Statistik Asas

| Nilai Portfolio | $ 146,302,661 |

| Kedudukan Semasa | 318 |

Pegangan Terkini, Prestasi, AUM (dari 13F, 13D)

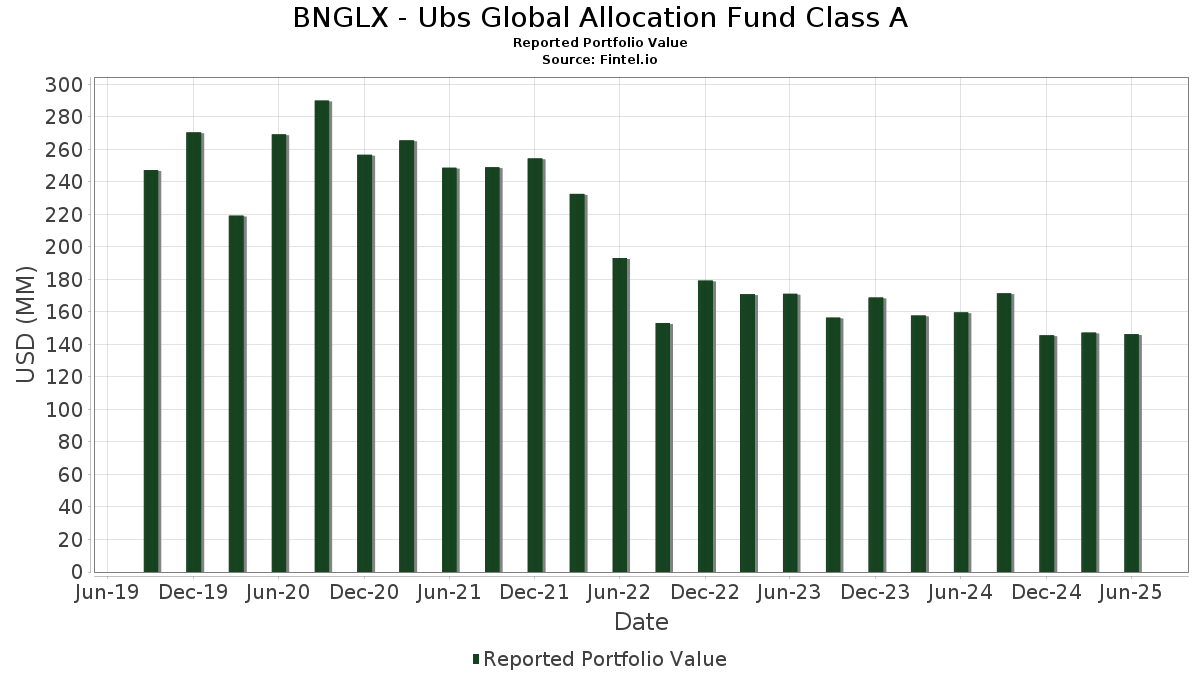

BNGLX - Ubs Global Allocation Fund Class A telah mendedahkan 318 jumlah pegangan dalam pemfailan SEC terkini mereka. Nilai portfolio terkini dikira sebagai $ 146,302,661 USD. Aset Sebenar Di Bawah Pengurusan (AUM) ialah nilai ini ditambah dengan tunai (yang tidak didedahkan). Pegangan teratas BNGLX - Ubs Global Allocation Fund Class A ialah PACE International Equity Investments (US:US69375U8650) , PACE High Yield Investments (US:US69375U6001) , SPDR Series Trust - SPDR Portfolio High Yield Bond ETF (US:SPHY) , UBS Emerging Markets Equity Opportunity Fund (US:US90267D7460) , and SPDR Series Trust - SPDR Bloomberg Emerging Markets Local Bond ETF (US:EBND) . Kedudukan baharu BNGLX - Ubs Global Allocation Fund Class A termasuk SPDR Series Trust - SPDR Bloomberg Emerging Markets Local Bond ETF (US:EBND) , iShares Trust - iShares Core S&P 500 ETF (US:IVV) , iShares, Inc. - iShares MSCI Global Silver and Metals Miners ETF (US:SLVP) , Bank of America Corp (US:US06051GKA66) , and Morgan Stanley (US:US61747YEU55) .

Kenaikan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.27 | 5.88 | 4.0192 | 4.0192 | |

| 0.01 | 4.48 | 3.0617 | 3.0617 | |

| 0.88 | 17.43 | 11.9047 | 1.8123 | |

| 0.08 | 1.43 | 0.9748 | 0.9748 | |

| 0.02 | 2.79 | 1.9066 | 0.7996 | |

| 0.01 | 2.89 | 1.9771 | 0.7515 | |

| 0.03 | 1.47 | 1.0057 | 0.4989 | |

| 2.33 | 2.33 | 1.5927 | 0.4752 | |

| 0.57 | 0.3905 | 0.3905 | ||

| 0.56 | 0.3845 | 0.3845 |

Penurunan Teratas Suku Tahun Ini

Kami menggunakan perubahan dalam peruntukan portfolio kerana ini adalah metrik yang paling bermakna. Perubahan boleh disebabkan oleh perdagangan atau perubahan dalam harga saham.

| Sekuriti | Saham (MM) |

Nilai (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.20 | 3.05 | 2.0805 | -3.0199 | |

| 0.10 | 0.0677 | -2.6954 | ||

| 4.14 | 4.14 | 2.8254 | -2.1880 | |

| 0.50 | 0.3400 | -0.4339 | ||

| 0.33 | 0.2237 | -0.4321 | ||

| 0.19 | 0.1311 | -0.4002 | ||

| 0.00 | 0.22 | 0.1500 | -0.3845 | |

| 0.09 | 0.0636 | -0.3770 | ||

| 0.20 | 0.1384 | -0.3494 | ||

| 0.01 | 0.37 | 0.2541 | -0.2906 |

13F dan Pemfailan Dana

Borang ini telah difailkan pada 2025-08-26 untuk tempoh pelaporan 2025-06-30. Klik ikon pautan untuk melihat sejarah transaksi penuh.

