Statistik Asas

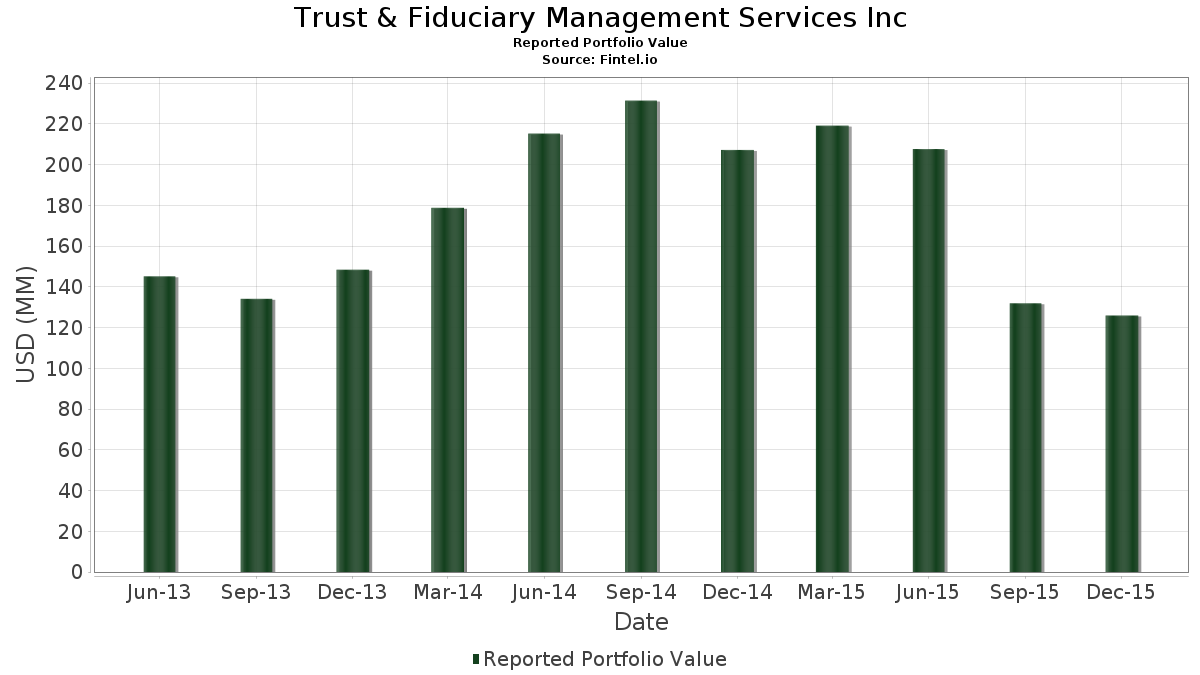

| Nilai Portfolio | $ 125,919,000 |

| Kedudukan Semasa | 38 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Trust & Fiduciary Management Services Inc telah mendedahkan 38 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 125,919,000 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Trust & Fiduciary Management Services Inc ialah SFL Corporation Ltd. (US:SFL) , Apollo Commercial Real Estate Finance, Inc. (US:ARI) , Starwood Property Trust, Inc. (US:STWD) , Sunoco Logistics Partners L.P. (US:SXL) , and Nuveen Preferred & Income Opportunities Fund (US:JPC) . Kedudukan baharu Trust & Fiduciary Management Services Inc termasuk Nuveen Preferred & Income Securities Fund (US:JPS) , Nuveen Preferred Securities & Income Opportunities Fund (US:JPI) , Enterprise Products Partners L.P. - Limited Partnership (US:EPD) , Kinder Morgan, Inc. (US:KMI) , and .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.17 | 5.61 | 4.4560 | 4.4560 | |

