Statistik Asas

| Nilai Portfolio | $ 299,743,701 |

| Kedudukan Semasa | 101 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

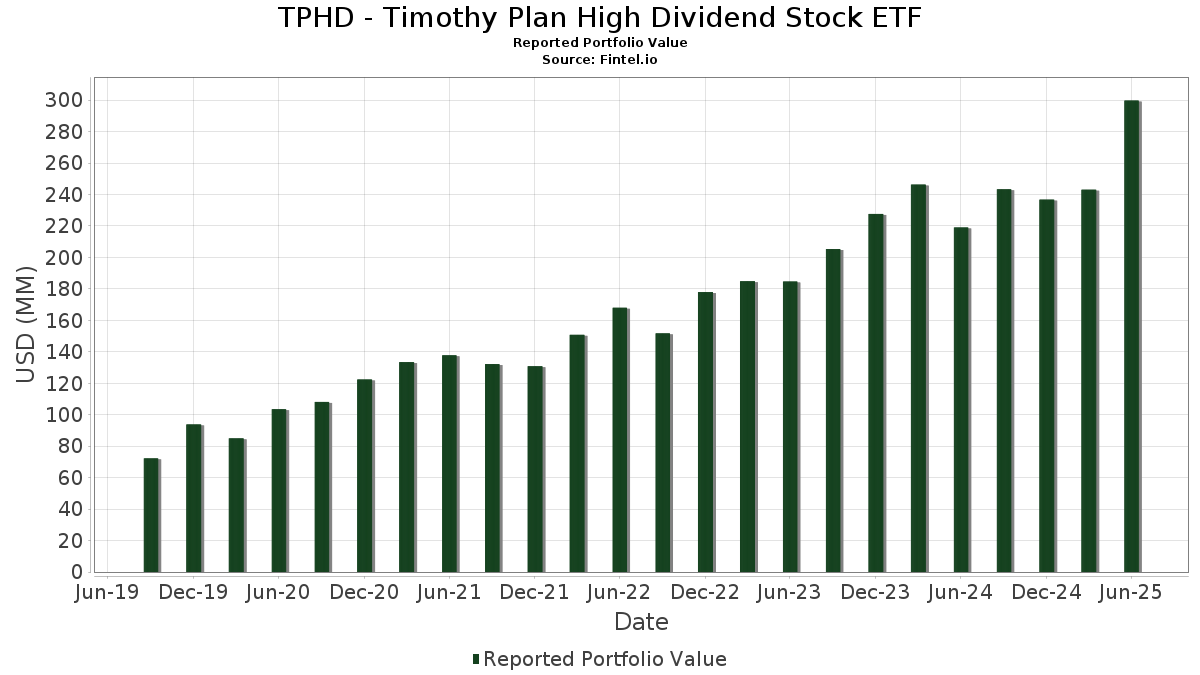

TPHD - Timothy Plan High Dividend Stock ETF telah mendedahkan 101 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 299,743,701 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas TPHD - Timothy Plan High Dividend Stock ETF ialah Evergy, Inc. (US:EVRG) , Atmos Energy Corporation (US:ATO) , Seagate Technology Holdings plc (US:STX) , CME Group Inc. (US:CME) , and NiSource Inc. (US:NI) . Kedudukan baharu TPHD - Timothy Plan High Dividend Stock ETF termasuk CME Group Inc. (US:CME) , Quest Diagnostics Incorporated (US:DGX) , Texas Roadhouse, Inc. (US:TXRH) , Texas Instruments Incorporated (US:TXN) , and The Progressive Corporation (US:PGR) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 4.34 | 1.4416 | 1.4416 | |

| 0.02 | 3.52 | 1.1690 | 1.1690 | |

| 0.02 | 3.10 | 1.0307 | 1.0307 | |

| 0.01 | 3.00 | 0.9965 | 0.9965 | |

| 0.01 | 2.95 | 0.9810 | 0.9810 | |

| 0.02 | 2.95 | 0.9802 | 0.9802 | |

| 0.04 | 2.94 | 0.9765 | 0.9765 | |

| 0.02 | 2.87 | 0.9553 | 0.9553 | |

| 0.02 | 2.86 | 0.9523 | 0.9523 | |

| 0.03 | 4.38 | 1.4555 | 0.9032 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 2.49 | 0.8289 | -0.8465 | |

| 0.01 | 2.48 | 0.8248 | -0.5716 | |

| 0.11 | 3.13 | 1.0391 | -0.5046 | |

| 0.05 | 3.01 | 0.9995 | -0.4630 | |

| 0.03 | 3.27 | 1.0884 | -0.3915 | |

| 0.03 | 2.61 | 0.8688 | -0.3242 | |

| 0.02 | 3.34 | 1.1119 | -0.3235 | |

| 0.11 | 4.28 | 1.4219 | -0.3019 | |

| 0.04 | 3.73 | 1.2395 | -0.3007 | |

| 0.05 | 2.58 | 0.8590 | -0.2954 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-28 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| EVRG / Evergy, Inc. | 0.07 | 28.24 | 4.90 | 28.21 | 1.6274 | 0.0656 | |||