Tingkatkan untuk membuka data premium dan eksport ke Excel ![]() .

.

| Sekuriti | Jenis | Purata Harga Saham | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US69375U8650 / PACE International Equity Investments | 0.88 | 9.10 | 17.43 | 21.64 | 11.9047 | 1.8123 | |||

| US69375U6001 / PACE High Yield Investments | 0.84 | 1.49 | 7.59 | 3.10 | 5.1832 | -0.0014 | |||

| SPHY / SPDR Series Trust - SPDR Portfolio High Yield Bond ETF | 0.31 | 0.00 | 7.30 | 1.61 | 4.9891 | -0.0735 | |||

| US90267D7460 / UBS Emerging Markets Equity Opportunity Fund | 0.75 | 0.00 | 6.61 | 10.96 | 4.5161 | 0.3190 | |||

| EBND / SPDR Series Trust - SPDR Bloomberg Emerging Markets Local Bond ETF | 0.27 | 5.88 | 4.0192 | 4.0192 | |||||

| EMB / iShares Trust - iShares J.P. Morgan USD Emerging Markets Bond ETF | 0.05 | 0.00 | 4.60 | 2.25 | 3.1388 | -0.0270 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.01 | 4.48 | 3.0617 | 3.0617 | |||||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 4.14 | -41.88 | 4.14 | -41.89 | 2.8254 | -2.1880 | |||

| US69375U8577 / PACE International Emerging Markets Equity Investments | 0.20 | -62.38 | 3.05 | -57.95 | 2.0805 | -3.0199 | |||

| RING / iShares, Inc. - iShares MSCI Global Gold Miners ETF | 0.07 | -12.10 | 2.90 | 0.31 | 1.9781 | -0.0551 | |||

| MSFT / Microsoft Corporation | 0.01 | 25.54 | 2.89 | 66.42 | 1.9771 | 0.7515 | |||

| NVDA / NVIDIA Corporation | 0.02 | 21.83 | 2.79 | 77.66 | 1.9066 | 0.7996 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 2.33 | 46.96 | 2.33 | 46.97 | 1.5927 | 0.4752 | |||

| AAPL / Apple Inc. | 0.01 | 25.55 | 1.87 | 15.96 | 1.2755 | 0.1413 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 25.56 | 1.69 | 44.82 | 1.1566 | 0.3328 | |||

| CQQQ / Invesco Exchange-Traded Fund Trust II - Invesco China Technology ETF | 0.03 | 104.90 | 1.47 | 104.73 | 1.0057 | 0.4989 | |||

| SLVP / iShares, Inc. - iShares MSCI Global Silver and Metals Miners ETF | 0.08 | 1.43 | 0.9748 | 0.9748 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1.30 | 40.19 | 0.8888 | 0.2348 | |||||

| US06051GKA66 / Bank of America Corp | 1.26 | 47.89 | 0.8631 | 0.2614 | |||||

| US61747YEU55 / Morgan Stanley | 1.25 | 41.20 | 0.8547 | 0.2302 | |||||

| META / Meta Platforms, Inc. | 0.00 | 25.55 | 1.19 | 60.68 | 0.8127 | 0.2914 | |||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1.10 | 50.62 | 0.7500 | 0.2365 | |||||

| GOOGL / Alphabet Inc. | 0.01 | 28.88 | 1.02 | 46.97 | 0.6952 | 0.2071 | |||

| US25470DBJ72 / DISCOVERY COMMUNICATIONS LLC 3.625% 05/15/2030 | 1.01 | 25.09 | 0.6914 | 0.1210 | |||||

| US11135FAS02 / BROADCOM INC 4.3% 11/15/2032 | 0.87 | 1.51 | 0.5963 | -0.0088 | |||||

| US37045VAY65 / General Motors Co. | 0.83 | 1.47 | 0.5649 | -0.0088 | |||||

| US95000U3B74 / Wells Fargo & Co | 0.82 | 38.75 | 0.5602 | 0.1437 | |||||

| US68389XCJ28 / Oracle Corp | 0.81 | 1.50 | 0.5544 | -0.0091 | |||||

| US16411QAG64 / Cheniere Energy Partners LP | 0.80 | 1.78 | 0.5474 | -0.0076 | |||||

| US46625HRX07 / JPMorgan Chase & Co | 0.80 | 0.50 | 0.5455 | -0.0141 | |||||

| AVGO / Broadcom Inc. | 0.00 | 5.08 | 0.80 | 73.10 | 0.5455 | 0.2203 | |||

| US00914AAU60 / Air Lease Corp. | 0.77 | 0.52 | 0.5235 | -0.0138 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0.75 | 2.45 | 0.5154 | -0.0033 | |||||

| US845467AR03 / CORP. NOTE | 0.75 | 0.54 | 0.5128 | -0.0133 | |||||

| US694308JM04 / PACIFIC GAS and ELECTRIC CO 4.55% 07/01/2030 | 0.73 | 0.97 | 0.5000 | -0.0113 | |||||

| MA / Mastercard Incorporated | 0.00 | 10.61 | 0.70 | 13.52 | 0.4764 | 0.0432 | |||

| US15135BAY74 / Centene Corp | 0.70 | 205.26 | 0.4757 | 0.3151 | |||||

| WMT / Walmart Inc. | 0.01 | -5.34 | 0.70 | 5.46 | 0.4747 | 0.0104 | |||

| LLY / Eli Lilly and Company | 0.00 | 25.65 | 0.68 | 18.50 | 0.4643 | 0.0606 | |||

| US842400HS51 / Southern California Edison Co. | 0.65 | 0.00 | 0.4409 | -0.0136 | |||||

