Statistik Asas

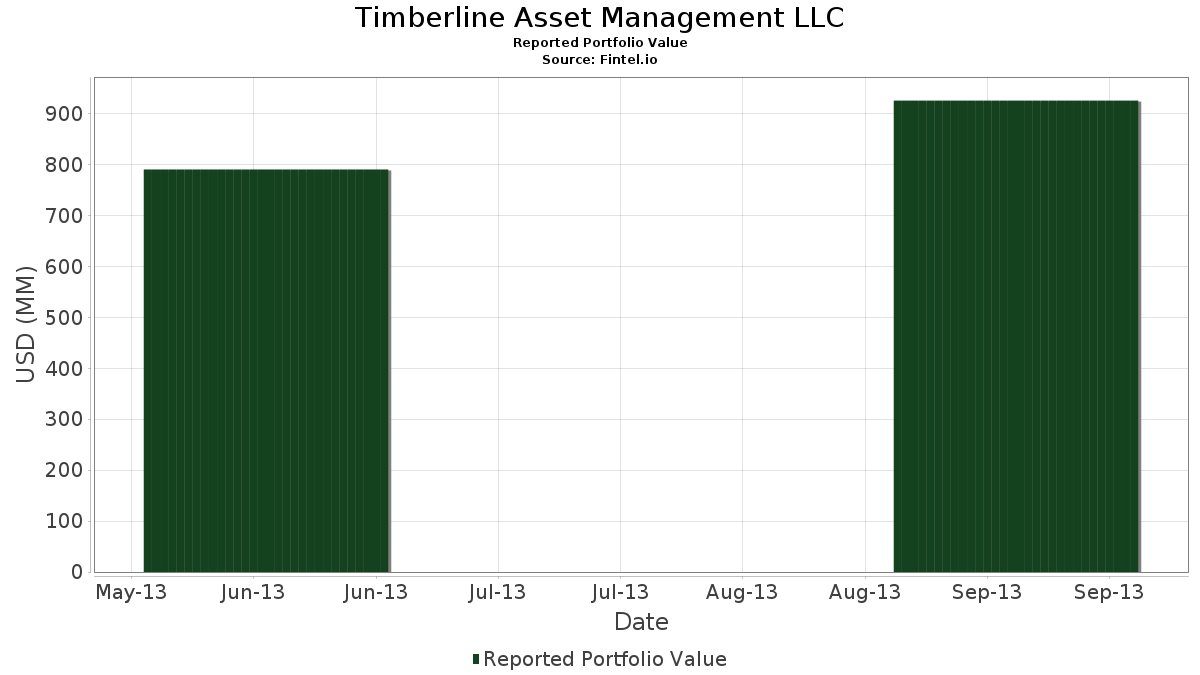

| Nilai Portfolio | $ 925,565,356 |

| Kedudukan Semasa | 126 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Timberline Asset Management LLC telah mendedahkan 126 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 925,565,356 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Timberline Asset Management LLC ialah Tidal Trust II - Nicholas Crypto Income ETF (US:BLOX) , Aspen Technology, Inc. (US:AZPN) , MontaVista Software, LLC (US:CAVM) , DigitalGlobe, Inc. (US:DGI) , and Brunswick Corporation (US:BC) . Kedudukan baharu Timberline Asset Management LLC termasuk Himax Technologies, Inc. - Depositary Receipt (Common Stock) (US:HIMX) , Maximus, Inc. (US:MMS) , H.B. Fuller Company (US:FUL) , Telaria, Inc. (US:TLRA) , and Yelp Inc. (US:YELP) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.54 | 22.38 | 2.4176 | 2.4176 | |

| 0.63 | 21.82 | 2.3580 | 2.3580 | |

| 0.44 | 18.28 | 1.9754 | 1.9754 | |

| 0.56 | 17.73 | 1.9153 | 1.9153 | |

| 0.44 | 17.73 | 1.9151 | 1.9151 | |

| 1.72 | 17.35 | 1.8747 | 1.8747 | |

| 0.23 | 16.98 | 1.8346 | 1.8346 | |

| 0.19 | 16.96 | 1.8322 | 1.8322 | |

| 0.23 | 16.45 | 1.7773 | 1.7773 | |

| 0.47 | 16.30 | 1.7615 | 1.7615 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.6943 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2013-11-13 untuk tempoh pelaporan 2013-09-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BLOX / Tidal Trust II - Nicholas Crypto Income ETF | 0.54 | -44.75 | 22.38 | -21.04 | 2.4176 | 2.4176 | |||

| AZPN / Aspen Technology, Inc. | 0.63 | 213.51 | 21.82 | 276.28 | 2.3580 | 2.3580 | |||

