Statistik Asas

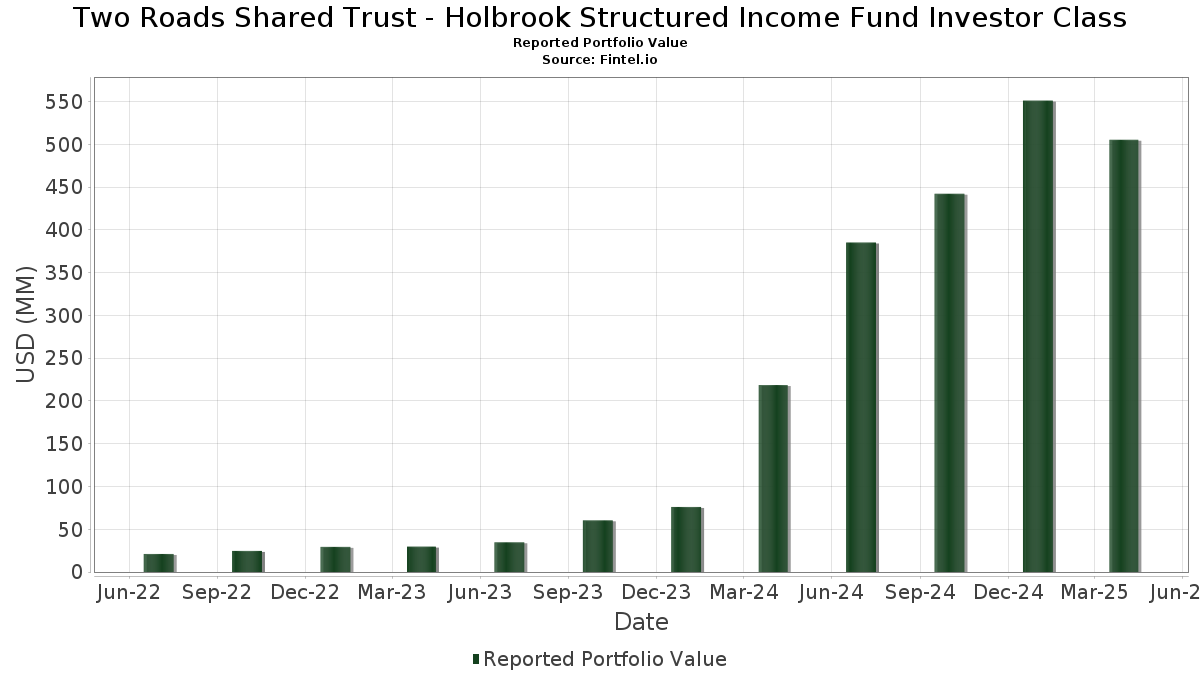

| Nilai Portfolio | $ 505,402,987 |

| Kedudukan Semasa | 149 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

Two Roads Shared Trust - Holbrook Structured Income Fund Investor Class telah mendedahkan 149 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 505,402,987 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas Two Roads Shared Trust - Holbrook Structured Income Fund Investor Class ialah First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , Sound Point Clo XVI Ltd (KY:US83610KAG85) , BXHPP Trust 2021-FILM (US:US05609JAA07) , HLA 18-2 C CLO 144A FRN (L+340) 01-22-31 (US:US40490AAJ97) , and Battalion CLO IX Ltd (US:US07132EAQ89) . Kedudukan baharu Two Roads Shared Trust - Holbrook Structured Income Fund Investor Class termasuk First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , Sound Point Clo XVI Ltd (KY:US83610KAG85) , BXHPP Trust 2021-FILM (US:US05609JAA07) , HLA 18-2 C CLO 144A FRN (L+340) 01-22-31 (US:US40490AAJ97) , and Battalion CLO IX Ltd (US:US07132EAQ89) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 22.54 | 4.4700 | 4.4700 | ||

| 21.06 | 4.1769 | 4.1769 | ||

| 13.32 | 2.6404 | 2.6404 | ||

| 8.98 | 1.7802 | 1.7802 | ||

| 7.49 | 1.4854 | 1.4854 | ||

| 7.60 | 1.5079 | 1.3208 | ||

| 6.29 | 1.2475 | 1.2475 | ||

| 6.11 | 1.2122 | 1.2122 | ||

| 5.90 | 1.1696 | 1.1696 | ||

| 5.73 | 1.1353 | 1.1353 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 5.38 | 1.0660 | -1.5145 | ||