| TTWO / Take-Two Interactive Software, Inc. | 0.00 | -18.52 | 0.64 | -4.50 | 0.4349 | -0.0348 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -24.32 | 0.61 | -30.98 | 0.4141 | -0.2045 | |||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 0.60 | 42.96 | 0.4098 | 0.1369 | |||||

| US31418EW227 / Fannie Mae Pool | 0.57 | -1.88 | 0.3927 | -0.0200 | |||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 0.57 | 0.3905 | 0.3905 | ||||||

| US422806AB58 / HEICO Corp. | 0.56 | 0.3845 | 0.3845 | ||||||

| San Diego Gas & Electric Co. / DBT (US797440CG74) | 0.56 | 0.3836 | 0.3836 | ||||||

| J1BH34 / J.B. Hunt Transport Services, Inc. - Depositary Receipt (Common Stock) | 0.56 | 0.3812 | 0.3812 | ||||||

| U.S. Treasury Bills / STIV (US912797PZ47) | 0.55 | 0.3754 | 0.3754 | ||||||

| Future / DE (000000000) | 0.52 | 0.3543 | 0.3543 | ||||||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 0.51 | 12.64 | 0.3471 | 0.0532 | |||||

| US87264ABW45 / T-Mobile USA Inc | 0.51 | 1.60 | 0.3463 | -0.0054 | |||||

| US31418EU999 / Fannie Mae Pool | 0.50 | 0.3443 | 0.3443 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.50 | 0.3441 | 0.3441 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.50 | 0.3441 | 0.3441 | ||||||

| NEE / NextEra Energy, Inc. | 0.01 | -24.58 | 0.50 | -26.22 | 0.3427 | -0.1358 | |||

| ORCL / Oracle Corporation | 0.00 | 7.55 | 0.50 | 68.24 | 0.3402 | 0.1316 | |||

| NZIIBDT002C2 / New Zealand Government Inflation Linked Bond | 0.50 | -54.74 | 0.3400 | -0.4339 | |||||

| US31418DKQ42 / Fannie Mae Pool | 0.46 | -1.92 | 0.3136 | -0.0164 | |||||

| BMY / Bristol-Myers Squibb Company | 0.01 | -24.58 | 0.45 | -42.75 | 0.3102 | -0.2487 | |||

| IR / Ingersoll Rand Inc. | 0.01 | -20.11 | 0.45 | -16.94 | 0.3081 | -0.0745 | |||

| US31418DNG33 / FN MA3990 2.5 4/1/50 | 0.44 | -2.20 | 0.3035 | -0.0166 | |||||

| WFC / Wells Fargo & Company | 0.01 | -51.25 | 0.44 | -45.61 | 0.3009 | -0.2694 | |||

| COF / Capital One Financial Corporation | 0.00 | -41.26 | 0.43 | -30.34 | 0.2969 | -0.1423 | |||

| Purchased EUR / Sold USD / DFE (000000000) | 0.42 | 0.2874 | 0.2874 | ||||||

| Charter Communications Operating LLC/Charter Communications Operating Capital / DBT (US161175CQ56) | 0.42 | 0.2861 | 0.2861 | ||||||

| US13607H6M92 / Canadian Imperial Bank of Commerce | 0.40 | 0.00 | 0.2730 | -0.0083 | |||||

| US36179WLP13 / Ginnie Mae II Pool | 0.40 | -2.92 | 0.2729 | -0.0171 | |||||

| US209111GF42 / CONSOLIDATED EDISON CO OF NY 5.5% 03/15/2034 | 0.39 | 0.52 | 0.2664 | -0.0064 | |||||

| ZS / Zscaler, Inc. | 0.00 | 60.67 | 0.39 | 154.25 | 0.2663 | 0.1583 | |||

| US91282CBL46 / United States Treasury Note/Bond | 0.39 | 1.57 | 0.2660 | -0.0038 | |||||

| Aptiv PLC / EC (JE00BTDN8H13) | 0.01 | -14.11 | 0.37 | -1.33 | 0.2542 | -0.0120 | |||

| WMB / The Williams Companies, Inc. | 0.01 | -54.23 | 0.37 | -52.01 | 0.2541 | -0.2906 | |||

| FWONK / Formula One Group | 0.00 | 25.00 | 0.37 | 44.84 | 0.2498 | 0.0723 | |||

| BLK / BlackRock, Inc. | 0.00 | -24.01 | 0.36 | -15.85 | 0.2473 | -0.0554 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.01 | 48.74 | 0.35 | 66.82 | 0.2405 | 0.0914 | |||

| PM / Philip Morris International Inc. | 0.00 | -24.34 | 0.35 | -13.09 | 0.2405 | -0.0452 | |||

| SHOP / Shopify Inc. | 0.00 | 115.71 | 0.35 | 161.19 | 0.2391 | 0.1446 | |||

| US3140QEPQ93 / Federal National Mortgage Association | 0.35 | -2.51 | 0.2391 | -0.0138 | |||||

| US36179WVT25 / GNII II 2% 01/20/2052#MA7826 | 0.35 | -2.81 | 0.2369 | -0.0142 | |||||

| US3140JACX43 / Fannie Mae Pool | 0.34 | -2.56 | 0.2341 | -0.0133 | |||||

| EXE / Expand Energy Corporation | 0.00 | -24.59 | 0.34 | -20.88 | 0.2334 | -0.0704 | |||

| COO / The Cooper Companies, Inc. | 0.00 | 81.75 | 0.34 | 53.39 | 0.2318 | 0.0759 | |||

| US3140XGTV18 / Federal National Mortgage Association | 0.34 | -2.62 | 0.2292 | -0.0131 | |||||

| TDG / TransDigm Group Incorporated | 0.00 | 25.86 | 0.33 | 38.75 | 0.2275 | 0.0579 | |||

| US21H0606713 / Ginnie Mae | 0.33 | 229.00 | 0.2252 | 0.1598 | |||||

| ANET / Arista Networks Inc | 0.00 | 0.33 | 0.2252 | 0.2252 | |||||

| US91282CAE12 / United States Treasury Note/Bond | 0.33 | -64.88 | 0.2237 | -0.4321 | |||||