| CAVM / MontaVista Software, LLC | 0.44 | 2.41 | 18.28 | 19.29 | 1.9754 | 1.9754 | |||

| DGI / DigitalGlobe, Inc. | 0.56 | 2.82 | 17.73 | 4.84 | 1.9153 | 1.9153 | |||

| BC / Brunswick Corporation | 0.44 | 8.33 | 17.73 | 35.32 | 1.9151 | 1.9151 | |||

| KERX / Keryx Biopharmaceuticals, Inc. | 1.72 | 3.45 | 17.35 | 39.74 | 1.8747 | 1.8747 | |||

| OSIS / OSI Systems, Inc. | 0.23 | 84.49 | 16.98 | 113.02 | 1.8346 | 1.8346 | |||

| WEX / WEX Inc. | 0.19 | 8.21 | 16.96 | 23.80 | 1.8322 | 1.8322 | |||

| CEB / CEB Inc. | 0.23 | 3.11 | 16.45 | 18.45 | 1.7773 | 1.7773 | |||

| EHC / Encompass Health Corporation | 0.47 | -5.05 | 16.30 | 13.67 | 1.7615 | 1.7615 | |||

| HIMX / Himax Technologies, Inc. - Depositary Receipt (Common Stock) | 1.57 | 15.70 | 1.6959 | 1.6959 | |||||

| 777779307 / Rosetta Resources, Inc. | 0.29 | 151.61 | 15.58 | 222.35 | 1.6833 | 1.0717 | |||

| SFLY / Shutterfly, Inc. | 0.28 | -4.65 | 15.49 | -4.71 | 1.6741 | 1.6741 | |||

| IMAX / IMAX Corporation | 0.50 | 202.22 | 15.10 | 267.62 | 1.6317 | 1.6317 | |||

| MKTG / Responsys Inc | 0.90 | 194.39 | 14.79 | 239.87 | 1.5981 | 1.5981 | |||

| SCS / Steelcase Inc. | 0.89 | 3.31 | 14.75 | 17.77 | 1.5939 | 1.5939 | |||

| SPSC / SPS Commerce, Inc. | 0.22 | 3.16 | 14.54 | 25.52 | 1.5705 | 1.5705 | |||

| ELLI / Ellie Mae, Inc. | 0.45 | 140.13 | 14.50 | 233.07 | 1.5661 | 1.5661 | |||

| ININ / Interactive Intelligence Group, Inc. | 0.22 | -5.24 | 14.09 | 16.60 | 1.5219 | 1.5219 | |||

| IWO / iShares Trust - iShares Russell 2000 Growth ETF | 0.11 | -6.61 | 14.00 | 5.39 | 1.5130 | 1.5130 | |||

| BECN / Beacon Roofing Supply, Inc. | 0.38 | 140.13 | 13.94 | 133.74 | 1.5062 | 1.5062 | |||

| EPAC / Enerpac Tool Group Corp. | 0.36 | 3.34 | 13.93 | 21.74 | 1.5053 | 1.5053 | |||

| CSGP / CoStar Group, Inc. | 0.08 | 64.98 | 13.74 | 114.64 | 1.4840 | 1.4840 | |||

| GME / GameStop Corp. | 0.28 | -25.89 | 13.70 | -12.46 | 1.4804 | 1.4804 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.67 | -9.98 | 13.60 | 9.89 | 1.4695 | 1.4695 | |||

| EXAM / ExamWorks Group, Inc. | 0.52 | 48.91 | 13.45 | 82.32 | 1.4530 | 1.4530 | |||

| RRGB / Red Robin Gourmet Burgers, Inc. | 0.18 | -21.33 | 13.12 | 1.36 | 1.4175 | 1.4175 | |||

| BZH / Beazer Homes USA, Inc. | 0.71 | 190.72 | 12.87 | 198.72 | 1.3904 | 1.3904 | |||

| TRAK / ReposiTrak, Inc. | 0.30 | 53.98 | 12.87 | 86.20 | 1.3903 | 1.3903 | |||

| MMS / Maximus, Inc. | 0.28 | 12.80 | 1.3830 | 1.3830 | |||||

| 04685W103 / athenahealth, Inc. | 0.12 | 97.35 | 12.80 | 152.94 | 1.3829 | 1.3829 | |||

| JACK / Jack in the Box Inc. | 0.32 | -8.76 | 12.67 | -7.13 | 1.3688 | 1.3688 | |||

| CNC / Centene Corporation | 0.20 | 34.03 | 12.62 | 63.42 | 1.3637 | 1.3637 | |||

