Statistik Asas

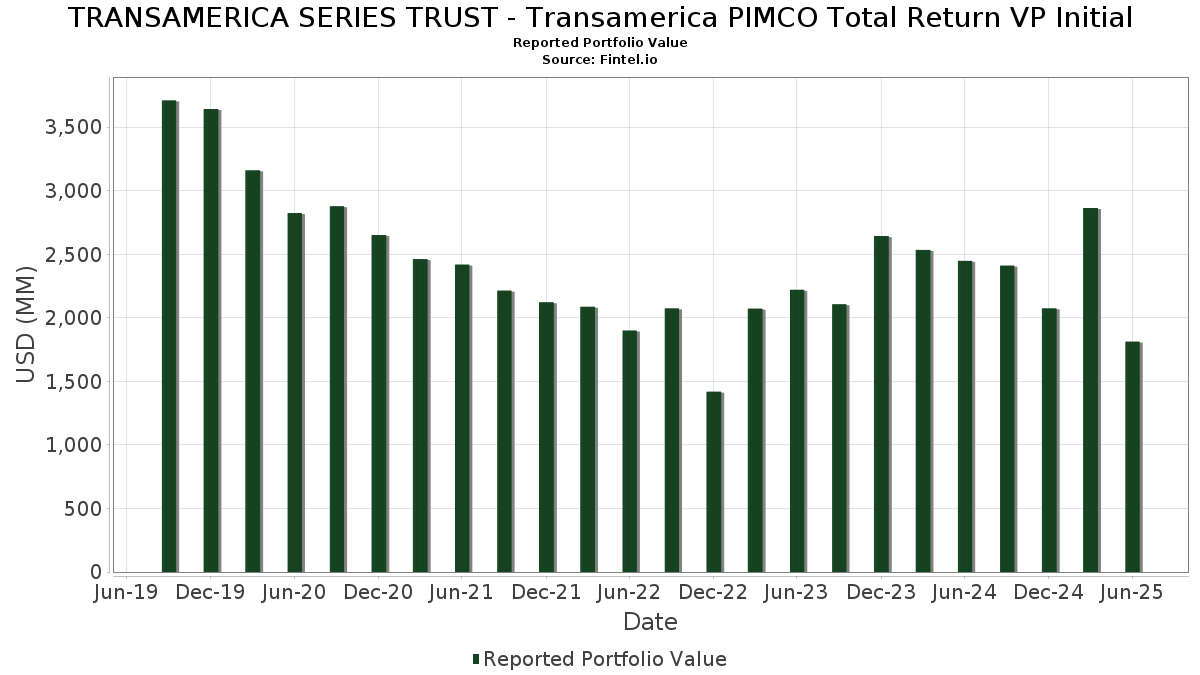

| Nilai Portfolio | $ 1,811,774,092 |

| Kedudukan Semasa | 495 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

TRANSAMERICA SERIES TRUST - Transamerica PIMCO Total Return VP Initial telah mendedahkan 495 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 1,811,774,092 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas TRANSAMERICA SERIES TRUST - Transamerica PIMCO Total Return VP Initial ialah TREASURY BOND (US:US912810TF57) , UMBS, 30 Year, Single Family (US:US01F0206791) , United States Treasury Note/Bond (US:US912810TS78) , Uniform Mortgage-Backed Security, TBA (US:US01F0226757) , and United States Treas Bds Bond (US:US912810QA97) . Kedudukan baharu TRANSAMERICA SERIES TRUST - Transamerica PIMCO Total Return VP Initial termasuk TREASURY BOND (US:US912810TF57) , UMBS, 30 Year, Single Family (US:US01F0206791) , United States Treasury Note/Bond (US:US912810TS78) , Uniform Mortgage-Backed Security, TBA (US:US01F0226757) , and United States Treas Bds Bond (US:US912810QA97) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 17.82 | 1.0295 | 1.0295 | ||

| 16.92 | 0.9778 | 0.9778 | ||

| 13.33 | 0.7704 | 0.7704 | ||

| 13.13 | 0.7588 | 0.7588 | ||

| 5.73 | 0.3310 | 0.3310 | ||

| 12.62 | 0.7291 | 0.3131 | ||

| 5.33 | 0.3079 | 0.3079 | ||

| 5.27 | 0.3046 | 0.3046 | ||

| 5.16 | 0.2984 | 0.2984 | ||

| 19.80 | 1.1443 | 0.2951 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 12.36 | 0.7141 | -0.9892 | ||

| 1.90 | 0.1099 | -0.7012 | ||

| 25.29 | 1.4612 | -0.6960 | ||

| 4.31 | 0.2492 | -0.4817 | ||

| 6.36 | 0.3676 | -0.2882 | ||

| 3.50 | 0.2020 | -0.2669 | ||

| 37.32 | 2.1566 | -0.2391 | ||

| 4.12 | 0.2378 | -0.2366 | ||

| 5.21 | 0.3009 | -0.2248 | ||

| 6.84 | 0.3951 | -0.2231 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-27 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US912810TF57 / TREASURY BOND | 41.91 | -10.54 | 2.4218 | -0.0556 | |||||

| US01F0206791 / UMBS, 30 Year, Single Family | 37.32 | -32.38 | 2.1566 | -0.2391 | |||||

| US912810TS78 / United States Treasury Note/Bond | 25.99 | -1.78 | 1.5016 | 0.1025 | |||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 25.29 | -38.01 | 1.4612 | -0.6960 | |||||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 19.80 | 1.23 | 1.1443 | 0.2951 | |||||

| MUFG Securities Canada Ltd. / STIV (US62479UWJ05) | 19.80 | 1.09 | 1.1443 | 0.1085 | |||||

| US912810QA97 / United States Treas Bds Bond | 18.79 | -17.40 | 1.0859 | -0.1171 | |||||

| US912810SN90 / UNITED STATES TREASURY BOND 1.25% 05/15/2050 | 18.44 | -3.52 | 1.0656 | 0.0549 | |||||

| E1MR34 / Emerson Electric Co. - Depositary Receipt (Common Stock) | 17.82 | 1.0295 | 1.0295 | ||||||

| US912810QX90 / United States Treas Bds Bond | 17.66 | -1.62 | 1.0206 | 0.0713 | |||||

| Versailles Commercial Paper LLC / STIV (US92512LU339) | 17.59 | 1.13 | 1.0163 | 0.0966 | |||||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 16.92 | 0.9778 | 0.9778 | ||||||

| U.S. Treasury Bonds / DBT (US912810TZ12) | 15.79 | -16.41 | 0.9122 | -0.0865 | |||||

| US912810SL35 / United States Treasury Note/Bond | 14.96 | -16.62 | 0.8644 | -0.0843 | |||||

| US3132DWHT36 / FEDERAL HOME LOAN MORTGAGE CORP | 14.93 | -2.33 | 0.8628 | 0.0544 | |||||

| U.S. Treasury Bonds / DBT (US912810UB25) | 14.88 | -1.88 | 0.8598 | 0.0579 | |||||

| LMA-Americas LLC / STIV (US53944QV809) | 13.33 | 0.7704 | 0.7704 | ||||||

| Glencove Funding LLC / STIV (US37828VWB51) | 13.13 | 0.7588 | 0.7588 | ||||||

| US912828Z948 / United States Treasury Note/Bond | 12.62 | 25.54 | 0.7291 | 0.3131 | |||||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 12.36 | -68.51 | 0.7141 | -0.9892 | |||||

| US91282CDJ71 / United States Treasury Note/Bond | 12.28 | 34.89 | 0.7096 | 0.2282 | |||||

| US91282CCB54 / UST NOTES 1.625% 05/15/2031 | 11.30 | -16.23 | 0.6529 | -0.0603 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 11.06 | -1.73 | 0.6389 | 0.0439 | |||||

| U.S. Treasury Notes / DBT (US91282CLM19) | 10.51 | 1.01 | 0.6072 | 0.0571 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 10.01 | -3.74 | 0.5782 | 0.0285 | |||||

| COLT Mortgage Loan Trust / ABS-MBS (US19688VAA89) | 9.54 | -7.61 | 0.5512 | 0.0052 | |||||

| US91282CJQ50 / United States Treasury Note/Bond - When Issued | 9.40 | 1.04 | 0.5430 | 0.0512 | |||||

| US44928XAY04 / ICG US CLO 2014-1 Ltd | 9.33 | -0.01 | 0.5390 | 0.0457 | |||||

| US92212KAB26 / Vantage Data Centers LLC | 9.10 | 0.86 | 0.5258 | 0.0487 | |||||

| US912810SY55 / United States Treasury Note/Bond | 9.06 | -1.61 | 0.5234 | 0.0366 | |||||

| US91282CCS89 / United States Treasury Note/Bond | 8.98 | -33.04 | 0.5189 | -0.1902 | |||||

| U.S. Treasury Bonds / DBT (US912810UE63) | 8.96 | -2.79 | 0.5176 | 0.0303 | |||||

| US3140XKP385 / Fannie Mae Pool | 8.94 | -4.33 | 0.5167 | 0.0224 | |||||

| US67740QAH92 / Ohio National Financial Services, Inc. | 8.94 | 0.81 | 0.5166 | 0.0477 | |||||

| U.S. Treasury Notes / DBT (US91282CLF67) | 8.65 | 73.97 | 0.4998 | 0.2368 | |||||

| VEGAS Trust / ABS-MBS (US92254AAA51) | 8.61 | 0.71 | 0.4977 | 0.0455 | |||||

| US3140QRW661 / Federal National Mortgage Association | 8.60 | -0.83 | 0.4972 | 0.0384 | |||||

| US126405AA77 / CSMC 2020-RPL4 Trust | 8.42 | -1.96 | 0.4867 | 0.0324 | |||||

| US32113CBV19 / First National Master Note Trust | 8.25 | -0.12 | 0.4767 | 0.0399 | |||||

| US3140XKUQ16 / Federal National Mortgage Association | 8.10 | -3.44 | 0.4678 | 0.0245 | |||||

| US91282CFF32 / United States Treasury Note/Bond | 7.88 | 125.56 | 0.4555 | 0.2706 | |||||

| Verus Securitization Trust / ABS-MBS (US924925AA84) | 7.71 | -6.38 | 0.4453 | 0.0101 | |||||

| US3140XKS769 / Federal National Mortgage Association | 7.69 | -2.25 | 0.4446 | 0.0284 | |||||

| US12510HAS94 / CARS DB7 LP | 7.56 | -0.12 | 0.4370 | 0.0366 | |||||

| U.S. Treasury Bonds / DBT (US912810UF39) | 7.45 | -1.86 | 0.4307 | 0.0291 | |||||

| US912810SD19 / United States Treas Bds Bond | 7.26 | -39.92 | 0.4195 | -0.2195 | |||||

| US89181JAA07 / Towd Point Mortgage Trust, Series 2023-1, Class A1 | 7.25 | -2.92 | 0.4190 | 0.0241 | |||||

| US3140XKTV20 / Federal National Mortgage Association | 7.19 | -1.38 | 0.4157 | 0.0299 | |||||

| U.S. Treasury Bonds / DBT (US912810UC08) | 7.05 | -2.77 | 0.4075 | 0.0240 | |||||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 6.86 | -36.15 | 6.86 | -36.14 | 0.3964 | -0.1717 | |||

| US912810QB70 / United States Treas Bds Bond | 6.84 | -41.51 | 0.3951 | -0.2231 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 6.79 | -6.14 | 0.3924 | 0.0098 | |||||

| US61945WAA71 / Mosaic Solar Loan Trust 2023-2 | 6.56 | -2.13 | 0.3792 | 0.0246 | |||||

| US912810ST60 / TREASURY BOND | 6.48 | 78.23 | 0.3743 | 0.1821 | |||||

| US26245JAQ13 / Dryden 80 CLO Ltd | 6.46 | -3.48 | 0.3733 | 0.0194 | |||||

| US91282CDY49 / United States Treasury Note/Bond | 6.36 | -48.71 | 0.3676 | -0.2882 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 6.31 | -6.13 | 0.3646 | 0.0092 | |||||

| US23802WAA99 / DATABANK ISSUER LLC | 6.28 | 0.71 | 0.3628 | 0.0332 | |||||

| US92852LAC37 / Viterra Finance BV | 6.21 | 0.34 | 0.3590 | 0.0316 | |||||

| Angel Oak Mortgage Trust / ABS-MBS (US034934AA73) | 6.17 | -2.85 | 0.3565 | 0.0207 | |||||

| US06051GLS65 / Bank of America Corp | 6.10 | -6.34 | 0.3526 | 0.0081 | |||||

| US505742AM88 / LADDER CAP FIN LLLP/CORP SR UNSECURED 144A 02/27 4.25 | 6.05 | 1.24 | 0.3496 | 0.0336 | |||||

| US42806MAF68 / Hertz Vehicle Financing III LP | 6.01 | 0.35 | 0.3475 | 0.0306 | |||||

| Capital Automotive REIT / ABS-O (US12510HAZ38) | 5.99 | 0.42 | 0.3463 | 0.0307 | |||||

| US64830TAD00 / NRZT 2020-1A A1B | 5.93 | -3.75 | 0.3425 | 0.0169 | |||||

| US3132DWGZ05 / Freddie Mac Pool | 5.92 | -2.79 | 0.3423 | 0.0200 | |||||

| Bank of America Corp. / DBT (US06051GMW68) | 5.73 | 0.3310 | 0.3310 | ||||||

| U.S. Treasury Bonds / DBT (US912810UG12) | 5.73 | 116.28 | 0.3310 | 0.1909 | |||||

| US89178BAA26 / TOWD POINT MORTGAGE TRUST TPMT 2019 4 A1 144A | 5.69 | -4.14 | 0.3289 | 0.0149 | |||||

| US89175TAA60 / Towd Point Mortgage Trust 2018-4 | 5.67 | -3.74 | 0.3274 | 0.0161 | |||||

| US90117PAA30 / 1211 AVENUE OF THE AMERICAS TR AOTA 2015 1211 A1A1 144A | 5.64 | -2.46 | 0.3259 | 0.0202 | |||||

| US05377RHL15 / Avis Budget Rental Car Funding AESOP LLC | 5.50 | 0.24 | 0.3179 | 0.0277 | |||||

| US64829VAA44 / New Residential Mortgage Loan Trust 2018-RPL1 | 5.49 | -4.36 | 0.3171 | 0.0137 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RHY36) | 5.41 | 0.63 | 0.3125 | 0.0283 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 5.35 | -5.99 | 0.3094 | 0.0082 | |||||

| US13645RBF01 / Canadian Pacific Railway Co | 5.33 | 0.3079 | 0.3079 | ||||||

| XS1385999492 / Cloverie PLC for Zurich Insurance Co Ltd | 5.29 | -6.92 | 0.3054 | 0.0051 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 5.27 | 0.3046 | 0.3046 | ||||||

| CAFCO LLC / STIV (US1247P2WA82) | 5.23 | 1.08 | 0.3021 | 0.0286 | |||||

| US89179JAA43 / Towd Point Mortgage Trust 2020-4 | 5.21 | -47.62 | 0.3009 | -0.2248 | |||||

| US89175JAA88 / TOWD POINT MORTGAGE TRUST | 5.19 | -9.58 | 0.3001 | -0.0036 | |||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 5.16 | 0.2984 | 0.2984 | ||||||

| U.S. Treasury Notes / DBT (US91282CLW90) | 5.08 | 0.30 | 0.2934 | 0.0257 | |||||

| Mexico Remittances Funding Fiduciary Estate Management SARL / DBT (US593035AB42) | 5.05 | -1.27 | 0.2921 | 0.0214 | |||||

| EFN / Element Fleet Management Corp. | 5.01 | 0.2893 | 0.2893 | ||||||

| US91282CFV81 / United States Treasury Note/Bond | 5.00 | 0.77 | 0.2886 | 0.0265 | |||||

| Primo Water Holdings, Inc./Triton Water Holdings, Inc. / DBT (US74168RAB96) | 4.93 | 1.61 | 0.2849 | 0.0283 | |||||

| RGA Global Funding / DBT (US76209PAF09) | 4.93 | -6.49 | 0.2847 | 0.0061 | |||||

| US12635WAA53 / COMM 2016-787S MORTGAGE TRUST COMM 2016-787S A | 4.91 | 0.22 | 0.2839 | 0.0246 | |||||

| US78403DAZ33 / SBA TOWER TRUST | 4.91 | -16.43 | 0.2836 | -0.0270 | |||||

| US89180YAA82 / Towd Point Mortgage Trust 2022-4 | 4.89 | -2.61 | 0.2825 | 0.0171 | |||||

| US05565AS207 / BNP Paribas SA | 4.88 | -6.63 | 0.2818 | 0.0056 | |||||

| Symphony CLO XXIII Ltd. / ABS-CBDO (US87167NDL64) | 4.86 | -2.13 | 0.2811 | 0.0182 | |||||

| US03767VAG32 / Apidos CLO XXXI | 4.86 | -1.34 | 0.2808 | 0.0203 | |||||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 4.82 | -0.96 | 0.2788 | 0.0212 | |||||

| US36262GAD34 / GXO Logistics Inc | 4.80 | -4.97 | 0.2771 | 0.0102 | |||||

| US90137LAC46 / 20 Times Square Trust 2018-20TS | 4.77 | 5.39 | 0.2759 | 0.0364 | |||||