| TMUS / T-Mobile US, Inc. | 0.00 | -24.64 | 0.31 | -32.83 | 0.2130 | -0.1133 | |||

| DIS / The Walt Disney Company | 0.00 | -24.63 | 0.31 | -5.25 | 0.2100 | -0.0187 | |||

| US36179XFK72 / Government National Mortgage Association (GNMA) | 0.31 | 0.2089 | 0.2089 | ||||||

| FHN / First Horizon Corporation | 0.01 | -24.62 | 0.31 | -17.79 | 0.2088 | -0.0529 | |||

| MRVL / Marvell Technology, Inc. | 0.00 | 154.03 | 0.30 | 221.28 | 0.2068 | 0.1400 | |||

| US3133AYLJ73 / Federal Home Loan Mortgage Corporation | 0.30 | 0.2062 | 0.2062 | ||||||

| TYIA / Johnson Controls International plc | 0.00 | 52.00 | 0.30 | 101.36 | 0.2024 | 0.0983 | |||

| NOC / Northrop Grumman Corporation | 0.00 | -40.37 | 0.29 | -41.83 | 0.1998 | -0.1540 | |||

| BSX / Boston Scientific Corporation | 0.00 | 50.08 | 0.28 | 59.55 | 0.1946 | 0.0690 | |||

| DT / Dynatrace, Inc. | 0.01 | 25.54 | 0.28 | 47.15 | 0.1943 | 0.0580 | |||

| LYV / Live Nation Entertainment, Inc. | 0.00 | 25.53 | 0.28 | 45.55 | 0.1905 | 0.0554 | |||

| SPF / Spotify Technology S.A. | 0.00 | 0.27 | 0.1840 | 0.1840 | |||||

| US3140MHS917 / Fannie Mae Pool | 0.27 | -1.82 | 0.1840 | -0.0094 | |||||

| BIO / Bio-Rad Laboratories, Inc. | 0.00 | -24.64 | 0.27 | -25.42 | 0.1830 | -0.0697 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -24.45 | 0.26 | 4.35 | 0.1806 | 0.0021 | |||

| SCHW / The Charles Schwab Corporation | 0.00 | 25.53 | 0.26 | 46.67 | 0.1805 | 0.0533 | |||

| KHC / The Kraft Heinz Company | 0.01 | -24.36 | 0.26 | -35.94 | 0.1795 | -0.1089 | |||

| PLD / Prologis, Inc. | 0.00 | -24.64 | 0.26 | -29.08 | 0.1786 | -0.0813 | |||

| A5G / AIB Group plc | 0.03 | -14.45 | 0.26 | 8.82 | 0.1772 | 0.0095 | |||

| APO / Apollo Global Management, Inc. | 0.00 | -24.63 | 0.26 | -21.75 | 0.1770 | -0.0568 | |||

| US91282CCH25 / United States Treasury Note/Bond | 0.26 | -48.19 | 0.1762 | -0.1737 | |||||

| US80287GAE08 / Santander Drive Auto Receivables Trust, Series 2023-1, Class C | 0.26 | 0.1752 | 0.1752 | ||||||

| EW / Edwards Lifesciences Corporation | 0.26 | 26.24 | 0.1747 | 0.0363 | |||||

| VMC / Vulcan Materials Company | 0.00 | 25.51 | 0.26 | 40.88 | 0.1744 | 0.0462 | |||

| MU / Micron Technology, Inc. | 0.00 | -56.41 | 0.25 | -38.29 | 0.1734 | -0.1158 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.00 | -11.03 | 0.25 | -5.97 | 0.1724 | -0.0170 | |||

| HPEFS Equipment Trust / ABS-O (US403963AD30) | 0.25 | 0.1715 | 0.1715 | ||||||

| OHA Credit Partners XV Ltd. / ABS-CBDO (US67707BAT70) | 0.25 | -0.40 | 0.1714 | -0.0057 | |||||

| VOYA / Voya Financial, Inc. | 0.00 | -20.48 | 0.24 | -22.54 | 0.1667 | -0.0310 | |||

| WM / Waste Management, Inc. | 0.00 | 0.24 | 0.1647 | 0.1647 | |||||

| US08163JAE47 / Benchmark 2021-B29 Mortgage Trust | 0.24 | 1.69 | 0.1642 | -0.0024 | |||||

| JP1120261M59 / JAPAN GOVT CPI LINKED BONDS 03/31 0.005 | 0.24 | -37.50 | 0.1641 | -0.1065 | |||||

| XS2068932222 / HSBC BANK PLC WARRANT | 0.24 | 0.1631 | 0.1631 | ||||||

| RRX / Regal Rexnord Corporation | 0.00 | -24.64 | 0.24 | -4.08 | 0.1611 | -0.0120 | |||

| 6758 / Sony Group Corporation | 0.01 | -14.95 | 0.24 | -12.96 | 0.1610 | -0.0297 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.23 | 0.1583 | 0.1583 | ||||||

| MMC / Marsh & McLennan Companies, Inc. | 0.00 | -15.25 | 0.23 | -24.00 | 0.1561 | -0.0559 | |||

| TSLA / Tesla, Inc. | 0.00 | -22.27 | 0.23 | -4.64 | 0.1545 | -0.0127 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -51.41 | 0.22 | -71.11 | 0.1500 | -0.3845 | |||

| HUBS / HubSpot, Inc. | 0.00 | -8.37 | 0.22 | -10.61 | 0.1498 | -0.0232 | |||

| US36179XLH79 / Ginnie Mae II Pool | 0.22 | -3.56 | 0.1489 | -0.0100 | |||||

| PGR / The Progressive Corporation | 0.00 | -24.30 | 0.22 | -28.71 | 0.1482 | -0.0659 | |||

| WMS / Advanced Drainage Systems, Inc. | 0.00 | -24.56 | 0.22 | -20.37 | 0.1473 | -0.0431 | |||