| ENV / Envestnet, Inc. | 0.40 | 40.16 | 12.48 | 76.63 | 1.3489 | 1.3489 | |||

| CASY / Casey's General Stores, Inc. | 0.17 | 3.10 | 12.47 | 25.77 | 1.3473 | 1.3473 | |||

| TFM / Fresh Market Holdings Inc (The) | 0.26 | 0.70 | 12.42 | -4.19 | 1.3423 | 1.3423 | |||

| ACHC / Acadia Healthcare Company, Inc. | 0.31 | -7.84 | 12.34 | 9.88 | 1.3336 | 1.3336 | |||

| GWRE / Guidewire Software, Inc. | 0.26 | 4.53 | 12.11 | 17.12 | 1.3084 | 1.3084 | |||

| SIX / Six Flags Entertainment Corporation | 0.36 | 170.33 | 12.10 | 159.84 | 1.3071 | 1.3071 | |||

| CVLT / Commvault Systems, Inc. | 0.13 | 55.45 | 11.82 | 80.11 | 1.2775 | 1.2775 | |||

| MINI / Mobile Mini, Inc. | 0.34 | 129.20 | 11.68 | 135.52 | 1.2622 | 1.2622 | |||

| USG / USCF ETF Trust - USCF Gold Strategy Plus Income Fund | 0.33 | 39.87 | 9.35 | 73.42 | 1.0102 | 1.0102 | |||

| FUL / H.B. Fuller Company | 0.20 | 9.06 | 0.9792 | 0.9792 | |||||

| DXCM / DexCom, Inc. | 0.31 | -36.72 | 8.76 | -20.46 | 0.9461 | 0.9461 | |||

| DORM / Dorman Products, Inc. | 0.18 | -20.07 | 8.74 | -13.20 | 0.9447 | 0.9447 | |||

| OAS / Oasis Petroleum Inc. - New | 0.18 | 20.67 | 8.67 | 52.53 | 0.9366 | 0.9366 | |||

| PRXL / PAREXEL International Corp. | 0.17 | -29.07 | 8.61 | -22.54 | 0.9307 | 0.9307 | |||

| FURX / Furiex Pharmaceuticals, Inc. | 0.19 | 29.94 | 8.37 | 67.77 | 0.9044 | 0.9044 | |||

| TXTR / Textura Corp. | 0.19 | 26.97 | 8.31 | 110.31 | 0.8973 | 0.8973 | |||

| LNN / Lindsay Corporation | 0.10 | 43.95 | 7.93 | 56.72 | 0.8568 | 0.8568 | |||

| BANR / Banner Corporation | 0.21 | 4.34 | 7.89 | 17.82 | 0.8530 | 0.8530 | |||

| ECOL / US Ecology Inc. | 0.26 | -28.12 | 7.89 | -21.07 | 0.8529 | 0.8529 | |||

| HXL / Hexcel Corporation | 0.20 | -39.32 | 7.64 | -30.86 | 0.8254 | 0.8254 | |||

| HITT / Hittite Microwave Corp | 0.12 | -37.61 | 7.64 | -29.70 | 0.8249 | 0.8249 | |||

| GWR / Genesee & Wyoming, Inc. | 0.08 | -43.14 | 7.57 | -37.70 | 0.8175 | 0.8175 | |||

| ZUMZ / Zumiez Inc. | 0.27 | -43.08 | 7.46 | -45.48 | 0.8062 | 0.8062 | |||

| JLL / Jones Lang LaSalle Incorporated | 0.08 | 76.65 | 7.31 | 69.21 | 0.7898 | 0.7898 | |||

| PEB / Pebblebrook Hotel Trust | 0.25 | 4.08 | 7.28 | 15.60 | 0.7863 | 0.7863 | |||

| TLRA / Telaria, Inc. | 0.78 | 7.23 | 0.7809 | 0.7809 | |||||

| 43739Q100 / HomeAway, Inc. | 0.25 | -16.36 | 6.96 | -27.69 | 0.7517 | 0.7517 | |||

| SPNC / Spectranetics Corp. (The) | 0.41 | -26.92 | 6.85 | -34.28 | 0.7397 | 0.7397 | |||

| YELP / Yelp Inc. | 0.10 | 6.55 | 0.7080 | 0.7080 | |||||

| EGP / EastGroup Properties, Inc. | 0.11 | 4.09 | 6.52 | 9.53 | 0.7042 | 0.7042 | |||

| NQ / NQ Mobile Inc. | 0.29 | 6.43 | 0.6942 | 0.6942 | |||||

| DSX / Diana Shipping Inc. | 0.53 | 6.38 | 0.6892 | 0.6892 | |||||

| US35904G1076 / Altisource Residential Corp | 0.27 | 6.30 | 0.6805 | 0.6805 | |||||