| 26.17 | 5.1901 | -1.2585 | ||

| 4.86 | 0.9631 | -1.0117 | ||

| 17.35 | 3.4410 | -0.3834 | ||

| 0.55 | 0.1088 | -0.3760 | ||

| 1.86 | 0.3685 | -0.3759 | ||

| 1.98 | 0.3931 | -0.2666 | ||

| 1.97 | 0.3899 | -0.1142 | ||

| 1.96 | 0.3889 | -0.0950 | ||

| 0.34 | 0.0665 | -0.0776 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-06-26 untuk tempoh pelaporan 2025-04-30. Pelabur ini tidak mendedahkan sekuriti yang dikira dalam saham, jadi lajur berkaitan saham dalam jadual di bawah tidak dimasukkan. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 26.17 | -24.29 | 5.1901 | -1.2585 | ||

| US83610KAG85 / Sound Point Clo XVI Ltd | 22.54 | 4.4700 | 4.4700 | |||

| US05609JAA07 / BXHPP Trust 2021-FILM | 21.06 | 4.1769 | 4.1769 | |||

| US40490AAJ97 / HLA 18-2 C CLO 144A FRN (L+340) 01-22-31 | 17.90 | -0.43 | 3.5495 | 0.1960 | ||

| US07132EAQ89 / Battalion CLO IX Ltd | 17.35 | -15.36 | 3.4410 | -0.3834 | ||

| WINDR 2015-1A DR / ABS-CBDO (US88432FBG37) | 16.03 | -0.50 | 3.1794 | 0.1737 | ||

| US05549GAS03 / BHMS 2018-MZB | 13.32 | 2.6404 | 2.6404 | |||

| CFGMS 2025-31 B / ABS-O (US14023CAB37) | 13.07 | 0.57 | 2.5926 | 0.1677 | ||

| 66860CAJ2 / Northwoods Capital XI-B Ltd. and Northwoods Capital XI-B LLC Series 2018-14BA Class D (3-Month U.S. LIBOR plus 340 bps) | 12.49 | -0.51 | 2.4763 | 0.1350 | ||

| US14311DBU90 / Carlyle Global Market Strategies CLO 2015-1 Ltd | 11.95 | 7.87 | 2.3689 | 0.3030 | ||

| US66858CAJ62 / Northwoods Capital XII-B Ltd | 10.31 | -0.82 | 2.0444 | 0.1055 | ||

| WINDR 2014-3KRA D / ABS-CBDO (US88390BAJ70) | 9.99 | -0.82 | 1.9810 | 0.1020 | ||

| US12551JAS50 / CIFC 2017-4A CR | 8.98 | 1.7802 | 1.7802 | |||

| US52111PAM32 / LCM XXIII Ltd | 7.60 | 658.88 | 1.5079 | 1.3208 | ||

| US92539GAA94 / Verus Securitization Trust 2023-3 | 7.49 | 1.4854 | 1.4854 | |||

| US44330DAL47 / Highbridge Loan Management 2013-2 Ltd | 7.47 | 86.24 | 1.4817 | 0.7331 | ||

| ZAIS7 2017-2A D / ABS-CBDO (US98887VAG86) | 7.02 | 39.08 | 1.3910 | 0.4501 | ||

| US15033AAA43 / Cedar Funding VII CLO Ltd., Series 2018-7A, Class E | 7.00 | 54.88 | 1.3875 | 0.5449 | ||

| US14889DAS71 / Catamaran CLO 2014-1 Ltd | 6.39 | 340.36 | 1.2679 | 0.9969 | ||

| MSC 2024-BPR2 E / ABS-O (US61776EAL74) | 6.29 | 1.2475 | 1.2475 | |||

| MSC 2024-BPR2 C / ABS-O (US61776EAG89) | 6.19 | 0.42 | 1.2268 | 0.0776 | ||

| OBX 2024-NQM12 A1 / ABS-O (US67448PAA12) | 6.11 | 1.2122 | 1.2122 | |||

| US04942JAJ07 / Atlas Senior Loan Fund X Ltd., Series 2018-10A, Class D | 5.90 | 1.1696 | 1.1696 | |||