| DVN / Devon Energy Corporation | 0.01 | -6.22 | 0.22 | -20.37 | 0.1472 | -0.0431 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 0.21 | -3.62 | 0.1455 | -0.0102 | |||||

| BATS / British American Tobacco p.l.c. | 0.00 | -14.44 | 0.21 | -0.93 | 0.1453 | -0.0058 | |||

| US3132DMYS87 / Freddie Mac Pool | 0.21 | -1.85 | 0.1450 | -0.0076 | |||||

| SPGI / S&P Global Inc. | 0.00 | 25.56 | 0.21 | 30.19 | 0.1415 | 0.0295 | |||

| EW / Edwards Lifesciences Corporation | 0.20 | -72.99 | 0.1384 | -0.3494 | |||||

| ASML / ASML Holding N.V. | 0.00 | -14.43 | 0.20 | 3.13 | 0.1358 | 0.0001 | |||

| EW / Edwards Lifesciences Corporation | 0.20 | -23.14 | 0.1339 | -0.0408 | |||||

| BBVA / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0.01 | -14.44 | 0.19 | -3.48 | 0.1326 | -0.0092 | |||

| APP / AppLovin Corporation | 0.00 | 25.28 | 0.19 | 65.52 | 0.1315 | 0.0496 | |||

| US912828YU85 / United States Treasury Note/Bond | 0.19 | -74.67 | 0.1311 | -0.4002 | |||||

| US3140QFUZ03 / Fannie Mae Pool | 0.19 | -2.58 | 0.1296 | -0.0073 | |||||

| WELL / Welltower Inc. | 0.00 | 0.19 | 0.1293 | 0.1293 | |||||

| US161175AY09 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.19 | 0.00 | 0.1277 | -0.0040 | |||||

| KBX / Knorr-Bremse AG | 0.00 | -14.41 | 0.19 | -9.31 | 0.1267 | -0.0170 | |||

| CP / Canadian Pacific Kansas City Limited | 0.00 | -14.97 | 0.18 | -3.70 | 0.1248 | -0.0089 | |||

| LYFT / Lyft, Inc. | 0.01 | -24.43 | 0.18 | 0.56 | 0.1238 | -0.0034 | |||

| FR0014002WK3 / French Republic Government Bond OAT | 0.18 | -58.37 | 0.1229 | -0.1807 | |||||

| IFNNF / Infineon Technologies AG | 0.00 | -14.41 | 0.18 | 9.20 | 0.1217 | 0.0068 | |||

| US06539VAJ70 / BANK 2022-BNK39 | 0.18 | 1.71 | 0.1217 | -0.0020 | |||||

| GTES / Gates Industrial Corporation plc | 0.01 | 0.27 | 0.18 | 25.53 | 0.1215 | 0.0216 | |||

| US38013JAG85 / GMCAR 2023-1 C | 0.18 | 0.1209 | 0.1209 | ||||||

| US3132DWEK53 / Freddie Mac Pool | 0.18 | -2.22 | 0.1207 | -0.0066 | |||||

| ADI / Analog Devices, Inc. | 0.00 | 0.18 | 0.1200 | 0.1200 | |||||

| US3140XLG770 / Fannie Mae Pool | 0.18 | -2.23 | 0.1198 | -0.0069 | |||||

| Future / DIR (000000000) | 0.17 | 0.1176 | 0.1176 | ||||||

| US36179W2V97 / Ginnie Mae II Pool | 0.17 | -2.84 | 0.1168 | -0.0073 | |||||

| US3140XAH961 / Fannie Mae Pool | 0.17 | -2.31 | 0.1158 | -0.0067 | |||||

| UMG / Universal Music Group N.V. | 0.01 | -14.40 | 0.17 | 0.60 | 0.1156 | -0.0032 | |||

| LVS / Las Vegas Sands Corp. | 0.00 | -24.72 | 0.17 | -15.08 | 0.1156 | -0.0250 | |||

| BN / Danone S.A. | 0.00 | -14.42 | 0.17 | -8.29 | 0.1136 | -0.0145 | |||

| PHIA / Koninklijke Philips N.V. | 0.01 | -14.43 | 0.17 | -19.51 | 0.1132 | -0.0313 | |||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 0.00 | -16.04 | 0.16 | -2.96 | 0.1124 | -0.0072 | |||

| US36179VDP22 / Ginnie Mae II Pool | 0.16 | -3.55 | 0.1119 | -0.0074 | |||||

| SDZ / Sandoz Group AG | 0.00 | -14.45 | 0.16 | 11.72 | 0.1108 | 0.0085 | |||

| WLK / Westlake Corporation | 0.00 | 27.19 | 0.16 | -3.59 | 0.1102 | -0.0075 | |||

| NZTB / New Zealand Government Bond | 0.15 | -50.80 | 0.1056 | -0.1149 | |||||

| Future / DE (000000000) | 0.15 | 0.1037 | 0.1037 | ||||||

| ALC / Alcon Inc. | 0.00 | -14.46 | 0.15 | -20.21 | 0.1026 | -0.0301 | |||

| NOVN / Novartis AG | 0.00 | -14.43 | 0.15 | -6.25 | 0.1026 | -0.0107 | |||

| LGI / Legal & General Group Plc | 0.04 | -14.43 | 0.15 | -5.10 | 0.1022 | -0.0089 | |||

| DTG / Daimler Truck Holding AG | 0.00 | 8.28 | 0.15 | 26.50 | 0.1015 | 0.0187 | |||

| BG / BAWAG Group AG | 0.00 | -14.42 | 0.15 | 5.80 | 0.1004 | 0.0027 | |||

| US3132DMVD46 / UMBS | 0.15 | -2.67 | 0.1002 | -0.0059 | |||||

| FSLR / First Solar, Inc. | 0.00 | 0.14 | 0.0989 | 0.0989 | |||||

| 1299 / AIA Group Limited | 0.02 | -15.04 | 0.14 | 0.71 | 0.0969 | -0.0024 | |||

| NKE / NIKE, Inc. | 0.00 | -24.76 | 0.14 | -15.57 | 0.0966 | -0.0217 | |||

| EBS / Erste Group Bank AG | 0.00 | -14.43 | 0.14 | 5.26 | 0.0962 | 0.0020 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.14 | 0.0945 | 0.0945 | ||||||

| 8001 / ITOCHU Corporation | 0.00 | -16.13 | 0.14 | -4.90 | 0.0932 | -0.0082 | |||

| 4733 / OBIC Business Consultants Co., Ltd. | 0.00 | -4.17 | 0.14 | 16.24 | 0.0931 | 0.0106 | |||

| US12511JAC99 / CCG Receivables Trust 2022-1 | 0.13 | 0.0920 | 0.0920 | ||||||

| XOM / Exxon Mobil Corporation | 0.00 | 25.53 | 0.13 | 13.56 | 0.0920 | 0.0086 | |||

| US912810RB61 / United States Treas Bds Bond | 0.13 | -72.37 | 0.0916 | -0.2507 | |||||

| NESN / Nestlé S.A. | 0.00 | -14.44 | 0.13 | -15.82 | 0.0913 | -0.0206 | |||

| US29375NAB10 / EFF_23-2 | 0.13 | 33.00 | 0.0911 | 0.0227 | |||||

| US3132DWBH51 / UMBS | 0.13 | 0.0892 | 0.0892 | ||||||

| AHT / Ashtead Group plc | 0.00 | -14.40 | 0.13 | 1.59 | 0.0877 | -0.0014 | |||

| US95001NBB38 / Wells Fargo Commercial Mortgage Trust 2018-C45 | 0.13 | 0.80 | 0.0867 | -0.0020 | |||||

| Santander Drive Auto Receivables Trust / ABS-O (US802919AB63) | 0.12 | 0.0852 | 0.0852 | ||||||

| CELH / Celsius Holdings, Inc. | 0.00 | 0.12 | 0.0848 | 0.0848 | |||||

| AU3TB0000150 / Australia Government Bond | 0.12 | -51.57 | 0.0847 | -0.0945 | |||||

| JP1201561G37 / Japan Government Twenty Year Bond | 0.12 | -67.20 | 0.0841 | -0.1801 | |||||

| 6861 / Keyence Corporation | 0.00 | 0.00 | 0.12 | 2.56 | 0.0823 | -0.0008 | |||

| 4063 / Shin-Etsu Chemical Co., Ltd. | 0.00 | -7.69 | 0.12 | 7.21 | 0.0815 | 0.0031 | |||

| FA9 / Spectris plc | 0.00 | -14.32 | 0.12 | 49.37 | 0.0812 | 0.0252 | |||

| US912828YB05 / Us Treasury N/b 1.625000% 08/15/2029 Bond | 0.12 | -52.80 | 0.0811 | -0.0956 | |||||

| US91282CHT18 / US TNOTE 3.875% DUE 08/15/2033 | 0.12 | -52.80 | 0.0807 | -0.0960 | |||||

| BA. / BAE Systems plc | 0.00 | -14.38 | 0.11 | 10.68 | 0.0780 | 0.0047 | |||

| CRM / Salesforce, Inc. | 0.00 | 0.11 | 0.0771 | 0.0771 | |||||

| DB1 / Deutsche Börse AG | 0.00 | 0.11 | 0.0764 | 0.0764 | |||||

| ROP / Roper Technologies, Inc. | 0.00 | -24.52 | 0.11 | -27.45 | 0.0763 | -0.0321 | |||

| GLEN / Glencore plc | 0.03 | 1.42 | 0.11 | 7.77 | 0.0763 | 0.0034 | |||

| Future / DE (000000000) | 0.11 | 0.0761 | 0.0761 | ||||||

| US912810SQ22 / United States Treasury Note/Bond | 0.11 | -43.30 | 0.0756 | -0.0612 | |||||

| GALP / Galp Energia, SGPS, S.A. | 0.01 | -14.40 | 0.11 | -10.66 | 0.0751 | -0.0113 | |||

| TRMLF / Tourmaline Oil Corp. | 0.00 | -14.39 | 0.11 | -14.40 | 0.0735 | -0.0150 | |||

| DE0001102556 / BUNDESREPUB. DEUTSCHLAND /EUR/ REGD REG S 0.00000000 | 0.10 | -48.50 | 0.0709 | -0.0703 | |||||

| GB00BFX0ZL78 / United Kingdom Gilt | 0.10 | -63.31 | 0.0703 | -0.1259 | |||||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.00 | -14.04 | 0.10 | -27.66 | 0.0701 | -0.0293 | |||

| US24703GAD60 / DELL EQUIPMENT FINANCE TRUST 2023-2 DEFT 2023-2 B | 0.10 | 0.0687 | 0.0687 | ||||||

| US40443DAD49 / HPEFS Equipment Trust 2023-1 | 0.10 | 0.0684 | 0.0684 | ||||||

| 4519 / Chugai Pharmaceutical Co., Ltd. | 0.00 | -13.64 | 0.10 | -1.00 | 0.0678 | -0.0032 | |||

| U.S. Treasury Bills / STIV (US912797PX98) | 0.10 | -97.48 | 0.0677 | -2.6954 | |||||

| US912810QY73 / United States Treas Bds Bond | 0.10 | -1.98 | 0.0676 | -0.0036 | |||||

| US17291DAD57 / Citigroup Commercial Mortgage Trust 2018-C5 | 0.10 | 1.03 | 0.0675 | -0.0015 | |||||

| Future / DIR (000000000) | 0.10 | 0.0654 | 0.0654 | ||||||

| US91282CCJ80 / United States Treasury Note/Bond | 0.09 | -85.12 | 0.0636 | -0.3770 | |||||