| US912810TL26 / TREASURY BOND | 4.77 | -2.52 | 0.2754 | 0.0169 | |||||

| AXASA / AXA SA | 4.74 | -6.47 | 0.2738 | 0.0059 | |||||

| US23345LAA70 / DOLP Trust 2021-NYC | 4.72 | 1.44 | 0.2725 | 0.0267 | |||||

| QTS Issuer ABS I LLC / ABS-O (US74690DAA90) | 4.69 | 0.2708 | 0.2708 | ||||||

| GCAT Trust / ABS-MBS (US36169HAA14) | 4.64 | -8.32 | 0.2680 | 0.0005 | |||||

| Hyundai Capital America / DBT (US44891ADX28) | 4.53 | 0.2617 | 0.2617 | ||||||

| MVW LLC / ABS-O (US55389QAC15) | 4.52 | -8.44 | 0.2614 | 0.0001 | |||||

| Sitios Latinoamerica SAB de CV / DBT (US82983PAA12) | 4.50 | 1.01 | 0.2601 | 0.0245 | |||||

| US203372AX50 / CommScope Inc | 4.50 | 9.76 | 0.2600 | 0.0432 | |||||

| ICG U.S. CLO Ltd. / ABS-CBDO (US449303AL08) | 4.50 | -0.02 | 0.2599 | 0.0220 | |||||

| US91153LAA52 / United Shore Financial Services LLC | 4.48 | 0.27 | 0.2588 | 0.0226 | |||||

| U.S. Treasury Bonds / DBT (US912810UJ50) | 4.46 | -1.94 | 0.2576 | 0.0172 | |||||

| JBS USA Holding Lux SARL/JBS USA Foods Group Holdings, Inc./JBS USA Food Co. / DBT (US472140AE22) | 4.45 | 0.2572 | 0.2572 | ||||||

| SCF Equipment Trust LLC / ABS-O (US78437DAC48) | 4.44 | 0.98 | 0.2564 | 0.0240 | |||||

| US05548WAG24 / BBCMS 2018-TALL Mortgage Trust | 4.38 | 2.92 | 0.2529 | 0.0281 | |||||

| BATBC / British American Tobacco Bangladesh Company Limited | 4.33 | 0.2502 | 0.2502 | ||||||

| US912828ZZ63 / United States Treasury Inflation Indexed Bonds | 4.31 | -68.81 | 0.2492 | -0.4817 | |||||

| US64830DAB91 / New Residential Mortgage Loan Trust 2019-2 | 4.31 | -3.93 | 0.2488 | 0.0118 | |||||

| US42806MCA53 / HERTZ VEHICLE FINANCING III LLC SER 2023-3A CL A REGD 144A P/P 5.94000000 | 4.29 | -0.07 | 0.2478 | 0.0209 | |||||

| US912810SH23 / United States Treas Bds Bond | 4.24 | 226.35 | 0.2448 | 0.1761 | |||||

| Mainbeach Funding LLC / STIV (US56037BVT87) | 4.22 | 1.10 | 0.2438 | 0.0231 | |||||

| NNN / NNN REIT, Inc. | 4.20 | 0.2424 | 0.2424 | ||||||

| US89788MAM47 / Truist Financial Corp | 4.19 | -5.03 | 0.2422 | 0.0088 | |||||

| US89170VAA61 / Towd Point Mortgage Trust 2022-1 | 4.12 | -54.13 | 0.2378 | -0.2366 | |||||

| Uzbek Industrial & Construction Bank ATB / DBT (US917935AA60) | 4.11 | 1.31 | 0.2376 | 0.0229 | |||||

| Drive Auto Receivables Trust / ABS-O (US26207AAF03) | 4.11 | 0.47 | 0.2372 | 0.0211 | |||||

| Hudson Yards Mortgage Trust / ABS-MBS (US44855PAA66) | 4.09 | 1.44 | 0.2365 | 0.0231 | |||||

| Dominican Republic International Bonds / DBT (US25714PEZ71) | 4.04 | 1.20 | 0.2333 | 0.0223 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 4.02 | 2.26 | 0.2326 | 0.0245 | |||||

| Sierra Timeshare Receivables Funding LLC / ABS-O (US82653BAC72) | 4.02 | -15.38 | 0.2324 | -0.0189 | |||||

| US06738ECC75 / Barclays PLC | 4.01 | -7.45 | 0.2317 | 0.0025 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 3.99 | -5.63 | 0.2304 | 0.0069 | |||||

| LBTYB / Liberty Global Ltd. | 3.94 | 3.85 | 0.2277 | 0.0270 | |||||

| US682680BG78 / ONEOK INC | 3.92 | -5.91 | 0.2264 | 0.0062 | |||||

| U.S. Treasury Bonds / DBT (US912810UD80) | 3.91 | -1.83 | 0.2262 | 0.0153 | |||||

| Expedia Group, Inc. / DBT (US30212PBL85) | 3.91 | -5.72 | 0.2258 | 0.0067 | |||||

| OZLM XV Ltd. / ABS-CBDO (US67111DBE58) | 3.90 | -0.15 | 0.2254 | 0.0188 | |||||

| US03938LBE39 / ArcelorMittal SA | 3.90 | -6.77 | 0.2253 | 0.0042 | |||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 3.84 | -5.60 | 0.2221 | 0.0068 | |||||

| US11135FBP53 / SR UNSECURED 144A 11/35 3.137 | 3.84 | -5.23 | 0.2219 | 0.0076 | |||||

| US92332YAC57 / Venture Global LNG Inc | 3.84 | 1.56 | 0.2216 | 0.0220 | |||||

| US131347CR51 / Calpine Corp | 3.84 | 4.16 | 0.2216 | 0.0269 | |||||

| Bunge Ltd. Finance Corp. / DBT (US120568BF69) | 3.83 | -6.36 | 0.2213 | 0.0051 | |||||

| US46284VAE11 / Iron Mountain Inc | 3.82 | 1.89 | 0.2209 | 0.0225 | |||||

| L1CA34 / Labcorp Holdings Inc. - Depositary Receipt (Common Stock) | 3.75 | -5.30 | 0.2168 | 0.0073 | |||||

| American Homes 4 Rent LP / DBT (US02666TAG22) | 3.75 | -5.23 | 0.2167 | 0.0074 | |||||

| PXTJ / Petroleos Mexicanos | 3.74 | 4.12 | 0.2160 | 0.0261 | |||||

| US49177JAH59 / Kenvue Inc | 3.72 | -5.97 | 0.2150 | 0.0058 | |||||

| Genesis Energy LP/Genesis Energy Finance Corp. / DBT (US37185LAR33) | 3.70 | 3.82 | 0.2138 | 0.0253 | |||||

| US00109LAA17 / ADT Security Corp. | 3.70 | 2.89 | 0.2137 | 0.0236 | |||||

| OBX Trust / ABS-MBS (US67118TAA25) | 3.68 | -7.10 | 0.2125 | 0.0032 | |||||

| BRO / Brown & Brown, Inc. | 3.64 | 0.2103 | 0.2103 | ||||||

| Ivory Coast Government International Bonds / DBT (US221625AU01) | 3.63 | 0.33 | 0.2099 | 0.0185 | |||||

| US38141GYN86 / Goldman Sachs Group Inc/The | 3.63 | -22.44 | 0.2099 | -0.0377 | |||||

| MVFPSO / MV24 Capital BV | 3.62 | -2.19 | 0.2091 | 0.0134 | |||||

| US16411QAK76 / CORP. NOTE | 3.61 | -21.68 | 0.2087 | -0.0352 | |||||

| US096630AH15 / Boardwalk Pipelines LP | 3.60 | -5.51 | 0.2083 | 0.0066 | |||||

| Tyco Electronics Group SA / DBT (US902133BD84) | 3.59 | 0.2076 | 0.2076 | ||||||

| US548661EH62 / LOW 3 3/4 04/01/32 | 3.58 | -5.14 | 0.2069 | 0.0073 | |||||

| US95000U3F88 / Wells Fargo & Co. | 3.58 | -24.00 | 0.2068 | -0.0422 | |||||

| OBX Trust / ABS-MBS (US67118XAA37) | 3.57 | -7.27 | 0.2063 | 0.0027 | |||||

| US29278NAE31 / Energy Transfer Operating LP | 3.56 | -25.32 | 0.2059 | -0.0464 | |||||

| US422806AB58 / HEICO Corp. | 3.54 | -5.45 | 0.2046 | 0.0065 | |||||

| Chile Electricity Lux MPC II SARL / DBT (US16882LAA08) | 3.54 | -2.16 | 0.2045 | 0.0132 | |||||