| US67112MAG06 / OZLM XX Ltd | 5.73 | 1.1353 | 1.1353 | |||

| ZAIS6 2017-1A D / ABS-CBDO (US98887TAE82) | 5.59 | -0.29 | 1.1084 | 0.0628 | ||

| US14022TAB70 / MCFMT 2022-PM01 B | 5.38 | -61.14 | 1.0660 | -1.5145 | ||

| US92916MAD39 / Voya CLO LTD VOYA 2017 1A C 144A | 5.10 | 1.0109 | 1.0109 | |||

| XCAL 2024-SURF A / ABS-O (US98373XBP42) | 5.06 | 0.00 | 1.0041 | 0.0595 | ||

| US13876JAJ16 / Canyon Capital CLO 2012-1 R Ltd | 5.04 | -0.41 | 1.0000 | 0.0555 | ||

| US67590ABX90 / Octagon Investment Partners XIV Ltd | 5.01 | 0.9936 | 0.9936 | |||

| US67515EAX40 / Ocean Trails CLO V | 4.99 | 0.9887 | 0.9887 | |||

| US05608BAQ32 / BX Commercial Mortgage Trust 2019-IMC | 4.86 | -54.12 | 0.9631 | -1.0117 | ||

| US88432DBL73 / Wind River 2014-3 CLO Ltd | 4.75 | -0.61 | 0.9410 | 0.0504 | ||

| MFRA 2024-NQM3 A1 / ABS-O (US55287GAA04) | 4.69 | 0.9308 | 0.9308 | |||

| US50189GAJ13 / LCM XXII Ltd | 4.60 | 0.9129 | 0.9129 | |||

| XCAL 2023-HOAKS A / ABS-O (US98373XBG43) | 4.59 | -0.11 | 0.9095 | 0.0531 | ||

| US92329FAV94 / Venture XVIII CLO Ltd | 4.49 | -0.40 | 0.8907 | 0.0495 | ||

| US92331MAD02 / Venture XXVI CLO Ltd | 4.39 | -0.45 | 0.8708 | 0.0480 | ||

| CFGMS 2024-28 B / ABS-O (US14022BAB62) | 4.28 | -0.07 | 0.8493 | 0.0498 | ||

| US28622VAJ98 / Elevation CLO 2017-8 Ltd | 4.24 | 100.66 | 0.8417 | 0.4470 | ||

| US98370NAC92 / XCAL 2021-7 B1 | 4.16 | 0.27 | 0.8251 | 0.0511 | ||

| US81883EAD31 / Shackleton 2017-XI Clo Ltd | 4.01 | -0.67 | 0.7944 | 0.0420 | ||

| CFGMS 2024-29 B / ABS-O (US14022JAB98) | 4.01 | -0.25 | 0.7943 | 0.0454 | ||

| XCAL 2024-OPAL A / ABS-O (US98373XBS80) | 4.00 | -0.12 | 0.7936 | 0.0461 | ||

| US88432CBE57 / THL Credit Wind River 2014-1 CLO Ltd | 4.00 | -0.67 | 0.7927 | 0.0419 | ||

| US09202VAN82 / Black Diamond Clo 2017-1 Ltd | 3.91 | -0.48 | 0.7759 | 0.0425 | ||

| US78458MAL81 / SMR 2022-IND Mortgage Trust | 3.85 | -0.67 | 0.7626 | 0.0404 | ||

| US69355DAG25 / PPM CLO 2018-1 Ltd | 3.74 | -0.74 | 0.7418 | 0.0386 | ||

| XCAL 2023-DMNK B1 / ABS-O (US98373XBM11) | 3.32 | -0.15 | 0.6587 | 0.0382 | ||

| BRAVO 2025-NQM2 A1 / ABS-O (US10569NAC56) | 2.96 | 0.5872 | 0.5872 | |||

| MP15 2019-1A E / ABS-CBDO (US56606XAA54) | 2.95 | 0.5850 | 0.5850 | |||

| US81881QAY26 / Shackleton 2013-III CLO Ltd | 2.89 | 33.98 | 0.5740 | 0.1711 | ||