| US3132DWC353 / FR SD8190 | 0.09 | -3.16 | 0.0631 | -0.0043 | |||||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 0.02 | -14.41 | 0.09 | -12.38 | 0.0630 | -0.0116 | |||

| Future / DE (000000000) | 0.09 | 0.0610 | 0.0610 | ||||||

| AU0000249302 / AUSTRALIA GOVT AUD REG S 3.75% 05-21-34 | 0.09 | -66.41 | 0.0602 | -0.1248 | |||||

| AU0000274706 / AUSTRALIAN GOVERNMENT /AUD/ REGD REG S SER 168 3.50000000 | 0.09 | -37.41 | 0.0599 | -0.0383 | |||||

| MELI / MercadoLibre, Inc. | 0.00 | 10.00 | 0.09 | 48.28 | 0.0589 | 0.0177 | |||

| Canada Government Bonds / DBT (CA135087Q988) | 0.09 | -41.78 | 0.0586 | -0.0445 | |||||

| OE8S / Spain Government Bond | 0.08 | -48.78 | 0.0580 | -0.0578 | |||||

| US91282CCY57 / UNITED STATES TREASURY NOTE 1.25000000 | 0.08 | -65.85 | 0.0575 | -0.1163 | |||||

| GB00BLH38158 / United Kingdom Gilt | 0.08 | -42.66 | 0.0562 | -0.0449 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -61.29 | 0.08 | -68.70 | 0.0532 | -0.1207 | |||

| IT0005449969 / Italy Buoni Poliennali Del Tesoro | 0.07 | -59.12 | 0.0507 | -0.0775 | |||||

| IT0005365165 / Italy Buoni Poliennali Del Tesoro | 0.07 | -52.29 | 0.0502 | -0.0575 | |||||

| Future / DIR (000000000) | 0.07 | 0.0500 | 0.0500 | ||||||

| FR0014007L00 / French Republic Government Bond OAT | 0.07 | 10.77 | 0.0497 | 0.0036 | |||||

| US912810RQ31 / United States Treas Bds Bond | 0.07 | -43.75 | 0.0492 | -0.0409 | |||||

| GB00BM8Z2S21 / UNITED KINGDOM G.B. and N.IRELAND 0.875% 07/31/2033 REGS | 0.07 | -53.90 | 0.0490 | -0.0601 | |||||

| GB00BM8Z2T38 / U.K. Gilt | 0.07 | -44.72 | 0.0471 | -0.0400 | |||||

| IE00BH3SQB22 / Ireland Government Bond | 0.07 | -65.80 | 0.0451 | -0.0910 | |||||

| US912810SN90 / UNITED STATES TREASURY BOND 1.25% 05/15/2050 | 0.06 | -55.94 | 0.0436 | -0.0578 | |||||

| DE0001135481 / Bundesrepublik Deutschland Bundesanleihe | 0.06 | -56.55 | 0.0434 | -0.0590 | |||||

| US91282CBT71 / United States Treasury Note/Bond - When Issued | 0.06 | -74.38 | 0.0427 | -0.1281 | |||||

| JP1400121K57 / Japan Government Forty Year Bond | 0.06 | -4.69 | 0.0418 | -0.0035 | |||||

| GGB / Gerdau S.A. - Depositary Receipt (Common Stock) | 0.02 | 5.06 | 0.06 | 8.93 | 0.0418 | 0.0019 | |||

| US36179RVA49 / Ginnie Mae II Pool | 0.06 | -3.23 | 0.0415 | -0.0027 | |||||

| US91282CCS89 / United States Treasury Note/Bond | 0.06 | 0.00 | 0.0409 | -0.0007 | |||||

| Future / DE (000000000) | 0.06 | 0.0403 | 0.0403 | ||||||

| ES00000124H4 / Spain Government Bond | 0.06 | -43.43 | 0.0383 | -0.0322 | |||||

| US912810RY64 / United States Treas Bds Bond | 0.06 | -43.30 | 0.0380 | -0.0305 | |||||

| IT0003934657 / Italy Buoni Poliennali Del Tesoro | 0.06 | -57.36 | 0.0379 | -0.0530 | |||||

| US36179RQZ54 / Ginnie Mae II Pool | 0.05 | -3.70 | 0.0361 | -0.0022 | |||||

| FR0013515806 / French Republic Government Bond OAT | 0.05 | -10.53 | 0.0351 | -0.0055 | |||||

| BE0000331406 / Kingdom of Belgium Government Bond | 0.05 | -35.90 | 0.0347 | -0.0206 | |||||

| CA135087F825 / Canadian Government Bond | 0.05 | -71.43 | 0.0346 | -0.0889 | |||||

| CA135087WL43 / CANADIAN GOVERNMENT | 0.05 | -65.00 | 0.0340 | -0.0652 | |||||

| ES00000128P8 / Spain Government Bond | 0.05 | -54.37 | 0.0327 | -0.0402 | |||||

| TEAM / Atlassian Corporation | 0.00 | 6.85 | 0.05 | 2.17 | 0.0325 | -0.0003 | |||

| Future / DIR (000000000) | 0.04 | 0.0277 | 0.0277 | ||||||

| NZGOVDT437C0 / New Zealand Government Bond | 0.04 | 0.0274 | 0.0274 | ||||||

| PRMRF / Paramount Resources Ltd. | 0.00 | -14.34 | 0.04 | 5.41 | 0.0273 | 0.0005 | |||

| FRTR / France - Sovereign or Government Agency Debt | 0.04 | -58.06 | 0.0268 | -0.0393 | |||||

| Future / DE (000000000) | 0.04 | 0.0262 | 0.0262 | ||||||

| JP1300511G61 / Japan Government Thirty Year Bond | 0.03 | 3.03 | 0.0236 | -0.0003 | |||||

| IT0005094088 / Italy Buoni Poliennali Del Tesoro | 0.03 | 10.34 | 0.0223 | 0.0018 | |||||

| US33849NAB10 / Flagstar Mortgage Trust, Series 2018-5, Class A2 | 0.03 | -3.23 | 0.0212 | -0.0009 | |||||

| US912810PW27 / Us Treasury Bond | 0.03 | -73.64 | 0.0205 | -0.0575 | |||||

| ITALY / Italy Buoni Poliennali Del Tesoro | 0.03 | -63.64 | 0.0193 | -0.0356 | |||||

| ES00000128Q6 / Spain Government Bond | 0.02 | -60.34 | 0.0162 | -0.0247 | |||||

| US91282CBS98 / United States Treasury Note/Bond | 0.02 | -40.54 | 0.0154 | -0.0107 | |||||

| AT0000A0VRQ6 / Republic of Austria Government Bond | 0.02 | -54.35 | 0.0147 | -0.0180 | |||||

| GB00BN65R313 / United Kingdom Gilt | 0.02 | -50.00 | 0.0142 | -0.0146 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0.02 | 0.0142 | 0.0142 | ||||||

| ES0000012932 / Spain Government Bond | 0.02 | -60.00 | 0.0139 | -0.0218 | |||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 0.02 | -53.66 | 0.0133 | -0.0160 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 0.02 | -51.28 | 0.0133 | -0.0145 | |||||

| Purchased EUR / Sold USD / DFE (000000000) | 0.02 | 0.0129 | 0.0129 | ||||||

| FI4000242870 / Finland Government Bond | 0.02 | 14.29 | 0.0109 | 0.0006 | |||||

| US55283FAA66 / MFRA 2021-NQM1 A1 | 0.02 | -6.25 | 0.0105 | -0.0014 | |||||

| Purchased EUR / Sold USD / DFE (000000000) | 0.01 | 0.0082 | 0.0082 | ||||||

| US552757AA45 / MFA 2020-NQM3 Trust | 0.01 | -15.38 | 0.0080 | -0.0012 | |||||

| ES00000128E2 / Spain Government Bond | 0.01 | 11.11 | 0.0070 | 0.0005 | |||||

| SFS Auto Receivables Securitization Trust / ABS-O (US78435VAB80) | 0.01 | -73.08 | 0.0051 | -0.0138 | |||||

| Purchased JPY / Sold USD / DFE (000000000) | 0.01 | 0.0041 | 0.0041 | ||||||

| Future / DE (000000000) | 0.01 | 0.0041 | 0.0041 | ||||||

| Purchased NZD / Sold USD / DFE (000000000) | 0.01 | 0.0040 | 0.0040 | ||||||

| Purchased GBP / Sold USD / DFE (000000000) | 0.00 | 0.0032 | 0.0032 | ||||||

| Purchased JPY / Sold USD / DFE (000000000) | 0.00 | 0.0027 | 0.0027 | ||||||

| Purchased SEK / Sold USD / DFE (000000000) | 0.00 | 0.0025 | 0.0025 | ||||||

| Purchased AUD / Sold USD / DFE (000000000) | 0.00 | 0.0019 | 0.0019 | ||||||

| US30166RAF47 / Exeter Automobile Receivables Trust | 0.00 | -90.00 | 0.0018 | -0.0123 | |||||

| Purchased CAD / Sold USD / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| Purchased CAD / Sold USD / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| Purchased CNY / Sold USD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| Purchased USD / Sold CAD / DFE (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0.00 | -0.0001 | -0.0001 | ||||||

| Future / DE (000000000) | -0.00 | -0.0010 | -0.0010 | ||||||

| Purchased USD / Sold TWD / DFE (000000000) | -0.00 | -0.0015 | -0.0015 | ||||||

| Purchased USD / Sold CAD / DFE (000000000) | -0.00 | -0.0016 | -0.0016 | ||||||

| Purchased USD / Sold GBP / DFE (000000000) | -0.00 | -0.0017 | -0.0017 | ||||||

| Future / DCO (000000000) | -0.00 | -0.0021 | -0.0021 | ||||||

| Purchased USD / Sold EUR / DFE (000000000) | -0.00 | -0.0022 | -0.0022 | ||||||

| XS2068932222 / HSBC BANK PLC WARRANT | -0.00 | -0.0023 | -0.0023 | ||||||

| Purchased JPY / Sold USD / DFE (000000000) | -0.00 | -0.0024 | -0.0024 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.00 | -0.0027 | -0.0027 | ||||||

| Purchased USD / Sold CNH / DFE (000000000) | -0.00 | -0.0030 | -0.0030 | ||||||

| Future / DIR (000000000) | -0.00 | -0.0031 | -0.0031 | ||||||

| Purchased USD / Sold NZD / DFE (000000000) | -0.01 | -0.0064 | -0.0064 | ||||||

| Purchased USD / Sold THB / DFE (000000000) | -0.01 | -0.0067 | -0.0067 | ||||||

| Future / DE (000000000) | -0.02 | -0.0105 | -0.0105 | ||||||

| Future / DE (000000000) | -0.02 | -0.0123 | -0.0123 | ||||||

| Purchased USD / Sold AUD / DFE (000000000) | -0.03 | -0.0184 | -0.0184 | ||||||

| Future / DIR (000000000) | -0.03 | -0.0200 | -0.0200 | ||||||

| Purchased USD / Sold GBP / DFE (000000000) | -0.03 | -0.0228 | -0.0228 | ||||||

| Purchased THB / Sold GBP / DFE (000000000) | -0.04 | -0.0292 | -0.0292 | ||||||

| Future / DE (000000000) | -0.07 | -0.0478 | -0.0478 | ||||||

| Future / DIR (000000000) | -0.10 | -0.0711 | -0.0711 | ||||||

| Future / DIR (000000000) | -0.15 | -0.0997 | -0.0997 | ||||||

| Purchased USD / Sold CHF / DFE (000000000) | -0.20 | -0.1337 | -0.1337 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | -0.20 | -0.1384 | -0.1384 |