Statistik Asas

| Nilai Portfolio | $ 297,372,000 |

| Kedudukan Semasa | 71 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

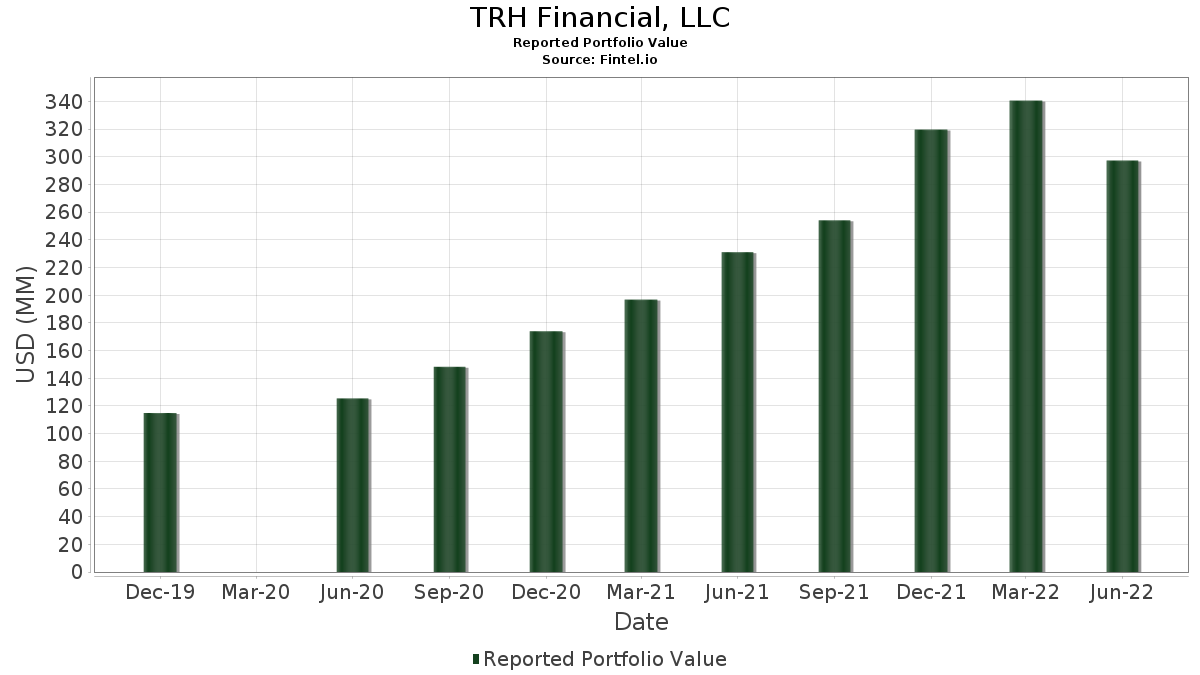

TRH Financial, LLC telah mendedahkan 71 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 297,372,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas TRH Financial, LLC ialah SPDR Series Trust - SPDR Portfolio S&P 1500 Composite Stock Market ETF (US:SPTM) , The Procter & Gamble Company (US:PG) , Apple Inc. (US:AAPL) , Johnson & Johnson (US:JNJ) , and McDonald's Corporation (US:MCD) . Kedudukan baharu TRH Financial, LLC termasuk J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Ultra-Short Income ETF (US:JPST) , Splash Beverage Group, Inc. (US:SBEV) , .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 8.28 | 2.7844 | 0.6393 | |

| 0.09 | 7.14 | 2.4027 | 0.4722 | |

| 0.05 | 9.62 | 3.2364 | 0.4431 | |

| 0.14 | 9.09 | 3.0564 | 0.4420 | |

| 0.10 | 9.22 | 3.1012 | 0.4327 | |

| 0.06 | 9.39 | 3.1577 | 0.4058 | |

| 0.04 | 9.48 | 3.1889 | 0.4042 | |

| 0.02 | 6.88 | 2.3133 | 0.3660 | |

| 0.12 | 6.90 | 2.3203 | 0.3320 | |

| 0.05 | 6.42 | 2.1599 | 0.3236 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.83 | 38.39 | 12.9101 | -0.5374 | |