| 0.57 | 5.22 | 4.1455 | 4.1455 | |

| 0.23 | 5.22 | 4.1431 | 4.1431 | |

| 0.20 | 5.00 | 3.9748 | 3.9748 | |

| 0.08 | 4.39 | 3.4888 | 3.4888 | |

| 0.10 | 4.16 | 3.3037 | 3.3037 | |

| 0.25 | 5.32 | 4.2281 | 1.9122 | |

| 0.16 | 2.35 | 1.8702 | 1.8702 | |

| 1.03 | 4.82 | 3.8302 | 1.1596 | |

| 0.27 | 2.84 | 2.2522 | 1.0977 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.12 | 2.35 | 1.8702 | -3.1322 | |

| 0.00 | 0.00 | -2.3166 | ||

| 0.16 | 2.44 | 1.9393 | -2.1807 | |

| 0.00 | 0.00 | -1.8898 | ||

| 0.00 | 0.00 | -1.6230 | ||

| 0.29 | 4.17 | 3.3156 | -1.5071 | |

| 0.06 | 1.17 | 0.9268 | -1.4672 | |

| 0.00 | 0.00 | -1.3994 | ||

| 0.13 | 2.80 | 2.2205 | -1.3856 | |

| 0.00 | 0.00 | -1.2281 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2016-02-10 untuk tempoh pelaporan 2015-12-31. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SFL / SFL Corporation Ltd. | 0.44 | -1.69 | 7.32 | 0.25 | 5.8101 | 0.2778 | |||

| ARI / Apollo Commercial Real Estate Finance, Inc. | 0.39 | -3.22 | 6.69 | 6.14 | 5.3153 | 0.5350 | |||

| STWD / Starwood Property Trust, Inc. | 0.31 | -2.90 | 6.32 | -2.69 | 5.0199 | 0.0955 | |||

| SXL / Sunoco Logistics Partners L.P. | 0.17 | 48.98 | 5.61 | -3.49 | 4.4560 | 4.4560 | |||

| JPC / Nuveen Preferred & Income Opportunities Fund | 0.59 | -1.81 | 5.41 | 0.06 | 4.2996 | 0.1977 | |||

| FPF / First Trust Intermediate Duration Preferred & Income Fund | 0.25 | 75.68 | 5.32 | 74.27 | 4.2281 | 1.9122 | |||

| JPS / Nuveen Preferred & Income Securities Fund | 0.57 | 5.22 | 4.1455 | 4.1455 | |||||

| HPT / Hospitality Properties Trust | 0.20 | -7.10 | 5.22 | -5.02 | 4.1447 | -0.0208 | |||

| JPI / Nuveen Preferred Securities & Income Opportunities Fund | 0.23 | 5.22 | 4.1431 | 4.1431 | |||||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.20 | 5.00 | 3.9748 | 3.9748 | |||||

| FTR / Frontier Communications Corp. | 1.03 | 39.22 | 4.82 | 36.90 | 3.8302 | 1.1596 | |||

| TNH / Terra Nitrogen Co., L.P. | 0.05 | -1.44 | 4.68 | -7.22 | 3.7175 | -0.1069 | |||

| EPR / EPR Properties | 0.08 | -2.05 | 4.50 | 11.00 | 3.5753 | 0.5006 | |||

| CNXC / Concentrix Corporation | 0.08 | 53.04 | 4.39 | 62.40 | 3.4888 | 3.4888 | |||

| ARCC / Ares Capital Corporation | 0.29 | -33.32 | 4.17 | -34.38 | 3.3156 | -1.5071 | |||

| KMI / Kinder Morgan, Inc. | 0.10 | 4.16 | 3.3037 | 3.3037 | |||||

| STON / StoneMor Inc | 0.15 | -2.11 | 4.07 | -4.10 | 3.2322 | 0.0150 | |||

| NRZ / New Residential Investment Corp | 0.28 | -4.19 | 3.46 | -11.06 | 2.7470 | -0.2011 | |||

| MTGE / American Capital Mortgage Investment Corp. | 0.19 | 0.00 | 3.03 | 0.00 | 2.4063 | 0.1094 | |||