| ATO / Atmos Energy Corporation | 0.03 | 7.68 | 4.39 | 7.36 | 1.4595 | -0.2133 | |||

| STX / Seagate Technology Holdings plc | 0.03 | 90.86 | 4.38 | 224.30 | 1.4555 | 0.9032 | |||

| CME / CME Group Inc. | 0.02 | 4.34 | 1.4416 | 1.4416 | |||||

| NI / NiSource Inc. | 0.11 | 0.86 | 4.28 | 1.50 | 1.4219 | -0.3019 | |||

| DTE / DTE Energy Company | 0.03 | 33.96 | 4.18 | 28.32 | 1.3905 | 0.0573 | |||

| CMS / CMS Energy Corporation | 0.06 | 23.15 | 4.13 | 13.61 | 1.3714 | -0.1141 | |||

| ITW / Illinois Tool Works Inc. | 0.02 | 18.76 | 3.93 | 18.40 | 1.3068 | -0.0513 | |||

| WEC / WEC Energy Group, Inc. | 0.04 | 11.33 | 3.92 | 6.43 | 1.3047 | -0.2034 | |||

| LNT / Alliant Energy Corporation | 0.06 | 15.24 | 3.87 | 8.29 | 1.2861 | -0.1751 | |||

| SO / The Southern Company | 0.04 | 11.17 | 3.79 | 11.01 | 1.2601 | -0.1364 | |||

| OTIS / Otis Worldwide Corporation | 0.04 | 35.91 | 3.74 | 30.37 | 1.2432 | 0.0702 | |||

| AEE / Ameren Corporation | 0.04 | 3.51 | 3.73 | -0.98 | 1.2395 | -0.3007 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.05 | 27.32 | 3.62 | 29.84 | 1.2023 | 0.0632 | |||

| AEP / American Electric Power Company, Inc. | 0.03 | 13.13 | 3.60 | 7.43 | 1.1977 | -0.1741 | |||

| PPG / PPG Industries, Inc. | 0.03 | 37.25 | 3.60 | 42.78 | 1.1971 | 0.1654 | |||

| SYY / Sysco Corporation | 0.05 | 30.94 | 3.60 | 32.16 | 1.1955 | 0.0825 | |||

| MKC / McCormick & Company, Incorporated | 0.05 | 58.84 | 3.55 | 46.35 | 1.1798 | 0.1877 | |||

| DGX / Quest Diagnostics Incorporated | 0.02 | 3.52 | 1.1690 | 1.1690 | |||||

| KMB / Kimberly-Clark Corporation | 0.03 | 31.98 | 3.46 | 19.63 | 1.1510 | -0.0328 | |||

| GD / General Dynamics Corporation | 0.01 | 4.43 | 3.46 | 11.72 | 1.1501 | -0.1164 | |||

| UNP / Union Pacific Corporation | 0.02 | 15.15 | 3.45 | 12.15 | 1.1481 | -0.1115 | |||

| AVY / Avery Dennison Corporation | 0.02 | 41.32 | 3.45 | 39.33 | 1.1461 | 0.1340 | |||

| CINF / Cincinnati Financial Corporation | 0.02 | 17.04 | 3.39 | 17.97 | 1.1265 | -0.0482 | |||

| ES / Eversource Energy | 0.05 | 20.78 | 3.37 | 28.59 | 1.1201 | 0.0616 | |||

| AFL / Aflac Incorporated | 0.03 | 32.86 | 3.35 | 26.00 | 1.1135 | 0.0263 | |||

| PAYX / Paychex, Inc. | 0.02 | 1.09 | 3.34 | -4.70 | 1.1119 | -0.3235 | |||

| LYB / LyondellBasell Industries N.V. | 0.06 | 86.18 | 3.28 | 53.05 | 1.0915 | 0.2138 | |||

| ED / Consolidated Edison, Inc. | 0.03 | -0.27 | 3.27 | -9.51 | 1.0884 | -0.3915 | |||

| CSX / CSX Corporation | 0.10 | 15.82 | 3.27 | 28.44 | 1.0884 | 0.0455 | |||

| CNP / CenterPoint Energy, Inc. | 0.09 | -3.01 | 3.26 | -1.63 | 1.0840 | -0.2721 | |||

| FIS / Fidelity National Information Services, Inc. | 0.04 | 35.89 | 3.26 | 48.11 | 1.0829 | 0.1834 | |||