| 0.04 | 6.20 | 2.0846 | -0.5366 | |

| 0.04 | 4.66 | 1.5671 | -0.3696 | |

| 0.07 | 9.72 | 3.2696 | -0.3402 | |

| 0.00 | 0.34 | 0.1137 | -0.3354 | |

| 0.00 | 0.39 | 0.1322 | -0.3290 | |

| 0.01 | 0.74 | 0.2478 | -0.2782 | |

| 0.01 | 0.31 | 0.1053 | -0.2634 | |

| 0.06 | 6.91 | 2.3237 | -0.2241 | |

| 0.00 | 0.53 | 0.1779 | -0.2225 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2022-07-26 untuk tempoh pelaporan 2022-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPTM / SPDR Series Trust - SPDR Portfolio S&P 1500 Composite Stock Market ETF | 0.83 | 0.21 | 38.39 | -16.20 | 12.9101 | -0.5374 | |||

| PG / The Procter & Gamble Company | 0.16 | -3.89 | 22.87 | -9.56 | 7.6914 | 0.2683 | |||

| AAPL / Apple Inc. | 0.07 | 0.97 | 9.72 | -20.94 | 3.2696 | -0.3402 | |||

| JNJ / Johnson & Johnson | 0.05 | 0.98 | 9.62 | 1.13 | 3.2364 | 0.4431 | |||

| MCD / McDonald's Corporation | 0.04 | 0.13 | 9.48 | -0.04 | 3.1889 | 0.4042 | |||

| PEP / PepsiCo, Inc. | 0.06 | 0.59 | 9.39 | 0.16 | 3.1577 | 0.4058 | |||

| RTX / RTX Corporation | 0.10 | 4.56 | 9.22 | 1.44 | 3.1012 | 0.4327 | |||

| KO / The Coca-Cola Company | 0.14 | 0.57 | 9.09 | 2.04 | 3.0564 | 0.4420 | |||

| ADP / Automatic Data Processing, Inc. | 0.04 | 0.63 | 8.75 | -7.10 | 2.9414 | 0.1776 | |||

| APD / Air Products and Chemicals, Inc. | 0.03 | 2.37 | 8.33 | -1.49 | 2.8022 | 0.3192 | |||

| KMB / Kimberly-Clark Corporation | 0.06 | 3.25 | 8.28 | 13.30 | 2.7844 | 0.6393 | |||

| ABT / Abbott Laboratories | 0.08 | 2.54 | 8.20 | -5.87 | 2.7572 | 0.2005 | |||

| SPGI / S&P Global Inc. | 0.02 | 3.94 | 7.85 | -14.58 | 2.6411 | -0.0579 | |||

| BDX / Becton, Dickinson and Company | 0.03 | 4.43 | 7.52 | -3.22 | 2.5302 | 0.2483 | |||

| WMT / Walmart Inc. | 0.06 | 3.17 | 7.48 | -15.77 | 2.5140 | -0.0913 | |||

| EMR / Emerson Electric Co. | 0.09 | 2.73 | 7.44 | -16.66 | 2.5026 | -0.1186 | |||

| MSFT / Microsoft Corporation | 0.03 | 3.02 | 7.36 | -14.17 | 2.4740 | -0.0421 | |||

| LOW / Lowe's Companies, Inc. | 0.04 | 3.42 | 7.28 | -10.66 | 2.4484 | 0.0562 | |||

| MDT / Medtronic plc | 0.08 | 2.88 | 7.26 | -16.78 | 2.4417 | -0.1193 | |||

| NEE.PRN / NextEra Energy Capital Holdings, Inc. - Corporate Bond/Note | 0.09 | 18.80 | 7.14 | 8.64 | 2.4027 | 0.4722 | |||