| VER / VEREIT Inc | 0.37 | -4.51 | 2.95 | -2.03 | 2.3420 | 0.0602 | |||

| PSEC / Prospect Capital Corporation | 0.42 | 1.25 | 2.91 | -0.85 | 2.3094 | 0.0860 | |||

| VTA / Invesco Dynamic Credit Opportunities Fund | 0.27 | 86.59 | 2.84 | 86.21 | 2.2522 | 1.0977 | |||

| MMLP / Martin Midstream Partners L.P. - Limited Partnership | 0.13 | -33.90 | 2.80 | -41.22 | 2.2205 | -1.3856 | |||

| KKR / KKR & Co. Inc. | 0.16 | -51.64 | 2.44 | -55.07 | 1.9393 | -2.1807 | |||

| FSK / FS KKR Capital Corp. | 0.26 | -2.62 | 2.36 | -6.08 | 1.8774 | -0.0306 | |||

| CLMT / Calumet, Inc. | 0.12 | -56.48 | 2.35 | -64.31 | 1.8702 | -3.1322 | |||

| APO / Apollo Global Management, Inc. | 0.16 | -1.59 | 2.35 | -13.04 | 1.8702 | 1.8702 | |||

| UAN / CVR Partners, LP - Limited Partnership | 0.21 | -1.75 | 1.68 | -15.82 | 1.3310 | -0.1783 | |||

| IVR / Invesco Mortgage Capital Inc. | 0.12 | -39.24 | 1.54 | -38.51 | 1.2198 | -0.6738 | |||

| US58503F5026 / Medley Capital Corp. | 0.18 | -1.60 | 1.34 | -0.52 | 1.0674 | 0.0432 | |||

| CMO / Capstead Mortgage Corp. | 0.13 | -49.74 | 1.18 | -55.59 | 0.9339 | -1.0734 | |||

| CVRR / CVR Refining LP | 0.06 | -62.68 | 1.17 | -63.05 | 0.9268 | -1.4672 | |||

| EHI / Western Asset Global High Income Fund Inc. | 0.09 | -66.74 | 0.77 | -67.66 | 0.6099 | -1.1905 | |||

| OCSL / Oaktree Specialty Lending Corporation | 0.12 | -63.18 | 0.76 | -61.92 | 0.6036 | -0.9095 | |||

| HYT / BlackRock Corporate High Yield Fund, Inc. | 0.08 | -66.22 | 0.76 | -66.52 | 0.6004 | -1.1113 | |||

| OIA / Invesco Municipal Income Opportunities Trust | 0.07 | -7.79 | 0.51 | -0.59 | 0.4026 | 0.0160 | |||

| XALL / Xalles Holdings Inc. | 0.09 | -66.19 | 0.33 | -68.96 | 0.2652 | -0.5504 | |||

| PMM / Putnam Managed Municipal Income Trust | 0.03 | -11.40 | 0.26 | -8.87 | 0.2041 | -0.0097 | |||

| NHF / NexPoint Strategic Opportunities Fund | 0.00 | -100.00 | 0.00 | -100.00 | -1.3994 | ||||

| SNH / Senior Housing Properties Trust | 0.00 | -100.00 | 0.00 | -100.00 | -1.0886 | ||||

| ACP / Abrdn Income Credit Strategies Fund | 0.00 | -100.00 | 0.00 | -100.00 | -1.2281 | ||||

| NRF / NorthStar Realty Finance Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -1.8898 | ||||

| EMD / Western Asset Emerging Markets Debt Fund Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| NTI / Northern Tier Energy LP | 0.00 | -100.00 | 0.00 | -100.00 | -2.3166 | ||||

| NMM / Navios Maritime Partners L.P. - Limited Partnership | 0.00 | -100.00 | 0.00 | -100.00 | -1.6230 | ||||

| STAG / STAG Industrial, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0871 |