| VERUS 2024-9 A1 / ABS-O (US92540RAC88) | 2.89 | 0.5735 | 0.5735 | |||

| GSMS 2024-FAIR D / ABS-O (US36270JAG04) | 2.84 | 37.45 | 0.5635 | 0.1779 | ||

| US83607HAG02 / SOUND POINT CLO VIII-R LTD | 2.70 | 0.5349 | 0.5349 | |||

| ADMT 2024-NQM3 A1 / ABS-O (US00039HAA59) | 2.67 | -3.76 | 0.5286 | 0.0120 | ||

| US98373XAY67 / XCALFD 11 03/01/25 | 2.64 | 0.15 | 0.5234 | 0.0318 | ||

| CFGMS 2025-P05 B / ABS-O (US139917AB47) | 2.53 | -0.16 | 0.5008 | 0.0290 | ||

| KSTAT 2022-1A ER2 / ABS-CBDO (US48255RAE18) | 2.49 | -1.39 | 0.4943 | 0.0229 | ||

| XCAL 2024-OPAL B1 / ABS-O (US98373XBT63) | 2.45 | -0.16 | 0.4863 | 0.0282 | ||

| HSLT 2024-1 C / DBT (US41756NAC39) | 2.35 | -1.34 | 0.4657 | 0.0217 | ||

| US28851QAL77 / Ellington Clo I Ltd | 2.32 | -8.35 | 0.4592 | -0.0121 | ||

| US69702JAA25 / Palmer Square Loan Funding Ltd | 2.25 | -0.04 | 0.4467 | 0.0263 | ||

| OBX 2024-NQM4 A1 / ABS-O (US67118TAA25) | 2.06 | 0.4082 | 0.4082 | |||

| US13875LAU26 / Canyon Capital CLO 2014-1 Ltd | 2.00 | -0.60 | 0.3960 | 0.0211 | ||

| US85816VAD82 / Steele Creek Clo 2017-1 Ltd | 1.99 | 0.3956 | 0.3956 | |||

| US30297MAU45 / FREMF 2018-K733 Mortgage Trust | 1.98 | -43.95 | 0.3931 | -0.2666 | ||

| US30296XAG25 / FREMF Mortgage Trust, Series 2018-K78, Class B | 1.97 | -27.24 | 0.3899 | -0.1142 | ||

| US30305EAE86 / FREMF Mortgage Trust, Series 2017-K68, Class B | 1.97 | 1.97 | 0.3897 | 0.0302 | ||

| US30298MAC38 / FREMF 2019-K736 Mortgage Trust | 1.96 | -24.40 | 0.3889 | -0.0950 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.89 | -0.26 | 0.3757 | 0.0214 | ||

| US00002DAA72 / A&D Mortgage Trust 2023-NQM2 | 1.86 | 0.3688 | 0.3688 | |||

| JPMMT 2024-12 A4 / ABS-O (US46658TAD63) | 1.86 | -53.43 | 0.3685 | -0.3759 | ||

| US67111NAJ37 / OZLM XVII, Ltd. | 1.84 | -0.70 | 0.3641 | 0.0191 | ||

| US48250GAW06 / KKR 10 DR | 1.77 | -0.34 | 0.3517 | 0.0197 | ||

| XCAL 2024-MSD B1 / ABS-O (US98373XBX75) | 1.75 | 0.00 | 0.3467 | 0.0205 | ||

| MVEW 2017-2A D / ABS-CBDO (US62432LAG68) | 1.72 | -0.69 | 0.3420 | 0.0181 | ||

| US30316EAE59 / FREMF Mortgage Trust, Series 2020-KF76, Class B | 1.71 | -0.70 | 0.3387 | 0.0177 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.63 | -3.77 | 0.3240 | 0.0072 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.60 | 11.34 | 0.3175 | 0.0493 | ||

| US30313LAG77 / FREMF 2019-KF69 B | 1.54 | 0.3058 | 0.3058 | |||

| US12570GAC33 / CIM Trust 2023-R3 | 1.54 | -0.90 | 0.3049 | 0.0156 | ||

| DFS 2025-RTL1 M / ABS-O (US25746DAC11) | 1.50 | 0.2982 | 0.2982 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 1.50 | -8.94 | 0.2969 | -0.0099 | ||

| US01750CAJ27 / Allegro CLO VII Ltd | 1.50 | 0.2967 | 0.2967 | |||

| CEDF 2016-5A DR / ABS-CBDO (US15032AAW71) | 1.49 | -0.73 | 0.2963 | 0.0154 | ||

| US67112AAG67 / OZLM XXI Ltd | 1.49 | -0.86 | 0.2963 | 0.0151 | ||

| HSLT 2024-1 B / DBT (US41756NAB55) | 1.46 | -0.75 | 0.2889 | 0.0149 | ||

| US693984AA42 / PRKCM Trust, Series 2023-AFC3, Class A1 | 1.42 | -4.77 | 0.2814 | 0.0035 | ||