| XS1040508167 / Imperial Brands Finance plc | 3.52 | 0.2035 | 0.2035 | ||||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 3.51 | -6.10 | 0.2029 | 0.0052 | |||||

| M1GM34 / MGM Resorts International - Depositary Receipt (Common Stock) | 3.51 | 2.79 | 0.2026 | 0.0222 | |||||

| U.S. Treasury Notes / DBT (US91282CKC46) | 3.50 | -60.57 | 0.2020 | -0.2669 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 3.49 | -5.98 | 0.2018 | 0.0054 | |||||

| US369604BH58 / General Electric Co | 3.47 | -6.19 | 0.2006 | 0.0050 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 3.46 | 53.68 | 0.2002 | 0.1023 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 3.45 | -6.13 | 0.1993 | 0.0051 | |||||

| US89177BAA35 / Towd Point Mortgage Trust 2019-1 | 3.43 | -55.20 | 0.1983 | -0.2067 | |||||

| US446413AZ96 / Huntington Ingalls Industries Inc | 3.43 | -4.91 | 0.1980 | 0.0074 | |||||

| US826944AA88 / Sierra Timeshare 2023-3 Receivables Funding LLC | 3.40 | -12.37 | 0.1966 | -0.0087 | |||||

| US06051GJP54 / Bank of America Corp | 3.39 | -5.17 | 0.1961 | 0.0069 | |||||

| US912810RT79 / United States Treas Bds Bond | 3.38 | -2.17 | 0.1954 | 0.0127 | |||||

| US826943AA06 / Sierra Timeshare 2023-1 Receivables Funding LLC | 3.36 | -10.74 | 0.1940 | -0.0049 | |||||

| US693475BS39 / PNC FINANCIAL SERVICES GROUP INC | 3.34 | -5.22 | 0.1931 | 0.0067 | |||||

| US830867AB33 / Delta Air Lines Inc / SkyMiles IP Ltd | 3.34 | -6.31 | 0.1930 | 0.0045 | |||||

| US912810TR95 / United States Treasury Note/Bond | 3.31 | -2.65 | 0.1912 | 0.0114 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 3.26 | -7.01 | 0.1884 | 0.0030 | |||||

| Sierra Timeshare Receivables Funding LLC / ABS-O (US82653BAA17) | 3.25 | -14.84 | 0.1877 | -0.0140 | |||||

| US55283QAA22 / MFA 2021-RPL1 Trust | 3.24 | -4.23 | 0.1870 | 0.0083 | |||||

| US46115HBV87 / INTESA SANPAOLO SPA | 3.22 | -5.88 | 0.1859 | 0.0052 | |||||

| US20030NCT63 / Comcast Corp Bond | 3.21 | -26.26 | 0.1857 | -0.0447 | |||||

| US81728UAA25 / Sensata Technologies Inc | 3.21 | 3.35 | 0.1853 | 0.0213 | |||||

| Battalion CLO XXI Ltd. / ABS-CBDO (US07134WAN39) | 3.20 | 0.1849 | 0.1849 | ||||||

| US817826AE03 / 7-Eleven Inc | 3.17 | -4.78 | 0.1830 | 0.0072 | |||||

| US91282CEP23 / WI TREASURY N/B REGD 2.87500000 | 3.17 | 1.05 | 0.1830 | 0.0173 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 3.17 | -22.17 | 0.1830 | -0.0321 | |||||

| Takeda U.S. Financing, Inc. / DBT (US87406BAA08) | 3.17 | 0.1829 | 0.1829 | ||||||

| US45790TAB17 / InRetail Consumer | 3.15 | 0.29 | 0.1819 | 0.0159 | |||||

| US962166BY91 / Weyerhaeuser Co | 3.14 | -5.67 | 0.1816 | 0.0055 | |||||

| US902613BF40 / UBS Group AG | 3.11 | -6.47 | 0.1796 | 0.0039 | |||||

| US12510HAK68 / Capital Automotive REIT | 3.10 | 0.45 | 0.1791 | 0.0160 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 3.07 | -5.21 | 0.1776 | 0.0061 | |||||

| US30303M8M79 / Meta Platforms Inc | 3.07 | -6.07 | 0.1771 | 0.0046 | |||||

| NTRCN / Nutrien Ltd | 3.06 | -5.94 | 0.1767 | 0.0047 | |||||

| US64830HAA23 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2019-RPL2 SER 2019-RPL2 CL A1 V/R REGD 144A P/P 3.25000000 | 3.04 | -4.56 | 0.1755 | 0.0072 | |||||

| US67059TAE55 / NuStar Logistics LP | 3.03 | 1.34 | 0.1749 | 0.0169 | |||||

| US345397B280 / FORD MTR CR CO LLC 3.375% 11/13/2025 | 3.03 | -6.43 | 0.1748 | 0.0038 | |||||

| US87165YAC75 / Symphony CLO XIX Ltd | 3.02 | -4.37 | 0.1744 | 0.0075 | |||||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 3.01 | 0.1741 | 0.1741 | ||||||

| US94950NAS18 / Wellfleet CLO Ltd. | 3.00 | 0.13 | 0.1735 | 0.0149 | |||||

| US18972EAA38 / Clydesdale Acquisition Holdings Inc | 3.00 | 0.94 | 0.1734 | 0.0162 | |||||

| BRAVO Residential Funding Trust / ABS-MBS (US10569LAA35) | 3.00 | -7.64 | 0.1734 | 0.0016 | |||||

| US07134WAA18 / Battalion CLO Ltd., Series 2021-21A, Class A | 3.00 | -0.03 | 0.1734 | 0.0146 | |||||

| US50212YAD67 / LPL Holdings Inc | 3.00 | -5.52 | 0.1732 | 0.0055 | |||||

| VIKCRU / Viking Cruises Ltd | 2.99 | 0.57 | 0.1729 | 0.0156 | |||||

| US925650AC72 / VICI Properties LP | 2.98 | -5.47 | 0.1719 | 0.0055 | |||||

| R1OP34 / Roper Technologies, Inc. - Depositary Receipt (Common Stock) | 2.97 | -5.77 | 0.1718 | 0.0050 | |||||

| Aon North America, Inc. / DBT (US03740MAF77) | 2.97 | -6.49 | 0.1714 | 0.0036 | |||||

| US67113DAW48 / OZLM XXIV Ltd | 2.96 | -23.55 | 0.1713 | -0.0337 | |||||

| US432833AJ07 / HILTON DOMESTIC OPERATING CO INC 3.75% 05/01/2029 144A | 2.95 | 2.83 | 0.1704 | 0.0188 | |||||

| US71654QDC33 / Petroleos Mexicanos | 2.94 | 5.76 | 0.1699 | 0.0229 | |||||

| US12661PAD15 / CSL UK Holdings Ltd | 2.94 | -7.53 | 0.1697 | 0.0018 | |||||

| US12429TAD63 / Mauser Packaging Solutions Holding Co | 2.92 | 3.73 | 0.1689 | 0.0199 | |||||

| US89173UAA51 / Towd Point Mortgage Trust 2017-4 | 2.91 | -10.26 | 0.1684 | -0.0033 | |||||

| US186108CK02 / Cleveland Electric Illuminating Co. (The) | 2.91 | 1.15 | 0.1684 | 0.0160 | |||||

| A1TT34 / The Allstate Corporation - Depositary Receipt (Common Stock) | 2.91 | -5.86 | 0.1681 | 0.0047 | |||||

| Foundry JV Holdco LLC / DBT (US350930AG89) | 2.90 | -5.10 | 0.1678 | 0.0060 | |||||

| US87229WAQ42 / TCI-Symphony CLO Ltd., Series 2016-1A, Class AR2 | 2.90 | -5.69 | 0.1676 | 0.0049 | |||||

| COLT Mortgage Loan Trust / ABS-MBS (US12665LAA26) | 2.89 | -10.38 | 0.1671 | -0.0035 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 2.89 | 3.66 | 0.1671 | 0.0196 | |||||

| Safehold GL Holdings LLC / DBT (US785931AA40) | 2.89 | -5.65 | 0.1669 | 0.0050 | |||||

| VIH1 / VIB Vermögen AG | 2.88 | 0.1667 | 0.1667 | ||||||

| US516806AH93 / Laredo Petroleum Inc | 2.88 | -9.23 | 0.1666 | -0.0014 | |||||

| Dell International LLC/EMC Corp. / DBT (US24703DBQ34) | 2.88 | -32.73 | 0.1663 | -0.0599 | |||||