| TROW / T. Rowe Price Group, Inc. | 0.06 | 5.94 | 6.91 | -20.39 | 2.3237 | -0.2241 | |||

| AFL / Aflac Incorporated | 0.12 | 18.53 | 6.90 | 1.86 | 2.3203 | 0.3320 | |||

| LIN / Linde plc | 0.02 | 15.21 | 6.88 | 3.69 | 2.3133 | 0.3660 | |||

| CAT / Caterpillar Inc. | 0.04 | 22.62 | 6.51 | -1.63 | 2.1905 | 0.2468 | |||

| MMM / 3M Company | 0.05 | 18.12 | 6.42 | 2.67 | 2.1599 | 0.3236 | |||

| CARR / Carrier Global Corporation | 0.17 | 7.67 | 6.22 | -16.31 | 2.0933 | -0.0899 | |||

| TGT / Target Corporation | 0.04 | 4.32 | 6.20 | -30.58 | 2.0846 | -0.5366 | |||

| SWK / Stanley Black & Decker, Inc. | 0.06 | 6.94 | 5.87 | -19.79 | 1.9750 | -0.1743 | |||

| GOOGL / Alphabet Inc. | 0.00 | 4.44 | 5.56 | -18.21 | 1.8697 | -0.1257 | |||

| AMZN / Amazon.com, Inc. | 0.04 | 2,067.89 | 4.66 | -29.37 | 1.5671 | -0.3696 | |||

| INTC / Intel Corporation | 0.12 | 18.48 | 4.42 | -10.58 | 1.4870 | 0.0355 | |||

| CVX / Chevron Corporation | 0.01 | -10.61 | 1.10 | -20.50 | 0.3716 | -0.0364 | |||

| SYY / Sysco Corporation | 0.01 | -17.41 | 1.07 | -14.33 | 0.3598 | -0.0068 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -3.95 | 1.02 | -19.76 | 0.3440 | -0.0302 | |||

| GD / General Dynamics Corporation | 0.00 | -21.75 | 0.96 | -28.21 | 0.3218 | -0.0695 | |||

| SPSM / SPDR Series Trust - SPDR Portfolio S&P 600 Small Cap ETF | 0.03 | -26.29 | 0.94 | -36.97 | 0.3164 | -0.1218 | |||

| SPMD / SPDR Series Trust - SPDR Portfolio S&P 400 Mid Cap ETF | 0.02 | -33.37 | 0.89 | -43.94 | 0.3003 | -0.1673 | |||

| RLY / SSGA Active Trust - SPDR SSGA Multi-Asset Real Return ETF | 0.03 | -2.01 | 0.81 | -11.12 | 0.2741 | 0.0049 | |||

| JPST / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Ultra-Short Income ETF | 0.02 | 0.80 | 0.2704 | 0.2704 | |||||

| PPG / PPG Industries, Inc. | 0.01 | -52.84 | 0.74 | -58.87 | 0.2478 | -0.2782 | |||

| ATO / Atmos Energy Corporation | 0.01 | -47.07 | 0.73 | -50.34 | 0.2441 | -0.1850 | |||

| SPDW / SPDR Index Shares Funds - SPDR Portfolio Developed World ex-US ETF | 0.02 | -45.76 | 0.70 | -54.37 | 0.2351 | -0.2146 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | -2.64 | 0.69 | -19.34 | 0.2314 | -0.0190 | |||

| DGRO / iShares Trust - iShares Core Dividend Growth ETF | 0.01 | -4.19 | 0.65 | -14.49 | 0.2182 | -0.0045 | |||

| SPYG / SPDR Series Trust - SPDR Portfolio S&P 500 Growth ETF | 0.01 | -12.93 | 0.60 | -31.31 | 0.2021 | -0.0547 | |||