| MKTX / MarketAxess Holdings Inc. | 0.10 | 6.27 | 0.6769 | 0.6769 | |||||

| SONS / Sonus Networks, Inc. | 1.83 | -12.30 | 6.18 | -1.81 | 0.6680 | 0.6680 | |||

| TAL / TAL Education Group - Depositary Receipt (Common Stock) | 0.42 | 6.07 | 0.6562 | 0.6562 | |||||

| ULTI / Ultimate Software Group, Inc. (The) | 0.04 | -26.85 | 6.07 | -8.08 | 0.6560 | 0.6560 | |||

| TBI / TrueBlue, Inc. | 0.25 | 5.98 | 0.6466 | 0.6466 | |||||

| WAGE / WageWorks Inc. | 0.11 | -12.12 | 5.74 | 28.69 | 0.6203 | 0.6203 | |||

| SSB / SouthState Corporation | 0.10 | 5.71 | 0.6174 | 0.6174 | |||||

| IRWD / Ironwood Pharmaceuticals, Inc. | 0.48 | 5.66 | 0.6112 | 0.6112 | |||||

| PESX / Pioneer Energy Services Corp. | 0.74 | 4.26 | 5.59 | 18.29 | 0.6039 | 0.6039 | |||

| PRIM / Primoris Services Corporation | 0.22 | 5.52 | 0.5959 | 0.5959 | |||||

| HOS / Hornbeck Offshore Services Inc | 0.10 | 41.07 | 5.50 | 51.47 | 0.5942 | 0.5942 | |||

| OZRK / Bank of the Ozarks, Inc. | 0.11 | 4.32 | 5.28 | 15.43 | 0.5706 | 0.5706 | |||

| HAE / Haemonetics Corporation | 0.13 | 18.92 | 5.23 | 14.71 | 0.5652 | 0.5652 | |||

| VSI / Vitamin Shoppe, Inc. | 0.11 | -59.32 | 4.99 | -60.31 | 0.5393 | 0.5393 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.11 | 3.88 | 4.88 | 14.77 | 0.5272 | 0.5272 | |||

| US29266S3040 / Endologix, Inc. | 0.30 | 24.46 | 4.86 | 51.28 | 0.5254 | 0.5254 | |||

| LUMO / Lumos Pharma, Inc. | 0.25 | 44.46 | 4.73 | 37.59 | 0.5109 | 0.5109 | |||

| CAR / Avis Budget Group, Inc. | 0.16 | 9.35 | 4.70 | 9.64 | 0.5075 | 0.5075 | |||

| US40425J1016 / HMS Holdings Corp. | 0.21 | -59.08 | 4.53 | -62.27 | 0.4898 | 0.4898 | |||

| ABCO / Advisory Board Co. (The) | 0.07 | 3.97 | 4.43 | 13.14 | 0.4790 | 0.4790 | |||

| BJRI / BJ's Restaurants, Inc. | 0.15 | -64.49 | 4.19 | -72.56 | 0.4525 | 0.4525 | |||

| OREX / Orexigen Therapeutics, Inc. | 0.62 | -23.84 | 3.82 | -20.13 | 0.4129 | 0.4129 | |||

| FBIO / Fortress Biotech, Inc. | 0.39 | -9.33 | 2.74 | -26.08 | 0.2965 | 0.2965 | |||

| PBYI / Puma Biotechnology, Inc. | 0.04 | 2.32 | 0.2509 | 0.2509 | |||||

| 09689U102 / Body Central Corp. | 0.34 | 165.92 | 2.09 | 21.77 | 0.2254 | 0.2254 | |||

| KBH / KB Home | 0.03 | 0.45 | 0.0491 | 0.0491 | |||||

| RAX / Rackspace Hosting, Inc. | 0.01 | 6.69 | 0.40 | 48.53 | 0.0437 | 0.0437 | |||

| INFA / Informatica Inc. | 0.01 | -2.53 | 0.40 | 8.49 | 0.0429 | 0.0429 | |||

| MGM / MGM Resorts International | 0.02 | -2.51 | 0.40 | 35.15 | 0.0428 | 0.0428 | |||

| ATML / Atmel Corporation | 0.05 | 0.39 | 0.0421 | 0.0421 | |||||

| EXPD / Expeditors International of Washington, Inc. | 0.01 | 0.37 | 0.0402 | 0.0402 | |||||

| GRMN / Garmin Ltd. | 0.01 | 0.34 | 0.0363 | 0.0363 | |||||

| TEX / Terex Corporation | 0.01 | 27.72 | 0.33 | 63.55 | 0.0359 | 0.0359 | |||

| RMD / ResMed Inc. | 0.01 | -2.58 | 0.33 | 14.14 | 0.0358 | 0.0358 | |||

| ADS / Bread Financial Holdings Inc | 0.00 | -16.55 | 0.33 | -2.40 | 0.0353 | 0.0353 | |||

| AMG / Affiliated Managers Group, Inc. | 0.00 | -2.35 | 0.33 | 8.70 | 0.0352 | 0.0352 | |||

| WBC / Wabco Holdings, Inc. | 0.00 | -2.51 | 0.32 | 9.97 | 0.0346 | 0.0346 | |||

| HLF / Herbalife Ltd. | 0.00 | 0.32 | 0.0343 | 0.0343 | |||||

| MELI / MercadoLibre, Inc. | 0.00 | 0.32 | 0.0343 | 0.0343 | |||||

| ZION / Zions Bancorporation, National Association | 0.01 | -2.55 | 0.31 | -7.53 | 0.0332 | 0.0332 | |||

| FTNT / Fortinet, Inc. | 0.02 | 0.30 | 0.0329 | 0.0329 | |||||

| VMI / Valmont Industries, Inc. | 0.00 | 6.92 | 0.30 | 3.81 | 0.0324 | 0.0324 | |||

| MTD / Mettler-Toledo International Inc. | 0.00 | 0.30 | 0.0321 | 0.0321 | |||||

| 891894107 / Towers Watson & Co. | 0.00 | 0.30 | 0.0319 | 0.0319 | |||||

| RHI / Robert Half Inc. | 0.01 | 0.29 | 0.0317 | 0.0317 | |||||

| PWR / Quanta Services, Inc. | 0.01 | 12.97 | 0.29 | 17.27 | 0.0316 | 0.0316 | |||

| NUS / Nu Skin Enterprises, Inc. | 0.00 | -40.00 | 0.29 | -6.13 | 0.0315 | 0.0315 | |||

| BEAV / B/E Aerospace, Inc. | 0.00 | -2.51 | 0.29 | 14.23 | 0.0312 | 0.0312 | |||

| FLS / Flowserve Corporation | 0.00 | -2.61 | 0.29 | 12.89 | 0.0312 | 0.0312 | |||

| URI / United Rentals, Inc. | 0.00 | 0.29 | 0.0309 | 0.0309 | |||||

| CNQR / | 0.00 | -30.21 | 0.28 | -5.41 | 0.0303 | 0.0303 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.01 | -2.56 | 0.27 | 3.82 | 0.0295 | 0.0295 | |||

| RYN / Rayonier Inc. | 0.00 | -3.02 | 0.27 | -2.52 | 0.0293 | 0.0293 | |||

| FFIV / F5, Inc. | 0.00 | 0.26 | 0.0276 | 0.0276 | |||||

| LKQ / LKQ Corporation | 0.01 | -2.54 | 0.25 | 20.48 | 0.0274 | 0.0274 | |||

| OII / Oceaneering International, Inc. | 0.00 | -23.23 | 0.24 | -13.78 | 0.0265 | 0.0265 | |||

| FLT / Corpay, Inc. | 0.00 | 0.22 | 0.0242 | 0.0242 | |||||

| PCYC / Pharmacyclics | 0.00 | 0.22 | 0.0239 | 0.0239 | |||||

| SPNV / Supernova Partners Acquisition Company Inc - Class A | 0.01 | 7.14 | 0.22 | 3.37 | 0.0233 | 0.0233 | |||

| PNRA / Panera Bread Co. | 0.00 | -46.76 | 0.21 | -54.61 | 0.0224 | 0.0224 | |||

| EXLS / ExlService Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| / FRANCESCAS HLDGS CORP | 0.00 | -100.00 | 0.00 | -100.00 | -0.6943 | ||||

| CCK / Crown Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| GMCR / Keurig Green Mountain, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| ONXX / Onyx Pharmaceuticals Inc | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| AJG / Arthur J. Gallagher & Co. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| SPF / | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| INAP / Internap Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| TNGO / Tangoe, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| INVN / The Alger ETF Trust - Alger Russell Innovation ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| LII / Lennox International Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| IONS / Ionis Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| / VIVUS, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| CLC / CLARCOR Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| MNRO / Monro, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| / FRANCESCAS HLDGS CORP | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| BIOS / BioPlus Acquisition Corp - Class A | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| POLY / Plantronics, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| FIRE / Sourcefire Inc | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| URBN / Urban Outfitters, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 |