| WPC / W. P. Carey Inc. | 2.88 | -5.11 | 0.1663 | 0.0059 | |||||

| US337738BD90 / Fiserv Inc | 2.87 | -6.39 | 0.1660 | 0.0037 | |||||

| OBX Trust / ABS-MBS (US67119XAC83) | 2.86 | -7.35 | 0.1653 | 0.0020 | |||||

| Cargill, Inc. / DBT (US141781CD42) | 2.86 | -5.89 | 0.1653 | 0.0045 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 2.85 | -6.60 | 0.1644 | 0.0033 | |||||

| HCA, Inc. / DBT (US404119CV94) | 2.84 | -5.39 | 0.1643 | 0.0054 | |||||

| US123919AA08 / BXG Receivables Note Trust 2023-A | 2.83 | -13.03 | 0.1636 | -0.0085 | |||||

| US958667AE72 / Western Midstream Operating LP | 2.82 | -6.00 | 0.1631 | 0.0043 | |||||

| VLTO / Veralto Corporation | 2.81 | -5.64 | 0.1623 | 0.0049 | |||||

| BHCCN / Bausch Health Cos Inc | 2.81 | 7.34 | 0.1623 | 0.0239 | |||||

| US912810TQ13 / United States Treasury Note/Bond | 2.80 | -1.79 | 0.1618 | 0.0110 | |||||

| I1RP34 / Trane Technologies plc - Depositary Receipt (Common Stock) | 2.73 | -5.50 | 0.1580 | 0.0050 | |||||

| US29082HAD44 / Embraer Netherlands Finance BV | 2.73 | 0.74 | 0.1575 | 0.0144 | |||||

| GILD / Gilead Sciences, Inc. - Depositary Receipt (Common Stock) | 2.72 | -23.84 | 0.1570 | -0.0316 | |||||

| CLF / Cleveland-Cliffs Inc. | 2.71 | 0.37 | 0.1563 | 0.0138 | |||||

| US69047QAC69 / Ovintiv Inc | 2.70 | -6.83 | 0.1562 | 0.0028 | |||||

| US418751AE33 / HAT Holdings I LLC / HAT Holdings II LLC | 2.69 | -6.11 | 0.1553 | 0.0039 | |||||

| US718172BL29 / Philip Morris International Inc | 2.68 | -5.34 | 0.1548 | 0.0052 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 2.67 | -5.59 | 0.1544 | 0.0047 | |||||

| US350930AA10 / Foundry JV Holdco LLC | 2.67 | -26.86 | 0.1542 | -0.0387 | |||||

| US482480AL46 / KLA Corp | 2.67 | -5.49 | 0.1541 | 0.0049 | |||||

| M1CH34 / Microchip Technology Incorporated - Depositary Receipt (Common Stock) | 2.65 | -6.04 | 0.1529 | 0.0040 | |||||

| US78081BAK98 / Royalty Pharma PLC | 2.61 | -28.02 | 0.1507 | -0.0408 | |||||

| US91324PEX69 / UnitedHealth Group Inc | 2.61 | -7.81 | 0.1507 | 0.0011 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2.59 | -6.34 | 0.1495 | 0.0035 | |||||

| US007903BF39 / Advanced Micro Devices Inc | 2.58 | -5.32 | 0.1491 | 0.0050 | |||||

| Ambipar Lux SARL / DBT (US02319WAA99) | 2.57 | -4.50 | 0.1484 | 0.0062 | |||||

| V1MC34 / Vulcan Materials Company - Depositary Receipt (Common Stock) | 2.56 | -5.82 | 0.1479 | 0.0042 | |||||

| US03842VAA52 / Aqua Finance Trust 2017-A | 2.54 | -11.63 | 0.1468 | -0.0052 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 2.53 | -5.73 | 0.1464 | 0.0043 | |||||

| US097023CX16 / BOEING CO 5.93 5/60 | 2.53 | -5.56 | 0.1463 | 0.0045 | |||||

| Venture 43 CLO Ltd. / ABS-CBDO (US92290CAR07) | 2.50 | 0.12 | 0.1446 | 0.0125 | |||||

| US55389TAB70 / MVW 2021-1W LLC | 2.49 | -8.25 | 0.1440 | 0.0004 | |||||

| US912810TW80 / United States Treasury Note/Bond | 2.49 | -1.86 | 0.1437 | 0.0097 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAR33) | 2.47 | 2.57 | 0.1429 | 0.0154 | |||||

| US785592AZ90 / Sabine Pass Liquefaction LLC | 2.47 | -5.79 | 0.1429 | 0.0041 | |||||

| Hilton Grand Vacations Trust / ABS-O (US43283JAA43) | 2.47 | -8.84 | 0.1425 | -0.0005 | |||||

| US21871XAS80 / Corebridge Financial Inc | 2.46 | -5.53 | 0.1421 | 0.0044 | |||||

| US378272BG28 / Glencore Funding LLC | 2.45 | -5.12 | 0.1414 | 0.0050 | |||||

| US49338LAE39 / KEYSIGHT TECHNOLOGIES SR UNSECURED 04/27 4.6 | 2.44 | -6.37 | 0.1410 | 0.0032 | |||||

| US690742AG60 / Owens Corning | 2.44 | -6.52 | 0.1410 | 0.0030 | |||||

| US161175BS22 / Charter Communications Operating LLC / Charter Communications Operating Capital | 2.44 | -2.01 | 0.1409 | 0.0093 | |||||

| US92769XAR61 / Virgin Media Secured Finance PLC | 2.44 | 5.82 | 0.1407 | 0.0190 | |||||

| US64830WAD39 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2019-4 NRZT 2019-4A A1B | 2.43 | -52.15 | 0.1403 | -0.1280 | |||||

| US91822Q2E63 / Republic of Uzbekistan International Bond | 2.42 | 5.36 | 0.1397 | 0.0184 | |||||

| Rocket Cos., Inc. / DBT (US77311WAB72) | 2.41 | 0.1395 | 0.1395 | ||||||

| US013092AC57 / Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC | 2.41 | 0.88 | 0.1394 | 0.0129 | |||||

| US05533UAG31 / BBVA Bancomer SA/Texas | 2.41 | 2.08 | 0.1391 | 0.0144 | |||||

| CAH / Cardinal Health, Inc. - Depositary Receipt (Common Stock) | 2.37 | -5.53 | 0.1372 | 0.0043 | |||||

| US294429AV70 / Equifax, Inc. | 2.37 | -6.58 | 0.1370 | 0.0028 | |||||

| OBX Trust / ABS-MBS (US67119CAA80) | 2.36 | -7.71 | 0.1363 | 0.0011 | |||||

| US67091TAA34 / OCP SA | 2.33 | 0.91 | 0.1348 | 0.0125 | |||||

| US92940PAE43 / WRKCo Inc | 2.33 | -5.83 | 0.1344 | 0.0038 | |||||

| US64829LAA61 / New Residential Mortgage Loan Trust 2016-4 | 2.31 | -2.53 | 0.1335 | 0.0081 | |||||

| Sierra Timeshare Receivables Funding LLC / ABS-O (US82650DAC65) | 2.29 | -14.06 | 0.1325 | -0.0086 | |||||

| A2RW34 / Arrow Electronics, Inc. - Depositary Receipt (Common Stock) | 2.29 | -4.83 | 0.1322 | 0.0051 | |||||

| US780153BG60 / Royal Caribbean Cruises Ltd | 2.28 | 1.69 | 0.1318 | 0.0132 | |||||

| US25265LAA89 / Diamond Infrastructure Funding LLC | 2.27 | 0.44 | 0.1311 | 0.0116 | |||||

| US15135BAV36 / CENTENE CORP 3.375% 02/15/2030 | 2.25 | -5.22 | 0.1302 | 0.0045 | |||||

| XS2066744231 / Carnival PLC | 2.25 | 3.59 | 0.1302 | 0.0152 | |||||

| US62582PAA84 / MUNICH RE | 2.25 | -8.09 | 0.1300 | 0.0006 | |||||

| US64830MAG87 / New Residential Mortgage Loan Trust 2019-5 | 2.24 | -3.24 | 0.1293 | 0.0070 | |||||

| MUR / Murphy Oil Corporation | 2.23 | -0.80 | 0.1287 | 0.0099 | |||||

| ZF North America Capital, Inc. / DBT (US98877DAG07) | 2.19 | -0.36 | 0.1268 | 0.0103 | |||||

| US05401AAK79 / Avolon Holdings Funding Ltd | 2.19 | -7.12 | 0.1266 | 0.0018 | |||||

| OBX Trust / ABS-MBS (US67120VAA35) | 2.19 | -5.37 | 0.1264 | 0.0042 | |||||

| HCA, Inc. / DBT (US404119CU12) | 2.18 | -5.05 | 0.1260 | 0.0045 | |||||

| UPSS34 / United Parcel Service, Inc. - Depositary Receipt (Common Stock) | 2.18 | 0.1258 | 0.1258 | ||||||