| ABBV / AbbVie Inc. | 0.00 | 1.51 | 0.60 | -4.01 | 0.2011 | 0.0182 | |||

| SPYV / SPDR Series Trust - SPDR Portfolio S&P 500 Value ETF | 0.02 | -35.54 | 0.59 | -43.16 | 0.1984 | -0.1063 | |||

| ROP / Roper Technologies, Inc. | 0.00 | -53.55 | 0.53 | -61.22 | 0.1779 | -0.2225 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -5.10 | 0.51 | -20.74 | 0.1722 | -0.0174 | |||

| V / Visa Inc. | 0.00 | -18.36 | 0.46 | -27.40 | 0.1550 | -0.0314 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -3.47 | 0.40 | -25.23 | 0.1355 | -0.0227 | |||

| ECL / Ecolab Inc. | 0.00 | -71.25 | 0.39 | -74.98 | 0.1322 | -0.3290 | |||

| PETQ / PetIQ, Inc. | 0.02 | -4.51 | 0.35 | -34.38 | 0.1194 | -0.0394 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -68.38 | 0.34 | -77.91 | 0.1137 | -0.3354 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.33 | -21.75 | 0.1113 | -0.0129 | |||

| T / AT&T Inc. | 0.01 | -71.88 | 0.31 | -75.08 | 0.1053 | -0.2634 | |||

| SHW / The Sherwin-Williams Company | 0.00 | -16.13 | 0.31 | -24.76 | 0.1053 | -0.0169 | |||

| AMJ / JPMorgan Alerian MLP Index ETN - Corporate Bond/Note | 0.00 | -13.98 | 0.30 | -28.97 | 0.1022 | -0.0234 | |||

| XOM / Exxon Mobil Corporation | 0.00 | -12.41 | 0.30 | -9.15 | 0.1002 | 0.0039 | |||

| AEE / Ameren Corporation | 0.00 | 0.55 | 0.29 | -3.28 | 0.0992 | 0.0097 | |||

| ED / Consolidated Edison, Inc. | 0.00 | -38.78 | 0.29 | -38.61 | 0.0979 | -0.0413 | |||

| AMT / American Tower Corporation | 0.00 | 0.09 | 0.28 | 1.83 | 0.0935 | 0.0134 | |||

| LNT / Alliant Energy Corporation | 0.00 | 0.31 | 0.26 | -6.07 | 0.0884 | 0.0063 | |||

| HWKN / Hawkins, Inc. | 0.01 | 0.38 | 0.24 | -21.05 | 0.0807 | -0.0085 | |||

| NSC / Norfolk Southern Corporation | 0.00 | -3.16 | 0.24 | -22.80 | 0.0797 | -0.0104 | |||

| SPHQ / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Quality ETF | 0.01 | 0.00 | 0.22 | -15.71 | 0.0740 | -0.0026 | |||

| ZBRA / Zebra Technologies Corporation | 0.00 | -26.92 | 0.22 | -47.97 | 0.0733 | -0.0497 | |||

| CTXS / Citrix Systems, Inc. | 0.00 | 0.00 | 0.22 | -3.57 | 0.0726 | 0.0069 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.14 | 0.20 | -22.52 | 0.0683 | -0.0086 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.01 | 4.74 | 0.12 | -6.40 | 0.0393 | 0.0027 | |||

| SBEV / Splash Beverage Group, Inc. | 0.03 | 0.09 | 0.0303 | 0.0303 | |||||

| BAC.PRB / Bank of America Corporation - Preferred Stock | 0.00 | -100.00 | 0.00 | -100.00 | -0.0593 | ||||

| VFC / V.F. Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1183 | ||||

| DIS / The Walt Disney Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0816 | ||||

| SPEM / SPDR Index Shares Funds - SPDR Portfolio Emerging Markets ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0866 | ||||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.0904 | ||||

| ITW / Illinois Tool Works Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0616 | ||||

| PFE / Pfizer Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0599 | ||||

| VZ / Verizon Communications Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0649 |