| CAT / Caterpillar Inc. | 0.01 | 58.01 | 3.24 | 56.89 | 1.0781 | 0.2331 | |||

| PFG / Principal Financial Group, Inc. | 0.04 | 28.12 | 3.22 | 20.64 | 1.0709 | -0.0216 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.04 | 1.38 | 3.18 | 3.71 | 1.0582 | -0.1974 | |||

| RPM / RPM International Inc. | 0.03 | 48.92 | 3.16 | 41.41 | 1.0504 | 0.1364 | |||

| EOG / EOG Resources, Inc. | 0.03 | 37.33 | 3.14 | 28.09 | 1.0429 | 0.0411 | |||

| KMI / Kinder Morgan, Inc. | 0.11 | -19.63 | 3.13 | -17.20 | 1.0391 | -0.5046 | |||

| HRL / Hormel Foods Corporation | 0.10 | 69.79 | 3.11 | 66.03 | 1.0350 | 0.2678 | |||

| PKG / Packaging Corporation of America | 0.02 | 22.97 | 3.11 | 17.04 | 1.0323 | -0.0531 | |||

| EWBC / East West Bancorp, Inc. | 0.03 | 35.51 | 3.11 | 52.50 | 1.0322 | 0.1991 | |||

| TXRH / Texas Roadhouse, Inc. | 0.02 | 3.10 | 1.0307 | 1.0307 | |||||

| OXY / Occidental Petroleum Corporation | 0.07 | 50.74 | 3.03 | 28.27 | 1.0078 | 0.0412 | |||

| ROK / Rockwell Automation, Inc. | 0.01 | 55.41 | 3.02 | 99.87 | 1.0053 | 0.3862 | |||

| WMB / The Williams Companies, Inc. | 0.05 | -19.99 | 3.01 | -15.92 | 0.9995 | -0.4630 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 3.00 | 0.9965 | 0.9965 | |||||

| PSX / Phillips 66 | 0.03 | 56.77 | 2.98 | 51.50 | 0.9916 | 0.1861 | |||

| MAS / Masco Corporation | 0.05 | 77.92 | 2.98 | 64.68 | 0.9904 | 0.2503 | |||

| PGR / The Progressive Corporation | 0.01 | 2.95 | 0.9810 | 0.9810 | |||||

| SNX / TD SYNNEX Corporation | 0.02 | 2.95 | 0.9802 | 0.9802 | |||||

| FAST / Fastenal Company | 0.07 | 115.00 | 2.95 | 16.44 | 0.9795 | -0.0555 | |||

| IFF / International Flavors & Fragrances Inc. | 0.04 | 2.94 | 0.9765 | 0.9765 | |||||

| SCI / Service Corporation International | 0.04 | -0.15 | 2.91 | 1.36 | 0.9668 | -0.2070 | |||

| AWK / American Water Works Company, Inc. | 0.02 | 5.58 | 2.90 | -0.45 | 0.9631 | -0.2272 | |||

| NSC / Norfolk Southern Corporation | 0.01 | 37.78 | 2.89 | 48.94 | 0.9592 | 0.1666 | |||

| CDW / CDW Corporation | 0.02 | 2.87 | 0.9553 | 0.9553 | |||||

| IEX / IDEX Corporation | 0.02 | 2.86 | 0.9523 | 0.9523 | |||||

| CF / CF Industries Holdings, Inc. | 0.03 | 35.48 | 2.82 | 59.54 | 0.9371 | 0.2142 | |||

| MCHP / Microchip Technology Incorporated | 0.04 | 115.33 | 2.80 | 212.95 | 0.9323 | 0.5658 | |||

| SNA / Snap-on Incorporated | 0.01 | 10.00 | 2.80 | 1.56 | 0.9312 | -0.1969 | |||

| RS / Reliance, Inc. | 0.01 | 25.75 | 2.75 | 36.75 | 0.9142 | 0.0913 | |||

| CRBG / Corebridge Financial, Inc. | 0.08 | 26.23 | 2.74 | 41.96 | 0.9099 | 0.1211 | |||

| NEE / NextEra Energy, Inc. | 0.04 | 51.89 | 2.74 | 48.75 | 0.9099 | 0.1572 | |||

| COP / ConocoPhillips | 0.03 | 25.42 | 2.73 | 7.17 | 0.9090 | -0.1346 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.01 | 16.86 | 2.69 | 17.69 | 0.8958 | -0.0405 | |||

| EG / Everest Group, Ltd. | 0.01 | 27.77 | 2.69 | 19.48 | 0.8935 | -0.0264 | |||

| CTRA / Coterra Energy Inc. | 0.10 | 5.75 | 2.66 | -7.13 | 0.8830 | -0.2869 | |||