| US16411QAG64 / Cheniere Energy Partners LP | 2.17 | -5.19 | 0.1257 | 0.0043 | |||||

| US67448GAA13 / OBX 23-NQM4 A1 144A 6.113% 03-25-63/05-25-27 | 2.16 | -6.81 | 0.1250 | 0.0023 | |||||

| Bravo Residential Funding Trust / ABS-MBS (US10569MAC73) | 2.16 | -4.25 | 0.1249 | 0.0055 | |||||

| US37045VAF76 / General Motors Co | 2.16 | -4.60 | 0.1246 | 0.0051 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 2.15 | 0.1245 | 0.1245 | ||||||

| GXO / GXO Logistics, Inc. | 2.15 | -4.66 | 0.1241 | 0.0050 | |||||

| US92343VDY74 / Verizon Communications Inc | 2.13 | -6.49 | 0.1233 | 0.0026 | |||||

| K1RC34 / The Kroger Co. - Depositary Receipt (Common Stock) | 2.13 | -5.29 | 0.1232 | 0.0042 | |||||

| Hess Midstream Operations LP / DBT (US428102AG28) | 2.13 | 1.00 | 0.1231 | 0.0116 | |||||

| US020002BK68 / Allstate Corp/The | 2.13 | -5.72 | 0.1229 | 0.0036 | |||||

| US159864AJ65 / Charles River Laboratories International Inc | 2.11 | 2.22 | 0.1222 | 0.0128 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 2.11 | -5.42 | 0.1219 | 0.0040 | |||||

| US12543DBM11 / CHS/Community Health Systems Inc | 2.10 | 7.68 | 0.1215 | 0.0182 | |||||

| US156504AL63 / CENTURY COMMUNITIES REGD 6.75000000 | 2.10 | 0.19 | 0.1215 | 0.0105 | |||||

| US928668BN15 / VOLKSWAGEN GROUP AMER FIN LLC 1.625% 11/24/2027 144A | 2.10 | -7.04 | 0.1213 | 0.0019 | |||||

| Amrize Finance U.S. LLC / DBT (US43475RAD89) | 2.07 | 0.1198 | 0.1198 | ||||||

| US22003BAL09 / Corporate Office Properties LP | 2.07 | -6.29 | 0.1198 | 0.0028 | |||||

| C1DN34 / Cadence Design Systems, Inc. - Depositary Receipt (Common Stock) | 2.05 | -5.57 | 0.1187 | 0.0037 | |||||

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust / DBT (US00774MBM64) | 2.05 | -5.24 | 0.1182 | 0.0041 | |||||

| MVW LLC / ABS-O (US62847RAC16) | 2.04 | -9.56 | 0.1181 | -0.0014 | |||||

| US05369AAA97 / Aviation Capital Group LLC | 2.04 | -6.07 | 0.1181 | 0.0030 | |||||

| US552953CH22 / MGM Resorts International | 2.04 | 2.61 | 0.1180 | 0.0127 | |||||

| H / Hyatt Hotels Corporation | 2.04 | -6.17 | 0.1177 | 0.0029 | |||||

| US092113AM13 / Black Hills Corp | 2.04 | 0.49 | 0.1177 | 0.0105 | |||||

| US571903BH57 / Marriott International Inc/MD | 2.03 | -4.33 | 0.1175 | 0.0051 | |||||

| US74762EAF97 / Quanta Services Inc | 2.03 | -4.61 | 0.1174 | 0.0048 | |||||

| Greensaif Pipelines Bidco SARL / DBT (US39541EAD58) | 2.03 | -0.15 | 0.1173 | 0.0098 | |||||

| SYY / Sysco Corporation - Depositary Receipt (Common Stock) | 2.03 | -5.68 | 0.1171 | 0.0035 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 2.02 | -5.53 | 0.1166 | 0.0036 | |||||

| US05492PAA66 / BANC OF AMERICA MERRILL LYNCH BAMLL 2019 BPR ANM 144A | 2.01 | 0.50 | 0.1159 | 0.0104 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 1.99 | -5.91 | 0.1150 | 0.0031 | |||||

| T-Mobile USA, Inc. / DBT (US87264ADF93) | 1.98 | -50.66 | 0.1145 | -0.0978 | |||||

| Retained Vantage Data Centers Issuer LLC / ABS-O (US76134KAH77) | 1.98 | 0.97 | 0.1145 | 0.0107 | |||||

| US912810RK60 / United States Treas Bds Bond | 1.97 | -1.94 | 0.1141 | 0.0076 | |||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 1.95 | 0.1124 | 0.1124 | ||||||

| US68389XCK90 / ORACLE CORPORATION | 1.94 | -51.64 | 0.1124 | -0.1002 | |||||

| MKLC34 / Markel Group Inc. - Depositary Receipt (Common Stock) | 1.94 | -7.22 | 0.1121 | 0.0015 | |||||

| US00774MAL90 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 1.94 | -7.32 | 0.1120 | 0.0014 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 1.93 | -6.36 | 0.1114 | 0.0025 | |||||

| Organon & Co./Organon Foreign Debt Co-Issuer BV / DBT (US68622FAA93) | 1.92 | -2.09 | 0.1112 | 0.0073 | |||||

| US501889AF63 / LKQ Corp | 1.91 | -5.39 | 0.1105 | 0.0036 | |||||

| US126307BH94 / CSC Holdings LLC | 1.91 | -2.90 | 0.1103 | 0.0063 | |||||

| US195325DS19 / Colombia Government International Bond | 1.91 | 1.60 | 0.1102 | 0.0110 | |||||

| US912803GK39 / STRIP PRINC | 1.90 | -87.60 | 0.1099 | -0.7012 | |||||

| US05565EAH80 / BMW US Capital LLC | 1.90 | -6.46 | 0.1096 | 0.0024 | |||||

| US432917AA05 / Hilton Grand Vacations Trust, Series 2023-1A, Class A | 1.89 | -11.30 | 0.1093 | -0.0035 | |||||

| US92343VFX73 / Verizon Communications Inc | 1.87 | -5.23 | 0.1079 | 0.0037 | |||||

| US832696AY47 / J M Smucker Co/The | 1.86 | -8.02 | 0.1073 | 0.0005 | |||||

| Corp. Financiera de Desarrollo SA / DBT (US21987DAH70) | 1.86 | 0.1073 | 0.1073 | ||||||

| US07274NAZ69 / Bayer US Finance II LLC | 1.84 | 0.1062 | 0.1062 | ||||||

| US89788MAQ50 / Truist Financial Corp | 1.84 | -6.47 | 0.1061 | 0.0023 | |||||

| US345397D260 / Ford Motor Credit Co LLC | 1.83 | -10.19 | 0.1060 | -0.0020 | |||||

| US031162DS61 / Amgen Inc | 1.83 | -6.58 | 0.1059 | 0.0021 | |||||

| US716973AF98 / PFIZER INVESTMENT ENTERPRISES PTE LTD | 1.83 | -38.45 | 0.1058 | -0.0514 | |||||

| Georgia-Pacific LLC / DBT (US37331NAT81) | 1.83 | 0.1056 | 0.1056 | ||||||

| US87264ABW45 / T-Mobile USA Inc | 1.82 | -5.56 | 0.1051 | 0.0033 | |||||

| US07274NAL73 / Bayer Us Finance Ii Llc 4.375% 12/15/2028 144a Bond | 1.81 | -8.35 | 0.1047 | 0.0002 | |||||

| LPL Holdings, Inc. / DBT (US50212YAJ38) | 1.81 | -6.70 | 0.1046 | 0.0020 | |||||

| US55261FAS39 / M&T Bank Corp | 1.80 | -6.19 | 0.1043 | 0.0026 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 1.80 | -5.75 | 0.1042 | 0.0030 | |||||

| US361841AP42 / GLP Capital LP / GLP Financing II Inc | 1.80 | -32.41 | 0.1039 | -0.0368 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 1.79 | -6.47 | 0.1037 | 0.0023 | |||||

| US64828GAD25 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2019-6 NRZT 2019-6A A1B | 1.79 | -5.20 | 0.1033 | 0.0035 | |||||

| COLT Mortgage Loan Trust / ABS-MBS (US19688WAA62) | 1.78 | -4.35 | 0.1029 | 0.0045 | |||||

| W1MC34 / Waste Management, Inc. - Depositary Receipt (Common Stock) | 1.77 | 0.1024 | 0.1024 | ||||||

| US12008RAN70 / Builders FirstSource Inc | 1.77 | 2.73 | 0.1022 | 0.0112 | |||||

| US17327CAR43 / Citigroup Inc | 1.77 | -4.70 | 0.1020 | 0.0040 | |||||

| US62482BAA08 / Mozart Debt Merger Sub Inc | 1.75 | 2.65 | 0.1009 | 0.0110 | |||||

