Statistik Asas

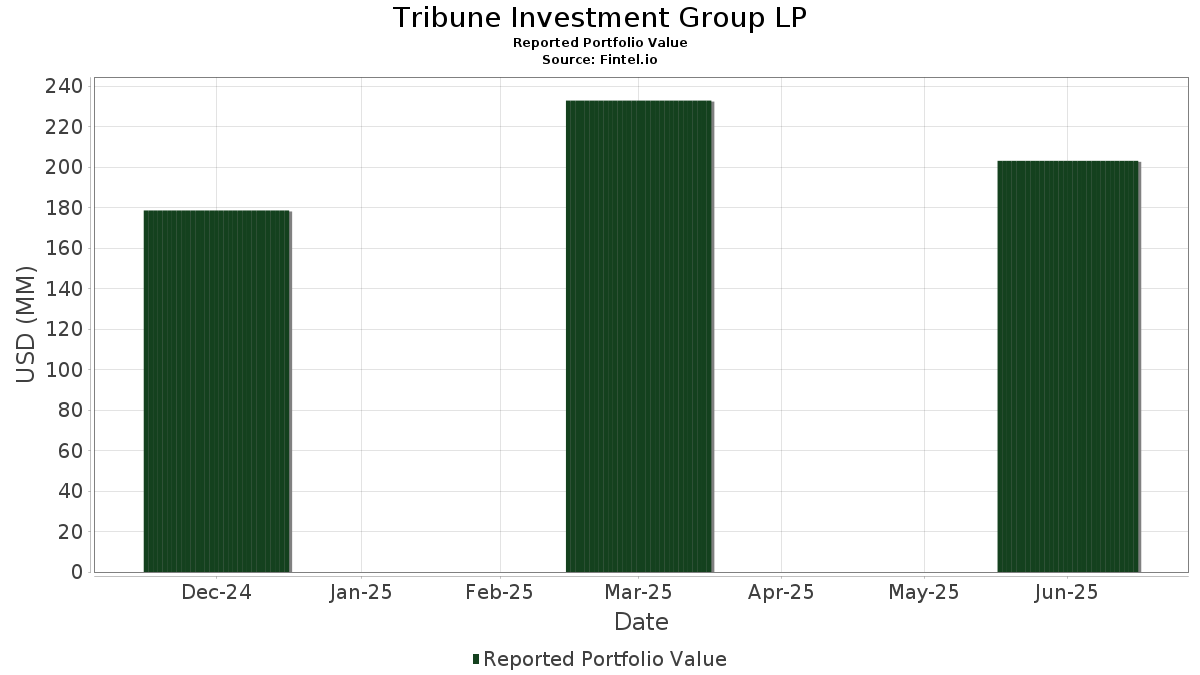

| Nilai Portfolio | $ 203,115,650 |

| Kedudukan Semasa | 24 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Tribune Investment Group LP telah mendedahkan 24 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 203,115,650 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Tribune Investment Group LP ialah Johnson Controls International plc (US:JCI) , CoStar Group, Inc. (US:CSGP) , Curtiss-Wright Corporation (US:CW) , Woodward, Inc. (US:WWD) , and UniFirst Corporation (US:UNF) . Kedudukan baharu Tribune Investment Group LP termasuk CoStar Group, Inc. (US:CSGP) , Honeywell International Inc. (US:HON) , The Charles Schwab Corporation (US:SCHW) , QXO, Inc. (US:QXO) , and Cummins Inc. (US:CMI) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.18 | 14.47 | 7.1250 | 7.1250 | |

| 0.18 | 19.01 | 9.3600 | 6.7112 | |

| 0.05 | 10.95 | 5.3887 | 5.3887 | |

| 0.10 | 9.12 | 4.4920 | 4.4920 | |

| 0.42 | 9.05 | 4.4540 | 4.4540 | |

| 0.03 | 8.84 | 4.3534 | 4.3534 | |

| 0.27 | 8.81 | 4.3375 | 4.3375 | |

| 0.03 | 12.21 | 6.0132 | 4.1058 | |

| 0.04 | 7.04 | 3.4673 | 3.4673 | |

| 0.02 | 6.78 | 3.3370 | 3.3370 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 4.39 | 2.1625 | -3.3389 | |