| ARES / Ares Management Corporation | 0.02 | -23.28 | 2.64 | 29.20 | 0.8767 | -0.1111 | |||

| OKE / ONEOK, Inc. | 0.03 | 8.92 | 2.61 | -10.39 | 0.8688 | -0.3242 | |||

| VLO / Valero Energy Corporation | 0.02 | 45.32 | 2.61 | 47.93 | 0.8682 | 0.1459 | |||

| ADI / Analog Devices, Inc. | 0.01 | 55.65 | 2.61 | 83.72 | 0.8669 | 0.2862 | |||

| EQH / Equitable Holdings, Inc. | 0.05 | -14.99 | 2.58 | -8.43 | 0.8590 | -0.2954 | |||

| LECO / Lincoln Electric Holdings, Inc. | 0.01 | 63.39 | 2.56 | 290.84 | 0.8512 | -0.0513 | |||

| TSCO / Tractor Supply Company | 0.05 | 26.47 | 2.55 | 21.12 | 0.8485 | -0.0135 | |||

| DVN / Devon Energy Corporation | 0.08 | 54.15 | 2.55 | 31.12 | 0.8475 | 0.0522 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.03 | 82.86 | 2.54 | 71.35 | 0.8433 | 0.2377 | |||

| PR / Permian Resources Corporation | 0.19 | 43.10 | 2.52 | 40.77 | 0.8391 | 0.1054 | |||

| NRG / NRG Energy, Inc. | 0.02 | -9.34 | 2.52 | 52.54 | 0.8389 | 0.1621 | |||

| ETR / Entergy Corporation | 0.03 | -37.39 | 2.49 | -39.14 | 0.8289 | -0.8465 | |||

| NTAP / NetApp, Inc. | 0.02 | 75.45 | 2.49 | 112.93 | 0.8268 | 0.3488 | |||

| HUBB / Hubbell Incorporated | 0.01 | -34.03 | 2.48 | -14.03 | 0.8248 | -0.5716 | |||

| JEF / Jefferies Financial Group Inc. | 0.04 | 27.71 | 2.46 | 30.40 | 0.8172 | 0.0460 | |||

| KVUE / Kenvue Inc. | 0.11 | 24.84 | 2.40 | 8.93 | 0.7990 | -0.1032 | |||

| SLB / Schlumberger Limited | 0.07 | 47.44 | 2.39 | 19.24 | 0.7953 | -0.0255 | |||

| FANG / Diamondback Energy, Inc. | 0.02 | 69.01 | 2.39 | 45.25 | 0.7930 | 0.1212 | |||

| LEN / Lennar Corporation | 0.02 | 2.35 | 0.7822 | 0.7822 | |||||

| BKR / Baker Hughes Company | 0.06 | 7.85 | 2.30 | -5.88 | 0.7656 | -0.2356 | |||

| IP / International Paper Company | 0.05 | 31.18 | 2.30 | 15.14 | 0.7638 | -0.0524 | |||

| CPB / The Campbell's Company | 0.07 | 32.23 | 2.24 | 1.54 | 0.7450 | -0.1579 | |||

| NXPI / NXP Semiconductors N.V. | 0.01 | 62.20 | 2.24 | 86.50 | 0.7442 | 0.2531 | |||

| OVV / Ovintiv Inc. | 0.06 | 31.02 | 2.24 | 16.46 | 0.7435 | -0.0419 | |||

| WLK / Westlake Corporation | 0.03 | 136.99 | 2.21 | 19.76 | 0.7354 | -0.0196 | |||

| HAL / Halliburton Company | 0.11 | 59.62 | 2.18 | 28.21 | 0.7239 | 0.0293 | |||

| POOL / Pool Corporation | 0.01 | 2.16 | 0.7177 | 0.7177 | |||||

| NEM / Newmont Corporation | 0.04 | 2.16 | 0.7169 | 0.7169 | |||||

| GPC / Genuine Parts Company | 0.02 | 5.61 | 2.15 | 7.52 | 0.7136 | -0.1029 | |||

| NUE / Nucor Corporation | 0.02 | 24.04 | 2.12 | 33.48 | 0.7040 | 0.0553 | |||

| WSO / Watsco, Inc. | 0.00 | 15.93 | 2.03 | 0.74 | 0.6751 | -0.1496 | |||

| OWL / Blue Owl Capital Inc. | 0.10 | 24.84 | 2.00 | 19.73 | 0.6659 | -0.0187 | |||

| DG / Dollar General Corporation | 0.02 | 16.54 | 1.81 | 51.59 | 0.6007 | 0.1131 | |||

| S P 500 EMINI FUTURE SEP25 / DE (N/A) | 0.02 | 0.0070 | 0.0070 |