| US806851AK71 / Schlumberger Holdings Corp | 1.72 | -6.32 | 0.0994 | 0.0023 | |||||

| US166756AS52 / Chevron USA Inc | 1.72 | -5.34 | 0.0993 | 0.0033 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 1.67 | 0.0964 | 0.0964 | ||||||

| US12551JAL08 / CIFC FUNDING LTD CIFC 2017 4A A1R 144A | 1.66 | -23.35 | 0.0962 | -0.0187 | |||||

| US125523CL22 / Cigna Corp | 1.65 | -5.16 | 0.0955 | 0.0034 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 1.65 | 0.0955 | 0.0955 | ||||||

| US82650BAA44 / Sierra Timeshare 2023-2 Receivables Funding LLC | 1.61 | -10.73 | 0.0928 | -0.0024 | |||||

| US30231GAT94 / Exxon Mobil Cor Bond | 1.60 | -38.13 | 0.0925 | -0.0443 | |||||

| US92343VFR06 / Verizon Communications Inc | 1.59 | -5.02 | 0.0919 | 0.0034 | |||||

| Sierra Timeshare Receivables Funding LLC / ABS-O (US826935AC20) | 1.58 | -12.74 | 0.0915 | -0.0045 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 1.58 | -5.95 | 0.0913 | 0.0025 | |||||

| US00217GAB95 / Aptiv PLC / Aptiv Corp | 1.58 | -4.25 | 0.0912 | 0.0041 | |||||

| US62886EAY41 / NCR CORPORATION NEW 5% 10/01/2028 144A | 1.57 | 2.89 | 0.0905 | 0.0100 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 1.57 | 3.51 | 0.0905 | 0.0105 | |||||

| US46143NAB64 / Investment Energy Resources Ltd | 1.56 | 2.10 | 0.0899 | 0.0093 | |||||

| US44963LAC00 / IHS Netherlands Holdco BV | 1.55 | 0.19 | 0.0897 | 0.0077 | |||||

| Q1UA34 / Quanta Services, Inc. - Depositary Receipt (Common Stock) | 1.53 | -4.38 | 0.0883 | 0.0038 | |||||

| US031162DA53 / AMGEN INC 2.8% 08/15/2041 | 1.52 | -5.87 | 0.0881 | 0.0025 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.49 | -5.68 | 0.0864 | 0.0026 | |||||

| MVW LLC / ABS-O (US55389QAA58) | 1.48 | -7.03 | 0.0857 | 0.0014 | |||||

| US62482BAB80 / MOZART DEBT MERGER SUB INC | 1.45 | 3.36 | 0.0837 | 0.0096 | |||||

| Eaton Capital ULC / DBT (US27806HAA95) | 1.45 | 0.0836 | 0.0836 | ||||||

| Fortitude Group Holdings LLC / DBT (US34966XAA63) | 1.45 | -4.99 | 0.0836 | 0.0031 | |||||

| US80874YBC30 / Scientific Games International Inc | 1.44 | 0.35 | 0.0834 | 0.0073 | |||||

| US26441CBW47 / Duke Energy Corp | 1.43 | 0.70 | 0.0828 | 0.0075 | |||||

| US845467AS85 / Southwestern Energy Co | 1.43 | -5.79 | 0.0828 | 0.0023 | |||||

| HRI / Herc Holdings Inc. | 1.43 | 0.0826 | 0.0826 | ||||||

| K1SG34 / Keysight Technologies, Inc. - Depositary Receipt (Common Stock) | 1.41 | -5.80 | 0.0818 | 0.0024 | |||||

| US156504AM47 / Century Communities Inc | 1.41 | 3.07 | 0.0815 | 0.0091 | |||||

| YPFD / YPF Sociedad Anónima | 1.41 | 0.79 | 0.0815 | 0.0075 | |||||

| AIG / American International Group, Inc. - Depositary Receipt (Common Stock) | 1.40 | 0.0812 | 0.0812 | ||||||

| US18453HAD89 / CLEAR CHANNEL OUTDOOR HOLDINGS INC 7.5% 06/01/2029 144A | 1.39 | 12.09 | 0.0804 | 0.0148 | |||||

| US126650DX53 / CVS Health Corp | 1.39 | -5.63 | 0.0803 | 0.0024 | |||||

| US045054AQ67 / Ashtead Capital Inc | 1.39 | -10.99 | 0.0801 | -0.0023 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 1.39 | 0.07 | 0.0800 | 0.0068 | |||||

| US87264ABF12 / CORP. NOTE | 1.38 | -5.55 | 0.0796 | 0.0025 | |||||

| US25714PEF18 / Dominican Republic International Bond | 1.37 | 1.70 | 0.0794 | 0.0080 | |||||

| OBX Trust / ABS-MBS (US67448NAA63) | 1.37 | -8.36 | 0.0792 | 0.0001 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 1.37 | -7.75 | 0.0791 | 0.0007 | |||||

| EQT / EQT Corporation | 1.37 | 0.0789 | 0.0789 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 1.36 | -6.33 | 0.0787 | 0.0018 | |||||

| US88576XAA46 / 321 Henderson Receivables VI LLC | 1.34 | -10.05 | 0.0777 | -0.0013 | |||||

| US87612BBU52 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 1.34 | -5.82 | 0.0777 | 0.0022 | |||||

| BK / The Bank of New York Mellon Corporation - Depositary Receipt (Common Stock) | 1.34 | -6.05 | 0.0772 | 0.0020 | |||||

| US68389XBZ78 / Oracle Corp | 1.33 | -5.19 | 0.0771 | 0.0027 | |||||

| US12510HAM25 / Capital Automotive REIT | 1.32 | 0.46 | 0.0765 | 0.0068 | |||||

| US92331LBC37 / VENTURE CDO LTD VENTR 2017 27A AR 144A | 1.31 | -42.21 | 0.0757 | -0.0442 | |||||

| Health Care Service Corp. A Mutual Legal Reserve Co. / DBT (US42218SAM08) | 1.31 | -7.30 | 0.0756 | 0.0009 | |||||

| US629377CR16 / NRG ENERGY INC 3.625% 02/15/2031 144A | 1.30 | 3.93 | 0.0749 | 0.0089 | |||||

| US17313EAA38 / Citigroup Mortgage Loan Trust 2007-FS1 | 1.27 | -3.26 | 0.0736 | 0.0040 | |||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 1.27 | -2.53 | 0.0734 | 0.0045 | |||||

| US629377CQ33 / NRG ENERGY INC 3.375% 02/15/2029 144A | 1.27 | 2.75 | 0.0734 | 0.0080 | |||||

| US46124HAH93 / Intuit Inc | 1.27 | -6.71 | 0.0731 | 0.0014 | |||||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 1.25 | 0.0722 | 0.0722 | ||||||

| US22788CAA36 / CROWDSTRIKE HOLDINGS INC 3% 02/15/2029 | 1.24 | 2.65 | 0.0716 | 0.0078 | |||||

| US103557AC88 / Boyne USA Inc | 1.24 | 3.00 | 0.0714 | 0.0079 | |||||

| US82652QAB77 / Sierra Timeshare Receivables Funding LLC | 1.22 | -10.39 | 0.0703 | -0.0015 | |||||

| US88033GDB32 / CORP. NOTE | 1.19 | 1.37 | 0.0687 | 0.0066 | |||||

| Sierra Timeshare Receivables Funding LLC / ABS-O (US826935AA63) | 1.18 | -12.77 | 0.0679 | -0.0034 | |||||

| US345370CR99 / Ford Motor Comp Bond | 1.17 | -6.17 | 0.0677 | 0.0017 | |||||

| US58933YBM66 / MERCK & CO INC | 1.15 | -7.01 | 0.0667 | 0.0011 | |||||

| F2IC34 / Fair Isaac Corporation - Depositary Receipt (Common Stock) | 1.15 | 0.0665 | 0.0665 | ||||||

| US02377LAA26 / American Airlines Pass Through Trust, Series 2019-1, Class AA | 1.15 | -6.58 | 0.0665 | 0.0014 | |||||

| US61945CAG87 / MOSAIC CO SR UNSECURED 11/27 4.05 | 1.15 | -6.29 | 0.0664 | 0.0016 | |||||

| US92556VAC00 / CORP. NOTE | 1.13 | -5.75 | 0.0655 | 0.0019 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 1.13 | 0.0652 | 0.0652 | ||||||

| US59166BAA98 / Metlife Securitization Trust, Series 2017-1A, Class A | 1.11 | -2.97 | 0.0643 | 0.0037 | |||||

| W1HR34 / Whirlpool Corporation - Depositary Receipt (Common Stock) | 1.10 | 0.0637 | 0.0637 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1.08 | 2.09 | 0.0623 | 0.0065 | |||||