| JPMMT 2024-11 A6 / ABS-O (US46659AAJ34) | 1.28 | -6.72 | 0.2534 | -0.0022 | ||

| US69702LAC37 / PSTAT 2022-1A E | 1.26 | -0.08 | 0.2490 | 0.0147 | ||

| US26244QAU76 / Dryden 49 Senior Loan Fund | 1.25 | 0.2474 | 0.2474 | |||

| US30296PAS39 / FREMF 2018-K75 Mortgage Trust | 1.21 | 2.97 | 0.2407 | 0.0207 | ||

| OLIT 2024-HB2 M4 / ABS-O (US68278DAE31) | 1.13 | 1.81 | 0.2234 | 0.0171 | ||

| US09629VAJ26 / BLUEM 18-2 D CLO 144A FRN (TSFR3M + 341.16) 08-15-31 | 1.10 | 0.2175 | 0.2175 | |||

| US44422PBY79 / HUDSONS BAY SIMON JV TRUST 2015-HBS SER 2015-HB10 CL C10 V/R REGD 144A P/P 5.44700000 | 1.04 | 4.93 | 0.2070 | 0.0215 | ||

| MFRA 2024-NQM2 A1 / ABS-O (US58004JAA07) | 1.04 | 0.2069 | 0.2069 | |||

| VERUS 2025-3 A1 / ABS-O (US924928AA24) | 1.00 | 0.1989 | 0.1989 | |||

| XCALFD 25 09/01/25 / ABS-O (US98373XAE04) | 1.00 | -0.10 | 0.1983 | 0.0115 | ||

| US70016RAJ41 / Park Avenue Institutional Advisers CLO Ltd 2018-1 3.52 | 1.00 | 0.1982 | 0.1982 | |||

| US92915PAR64 / Voya CLO Ltd., Series 2014-1A, Class CR2 | 1.00 | 0.1982 | 0.1982 | |||

| OCT27 / Octagon Investment Partners 27 Ltd | 1.00 | 0.1981 | 0.1981 | |||

| US65023PAU49 / Newark BSL CLO 2 Ltd | 1.00 | 0.1980 | 0.1980 | |||

| US92913UAW62 / Voya CLO 2015-3 Ltd | 1.00 | 0.1975 | 0.1975 | |||

| US67591VAJ44 / Octagon Investment Partners 37 Ltd | 1.00 | 0.1975 | 0.1975 | |||

| US88432ABC36 / THL Credit Wind River 2013-2 CLO Ltd | 0.99 | 0.1972 | 0.1972 | |||

| US35708WAU45 / FREMF Mortgage Trust, Series 2017-K71, Class C | 0.98 | 1.77 | 0.1933 | 0.0145 | ||

| GNR 2024-76 KA / ABS-O (US38384NTQ87) | 0.96 | -19.92 | 0.1899 | -0.0331 | ||

| OLIT 2024-HB2 M3 / ABS-O (US68278DAD57) | 0.94 | 1.40 | 0.1869 | 0.0136 | ||

| CFMT 2024-HB15 M3 / ABS-O (US15723AAD37) | 0.94 | 1.52 | 0.1859 | 0.0137 | ||

| US465986AK33 / JP Morgan Mortgage Trust 2023-10 | 0.91 | -17.02 | 0.1799 | -0.0240 | ||

| BRAVO 2024-NQM3 A1 / ABS-O (US10569LAA35) | 0.80 | 0.1580 | 0.1580 | |||

| SEMT 2024-3 A4 / ABS-O (US81749JAD63) | 0.76 | -6.29 | 0.1508 | -0.0006 | ||

| ATCLO 2017-8A C / ABS-CBDO (US04943AAG40) | 0.75 | -0.13 | 0.1490 | 0.0087 | ||

| US88432VAJ35 / THL CREDIT WIND RIVER 2018-1 CLO LTD | 0.70 | -0.43 | 0.1386 | 0.0076 | ||

| US12549BAW81 / CIFC Funding 2013-II Ltd | 0.62 | -0.48 | 0.1239 | 0.0068 | ||

| US28853RAG48 / Ellington CLO IV Ltd | 0.55 | -78.91 | 0.1088 | -0.3760 | ||

| LLP 2024-4 B / ABS-O (US55068XAB64) | 0.54 | 0.19 | 0.1074 | 0.0066 | ||

| BRAVO 2024-NQM2 A1 / ABS-O (US10569KAA51) | 0.54 | 0.1067 | 0.1067 | |||

| CRMN 2018-1A D / ABS-CBDO (US14900CAJ45) | 0.50 | 0.0997 | 0.0997 | |||

| US27830TAJ43 / Eaton Vance CLO 2014-1R Ltd. | 0.50 | -0.80 | 0.0987 | 0.0051 | ||

