.00 | 0.00 | 0.39 | 14.58 | 0.0399 | 0.0065 | |||

| PODD / Insulet Corporation | 0.00 | 0.00 | 0.37 | 0.54 | 0.0379 | 0.0018 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.36 | -15.93 | 0.0364 | -0.0052 | |||

| MRK / Merck & Co., Inc. | 0.00 | 0.00 | 0.31 | -9.91 | 0.0314 | -0.0020 | |||

| BLK / BlackRock, Inc. | 0.00 | 0.00 | 0.28 | -7.82 | 0.0288 | -0.0011 | |||

| CMCSA / Comcast Corporation | 0.01 | -19.98 | 0.28 | -21.29 | 0.0285 | -0.0063 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.00 | 0.27 | -4.58 | 0.0275 | -0.0001 | |||

| HON / Honeywell International Inc. | 0.00 | -5.27 | 0.27 | -11.51 | 0.0274 | -0.0022 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 0.00 | 0.27 | 1.51 | 0.0274 | 0.0015 | |||

| DXCM / DexCom, Inc. | 0.00 | 0.00 | 0.26 | -12.20 | 0.0263 | -0.0024 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.00 | 0.25 | -7.01 | 0.0256 | -0.0009 | |||

| ROST / Ross Stores, Inc. | 0.00 | 0.00 | 0.25 | -15.82 | 0.0255 | -0.0035 | |||

| ED / Consolidated Edison, Inc. | 0.00 | 0.22 | 0.0224 | 0.0224 | |||||

| BXMT / Blackstone Mortgage Trust, Inc. | 0.01 | 0.00 | 0.22 | 15.18 | 0.0223 | 0.0037 | |||

| FTV / Fortive Corporation | 0.00 | -14.89 | 0.22 | -17.05 | 0.0223 | -0.0035 | |||

| ZTS / Zoetis Inc. | 0.00 | 0.00 | 0.21 | 1.44 | 0.0214 | 0.0011 | |||

| BX / Blackstone Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | -100.00 | 0.00 | 0.0000 |