| US694308JG36 / Pacific Gas and Electric Co | 1.07 | -42.81 | 0.0618 | -0.0371 | |||||

| MVW LLC / ABS-O (US62847RAA59) | 1.07 | -8.63 | 0.0618 | -0.0001 | |||||

| US45332JAA07 / Rackspace Hosting Inc | 1.06 | -2.04 | 0.0612 | 0.0040 | |||||

| Ashtead Capital, Inc. / DBT (US045054AS24) | 1.06 | -14.62 | 0.0611 | -0.0044 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 1.05 | -14.94 | 0.0609 | -0.0046 | |||||

| US3140X4YR13 / Fannie Mae Pool | 1.05 | -1.04 | 0.0607 | 0.0046 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 1.01 | -4.82 | 0.0582 | 0.0023 | |||||

| US03329WAG24 / Anchorage Capital CLO 25 Ltd. | 1.00 | 0.00 | 0.0578 | 0.0049 | |||||

| US747525BJ18 / QUALCOMM Inc | 0.98 | -7.47 | 0.0566 | 0.0006 | |||||

| Sierra Timeshare Receivables Funding LLC / ABS-O (US826935AB47) | 0.96 | -12.72 | 0.0556 | -0.0027 | |||||

| BRO / Brown & Brown, Inc. | 0.94 | 0.0545 | 0.0545 | ||||||

| Amrize Finance U.S. LLC / DBT (US43475RAK23) | 0.93 | 0.0539 | 0.0539 | ||||||

| Ellucian Holdings, Inc. / DBT (US289178AA37) | 0.92 | 4.07 | 0.0532 | 0.0064 | |||||

| US17325DAE31 / Citigroup Commercial Mortgage Trust, Series 2016-P5, Class AAB | 0.91 | -30.41 | 0.0524 | -0.0165 | |||||

| US670001AG19 / Novelis Corp | 0.90 | 1.81 | 0.0520 | 0.0052 | |||||

| US01400EAF07 / ALCON FINANCE CORP | 0.89 | -0.23 | 0.0512 | 0.0042 | |||||

| Citadel LP / DBT (US17288XAD66) | 0.87 | -5.25 | 0.0501 | 0.0017 | |||||

| U.S. Treasury Notes / DBT (US91282CLD10) | 0.86 | 0.0496 | 0.0496 | ||||||

| GMZB / Ally Financial Inc. - Preferred Stock | 0.85 | 0.0492 | 0.0492 | ||||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.80 | -5.33 | 0.0462 | 0.0015 | |||||

| RNR / RenaissanceRe Holdings Ltd. | 0.77 | -54.59 | 0.0443 | -0.0450 | |||||

| U.S. Treasury Notes / DBT (US91282CKF76) | 0.75 | 0.95 | 0.0432 | 0.0040 | |||||

| US3140JVPM87 / Fannie Mae Pool | 0.75 | -0.80 | 0.0431 | 0.0034 | |||||

| US55400EAA73 / MVW 2020-1 LLC | 0.74 | -9.01 | 0.0426 | -0.0002 | |||||

| US3133B9Z562 / UMBS | 0.73 | -1.89 | 0.0421 | 0.0029 | |||||

| US3140MMBG20 / FNMA POOL BV7238 FN 05/52 FIXED 3 | 0.73 | -2.29 | 0.0420 | 0.0027 | |||||

| US80286XAF15 / Santander Drive Auto Receivables Trust 2021-2 | 0.71 | -52.96 | 0.0413 | -0.0390 | |||||

| US25273CAB63 / DIAMOND RESORTS OWNER TRUST 2021-1 | 0.69 | -8.72 | 0.0400 | -0.0001 | |||||

| US62886EBA55 / NCR Corp | 0.68 | 3.48 | 0.0396 | 0.0046 | |||||

| US12669UCN81 / Reperforming Loan REMIC Trust 2006-R1 | 0.68 | -7.46 | 0.0395 | 0.0004 | |||||

| US437084CZ75 / Home Equity Asset Trust 2004-4 | 0.68 | -8.85 | 0.0393 | -0.0002 | |||||

| US36962G3P70 / General Electric Capital 5.875% Senior Notes 1/14/38 | 0.66 | -5.59 | 0.0381 | 0.0011 | |||||

| Hilton Grand Vacations Trust / ABS-O (US43283YAC75) | 0.64 | -14.91 | 0.0370 | -0.0027 | |||||

| Hilton Grand Vacations Trust / ABS-O (US43283YAB92) | 0.63 | -14.78 | 0.0366 | -0.0027 | |||||

| US59981AAC09 / Mill City Mortgage Loan Trust 2019-1 | 0.63 | -4.39 | 0.0365 | 0.0016 | |||||

| GM / General Motors Company - Depositary Receipt (Common Stock) | 0.61 | 0.0354 | 0.0354 | ||||||

| US36251PAE43 / GS Mortgage Securities Trust 2016-GS3 | 0.59 | -27.79 | 0.0344 | -0.0092 | |||||

| US06051GDM87 / Banc of America Funding 2005-D Trust | 0.59 | -5.57 | 0.0343 | 0.0010 | |||||

| U.S. Treasury Bonds / DBT (US912810UA42) | 0.59 | -2.65 | 0.0340 | 0.0020 | |||||

| Sierra Timeshare Receivables Funding LLC / ABS-O (US826935AD03) | 0.57 | -12.92 | 0.0328 | -0.0016 | |||||

| US82652QAC50 / Sierra Timeshare 2021-1 Receivables Funding LLC | 0.54 | -10.39 | 0.0309 | -0.0007 | |||||

| US55389TAA97 / MVW 2021-1W LLC | 0.53 | -8.13 | 0.0307 | 0.0001 | |||||

| US31334YHW03 / Freddie Mac Pool | 0.50 | -2.51 | 0.0292 | 0.0018 | |||||

| US92922F4M79 / WaMu Mortgage Pass-Through Certificates Series 2005-AR13 Trust | 0.49 | -4.46 | 0.0285 | 0.0012 | |||||

| US62886HBA86 / NCL Corp Ltd | 0.49 | 0.41 | 0.0282 | 0.0025 | |||||

| Albertsons Cos., Inc./Safeway, Inc./New Albertsons LP/Albertsons LLC / DBT (US01309QAB41) | 0.48 | 2.56 | 0.0278 | 0.0030 | |||||

| US570535AT11 / Markel Corp | 0.45 | -7.02 | 0.0260 | 0.0004 | |||||

| US694308HW04 / PACIFIC GAS + ELECTRIC SR UNSECURED 12/27 3.3 | 0.39 | 0.78 | 0.0224 | 0.0021 | |||||

| ASP Unifrax Holdings, Inc. / DBT (US00218LAH42) | 0.33 | -15.09 | 0.0192 | -0.0015 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0.19 | 3.31 | 0.0109 | 0.0013 | |||||

| US3140J6GM33 / FANNIE MAE 4% 10/01/2047 FNL | 0.15 | -2.00 | 0.0085 | 0.0006 | |||||

| US89175VAA17 / Towd Point Mortgage Trust 2018-2 | 0.10 | -16.24 | 0.0057 | -0.0005 | |||||

| US41161VAC46 / HarborView Mortgage Loan Trust 2006-7 | 0.08 | -2.33 | 0.0049 | 0.0003 | |||||

| US3128QJGY61 / Freddie Mac Non Gold Pool | 0.05 | 0.00 | 0.0031 | 0.0002 | |||||

| US31406TV990 / Fannie Mae Pool | 0.04 | -2.70 | 0.0021 | 0.0001 | |||||

| US31402LPB26 / FANNIE MAE 2.757% 06/01/2043 FAR FNARM | 0.02 | -5.56 | 0.0010 | 0.0001 | |||||

| US3128NHK362 / Freddie Mac Non Gold Pool | 0.01 | -8.33 | 0.0007 | 0.0000 | |||||

| US3140X5A295 / Fannie Mae Pool | 0.01 | -37.50 | 0.0003 | -0.0001 | |||||

| US31410UK688 / Fannie Mae Pool | 0.00 | 0.00 | 0.0002 | 0.0000 | |||||

| US31407EYE75 / Fannie Mae Pool | 0.00 | -25.00 | 0.0002 | 0.0000 | |||||

| US31412AKM52 / Fannie Mae Pool | 0.00 | -76.92 | 0.0002 | -0.0005 | |||||

| US31406L3C03 / Fannie Mae Pool | 0.00 | -100.00 | 0.0001 | 0.0000 | |||||

| US31379KVP55 / Fannie Mae Pool | 0.00 | 0.0000 | -0.0000 | ||||||

| US31405U2C23 / Fannie Mae Pool | 0.00 | 0.0000 | 0.0000 |