| US98373XAD21 / XCALFD 11 09/24/24 | 0.50 | -0.60 | 0.0986 | 0.0054 | ||

| GUGG4 2016-1A CR / ABS-CBDO (US282523BF53) | 0.49 | -0.60 | 0.0980 | 0.0054 | ||

| US35708YAS54 / FREMF 2018-K733 Mortgage Trust | 0.49 | 0.0973 | 0.0973 | |||

| US46652BBJ70 / JP Morgan Chase Commercial Mortgage Securities Trust 2020-NNN | 0.49 | -2.21 | 0.0965 | 0.0038 | ||

| US98372NAC74 / XCALI 2020-1 Mortgage Trust | 0.47 | 0.21 | 0.0929 | 0.0056 | ||

| CFMT 2025-HB16 M3 / ABS-O (US12531BAD01) | 0.46 | 0.0913 | 0.0913 | |||

| US30288LAN38 / FREMF Mortgage Trust, Series 2016-K53, Class B | 0.45 | 0.0884 | 0.0884 | |||

| US08763QAG73 / Betony CLO 2 Ltd | 0.42 | -0.48 | 0.0824 | 0.0045 | ||

| US98401JAB35 / XCALI 2020-5 Mortgage Trust | 0.37 | -0.80 | 0.0739 | 0.0039 | ||

| MSRM 2024-NQM3 A1 / ABS-O (US61776UAA51) | 0.35 | 0.0702 | 0.0702 | |||

| US30311LAG95 / FREMF 2019-KF61 B | 0.35 | 0.0702 | 0.0702 | |||

| US98875LAG41 / Zais CLO 5 Ltd | 0.34 | -56.61 | 0.0665 | -0.0776 | ||

| US92539TAA16 / Verus Securitization Trust, Series 2023-4, Class A1 | 0.29 | 0.0567 | 0.0567 | |||

| PAID 2024-1 A / ABS-O (US69548AAA97) | 0.26 | -16.46 | 0.0525 | -0.0066 | ||

| US69702HAG39 / Palmer Square Loan Funding Ltd., Series 2021-4A, Class C | 0.25 | -0.40 | 0.0494 | 0.0027 | ||

| US87231BAJ26 / TFLAT 2017-1A D | 0.25 | -0.40 | 0.0494 | 0.0026 | ||

| US46650RAC07 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2019-ICON | 0.24 | -19.19 | 0.0477 | -0.0078 | ||

| BRAVO 2024-NQM5 A1 / ABS-O (US105925AA98) | 0.24 | 0.0473 | 0.0473 | |||

| REACH 2024-1A A / ABS-O (US75526PAA93) | 0.23 | -32.95 | 0.0462 | -0.0185 | ||

| US06540RAF10 / BANK 2017-BNK9 | 0.22 | 0.0430 | 0.0430 | |||

| US05608BAS97 / BX TRUST 2019-IMC G 1ML+360 04/15/2034 144A | 0.19 | -0.53 | 0.0373 | 0.0020 | ||

| US17327FBG00 / Citigroup Commercial Mortgage Trust 2018-B2 | 0.13 | 0.0264 | 0.0264 | |||

| JPMCC 2019-ICON XB / ABS-O (US46650RAE62) | 0.09 | -32.85 | 0.0184 | -0.0072 | ||

| US26844QAB32 / EFMT 2023-1 | 0.07 | -4.11 | 0.0140 | 0.0003 | ||

| US98373XBE94 / XCAL 2023-MF9 B1 | 0.06 | -85.44 | 0.0122 | -0.0660 | ||

| US87265XAA28 / TRK_22-INV2 | 0.05 | 0.0098 | 0.0098 | |||

| US12594PAX96 / COMMERCIAL MORT BACKED SEC IO | 0.03 | -30.56 | 0.0050 | -0.0018 | ||

| US94989TBC71 / WELLS FARGO COMMERCIAL MORTGAGE TRUST 2015-LC22 SER 2015-LC22 CL XA V/R REGD 0.98385900 | 0.00 | -100.00 | 0.0002 | -0.0009 |