| 0.03 | 8.79 | 4.3276 | -0.3081 | |

| 0.06 | 4.41 | 2.1734 | -0.1293 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-14 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JCI / Johnson Controls International plc | 0.18 | 133.77 | 19.01 | 208.22 | 9.3600 | 6.7112 | |||

| CSGP / CoStar Group, Inc. | 0.18 | 14.47 | 7.1250 | 7.1250 | |||||

| CW / Curtiss-Wright Corporation | 0.03 | 78.57 | 12.21 | 175.01 | 6.0132 | 4.1058 | |||

| WWD / Woodward, Inc. | 0.05 | 2.13 | 11.76 | 37.16 | 5.7919 | 2.1088 | |||

| UNF / UniFirst Corporation | 0.06 | 17.65 | 11.29 | 27.26 | 5.5600 | 1.7494 | |||

| HON / Honeywell International Inc. | 0.05 | 10.95 | 5.3887 | 5.3887 | |||||

| DTM / DT Midstream, Inc. | 0.09 | 65.38 | 9.45 | 88.44 | 4.6536 | 2.4993 | |||

| SCHW / The Charles Schwab Corporation | 0.10 | 9.12 | 4.4920 | 4.4920 | |||||

| CBRE / CBRE Group, Inc. | 0.07 | 30.00 | 9.11 | 39.27 | 4.4840 | 1.6761 | |||

| QXO / QXO, Inc. | 0.42 | 9.05 | 4.4540 | 4.4540 | |||||

| CMI / Cummins Inc. | 0.03 | 8.84 | 4.3534 | 4.3534 | |||||

| CSX / CSX Corporation | 0.27 | 8.81 | 4.3375 | 4.3375 | |||||

| MORN / Morningstar, Inc. | 0.03 | -22.22 | 8.79 | -18.57 | 4.3276 | -0.3081 | |||

| SPXC / SPX Technologies, Inc. | 0.04 | 7.04 | 3.4673 | 3.4673 | |||||

| CEG / Constellation Energy Corporation | 0.02 | 6.78 | 3.3370 | 3.3370 | |||||

| NVT / nVent Electric plc | 0.09 | 6.59 | 3.2457 | 3.2457 | |||||

| GXO / GXO Logistics, Inc. | 0.14 | 6.57 | 3.2368 | 3.2368 | |||||

| AL / Air Lease Corporation | 0.11 | 6.43 | 3.1676 | 3.1676 | |||||

| HWM / Howmet Aerospace Inc. | 0.03 | 4.65 | 2.2909 | 2.2909 | |||||

| VSTS / Vestis Corporation | 0.80 | 4.58 | 2.2568 | 2.2568 | |||||

| GFF / Griffon Corporation | 0.06 | -18.67 | 4.41 | -17.68 | 2.1734 | -0.1293 | |||

| BKR / Baker Hughes Company | 0.12 | 4.41 | 2.1707 | 2.1707 | |||||

| CLH / Clean Harbors, Inc. | 0.02 | -70.77 | 4.39 | -65.72 | 2.1625 | -3.3389 | |||

| GPC / Genuine Parts Company | 0.04 | 4.37 | 2.1501 | 2.1501 | |||||

| WTW / Willis Towers Watson Public Limited Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AAON / AAON, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| APD / Air Products and Chemicals, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WY / Weyerhaeuser Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PH / Parker-Hannifin Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MMM / 3M Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WRB / W. R. Berkley Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SPGI / S&P Global Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TDY / Teledyne Technologies Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BATR.K / Atlanta Braves Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SPY / SPDR S&P 500 ETF | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| ULS / UL Solutions Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AIT / Applied Industrial Technologies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KKR / KKR & Co. Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HEI / HEICO Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BLD / TopBuild Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TRS / TriMas Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IP / International Paper Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IWM / iShares Trust - iShares Russell 2000 ETF | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| NOC / Northrop Grumman Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MDY / SPDR S&P MidCap 400 ETF Trust | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| KNTK / Kinetik Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |